We Make $294k Per Year: Should We Sell Our 5-Room HDB To Upgrade To A New Launch Or Buy 2 Properties Instead?

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

Hi. I love how stacked homes does unbiased reviews and advice the general public which is simple to understand coupled with realistic statistics.

I would like to seek advice whether which makes more sense to us.

My wife and I are 35 and 38 respectively. Our income is $8,500 and $14,000 respectively. We have 2 children aged 3 and 1. We have no helper and our parents stay over our house during weekdays to help take care of the children.

We live in a 5 room hdb in the west that has MOP-ed few months ago. Our loan has been cleared and we have about combined 30k in cpf + about 200k in cash that can be set aside for the purchase. Some neighbour sold similar 5 rooms in the estate priced between 750k to 790k.

We are looking at upgrading to condo to let our children enjoy the facilities. We now face a dilemma of whether to:

1. Upgrade to larger, newer condo ( >1,100 sqft) in the west/central based on new launches. We can move to parents house temporarily until condo is ready.

2. Sell 1 buy 2. In this case, we are looking at buying a resale (< 10 years, > 1,100 sqft) in the west, and another unit anywhere to rent out.

Some primary considerations we have for own stay: (priority in descending order)

1. Balcony/rooms not directly facing east/west to avoid direct sun into the house.

2. Within 1km to a school (which at least ranks in the middle)

3. Short walking distance to the school (<10 mins walk)

4. Nearby amenities (<10 min walk)

5. Size (minimally 1,100 sqft if layout is optimal, e.g. landscape living room, short corridor to rooms)

6. Unblocked view to parks/sea or high floor

I have no outstanding loan and the cpf used + accrued interest is about 475k.

Hello,

Thank you for reaching out to us, and for the kind words.

Your current situation is one that many other HDB upgraders can relate to. Having made a tidy sum from the BTO purchase, it’s natural for homeowners to start considering their next steps, particularly when their living requirements evolve.

As with many other homeowners, both your choices can basically be simplified to do you prioritise liveability and quality of life more, or the potential for more profits with an investment property.

In this piece, we’ll look at:

- Your estimated affordability based on the information you’ve provided.

- What are some options and the associated costs of buying a new launch in the west?

- Whether or not it also makes sense to consider a resale condo

- How the sell 1 buy 2 strategies would play out for you?

- A possible alternative solution for you

- Which strategy would be best based on the numbers?

Now before delving into the various options you’re considering, let’s begin by assessing your affordability:

Affordability

First, let’s look at how much you can sell your HDB for. Here are the recent transactions over the past 3 months from your HDB development:

| Date | Level | Sale price |

| Jun 2023 | 13 to 15 | $753,888 |

| Jun 2023 | 10 to 12 | $770,000 |

| May 2023 | 04 to 06 | $730,000 |

| May 2023 | 07 to 09 | $793,000 |

| May 2023 | 07 to 09 | $746,000 |

| May 2023 | 13 to 15 | $760,000 |

| May 2023 | 04 to 06 | $682,000 |

| May 2023 | 07 to 09 | $703,888 |

| May 2023 | 07 to 09 | $723,000 |

| Apr 2023 | 07 to 09 | $745,000 |

| Apr 2023 | 13 to 15 | $760,000 |

| Apr 2023 | 13 to 15 | $743,888 |

| Apr 2023 | 07 to 09 | $760,000 |

| Apr 2023 | 13 to 15 | $790,000 |

| Apr 2023 | 04 to 06 | $705,000 |

| Apr 2023 | 04 to 06 | $710,000 |

| Apr 2023 | 07 to 09 | $720,000 |

In total, there have been eighteen 5-room transactions with an average sale price of $740,921. We will round this up to $741,000 for calculation purposes.

Selling Calculations

| Description | Amount |

| Estimated sale price | $741,000 |

| Outstanding loan | $0 |

| CPF used and accrued interest to be returned into OA | $475,000 |

| Cash proceeds | $266,000 |

Combined affordability

| Description | Amount |

| Maximum loan based on ages of 35 and 38, fixed monthly combined income of $22,500 and interest rate of 4.6% | $2,335,641 (28 years tenure) |

| CPF funds ($475,000 + $30,000) | $505,000 |

| Cash ($266,000 + $200,000) | $466,000 |

| Total loan + CPF + Cash | $3,306,641 |

| BSD based on $3,306,641 | $137,998 |

| Estimated affordability | $3,168,643 |

Wife’s affordability

| Description | Amount |

| Maximum loan based on age of 35 and fixed monthly income of $8,500 with a 4.6% interest | $911,938 (30 years tenure) |

| CPF funds (We are assuming the total CPF funds of $505K is split equally) | $252,500 |

| Cash ($466K of cash split equally) | $233,000 |

| Total loan + CPF + Cash | $1,397,438 |

| BSD based on $1,397,438 | $40,497 |

| Estimated affordability | $1,356,941 |

Husband’s affordability

| Description | Amount |

| Maximum loan based on the age of 38 and fixed monthly income of $14,000 with a 4.6% interest | $1,427,193 (27 years tenure) |

| CPF funds (We are assuming the total CPF funds of $505K is split equally) | $252,500 |

| Cash ($466K of cash split equally) | $233,000 |

| Total loan + CPF + Cash | $1,912,693 |

| BSD based on $1,912,693 | $65,234 |

| Estimated affordability | $1,847,459 |

Now that we have a better understanding of your financial capacity, let’s look at the options you’re considering.

Options

Option 1: Upgrade to a larger, new launch condo in the West/Central region

With a budget of $3.1M, these are some new launches that match your requirements in terms of budget, size, location, and proximity to a decently ranked school and amenities.

| Project | Tenure | Estimated TOP | District | Size (sq ft) | No. of bedrooms | Price |

| Blossoms by the Park | 99 years | 2027 | 05 | 1,227 | 3 | $2,843,000 |

| The Botany at Dairy Farm | 99 years | 2027 | 23 | 1,206 | 3 | $2,362,000 |

| The Reserve Residences | 99 years | 2028 | 21 | 1,119 | 3 | $2,944,829 |

| Pinetree Hill | 99 years | 2027 | 21 | 1,163 | 3 | ~$2.6 million |

Please note that these developments have been selected solely based on their affordability and alignment with your requirements, but they may or may not be suitable for you.

In short, The Botany at Dairy Farm will probably be the weakest link here if proximity to a good primary school is important. The Reserve Residences will be the top choice here, as it’s close to both Pei Hwa Primary and Methodist Girls Primary. Blossoms by the Park has Fairfield Primary, while Pinetree Hill can count the popular Henry Park Primary to be within the 1 km radius.

Bear in mind that buying a property strictly for school entry is a very risky proposition – so it’s good to set some expectations. There is no guarantee that your child can enrol in your school of choice. But at least you can stand a chance if you are within a 1km radius of a popular school.

You also mentioned enjoying the facilities for your kids as a primary reason for the upgrade. And for that reason, Blossoms by the Park may come up short here as compared to the other 3 projects. The standard for condo facilities today is high, so picking between the 3 based on facilities is really going to be by slim margins – you’d be better off looking at the number of units (so less chance for crowds) to decide.

Going by that The Botany at Dairy Farm and Pinetree Hill will be strong candidates, given that they have fewer units for their respective land sizes.

That said, considering your preference for having a primary school nearby, we assume that you plan to stay in the unit at least until your children complete their primary education, which is estimated to be around 11 years, given that your youngest child is only a year old.

We have previously touched on the topic of how buying a new launch does not necessarily guarantee profits and you can read more on that here. With that being said, an alternative worth considering is the purchase of a resale project with a freehold or 999-year leasehold tenure.

Given your extended holding period, this option may be suitable since such developments typically demonstrate better value retention and long-term growth potential.

These are some freehold/999-year leasehold developments that match your requirements in terms of budget, size, location, and proximity to a decently-ranked school and amenities.

| Project | Tenure | Completion year | District | Size (sqft) | No. of bedrooms | Price |

| Country Grandeur | Freehold | 1996 | 20 | 1,442 | 3 | $2,780,000 |

| Blossomvale | 999 year | 1999 | 21 | 1,335 | 3 | $2,950,000 |

| Southaven II | 999 year | 2000 | 21 | 1,410 | 3 | $2,600,000 |

As before, these developments have been selected solely based on their affordability and alignment with your requirements and we highly recommend a consultation for a more comprehensive analysis.

We will now examine the expenses associated with the purchase of both a new launch property and a resale property.

Let’s say you were to purchase a unit at Blossoms by the Park for $2,843,000.

| Description | Amount |

| Purchase price | $2,843,000 |

| CPF funds | $505,000 |

| Cash | $466,000 |

| BSD | $111,750 |

| Loan required after deducting CPF and cash | $1,983,750 |

| Booking fee (5% cash) | $142,150 |

| Completion (15% cash/CPF) | $426,450 |

| Foundation stage (5% cash/CPF) | $142,150 |

| Total downpayment | $710,750 |

The following is the progressive payment plan. We are using an interest rate of 4.6% and the longest duration for each stage. Do note that interest costs fluctuates and that the use of 4.6% is simply a reflection of the high-interest environment today.

| Stage | % of purchase price | Disbursement amount | Monthly estimated payment | Monthly estimated interest | Monthly estimated principal | Duration | Total interest cost |

| Completion of foundation | 0% | $0 | $0 | $0 | $0 | 6-9 months (from launch) | $0 |

| Completion of reinforced concrete | 9% | $255,870 | $1,356 | $981 | $375 | 6-9 months | $8,829 |

| Completion of brick wall | 5% | $142,150 | $2,109 | $1,526 | $583 | 3-6 months | $9,156 |

| Completion of ceiling/roofing | 5% | $142,150 | $2,862 | $2,071 | $791 | 3-6 months | $12,426 |

| Completion of electrical wiring/plumbing | 5% | $142,150 | $3,615 | $2,616 | $1,000 | 3-6 months | $15,696 |

| Completion of roads/car parks/drainage | 5% | $142,150 | $4,368 | $3,160 | $1,208 | 3-6 months | $18,960 |

| Issuance of TOP | 25% | $710,750 | $8,134 | $5,885 | $2,249 | Usually a year before CSC | $70,620 |

| Certificate of Statutory Completion (CSC) | 15% | $426,450 | $10,394 | $7,520 | $2,874 | Monthly repayment until property is sold (78 months until 11 year mark) | $586,560 |

Cost of purchasing a new launch and staying until your youngest child finishes primary school:

| Description | Amount |

| BSD | $111,750 |

| Interest expense | $722,247 |

| Maintenance fee (Assuming $400/month) | $36,000 |

| Property tax | $57,085 |

| Total cost | $927,082 |

In total, the cost of purchasing a new launch property and holding it for 11 years is $927,082.

What about buying a resale property instead? Let’s assume you purchase the Blossomvale unit at $2,950,000.

| Description | Amount |

| Purchase price | $2,950,000 |

| CPF funds | $505,000 |

| Cash | $466,000 |

| BSD | $117,100 |

| Loan required after deducting CPF and cash | $2,096,100 |

Cost of purchasing a resale property and staying for 11 years:

| Description | Amount |

| BSD | $117,100 |

| Interest expense | $939,633 |

| Maintenance fee (Assuming $500/month) | $66,000 |

| Property tax | $98,890 |

| Total cost | $1,221,623 |

You immediately see that buying a resale property incurs a higher cost, assuming all other things equal. Why?

That’s because the loan is disbursed periodically and there are no maintenance fees or property taxes to be paid during the construction years.

Although it must be said, we didn’t take into account the rental costs when buying a new launch given you mentioned you are able to stay with your parents. There is an additional benefit to buying a resale here, as you are able to move in almost immediately. There’s less stress and adjustment of having to move twice as compared to moving to your parents, and then to a new launch later on.

Of course, it’s crazy to imagine paying over a million dollars in costs over 10 years. This is far-fetched as we did not account for property price growth.

So let’s do a simple projection to determine the potential profits in both situations. It’s important to note that these estimations are rudimentary and intended only as a rough guideline. Depending on market conditions, the actual outcomes may differ from the projections. We’ll also be keeping projections the same across both comparisons so that we can better compare strategies.

We’ll gauge our annualised returns by looking at the Property Price Index (PPI) of private residential properties:

For our purpose, we’ll only be looking at the past 10 years’ worth of data – 2012 to 2022. This results in an annualised growth rate of 2.21%.

Over an 11-year period, here’s what the capital gains look like:

| Time period | Capital gains |

| Starting point | $0 |

| Year 1 | $62,830 |

| Year 2 | $127,049 |

| Year 3 | $192,687 |

| Year 4 | $259,776 |

| Year 5 | $328,347 |

| Year 6 | $398,434 |

| Year 7 | $470,070 |

| Year 8 | $543,289 |

| Year 9 | $618,126 |

| Year 10 | $694,616 |

| Year 11 | $772,798 |

Taking the cost of $927,082 into consideration, you could potentially make a loss of $154,284. This is natural given the assumed high interest rate environment continues for 11 years. If interest rates were lower on average, you could turn a profit.

Now, let’s do a similar projection for the scenario where you purchase a resale unit at Blossomvale. We will use the same annualised growth rate of 2.21%.

| Time period | Capital gains |

| Starting point | $ – |

| Year 1 | $65,195 |

| Year 2 | $131,831 |

| Year 3 | $199,939 |

| Year 4 | $269,553 |

| Year 5 | $340,705 |

| Year 6 | $413,430 |

| Year 7 | $487,761 |

| Year 8 | $563,736 |

| Year 9 | $641,390 |

| Year 10 | $720,759 |

| Year 11 | $801,883 |

Taking the cost of $1,221,623 into consideration, you could potentially make a loss of $419,740.

By assuming a similar growth rate, it’s evident that the potential financial loss associated with purchasing a new launch property is considerably less compared to buying a resale property.

The reduced expenses resulting from the deferred payment plan and the exclusion of maintenance and property tax payments during the construction period make a significant impact.

What this means is that in a high-interest rate environment, purchasing a new launch is financially less expensive as you wouldn’t have to borrow everything right away – and the cost of ownership only increases once the development TOPs. This would normally be offset by the fact that you’d have to rent a place to stay, but in your case, staying with your parents is an option.

The alternative is to purchase the resale property and rent it out right away for rental income. You’ll then stay with your parents. While it sounds great, the cost of ownership plus the high-interest environment would more or less negate your rental income. Let’s not forget that property tax on non-owner occupied properties is much higher than owner-occupied ones. In this case, it may not make a lot of sense to buy a resale property just to rent it out and move in with your parents.

Nevertheless, it is crucial to recognise that the performance of individual projects differs, and the profitability of your investment ultimately relies on the particular property you choose to purchase.

Now let’s consider your second option:

Option 2: Sell the HDB and buy 2 properties

Buying 2 properties sounds great on the surface but it comes with 1 main sacrifice – your own stay-home may not be as big, or as centrally-located (depending on your criteria).

This means that you may not be able to find one that fulfils all your requirements.

These are some of the available units on the market that matches your requirements as much as possible. We will assume the higher affordability of $1.8M for your own stay property.

| Project | Tenure | Completion year | District | Size (sq ft) | No. of bedrooms | Price |

| Westwood Residences | 99 years | 2018 | 22 | 1,238 | 4 | $1,500,000 |

| Wandervale | 99 years | 2019 | 23 | 1,130 | 3 | $1,430,000 |

| Sol Acres | 99 years | 2019 | 23 | 1,163 | 4 | $1,650,000 |

Regarding the investment property, we will look at 2-bedroom units as they generally possess stronger resale potential and will attract a larger pool of buyers compared to 1-bedroom units. Here are a few relatively new developments priced below $1.3M that currently offer favourable rental yields.

| Project | Tenure | Completion year | District | Size (sq ft) | Unit type | Price | Avg rent (Mar – May) | Avg rental yield |

| Sol Acres | 99 years | 2019 | 23 | 732 | 2b2b | $1,050,000 | $3,433 | 3.9% |

| Twin VEW | 99 years | 2021 | 05 | 743 | 2b2b | $1,300,000 | $4,675 | 4.3% |

| Grandeur Park Residences | 99 years | 2021 | 16 | 581 | 2b1b | $1,210,000 | $3,983 | 4% |

Similarly, we will look at the cost involved and also do a simple projection to determine the potential profits. We will be using the same annualised growth rate of 2.21% as in option 1 as a fair comparison.

Let’s say you were to purchase a unit at Wandervale for your own stay and another one at Twin VEW for investment and hold them for 11 years, here’s how it could play out:

Purchase your own stay unit at Wandervale

In Q2 2023, there were 24 3-bedroom transactions made in Wandervale with an average price of $1,394,912. We will use this as the purchase price.

| Description | Amount |

| Purchase price | $1,394,912 |

| CPF funds | $252,500 |

| Cash | $233,000 |

| BSD | $40,396 |

| Loan required after deducting CPF and cash | $949,808 |

Cost of purchasing a unit at Wandervale and staying for 11 years:

| Description | Amount |

| BSD | $40,396 |

| Interest expense (27 year tenure with a 4.6% interest rate) | $422,151 |

| Maintenance fee (Assuming $350/month) | $46,200 |

| Property tax | $18,315 |

| Total cost | $527,062 |

| Time period | Capital gains |

| Starting point | $0 |

| Year 1 | $30,828 |

| Year 2 | $62,336 |

| Year 3 | $94,542 |

| Year 4 | $127,459 |

| Year 5 | $161,103 |

| Year 6 | $195,491 |

| Year 7 | $230,639 |

| Year 8 | $266,563 |

| Year 9 | $303,282 |

| Year 10 | $340,812 |

| Year 11 | $379,172 |

Taking the cost of $527,062 into consideration, the potential loss made after 11 years is $147,890.

Now let’s look at the 2-bedroom investment unit:

In Q2 2023, there were two 2-bedroom transactions made in Twin VEW with an average sale price of $1,279,000. We will use this as the purchase price.

| Description | Amount |

| Purchase price | $1,279,000 |

| CPF funds | $252,500 |

| Cash | $233,000 |

| BSD | $35,760 |

| Loan required after deducting CPF and cash | $829,260 |

Cost of purchasing a unit at Twin VEW and renting it out for 11 years:

| Description | Amount |

| BSD | $35,760 |

| Interest expense (30 year tenure with a 4.6% interest rate) | $377,354 |

| Maintenance fee (Assuming $300/month) | $39,600 |

| Property tax | $106,788 |

| Rental income (Assuming rent of $4,675/month and no vacancy period) | $617,100 |

| Agency fees (Payable once every 2 years) | $25,245 |

| Total profits | $32,353 |

| Twin VEW Purchase | Property Price (2.21% Growth) | Capital Gains |

| Purchased At | $1,279,000 | |

| Year 1 | $1,307,266 | $28,266 |

| Year 2 | $1,336,156 | $57,156 |

| Year 3 | $1,365,686 | $86,686 |

| Year 4 | $1,395,867 | $116,867 |

| Year 5 | $1,426,716 | $147,716 |

| Year 6 | $1,458,246 | $179,246 |

| Year 7 | $1,490,474 | $211,474 |

| Year 8 | $1,523,413 | $244,413 |

| Year 9 | $1,557,080 | $278,080 |

| Year 10 | $1,591,492 | $312,492 |

| Year 11 | $1,626,664 | $347,664 |

Adding the profits of $32,353, the potential profits made after 11 years is $347,664 $380,017 *Editor’s note: Corrected calculations*

Total profits from both properties: $380,017 $232,127

From a financial standpoint, it’s obvious that selling your HDB to buy 2 properties results in a better financial outcome. Why? Because a part of your property budget is put into an income-producing asset – Twin VEW. If you had purchased just 1 property, the entire budget is spent on an own-stay home instead.

This is why selling your HDB to buy 2 properties could possibly yield a profit of $380,017 $232,127 compared to option 1 which yields a loss of $154,284 and $419,740 for a new and resale property purchase respectively.

Aside from the dollars and cents, another notable benefit of purchasing two properties is the clear separation between your primary residence and your investment.

This means that if you decide to sell the investment property, your living situation remains unaffected. Furthermore, acquiring two properties helps diversify risk, and by renting out the investment property, the rental income acts as a buffer and helps to partially offset monthly expenses while you wait for property prices to appreciate.

As we’ve stressed before, the profitability of any investment ultimately hinges on the specific project you choose.

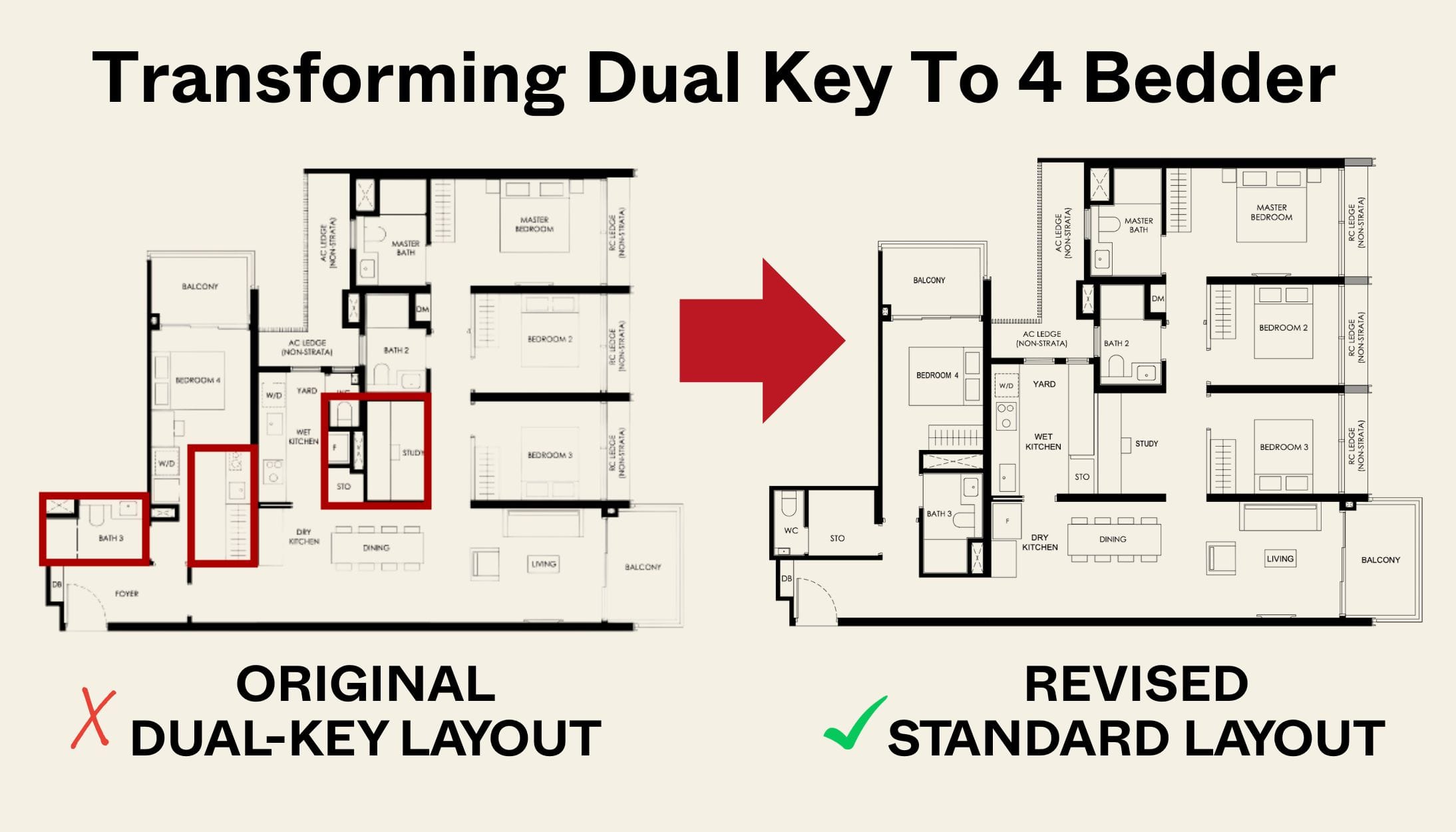

Since we are on the topic of buying one for own stay and another for investment, our minds naturally turn to such a product designed for this use case: dual-key units.

Option 3: Buy a dual-key unit

With a dual key unit, you have the advantage of residing in the property while simultaneously renting out a portion of it while still maintaining your privacy.

However, your preferences for the Western/Central region and proximity to a reputable school may limit the choices since this unit type is not available in every development.

Currently, there is one property that meets these criteria available on the market:

| Project | Tenure | Completion year | District | Size (sqft) | No. of bedrooms | Price |

| Whistler Grand | 99 years | 2022 | 05 | 1,270 | 4 (3 + Studio) | $2,399,999 |

One possible drawback of a dual key unit is that it caters to a specific audience: buyers who desire to reside in the property while generating rental income and preserving their privacy, or families who want to live together while having individual spaces.

Consequently, when it comes to selling the property in the future, it may prove more challenging compared to a conventional 3 or 4-bedroom unit.

Let’s look at the costs involved in this scenario. We are assuming an interest rate of 4.6% on the loan.

| Description | Amount |

| Purchase price | $2,399,999 |

| CPF funds | $505,000 |

| Cash | $466,000 |

| BSD | $89,599 |

| Loan required after deducting CPF and cash | $1,518,598 |

Cost of purchasing a unit at Whistler Grand and renting out the studio for 11 years:

| Description | Amount |

| BSD | $89,599 |

| Interest expense | $680,752 |

| Maintenance fee (Assuming $420/month) | $55,440 |

| Property tax | $60,280 |

| Rental income (Assuming $2,500/month and no vacancy period) | $330,000 |

| Agency fee (Payable once every 2 years) | $13,500 |

| Total cost | $569,571 |

We will also do a simple projection for an 11-year holding period, employing the same average annualised growth rate of 2.21%.

| Time period | Capital gains |

| Starting point | $0 |

| Year 1 | $53,040 |

| Year 2 | $107,252 |

| Year 3 | $162,662 |

| Year 4 | $219,297 |

| Year 5 | $277,184 |

| Year 6 | $336,349 |

| Year 7 | $396,823 |

| Year 8 | $458,632 |

| Year 9 | $521,808 |

| Year 10 | $586,380 |

| Year 11 | $652,379 |

Taking into consideration the costs of $569,571, the potential profits after 11 years is $82,808.

To summarise…

Here’s a look at your total profits at the end of 11 years based on the different options:

Option #1A – Buy a new launch and move in with your parents = Loss of $154,284

Option #1B – Buy a resale property and move in = Loss of $419,740

Option #2 – Sell your HDB, and buy 2 private property = Profit of 347,664

Option #3 – Sell your HDB, buy a dual-key unit = Profit of $82,808

Options 2 and 3 are more profitable given the the utilisation of your property to draw rental income. If we’re going purely by this metric, options 2 and 3 would be our choice.

However, there are many fundamental reasons why just looking at just these numbers do not make sense.

When buying a new launch, you have an advantage of choice right at the start. Even though balloting is the norm now, it’s still much easier to buy a new launch property with the number of units available. Moreover, buying a resale property is really dependent on whether there’s supply, to begin with – and we’re still in a low-supply situation today.

While our study has shown that the average profits between new and resale purchases are quite similar, it is easier to identify value buys in new launches compared to sporadic resale units hitting the market. This is because developers may misprice (lower or higher) their units, and it’s just a lot easier to pick between different stacks based on their price differences to gun for a unit that’ll likely appreciate more.

However, it is important to consider whether residing at your parent’s place for a 3-4 year duration is a feasible solution, as your children are growing and may require more space. Renting a place during this period can incur significant costs.

Opting for a resale property may cost the most, but you do get to move in right away. This is a huge advantage from a lifestyle perspective as you wouldn’t have to deal with privacy issues when staying with your family.

Opting to buy 2 properties allows you to keep your primary home and investment property separate, providing greater flexibility. If the investment property performs well and you decide to sell it, your living situation will remain unaffected. Renting out the unit also helps offset mortgage expenses and reduces costs.

The last option of purchasing a dual key unit offers a combination of benefits. However, selling the property in the future may pose challenges due to the smaller target audience for this unit type. As an own-stay home, you may not like the idea of sharing the same front entrance as your tenant – particularly if you don’t get along.

Have a question to ask? Shoot us an email at hello@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

We hope that our analysis will help you in your decision-making. If you’d like to get in touch for a more in-depth consultation, you can do so here.

Read next from Property Advice

Property Advice We Ranked The Most Important Things To Consider Before Buying A Property In Singapore: This One Came Top

Property Advice Why Punggol Northshore Could Be The Next Hotspot In The HDB Resale Market

Property Advice How Much Is Your Home Really Worth? How Property Valuations Work in Singapore

Property Advice Why I Had Second Thoughts After Buying My Dream Home In Singapore

Latest Posts

New Launch Condo Analysis This New 376-Unit Condo In Sembawang Might Be The Best Pick For Young Families: Here’s Why

Landed Home Tours Where To Find Freehold Semi-D Landed Homes From $4.4m: Touring Gilstead Road

Singapore Property News The Trick to Seeing Through a Condo Showflat (Most Buyers Never Do This)

Overseas Property Investing Can You Really Buy A House In Italy For €1? Here’s What Singaporeans Should Know

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?

Property Market Commentary We Tracked The Rise Of Million-Dollar HDB Flats By Estate — And The Results May Surprise You

Editor's Pick LyndenWoods Condo Pricing Breakdown: We Compare Its Pricing Against Bloomsbury Residences, Normanton Park & One-North Eden

Property Market Commentary 2-Bedder vs 2+Study Units: Which Condo Layout Has Better Returns Over The Last Decade?

Homeowner Stories Does The “Sell One, Buy Two” Strategy Still Work In 2025? 3 Real Stories From Singapore Homeowners

Editor's Pick Where $4 Million Semi-Ds Sit Next To $40 Million GCBs: Touring First Avenue In Bukit Timah

Singapore Property News So Is The 99-1 Property Split Strategy Legal Or Not?

New Launch Condo Reviews Transforming A Dual-Key Into A Family-Friendly 4-Bedder: We Revisit Nava Grove’s New Layout

Should Option 3’s profit net off the loss from staying at the Wandervale for 11 years?