Could Prime CCR Condos Start Surging In Demand After Q3 2021?

October 10, 2021

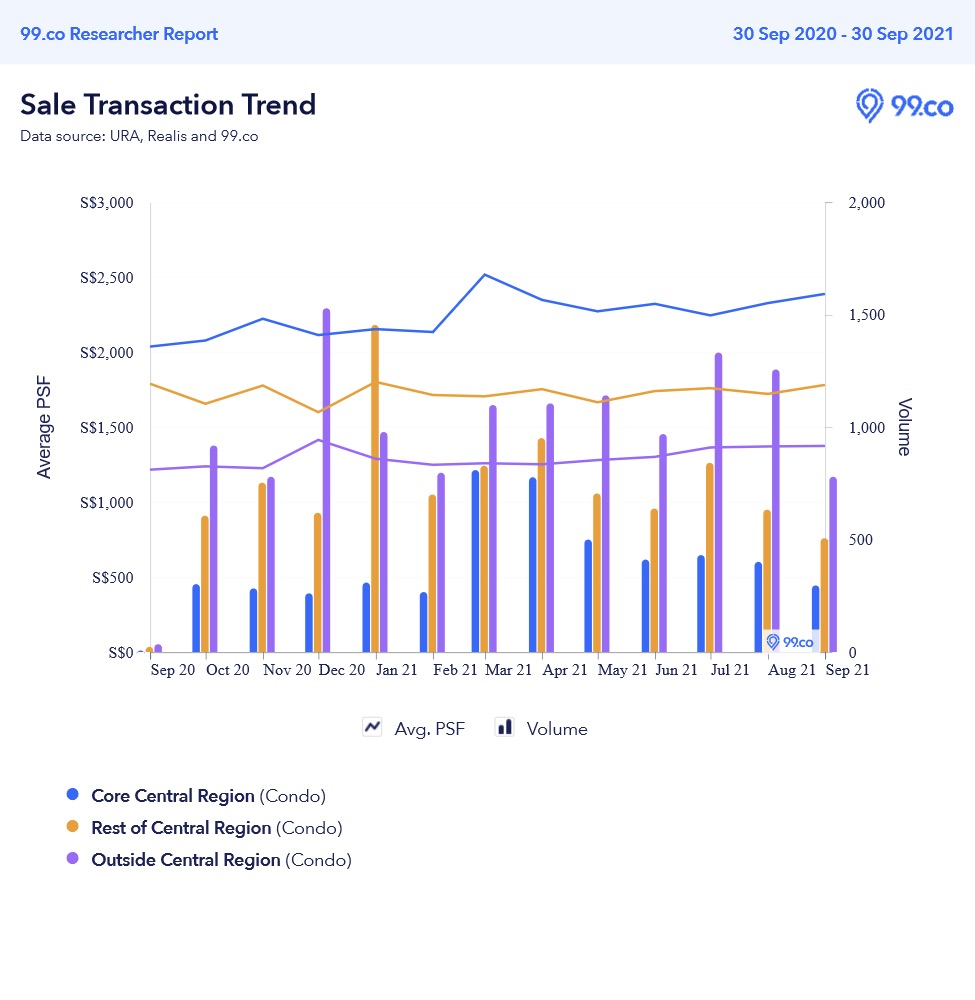

Overall home prices continued their steady upward pace in 2021; but property analysts have tipped private property prices to continue their rise as 2021 comes to a close. Prime region properties, which were lagging far behind fringe region counterparts, have shown signs that demand could be on the uptrend. Let’s look at what’s been happening and some of the possible reasons why:

How do non-landed residential prices look in Q3 2021?

The condo market retains its momentum, climbing for the sixth consecutive quarter. URA flash estimates show prices edging up to around 0.9 per cent, broadly similar to the pace set in Q2 (0.8 per cent rise).

While modest, Q3 mostly beat expectations. It was thought that a combination of the Heightened Alert (July to August), and the Seventh Month Festival (August to September) would see a much cooler market in Q3. As it turns out, most buyers have shrugged off these concerns.

The Core Central Region (CCR) saw prices dip by 0.6 per cent, as opposed to a 1.1 per cent increase in Q2.

Interestingly, the red-hot Outside of Central Region (OCR) market also saw prices drop; a decrease of around 0.2 per cent, down from a 1.9 per cent increase in the previous quarter. This is despite the majority of top sellers – at least for the month of August – coming from this region.

The RCR saw the highest increase with prices up 2.2 per cent. In the previous quarter, RCR home prices were only up 0.1 per cent. But this is mainly on the back of Normanton Park and Avenue South Residence, where developers raised prices.

Average prices for end-September 2021

Data below excludes ECs

In the CCR, condo prices averaged $2,387 psf, while RCR condos averaged $1,781 psf. In the OCR, prices averaged $1,374 psf.

Singapore Property NewsCCR Condos Are Showing Signs Of An Improvement; Here’s Why

by Ryan J. OngBest selling condos for August 2021*

Details for the best sellers of September 2021 are not yet released at the time of writing. Follow us on Stacked so we can provide you with an update.

| Development | Units Sold | Total sold | Median price |

| The Watergardens at Canberra | 267 | 267 of 448 | $1,469 psf |

| Normanton Park | 131 | 1,175 of 1,862 | $1,828 psf |

| The Florence Residences | 66 | 1,187 of 1,410 | $1,682 psf |

| Midwood | 62 | 408 of 564 | $1,732 psf |

| Ola (EC) | 57 | 434 of 548 | $1,152 psf |

| Treasure at Tampines | 50 | 2,099 of 2,203 | $1,372 psf |

| Dairy Farm Residences | 49 | 189 of 460 | $1,585 psf |

| Parc Clematis | 47 | 1,295 of 1,468 | $1,712 psf |

| Leedon Green | 32 | 224 of 638 | $2,718 psf |

| The Jovell | 28 | 332 of 428 | $1,351 psf |

| Avenue South Residence | 24 | 817 of 1,074 | $2,257 psf |

Note that apart from Leedon Green (CCR), Normanton Park (RCR), and Avenue South Residence (RCR), all other developments were in the OCR.

Despite the CCR’s apparent slowdown in Q3, there are two reasons they could start catching up now

There’s a growing demand for luxury homes in 2021. In August, for example, Les Maison Nassim saw a jaw-dropping transaction at $5,786 psf, or $35 million, which was the record for the month.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

We’ve Saved About $1m In Cash + CPF And Own 2 Condos: Should We Sell Both Or Rent For Now?

Good Day Team,

The boutique Park Nova at Orchard – which only recently launched – has already sold 18 units, at an average price of $5,016 psf. It’s certainly no small feat given the large sizes and subsequently large units. The cheapest unit transacted there so far was at $6.7 million – an amount that could get you a landed home in a decent location.

These types of boutique properties are small in number; so buyers unable to secure a unit are likely to cast their gaze over the wider CCR market. If so, there’s no end to new launches upcoming in 2021 in the region, such as Canninghill Piers and Perfect 10.

The second reason is the return of affluent foreign buyers. Certain incidents abroad, such as China’s clampdown on tech moguls, are also driving this; and due to political unrest, our closest competing real estate market – Hong Kong – may not be as viable right now.

The biggest signs are clear for all to see – 16 per cent of purchases in the Core Central Region during July and August 2021 were by foreigners, doubling the 8 per cent seen in Q2.

In fact, some realtors have pointed out that price dips may be related to this. Developers attempting to target wealthy Chinese buyers may be lowering the price slightly, hoping to raise awareness and get further momentum going.

(We don’t think buyers in this demographic are hugely concerned about the price though!)

Lastly, border measures have been easing which further points to more activity from foreigners looking to purchase property in Singapore.

| Category | Countries/Territories (From 13 October 2021) |

| I | Hong Kong, Macau, Mainland China, Taiwan |

| II | Australia, Austria (new), Bahrain (new), Belgium (new), Bhutan (new), Brunei, Bulgaria (new), Canada, Croatia (new), Cyprus (new), Czech Republic, Denmark, Egypt (new), Fiji (new), Finland, France, Germany, Greece (new), Iceland (new), Ireland (new), Italy, Japan, Liechtenstein (new), Luxembourg, Malta, Netherlands, New Zealand, Norway (new), Poland, Portugal, South Korea, Saudi Arabia, Slovakia (new), Spain, Sweden, Switzerland (new), Turkey (new), UK (new), USA (new), Vatican City (new) |

| III | Estonia (new), Latvia, Lithuania, Maldives, Slovenia (new) |

| IV | All other countries/territories |

| VTL | Current: Germany, Brunei From 19 Oct: Canada, Denmark, France, Italy, Netherlands, Spain, UK, USA From 15 Nov: South Korea |

| 💉 SHN Measures by Category and Vaccination Status | ||

| Fully-Vaccinated | Unvaccinated | |

| VTL | No SHN | Not allowed |

| Category I | No SHN | |

| Category II | 7-day SHN (home/hotel) | |

| Category III | 10-day SHN (home/hotel) | 10-day SHN (hotel) |

| Category IV | 10-day SHN (hotel) | |

Overall, developers with CCR offerings are likely in for an easy ride in 2021; despite Covid-19 and viewing difficulties.

For home buyers, it may be minor relief that prices seemed to slow in the CCR

It’s hard to draw too much from a single quarter. But given how crazy the market has been, any hint of a slowdown is great for first-time homebuyers/upgraders. Still though, realtors have mentioned there are not many new launches in the fringe regions as compared to the bumper crop from before.

This is still a limited supply, given the surge of upgraders who like the OCR. As such, you may want to start considering resale options.

We can provide you with the most in-depth reviews of new and resale properties alike on Stacked; so follow us for more insights as the market changes.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Will Prime CCR condos become more popular after 2021?

How did condo prices in the Prime Central Region change in Q3 2021?

Are foreign buyers influencing the demand for condos in Singapore's prime areas?

What factors might cause Prime CCR condos to start surging in demand?

Has the condo market in Singapore remained steady despite COVID-19 restrictions?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

0 Comments