New Private Home Sales Surged In July, Despite Viewing Restrictions: Here’s Why

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

You’d think that, with the return to Phase II restrictions, the number of property sales in July would be lower. As proof that nothing is truly predictable in real estate, we’ve seen the opposite. The number of private home sales in July is a whopping 82 per cent higher than the previous month. At this rate, we may be on an express train to cooling measures. Here’s what’s happening:

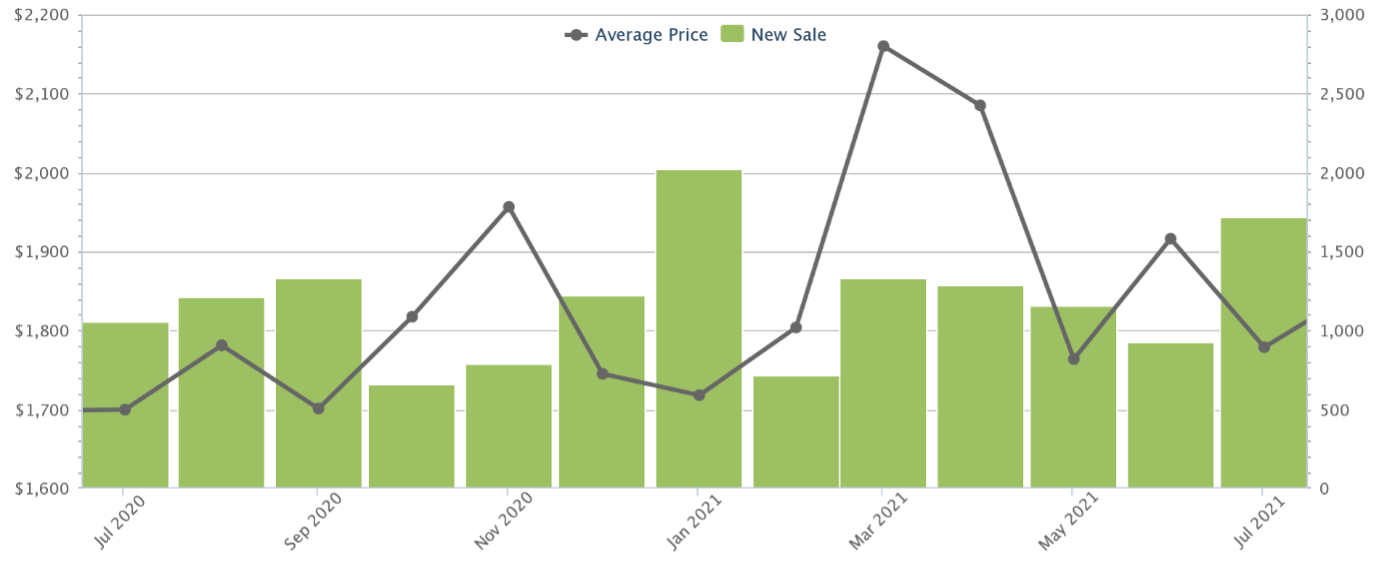

Transaction volumes for new private homes are climbing back to the last high in January

Developers moved 1,718 units in July this year, up from 920 units the month before. This is an increase of 86.7 per cent. This is around a 63 per cent increase from the same time last year.

Excluding Executive Condominiums (ECs), new home sales would amount to 1,589 units, up from 872 units the month before; or around an 82 per cent increase.

Note that new launch sales have been steadily dropping, since the last peak in January this year. Along with viewing restrictions from the return to Phase II, it’s surprising that July’s numbers managed to buck the trend by such a large margin.

Commensurately, there were around 1,104 new private homes going on the market in July; but note that this is only around a 35 per cent increase from the previous month.

The results are unexpected for two reasons:

First, the viewing restrictions imposed by a return to Phase II were expected to slow sales. This visibly didn’t happen, with realtors noting that many show flats had no shortage of bookings.

Second, it was expected that the new launch sales numbers would start to level off, after declining in January. This is on the basis that most current buyers, being HDB upgraders, have turned their attention to the more affordable resale condo market.

New launch condo prices averaged $1,779 psf for July, whereas resale condo prices were at $1,351 psf.

As HDB upgraders are mostly families, it they gravitate toward bigger units of 1,100 sq. ft. or above. This is more affordable in resale condos, which tend to be built bigger anyway.

The pick-up in new launch sales, however, suggests that buyers are just as eager for their smaller, more expensive counterparts.

Top selling projects for July 2021

| Development | District | Units sold | Median price |

| Pasir Ris 8 | 18 | 418 | $1,624 psf |

| Normanton Park | 05 | 125 | $1,825 psf |

| Midwood | 23 | 91 | $1,656 psf |

| Sengkang Grand Residences | 19 | 89 | $1,714 psf |

| Ki Residences at Brookvale | 21 | 61 | $1,851 psf |

Pricing from Square Foot Research

What is driving the surge of new launch sales?

- HDB upgraders looking for OCR properties

- Sense of urgency among buyers

- Strength of July’s new launch offerings

- A possible rush to buy before the 7th Month Festival

1. HDB upgraders looking for OCR properties

Condos in the Outside of Central Region (OCR) have seen the highest demand. Note that of the top five selling projects in July, four are located in the OCR – the only exception is Normanton Park, in the RCR.

This is a matter of affordability, as three and four-bedders in the CCR and RCR are often beyond the price range of HDB upgraders. Even for Normanton Park, note that this is a mega-development with generally lower prices; if you’re willing to settle for a 936 sq. ft. unit, for instance, Normanton Park might only run up a quantum of around $1.66 million.

More from Stacked

New Launches That Dropped Prices in 2013/14: How Are They Faring Now?

2013 was the peak of the last property market, with all the havoc that often implies. As cooling measures swept…

Huttons Research notes that close to half (49.6 per cent) of the transactions in June were below $1.5 million, with the average being around $1.7 million. This is more of less the “sweet spot” that most upgraders can aspire to.

2. Sense of urgency among buyers

After overwhelming interest at Pasir Ris 8, it was widely reported that other developers might follow the same tactics, and aggressively raise prices. This has contributed to a growing sense of urgency, with buyers worried that they’ll pay more if they keep waiting.

New Launch Condo ReviewsPasir Ris 8 Review: Rare Integrated Development In The East With Bigger Units

by Matt KEven for those with a longer term view, increased construction costs – coupled with higher land acquisition costs from land starved developers – are expected to raise prices in the long run. The more our developers need to pay, the more expensive your condo becomes.

Another latent fear is that, with prices and volumes rising, we may soon see another round of cooling measures. This could push home buyers to make their move now, before policy changes that might mean higher stamp duties, loan curbs, or other costly factors.

3. Strength of July’s new launch offerings

The new launch options in July presented an unusually strong slate.

Pasir Ris 8 was an integrated development with MRT access, Normanton Park is close to both One-North and Holland Village, Ki Residences offered first-mover advantage in its area, etc.

(Please see our full reviews on Stacked, for more information).

Some of the most anticipated launches of the year were up for grabs in July; and those who couldn’t get their desired units, like at Pasir Ris 8, probably found the alternatives to be on par.

4. A possible rush to buy before the 7th Month Festival

Some realtors have pointed out that a rush just before the 7th Month Festival (which begins in August) is cyclical. Most Singaporeans want to buy in a more auspicious time, and hence complete the transaction the month before.

This alone wouldn’t account for the huge surge in sale volumes, but it could be a contributing factor.

What can home buyers do about this in 2021?

While the resale condo market is also seeing prices go up, we’d suggest cost-conscious upgraders look in this segment first.

There are many resale condo owners who are eager to upgrade right now; either because they sense cooling measures coming, or because they feel the market is at a peak (they may not be wrong).

Regardless, if you’re looking for a family-sized unit, a resale condo is more likely to keep things below $1.5 million right now.

That said, home buyers should focus on affordability, not Fear Of Missing Out (FOMO). Before you walk into a show flat, have a defined plan on how much you’re willing to spend, and stick to it. This will be less stressful than having to make spur-of-the-moment decisions, if unit prices start to go up.

For more on the situation as it unfolds, follow us on Stacked. We’ll also provide you with the most in-depth reviews of new and resale condos alike.

If you’d like to get in touch for a more in-depth consultation, you can do so here.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Singapore Property News

Singapore Property News Clementi 4-Room HDB Sold For Record $1.28 Million – Here’s What Makes It So Special

Singapore Property News The Trick to Seeing Through a Condo Showflat (Most Buyers Never Do This)

Singapore Property News So Is The 99-1 Property Split Strategy Legal Or Not?

Singapore Property News Higher 2025 Seller’s Stamp Duty Rates Just Dropped: Should Buyers And Sellers Be Worried?

Latest Posts

On The Market 5 Biggest HDB Flats Over 1,700 Sqft From $950k

Pro 2 Reasons Costa Del Sol Underperformed—Despite Its Seafront Location And Family Appeal

Homeowner Stories I’ve Lived in Twin VEW for Four Years: What It’s Like Living Without an MRT Nearby

Editor's Pick The Surprising Truth Behind Singapore’s Longest Held Condos – And Why Residents Refuse To Sell After 20 Years

Pro 7 Reasons Reflections at Keppel Bay Underperformed—Despite Its Iconic Design and Prime Waterfront Location

Editor's Pick This New River Valley Condo Starts At $1.2M: And It’s Cheaper Than Some City-Fringe Launches

New Launch Condo Analysis This New 376-Unit Condo In Sembawang Might Be The Best Pick For Young Families: Here’s Why

Editor's Pick Where To Find Freehold Semi-D Landed Homes From $4.4m: Touring Gilstead Road

Editor's Pick Can You Really Buy A House In Italy For €1? Here’s What Singaporeans Should Know

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?

Property Market Commentary We Tracked The Rise Of Million-Dollar HDB Flats By Estate — And The Results May Surprise You

Editor's Pick LyndenWoods Condo Pricing Breakdown: We Compare Its Pricing Against Bloomsbury Residences, Normanton Park & One-North Eden