Resale Condos Were Underrated In 2020, But Might Take The Spotlight In 2021

December 26, 2020

You’ve been seeing one new launch after another for 2020; so it’s not surprising you may have missed the trend in the background. Resale condos have avoided the limelight despite sales volumes hitting a two-year high back in August, and prices also creeping up.

With an estimated 19 new launches in 2021 though (as opposed to more than 30 this year), there’s less distraction from the private resale market. And given the direction of the trend, there’s a good chance we’ll see and hear more about homes on the second-hand market:

What’s been happening with resale condos?

A strong uptrend was first noticed around August 2020; at the time, we had the above-linked report that resale condo volumes were at a two-year high. We were able to verify this with a check on Square Foot Research:

Resale transaction volumes were at 641 units in August 2018, with average prices at $1,301 psf. In August 2019, transaction volumes rose to 728, with average prices reaching $1,373 psf.

By August 2020, transaction volumes were at 1,166(!) units, although average prices had fallen to $1,247 psf.

We can also see that resale volumes more or continued to rise from that point – with a slight dip in September – ending at 1,006 units in November (we exclude December as the month is not yet over, at the time of writing).

Note that the resale volumes in the last few months of 2020 have been notably higher than the previous years. In fact, the Straits Times reported 9,200 resale transactions in the first 11 months of 2020; already higher than the 8,949 transactions alleged for the whole of 2019.

The highest transacted units in November 2020 were at Nassim Jade (Core Central Region), Corals at Keppel Bay (Rest of Central Region), and The Chuan (Outside of Central Region). See below for some details on these.

There are three important takeaways so far, regarding the resale condo market

The first is that pent-up demand, the reason given for the uptick in August 2020, is unlikely to be the sole or main reason.

To be sure, the Circuit Breaker did create pent-up demand, and affect resale volumes more than new launch condos – this is because fewer buyers are willing to purchase a resale property without direction inspection.

However, the volume of resale transactions continued to stay high in the months that followed, and even climbed to a peak of 1,268 units in October. It’s hard to attribute this to just pent-up demand from the Circuit Breaker.

Second, it suggests that anyone looking for the steepest “Covid-19 discount” may have missed the window. Prices did fall sharply in the aftermath of the Circuit Breaker – from an average of $1,421 psf in June, to $1,250 psf in September.

Since then, however, the price has tended upward again. It was up to $1,267 psf in October, and $1,284 in November. While December 2020 is not yet concluded, average prices already seem to be in the range of $1,286 psf; so all signs point toward a recovery.

Third, the volume of resale transactions managed to stay above the 1,000 mark between July to November this year. Prior to this year, resale volumes failed to reach 1,000 on any month, since around 2018.

This was due to the new cooling measures passed on July 2018, which increased the Additional Buyers Stamp Duty (ABSD), and tightened loan curbs. As such, passing the 1,000-transaction mark for almost five consecutive months suggests a recovery from the last bout of cooling measures.

The market may have adapted to government policies; which would also explain increasing sales despite Covid-19.

Besides the uptrend in 2020, resale condos may take the limelight next year for three other reasons.

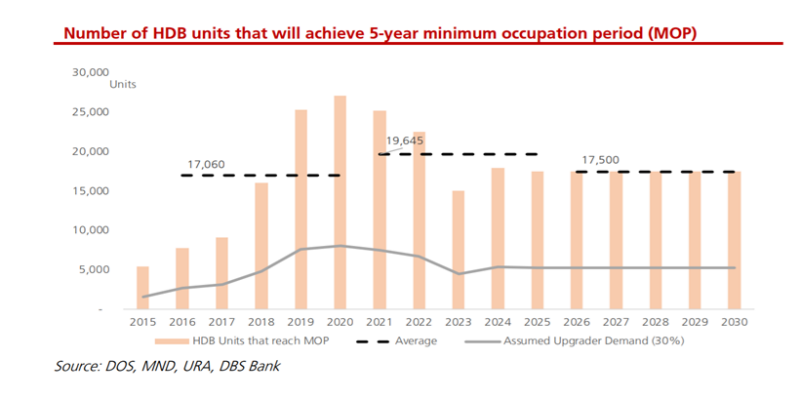

The first is the number of HDB upgraders entering the market. This buyer demographic has been one of the main forces pushing up the private market, ever since 2019.

The majority of HDB upgraders are families – most would have come from the ubiquitous 4-room flats, which are around 969 sq.ft. They would generally expect something larger or of similar size, if upgrading to a condo.

But take a look at the current trend, started by developments like The M or Midtown Bay. The current direction seems to be a low quantum, with a higher cost per square foot. This equates to smaller units, that are cheaper overall.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

6 Actionable Steps To Compare Between A New Launch And Resale Condo

We’ve covered the basics of new versus resale condos before, but now let’s get further into specifics. In practice, you’ll…

A lot of the first units to be snapped up at new launches are also compact units, in the 500 sq. ft. range; but these units are too small to cater to family buyers.

As we’ve mentioned before, older condos (much like older HDB flats) tend to be much bigger; and they’re generally cheaper on a price psf basis than newer counterparts. As such, older resale condos may come off as being more family-friendly, and appeal to the current demographic.

The second reason is the risk of construction delays, with deadlines already being extended. This can be a headache for upgraders who need temporary accommodation; and they still need to worry about renovations after the unit’s completion. New virus break-outs and “second waves” in other countries can also affect supply, resulting in even further delays.

For this reason, some buyers may opt for a unit that’s already complete and ready to move into.

Finally, as we mentioned above, there are fewer new launches in 2021. With fewer options, buyers may have to pick a resale unit instead, to get a home in a particular area. Agent listings may now get a minute in the spotlight, without being immediately plastered over by “NEW CONDO NEAR MRT” ads.

The highest transacted resale units for 2020

The following three developments were the highest resale transactions for the November 2020, for each region:

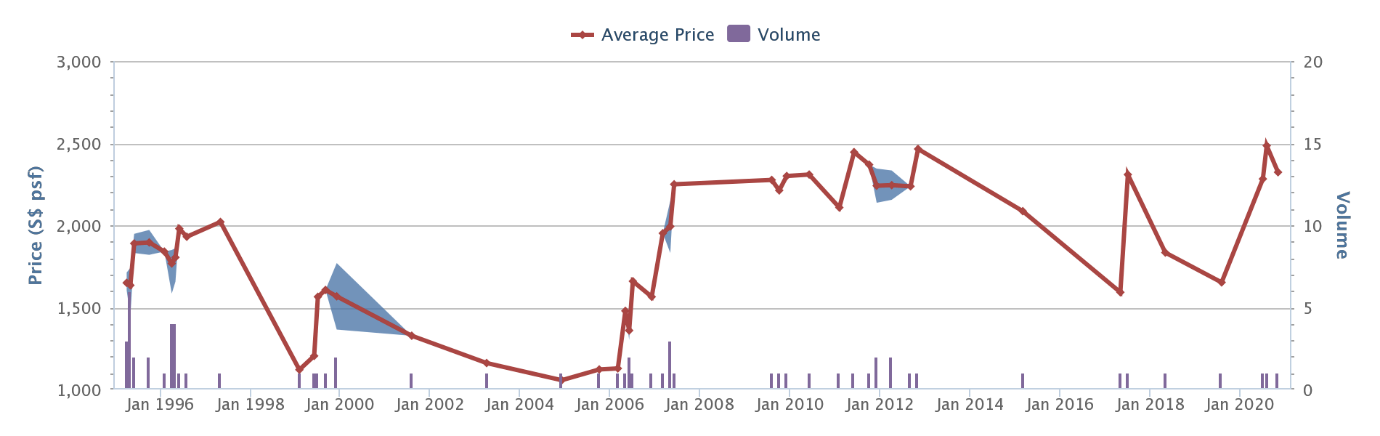

1. Nassim Jade (Highest in CCR)

The indicative price range from Square Foot Research is $2,282 to $2,485 psf. The average is $2,363 psf.

The highest transacted unit for November is indicated below. There were only two other transactions in 2020.

| Date | Unit size | Price (psf) | Quantum |

| 27 Nov 2020 | 5,038 sq. ft. | $2,323 | $11,700,000 |

| 16 Aug 2020 | 2,153 sq. ft. | $2,485 | $5,350,000 |

| 14 Jul 2020 | 1,841 sq. ft. | $2,282 | $4,200,00 |

There have been 26 profitable transactions, and nine unprofitable transactions.

Fact sheet

Address: Nassim Road (District 10)

Developer: Allegro Investment Pte. Ltd.

Lease: Freehold

Completion: 1997

Number of units: 39

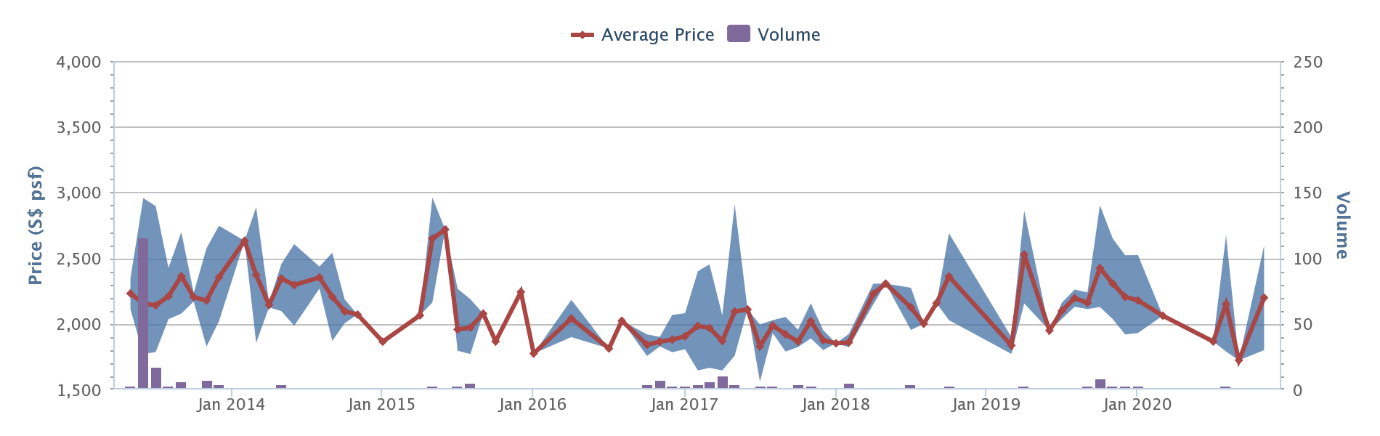

2. Corals at Keppel Bay (Highest in RCR)

The indicative price range from Square Foot Research is $1,722 to $2,675 psf. The average is $2,061 psf.

The highest transacted unit for November is indicated below, along with the four other most recent transactions this year:

| Date | Unit size | Price (psf) | Quantum |

| 25 Nov 2020 | 2,659 sq. ft. | $2,595 | $6,900,000 |

| 17 Nov 2020 | 861 sq. ft. | $1,800 | $1,550,000 |

| 10 Sep 2020 | 863 sq. ft. | $1,722 | $1,520,000 |

| 20 Aug 2020 | 1,421 sq. ft. | $1,983 | $2,817,000 |

| 7 Aug 2020 | 570 sq. ft. | $2,675 | $1,526,000 |

Transaction records on profitability / loss are not full available; there has been one recorded profitable transaction, and five recorded unprofitable transactions.

Fact sheet

Address: Keppel Bay Drive (District 04)

Developer: Keppel Bay Pte. Ltd.

Lease: 99-years from 2007

Completion: 2016

Number of units: 367

Condo ReviewsCorals at Keppel Bay Review: Best Waterfront Views At Keppel

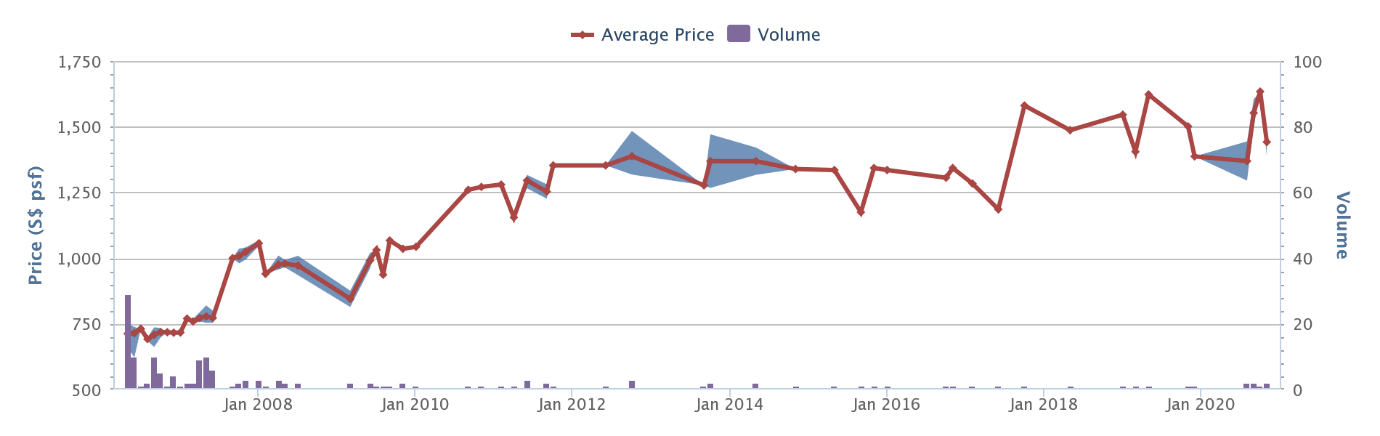

by Reuben Dhanaraj3. The Chuan (Highest in OCR)

The indicative price range from Square Foot Research is $1,295 to $1,634 psf. The average is $1,480 psf.

The highest transacted unit for November is indicated below, along with the four most recent transactions for the year:

| Date | Unit size | Price (psf) | Quantum |

| 17 Nov 2020 | 1,658 sq. ft. | $1,496 | $2,480,000 |

| 16 Nov 2020 | 2,594 sq. ft. | $1,388 | $3,600,000 |

| 28 Oct 2020 | 936 sq. ft. | $1,634 | $1,530,000 |

| 23 Sep 2020 | 1,367 sq. ft. | $1,500 | $2,050,000 |

| 17 Sep 2020 | 1,464 sq. ft. | $1,605 | $2,350,000 |

There have been 60 profitable transactions, with three unprofitable transactions.

Fact sheet

Address: Lorong Chuan (District 19)

Developer: Peak Residence Development Pte. Ltd.

Lease: 999-years from 1877

Completion: 2007

Number of units: 106

With resale condos once again in the picture, 2021 will be an interesting time for buyers and sellers alike.

Sellers are likely to be more confident given the recovering prices, while some buyers may still be inclined to wait and see; disappointments in the Covid-19 vaccine, or the wider economy, may yet cause sellers to flinch.

We’ll keep you updated on the resale condo situation as it unfolds, so do follow us on Stacked. We also have in-depth reviews of older as well as new condos, just in case you need somewhere to move in fast.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why did resale condos become more popular in 2020?

How did resale condo prices change during 2020?

What factors might make resale condos more attractive in 2021?

Which resale condos had the highest transactions in November 2020?

How might the HDB upgraders influence the resale condo market in 2021?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

0 Comments