7 Important Things To Know Before You Buy Any “Cheap” Johor Bahru Property

June 1, 2024

Interest in properties in Johor Bahru (JB) has picked up again; partly due to the high property prices in Singapore and the Malaysian Ringgit hitting a record low against the Sing dollar, but also due to encouraging news about the Rapid Transit System (RTS) link.

A few months ago, we received word that the link is now 70 per cent complete – this will make it easier for Singaporeans to travel to and from JB, if they have a second home there. But even though prices may be lower across the causeway, you do still need to exercise greater caution. Here are a few important things to check before you buy:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

First off, a quick reminder about your Minimum Occupancy Period (MOP)

You do need to wait out your five-year MOP before you can buy your second property in Johor (or 10 years if you have a Plus or Prime flat). It’s illegal, and a really bad idea, to try and sneak past HDB on this one – it could result in your flat being confiscated, among other penalties.

The same goes for living in your JB property while renting out your flat: remember you need to be past the MOP before you can rent out your entire flat.

That being said, here are some things to watch out for:

That being said, here are some things to watch out for:

- 1. The minimum purchase amount is always RM1 million

- 2. You can get a loan from a Malaysian bank, but it’s usually more complicated

- 3. It’s a bad idea to sell the property within the first five years

- 4. There’s actually a limit on the commission a realtor can charge

- 5. There are Real Estate Negotiators (RENs) and Real Estate Agents (REAs)

- 6. Older homes may actually be the better deal

- 7. JB is a lot bigger than Singapore, with many older properties; expect some inconsistencies

1. The minimum purchase amount is always RM1 million

It’s fairly well known that foreigners can only purchase a property that’s at least RM1 million (there are some exemptions for certain projects, but these are rare). However, some parts of Johor are designated as international zones (part of the broader Iskandar region). These include Iskandar Puteri, Medini, and Pasir Gudang. For landed properties in these zones, the minimum purchase price is RM2 million.

As a related aside, note that the minimum purchase amount can also differ in states besides Johor (e.g., in Perlis, the minimum is RM500,000.) The minimum purchase amount may also be lower if you’re buying under the Malaysia My Second Home (MM2H) programme; this is beyond the immediate scope of this article but you can check out the eligibility requirements here.

2. You can get a loan from a Malaysian bank, but it’s usually more complicated

The loan requirements will vary between the banks, but taking a home loan from a Malaysian bank is usually much easier if you’re buying under MM2H, due to the extended visa period.

Mortgage brokers that we’ve spoken to say the Loan To Value (LTV) ratio may be as low as 60 per cent for some foreigners, although this varies based on the applicant and bank. There’s a possibility that, to secure the usual loan quantum, the bank may require some form of fixed deposit or collateral.

It’s generally easier to go ahead with this using a local bank; but if you can’t, you may want to brace for the possibility of a bigger cash outlay. Also, note that loan approval times can be much longer, so you should start looking for a lender early if you’re after a particularly hot property.

Finally, do note that there’s a stamp duty of 0.5 per cent of the loan quantum.

3. It’s a bad idea to sell the property within the first five years

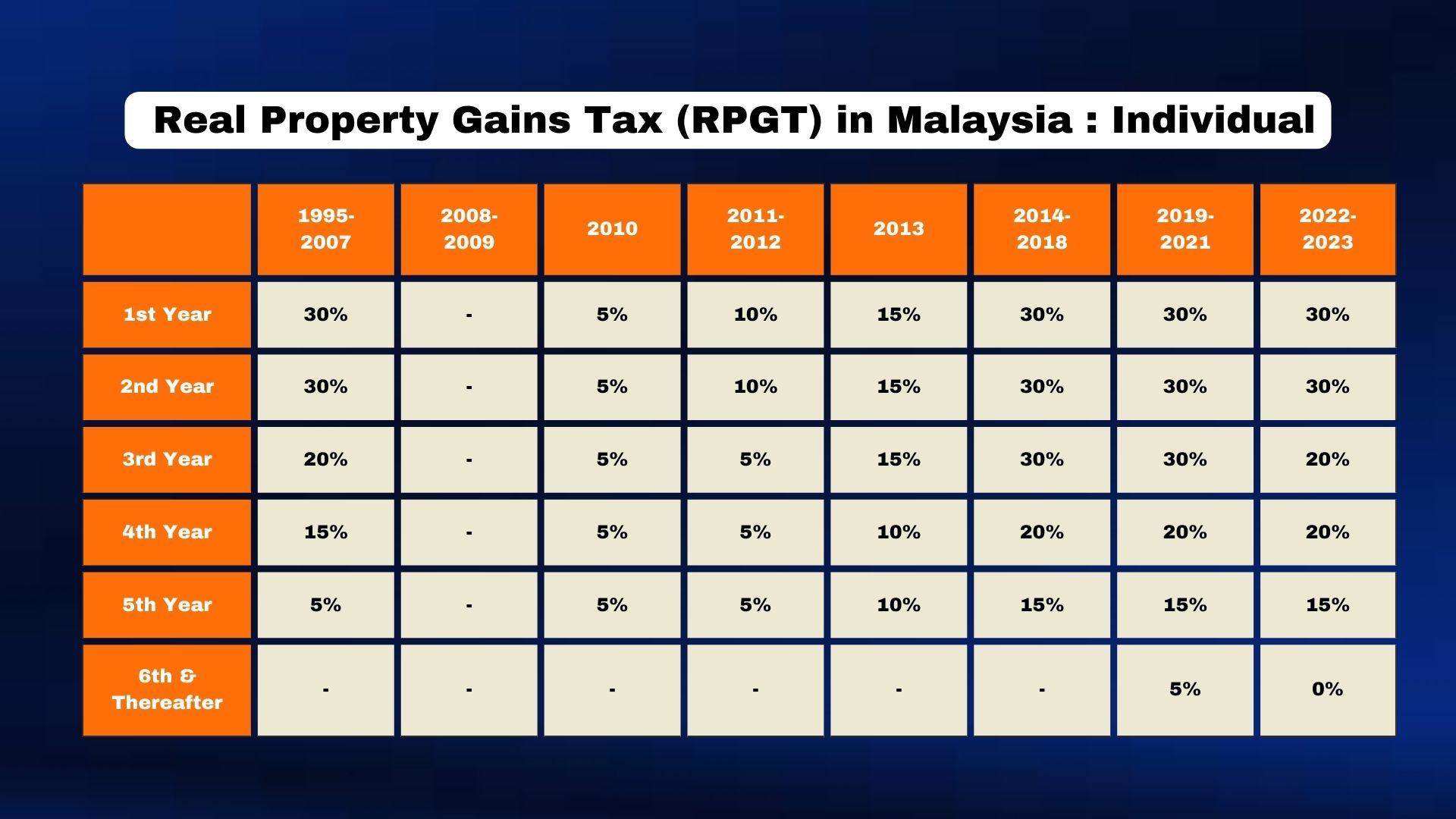

There is a Real Property Gains Tax (RPGT) applied on your net profit when you sell the property. For foreigners, this is 30 per cent if it is sold within the first five years, and 10 per cent after that.

Like the Sellers Stamp Duty (SSD) in Singapore, this discourages certain tactics like house-flipping; and you should be sure of where you want to stay for the next five years at least when you buy. That said, you do have some tax relief if you happen to sell the property at a loss.

4. There’s actually a limit on the commission a realtor can charge

As in Singapore, you can negotiate the commission with the property agent; but the difference is that Malaysia caps the commission rate at three per cent. This is under the Malaysian Institute of Estate Agents (MIEA).

More from Stacked

Here’s Why These Condos Lost Money Despite Buying At A Property Market Low

This week, we looked at some properties that saw losing transactions, despite being bought at an “ideal” time - during…

A minimum fee of RM1,000 applies, although we doubt any realtor will want to help for that little.

In Malaysia, the sellers can include this in the asking price (e.g., the listing price +3%). If they do this, it does mean the buyer is actually paying the commission.

5. There are Real Estate Negotiators (RENs) and Real Estate Agents (REAs)

The REAs have undergone more extensive training, and have a Diploma in Estate Agency. This is usually followed by another two or more years of practical training. The RENs have a much shorter training period, and just hold a Negotiator’s Certificate.

In terms of commissions, both have the same three per cent cap, and in practice, the fees will be around the same. Whilst some buyers or sellers will prefer a full-fledged agent due to the more extensive training, there’s no guarantee that a REN can’t have an equally wide pool of connections (or equal knowledge through sheer experience).

Note that both are accredited under the Malaysia Board of Valuers, Appraisers and Estate Agents Malaysia (BOVAEA). Both will have an ID that includes a QR code; note that a name card from an agency does not count as proof. In any case, all legitimate agents or negotiators will have a Real Estate Agent (blue) or Real Estate Negotiator (Red) tag that is issued by the Government, or you can search for them through this database.

6. Older homes may actually be the better deal

From word on the ground, we understand that many buyers – including Malaysians themselves – prefer older homes. We were told to be especially wary of newer construction that occurred during or right after the Covid period, as developers were hard pressed and more likely to cut corners.

We can’t attest as to how true this is; but it might be a good reason not to dismiss the older properties (pre-2000’s), as you may find the construction standards are actually better.

Of course, if you’re buying a landed property and can build your own house, this is less of an issue.

7. JB is a lot bigger than Singapore, with many older properties; expect some inconsistencies

Not all developments or areas may have detailed, verifiable transaction histories. We also have this issue with older properties in Singapore (e.g., walk-up apartments), but Johor is much bigger, and with a wider variety of properties.

This can mean that floor plans are unavailable, and changes to a unit may not be fully documented. This is where the help of an experienced REA/REN comes in, as they can spot illegal modifications done to a unit or shoddy work by “under-the-table” contractors (sometimes the previous owners tried to save money by hiring these unqualified handymen).

For older landed properties, be wary of previous owners who encroached onto the neighbour’s land. Malaysians tend to be quite neighbourly, so there may have been no issues if someone’s fence or wall is slightly over on their side; but you don’t know if future neighbours will be as understanding.

Finally, or perhaps most importantly, bear in mind the exchange rate issues

Currency exchange rates may be favourable now; but there’s no guarantee that will always be the case. Many who bought in the earlier years would feel the pain of buying a property in Malaysia due to the record low Ringitt now. Dealing with fluctuating rates adds a layer of complexity to your investment, as now the rise or fall of the ringgit affects your returns accordingly.

And that’s not adding to other issues to think about such as the potential oversupply of units or construction quality issues.

So unless you have a strong reason to stay or retire in JB, perhaps a better way to think about it would be to buy in Singapore and rent in JB instead.

For more on the property market, follow us on Stacked. You can also follow us for reviews of new and resale properties in Singapore. If you’d like help with your real estate needs, you can also reach out to us here.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What should I know about the minimum property price when buying in Johor Bahru as a foreigner?

Is it easy to get a mortgage from Malaysian banks for JB property?

Should I sell my JB property within the first five years?

How are real estate agents and negotiators regulated in Malaysia?

Are older homes in Johor Bahru a good investment?

What should I consider about property transactions and property condition in Johor Bahru?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Overseas Property Investing

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Overseas Property Investing What Under $200K Buys In Malaysia Today — From Freehold Apartments to Beachfront Suites

Overseas Property Investing A London Landmark Is Turning Into 975-Year Lease Homes — And The Entry Price May Surprise Singapore Buyers

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

1 Comments

Simply put: do not buy msia property, ever, if you are singaporean. The odds are stacked against you (high foreigner floor price, poor performance of the RM etc). Don’t be a “chai tao” or robert. You are wrong that Malaysians prefer “old houses” , they prefer “newly TOP” or fairly new house – simply because the developers there can sometimes “run road”, leaving one with an uncompleted property (but a big bank loan)! There have been so many stories of Singaporeans regretting buying property in JB. When will we learn? Just don’t buy- if you are desperate to live in JB, just rent a condo- it’s cheap, and saves you a lot of headache. Loan from Malaysian bank- not difficult. Why would it be? A Singaporean backed loan is a sure thing to them, unlike Malaysians who can just “run road” and default on their mortgage payments. (Singaporeans are very law abiding and they know that.) Again, reminder that Msian property loan is somewhere around 4-5% p.a.