2-Bedder vs 2+Study Units: Which Condo Layout Has Better Returns Over The Last Decade?

July 8, 2025

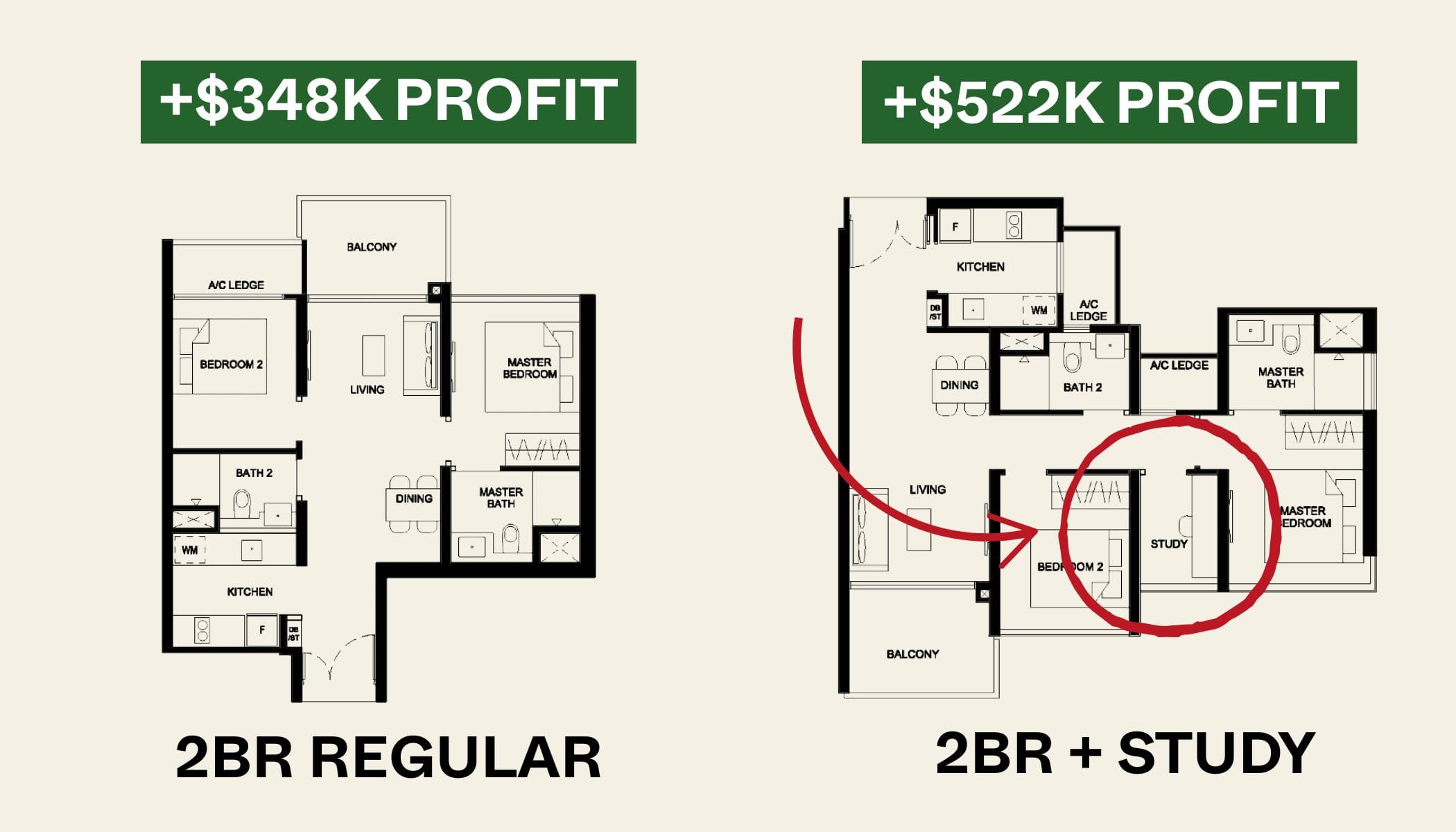

Two-bedders have become one of the most discussed layouts in the property market today, not just because three or four-bedders are now out of reach for many, but also because one-bedders have fallen out of favour with a broader group of buyers. As a result, two-bedders have emerged as the “default” choice for both homeowners and investors. This has also sparked growing interest in two-bedroom units that come with a bit more space, such as 2+1 units, or sometimes marketed as “compact three-bedders.”

But is that extra +1 worth the premium, or does it just eat into returns and lower rental yield? We looked at gains and rental data for two-bedders versus 2+1 units over the past decade to find out:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

In general, do two-bedders or 2+1 units see better resale gains?

Based on transactions from 2014 to 2024, here’s what we found in 11 projects, which have both two-bedders and 2+1 units:

| Project | 2-bedroom units | 2-bedroom + Study units | Difference in gains (2+S minus 2b) | Difference in % gains (2+S minus 2b) | ||||||

| Average gains | % gains | Average holding period (years) | No. of transactions | Average gains | % gains | Average holding period (years) | No. of transactions | |||

| AMBER PARK | $203,013 | 12% | 3.9 | 4 | $33,800 | 2% | 3.1 | 1 | -$169,213 | -10% |

| MARTIN MODERN | $219,340 | 13% | 6.6 | 1 | $293,050 | 15% | 6.1 | 8 | $73,710 | 2% |

| MIDWOOD | $223,570 | 20% | 3.3 | 7 | $231,750 | 19% | 3.5 | 2 | $8,180 | -1% |

| MONT BOTANIK RESIDENCE | $138,888 | 12% | 5.3 | 1 | $102,000 | 8% | 4.7 | 1 | -$36,888 | -4% |

| PARC ESTA | $323,711 | 27% | 4.6 | 42 | $476,266 | 35% | 5.0 | 11 | $152,555 | 7% |

| PARK COLONIAL | $228,110 | 19% | 5.2 | 42 | $220,500 | 18% | 5.4 | 4 | -$7,610 | -2% |

| STIRLING RESIDENCES | $268,719 | 22% | 4.5 | 99 | $476,290 | 36% | 5.2 | 13 | $207,571 | 14% |

| THE JOVELL | $142,600 | 18% | 4.9 | 3 | $183,250 | 21% | 4.4 | 4 | $40,650 | 3% |

| THE TAPESTRY | $146,796 | 16% | 4.7 | 46 | $178,070 | 17% | 4.7 | 4 | $31,274 | 1% |

| TREASURE AT TAMPINES | $167,758 | 19% | 4.2 | 43 | $194,505 | 20% | 4.0 | 35 | $26,746 | 1% |

| WHISTLER GRAND | $258,736 | 29% | 4.5 | 18 | $308,669 | 28% | 4.4 | 17 | $49,933 | -1% |

For some projects, the margin is rather slight. However, in 8 out of 11 projects, the two-bedroom plus study (2+1) units saw higher average gains than regular two-bedroom units.

At Stirling Residences, 2+1 units gained $476,290 (36 per cent) versus $268,719 (22 per cent) for two-bedders; a difference of around $207,000. At Parc Esta, the 2+1 units gained $476,266 (35 per cent) compared to $323,711 (27 per cent) for the standard layout.

There were a few projects where plain two-bedders won out – such as Amber Park and Mont Botanik Residence – but in general, 2+1 appears to have been the better option.

As an interesting aside, Martin Modern’s unprofitable transactions saw six two-bedder units, and only one 2+1 unit:

| Project | 2-bedroom units | 2-bedroom + Study units | Difference in gains (2+S minus 2b) | Difference in % gains (2+S minus 2b) | ||||||

| Average gains | % gains | Average holding period (years) | No. of transactions | Average gains | % gains | Average holding period (years) | No. of transactions | |||

| MARTIN MODERN | -$68,097 | -3% | 5.4 | 6 | -$6,660 | 0.0% | 5.1 | 1 | $61,437 | 3.2% |

We don’t want to read too much into this, as a single resale transaction (for 2+1) isn’t much to go on. But it is worth noting that only a single 2+1 unit saw a losing transaction, whilst the others were standard two-bedders.

But what about if you bought the units early on, and tried to sell before TOP? Would the larger two-bedder still perform better then? Let’s have a look at new-to-sub sale transactions:

Profitable new to sub sale transactions

| Project | 2-bedroom units | 2-bedroom + Study units | Difference in gains (2+S minus 2b) | Difference in % gains (2+S minus 2b) | ||||||

| Average gains | % gains | Average holding period (years) | No. of transactions | Average gains | % gains | Average holding period (years) | No. of transactions | |||

| AFFINITY AT SERANGOON | $179,478 | 16% | 4.8 | 10 | $175,641 | 16% | 4.5 | 74 | -$3,837 | 1% |

| AMBER PARK | $224,010 | 13% | 4.2 | 2 | $264,320 | 15% | 4.2 | 18 | $40,310 | 2% |

| KENT RIDGE HILL RESIDENCES | $177,978 | 14% | 4.8 | 13 | $133,041 | 10% | 3.7 | 4 | -$44,937 | -5% |

| MARTIN MODERN | $135,969 | 7% | 4.4 | 1 | $239,094 | 12% | 4.1 | 6 | $103,125 | 5% |

| MAYFAIR MODERN | $105,483 | 7% | 3.9 | 2 | $179,100 | 10% | 4.4 | 2 | $73,618 | 3% |

| MIDWOOD | $255,700 | 23% | 3.1 | 1 | $285,000 | 22% | 4.2 | 1 | $29,300 | -1% |

| PARC ESTA | $264,129 | 23% | 3.7 | 64 | $357,750 | 26% | 3.7 | 12 | $93,621 | 2% |

| PARK COLONIAL | $172,425 | 15% | 3.8 | 23 | $203,500 | 15% | 3.8 | 2 | $31,075 | 0% |

| PENROSE | $296,327 | 28% | 3.7 | 47 | $328,472 | 24% | 3.8 | 4 | $32,145 | -4% |

| SKY EVERTON | $142,444 | 9% | 3.3 | 2 | $114,400 | 7% | 3.9 | 5 | -$28,044 | -2% |

| STIRLING RESIDENCES | $220,520 | 19% | 3.6 | 42 | $271,056 | 20% | 3.6 | 16 | $50,536 | 2% |

| THE FLORENCE RESIDENCES | $187,949 | 19% | 4.1 | 125 | $246,921 | 24% | 4.4 | 17 | $58,972 | 5% |

| THE M | $281,950 | 19% | 3.7 | 2 | $339,196 | 19% | 3.8 | 3 | $57,246 | 0% |

| THE WATERGARDENS AT CANBERRA | $123,500 | 12% | 2.6 | 2 | $293,000 | 25% | 3.1 | 1 | $169,500 | 13% |

| TREASURE AT TAMPINES | $148,557 | 18% | 3.9 | 71 | $191,067 | 20% | 3.5 | 35 | $42,509 | 2% |

| WHISTLER GRAND | $193,817 | 23% | 3.5 | 13 | $252,458 | 24% | 3.5 | 13 | $58,641 | 1% |

More from Stacked

We Make $23k Per Month And Own A 29-Year-Old HDB: Should We Sell To Buy A Resale 3-Bedder Condo Or A Newer HDB Instead?

Dear Stacked Homes, Happy new year!

We still see a similar pattern. In 12 out of our 16 projects, two-bedroom plus study (2+1) units saw higher average gains than regular two-bedders.

The differences were significant in some cases: at Martin Modern, for instance, the 2+1 units gained $239,094 (12 per cent) versus just $135,969 (seven per cent) for two-bedders.

At Parc Esta the gap was even wider, with 2+1 units gaining $357,750 (26 per cent) compared to $264,129 (23 per cent).

Kent Ridge Hill Residences and Sky Everton were exceptions, where two-bedders outperformed 2+1 units by $44,937 and $28,044 respectively but these were outliers. Overall, the data suggests that for shorter holding periods (i.e., sub sales in particular), 2+1 layouts tend to fetch better resale outcomes.

Again as an aside, Sky Everton had two losing transactions, which involved a two-bedder and a 2+1 unit:

| Project | 2-bedroom units | 2-bedroom + Study units | Difference in gains (2+S minus 2b) | Difference in % gains (2+S minus 2b) | ||||||

| Average gains | % gains | Average holding period (years) | No. of transactions | Average gains | % gains | Average holding period (years) | No. of transactions | |||

| SKY EVERTON | -$132,000 | -8% | 3.1 | 1 | -$26,000 | -1% | 2.3 | 1 | $106,000 | 7% |

As before, we don’t want to read too much into individual transactions. However, we can’t help noticing that the 2+1 unit saw a significantly lower loss of $26,000 compared to the two-bedder’s $132,000.

(Although to be fair, the two-bedroom unit had a longer holding period of 3.1 years versus 2.3 years for the 2+, which may have contributed to the deeper loss.)

But from a landlord’s standpoint, does a 2+1 unit deliver better rental rates and yields?

This is also a common question, as one and two-bedder units are the sizes most often preferred by landlords. Unfortunately, rental data from URA does not include exact unit numbers or precise floor areas, only size ranges (e.g., 70–80 sqm). This makes it difficult to isolate yields for specific unit types, like two-bedders versus two-bedroom plus study layouts.

To work around this, we used the following approach:

- We rounded up unit sizes from caveated sale transactions to the nearest corresponding URA rental size band.

- We only matched pairs (sale and rental) within the same development and size range were included.

- We excluded units falling outside available size bands

We’re also going to look only at transactions from 2024, to reflect the real current rental conditions. This gives us a reasonable estimate of rental yields, though we acknowledge that it isn’t perfect, especially for developments where 2+1 units are very close in size to regular two-bedders.

| Project | 2-bedroom average price | 2-bedroom average rent | 2-bedroom + Study average price | 2-bedroom + Study average rent | Rental yield for 2-bedroom units | Rental yield for 2-bedroom + Study units |

| Amber Park | $1,943,000 | $4,631 | $2,157,247 | $5,190 | 2.86% | 2.89% |

| Kent Ridge Hill Residences | $1,289,960 | $3,944 | $1,550,000 | $4,420 | 3.67% | 3.42% |

| Martin Modern | $1,985,000 | $6,390 | $2,288,333 | $7,268 | 3.86% | 3.81% |

| Parc Esta | $1,526,663 | $4,641 | $1,861,293 | $5,458 | 3.65% | 3.52% |

| Stirling Residences | $1,488,437 | $4,530 | $1,865,968 | $5,043 | 3.65% | 3.24% |

| Whistler Grand | $1,179,789 | $3,906 | $1,435,923 | $4,354 | 3.97% | 3.64% |

From what we see above, a 2+1 unit doesn’t really give a big advantage to a landlord. The differences in yield are thin at best, and in most cases regular two-bedders edge out slightly in yield because of their lower price points.

For example, in Whistler Grand the average rental yield for a two-bedder is 3.97 per cent, compared to 3.64 per cent for a 2+1 unit. That’s only because of its higher average purchase price ($1.44 million vs. $1.18 million). Similarly, at Stirling Residences, the two-bedder yields 3.65 per cent, while the 2+1 is at 3.24 per cent. Even at Parc Esta, where the yield gap is smaller (3.65 per cent vs. 3.52 per cent), the two-bedder still comes out slightly ahead.

Honestly though, these differences are so slight we doubt most landlords would care.

What may tip the scale in favour of 2+1 units is something less tangible: rentability.

A 2+1 unit is more versatile, and it can be rented to small families, as well as roommates. It can also attract single tenants who need an extra home office or storage space for personal or business use, particularly in a post-pandemic era where hybrid work has driven greater demand for flexible living spaces. So while a 2+1 unit may not deliver a higher yield, it could make it easier to find and retain tenants. For landlords who can stretch the budget a bit, the larger unit could make better sense.

Conclusion:

In general, what we see favours the larger 2+1 units. As we mentioned above, some families are now priced out of three-bedders or larger units; so as high prices start to bite, we’re likely to see continued or growing interest in this size category.

That said, not all 2+1 units are equal. You also need to look out for layout issues, such as:

- Whether it’s a pre or post-harmonisation project, as the former may include wasted space in the form of planter boxes, big air-con ledges, etc.

- Whether the “+1” is truly functional. An actual enclosable room, for example, is far more preferable than an odd corner with no window and limited ventilation.

- The usefulness of kitchen spaces, which are especially important for families; nook kitchens are usually best, where there’s cabinetry and countertops of both sides of the kitchen

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Do 2+1 condo units tend to have better investment returns than regular two-bedroom units?

Are 2+1 units more profitable for early buyers who sell before completion?

Do 2+1 condo units offer better rental yields than regular two-bedroom units?

What should I consider when choosing a 2+1 condo unit for investment?

Is the extra space in a 2+1 unit worth the premium compared to a standard two-bedroom?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

0 Comments