I’m Looking To Buy A 3rd Property To Generate $10k Per Month Rental Income: Which $1.5m Property Is Best?

February 3, 2023

Hi

I kind of like the way you analyze things. And hence this email

Am looking to set up a pool of assets to generate passive income. Am hoping to generate 20k sgd of passive income a month (10k from residential assets and another 10k from CPF and dividends from shares)

Am currently holding on to 1 property outside Singapore (where I live in it) and 1 property along River valley generating 7k sgd a month. Am looking to buy 1 more property that can generate about 3k sgd a month

This pool of assets to generate passive income is for retirement planning and hence the next property I am looking at (which has to generate 3k sgd a month) has to be able to rent out easily. Unlikely I will sell. Am planning to buy and hold

My budget is around 1.5m sgd. Do you have a specific recommendation? 1 of the main requirement is to be able to rent out easily for years to come (this asset is meant to finance my family’s retirement)

Thank you

(This is part of an ongoing series where we answer reader questions about the property market. If you have one of your own, send it to stories@stackedhomes.com.)

Hi there,

Happy to hear that you like our work.

It’s great that you have a diversified portfolio which reduces your risk, especially with stable sources such as CPF. In this current market where rental rates are on the rise, finding a $1.5 million property that will generate a $3,000 rental isn’t the issue. The challenge really is if the property can continue to generate this rental amount in the long run.

So even though you are planning to rent out the property for the long term and have no plans on selling it anytime soon, it is still important to purchase a property that can hold its value. It will not make sense to earn a decent rental income but eventually, lose a huge chunk of your capital.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Before we go into it, let’s see if it is sensible to wait and see

It’s no secret that property prices are at an all-time high now and thus purchasing an investment property in the current climate may seem quite risky.

While we understand that rental rates are also at an all-time high, we have to factor in the high-interest cost today as well as the impact that a possible upcoming recession could have on the property market.

This leads us to think about two scenarios:

- The first scenario involves buying a $1.5M property today and renting it out. Gross rental is $4,700 per month, but after accounting for costs, the net rental gain is just around $3,250 per month. This translates to $78K in rental over 2 years.

- The second scenario involves waiting 2 years to see if prices do fall. We don’t have a crystal ball for this (obviously), but let’s say we assume property prices fall by 10%, which means you’ll be able to spend just $1,350,000 instead. This translates to a “savings” of $150,000 – about twice the amount that you could earn from renting out in the first scenario.

We also ran an analysis to see the difference between both scenarios when it comes to breaking even – assuming no capital appreciation in both cases and that interest rates are 4% within the first 2 years and 2.5% thereafter (assuming a recession results in lower interest rates).

The outcome is a difference in around 4-5 years, where buying today at $1.5M would take 4-5 years longer to breakeven as compared to buying it at $1.35M 2 years later.

Ultimately, the decision to wait depends on whether or not you believe that the property market would be impacted by an upcoming recession. It also depends if you are willing to take the risk in buying today when there are signs that we are at a market high now.

If you’d like to check out what your projected returns look like, you can use the tool that we created below:

Moving on, let’s consider scenario 1 in greater detail.

Costs of purchasing a third property

Although you will be purchasing your third property, the overseas property does not add to the ABSD count so assuming you are a Singaporean, the ABSD payable on this next property will be 17%.

As there is no mention of how you plan to finance the property, we will presume you’re paying the property in full.

| Description | Amount |

| Purchase price | $1,500,000 |

| BSD | $44,600 |

| ABSD | $255,000 |

| Total cash/CPF required for the purchase | $1,799,600 |

Now that you are clear on the funds necessary for the purchase, here are 3 developments that could make sense. Do note that these developments are recommended just based on the little that was shared and there could be better-suited developments for you.

Parc Esta

Parc Esta is a 99-year leasehold project situated in District 14. It is a mega development with 1,399 units of 1 – 5 bedroom types spread across 9 tower blocks. It just obtained its TOP last year but its lease starts in 2018, making it 5 years old.

The project is conveniently located just across the street from Eunos MRT station, and it is also within walking distance of both Eunos Crescent and Geylang Serai Market and Food Centre. There are also numerous other eateries, supermarkets and miscellaneous shops all within a 10-minute walk from the development so you’re well covered in terms of food and basic necessities, which would mean high rentability in terms of tenants.

Price

These are some of the recent 2-bedroom transactions:

| Date | Size (sqft) | No. of bedrooms | PSF | Price | Level |

| Jan 2023 | 635 | 2 | $2,441 | $1,550,000 | #08 |

| Dec 2022 | 829 | 2 | $2,105 | $1,745,000 | #09 |

| Dec 2022 | 743 | 2 | $1,963 | $1,458,000 | #04 |

| Dec 2022 | 635 | 2 | $2,173 | $1,380,000 | #17 |

| Nov 2022 | 700 | 2 | $2,201 | $1,540,000 | #09 |

| Nov 2022 | 829 | 2 | $2,051 | $1,700,000 | #05 |

| Nov 2022 | 635 | 2 | $2,173 | $1,380,000 | #15 |

| Nov 2022 | 581 | 2 | $2,219 | $1,290,000 | #11 |

| Nov 2022 | 743 | 2 | $1,950 | $1,448,000 | #03 |

| Oct 2022 | 635 | 2 | $2,181 | $1,385,000 | #15 |

| Oct 2022 | 635 | 2 | $2,078 | $1,320,000 | #11 |

| Oct 2022 | 840 | 2 | $2,132 | $1,790,000 | #16 |

| Oct 2022 | 840 | 2 | $2,011 | $1,688,000 | #05 |

The units we have highlighted in bold are the 2 bed 1 bath units which mostly fall within your affordability. With $1.5M, you might still be able to get the smaller 2 bed 2 bath on a lower floor.

The current average rental yield for a 2 bed 1 bath unit:

| Average price (2022) | Average rent (last 6 months) | Average rental yield |

| $1,309,911 | $4,702 | 4.3% |

Given that the rental market is booming right now, the rental yield will be inflated. If you want to be conservative and use a 3% rental yield instead, the average rent would be $3,274.

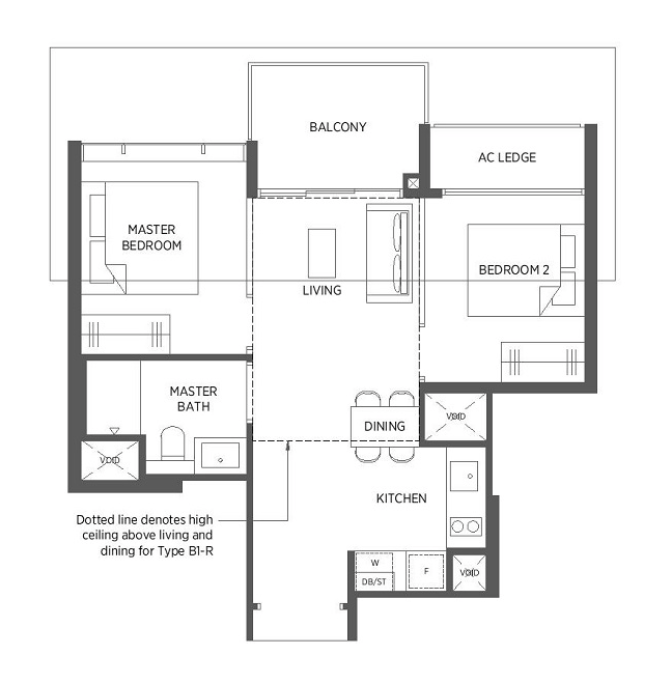

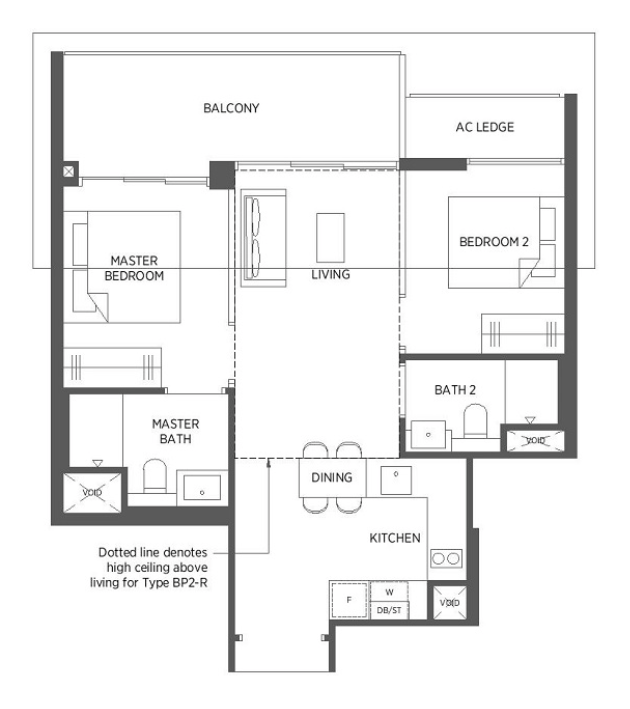

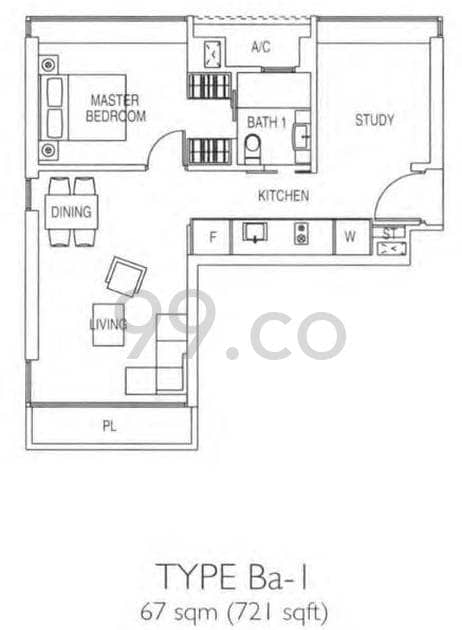

Floor plan analysis

There are several different sizes and layouts for the 2 bed 1 bath units, however, as an example, we’ll talk about the 581 sq ft unit. It is averagely sized for a 2 bed 1 bath and comes in a dumbbell layout which we prefer as it is more efficient and has less wasted space. Plus, it is better for renting to tenants given it gives better privacy to occupants of both bedrooms.

Also, both bedrooms are decently sized and can fit a double bed. The kitchen is nicely tucked in a corner so it is possible to enclose the kitchen but given your priority to rent this wouldn’t really be an issue. For all the 2 bed 1 bath layouts, there is no direct access to the bathroom from either room.

There are also a few different sizes and layouts for the 2 bedroom premium units (2b2b), this is the floor plan for the 710 sq ft unit which also comes with a dumbbell layout. All the 2 bedroom premium units have either a long balcony that extends from the living to the master bedroom or two separate balconies, one in the living and one in the master. The L-shaped kitchen maximises the available space and can also be enclosed if you prefer but that would leave little space for dining.

A 2b2b unit will definitely be preferable if you can find one within your budget as the buyer pool will be larger in the event you decide to sell since this layout caters to both own-stay buyers and investors as compared to a 2b1b which targets mostly investors.

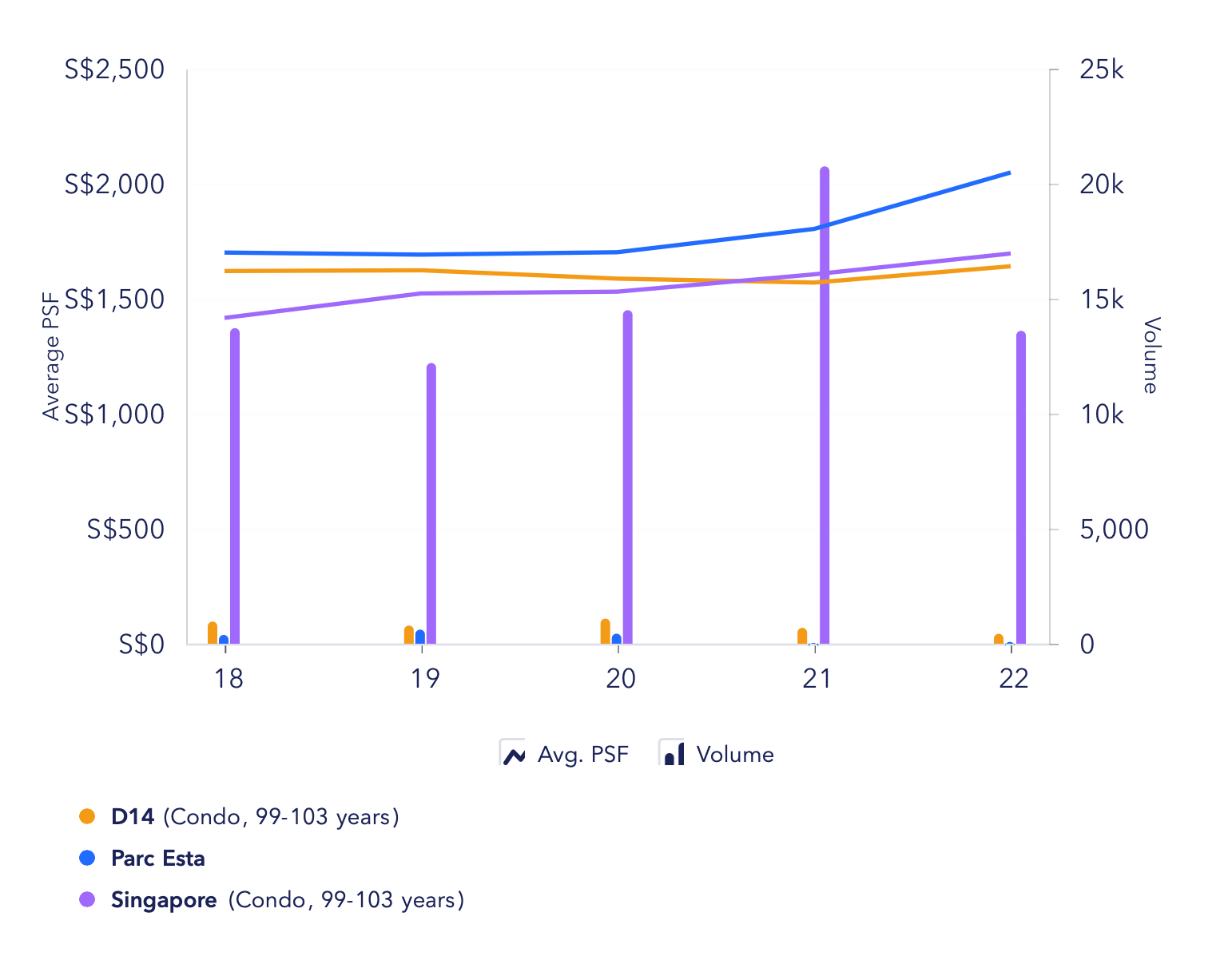

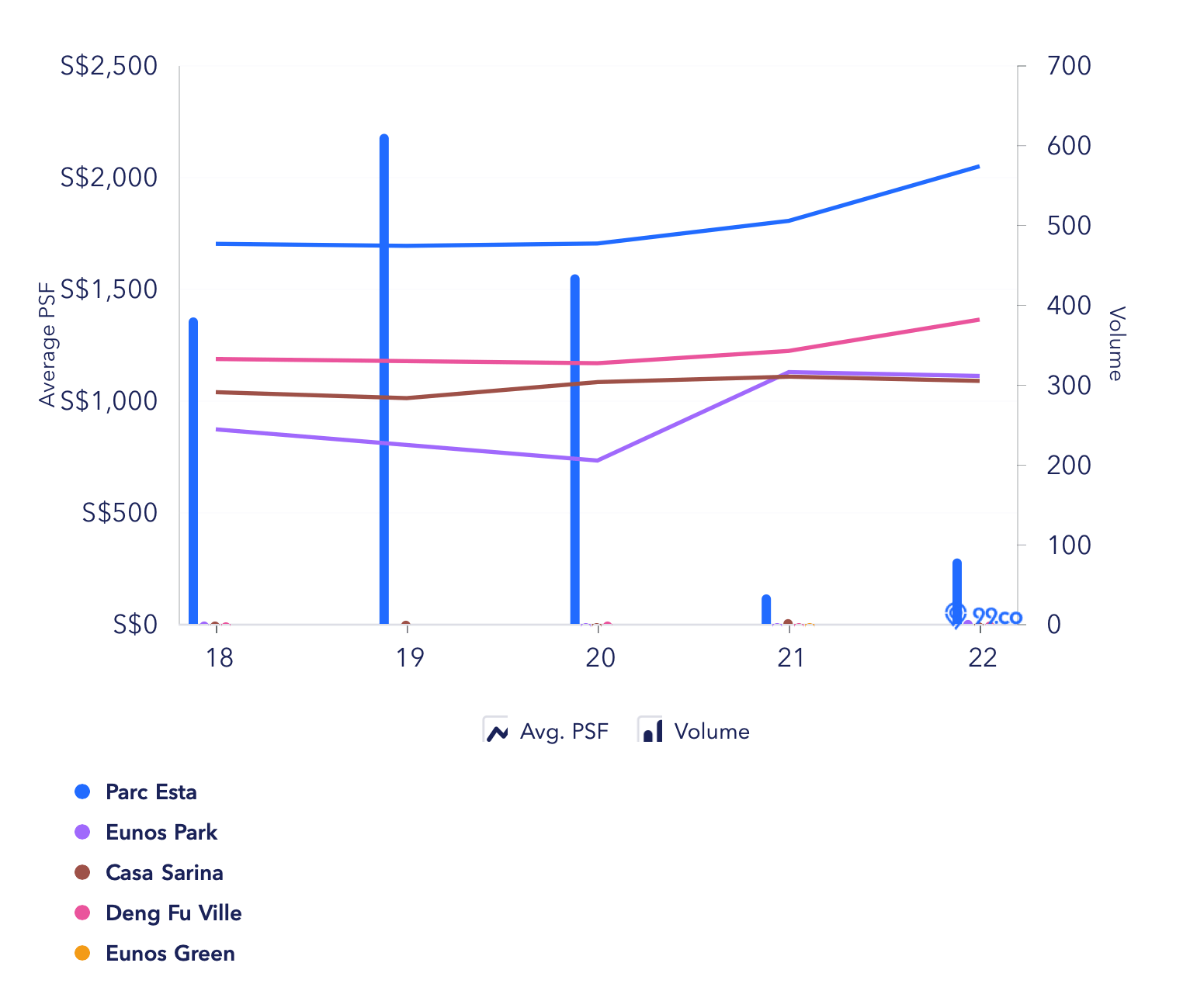

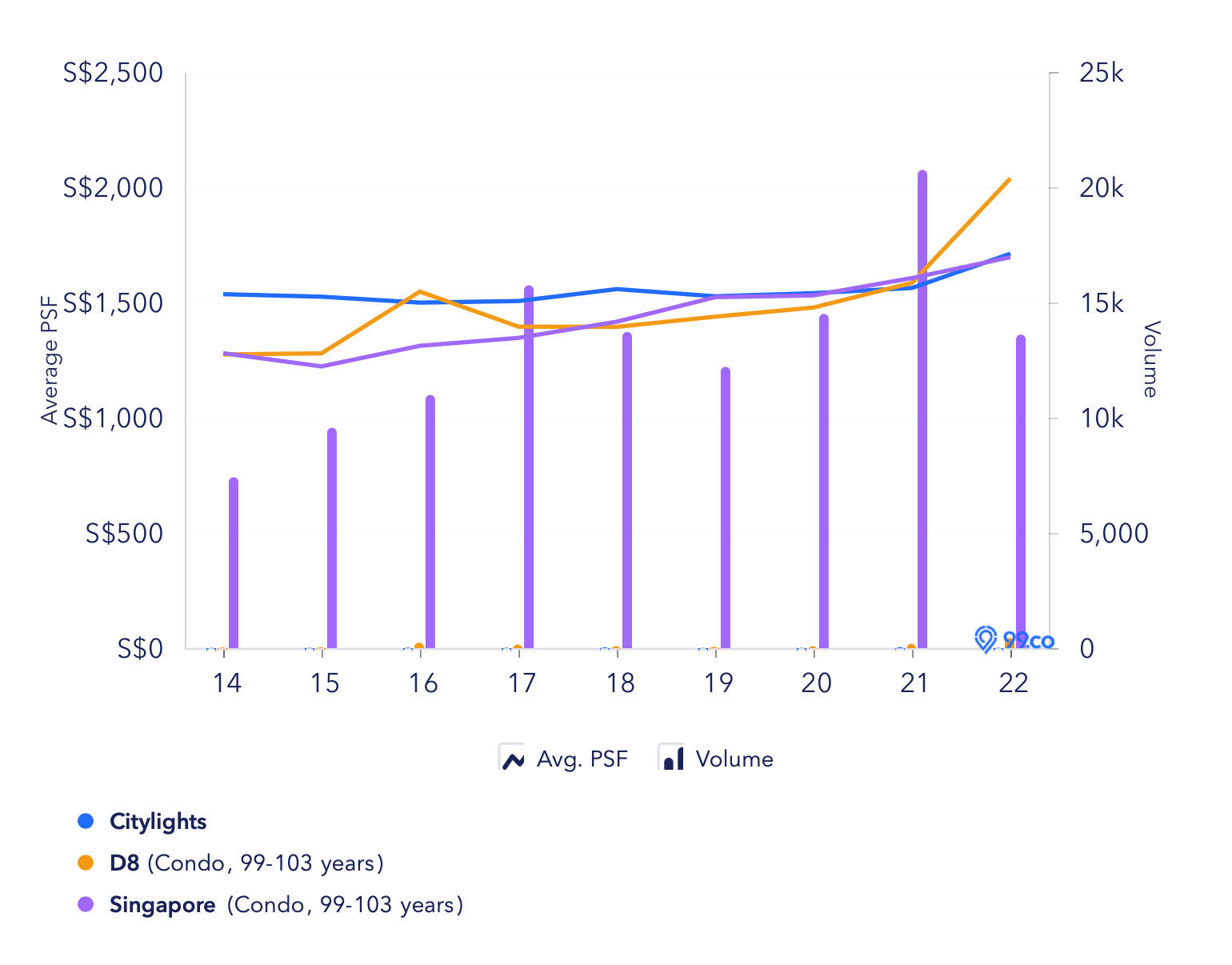

Performance

We can see from the graph above that prices at Parc Esta are moving in line with prices of the overall 99-year leasehold developments in Singapore and are performing better than that of 99-year leasehold developments in District 14. This does not come as a surprise given that it has recently obtained its TOP.

If you were to take a look at the projects in the vicinity of Parc Esta, you’ll notice that the majority of them are freehold boutique developments. As we have mentioned many times before, usually with these boutique developments, their transaction volumes are low which hinders their growth rates. Although you may get decent rental yields since the entry price is low, the potential for capital appreciation is also lower.

Seeing that there is a lack of good-sized developments with a healthy unit mix in the Eunos area, we believe Parc Esta will remain relevant in the long run.

Where are potential tenants coming from?

Parc Esta is just one MRT station away from the commercial hub at Paya Lebar Central which houses numerous office buildings such as the Paya Lebar Quarter (PLQ 1, 2, 3), Paya Lebar Square and Singpost Centre. It is also just a few stations away from Changi Business Park.

Citylights

Citylights is another 99-year leasehold development that is situated in District 8. It is a mid-sized project with 600 units consisting of 1 – 4 bedrooms as well as townhouses. It obtained its TOP in 2007 but its lease started in 2004, making it 19 years old.

The project is conveniently located just across the street from Lavender MRT station. There are lots of amenities just a stone’s throw from the development such as Aperia Shopping Mall, Kitchener Complex, North Bridge Road Food Centre and a wide variety of cafes and restaurants in the shophouses and HDB clusters nearby.

Price

These are some of the recent 1 and 2-bedroom transactions:

| Date | Size (sqft) | No. of bedrooms | PSF | Price | Level |

| Jan 2023 | 678 | 1 + S | $1,755 | $1,190,000 | #10 |

| Dec 2022 | 560 | 1 | $1,712 | $958,000 | #14 |

| Sep 2022 | 678 | 1 + S | $1,659 | $1,125,000 | #08 |

| Aug 2022 | 721 | 1 + S | $1,925 | $1,388,000 | #28 |

| Aug 2022 | 721 | 1 + S | $1,733 | $1,250,000 | #21 |

| Dec 2022 | 893 | 2 | $1,729 | $1,545,000 | #20 |

| Jun 2022 | 893 | 2 | $1,666 | $1,488,000 | #17 |

Average rental yield for a 1 + S unit:

| Average price (2022) | Average rent (last 6 months) | Average rental yield |

| $1,201,611 | $3,918 | 3.9% |

Average rental yield for a 2 bedroom unit:

| Average price (2022) | Average rent (last 6 months) | Average rental yield |

| $1,576,378 | $4,608 | 3.5% |

If you want to be conservative and use a 3% rental yield, the average rent would be $3,004 and $3,941 for a 1 + S and 2 bedroom respectively.

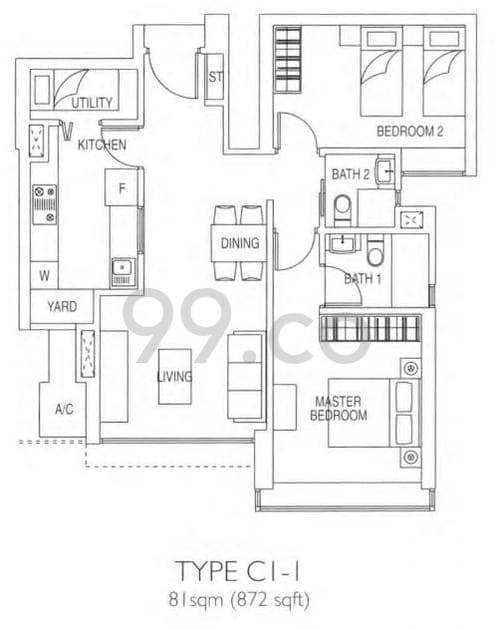

Floor plan analysis

The 1 + S come in a few sizes but their layouts are similar. In spite of the bay windows, the bedrooms are still considerably roomy with the master bedroom being able to fit a double bed, while a single bed might be better suited for the study so as not to cramp up the space. There are two entryways into the bathroom which is convenient as you won’t have to leave the bedroom in order to use it. One potential drawback is that the kitchen is facing the bathroom which some individuals may not prefer.

The 2 bedroom units also come in a couple of sizes but with similar layouts. The floor plan is efficient with minimal wastage of space. The kitchen is enclosed and comes with a yard and utility room which can also double as a store. The living area and bedrooms are nicely segregated and it is possible to do up a door to fully separate the two areas for increased privacy. Both bedrooms are spacious enough to fit a double bed and two bedside tables.

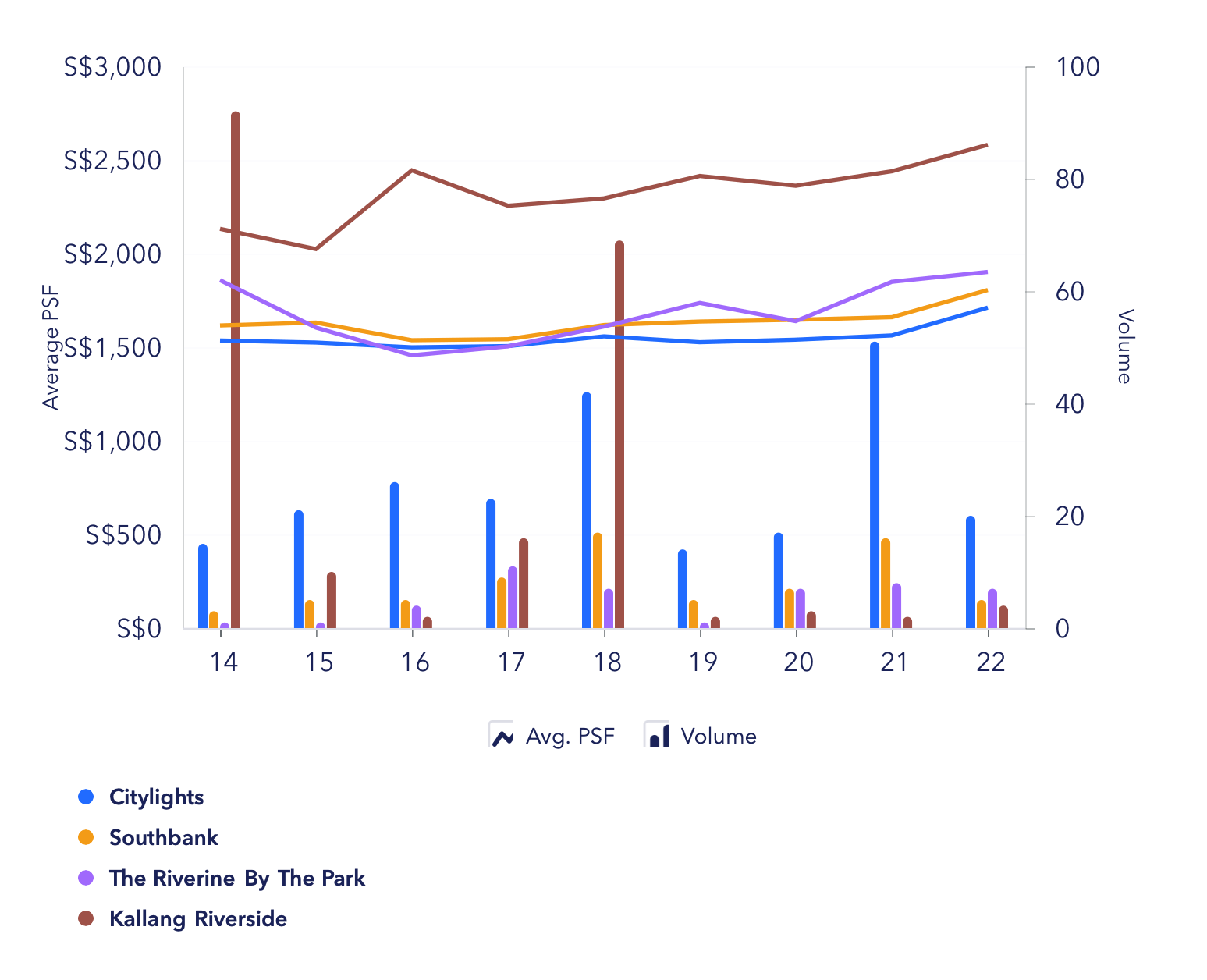

Performance

From the graph, you’ll notice that prices at Citylights have been rather stagnant up until 2021 when it started to pick up. The average PSF in District 8 had a huge spike in 2022 due to the launch of Piccadilly Grand.

As for the neighbouring developments, both The Riverine By The Park and Kallang Riverside are freehold developments which explain their higher PSF. Even though the average PSF for The Riverine By The Park is not a lot higher than Citylights and Southbank, its unit sizes are bigger so the overall quantum is much higher.

Southbank is also a 99-year leasehold development that is 2 years younger than Citylights but much smaller with 197 units mostly made up of 1 and 2 bedders. We can see from the graph above that their trend lines are parallel. Seeing as their performances are on par with one another, it can be said that Citylights may be a safer bet given its balanced unit mix and slightly more affordable entry price.

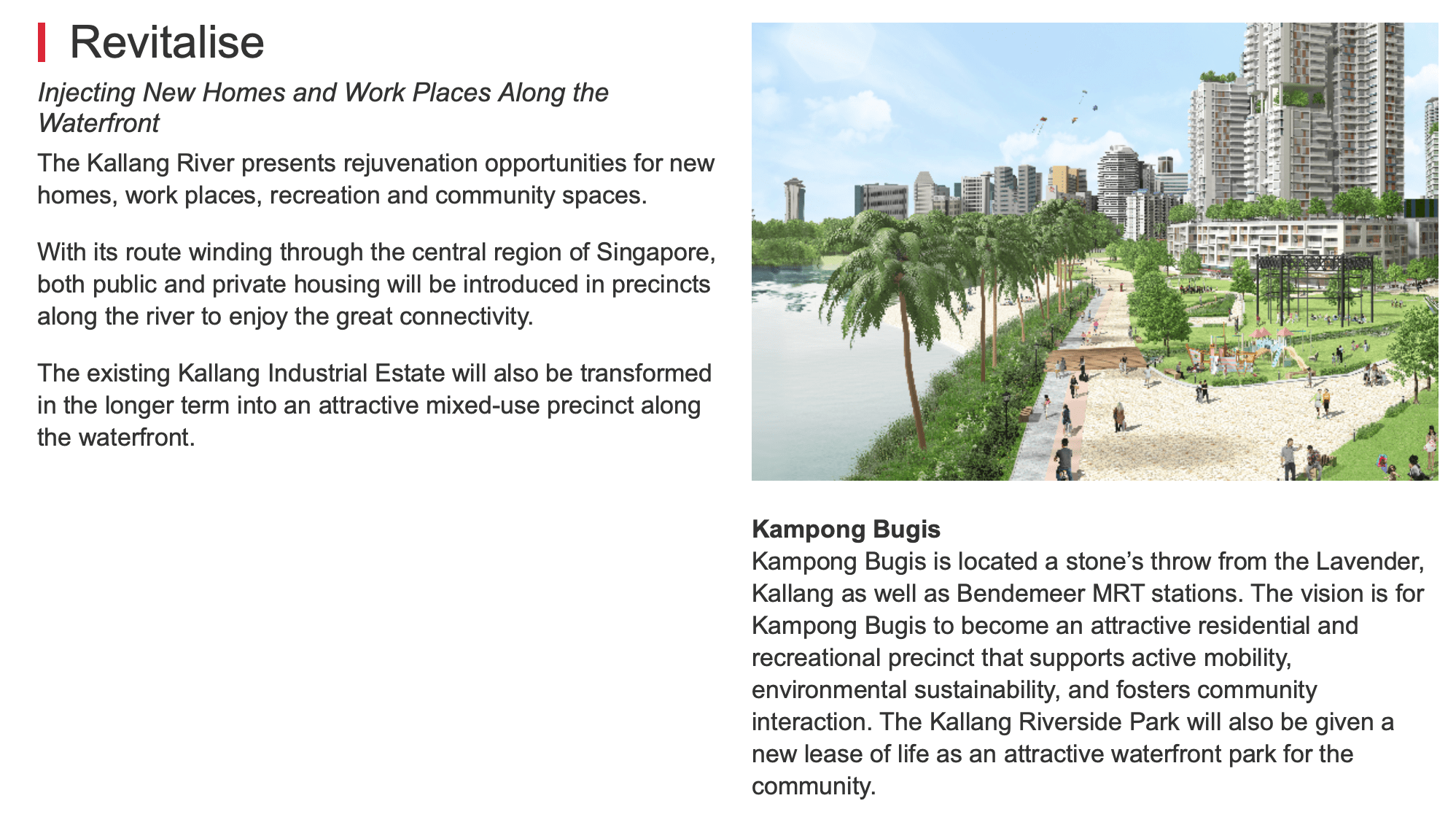

The upcoming transformation of Kampong Bugis, the Kallang River and the Kallang Industrial Estate will add greater convenience and increase the liveability of the area. Even though prices at Citylights have been stagnant before 2021, these future integrations may help to hold prices up but don’t be expecting a significant appreciation in prices in the long run. Since your plan is to rent out for the long term, rentability and value preservation would be the main priority.

Where are potential tenants coming from?

Citylights is located right next to a couple of office buildings such as CT Hub, CT Hub 2, Aperia Towers 1 & 2 and Pico Creative Centre where there are many working professionals. It is also just a few MRT stations away from the CBD which could be another potential source of tenants.

People’s Park Complex

Now, this is a unique one and may be seen as a bit of a risk depending on your appetite for it. Given its age and 99-year leasehold tenure, it may seem counter-intuitive given you intend to hold it in the long term. It obtained its TOP in 1970 while its lease started in 1968 making it 55 years old.

However, we note that prices are definitely more affordable than the younger neighbouring projects thus rental yield is much higher. This is due to its location in district 1 right above Chinatown MRT station with no lack of amenities in the area. It’s also a mixed-use development itself.

There is also potential for en bloc but there are of course risks to this. Mixed-use developments tend to be more difficult to get the common consensus needed for a collective sale, and one like People’s Park Complex with strata title commercial, residential, and car park may be just even tougher. Also, Far East Organization (FEO) who bought over the strata car park of the complex, will hold a 26% share of the total strata title of the complex and as such has a significant vote in the en-bloc process. The high rental yield and future en bloc potential are what make this development a possible consideration given your circumstances, however, it’s not without obvious risks here.

Do also note that if an en bloc were to take place within the first 3 years of your purchase, SSD will be payable.

Price

These are some of the recent transactions:

| Date | Size (sqft) | No. of bedrooms | PSF | Price | Level |

| Sep 2022 | 1,119 | 3 | $947 | $1,060,000 | #11 |

| Jul 2022 | 1,604 | 4 | $949 | $1,522,000 | #23 |

| Jul 2022 | 1,119 | 3 | $992 | $1,110,000 | #19 |

| Jun 2022 | 463 | 1 | $1,372 | $635,000 | #28 |

Since we are looking at a monthly rental of at least $3,000, we’d have to look at the 3 bedders and above.

Average rental yield for a 3 bedroom unit:

| Average price (2022) | Average rent (last 6 months) | Average rental yield |

| $1,087,378 | $4,538 | 5% |

Average rental yield for a 4 bedroom unit:

| Average price (2022) | Average rent (last 6 months) | Average rental yield |

| $1,522,000 | $5,450 | 4.3% |

If you wanted to be conservative and use a 3% rental yield, the average rent would be $2,718 and $3,805 for a 3-bedroom and 4-bedroom respectively.

Floor plan analysis

As People’s Park Complex is an old development, there isn’t any available floor plan of the units online but there are several listings on the various property portals which you can take a look at. We can see from the images and videos that the layouts are efficient and regularly shaped so furniture placement will be easy. The units are also well sized with all the bedrooms being able to fit a double bed and still having lots of space to manoeuvre around. As the surrounding buildings are mostly low-rise, units on the higher levels will get a nice unblocked view of the city.

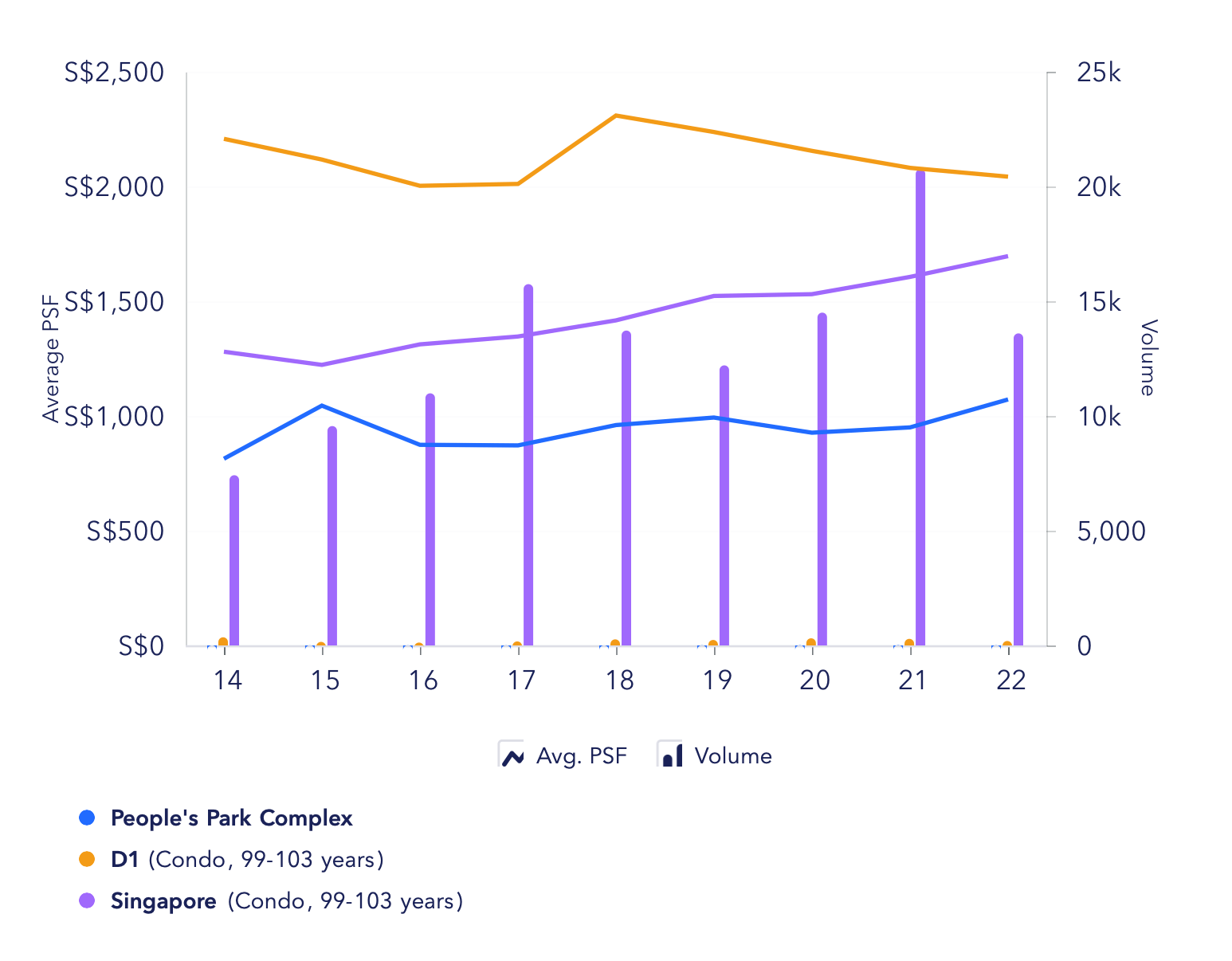

Performance

Typically with 99-year leasehold developments, prices start to show signs of stagnation after 21 years and will gradually decline as the project ages due to lease decay. However, we can see from the graph that in spite of its age, prices at People’s Park Complex are still holding up pretty well. It is not to say that prices will not go down in the years to come but given its centralised location and rental demand, it’s fair to say prices will hold up at least in the short to medium term.

Where are potential tenants coming from?

In addition to the potential tenant pool from the CBD, People’s Park Complex is also just one MRT station away from the Singapore General Hospital as well as other medical/healthcare facilities in the same area.

Conclusion

These are just a couple of options that may be suitable – but bear in mind that this is not an exhaustive list. For that, we would really need more information to give better advice.

But the general idea is to purchase a property that also has value preservation potential in the long run so you won’t lose out on your capital. A riskier venture is to bet on a high-yielding property with better en bloc potential.

And like what we mentioned in the beginning, given that you don’t have an obvious immediate need to purchase this property – you could still afford to wait for a little given where prices are at right now.

Finally, we have previously written a piece about 6 factors to consider before buying your first rental property which could also be helpful!

Have a question to ask? Shoot us an email at stories@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

0 Comments