Why 4,580 Homeowners Have Negative Cash Sales Despite High Property Prices

January 11, 2022

The CPF Board said this week that around 4,580 Singaporeans couldn’t refund the full amount of CPF they used for housing, after selling their property. This number was higher than around 3,960 people the year before, and around 3,380 people in 2018. That’s rather unexpected since 2020 saw home prices reach a new peak. So how could we also be seeing so many negative cash sales?

What’s a negative cash sale?

When buying a residential property, you can use your CPF Ordinary Account (CPF OA) to cover the down payment, stamp duties (including Additional Buyers Stamp Duty), and monthly loan repayments.

However, upon sale of the property, you must refund all the CPF monies used, along with the accrued interest rate of 2.5 per cent. This is partly to ensure you can’t withdraw your CPF money early, in a roundabout manner (otherwise you could use your CPF to buy the property, then sell the property, and pocket the cash early).

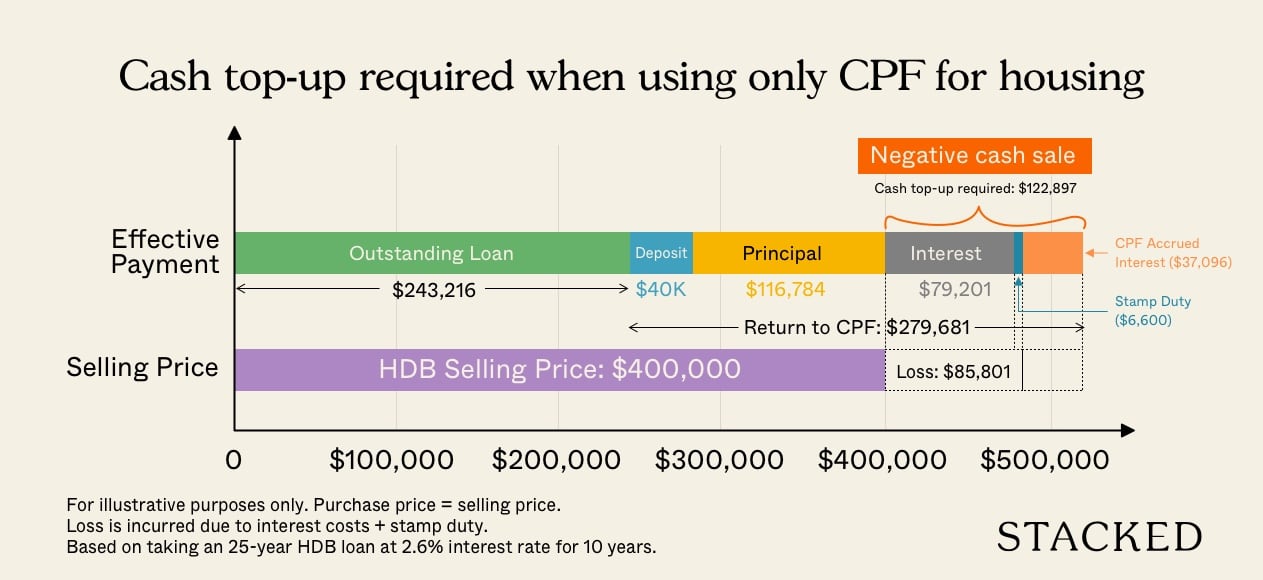

After discharging the outstanding home loan, you may have to refund more money to your CPF, than the remaining sale proceeds. For example:

Say you sell your flat for $500,000, with an outstanding home loan of $300,000. After discharging the outstanding loan, this leaves you with $200,000.

However, you’ve used $225,000 from your CPF to cover the initial down payment, stamp duties, and home loan repayments for your flat. This full amount must be refunded from the remaining sale proceeds of just $200,000.

This leaves you short by $25,000, and hence a negative cash sale.

Now as long as the flat was sold at or above market value, you don’t need to “top up” the difference of $25,000. But it does mean the entire remainder of the sale proceeds ($200,000) must go back into your CPF, leaving you with $0 in hand.

(While you can still use your CPF to buy a property right afterwards, bear in mind that a private property purchase requires you to pay the first five per cent downpayment in cash; this can be quite tough to do if all the remaining sale proceeds get locked back into your CPF and you don’t have much cash savings, to begin with).

We shouldn’t be seeing more negative cash sales when property prices are at a peak

In theory, rising home prices should result in a lower number of negative cash sales. If homes are selling at higher prices, then sellers should have more than sufficient funds to refund their CPF, and still have cash left over for the next property.

Given that prices rose in the second half of 2020, we can’t pinpoint the cause of low demand. Rather, it comes down to how Singaporeans have been using their CPF. Causes of negative sales are likely to be:

- Higher stamp duties

- Borrowers ignoring interest rates

- Covering every little cost with CPF

- Buyers seeking higher valuations and taking bigger loans

1. Higher stamp duties

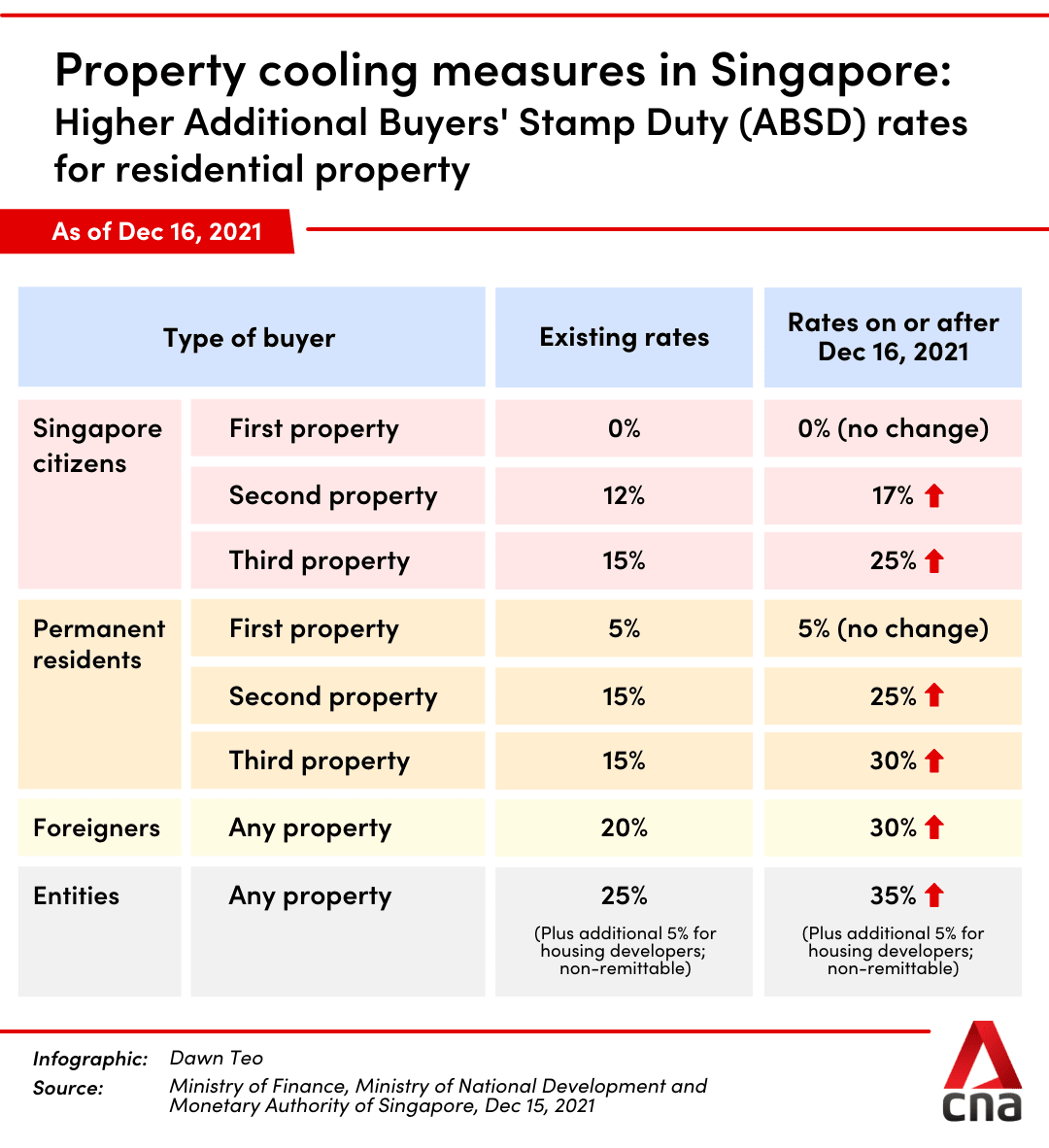

One possible contributing factor is the rise in ABSD, over the past decade. Back in 2011, for instance, the ABSD for Singapore Citizens only applied on the third property – and the amount was just three per cent.

By 2018, however, the ABSD was 12 per cent for the second property, and 15 per cent for the third (it has recently been revised to 17 per cent for the second, and 25 per cent for the third).

Now ABSD, just like the usual Buyers Stamp Duty (BSD), can be paid with CPF. Do note that for new launch condos you can draw from your CPF right away. For resale condos, you have to pay the ABSD in cash first (which is hefty), within 14 days of the transaction; but you can then apply to get a reimbursement from their CPF afterwards.

It’s possible that, over the years, buyers have been paying increasingly higher stamp duties with their CPF. There’s a psychological dimension involved here, as buyers may not feel the “sting” of ABSD when it’s coming from CPF instead of their own pocket.

However, willingness to pay high stamp duties means refunding more to your CPF, when you do sell. 12 per cent ABSD on a $1.5 million condo, for instance, is $180,000, accruing at 2.5 per cent per annum.

As such, it’s possible that the combination of higher stamp duties – coupled with the willingness to spend “CPF money that we can’t touch anyway” – is contributing to the growing number of negative cash sales.

With regard to upgraders, there may be a small minority who end up losing the ABSD money by accident. If you buy a new property before selling your old one, you’re liable to pay ABSD**. You can then claim ABSD remission, provided you sell your previous property within six months.

In a small number of cases, these upgraders miss the deadline and end up absorbing the ABSD. This could cause them to miscalculate, and lose the ABSD remission.

**An exception is if you’re upgrading from an HDB flat to an Executive Condominium (EC), in which case you don’t need to pay ABSD.

2. Borrowers ignoring interest rates

It’s a bit ironic that for over a decade now, HDB loan rates have been higher than private bank rates. Back in ’09, following the Global Financial Crisis, bank home loans even fell below one per cent for a time – and just as they were normalising, Covid-19 sent them back to record lows again.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Is A 1 Bedroom At Parc Riviera Or Parc Rosewood A Better Choice For A Rental Investment?

Hi Stacked Homes team!

In 2021, for instance, bank loan rates averaged 1.3 per cent, or about half the HDB loan rate of 2.6 per cent.

However, not every homeowner has been quick to refinance; there’s some anxiety involved in doing so, as you can refinance from an HDB loan to a bank loan, but not vice versa. As such, some borrowers tolerated higher HDB loan rates, simply because they know HDB will be more lenient than banks if they can’t make repayments.

Other borrowers may have expected that, anytime soon, bank loan rates would soar past HDB rates (before the financial crisis and throughout the ‘90s, bank loan rates were close to four per cent). Of course, they had no way of knowing Covid-19 would continue to keep rates low.

Finally, there’s a third category of borrowers who fail to pay attention to any of this, and remain ignorant that they may have been paying twice the interest for long stretches. If you are thinking that it’s unheard of that people could actually be consciously leaving money on the table, well, the Starbucks card is a great example of how lazy people can get sometimes. If you are familiar with how the Starbucks card works (basically deposits on the gift card or mobile apps), in FY 2019 it was estimated that Starbucks generated $141 million from those that are expected to not redeem eventually.

As many Singaporeans opt to service their flat loan with CPF, failing to track the interest rates – and refinance accordingly – could contribute to negative cash sales. Every dollar spent on the home loan is another dollar that has to be refunded later, with accrued interest.

Property Market CommentaryWhy Do Banks Even Bother Trying To Sell Home Loans With Higher Interest Rates?

by Ryan J. Ong3. Covering every little cost with CPF

In our experience, most home buyers are eager to use as much of their CPF, and as little of their bank accounts, as they possibly can.

This results in buyers who cover BSD, ABSD (if applicable), legal fees, down payments, and monthly home loans all with CPF monies. It’s quite common, especially among first-time homebuyers of BTO flats, to part with absolutely no money at all when buying (except $2,000 for the Option fee; but even then, most opt to have the money back later, instead of using it as part of the down payment).

It would be more prudent if buyers didn’t over-rely on CPF to this degree. Buyers who service the home loan in cash, for instance, are more likely to be conscious of the amount they pay each month (see point 2). They’re also less likely to reach the CPF withdrawal limit while unprepared.

4. Buyers seeking higher valuations and taking bigger loans

This point applies only to resale properties, as properties bought directly from the developer (whether a BTO flat or new launch condo) are considered to have the same valuation as the price.

If you’re buying a resale property, the seller’s price may be higher than the actual valuation. For example, if you’re buying a resale condo, the seller may ask for $1.3 million, when the actual valuation is $1.2 million.

The bank loan will be based on the lower of the price or valuation.

In the above example, a bank loan – capped at 75 per cent of the price or value – would have a maximum loan quantum of only $$900,000.

This may prompt buyers to seek out banks that take the highest possible valuation because they want to pay as little cash as possible. For example, they may seek out a bank willing to take a higher valuation of $1.25 million, thus increasing their loan quantum to $937,500.

Besides borrowing more, this can indirectly drive buyers to accept higher interest rates: the bank willing to accept the highest valuation may not be the cheapest bank.

Note that in conditions when property prices are rising rapidly, buyers are often exuberant, and sellers are quite confident. This can widen discrepancies between the seller’s prices and the property valuations: something to watch for in the current (2021/22) market.

Try not to pay for everything with CPF alone

For owner investors who want to upgrade, we suggest using a mix of cash and CPF. For example, cover your down payment with CPF, but make home loan repayments with both cash and CPF.

This keeps you conscious of the amount that you’re spending, while also minimising the risk of a negative cash sale later.

This is also important in case your income falls later on, and your CPF contributions become lower. You could end up using more of your CPF than you actively contribute, which can cause other problems with long term retirement planning.

For more on the situation as it unfolds, follow us on Stacked. You can also check out our in-depth reviews of new and resale condos alike, with their likely price points – this can help you to better manage both cash and CPF usage for home loans.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why are more homeowners in Singapore experiencing negative cash sales despite high property prices?

What exactly is a negative cash sale in property transactions?

How do higher stamp duties contribute to negative cash sales?

In what ways does ignoring interest rates affect the likelihood of negative cash sales?

Why do some buyers cover all costs with CPF, and how does this lead to negative cash sales?

What strategies can buyers use to avoid negative cash sales when upgrading or purchasing property?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

0 Comments