What Will Happen To The Resale Condo Market For The Rest Of 2021?

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

For a brief moment in May and June, resale condo volumes started to fall from record highs. It was a glimmer of hope for homebuyers who are truly looking for an own stay option. That hope was dashed when the results for July were out, and prices and volumes started to climb again. How much longer can this go on?

What’s happening to Singapore’s resale condo market?

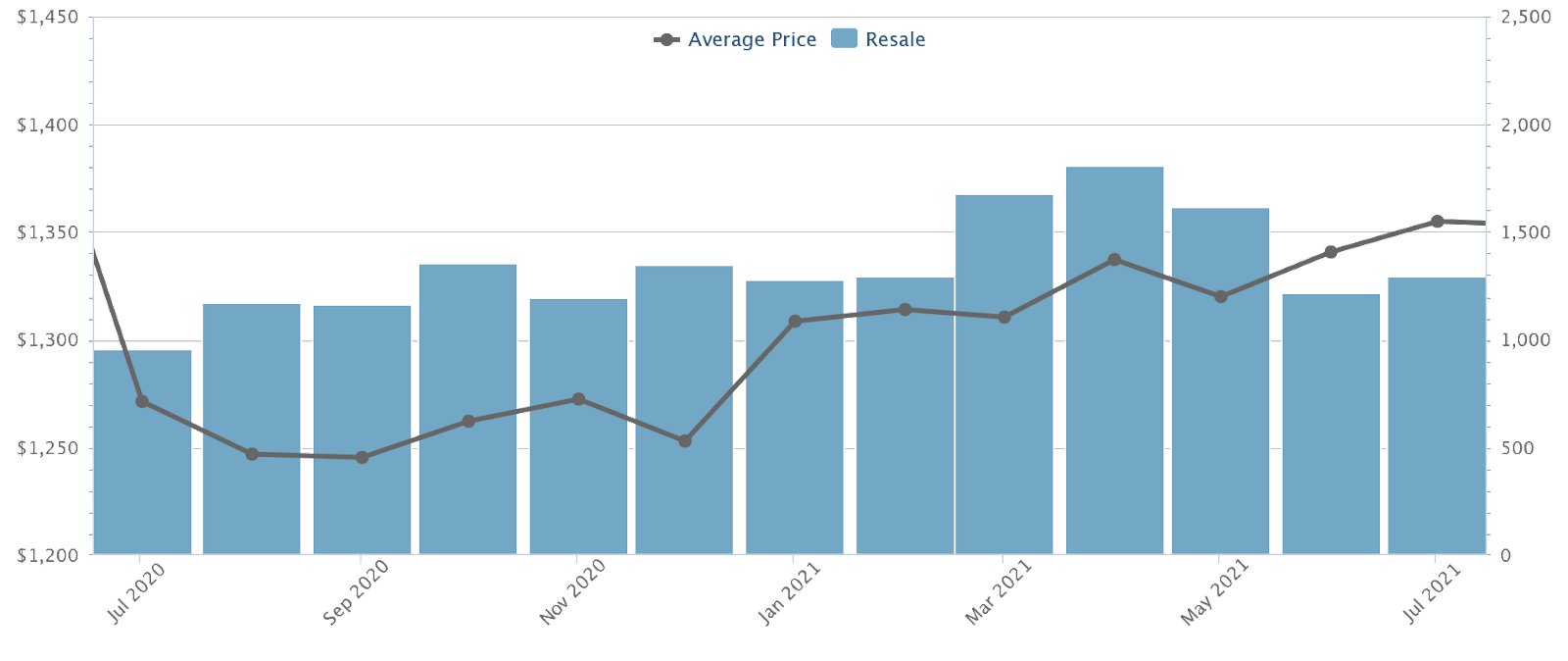

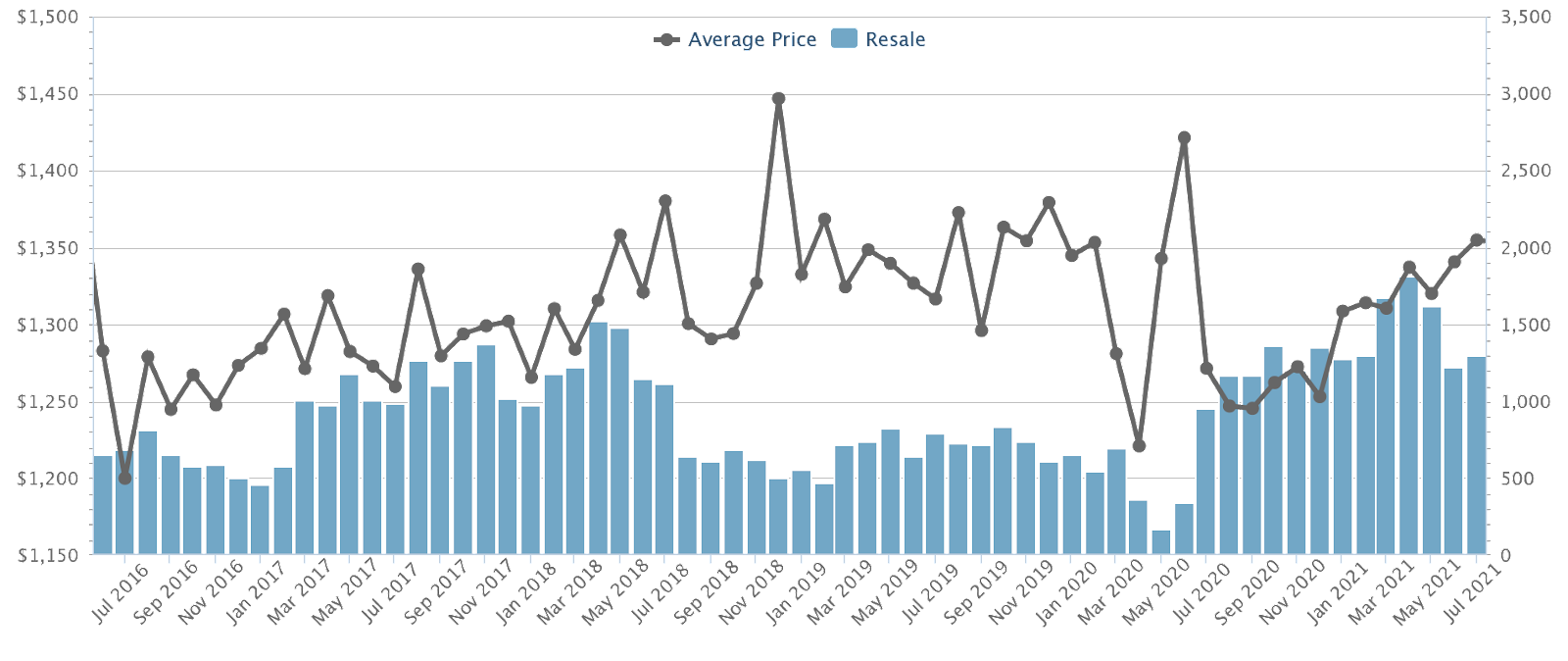

The transaction volumes for resale condos, along with their prices, have been on a steady incline for the past 12 months:

Prices have risen from an average of $1,271 to $1,355 psf, since last July. Resale volumes have also stayed at record highs: with the exception of July 2020, there hasn’t been a single month with fewer than 1,160 transactions.

In fact, April 2021, which saw 1,807 condos resold, is the highest we’ve seen in 10 years. This is what resale volumes have looked like, since the start of the pandemic:

We have now surpassed the levels seen in June 2018, just before cooling measures kicked in. This is significant because, if the government saw fit to intervene then, it has ample justification to do so now.

On a more immediate level, home buyers (particularly first-time homebuyers with no previous property to sell) have lost the proverbial light at the end of the tunnel.

After the spike in resale volumes in April (1,807 transactions), the volume fell to 1,611 and 1,214 transactions, in May and June respectively. This gave rise to the expectation that demand had peaked.

But as of end-July, volumes and prices rose again, to 1,289 units. This was especially unexpected, because July saw a return to Phase II. This had restricted home viewings, which are more important in the resale than the new launch market (e.g., it’s not uncommon to skip an idealised show flat, but only the most desperate or trusting buy a resale unit sight unseen).

The resale condo market is of huge importance to home buyers in 2020/21

Covid-19 has created more immediate housing needs. Indefinite Work From Home arrangements, fear of future circuit breakers, and fear of delays all make new construction less viable to many home buyers.

There’s also the issue that most home buyers today are HDB upgraders, who are in need of larger units. At new launch prices, three to four-bedders can hit a quantum of $1.8 million or higher (at present, the average is $1,780 psf, and many would only consider 1,000+ sq. ft. to be sufficient for families).

Property Picks10 Cheapest New Launch Condos In 2021 For Families (3 Bedroom Units)

by Ryan JThis leaves many HDB upgraders to look in the resale market, where they’re now seeing prices climb higher, and facing stronger competition for good units.

What might give resale condo buyers a break?

On a purely “fingers-crossed” level of speculation, realtors did remind us that rushed transactions often happen just before the start of the seventh month (this begins on 22nd August 2021).

There’s a chance – however slight – that the uptick in July was due to buyers wanting to transact at a more auspicious time. But there is, of course, no way to know this for sure. We do note that there were 1,162 resale transactions in September 2020 (the seventh month last year), which was only four fewer transactions than the previous month.

Still, if it was just a last-minute rush, we may see resale transactions dip again in end-August or beyond.

Where resale condo buyers can pin their hopes is the new launches reaching the Outside of Central Region (OCR) this year.

New launches in the Core Central Region (CCR) and Rest of Central Region (RCR) struggle to draw demand from HDB upgraders, due to their much higher price point. However, OCR condos – often referred to as mass market condos – can sometimes convince buyers to wait out construction periods.

More from Stacked

From EC To District 10 Condo: How A Couple’s Property Investment Decision Evolved

Would you pay off an Executive Condominium (EC) in full, or buy a District 10 condo on loan? They’re vastly…

This is because new launch three-bedders in the OCR can still be priced below $1.6 million, which is the “sweet spot” for most HDB upgraders. This is especially true of Executive Condominiums (ECs), which don’t require upfront Additional Buyers Stamp Duty (ABSD) for HDB upgraders.

Upcoming developments like Provence Residences (EC), Parc Central Residences (EC), Parc Greenwich, and the famed Pasir Ris 8 could shave some demand off the resale segment.

However, there’s still a lack of Normanton Park-style mega developments in the OCR. The last such development, Treasure at Tampines, is already down to its last tranche of remaining units (and yes, to remind you again that’s pretty amazing considering it has 2,203 units).

As such, some realtors have pointed out that – while these mass-market condos help – the number of units may not be significant. Given the huge surge of upgraders in 2020/21 (around 50,000 flats reached their MOP in this time), a handful of small to mid-sized developments isn’t sufficient to soak up the demand.

In addition, we don’t know the degree of urgency that’s truly in the market. If it turns out that home buyers need a place to move into right now, then a new launch is not going to draw them off; not even if it’s fancier and below $1.6 million.

If you need a home urgently and in the near term, we wouldn’t hold our breath

If you want to get your place before the end of 2022, you may have to bite the bullet. This could mean buying a resale unit where you have to compromise on certain features, be it a better view or being near the MRT.

There are, very simply, few reasons for resale condo prices and demand to drop in the short term. It’s the classic scenario of a supply and demand situation, with sellers raising their prices as they grow accustomed to more inquiries and offers.

As long as your expectations are realistic though, we may still be able to find you a reasonable home. Let us know about the area you’re interested in, and we can find you the most ideal options.

Finally, for resale flat buyers, note that all of this has a knock-on effect on you

The higher condo prices go (new or resale), the more upgraders need to fund their next purchase. This puts a lot of upward pressure on resale flat prices, with upgraders struggling to cover their 25 per cent minimum down payment.

As of July 2021, one in three resale flats was sold with Cash Over Valuation (COV). This was a phenomenon thought extinct, except for special maisonette units, Pinnacle @ Duxton, etc.

We should also consider that upgraders seeking a better location, or a larger home, may find even resale condo prices too high. This can lead to the purchase of a larger resale flat instead; and can explain the surge of million-dollar flats in 2021.

For example, between $1.3 million for a resale condo in Sengkang, and $1.295 million for a resale flat in the heart of Bishan, which would you choose? For pure home buyers, who have no interest in gains, the latter can be more appealing.

For more news and updates as the situation unfolds, follow us on Stacked. We’ll also provide you with the most in-depth reviews of new and resale properties alike.

If you’d like to get in touch for a more in-depth consultation, you can do so here.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Market Commentary

Property Market Commentary A First-Time Condo Buyer’s Guide To Evaluating Property Developers In Singapore

Property Market Commentary Why More Young Families Are Moving to Pasir Ris (Hint: It’s Not Just About the New EC)

Property Market Commentary This Upcoming 710-Unit Executive Condo In Pasir Ris Will Be One To Watch For Families

Property Market Commentary Which Central Singapore Condos Still Offer Long-Term Value? Here Are My Picks

Latest Posts

Landed Home Tours Where $4 Million Semi-Ds Sit Next To $40 Million GCBs: Touring First Avenue In Bukit Timah

Singapore Property News So Is The 99-1 Property Split Strategy Legal Or Not?

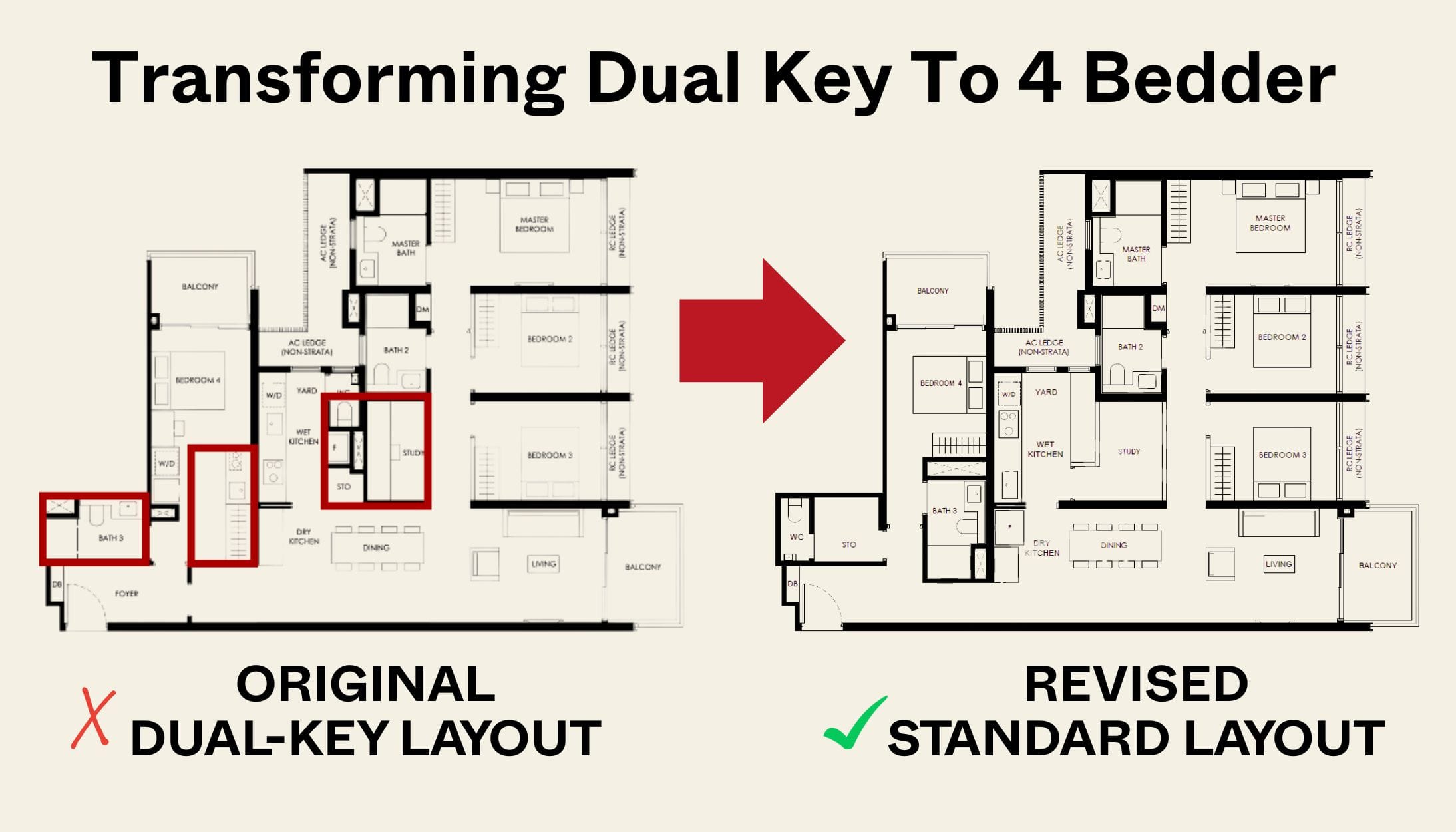

New Launch Condo Reviews Transforming A Dual-Key Into A Family-Friendly 4-Bedder: We Revisit Nava Grove’s New Layout

On The Market 5 Cheapest HDB Flats Near MRT Stations Under $500,000

New Launch Condo Reviews The Robertson Opus Review: A Rare 999-Year New Launch Condo Priced From $1.37m

Singapore Property News Higher 2025 Seller’s Stamp Duty Rates Just Dropped: Should Buyers And Sellers Be Worried?

Pro Same Location, But Over $700k Cheaper: We Compare New Launch Vs Resale Condos In District 7

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

New Launch Condo Analysis This Rare 999-Year New Launch Condo Is The Redevelopment Of Robertson Walk. Is Robertson Opus Worth A Look?

Pro We Compared New Vs Resale Condo Prices In District 10—Here’s Why New 2-Bedders Now Cost Over $600K More

Singapore Property News They Paid Rent On Time—And Still Got Evicted. Here’s The Messy Truth About Subletting In Singapore.

New Launch Condo Reviews LyndenWoods Condo Review: 343 Units, 3 Pools, And A Pickleball Court From $1.39m

Landed Home Tours We Tour Affordable Freehold Landed Homes In Balestier From $3.4m (From Jalan Ampas To Boon Teck Road)

Singapore Property News Is Our Housing Policy Secretly Singapore’s Most Effective Birth Control?

On The Market A 10,000 Sq Ft Freehold Landed Home In The East Is On The Market For $10.8M: Here’s A Closer Look