10 Free Property Research Tools To Boost Your Chances Of Buying The Right Property

March 24, 2021

For such a small country, Singapore sure has a lot of property options and nuances – which can certainly be overwhelming for new home buyers and first-time investors. It doesn’t help that you can sometimes find contradictory information, from different websites and sources. The good news is, a lot of Singapore’s property market has moved into the digital space – and a lot of information you once had to pay for is now free (to a certain extent). Here are some of the more useful ones for personal research:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

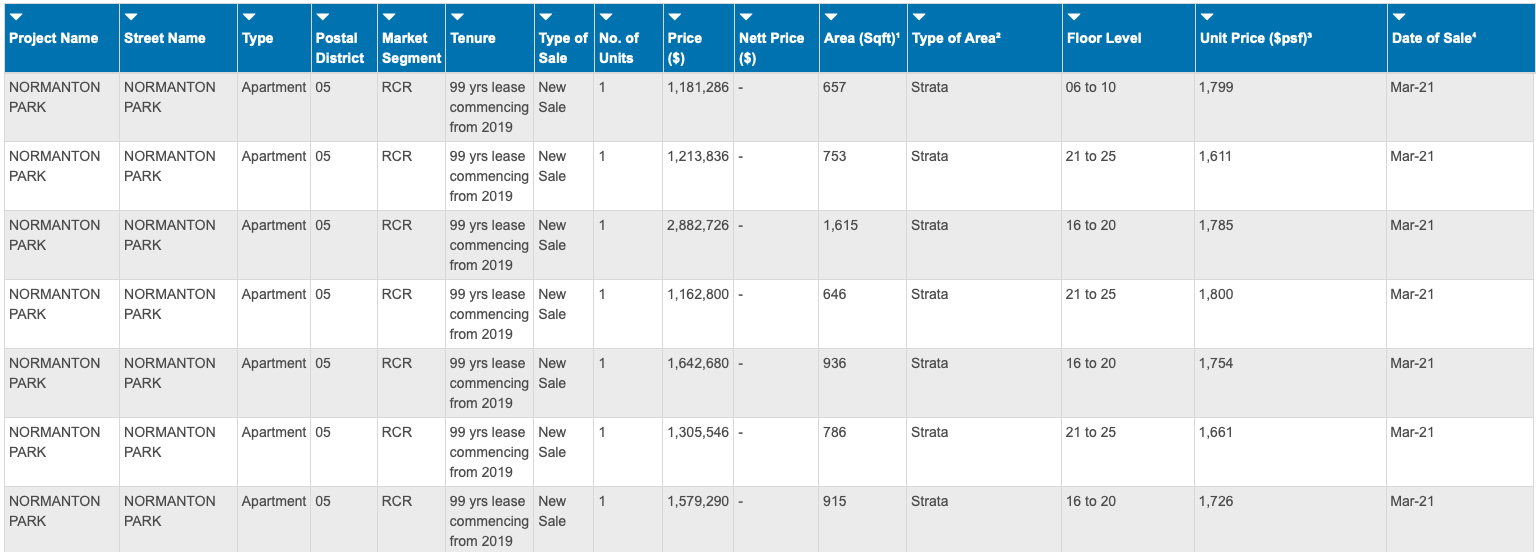

1. URA transaction data

We’ll let you in on a secret: most property websites and agents all draw their transaction data from the same well – the URA transaction data service. Here’s how it works:

When someone buys a property, the first step is often to secure the Option to Purchase (OTP). Once this is done, a caveat is lodged with URA. This information is made available to the public.

This is because sellers are not supposed to entertain further offers once you have the OTP. Should anyone else consider buying the property, they or their lawyer can see the caveat lodged.

As a happy side-effect of this, the caveats lodged also become a good research tool for property prices. One big reason is that caveats will indicate the actual transaction price; making it more accurate than just comparing asking prices on various property portals.

(The asking price is rarely the actual price, as it tends to get bargained down further).

The caveat lodged also indicates the floor of the unit sold, such as whether it’s on the first to fifth floor, or 26th to 30th floor. This is needed for fair comparison, as a unit on the 10th floor should usually be significantly cheaper than, say, a 25th floor unit, even if they have the same size and configuration.

Finally, the caveat indicates the date of the transaction. In general, focus on transactions within the past 12 months as a fair indicator. The earlier prices are less likely to be relevant, as properties appreciate over time; a unit that sold for $1.6 million in 2016 is unlikely to go for the same price in 2021.

(It’s not always possible to do this, as sometimes there are just no recent transactions. In these cases, just bear in mind that current prices are likely to end up increasingly higher, based on the amount of time that’s passed).

There are, however, two drawbacks to using URA data.

The first is that caveats are not always lodged. While it’s common to do so, it’s not required by law. Some buyers and sellers complete the transaction privately or right away, so it won’t show up on the URA data.

Second, only private property transaction data can be found. If you’re looking for resale flat prices, you need to use the HDB web service instead.

Finally, the URA data gets refreshed on Tuesday (1230 pm) for resale transactions, and Friday (330 pm) for new launch and resale transactions so watch out for that!

2. Square Foot Research

Besides basic information like a condo’s completion date, number of units, lease or freehold status etc. (you can find all those things in our full reviews too), Square Foot Research also highlights nearby properties.

This allows you to make at-a-glance comparisons with other nearby properties, in terms of prices and rental rates. It’s also nice that this is done in graph form for you; whole reels of numbers are harder to visualise.

Perhaps the most useful element is that it highlights all the surrounding alternatives (or competition, if you’re a landlord). This is not the be-all and end-all of comparisons – you’ll still need to deep dive, and compare space efficiency in floor plans, try to find the best stacks, etc. But at least you know which other condos to start comparing against.

Unfortunately, should you want to dive deeper into the data the best parts of Square Foot Research requires you to have a paid account (they do need to make money somehow). From the paid account you will have access to the exact unit details (unlike the URA site where it is limited to sections) and past transactions dating back to 1995 (URA only shows about 4 years back). There are other features such as tower view and land sales, but that might be less relevant for the casual user. Fret not, as there is another solution to old historic data in our next entry.

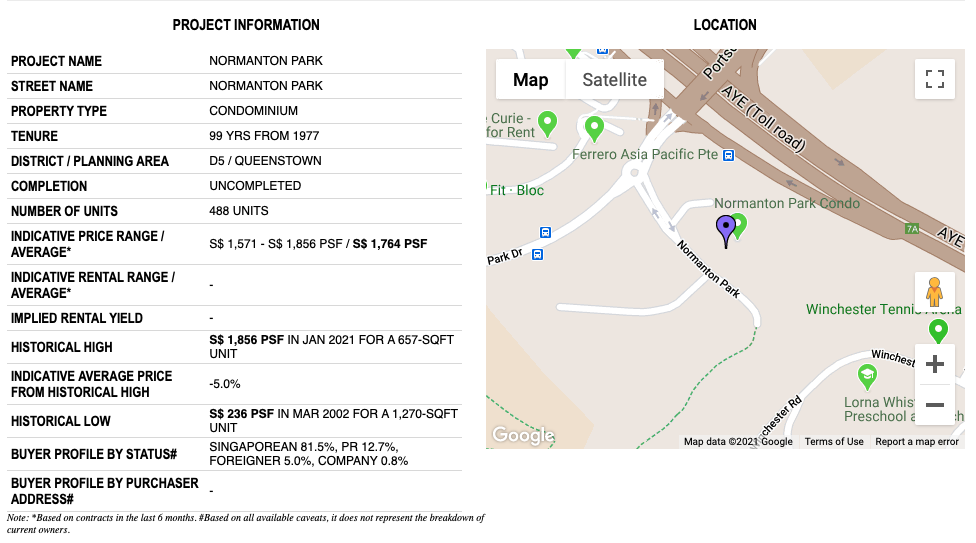

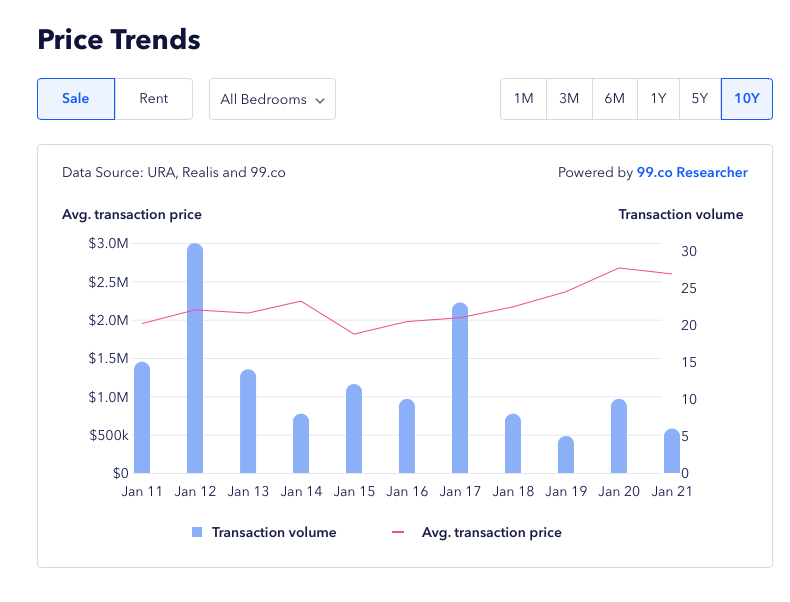

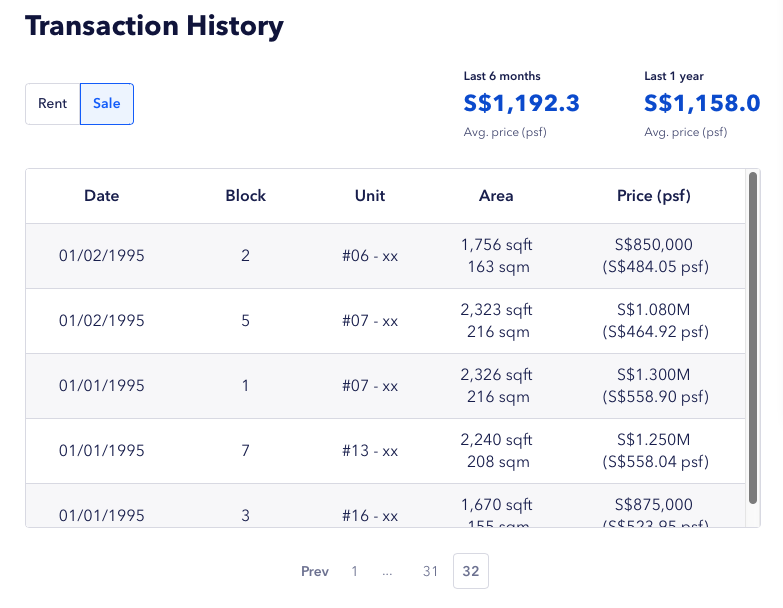

3. 99.co

Unlike its other rivals, what we like about 99.co is its more modern looking interface, plus not to mention, it is easier to navigate around as well.

But more importantly, it actually showcases the historic data too. So if you are looking at an older development, you are able to go all the way back to 1995!

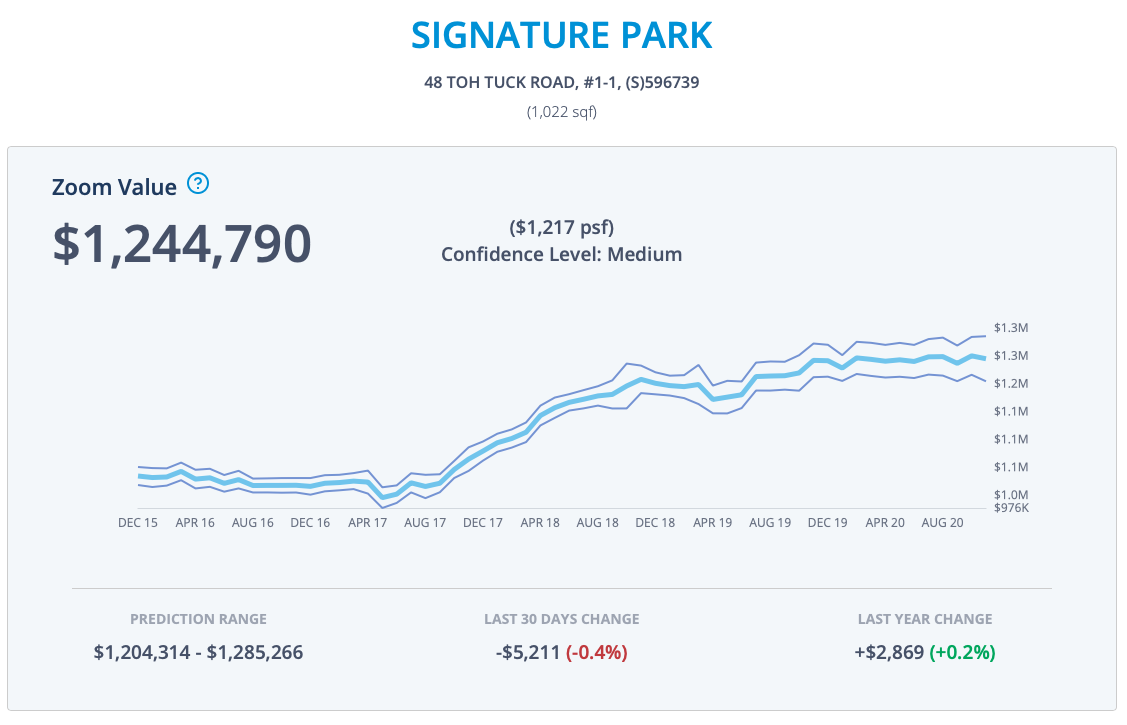

4. UrbanZoom

UrbanZoom is a straightforward and useful site for any seller – key in your address, and you’ll receive an estimation of your property value. This is done through an algorithm, which scans past transaction data and current asking prices, to provide a likely value.

This may not be perfect, such as in cases where data is limited or unavailable. It also comes down to how much you trust an algorithm to determine the value of your home; some sellers will argue that their extensive renovations, or one-of-a-kind layout, can’t be fairly compared to other units nearby.

However, UrbanZoom is great when used in conjunction with other data sources. For example, you could check URA data (see point 1), look up comparisons on Square Foot Research, and see how closely it tallies with Urban Zoom’s estimation of your property value.

When used together, you can form a picture of the right price range: the lowest you should go, and the highest you can expect (or vice versa if you’re a buyer).

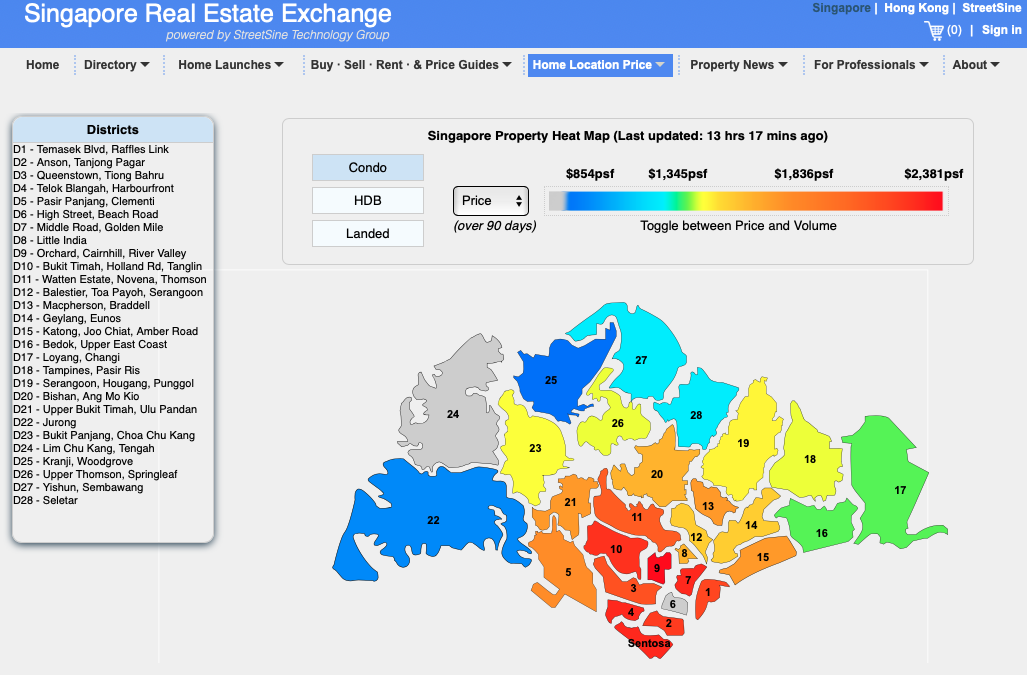

5. SRX Heat Map

The SRX heat map provides a higher-level view of prices in various towns / districts. While not too useful for comparing specific properties, it can help you to narrow down which areas are in your price range.

The heat map is colour coded from blue to red, with blue being the cheapest, and red the most expensive. While some parts of the map haven’t and won’t change for decade’s (there’s a snowball’s chance in a volcano that District 9 will ever turn blue), subtle changes do happen; especially in fringe regions.

Besides indicating price ranges, the heat map also shows transaction volumes. High transaction volumes can clue you in to gradual shifts, such as a launch with a strong location, buyers rushing into a district / town to take advantage of Master Plan upgrades, or a possible inflection point: this is when prices in the area don’t seem to be moving much, but transaction volumes are surging (a common prelude to an upswing in prices).

We do have to say that the site does look quite dated in comparison to some of the sleeker ones today, but it will come in handy for those who are newer to the property scene.

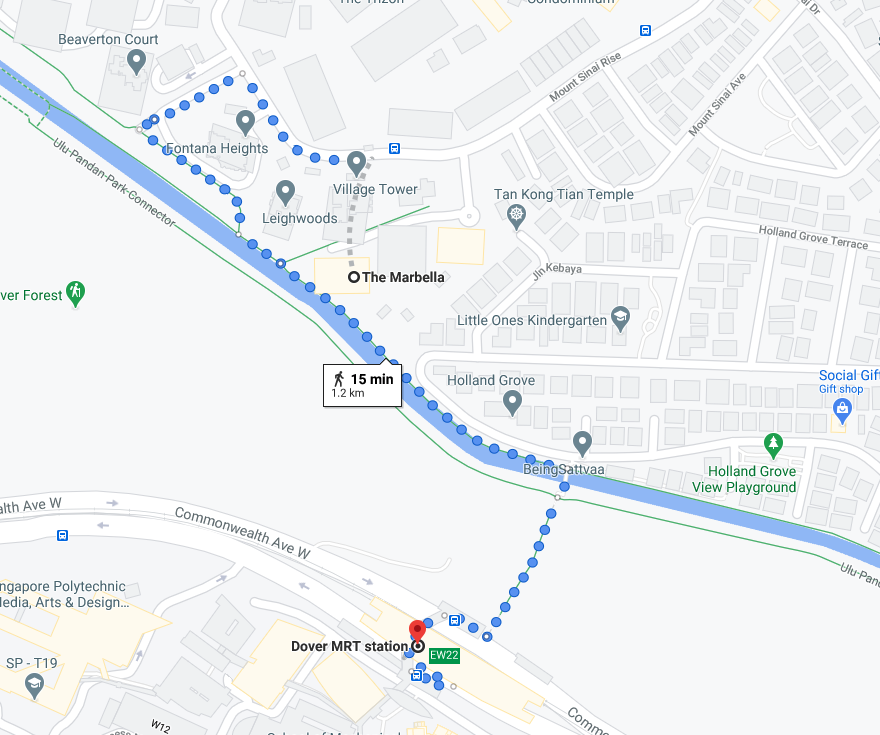

6. Google maps and Street Directory

Terms like “low density” or “near the MRT” can be a bit abstract. For this reason, you should always check out the actual area where the property is located, or will be located in the event of new launches.

Thanks to the power of the Internet, you no longer have to travel to the actual location. Just punch in the postal code on Google maps, and drag-and-drop onto the street view. This will give you a virtual tour of the surrounding area, where you can see how open the area is, where the coffee shops are, where the train station is, etc.

Some of the things to do are:

- Manually click around and navigate to the train station, mall, or other key amenities. This gives you a sense of what the journey is like (e.g., is it a sheltered or unsheltered walk? How many road crossings must the children make to get to the school?)

- Check the proximity to the roads, to get a sense of potential noise and congestion

- Look at the nearby properties, and try to see what’s potentially blocking your view – or identify the stacks that have the better vantage point.

- Examine the façade of the development. Even from the outside, you can usually tell at first glance when the stacks are too closely crowded. You can also see whether the age really shows, without the influence of “glamour shots” in listings.

That said, despite how far we’ve come technology wise, Google maps still isn’t the be all end all when it comes to finding out information on the ground. There are cases where routing from the condo to the nearest MRT will take you through a circuitous route instead. Google maps will not account for side gates at a condo or shortcuts through a HDB estate – ultimately personally going down will still be your best bet.

One more thing when it comes to Google maps is that it doesn’t show things like upcoming projects or MRT lines – so that’s when it’s time to use Street Directory instead.

From here you can get a good overview of the area and the developments around too (you can even see the shapes of the swimming pools). Street Directory is also useful to spot the more obscure condos in the area that you might not usually be able to find with Google maps or even from online listings.

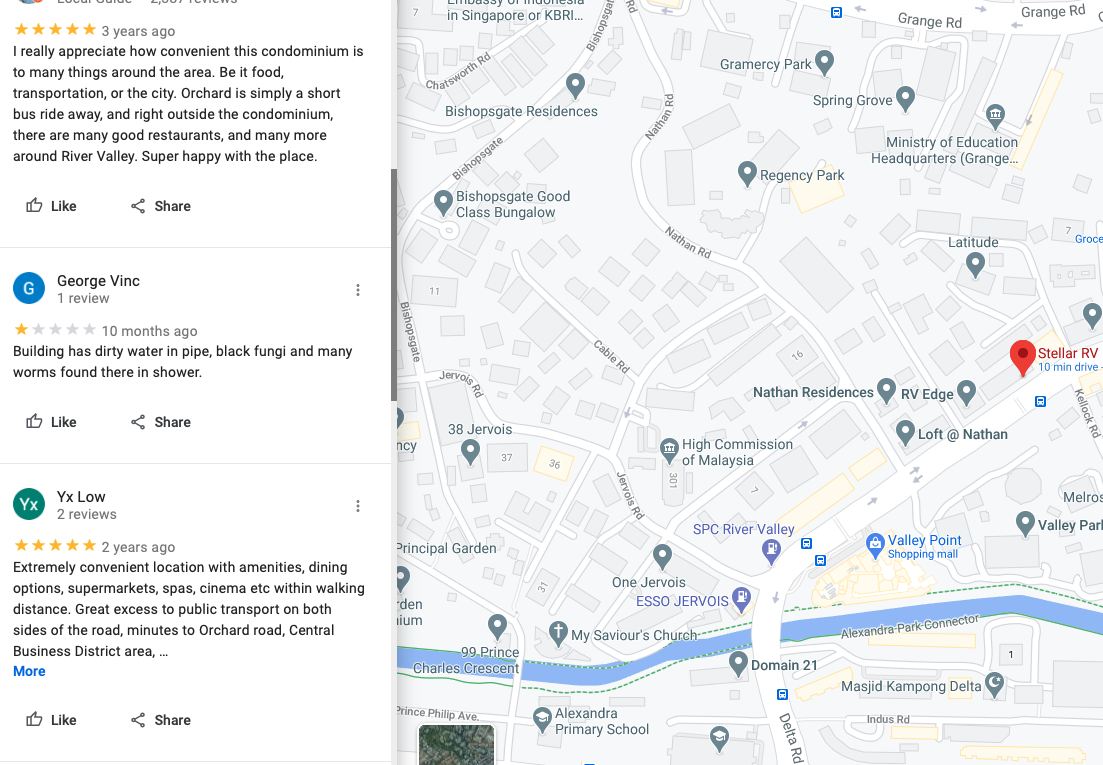

7. Google Reviews/Instagram Locations

Now we have to admit, this can be a bit of a sketchy tool to get an accurate view but when used smartly, it can actually be pretty useful.

While the overly positive reviews on Google can usually be attributed to property agents, once in a while you do get a few reviews that will reveal the actual state of the place.

As mentioned, take some of this with a pinch of salt as it is impossible to verify how genuine these can be. Do also take note of the date, if it is really old some of the issues may have been resolved by then.

For Instagram locations, just search for the condo you are looking for in the places tab.

Not every condo will have images, but for the bigger and older ones especially – you are sometimes able to find a trove of images from the development. So if you want an unfiltered take on the facilities, this could be a useful place to spot.

Now the next step might sound mildly stalker-ish, but sometimes the captions can reveal what people feel about living in that development itself. This isn’t easily uncovered, so it would really depend on how deeply motivated you are in sourcing for additional information.

8. Google Earth

As if we weren’t beholden to Google enough already, but Google Earth is a really useful tool especially for those concerned about their views and what could potentially be blocking your unit.

It still is a bit of a guessing game when it comes to a new launch, but it certainly will give you a better gauge than before.

You can also use Google Earth to measure out the distances between you and your neighbour (if you absolutely must know).

Just head on to the ruler tool (the last icon on the left) and you can easily measure out distances with it.

9. School Guide

We’ve actually covered this tool quite comprehensively before (which you can check it out here). But in a nutshell, it offers the most in-depth data on primary school information, taking into account school admissions and balloting data.

With how important an emphasis most Singaporeans place on education, it’s no surprise that some people move homes purely for the sake of their children’s (future) schools. So other than Schoolguide’s proprietary scoring algorithm that ranks primary schools, the feature that would be more appealing to buyers would be the home search function.

As you might imagine, with this feature you are able to find the closest residential homes to a primary school that you are eyeing.

The big difference here between this feature and what you’ll see in the big property portals is that Schoolguide will take into account school proximity by the block.

As an example, a big development like Leedon Residence will have some blocks within the range of Henry Park Primary School, while some would be outside the radius. In short, it can narrow down to the exact blocks to pick from. Useful, no?

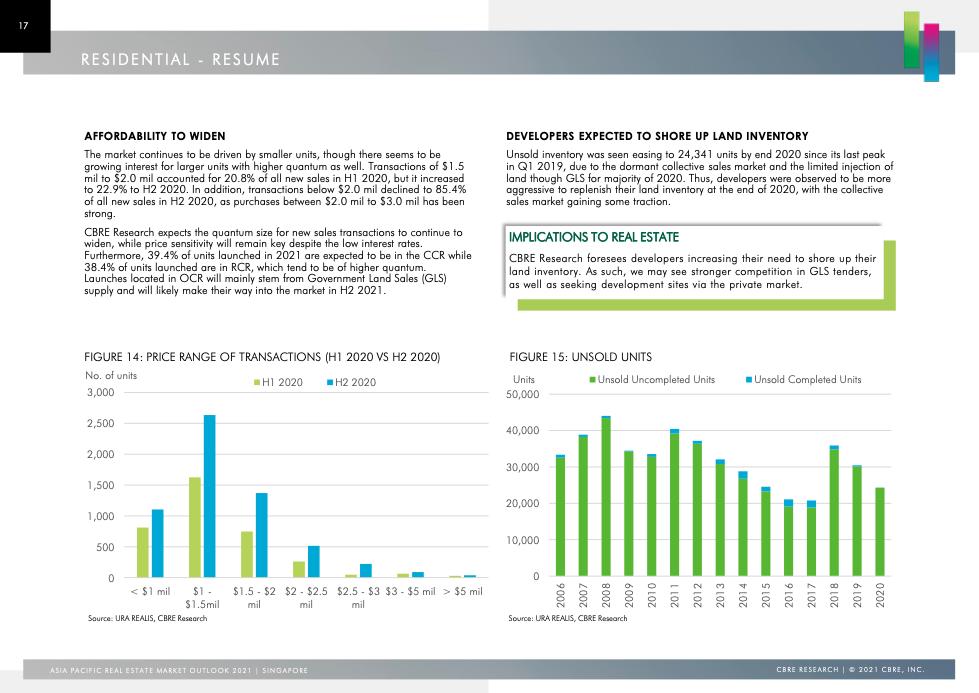

10. Research Reports

Here’s where it can get quite technical, but for buyers who want a more comprehensive overview of the market, you can actually get more information from research reports.

These are easily available from sites like CBRE, JLL, and Knight Frank.

You just have to navigate to the research and reports section. The reports would usually be in the form of a yearly market outlook, and a view on the market by quarters.

Some buyers might find these reports quite dry, so it really depends on your appetite for knowledge.

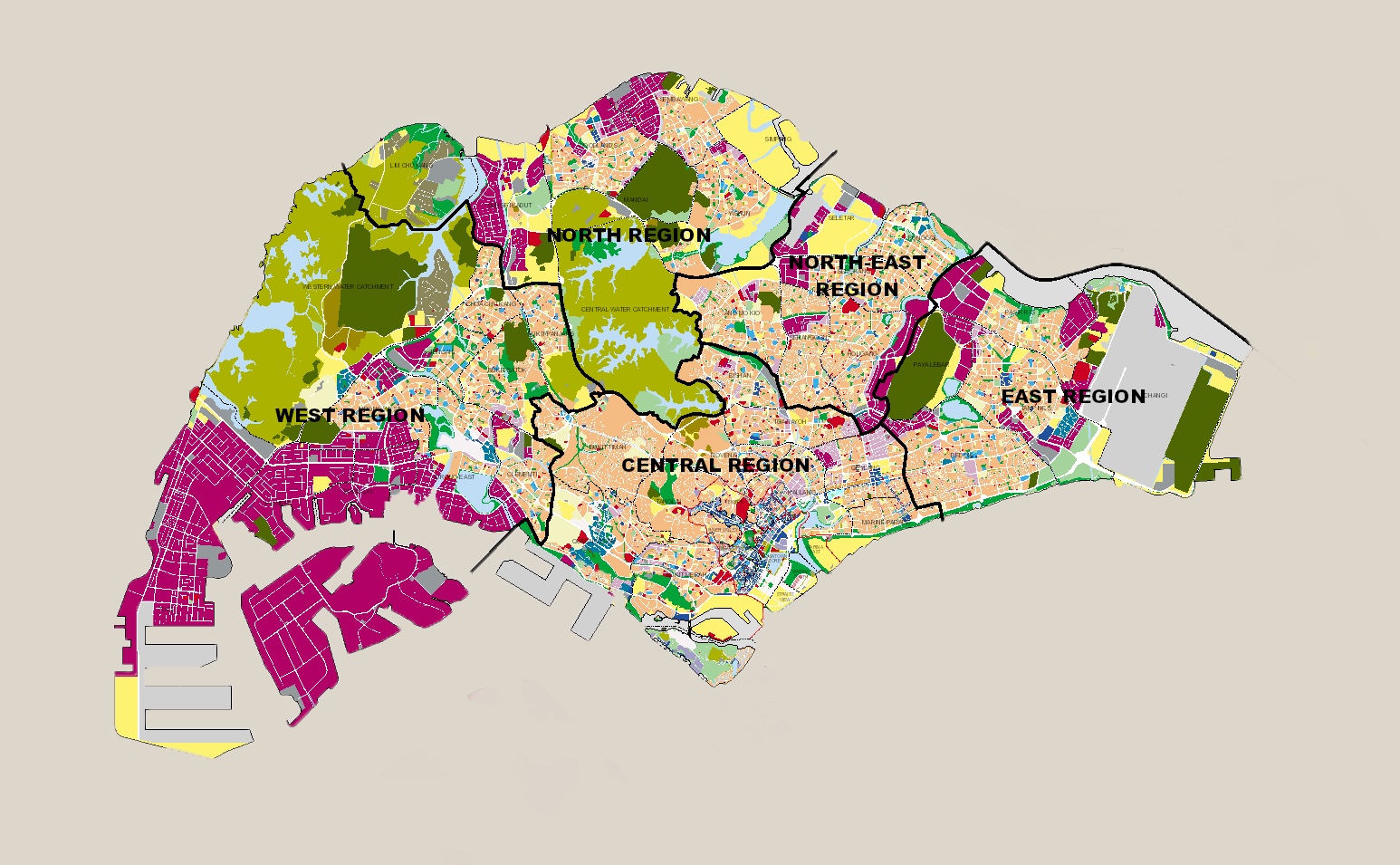

Finally, always consult the URA Master Plan

This is such a big topic, we have a whole separate article on how to interpret it. The URA Master Plan can be used with the other tools above, for some thorough DIY research into any given property.

For some condos however, we’ve already done this (and much more) for you – you can find it on our condo reviews on Stacked. If you’re still uncertain though, do reach out and contact us.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Singapore Property News Taking Questions: On Resale Levies and Buying Dilemmas

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

4 Comments

great tools!

Awesome article. Not planning on buying condo/private any time soon (aiming for resale hdb) but can tell alot of effort went into this.