Condo Progressive Payment in Singapore – All you need to know

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

Druce is the Chief Editor at the Stacked Editorial. He was first interested in property since university but never had any aspiration to become an agent, so this is probably the next best thing.

With many new developments slated to launch in Singapore in 2019 after the en bloc spree, it is definitely a buyers market right now. If you are currently looking out for all the new condo launches, one crucial aspect that you will need to know is about how the condo progressive payment works.

So since we are talking about new launches that have not been constructed yet, one big advantage for you as a buyer is that you do not have to make the full payment right at the start. This means that a new launch that has a condo progressive payment scheme is an attractive option for buyers as you can stretch out your repayments over a longer time. The payments are set out in milestones from the beginning, and these would only have to be paid up when the developer attains the set milestone. Thus, it is seen as less of an undertaking as the payments are spread out up until the Temporary Occupation Permit (TOP) is issued. After which you will have to pay quite a big lump sum of 25%.

Let us look at an example of a typical condo progressive payment in Singapore.

Assuming a condo purchase price of $1.5 million, this would be the usual progressive payment scheme you will see.

| Stage | % of Purchase Price | Amount SGD ($) |

| Upon grant of Option to Purchase | 5% (booking fee) | $75,000 |

| Upon signing of the Sale & Purchase Agreement or within 8 weeks from the option date | 15% | $225,000 |

| Stamp Duty (1st Property) This is payable within 2 weeks of sining the Sale & Purchase Agreement | $44,600 | |

| Completion of foundation work | 10% | $150,000 |

| Completion of reinforced concrete framework | 10% | $150,000 |

| Completion of partition walls of unit | 5% | $75,000 |

| Completion of ceiling of the unit | 5% | $75,000 |

| Completion of door and window frames, electrical wiring, internal plastering and plumbing of unit | 5% | $75,000 |

| Completion of car park, roads and drains serving the housing project | 5% | $75,000 |

| Temporary Occupation Permit or Certificate of Statutory Completion | 25% | $375,000 |

| On Completion Date | 15% | $225,000 |

Property Investment InsightsUltimate New Launch Cheat Sheet 2020 (Land Price, PSF PPR, Take Up Rate)

by SeanNote that in the scenario legal completion of the Sale & Purchase Agreement occurs before the issue of the Certificate of Statutory Completion (CSC), 2% will be paid to the developer on legal completion and the remaining 13% will be paid to the Singapore Academy of Law (SAL) as the stakeholder.

If the CSC is issued before the legal completion of the Sale & Purchase Agreement, 13% will have to be paid within 14 days after the buyer receives notice of the CSC. The final 2% will have to be paid to the developer upon legal completion.

So that is it for all you need to know about condo progressive payment in Singapore! As always feel free to leave a comment below or you can always reach us at hello@stackedhomes.com! If you need help to calculate, here is a useful calculator from moneyiq!

Druce Teo

Druce is the Chief Editor at the Stacked Editorial. He was first interested in property since university but never had any aspiration to become an agent, so this is probably the next best thing.Read next from Property Advice

Property Advice We Ranked The Most Important Things To Consider Before Buying A Property In Singapore: This One Came Top

Property Advice Why Punggol Northshore Could Be The Next Hotspot In The HDB Resale Market

Property Advice How Much Is Your Home Really Worth? How Property Valuations Work in Singapore

Property Advice Why I Had Second Thoughts After Buying My Dream Home In Singapore

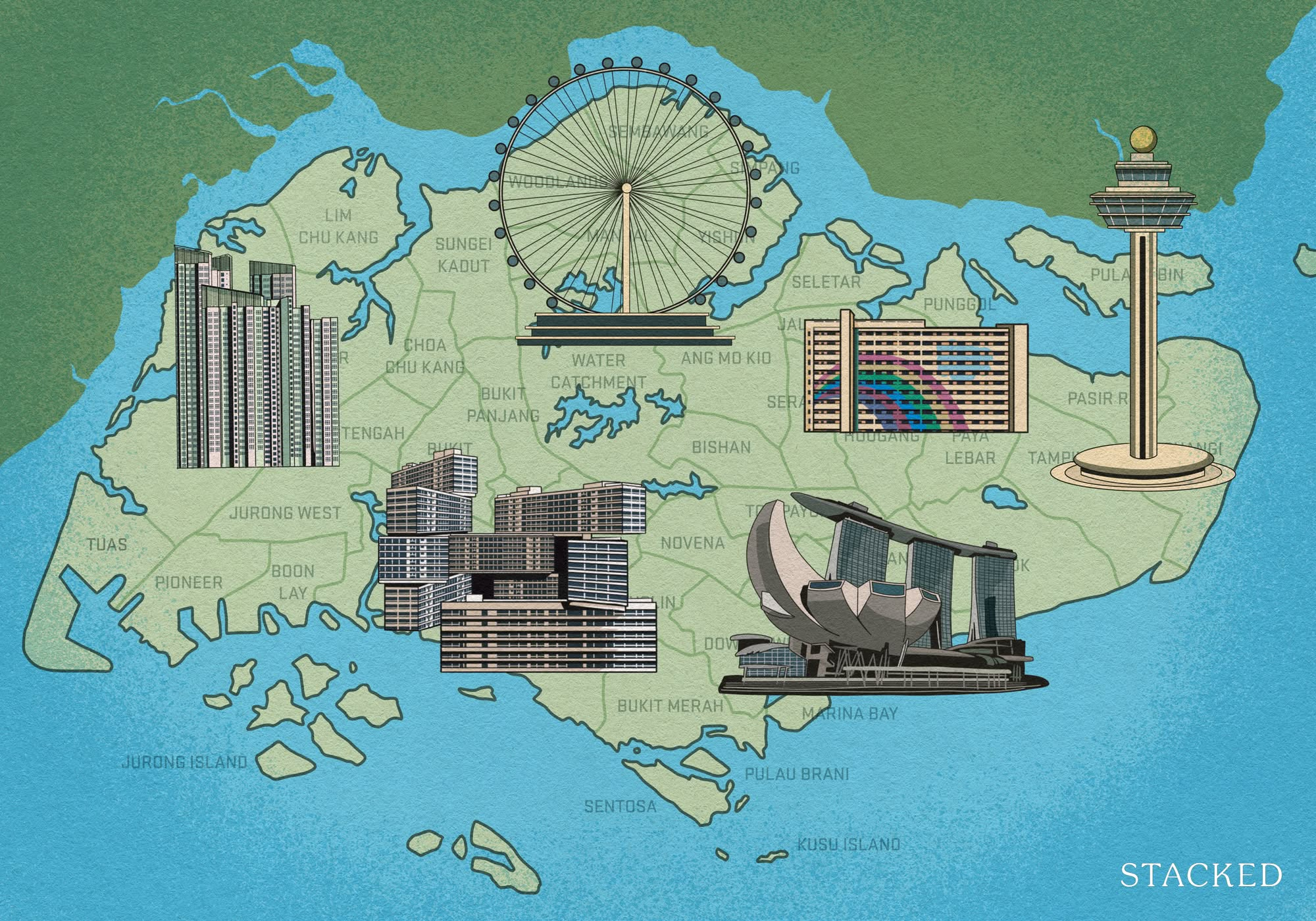

Latest Posts

New Launch Condo Reviews LyndenWoods Condo Review: 343 Units, 3 Pools, And A Pickleball Court From $1.39m

Landed Home Tours We Tour Affordable Freehold Landed Homes In Balestier From $3.4m (From Jalan Ampas To Boon Teck Road)

Singapore Property News Is Our Housing Policy Secretly Singapore’s Most Effective Birth Control?

Property Market Commentary Why More Young Families Are Moving to Pasir Ris (Hint: It’s Not Just About the New EC)

On The Market A 10,000 Sq Ft Freehold Landed Home In The East Is On The Market For $10.8M: Here’s A Closer Look

On The Market 5 Spacious Old But Freehold Condos Above 2,650 Sqft

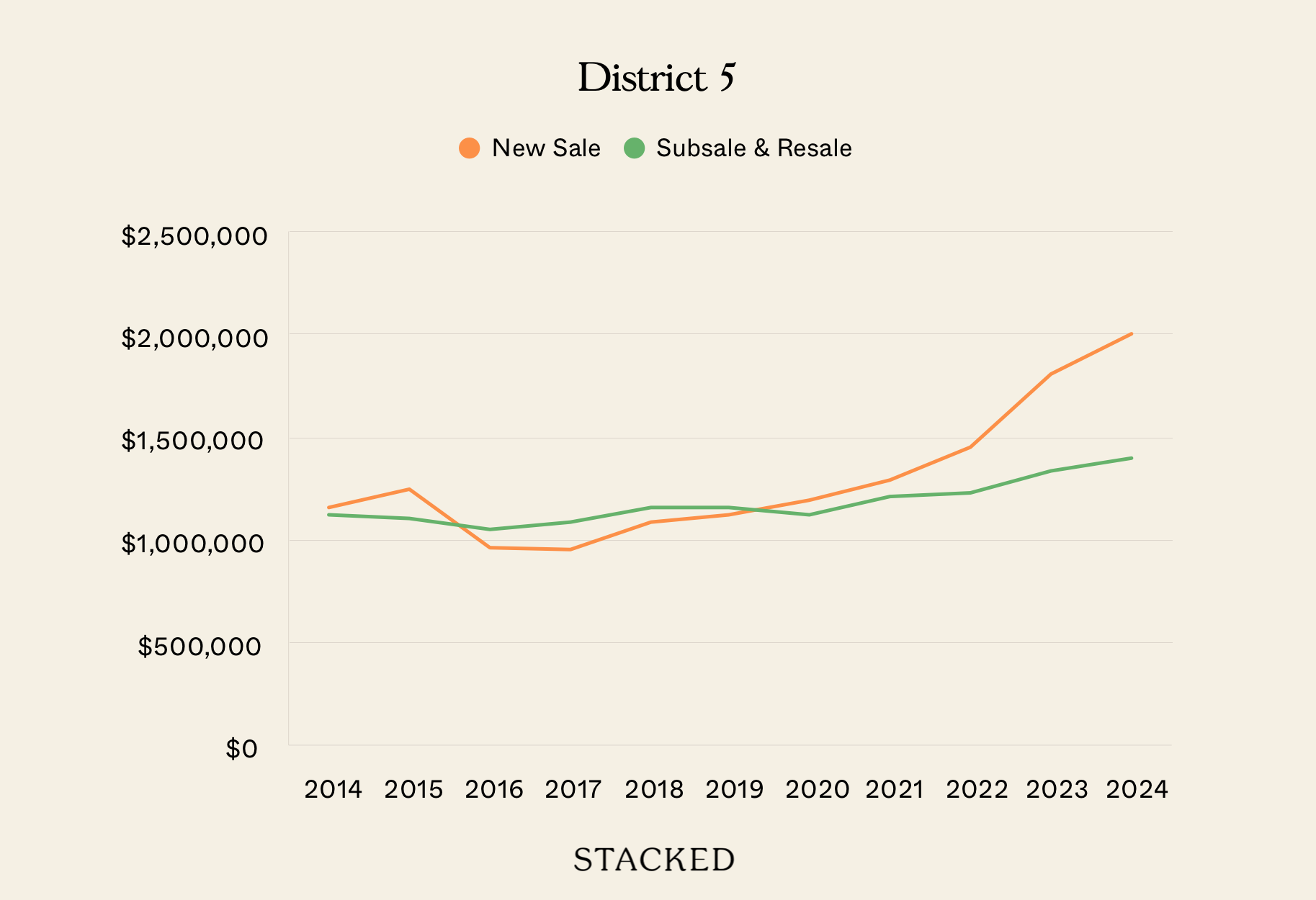

Property Investment Insights We Compared New Launch And Resale Condo Prices Across Districts—Here’s Where The Price Gaps Are The Biggest

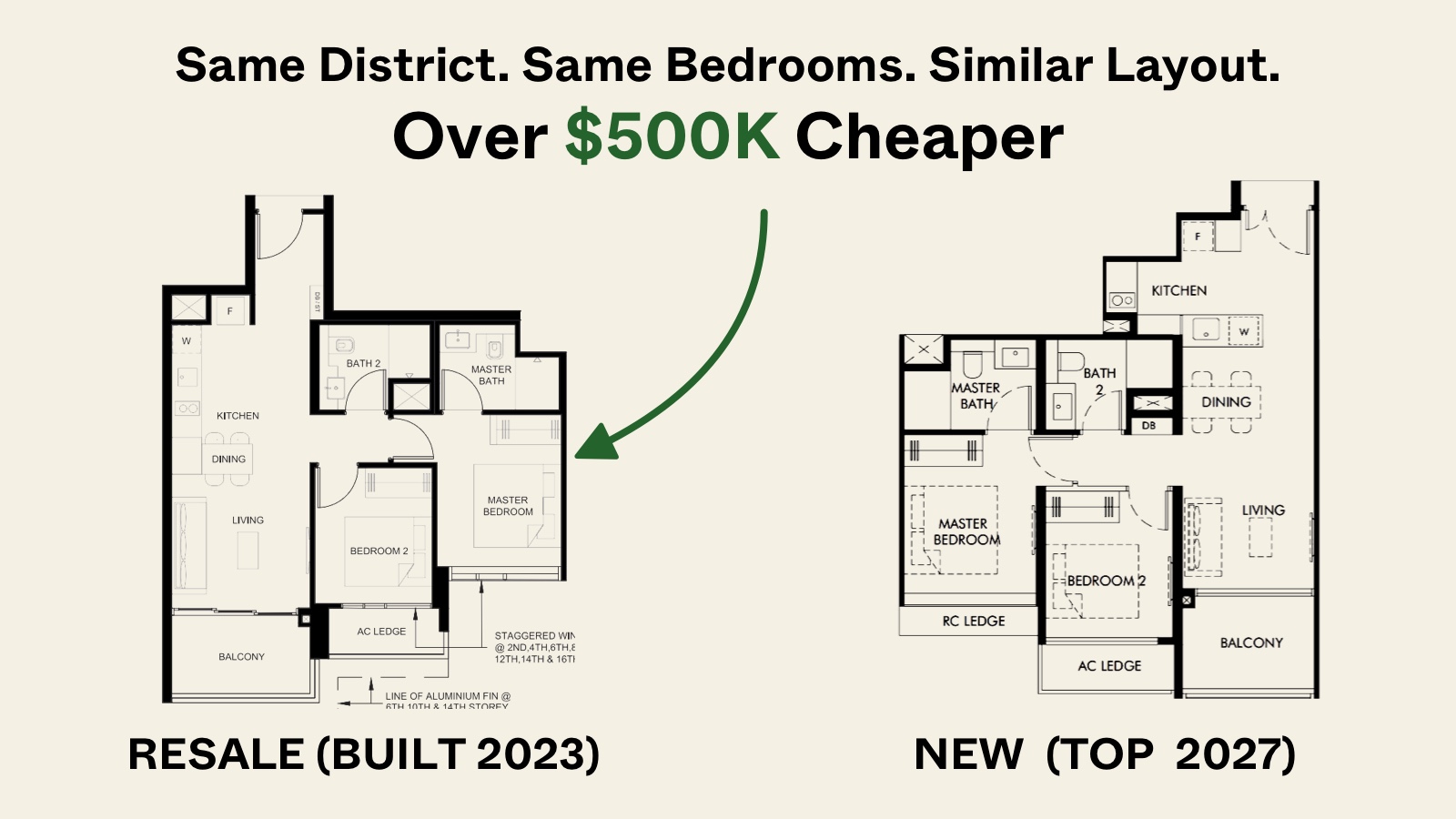

Pro Similar Layout, Same District—But Over $500K Cheaper? We Compare New Launch Vs Resale Condos In District 5

New Launch Condo Analysis The First New Condo In Science Park After 40 Years: Is LyndenWoods Worth A Look? (Priced From $2,173 Psf)

Editor's Pick Why The Johor-Singapore Economic Zone Isn’t Just “Iskandar 2.0”

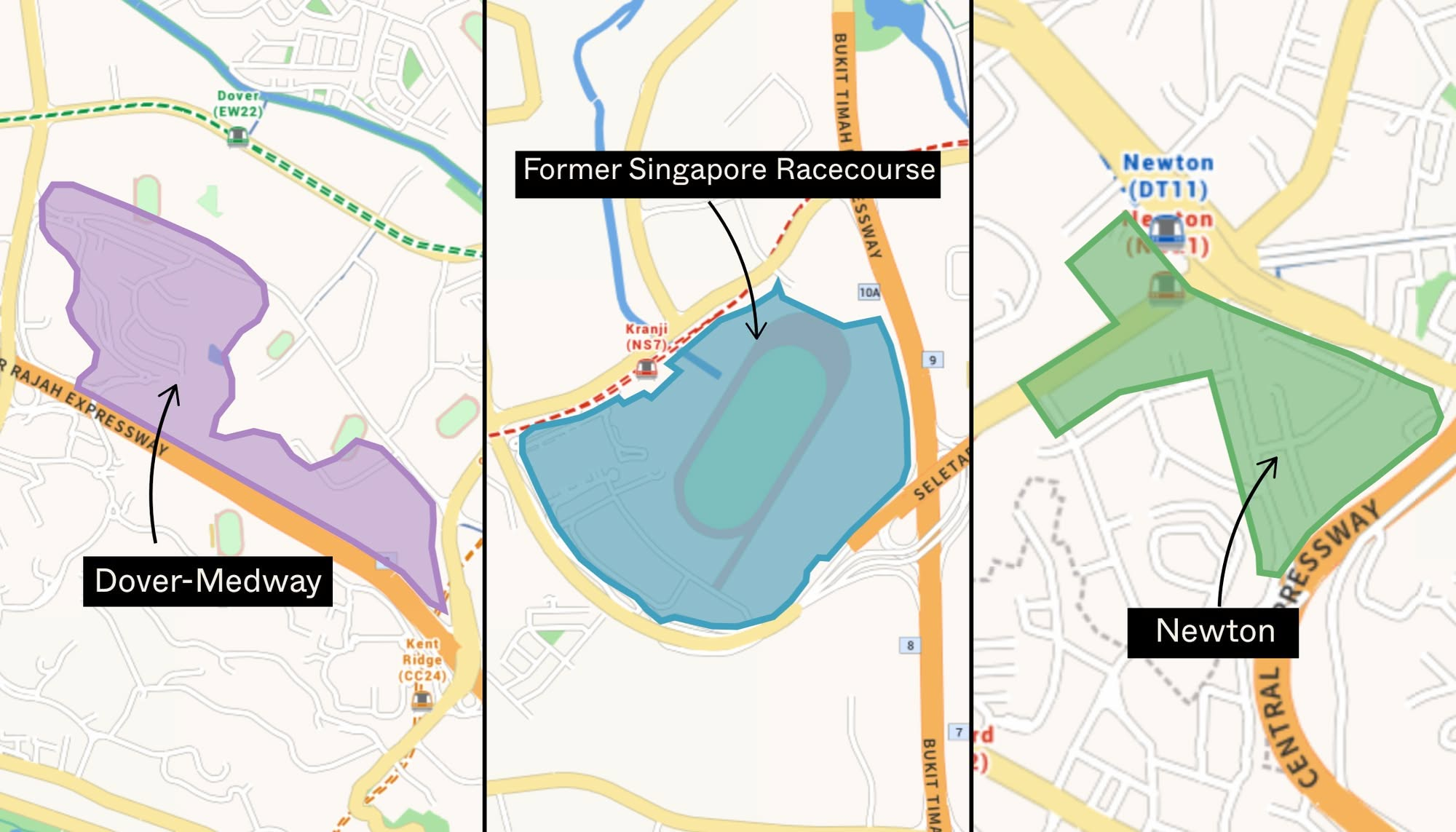

Editor's Pick URA’s 2025 Draft Master Plan: 80,000 New Homes Across 10 Estates — Here’s What To Look Out For

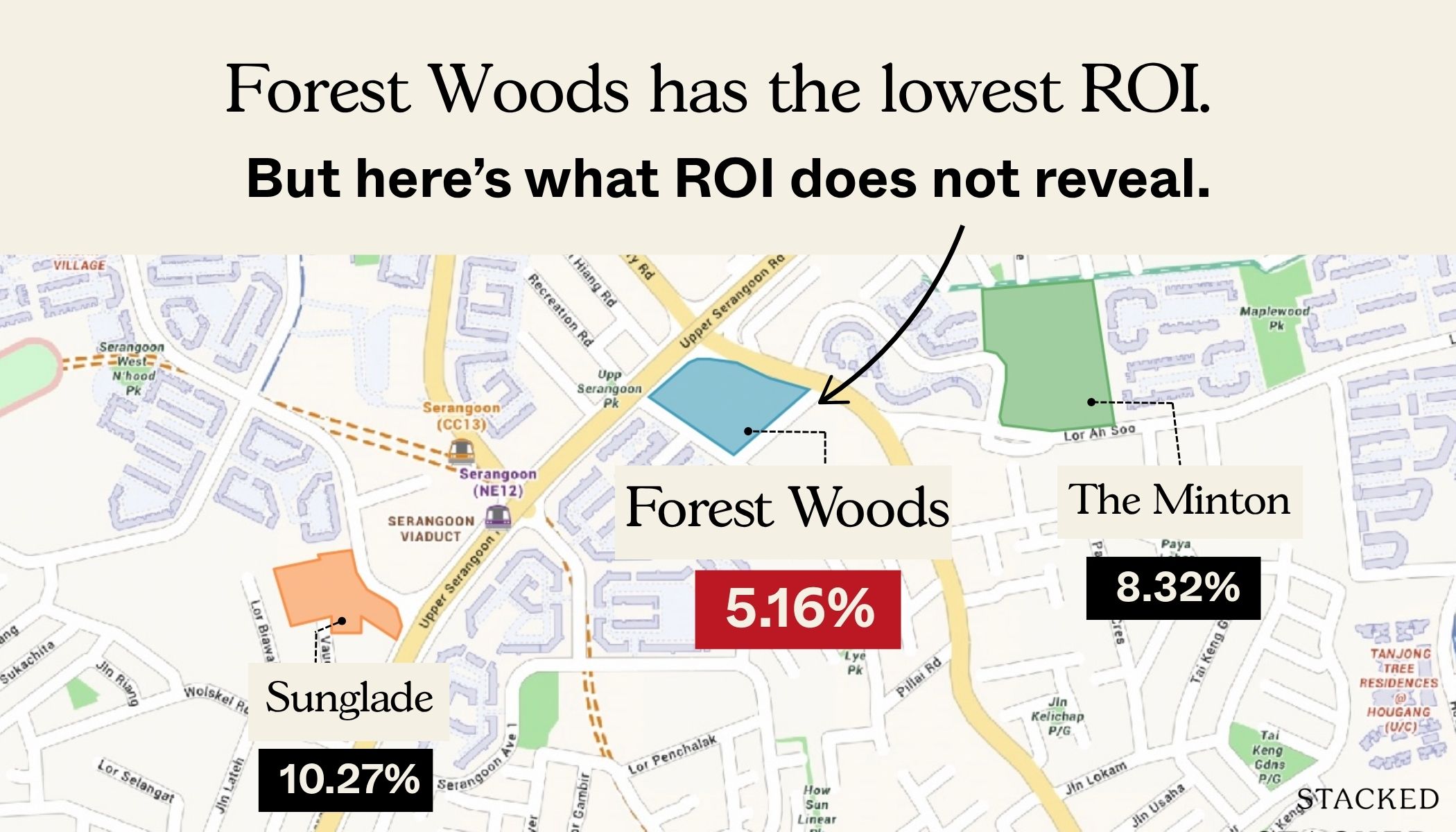

Pro Analysing Forest Woods Condo at Serangoon: Did This 2016 Project Hold Up Over Time?

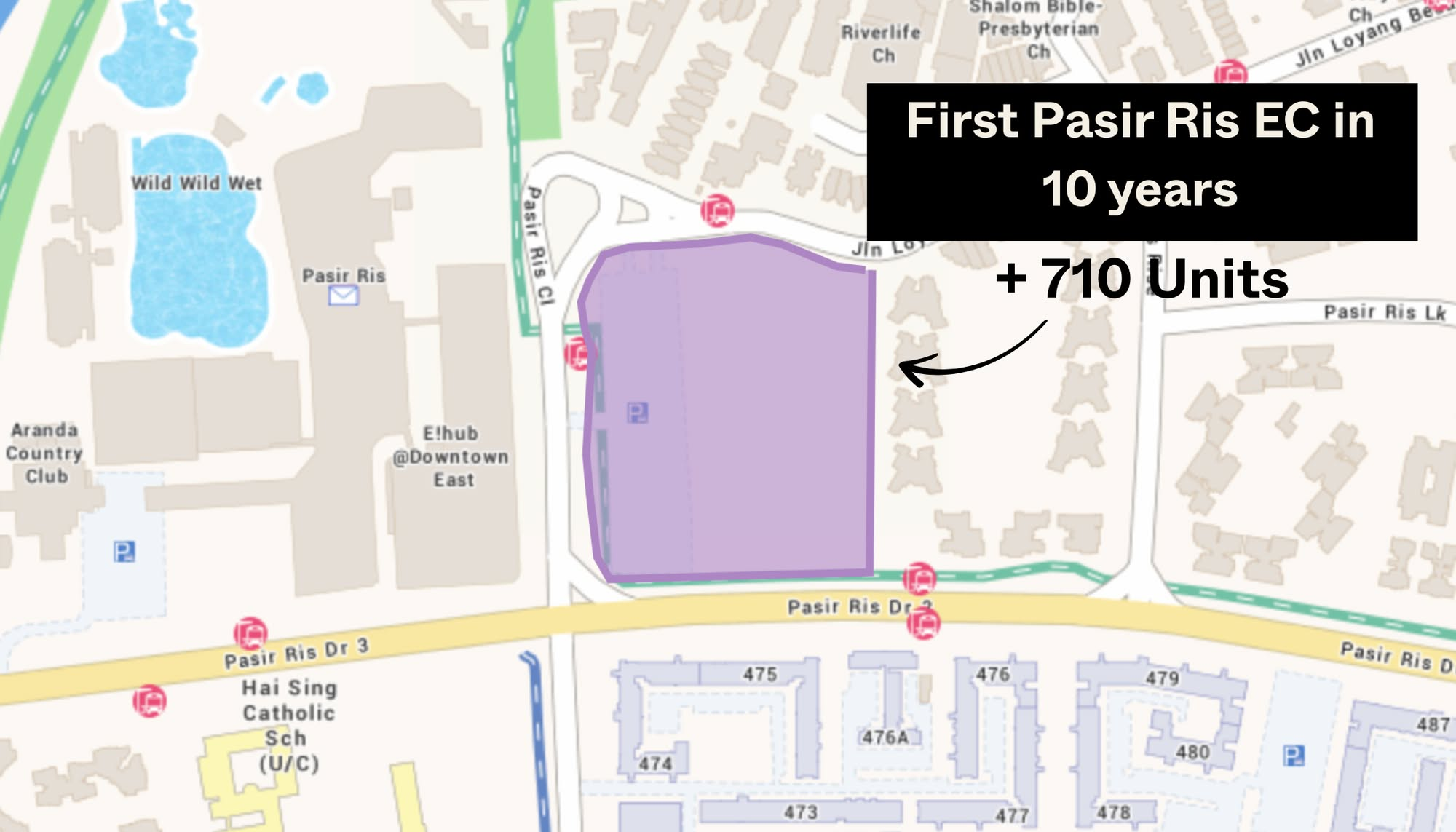

Property Market Commentary This Upcoming 710-Unit Executive Condo In Pasir Ris Will Be One To Watch For Families

Editor's Pick Where To Find Freehold Terrace & Semi-D Landed Homes From $4.85 million In The East

Singapore Property News She Lost $590,000 On A Shop Space That Didn’t Exist: The Problem With Floor Plans In Singapore

Can you share how this might change with delays in construction?