Would You Pay $900k For A 3-Room HDB? Let’s Break It Down

January 5, 2025

How much more would you pay for a very new (i.e., around five years old) resale flat?

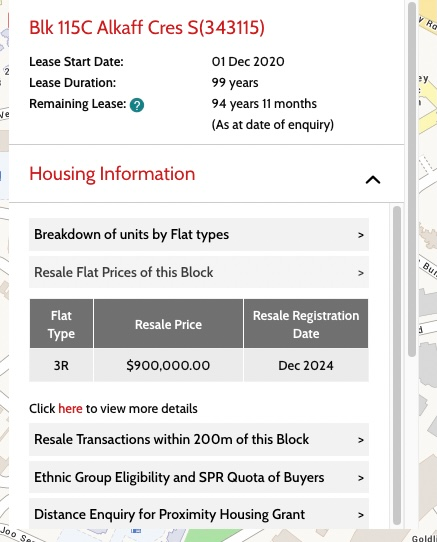

You might figure it’s at a premium, since (a) you can move in immediately and skip the construction time, and (b) the lease decay is negligible. But I think a lot of us underestimate how high the premium has gotten on these very young flats. Case in point, the price of this latest record-breaking 3-room flat, in the highly desirable Alkaff Crescent area:

You’re seeing that right: it’s $900,000 for a 3-room flat. For that price, you can get a resale EC unit like a two-bedder at Northwave, or a freehold two-bedder at Natura @ Hillview (based on recent asking prices I’ve seen).

Now it’s not purely about the flat’s age of course. This is an excellent location near Woodleigh MRT station, where the 4-room flats can reach up to $1.2 million; and access to both Woodleigh and Serangoon is super convenient. But there are also plenty of other resale flats in these areas, and, likely, one of the defining features of this 3-room unit is just how new it is.

This is a bit concerning as previously, the flat types that pushed into million-dollar territory were mostly old ones. Scarce units like jumbo flats and maisonettes, which aren’t built anymore, reached such a high quantum due to the combination of rarity and sheer square footage. This was a self-resolving problem, in that the 99-year lease would eventually diminish their value; many are as far as halfway through their lease already.

There’s also bound to be disgruntled responses from some of the public, who see this as profiteering.

The flat owners who hold for exactly five years, and then attempt to flip for a profit, are sometimes perceived as “not really needing” the flat. This may or may not be true; some do just use the flat as a stepping stone to a condo. It’s also not a new development in the property market. But as the prices of these young flats soar higher, more people have started to take notice; and it could well result in calls for new measures, like an extension of the Minimum Occupancy Period (MOP) beyond five years.

Will we one day see some standard flats hit with longer MOPs, as we have with Plus and Prime flats? I’m going to call it and say yes, if we start seeing five-year-old flats continue to push into million-dollar territory. I’d also expect HDB will throw in further limitations and controls, for special appeal cases where owners get to sell before their MOP is up.

Meanwhile, in other news, there’s been a lot of talk about some Singaporean buyers who got “scammed” with Malaysian property

This is over the Private Lease Scheme (PLS) in Malaysia, where the developer – not the condo buyer – owns the property. The “buyer” is actually a tenant, who purchases a 99-year lease.

Everyone who likes to insist HDB flats are leased and not sold will now jump out of their chairs and yell “SEE I TOLD YOU.” They’ll also see a similarity in that, to sell their condo units under the PLS, the owners will have to get permission from the developer.

Now is this a huge issue? In the sense that a developer could deny the right to sell, yes, it’s concerning; and I wouldn’t buy a unit like that. But on the flip side, developers almost never deny permission to sell even with the PLS.

(At least, I’ve never heard of such a denial, although I’m far less familiar with properties across the Causeway.)

More from Stacked

4 Potential Residential En Bloc Sites That Could Be Worth Watching In 2025

Despite the tough global trade war, developers seem to be confident in 2025. This is perhaps spurred by the strong…

For those who compare this to HDB, I would add that the restrictions on you as a buyer of an HDB is made clear from the start. In particular, the 5-year MOP where you cannot sell or rent the whole unit in the first 5 years. And while you are not the true owner (officially an HDB owner is a lessee), the restrictions on what you can or cannot do is all public information. Besides, wouldn’t lifting all these restrictions only make an HDB more similar to private properties – and thus its prices too?

A bigger concern is whether this was clearly expressed to the buyers.

This is one of the factors we often overlook when buying overseas. Without specific reference to Malaysia (this can happen anywhere,) I find Singaporeans are quite trusting of authorities, and tend to assume that regulatory bodies overseas are as stringent as ours. But the truth is, not every regulatory board is as stringent as CEA; and in some nearby jurisdictions (I’m not going to point fingers,) anyone can sell a property.

The data sources may be made up, they may have no real grasp of the transaction process, and lies of omission (as in our PLS case) may be permitted. So while we like to believe we’ve “done our homework,” we often overlook the possibility that the sources of said “homework” are questionable.

It’s an added risk to brace for, when choosing to buy abroad.

Meanwhile in other property news…

- Here’s our year-end wrap-up of 2024, the year that got crazier as its ending loomed closer.

- Condos that are only around $1.38 million, but still feature a private pool. Yes, they can still be found in Singapore today.

- Where were the most profitable resale condo transactions in Singapore, for 2024? The answers may surprise you, as some of these projects are far from famous.

- Million-dollar flats are old-hat. Our worry can now shift to $1.5 million flats, at which point, you really can buy a condo for their price. Here’s where such deals have actually happened.

- Cluster landed homes from just $3.85 million? Check out this awesome yet lesser-known landed enclave.

Weekly Sales Roundup (23 December – 29 December)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| 32 GILSTEAD | $14,578,000 | 4219 | $3,455 | FH |

| MEYER BLUE | $5,331,000 | 1528 | $3,488 | FH |

| GRAND DUNMAN | $3,393,000 | 1292 | $2,627 | 99 yrs (2022) |

| THE MYST | $3,300,000 | 1690 | $1,953 | 99 yrs (2023) |

| HILLOCK GREEN | $2,872,000 | 1346 | $2,135 | 99 yrs (2022) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE CONTINUUM | $1,510,000 | 560 | $2,698 | FH |

| KASSIA | $1,606,000 | 753 | $2,131 | FH |

| NAVA GROVE | $1,892,400 | 700 | $2,705 | 99 yrs (2024) |

| MEYER BLUE | $2,045,000 | 667 | $3,064 | FH |

| THE MYST | $2,167,000 | 1033 | $2,097 | 99 yrs (2023) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| EDEN RESIDENCES CAPITOL | $19,750,000 | 5802 | $3,404 | 99 yrs (2011) |

| REGENCY PARK | $7,000,000 | 3175 | $2,204 | FH |

| N.A. | $6,920,000 | 1745 | $3,966 | FH |

| 15 HOLLAND HILL | $6,150,000 | 1862 | $3,303 | FH |

| SOMMERVILLE PARK | $4,500,000 | 2314 | $1,944 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PARC ROSEWOOD | $640,800 | 431 | $1,488 | 99 yrs (2011) |

| 448@EAST COAST | $743,000 | 431 | $1,726 | FH |

| HILLION RESIDENCES | $808,000 | 463 | $1,746 | 99 yrs (2013) |

| 38 I SUITES | $840,000 | 463 | $1,815 | FH |

| ECO | $890,000 | 614 | $1,451 | 99 yrs (2012) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| SOMMERVILLE PARK | $4,500,000 | 2314 | $1,944 | $2,550,000 | 25 Years |

| AVON PARK | $3,580,000 | 2174 | $1,646 | $1,920,000 | 15 Years |

| THE LEGEND | $2,518,888 | 1453 | $1,733 | $1,608,888 | 20 Years |

| LAGUNA 88 | $2,280,000 | 2034 | $1,121 | $1,548,000 | 18 Years |

| REGENCY PARK | $7,000,000 | 3175 | $2,204 | $1,450,000 | 7 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| OUE TWIN PEAKS | $3,398,000 | 1399 | $2,428 | -$631,120 | 8 Years |

| REFLECTIONS AT KEPPEL BAY | $2,220,000 | 1055 | $2,105 | -$274,800 | 17 Years |

| TREASURE AT TAMPINES | $2,750,000 | 1690 | $1,627 | -$238,000 | 1 Years |

| V ON SHENTON | $980,000 | 452 | $2,168 | -$132,000 | 12 Years |

| MOUNT SOPHIA SUITES | $1,160,000 | 710 | $1,633 | -$20,000 | 14 Years |

Transaction Breakdown

Follow us on Stacked for more updates on the Singapore property market, over the coming year.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why are some very new resale flats in Singapore so expensive, reaching around $900,000 for a 3-room unit?

How does the price of a new resale flat compare to other property options in Singapore?

What is the concern with flats that are only five years old selling for such high prices?

Are Malaysian property schemes like the Private Lease Scheme similar to Singapore's HDB flats?

What are the risks of buying property abroad under schemes like Malaysia’s Private Lease Scheme?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Editor's Pick A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

2 Comments

No way

900k for 3 room flat

Crazy

The Main reason for The Newly MOP Flats going Up and up is, the Cpf restrictions of Older flats. This is a huge mistake on Govt part. OA is for Housing. So Restricting for older flats, making young couples go to Newly MOP flats. As everyone wants new ones, Prices of these flats are at ridiculous state now.