6 Potential Money Wasters To Avoid When Buying Property

July 21, 2021

Property is one of those purchases where “small extra costs” do matter. Even a few extra square feet can run up to thousands of dollars, so the Singapore property market rewards the detail-oriented. However, most new buyers only know to look for the most obvious elements, like the unit facing or comparative pricing. For this article, we’ll shed light on the “small” potential money wasters, that can actually make a bigger difference than you might think. Here’s what to watch out for:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Potential money-wasting features when buying property

- Large air-con ledges

- Long corridors, walkways, and antechambers

- Big planter boxes

- Paying for void space

- Pick an expensive conveyancing firm

- Unnecessary use of Deferred Payment Scheme

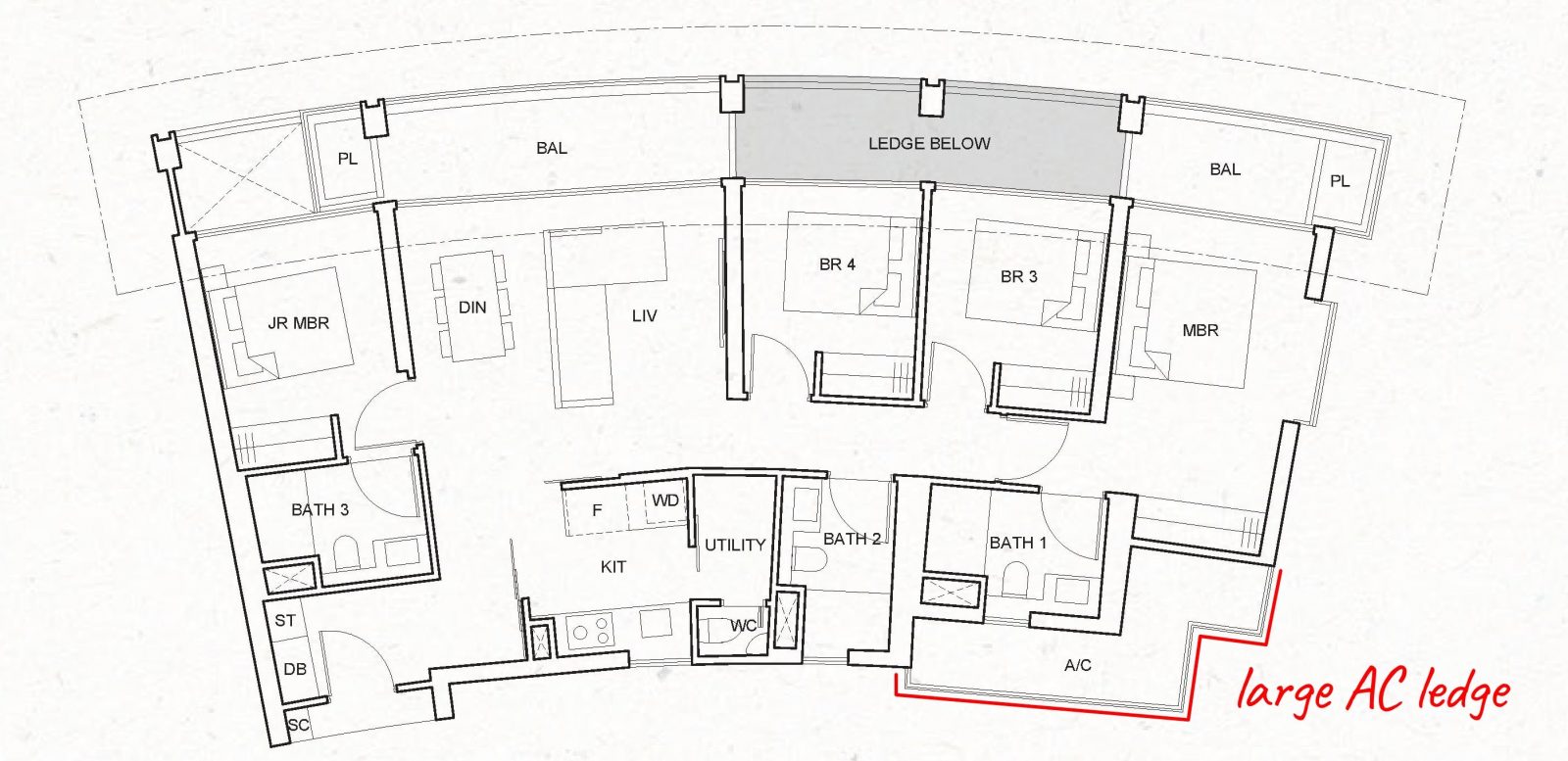

1. Large air-con ledges

Air-con ledges are not counted as part of the Gross Floor Area (GFA), so long as they don’t exceed one metre in width (measured perpendicular to the wall). However, they are considered part of the strata area.

This could incentivise developers to build unnecessarily large air-con ledges, at a cost to the buyer: you will pay for the square footage added by the ledge, but the developer didn’t have to pay for a higher GFA.

Landlords should also be concerned. Over the years, tenants have gotten savvier – many tenants will now check the usable square footage and not just the total unit size; it’s one of the first questions a landlord can expect, when tenants see big air-con ledges.

Back in 2017, the furor over this got all the way to Parliament. However, it’s worth noting the Ministry of National Development’s (MND) response:

“It is already mandatory for developers to provide prospective home buyers with a drawn-to-scale floor plan of the unit, and a detailed breakdown of the area of the unit by various types of spaces, such as bedrooms, bathrooms, air conditioner ledges, and balconies… Homebuyers are advised to review the information in order to make an informed decision over their purchases. “

In short, the practice of building big air-con ledges is not regulated. It’s up to you to check the floor plans, and determine if the size of the ledge makes sense.

For reference, the air-con ledge of a 4-room or 5-room HDB flat (around 970 to 1,184 sq. ft.) is around 32.3 sq. ft. Similar-sized condo units should not require a much larger ledge.

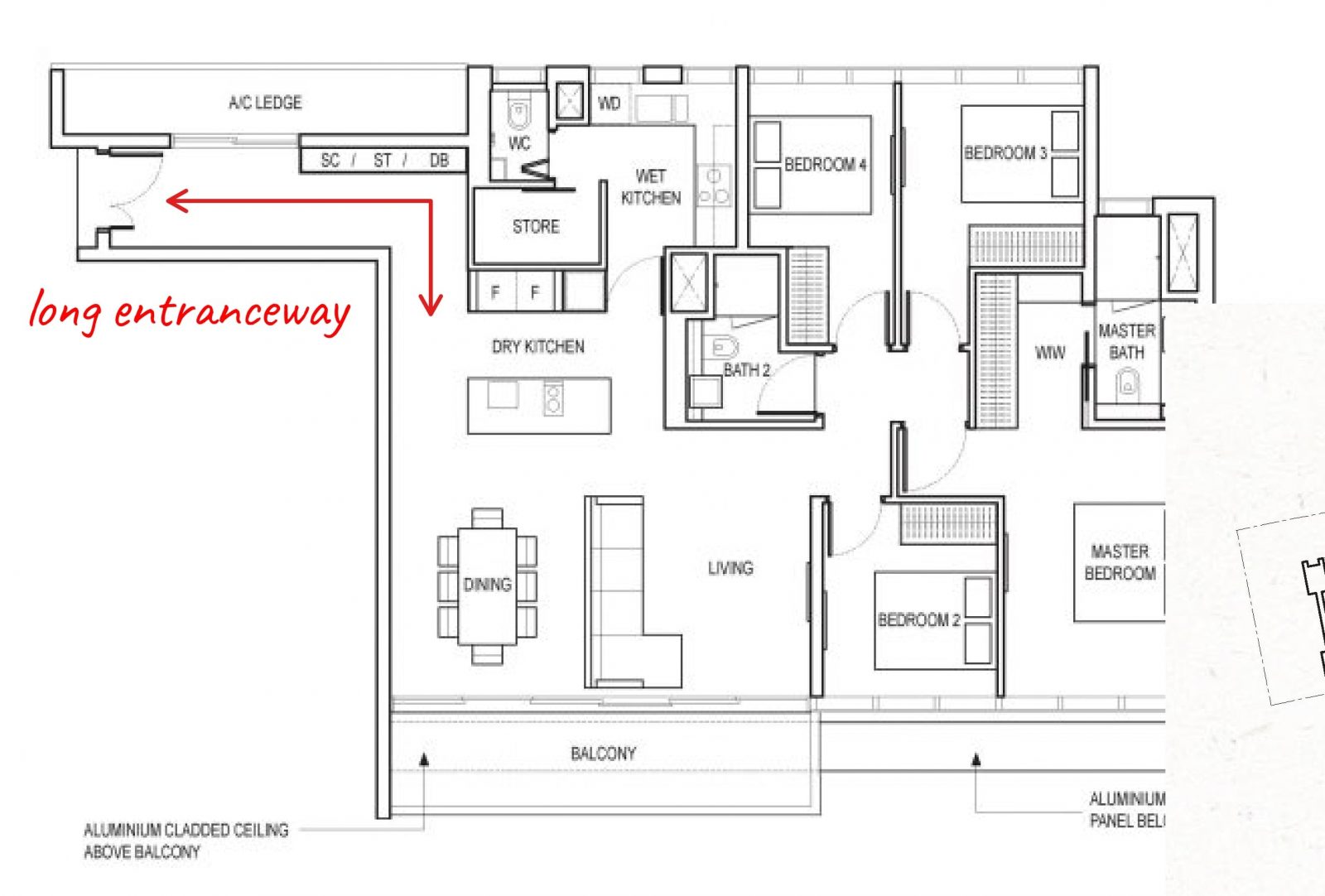

2. Long corridors, walkways, and antechambers

Traditionalists may disagree, but by today’s standards, most buyers consider walkways and corridors to be inefficient. These aren’t functional or living spaces, but you still pay for the square footage. As such, you might want to consider dumbbell layouts, where bedrooms are positioned on either side of the living room; this removes the need for a corridor.

Another feature, which may be found in older condos, is a sort of ante-chamber, or a small nook that the front door opens into. This is a place to put shoe racks, umbrella stands, etc., and which leads into the living room proper. This can also be wasted space, given its limited function.

(This said, some buyers dislike front doors that open directly into the living room. These buyers may not like dumbbell layouts.)

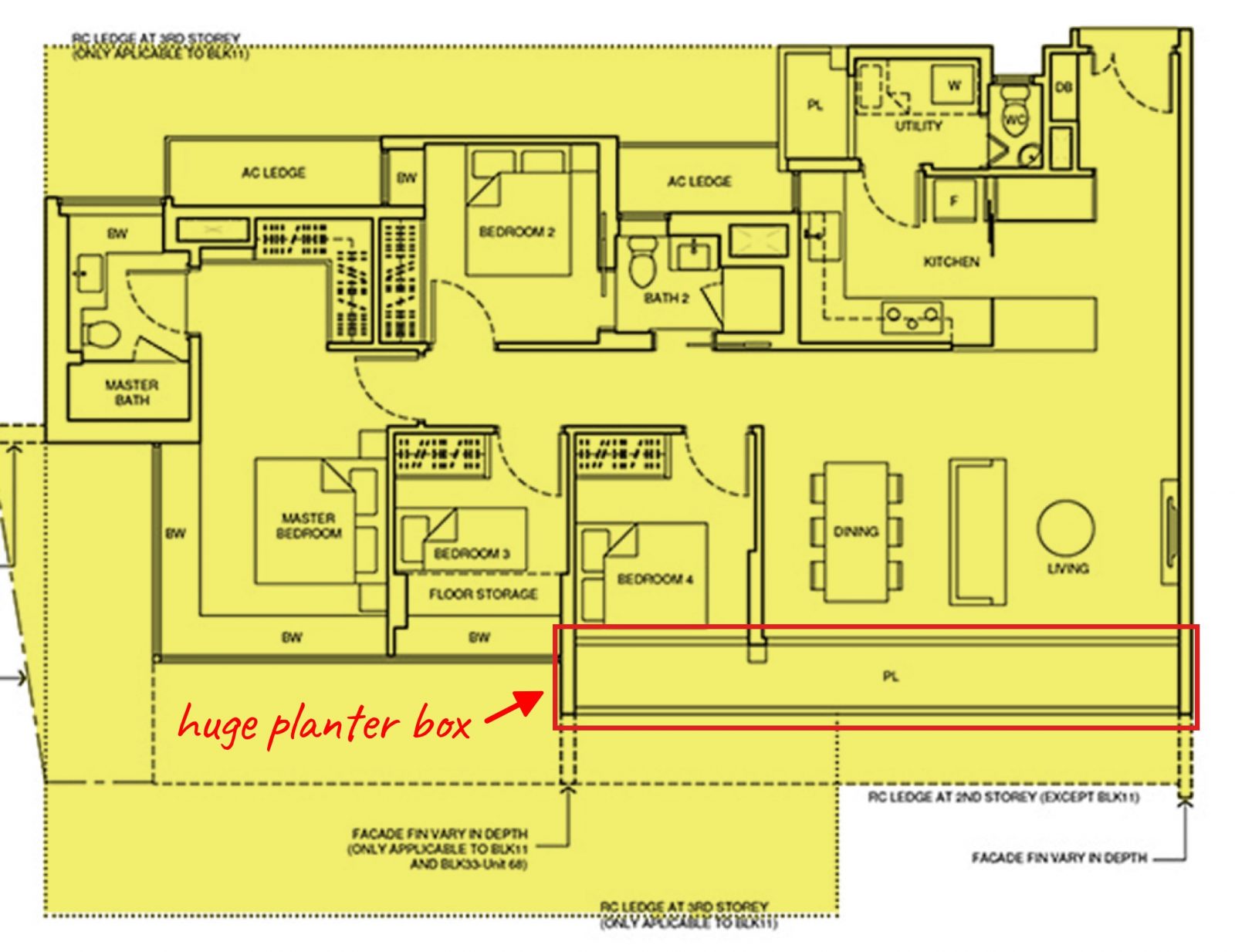

3. Big planter boxes

Planter boxes are more common in older condos. However, we do occasionally see big planter boxes still, such as in the recent One Pearl Bank.

Big planter boxes are supposed to give non-landed homeowners a shot at gardening. However, planter boxes require you to maintain the plants, lest they become an eyesore. Look up at condos that have these, and you’ll often see clumps of dead plants, or just empty planters. They’re also difficult – if not impossible – to convert to other uses (it often affects the façade of the condo, so the management won’t let you change it).

Tenants tend to exclude planter boxes as “usable space”, so landlords should think carefully about the added square footage and price.

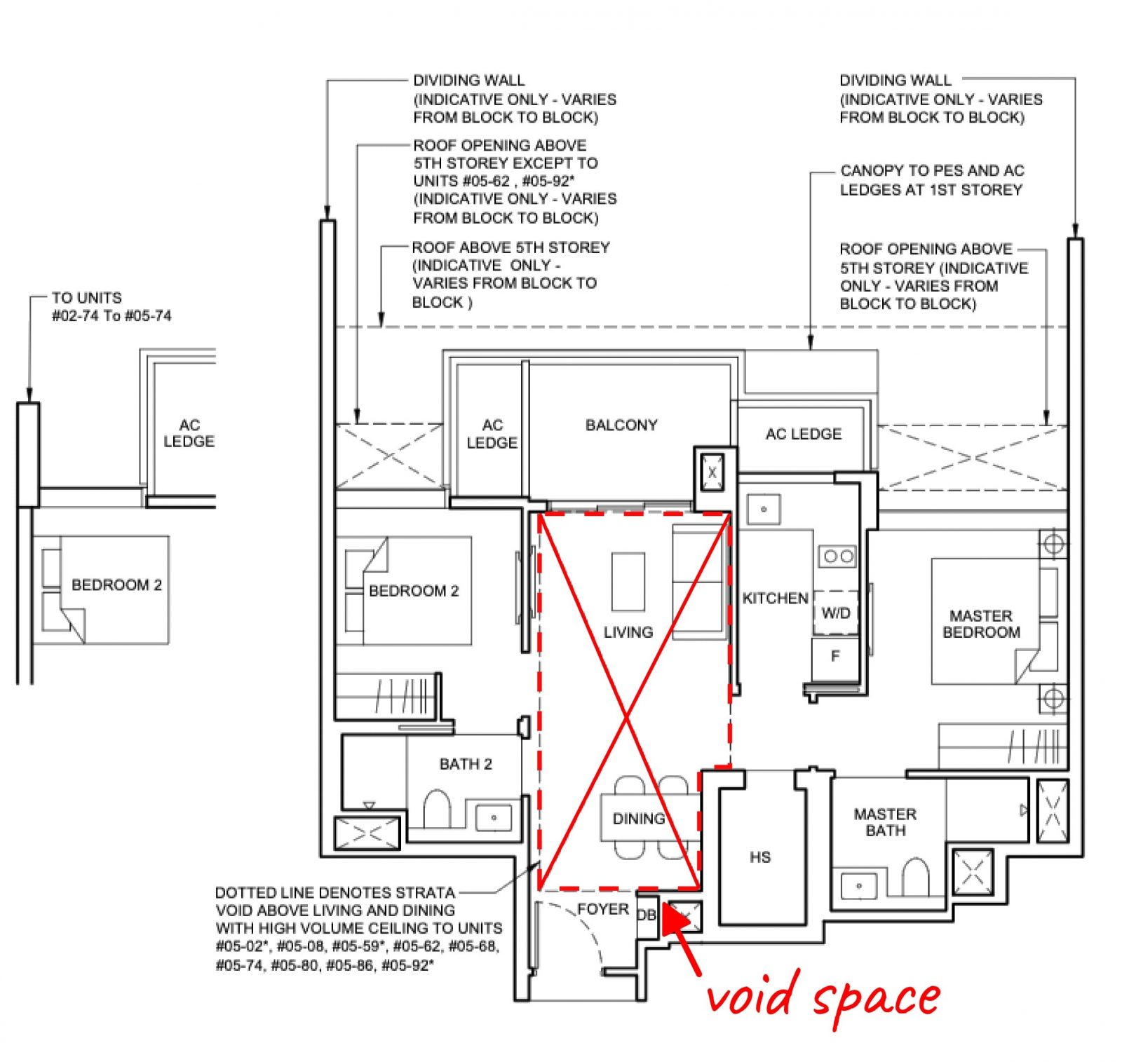

4. Paying for void space

The average floor-to-ceiling height of a condo unit is 2.8 metres. Once you reach four metres or more, however, there’s a chance you may be paying for void space. This refers to the empty space above the floor, which can be used to build mezzanine levels, or other floors. Void space counts toward the strata area, so buyers do pay for this.

The tricky part is figuring out whether it’s worth paying for. Void space may be worth its price in landed homes, where you’re more likely to get approval to build mezzanine floors, can add another level, etc.

Property Market CommentaryWhy Are Landed Home Sales Hitting New Highs Despite Covid-19?

by Ryan J. OngWith non-landed properties, however, the void space only serves a limited purpose: it makes the unit feel more spacious, and perhaps improves natural light. Beyond that, it might be nothing more than an expensive indulgence.

We suggest you go over the floor plans with an interior designer or contractor first, and work out your options.

For new developments, void space must be clearly indicated by the developer; you’ll be asked to give written confirmation that you understand the details, before you put down the booking fee.

For resale developments, you need to check the details yourself. You can find the information on INLIS.

5. Pick an expensive conveyancing firm

You need a conveyancing firm for your property transaction, which typically charges between $2,500 to $3,000. However, note that each bank tends to work with only a handful of conveyancing firms (they’re often described as being “on the bank’s board”).

In general, it’s best to avoid using a firm that is only on the board of your specific lender. This is because, if you attempt to refinance later, your new bank isn’t working with this firm. You’ll probably need to pick a conveyancing firm on your new bank’s board, and this will incur added legal paperwork (the new firm needs to take over from your existing one).

Regarding the legal fee of $2,500 to $3,000, there’s virtually no difference (unless you really like one specific lawyer). As such, savvy buyers will insist on picking the cheapest.

In general, bigger “brand name” law firms will charge more. Smaller firms, which may be focused on conveyancing only, might charge less.

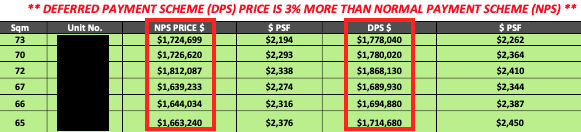

6. Unnecessary use of Deferred Payment Scheme

The Deferred Payment Scheme (DPS) is often advertised as a huge bonus to late-stage buyers. These are sometimes available for new launch properties, which have just received their Temporary Occupancy Permit (TOP).

The most common form of DPS allows for a 20 per cent down payment, after which you pay nothing for 24 another 24 months. During this two-year “break”, you’re free to move in and are sometimes even allowed to rent out the unit. It’s especially enticing to HDB upgraders: they can move in first, and then take their time to sell off their former flat.

However, we’d suggest you avoid taking the DPS just because you can.

The DPS can come at a steep cost – the overall quantum can be as much as 20 per cent higher. If you already have a home loan secured, and have the financial means, you might save more by just using a regular loan.

In addition, there’s a risk that your income level may change during the 24 months. If your income drops, and you can’t meet loan servicing ratios, there’s a chance you may not qualify for a sufficient loan. This would result in forfeiting your 20 per cent down payment, along with other potential penalties besides.

While DPS can give you extra “breathing room”, don’t mistake it for improved affordability. You will usually end up paying more, not less.

Remember that all the “small costs” add up

Viewed in isolation, each “small cost” may seem insignificant. But if you total up the square footage taken up by planter boxes and void space, pick the pricier law firm, get an inefficient layout that tenants won’t pay for, etc., the total cost to you can ultimately eclipse your returns.

If you’re not certain you’re getting the best deal, drop us a note at Stacked, and we can have experts give you a fair opinion. You can also follow us on Stacked, to get in-depth reviews and news on the Singapore private property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Pro Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

On The Market A Rare Pair Of Conserved Shophouses In Chinatown Just Hit The Market For $32.5M

Singapore Property News Some Units At This Freehold Riverfront Condo Could Lose Their Views — But Here’s How Prices Have Actually Moved

0 Comments