Just 5% Of All Property Transactions In 2022 Were Unprofitable: Here’s 5 Interesting Learning Lessons

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

2022 was one of the hottest years on record for the property market. Housing supply was (and still is) at a critically low point, and prices rose across all segments despite cooling measures. It would seem as though sellers couldn’t take a bad step during 2022.

This is why we thought it would be fascinating to see those who actually lost money in 2022 (however few there were) and see what commonalities we could find with the data:

Table Of Contents

- 1. Just over five per cent of condo transactions in 2022 were losses

- 2. Even with the housing supply at a low, some people lost money on sub sale transactions

- 3. The highest average losses (by overall return) are also found in the districts with the highest transaction volumes

- 4. Freehold status didn’t seem to make much difference

- 5. When it comes to property types, detached houses suffered the worst among losing transactions

1. Just over five per cent of condo transactions in 2022 were losses

| Type | Volume |

| Breakeven | 28 |

| Gain | 13,210 |

| Loss | 733 |

| Total | 13,971 |

We counted 13,971 private non-landed transactions with previous buy records in 2022. Of all the transactions we looked at, around 5.25 per cent (733 transactions) were losses.

Note: In 2022, there were 22,888 private non-landed (including ECs) transactions and 14,567 of them are sub sale and resale transactions (new sales are of no interest here since there’s no loss on a new sale as it’s the first purchase). Of these, 13,971 had a record allowing us to record its gain or loss. This is by no means representative of the entire property market as URA only records transactions where caveats are lodged.

The vast majority, unsurprisingly, were profitable as it was a hot market (94.5 per cent, or 13,210 transactions, were profitable). A tiny number, just 28 transactions, broke even.

While 5.25 per cent is a small number, it’s still interesting to try and observe where and how transactions can go still go wrong; even during a strong seller’s market.

2. Even with the housing supply at a low, some people lost money on sub sale transactions

Sub sales (i.e., selling a new launch unit before it’s built) are usually expected to do well in a low-supply situation. Home buyers are in urgent need of units they can move into sooner, and some buyers may be willing to offer even more than the price of a new sale.

Even so, some people managed to lose money in sub sales. The highest recorded loss was $297,600 before factoring in the Sellers Stamp Duty (SSD) of four per cent (this was a unit sold in Riviere). Here are some of the others we found:

| Project Name | Price | Size (sqft) | $PSF | Buy Price | Buy Date | Years Held | Quantum Loss | % Loss |

| RIVIERE | $3,900,000 | 1,711 | $2,279 | $4,197,600 | 11/5/2020 | 2.1 | -$297,600.00 | -7.0% |

| PARK COLONIAL | $2,200,000 | 1,410 | $1,560 | $2,403,000 | 12/26/2018 | 3.1 | -$203,000.00 | -8.0% |

| GEM RESIDENCES | $1,800,000 | 1,055 | $1,706 | $1,939,000 | 6/23/2018 | 4.1 | -$139,000.00 | -7.0% |

| SKY EVERTON | $1,575,000 | 646 | $2,439 | $1,707,000 | 7/1/2019 | 3.1 | -$132,000.00 | -8.0% |

| MARTIN MODERN | $1,880,000 | 764 | $2,460 | $1,990,800 | 3/30/2019 | 3.4 | -$110,800.00 | -6.0% |

| BUKIT 828 | $1,890,000 | 1,335 | $1,416 | $1,982,000 | 6/28/2020 | 1.6 | -$92,000.00 | -5.0% |

| 33 RESIDENCES | $1,030,000 | 700 | $1,472 | $1,113,000 | 9/16/2018 | 3.8 | -$83,000.00 | -7.0% |

| MIDTOWN BAY | $1,320,000 | 463 | $2,852 | $1,390,000 | 10/12/2019 | 2.4 | -$70,000.00 | -5.0% |

| ONE MEYER | $1,615,000 | 614 | $2,632 | $1,665,000 | 3/13/2019 | 3.4 | -$50,000.00 | -3.0% |

| THE WOODLEIGH RESIDENCES | $1,360,000 | 646 | $2,106 | $1,394,000 | 11/10/2018 | 3.6 | -$34,000.00 | -2.0% |

| AFFINITY AT SERANGOON | $1,810,000 | 1,249 | $1,450 | $1,842,000 | 6/2/2018 | 3.8 | -$32,000.00 | -2.0% |

We do note, however, that losses from sub sale units on average are still lower than losses from resale. The sub sale losses averaged -5.48 per cent, whereas among resale losers, the average was – 8.27 per cent.

We also compared between sale types, and found that those who bought new and resold (new sale to resale) lost the highest on average, at – 8.5 per cent. This could be explained by the mispricing that could occur during a new launch considering the mismatch of expectations versus reality later on.

Interestingly, those who went from sub sale to resale chalked up a lower loss, at an average of -7.4 per cent.

| Sale Type | Average % Loss |

| New Sale to Resale | -8.5% |

| New Sale to Sub Sale | -5.5% |

| Resale to Resale | -8.1% |

| Sub Sale to Resale | -7.4% |

That’s surprising, since subsale units usually cost more than new sale units (that’s usually the reason for the first buyer deciding to sell before completion). We don’t really have an explanation for this, other than perhaps higher interest rates giving some initial buyers cold feet.

Property Picks10 Biggest Property Losses Besides James Dyson’s $11.8m Penthouse Loss

by Ryan J3. The highest average losses (by overall return) are also found in the districts with the highest transaction volumes

| District | % Loss | Volume |

| 1 | -12% | 66 |

| 2 | -7% | 32 |

| 3 | -6% | 13 |

| 4 | -12% | 68 |

| 5 | -6% | 22 |

| 7 | -5% | 5 |

| 8 | -6% | 18 |

| 9 | -13% | 123 |

| 10 | -8% | 52 |

| 11 | -8% | 20 |

| 12 | -5% | 16 |

| 13 | -6% | 8 |

| 14 | -5% | 36 |

| 15 | -6% | 36 |

| 16 | -5% | 45 |

| 17 | -2% | 9 |

| 18 | -4% | 9 |

| 19 | -4% | 42 |

| 20 | -6% | 5 |

| 21 | -3% | 2 |

| 22 | -7% | 3 |

| 23 | -4% | 30 |

| 25 | -5% | 9 |

| 27 | -5% | 13 |

| 28 | -10% | 21 |

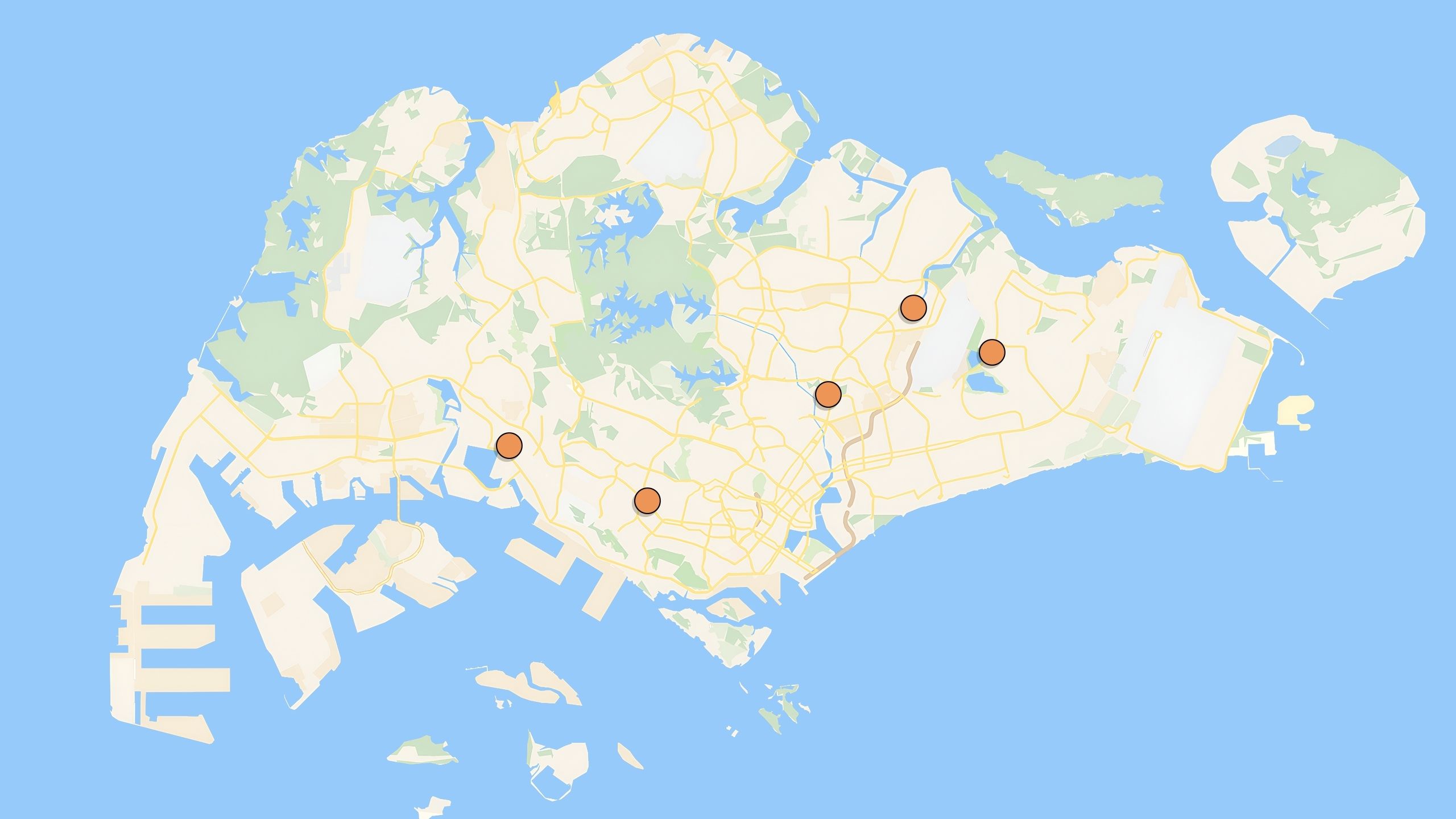

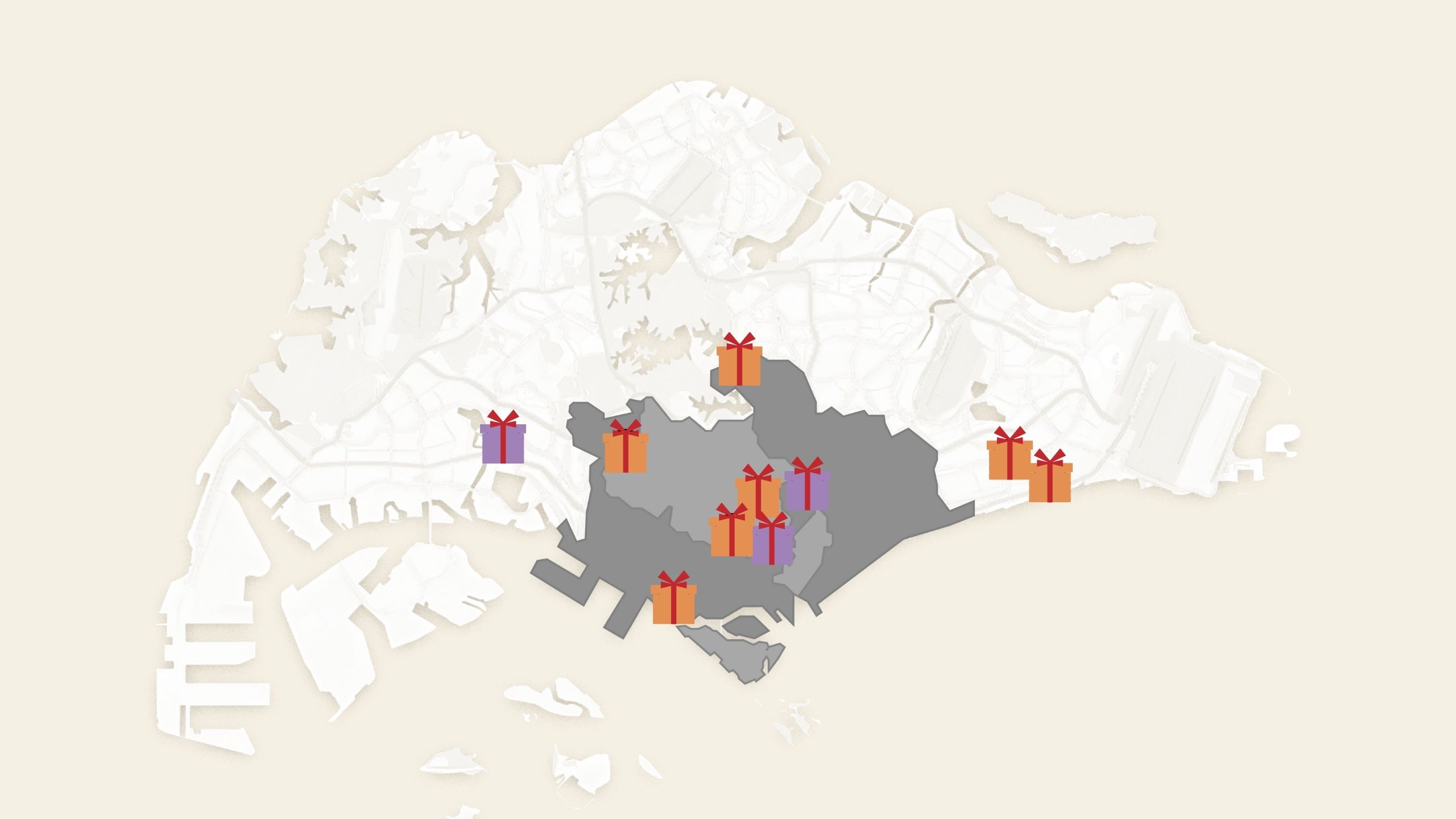

The highest losses were in districts 1 (Marina Square, Boat Quay), 4 (Sentosa), and 9 (Cairnhill, Orchard).

This is unsurprising, as during the 2007-2012 property market period, projects such as Reflections At Keppel Bay (District 4) came up and saw a lot of losses. In District 1, projects such as The Sail @ Marina Bay, and Marina Bay Suites also saw a lot of losses. In District 9, projects such as Helios Residences and Scotts Square also saw big losses.

We can say that the higher activity in these areas is due to the return of affluent foreign buyers, as well as investors who foresee an uptick in the rental market. However, the highest losses also tended to come from these areas.

Prime region condos have a very high quantum, and discounts to move them tend to be quite substantial (this is partly why the “million-dollar Orchard/Sentosa loss” is almost a cliché). At these price levels, the price drops might not really cause a dent for some of these wealthy owners, and they would be more willing to sell at a big loss and move on than your average owner.

More from Stacked

Low Floor vs. High Floor: What Transaction Data Reveals About the Premium

Higher-floor units almost always come with a price premium, but whether that premium is justified is less clear once you…

4. Freehold status didn’t seem to make much difference

For those who believe in freehold condos, we have some bad news. Among losses, freehold condos took a marginally worse hit, with losses averaging 8.49 per cent.

Leasehold condo losses averaged 8.05 per cent; perhaps due to their lower initial prices (freehold condos cost typically cost 15 to 20 per cent more as a rule of thumb).

It’s a slim gap between the two; but it does go to show that freehold doesn’t always make much difference.

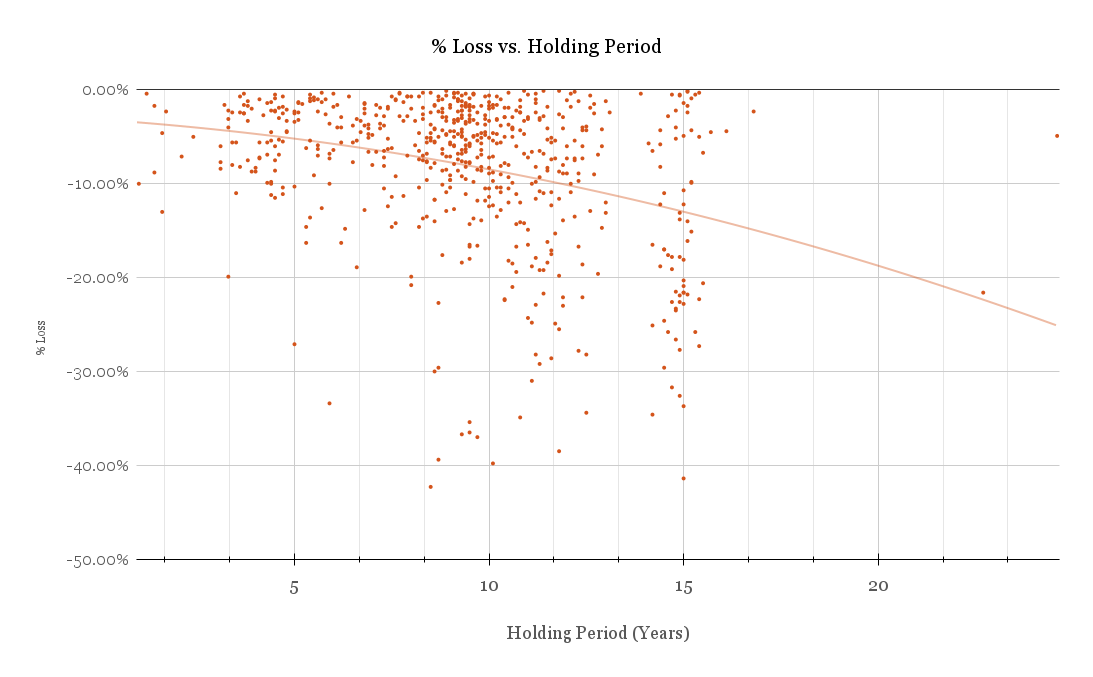

The oddest thing we found was that, among losing transactions, those with longer holding periods fared worse

Conventional wisdom holds that, the longer you hold a property, the higher the returns – or at least the lower the losses – should be. But when we plotted the holding period against the losses in a scatterplot, we found the opposite.

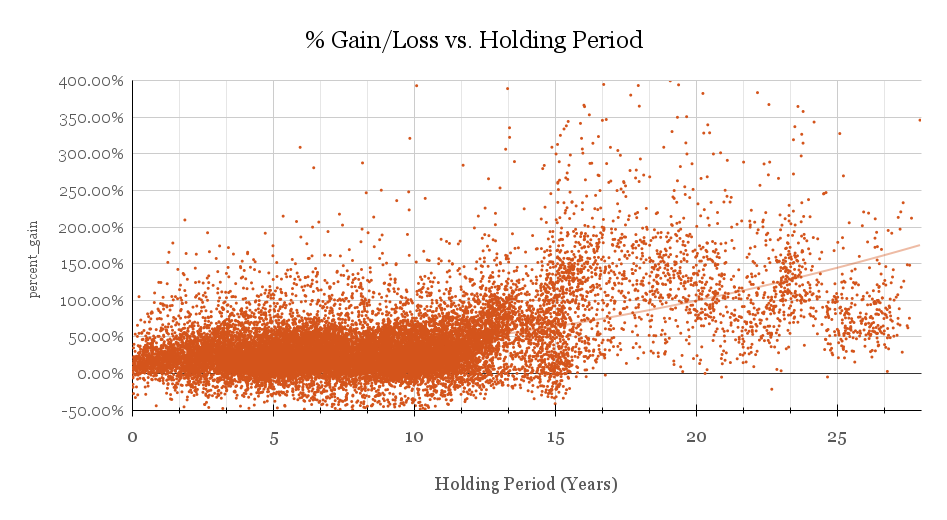

Before jumping to conclusion that “the longer you hold, the more you lose”, here’s what the scatterplot looks like if we take gains into consideration too:

So what could explain the strange pattern in the losses?

When we dug into the transaction data, we found some things of interest:

- Newton Planning Area saw 57 out of 733 losses with an average loss of 15%. This is higher than the 8% loss on average across all areas. The majority were purchased in 2007 – 2012.

- The Southern Island Planning Area (Sentosa) saw 30 out of 733 losses, the average loss being 16%.

- The Downtown Core Planning Area saw 96 out of 733 losses with an average loss of 10% (also mainly bought between 2007 – 2013)

- Bukit Merah (basically most of which are Reflections At Keppel Bay) had 60 out of 733 losses, averaging a 9% loss, and was purchased between 2007 – 2012.

Do you see a pattern here? Most were purchased between 2007 – 2012. As a result, the data is skewed towards heavier losses in the 10-15 year holding period.

This makes sense since during this period, property prices were moving fast which gave way to greater chances of property mispricing in the primary market. In other words, developers may have overhyped certain projects during the run-up in prices, and when reality came, these prices were not a true reflection (get it?!) of prices then.

To confirm this, we looked deeper and found the following:

- Newton: 60% of losses were new sales, 3% were sub sales

- Southern Island: 27% were new sales, 40% were sub sales

- Downtown Core: 52% were new sales, 12.5% were sub sales

- Bukit Merah: 65% were new sales, 6% were sub sales

As you can see, most of these purchases occurred in the primary market (or in the case of sub sales, when the project hasn’t reached TOP).

Apart from that, we also wanted to highlight two outliers in the scatterplot which registered losses even though they were held for more than two decades. This would be an extreme oddity in the market and are likely due to special circumstances (e.g., divorce, selling to their own children, or so forth).

| Project Name | Price | Size (sqft) | $PSF | Buy Price | Buy Date | Years Held | Quantum Loss | % Loss |

| CHELSEA GARDENS | $3,700,000 | 1959 | $1,889 | $3,890,000 | 6/12/1997 | 24.6 | -$190,000.00 | -4.9% |

| CHANGI GREEN | $980,000 | 872 | $1,124 | $1,250,000 | 10/1/1999 | 22.7 | -$270,000.00 | -21.6% |

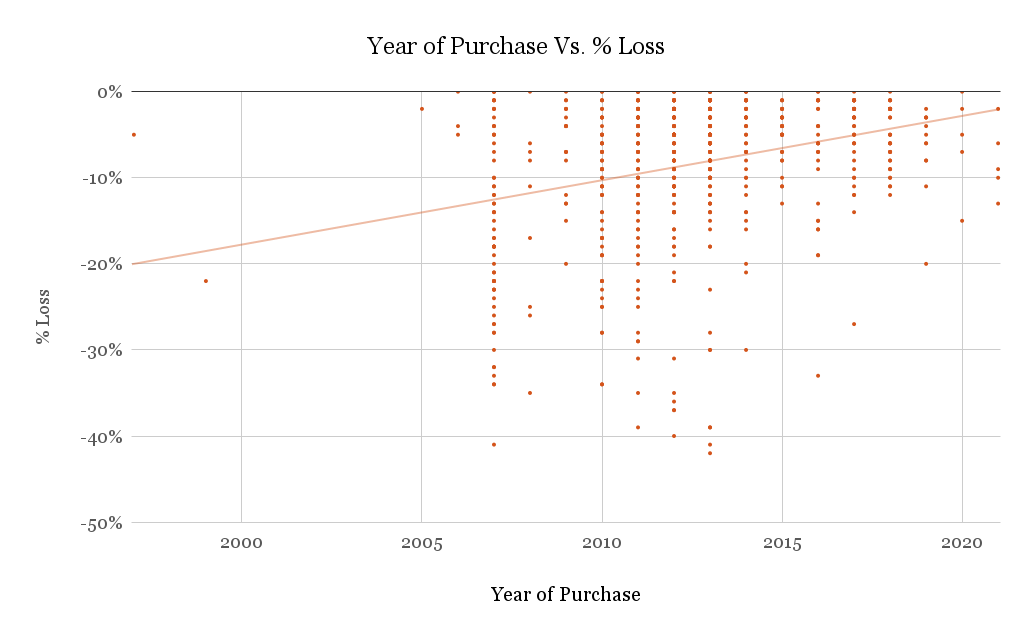

On a related note, here’s another way to view the losses:

Here we plot the year of the property purchase, to the percentage loss in its transaction. Again, you can see that a longer holding period seems to correspond to higher losses.

5. When it comes to property types, detached houses suffered the worst among losing transactions

| Property Type | Average of quantum | Average of percent_gain | Average of annualised_returns |

| Apartment | -$176,369 | -7.7% | -1.0% |

| Condominium | -$382,004 | -8.8% | -1.0% |

| Detached House | -$2,666,540 | -16.0% | -2.5% |

| Executive Condominium | -$58,600 | -5.4% | -0.6% |

| Semi-Detached House | -$350,012 | -8.2% | -1.6% |

| Terrace House | -$402,571 | -11.1% | -1.3% |

Detached houses lost around 16 per cent on average, with terrace houses following at a loss of about 11 per cent.

Among the losing transactions, Executive Condos (ECs) were the most spared, with average losses at just around 5.3 per cent.

This is likely due to the initial pricing of the properties. ECs are cheaper on average, which diminishes losses for the first batch of sellers.

Biggest losers by name

The following projects saw the biggest losses based on overall loss (quantum):

| Project Name | Price | Size (sqft) | $PSF | Buy Price | Buy Date | Years Held | Quantum Loss | % Loss | Annualised Loss | Type of Sale | Tenure |

| THE MARQ ON PATERSON HILL | $13,380,000 | 3089 | $4,331 | $20,542,400 | 40865 | 10.8 | -$7,162,400 | -34.90% | -3.90% | New Sale to Resale | Freehold |

| PATERSON SUITES | $13,800,000 | 6663 | $2,071 | $20,000,000 | 40865 | 11.1 | -$6,200,000 | -31.00% | -3.30% | Resale to Resale | Freehold |

| REFLECTIONS AT KEPPEL BAY | $5,850,000 | 3993 | $1,465 | $9,981,000 | 39212 | 15.0 | -$4,131,000 | -41.40% | -3.50% | New Sale to Resale | Leasehold |

| SEASCAPE | $5,900,000 | 3380 | $1,746 | $9,600,000 | 40555 | 11.8 | -$3,700,000 | -38.50% | -4.00% | New Sale to Resale | Leasehold |

| REFLECTIONS AT KEPPEL BAY | $12,200,000 | 6835 | $1,785 | $15,554,000 | 39321 | 15.0 | -$3,354,000 | -21.60% | -1.60% | New Sale to Resale | Leasehold |

| MARINA BAY SUITES | $5,000,000 | 2691 | $1,858 | $8,250,000 | 41619 | 8.7 | -$3,250,000 | -39.40% | -5.60% | New Sale to Resale | Leasehold |

| BELLE VUE RESIDENCES | $4,702,000 | 3552 | $1,324 | $7,400,000 | 41155 | 9.5 | -$2,698,000 | -36.50% | -4.70% | Resale to Resale | Freehold |

| THE LUMOS | $5,737,875 | 2433 | $2,359 | $8,433,000 | 39314 | 15.0 | -$2,695,125 | -32.00% | -2.50% | New Sale to Resale | Freehold |

| MARINA COLLECTION | $5,050,000 | 3412 | $1,480 | $7,700,000 | 40324 | 12.5 | -$2,650,000 | -34.40% | -3.30% | New Sale to Resale | Leasehold |

| CLIVEDEN AT GRANGE | $5,700,000 | 2153 | $2,648 | $8,341,040 | 39297 | 14.7 | -$2,641,040 | -31.70% | -2.60% | New Sale to Resale | Freehold |

| MARINA BAY RESIDENCES | $9,400,000 | 4435 | $2,120 | $11,979,000 | 39274 | 14.8 | -$2,579,000 | -21.50% | -1.60% | New Sale to Resale | Leasehold |

| CLIVEDEN AT GRANGE | $8,300,000 | 2842 | $2,921 | $10,824,540 | 39286 | 14.8 | -$2,524,540 | -23.30% | -1.80% | New Sale to Resale | Freehold |

| SILVERSEA | $9,500,000 | 4467 | $2,127 | $12,000,000 | 41745 | 8.0 | -$2,500,000 | -20.80% | -2.90% | New Sale to Resale | Leasehold |

| GRANGE INFINITE | $5,800,000 | 2573 | $2,255 | $8,236,533 | 39350 | 14.5 | -$2,436,533 | -29.60% | -2.40% | New Sale to Resale | Freehold |

| CLIVEDEN AT GRANGE | $8,000,000 | 2842 | $2,815 | $10,336,920 | 39235 | 14.9 | -$2,336,920 | -22.60% | -1.70% | New Sale to Resale | Freehold |

| CLIVEDEN AT GRANGE | $7,600,000 | 2842 | $2,674 | $9,935,000 | 39281 | 14.8 | -$2,335,000 | -23.50% | -1.80% | New Sale to Resale | Freehold |

| THE ARCADIA | $7,700,000 | 7503 | $1,026 | $10,000,000 | 40401 | 11.9 | -$2,300,000 | -23.00% | -2.20% | Resale to Resale | Leasehold |

| N.A. (8 Nassim Hill) | $9,790,000 | 4209 | $2,326 | $12,000,000 | 40407 | 11.5 | -$2,210,000 | -18.40% | -1.70% | New Sale to Resale | Freehold |

| MARINA COLLECTION | $3,700,000 | 2185 | $1,693 | $5,877,650 | 41192 | 9.7 | -$2,177,650 | -37.00% | -4.70% | Resale to Resale | Leasehold |

| CLIVEDEN AT GRANGE | $7,700,000 | 2842 | $2,710 | $9,864,600 | 39288 | 14.9 | -$2,164,600 | -21.90% | -1.70% | New Sale to Resale | Freehold |

| HELIOS RESIDENCES | $3,950,000 | 1668 | $2,368 | $6,110,700 | 41158 | 9.5 | -$2,160,700 | -35.40% | -4.50% | Resale to Resale | Freehold |

| HELIOS RESIDENCES | $3,950,000 | 1701 | $2,323 | $6,037,485 | 39497 | 14.2 | -$2,087,485 | -34.60% | -2.90% | Sub Sale to Resale | Freehold |

| HELIOS RESIDENCES | $2,800,000 | 1281 | $2,186 | $4,856,600 | 41473 | 8.5 | -$2,056,600 | -42.30% | -6.30% | Resale to Resale | Freehold |

| HELIOS RESIDENCES | $3,980,000 | 1701 | $2,340 | $6,000,000 | 39420 | 15.0 | -$2,020,000 | -33.70% | -2.70% | New Sale to Resale | Freehold |

| CITYVISTA RESIDENCES | $5,200,000 | 2626 | $1,980 | $7,152,996 | 39267 | 15.4 | -$1,952,996 | -27.30% | -2.10% | New Sale to Resale | Freehold |

| CITYVISTA RESIDENCES | $4,950,000 | 2626 | $1,885 | $6,827,600 | 39381 | 14.7 | -$1,877,600 | -27.50% | -2.20% | New Sale to Resale | Freehold |

| THE OCEANFRONT @ SENTOSA COVE | $6,730,000 | 3025 | $2,225 | $8,600,000 | 40486 | 11.4 | -$1,870,000 | -21.70% | -2.10% | Sub Sale to Resale | Leasehold |

| REFLECTIONS AT KEPPEL BAY | $7,308,000 | 3380 | $2,162 | $9,173,000 | 39321 | 15.0 | -$1,865,000 | -20.30% | -1.50% | New Sale to Resale | Leasehold |

| SEASCAPE | $4,280,000 | 2164 | $1,978 | $5,924,100 | 40296 | 12.3 | -$1,644,100 | -27.80% | -2.60% | New Sale to Resale | Leasehold |

| HELIOS RESIDENCES | $2,838,000 | 1281 | $2,216 | $4,481,500 | 41235 | 9.3 | -$1,643,500 | -36.70% | -4.80% | Resale to Resale | Freehold |

Here are the biggest losers by % loss:

| Project Name | Price | Size (sqft) | $PSF | Buy Price | Buy Date | Years Held | Quantum Loss | % Loss | Annualised Loss | Type of Sale | Tenure |

| HELIOS RESIDENCES | $2,800,000 | 1281 | $2,186 | $4,856,600 | 7/18/2013 | 8.5 | -$2,056,600 | -42.30% | -6.3% | Resale to Resale | Freehold |

| REFLECTIONS AT KEPPEL BAY | $5,850,000 | 3993 | $1,465 | $9,981,000 | 5/10/2007 | 15.0 | -$4,131,000 | -41.40% | -3.5% | New Sale to Resale | Leasehold |

| THE SCOTTS TOWER | $1,300,000 | 657 | $1,980 | $2,200,500 | 4/24/2013 | 9.5 | -$900,500 | -40.90% | -5.4% | New Sale to Resale | Leasehold |

| THE CLIFT | $1,400,000 | 829 | $1,689 | $2,326,400 | 7/9/2012 | 10.1 | -$926,400 | -39.80% | -4.9% | Resale to Resale | Leasehold |

| MARINA BAY SUITES | $5,000,000 | 2691 | $1,858 | $8,250,000 | 12/11/2013 | 8.7 | -$3,250,000 | -39.40% | -5.6% | New Sale to Resale | Leasehold |

| SEASCAPE | $5,900,000 | 3380 | $1,746 | $9,600,000 | 1/12/2011 | 11.8 | -$3,700,000 | -38.50% | -4.0% | New Sale to Resale | Leasehold |

| MARINA COLLECTION | $3,700,000 | 2185 | $1,693 | $5,877,650 | 10/10/2012 | 9.7 | -$2,177,650 | -37.00% | -4.7% | Resale to Resale | Leasehold |

| HELIOS RESIDENCES | $2,838,000 | 1281 | $2,216 | $4,481,500 | 11/22/2012 | 9.3 | -$1,643,500 | -36.70% | -4.8% | Resale to Resale | Freehold |

| BELLE VUE RESIDENCES | $4,702,000 | 3552 | $1,324 | $7,400,000 | 9/3/2012 | 9.5 | -$2,698,000 | -36.50% | -4.7% | Resale to Resale | Freehold |

| HELIOS RESIDENCES | $3,950,000 | 1668 | $2,368 | $6,110,700 | 9/6/2012 | 9.5 | -$2,160,700 | -35.40% | -4.5% | Resale to Resale | Freehold |

| THE MARQ ON PATERSON HILL | $13,380,000 | 3089 | $4,331 | $20,542,400 | 11/18/2011 | 10.8 | -$7,162,400 | -34.90% | -3.9% | New Sale to Resale | Freehold |

| HELIOS RESIDENCES | $3,950,000 | 1701 | $2,323 | $6,037,485 | 2/19/2008 | 14.2 | -$2,087,485 | -34.60% | -2.9% | Sub Sale to Resale | Freehold |

| MARINA COLLECTION | $5,050,000 | 3412 | $1,480 | $7,700,000 | 5/26/2010 | 12.5 | -$2,650,000 | -34.40% | -3.3% | New Sale to Resale | Leasehold |

| HELIOS RESIDENCES | $3,058,000 | 1313 | $2,329 | $4,623,000 | 8/6/2007 | 15.3 | -$1,565,000 | -33.90% | -2.7% | New Sale to Resale | Freehold |

| HELIOS RESIDENCES | $3,980,000 | 1701 | $2,340 | $6,000,000 | 12/4/2007 | 15.0 | -$2,020,000 | -33.70% | -2.7% | New Sale to Resale | Freehold |

| OUE TWIN PEAKS | $1,238,000 | 570 | $2,170 | $1,858,605 | 12/28/2016 | 5.9 | -$620,605 | -33.40% | -6.6% | Resale to Resale | Leasehold |

| HELIOS RESIDENCES | $2,800,000 | 1313 | $2,132 | $4,152,000 | 7/31/2007 | 14.9 | -$1,352,000 | -32.60% | -2.6% | New Sale to Resale | Freehold |

| THE LUMOS | $5,737,875 | 2433 | $2,359 | $8,433,000 | 8/20/2007 | 15.0 | -$2,695,125 | -32.00% | -2.5% | New Sale to Resale | Freehold |

| CLIVEDEN AT GRANGE | $5,700,000 | 2153 | $2,648 | $8,341,040 | 8/3/2007 | 14.7 | -$2,641,040 | -31.70% | -2.6% | New Sale to Resale | Freehold |

| MARINA BAY SUITES | $3,100,000 | 1593 | $1,946 | $4,506,400 | 7/9/2012 | 9.7 | -$1,406,400 | -31.20% | -3.8% | New Sale to Resale | Leasehold |

| PATERSON SUITES | $13,800,000 | 6663 | $2,071 | $20,000,000 | 11/18/2011 | 11.1 | -$6,200,000 | -31.00% | -3.3% | Resale to Resale | Freehold |

| OUE TWIN PEAKS | $1,200,000 | 549 | $2,186 | $1,714,000 | 5/17/2013 | 8.6 | -$514,000 | -30.00% | -4.0% | New Sale to Resale | Leasehold |

| GRANGE INFINITE | $5,800,000 | 2573 | $2,255 | $8,236,533 | 9/25/2007 | 14.5 | -$2,436,533 | -29.60% | -2.4% | New Sale to Resale | Freehold |

| THE SAIL @ MARINA BAY | $2,430,000 | 1313 | $1,850 | $3,450,000 | 9/25/2013 | 8.7 | -$1,020,000 | -29.60% | -4.0% | Resale to Resale | Leasehold |

| THE SAIL @ MARINA BAY | $2,550,000 | 1184 | $2,154 | $3,600,000 | 4/4/2011 | 11.3 | -$1,050,000 | -29.20% | -3.0% | Resale to Resale | Leasehold |

| VIDA | $1,080,000 | 527 | $2,048 | $1,513,000 | 1/13/2011 | 11.6 | -$433,000 | -28.60% | -2.9% | Resale to Resale | Freehold |

| ONE SHENTON | $2,560,000 | 1572 | $1,629 | $3,567,120 | 2/9/2011 | 11.2 | -$1,007,120 | -28.20% | -2.9% | New Sale to Resale | Leasehold |

| MARINA BAY SUITES | $3,808,000 | 2045 | $1,862 | $5,304,000 | 5/26/2010 | 12.5 | -$1,496,000 | -28.20% | -2.6% | New Sale to Resale | Leasehold |

| SEASCAPE | $4,280,000 | 2164 | $1,978 | $5,924,100 | 4/28/2010 | 12.3 | -$1,644,100 | -27.80% | -2.6% | New Sale to Resale | Leasehold |

| REFLECTIONS AT KEPPEL BAY | $3,860,700 | 2271 | $1,700 | $5,339,200 | 4/26/2007 | 14.9 | -$1,478,500 | -27.70% | -2.2% | Sub Sale to Resale | Leasehold |

In the property market, exceptions are the norm

All of this goes to show that conventional wisdom doesn’t always hold true. The property market – especially one as dynamic as Singapore – can be unpredictable.

Sellers can still make losses in a booming market; and conventional beliefs about holding periods and sub sales can be proven wrong.

It’s possible that some, or perhaps even most, of these losses were due to exceptional circumstances: the death of a co-owner, drastic changes in income, or selling between family members (these may be at a steep discount, such as if someone sells to a sibling or child).

But it’s not impossible that it can happen, and this also means hope for home buyers. Don’t stop looking, because you can see here that at least 733 buyers managed to transact at a lower price – even in the 2022 property market.

For more updates as the situation progresses, follow us on Stacked. We’ll also provide you with in-depth looks at new and resale properties alike.

If you’d like to get in touch for a more in-depth consultation, you can do so here.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Investment Insights

Property Investment Insights Why This Freehold Mixed-Use Condo in the East Is Underperforming the Market

Property Investment Insights Why This Large-Unit Condo in the Jervois Enclave Isn’t Keeping Up With the Market

Property Investment Insights These 5 Condos In Singapore Sold Out Fast in 2018 — But Which Ones Really Rewarded Buyers?

Property Investment Insights Why This New Condo in a Freehold-Dominated Enclave Is Lagging Behind

Latest Posts

Singapore Property News 10 New Upcoming Housing Sites Set for 2026 That Homebuyers Should Keep an Eye On

Homeowner Stories I Gave My Parents My Condo and Moved Into Their HDB — Here’s Why It Made Sense.

Singapore Property News Will Relaxing En-Bloc Rules Really Improve the Prospects of Older Condos in Singapore?

Property Market Commentary The Rare Condos With Almost Zero Sales for 10 Years In Singapore: What Does It Mean for Buyers?

Property Market Commentary 5 Upcoming Executive Condo Sites in 2026: Which Holds the Most Promise for Buyers?

Singapore Property News A Housing Issue That Slips Under the Radar in a Super-Aged Singapore: Here’s What Needs Attention

Landed Home Tours Inside One of Orchard’s Rarest Freehold Enclaves: Conserved Homes You Can Still Buy From $6.8M

On The Market We Found The Cheapest 4-Bedroom Condos You Can Still Buy from $2.28M

Homeowner Stories “I Thought I Could Wait for a Better New Launch Condo” How One Buyer’s Fear Ended Up Costing Him $358K

Editor's Pick This New Pasir Ris EC Starts From $1.438M For A 3-Bedder: Here’s What You Should Know

Singapore Property News This 5 Room Clementi Flat Just Hit a Record $1.488M — Here’s What the Sellers Took Home

Property Market Commentary We Analysed Dual-Key Condo Units Across 2, 3 and 4 Bedders — And One Clear Pattern Emerged

Editor's Pick We Toured A Quiet Landed Area In Central Singapore Where Terraces Have Sold Below $8 Million

Singapore Property News Are Singaporeans Moving Away From Property As A Retirement Strategy?

Editor's Pick Are New Launch Condos Really Getting Cheaper in 2025? The Truth Isn’t What You Think