Good News For HDB Buyers In 2023: How Budget 2023 Will Impact The Property Market

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Budget 2023 is being announced even as we write this, and there is some good news for flat buyers: higher CPF grants seem likely to make resale flats more affordable. There are also added balloting chances for a select group of home buyers. On the flip side, some private property buyers may soon face higher taxes. Here’s the initial rundown of today’s announcement, from a property perspective:

Table Of Contents

1. First-timers have higher chances during BTO balloting

Families with children, as well as married couples aged 40 and under, will receive an additional chance when getting their queue number for a BTO flat. This means they have three chances to get a flat, instead of the normal two for other first-timers.

In essence, these two groups (families already with children, and married couples aged 40 and below) are singled out for priority treatment among first-timers. That’s to distinguish them from those perceived as being in less need, such as those who have a home but have never before had a housing subsidy (they are also considered first-timers).

The extra ballot chance will be “among other measures” taken to help them get their keys faster. The full details and system will kick in later this year, after the Parliamentary debates that determine MND’s budget.

We suspect the age discrimination might be painful for older Singaporeans, and some may resent the tone of “have children or you’re less of a priority.” Still, it may be fair to argue those who have children right now, or will have soon, are in more urgent need of the space. It’s also been clarified that 95 per cent of 4-room or larger BTO flats (in both new and mature towns) are set aside for first-timers in general; so prioritising these two sub-groups won’t massively over-impact the chances of other first-timers.

2. Increased housing grants for those looking to buy a resale flat

First-timers who buy 2-room, 3-room, or 4-room HDB flats can now get a CPF Housing Grant of up to $80,000 (previously the cap was $50,000). For those buying 5-room or larger resale flats, the grant is now up to $50,000 (from a previous cap of $40,000).

This raises the maximum possible grant for first-timer families to $190,000 for resale flats.

The revised grant is available for those who submit resale applications on or after 1st April 2023. For those who haven’t completed their resale transaction by 3.30 pm on 14th February, or who submit their application between now and 31st March, the difference between the current and revised grant will be disbursed to you within three months of completing the resale transaction.

Note that the usual eligibility requirements for the grant still apply (e.g., at least one spouse must be a Singapore Citizen, the monthly income ceiling is $14,000, you must not have sold a private property 30 months prior, and so forth).

Some current house hunters we spoke to are expressing concern that sellers may respond accordingly, and raise their prices as they know more grants are available. If that happens though, we’d expect a further policy response.

3. Better housing grants for first-timer singles too

First-timer singles buying a 4-room or smaller resale flat can get up to $40,000 from the CPF Housing Grant (up from $25,000 previously). Those buying 5-room or larger resale flats can get up to $25,000 under the revised grant (up from $20,000 previously).

More from Stacked

2,000 New Units For GLS Sites In 2021: We Review The 4 New Additions

Some eyebrows were raised last week, when the supply of Government Land Sales (GLS) sites was hiked. In the first…

This broadly scales with the increased grants in point 2, but we believe singles are likely to feel the impact more. Singles can only buy 2-room flats if they go the BTO route, so lifelong singles are forced to pick from resale if they want a larger home. Also, with many of them being single-income, they may be more in need of grants than a dual-income family.

There’s no denying that families still get priority over singles, and it’s probably a sour note among singles who can’t be legally married. This current concession isn’t going to resolve that debate of course, but maybe it puts a band-aid on it.

4. Higher stamp duty rates for most private properties

The increased Buyer’s Stamp Duty (BSD) will impact property values above $1.5 million. This portion of the property value (above $1.5 million and up to $3 million) will be taxed at five per cent, up from the current four per cent.

Any remaining value above $3 million will then be taxed at six per cent:

| Dates | Before 15/2/2023 | On or after 15/2/2023 | Difference | |||

| Purchase Price | $1,000,000 | 4% | $24,600 | 4% | $24,600 | $0 |

| $1,200,000 | 4% | $34,600 | 4% | $34,600 | $0 | |

| $1,500,000 | 4% | $44,600 | 5% | $44,600 | $0 | |

| $2,000,000 | 4% | $64,600 | 5% | $69,600 | $5,000 | |

| $2,500,000 | 4% | $84,600 | 5% | $94,600 | $10,000 | |

| $3,000,000 | 4% | $104,600 | 5% | $119,600 | $15,000 | |

| $3,100,000 | 4% | $108,600 | 6% | $125,600 | $17,000 | |

| $3,500,000 | 4% | $124,600 | 6% | $149,600 | $25,000 |

At current prices, realtors said that many resale three-bedder or larger condo units are affected (such units are typically upward of $1.6 million right now), while among new launches, even some two-bedders might be impacted. Smaller properties, such as shoebox units, tend to be under $1.5 million and so may escape the higher taxation.

The earlier, lower BSD rates will still apply during a transitional period. You get the older rates if you meet three conditions:

- The OTP was granted on or before today (14th February)

- You exercise the OTP on or before 7th March or its validity period ends, whichever comes first

- The OTP is not varied on or after 15th February

Realtors told us that, while a wide swathe of private properties are affected (most HDB upgraders aim for three-bedders that will meet or cross the $1.5 million mark), the small increase is unlikely to dissuade buyers.

Similarly, for buyers who can afford a quantum of above $3 million, the amount is not significant enough to deter the well-heeled. As such, the overall impact on the private market is expected to be quite minimal; and it doesn’t amount to anything near as drastic as a cooling measure.

A note on non-residential property:

Do note that non-residential property is also impacted. For such units, the value in excess of $1 million and up to $1.5 million will be taxed at four per cent, while any amount in excess of $1.5 million is taxed at five per cent. This is up from the previous rate of three per cent.

Overall, this year’s budget announcement is a small win for home buyers. Flat buyers are finally receiving much-needed help; and while stamp duties are up, most buyers and realtors seem relieved that it’s not a full-blown cooling measure. What we have seems to be a slight scaling-up of grants, in line with rising inflation, and a tweak to the balloting system to better differentiate between types of first-timers. We do wonder if, going forward, the government will further those lines of differentiation.

Follow us as we continue to monitor the situation and update you on Stacked. We also provide you with in-depth reviews and the latest news and trends in the Singapore property market.

If you’d like to get in touch for a more in-depth consultation, you can do so here.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Market Commentary

Property Market Commentary A First-Time Condo Buyer’s Guide To Evaluating Property Developers In Singapore

Property Market Commentary Why More Young Families Are Moving to Pasir Ris (Hint: It’s Not Just About the New EC)

Property Market Commentary This Upcoming 710-Unit Executive Condo In Pasir Ris Will Be One To Watch For Families

Property Market Commentary Which Central Singapore Condos Still Offer Long-Term Value? Here Are My Picks

Latest Posts

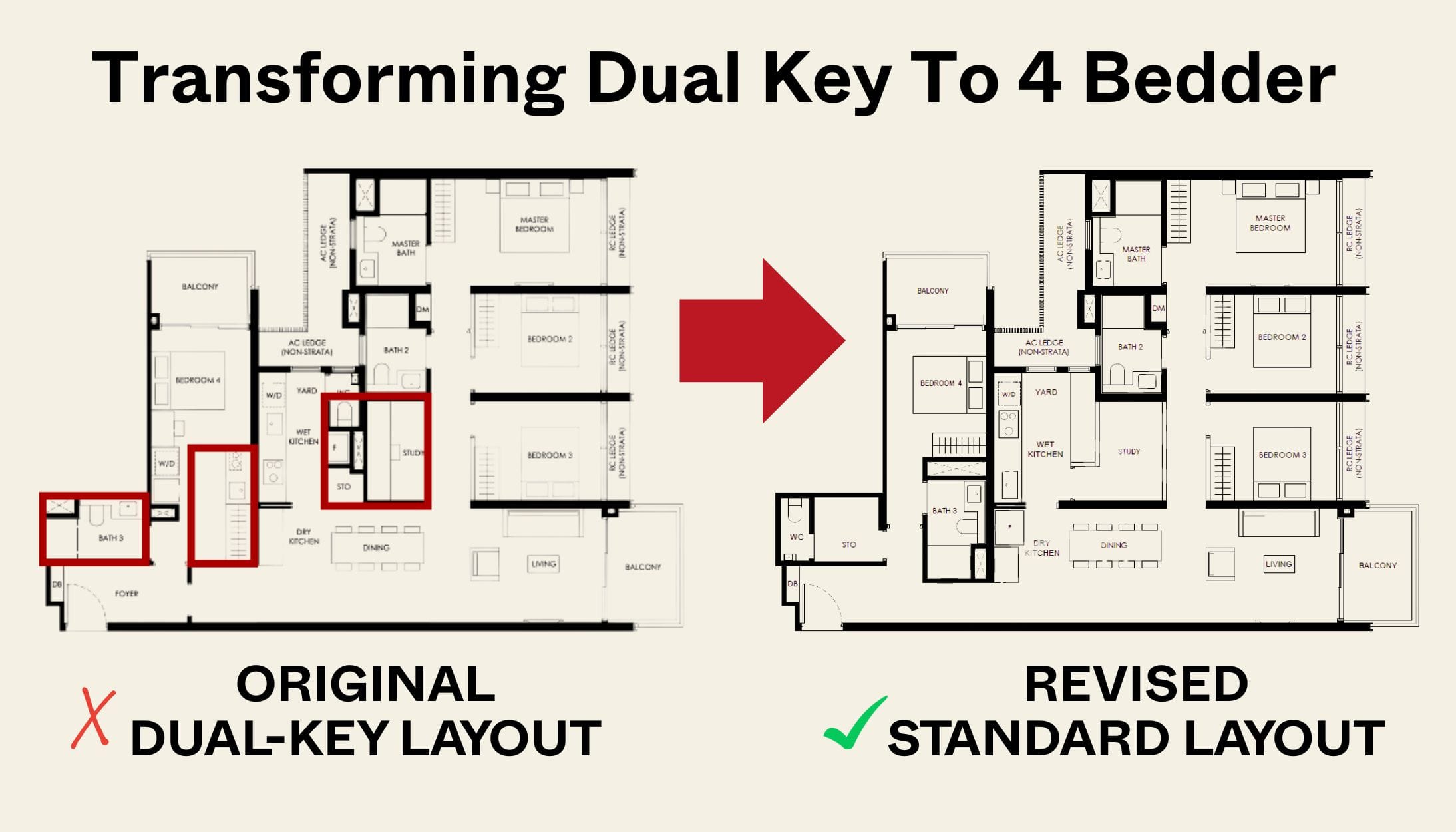

New Launch Condo Reviews Transforming A Dual-Key Into A Family-Friendly 4-Bedder: We Revisit Nava Grove’s New Layout

On The Market 5 Cheapest HDB Flats Near MRT Stations Under $500,000

New Launch Condo Reviews The Robertson Opus Review: A Rare 999-Year New Launch Condo Priced From $1.37m

Singapore Property News Higher 2025 Seller’s Stamp Duty Rates Just Dropped: Should Buyers And Sellers Be Worried?

Pro Same Location, But Over $700k Cheaper: We Compare New Launch Vs Resale Condos In District 7

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

New Launch Condo Analysis This Rare 999-Year New Launch Condo Is The Redevelopment Of Robertson Walk. Is Robertson Opus Worth A Look?

Pro We Compared New Vs Resale Condo Prices In District 10—Here’s Why New 2-Bedders Now Cost Over $600K More

Singapore Property News They Paid Rent On Time—And Still Got Evicted. Here’s The Messy Truth About Subletting In Singapore.

New Launch Condo Reviews LyndenWoods Condo Review: 343 Units, 3 Pools, And A Pickleball Court From $1.39m

Landed Home Tours We Tour Affordable Freehold Landed Homes In Balestier From $3.4m (From Jalan Ampas To Boon Teck Road)

Singapore Property News Is Our Housing Policy Secretly Singapore’s Most Effective Birth Control?

On The Market A 10,000 Sq Ft Freehold Landed Home In The East Is On The Market For $10.8M: Here’s A Closer Look

On The Market 5 Spacious Old But Freehold Condos Above 2,650 Sqft

Property Investment Insights We Compared New Launch And Resale Condo Prices Across Districts—Here’s Where The Price Gaps Are The Biggest