4 Reasons Why Resale Condos May Be More Popular In 2021

February 18, 2021

2020 was dominated by a slew of new condo launches. If you were listening to the radio or browsing property portals, there wouldn’t be a single day where you wouldn’t come across two or three ads – minimum – for a new launch somewhere. In fact, private home sales were up almost 19 per cent in November 2020, mostly on the sheer number of new launches. And that has just continued – December 2020 had 1,233 units, while January 2021 had a staggering 2,087 new sales.

Moving forward though, things may change. We don’t mean a slowdown in sales volumes; if anything the momentum seems to be gaining. The difference is that this year, buyer attention may be turned toward the resale condo market instead – and here’s why:

The resale condo market has been gaining momentum since end-2020

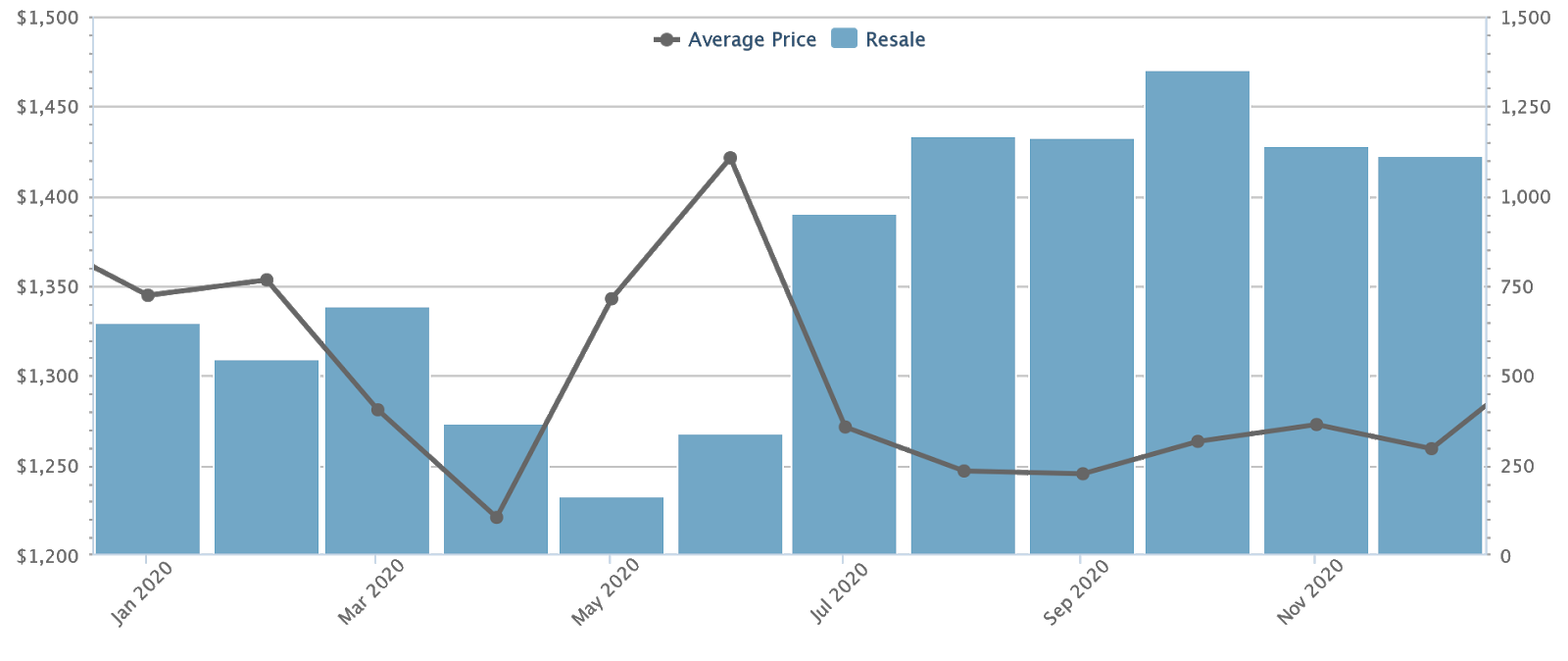

The pick-up in the resale condo market was first noticed between September and October last year. At the time, transaction numbers in October were the highest seen since 2018:

The last peak in resale condo volume was in April 2018, when the market saw 1,475 transactions.

Shortly after in July 2018, new cooling measures kicked in, keeping the market subdued. However, we can see resale transaction volumes started to climb after the Circuit Breaker, hitting 1,350 in October 2020. There were a total of 2,022 non-landed home transactions, so resale condos made up 67 per cent of non-landed sales that month.

This was often explained by the accompanying price movement. We can see that resale condo prices had fallen to an average of $1,263 psf in October, down around 8.7 per cent from the average of $1,380 psf in 2018.

This ran contrary to many of the expectations during the Circuit Breaker

Real estate agents had expected resale numbers to be negatively impacted, due to the difficulty of viewings (unlike properties under development, buyers almost always want a physical inspection of a resale property).

Instead, resale condos showed they were likely to sustain their momentum:

Transaction volumes in November and December did not exceed October; they numbered 1,140 and 1,109 units respectively. However, there are two important accompanying factors:

First, resale condo prices have now shown an upward movement for almost five consecutive months. As of December, they averaged $1,259 psf. For the year as a whole, resale condo prices rose 1.4 per cent despite a Covid-19 economy.

Second, while transaction volumes did fall, they managed to stay above 1,100 transactions for five consecutive months; a performance we haven’t seen since before the 2018 cooling measures.

We do, incidentally, think this incentivises the government toward a new round of cooling measures; it seems reflective of a private property market that’s adapted to existing stamp duties.

Why is there a strong pick-up in the resale condo market?

Based on on-the-ground inquiries, the common reasons given are:

- Pricing compared to new launches

- HDB upgraders making up the main buyer demographic

- Fear of construction delays

- Potential en bloc deals

1. Pricing compared to new launches

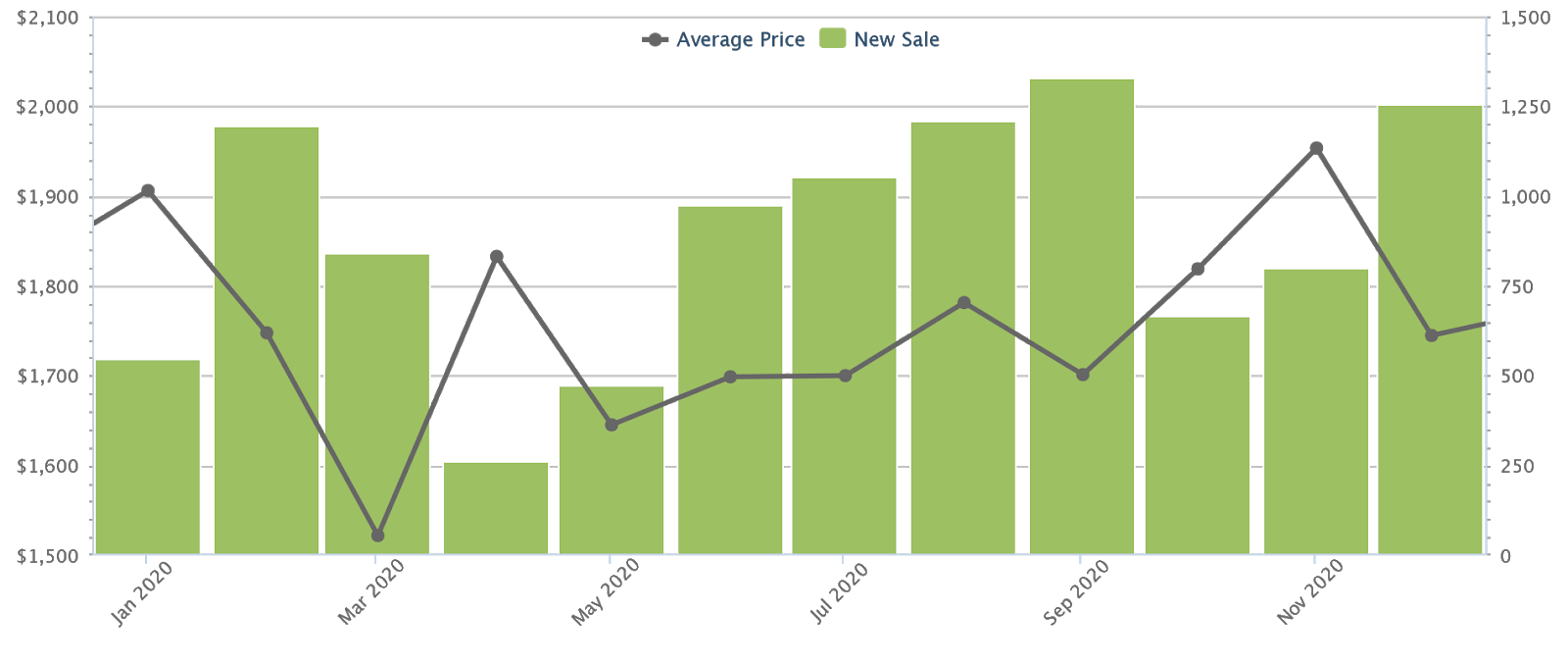

As of December 2020, the average price of a new launch condo was about $1,745 psf. At the same time, the average price for a resale condo was about $1,259 psf; a percentage difference of about 32.3 per cent. While new launch condos are always priced at higher than their existing counterparts, note that the price gap has widened significantly since 2018.

In January 2018, before the new cooling measures, the average price of a new launch condo was $1,490 psf, while resale condos averaged $1,266 psf; a price gap of just 16.2 per cent.

Of course, comparing psf numbers is never really the most accurate way to judge so we did dig a little deeper (that would be a new piece for tomorrow!), but in the meantime here’s a snapshot of what the gap is like based on overall quantum instead:

| District | Bedrooms | New Sale Price | Resale Price | Quantum Gap |

| 5 | 1 | $ 861,655 | $ 760,327 | 13% |

| 5 | 2 | $ 1,189,621 | $ 1,087,508 | 9% |

| 5 | 3 | $ 1,545,286 | $ 1,487,654 | 4% |

| 5 | 4 | $ 1,994,168 | $ 1,884,568 | 6% |

| 5 | 5 | $ 2,441,128 | $ 2,827,500 | -14% |

| 14 | 1 | $ 913,670 | $ 657,068 | 39% |

| 14 | 2 | $ 1,294,655 | $ 921,365 | 41% |

| 14 | 3 | $ 1,560,681 | $ 1,258,141 | 24% |

| 14 | 4 | $ 1,911,228 | $ 2,097,926 | -9% |

| 15 | 1 | $ 1,054,657 | $ 697,172 | 51% |

| 15 | 2 | $ 1,359,096 | $ 1,122,044 | 21% |

| 15 | 3 | $ 2,143,420 | $ 1,511,421 | 42% |

| 15 | 4 | $ 2,626,049 | $ 2,129,220 | 23% |

| 16 | 2 | $ 894,000 | $ 1,034,132 | -14% |

| 16 | 4 | $ 1,915,868 | $ 1,815,007 | 6% |

| 16 | 5 | $ 2,231,999 | $ 2,450,000 | -9% |

| 17 | 1 | $ 716,690 | $ 547,566 | 31% |

| 17 | 2 | $ 975,482 | $ 844,435 | 16% |

| 17 | 3 | $ 1,306,415 | $ 1,135,317 | 15% |

| 17 | 4 | $ 1,854,300 | $ 1,381,282 | 34% |

| 18 | 1 | $ 662,130 | $ 606,796 | 9% |

| 18 | 2 | $ 892,951 | $ 845,509 | 6% |

| 18 | 3 | $ 1,268,129 | $ 1,093,576 | 16% |

| 18 | 4 | $ 1,678,859 | $ 1,393,765 | 20% |

| 18 | 5 | $ 2,083,110 | $ 1,974,767 | 5% |

| 19 | 1 | $ 767,600 | $ 650,975 | 18% |

| 19 | 2 | $ 1,053,989 | $ 988,591 | 7% |

| 19 | 3 | $ 1,399,704 | $ 1,258,336 | 11% |

| 19 | 4 | $ 1,918,231 | $ 1,580,453 | 21% |

| 19 | 5 | $ 2,282,981 | $ 2,280,000 | 0% |

| 20 | 2 | $ 1,064,366 | $ 1,081,103 | -2% |

| 20 | 3 | $ 1,537,740 | $ 1,449,197 | 6% |

| 20 | 4 | $ 1,761,615 | $ 1,520,805 | 16% |

| 21 | 2 | $ 1,319,237 | $ 1,158,724 | 14% |

| 21 | 3 | $ 1,728,049 | $ 1,553,451 | 11% |

| 21 | 4 | $ 2,539,275 | $ 1,913,652 | 33% |

| 23 | 1 | $ 829,017 | $ 694,550 | 19% |

| 23 | 2 | $ 1,162,267 | $ 936,954 | 24% |

| 23 | 3 | $ 1,437,666 | $ 1,219,349 | 18% |

| 23 | 4 | $ 1,862,092 | $ 1,436,764 | 30% |

| 26 | 1 | $ 756,017 | $ 703,100 | 8% |

| 26 | 2 | $ 1,034,881 | $ 950,393 | 9% |

| 26 | 3 | $ 1,563,673 | $ 1,406,665 | 11% |

| 27 | 2 | $ 978,602 | $ 814,677 | 20% |

| 27 | 3 | $ 1,237,083 | $ 1,029,733 | 20% |

| 28 | 1 | $ 709,661 | $ 625,109 | 14% |

| 28 | 2 | $ 974,717 | $ 855,464 | 14% |

| 28 | 3 | $ 1,231,496 | $ 1,160,586 | 6% |

| 28 | 4 | $ 1,635,671 | $ 1,513,046 | 8% |

| 28 | 5 | $ 1,759,580 | $ 1,626,667 | 8% |

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Worrying About Your Property Purchase Choice? 5 Logical Things To Consider Before Backing Out

It’s not uncommon to get cold feet when buying a property. It’s a huge purchase that can mean a big…

It’s not a big gap across the board as you can see, and it really depends on the location and the new launch prices as well.

2. HDB upgraders make up the main buyer demographic

For more details on this, see our previous article on the bumper crop of flats reaching their Minimum Occupation Period (MOP) in 2020 and 2021.

HDB upgraders often have timeline concerns – many prefer to have a new home they can move into right away, rather than wait out a construction period of three to four years. As such, there’s often a preference for resale units.

Agents we spoke to also said that, for many families, the desire is to have immediate benefits regarding their location. For example, there’s no point moving to a condo closer to your child’s Primary school if she’s in Primary 4, and the new home will only be completed in three years.

Property AdviceGetting Your Child Into A Top Primary School And Finding Your Dream Home: Here’s How This Tool Can Help

by Druce TeoLikewise, it may not be enticing to pay so much for a home closer to the buyer’s office, if they’d still need to make an hour-long trip for the next three years. Most would opt for a resale unit close to the office, to take advantage of the location right away.

This buyer demographic also underlies the disproportionate demand for resale condos in the OCR. For the whole of 2020, the OCR accounted for over 60 per cent of resale condo transactions, with only around 16 per cent of transactions coming from the prime region.

HDB upgraders are more likely to pick the mass-market OCR units, for reasons of affordability.

3. Fear of construction delays

Covid-19 has increased the risk of construction delays, and in fact the government has given extensions on construction contracts.

These delays compound the problem for upgrader families (see point 2), who are already disinclined to wait out long construction times. It also affects investors, as long construction periods deprive them of cash flow and rental income (see below).

This could prompt buyers to opt for an already completed condo, rather than risk throwing more money on rental accommodation, or being cash-flow negative for longer.

4. Potential en bloc deals

Developers may turn out to be the most interested buyers.

We’ve covered this in some detail previously; but to summarise, we may see another slate of en-bloc sales in 2021, barring situations like tough new cooling measures. Government Land Sales (GLS) plots for 1H 2021 have been quite limited, with just three confirmed residential sites. Two of these are in the same general area in One-North, which doesn’t leave many options for developers.

On top of this, many of the en-bloc sales from 2017 have already been redeveloped, and sales were at their best in eight years for December 2020. We’ve also mentioned that many of the remaining HUDC estates are in the process of an en-bloc sale.

This can help to raise resale condo prices overall; and there will be a knock-on effect, as buyers are more willing to purchase older units when they sense good en-bloc potential.

Of course, all of this assumes the Covid-19 recovery continues, and we don’t see any sharp interventions by the government.

For more updates on that front, follow us on Stacked. You can also check out reviews of the top resale condo options in the Singapore private property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why might resale condos become more popular in 2021?

How do resale condo prices compare to new launch prices?

Who are the main buyers of resale condos?

What impact does construction delay have on the resale condo market?

Could en-bloc deals influence resale condo prices in 2021?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

0 Comments