A First-Time Homebuyer’s Journey: Single, Over 35, And Looking For A Multi-Generational Home

July 11, 2021

35 is a threshold year for many singles in Singapore. If you’re not fortunate enough to be able to afford private property, 35 is the age at which you can buy your first HDB flat and decide whether you want to experience independent living or continue staying in the family home. My 35th year (-ish) was slightly more eventful: my Mother had just moved to a much smaller place and I’d returned from living abroad (alone- bliss!) for 8 years. Then COVID-19 struck and it was hello to looooooong hours at home.

Suffice to say, my daydreams now consist entirely of house porn, moving out, and/or upgrading to a bigger place. After watching an insane number of YouTube home videos and shortlisting over 100 properties on PropertyGuru, I realised that I really should streamline my property search process, which I narrowed down to 3 steps.

It’s a long read, so let me first explain just why I am so passionate about getting this right:

Trust me, there’s no buyer’s remorse like a property buyer’s remorse: property is expensive, illiquid and the wrong choice can significantly decrease your quality of life. When I moved to the UK almost a decade ago, I was lucky enough that my Mom could buy me a small new launch flat. It was her first overseas property purchase, and she bought it based on the name of its well-known developer, stellar location (there was a “transformation plan” in place), and recommendation from family and friends. A delayed TOP date (i.e more money blown on rental), a doubled maintenance fee (within 3 years of TOP!), and the inability to sell despite listing at a price lower than we had paid later, let’s just say we could have bought something “better” at the same price if we’d had more understanding of the UK market.

On the Singapore front, right before I returned from the UK, my Mother was given a week’s notice to leave our home of 30 years. As we didn’t have much time to prepare, nor an understanding of what suited us (due to never really having moved before), we ended up in our current place where I promptly developed chronic gastritis. Which is why I now strongly advocate researching the heck out of your property purchase before committing (you’ll see more of my research in the next article)- a good way to start would be by reading our Stacked articles!

1. What’s the budget? Spare cash+ maximum loan possible + amount obtained by selling current property – costs

Obvious, but you need to know what you can comfortably afford!

A. Money in the bank + loans

As I currently don’t have a full-time job, and my Mother is over 70, we’re unable to get a loan- something that can feel like a first-world tragedy given today’s low-interest rate environment in which all my friends are talking about “free money”- so our budget is determined almost entirely by the price our current place can fetch. (Since we’re not able to take a loan and would like to move in ASAP, new-build condos are automatically a no-go, as their main advantage (in my opinion) is the flexibility of the payment schemes. That leaves me with a choice between a resale HDB, a resale condo, or – if we’re lucky enough to find a bargain or win the lottery- a landed property. I automatically excluded a BTO because of the small sizes and long lead time but if you want to find out more about BTO and the other HDB options for a single 35-year old, check this out.)

B. Valuation of current home

– Online valuation calculator

First things first, I checked the official valuation given by banks such as UOB, followed by free online valuation websites. Different ones give you different numbers- SRX and UOB differed by almost $200k so check a few. I’ve ranked the online valuation tools that I used, listed from the highest to the lowest valuation:

SRX: I particularly like the SRX valuation site- nothing to do with the fact that it gave me the highest figure, of course! Recommended by a friend who works for a real estate VC, it even tells me when the property was purchased and the purchase price! (Very useful when offering for properties as I get a better idea of the seller’s minimum price.)

Edgeprop: it shows 3 transactions from which it derives your property value. These aren’t the last 3 transactions as some may be omitted on purpose. (Indeed, I note that Edgeprop didn’t include the 2021 transaction with the highest psf for my development.)

Urbanzoom: as with all the other sites, an OTP is sent to you before you can get the valuation. However, Urbanzoom uses WhatsApp whilst everyone else uses SMS. (What happens if you don’t have Whatsapp, I wonder. Or is that a moot point in today’s world?)

Bluenest: much more cumbersome to use- for one, it didn’t automatically provide the unit size upon entering the address, unlike the other valuation calculators. It also took 2 hours for the report to arrive whilst the rest were instantaneous.

DBS: a bit of a pain as you have to call, email or text to get the valuation. I emailed yesterday but have not heard back- DBS didn’t say what info they needed l so I just sent the address.

Propertyguru and Ohmyhome: no valuation obtained as I was directed to their respective Homepages- after a few attempts, I gave up.

Note: I used these tools for various properties and different tools would rank the properties differently, so although SRX gave me the best valuation, it may not do so for you. Also, note that they input slightly different sizes for the same property. (For more detail on how to conduct your own independent valuation, check out this article and this one for information on property research tools.)

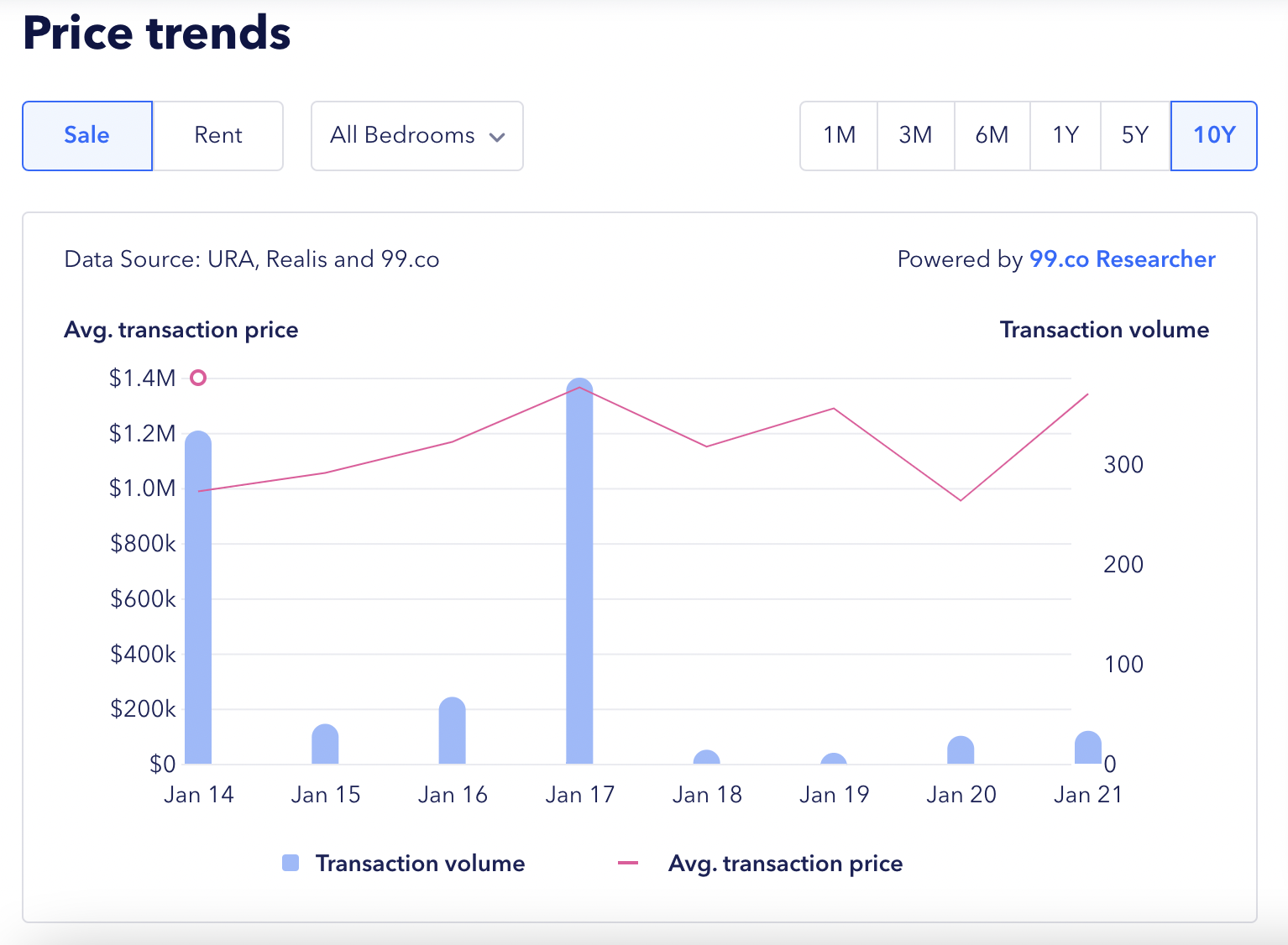

– Last transacted psf and current asking psf

Next, back to my bestie, PropertyGuru to calculate the value of my flat based on the last transacted psf and the current asking psf. (Urbanzoom is also very useful for this: it lists the highest and lowest psf for both current listings and past sales. However, I’m not sure if the values listed are specific to the entire development or the particular block as the highest past sales psf on UrbanZoom is lower than that on PropertyGuru.)

If there are outliers, I visit URA for more details- records only go back 5 years, but they tell you which floor (in ranges) the unit’s on so It can help explain particularly high values (skyline views and whatnot). For older records, check out 99.co or square foot research (For square foot research, you need a paid account- there’s no free lunch in the world, people.)

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

7 Close To TOP New Launch Condos In 2026/27 For Those Looking To Move In Quick

The projects completing in 2026–2027 were bought at a strange, high-octane moment: that jittery post-Covid rebound in 2021–2022, when the…

– Cost of renovation

Lastly, I calculate the cost of renovation done and add it to the valuation. Now comes the sad bit of deducting stamp duty, agent commission, renovation etc which brings me to the maximum I can afford to spend.

Since the entire purpose of selling is to move to a “better” place (instead of simply cashing out)- which usually translates into a higher psf or a larger floor size (i.e. higher quantum)- I need to work out whether this maximum budget can take me to my dream home. If not, I have to raise my asking price for my flat. It may not sell, but what’s the point in selling if I can’t move to where I want?

2. Make a list of the reasons why you and your family want to move

To be honest, I’m slightly reluctant to sell as we’re actually sitting on a “gold mine” in Singapore’s real estate terms (amongst other things, en bloc potential- my block is 4 stories high with a 2.1 plot ratio = a potential additional 20 stories = $$$ for the next owner if I sell, and not me, unfortunately. (By the way, if you’re looking to buy or sell a condo, plot ratios and the Singapore masterplan will be your new best friend.) So the next home needs to have a lot going for it to convince me!

To make sure the next home fits our needs and not get swept away by beautiful home decor (Home staging works wonders, people), I decided to write down the key reasons behind our move, divided into “essential” and “nice-to-have” factors. (I was briefly tempted to assign weights to each factor- pitfalls of having an Economics and Business degree- and then calculate the total score for the individual properties, but decided that my time could, very probably, be put to better use.)

The key criteria for my next home are:

1. It must be suitable for multi-generational living (Do 2 generations count as multi-generational?): after living alone for 8 amazing years, I need more space, more privacy and more independence when living with family. For example, my present room isn’t en-suite, which I initially thought wouldn’t be a big deal since I can easily walk 10 extra steps to the bathroom. Sometimes, however, you just want to go to the loo without seeing anyone, even if said someone is your Mother. (Judging from how my Mother leapt at the chance to return to the office, I think such feelings are mutual.) It doesn’t have to be a dual-key unit as I’m not convinced we need 2 kitchens but a dumbbell or duplex unit (with bedrooms on both floors) would fit the bill.

2. You can’t walk anywhere from my present condo and, at 72 years old, my Mother will stop driving soon. She loves her independence and popping out as and when she feels like it, so our forever home should be near shops and cafes, ideally in a familiar neighbourhood. (I’m thinking River Valley, Holland Village, or an MRT station nearby.)

3. Lots of natural light, space to garden, and preferably a North-South facing with no West sun. In the event of another Circuit Breaker, it would be nice to have more outside space!

4. A serene environment: I fully appreciate peace and quiet after living in between 2 construction sites for the last 2 years and, ironically, just as I want to sell, they’ve finished work!

5. Unblocked views- there’s something very depressing about staring into someone else’s apartment or at a blank wall.

6. Decent water pressure- random but I enjoy a good shower.

7. A functional driveway- I visited a condo in which the roundabout was so small, you had to do a 3-point turn to go around! Driving home every day would be a little stressful, especially during peak hours!

I won’t bore you with our long list of “nice to haves” but it includes points such as a low maintenance fee. Both the “must haves” and “nice to haves” are then printed as a table which I bring to every viewing and check off accordingly- this helps me keep organised after viewing so many different units! You can find another generic checklist that I like to use on viewings here. (If you’re wondering how these points were derived, I got my Mother to fill out a questionnaire before combining our criteria. If you don’t know what your ideal home is like, imagine a perfect day at home and you’ll be able to visualise it.)

3. A home vs an investment

Like every other own-stay property buyer in Singapore, I consider 2 aspects of a property: liveability (discussed above) and investment potential. For the latter, there’s capital appreciation (organic price growth vs en bloc windfalls) and potential rental yield (in case I ever need to rent the property out). In an ideal world, my home would make me a zillionaire but, since we live in the real world, I won’t insist on it- if the quantum for the property is low enough, it may be worth considering, which is why old resale HDBs and geriatric leasehold condos are on my shortlist.

However, given that most Singaporean properties cost a pretty penny, I’d like to know I can resell easily without suffering a huge loss, so it’s over to studying the Singapore Masterplan. If you’re not familiar with the Singapore Masterplan, here is a guide on how to use it.

After spending, to be honest, quite a bit of time on the above, I finally narrowed down my shortlist of property types to:

- HDB executive maisonette (corner unit)

- HDB jumbo flat (top floor, corner unit)

- HDB terrace house (corner unit)

- Resale condo (duplex with bedrooms on both floors or top floor dumbbell unit)

- Corner terrace or leasehold landed property (with space for a granny room on the ground floor)

For the next step in my buying journey, check back in next week! If you’ve enjoyed reading about the world of first-time property buying in Singapore, you may want to also read Jared’s story here.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

TJ

TJ's interest in property was sparked after returning from the UK- where balconies are not counted in one's square footage!- and finding that the Singapore property had totally changed in the 7 years she was away. When not reading and watching articles & videos about property, she is busy cooking and baking for friends, family & her blog GreedygirlgourmetNeed help with a property decision?

Speak to our team →Read next from Homeowner Stories

Homeowner Stories We Could Walk Away With $460,000 In Cash From Our EC. Here’s Why We Didn’t Upgrade.

Homeowner Stories What I Only Learned After My First Year Of Homeownership In Singapore

Homeowner Stories I Gave My Parents My Condo and Moved Into Their HDB — Here’s Why It Made Sense.

Homeowner Stories “I Thought I Could Wait for a Better New Launch Condo” How One Buyer’s Fear Ended Up Costing Him $358K

Latest Posts

Property Advice Should I Pay $500K More For A New Launch — Or Buy A Resale Condo Instead?

Singapore Property News A Rare Freehold CBD Office Unit Is Up For Sale At $20.5M — And Foreigners Can Buy It

Pro This Popular 520-Unit Condo Sold 85% At Launch — Here’s What Happened To Prices After

0 Comments