I Invested $19,000 SGD On Virtual Lands In The Metaverse. Here’s My Experience.

April 4, 2022

I remember my first time hearing about virtual real estate from my friend back in 2020. He shared with me about a blockchain 3D reality platform called ‘Decentraland’ – something he chanced upon when going down the Reddit rabbit hole one night.

After playfully joking with him for being a nerd, he announced that he was going to swap a bulk of his ETH for Decentraland coins called MANA that very night. It was a plan that was little more than a wing and a prayer at that point, but essentially, he would be purchasing some virtual lands on Decentraland using the MANA coins. At that time, ETH was worth about USD 400, while MANA was worth just USD 0.04.

For those who are already in the game of cryptocurrency, you’ll know how ludicrous that sounds, especially back in 2020. ETH is one of the few stable altcoins in the market, and to exchange it for something that lacked a healthy amount of demand at that time took a lot of guts (and risk tolerance). Not to mention the volatility in the market when the pandemic kicked in caused countless emotional cartwheels.

The next thing I knew, it was all over the news with investors snagging up parcels of virtual land for hundreds of thousands of dollars. As Matt Damon said in a crypto.com ad, “fortune favours the brave” and my friend’s big bet in 2020 has now multiplied many times over. To give you some idea – comparing 2020’s and today’s values, ETH is up an estimated 7x whereas MANA is around 60x. I’m happy for him, to say the least.

Though I’ve missed the first train into this new realm of virtual assets, I know we are still in the early days of the metaverse. Given that I’ve already done 345 hours of research (no kidding), it’s safe to say that I am thoroughly intrigued by the potential of it all.

Homeowner StoriesMy Journey Into The Metaverse: Here’s What I’ve Learnt From 345 Hours Of Research

by Cheryl TeoAs you can probably tell by the title, I eventually did drop $19,000 SGD on a plot of digital land. Here’s an overview of my reasons and how I did it.

Exploring Virtual Real Estate and its Value

As with any investment, you’d always have to understand what you are getting into. If you haven’t already read my personal research on the metaverse, please do so here.

Essentially, the metaverse is a 3D online virtual world where people can live as an alternate version of themselves to socialise, shop and game.

It supports the transfer of value through cryptocurrencies in the form of Non-Fungible Tokens (NFTs), where users can buy digital Balenciaga hoodies or virtual Gucci sneakers to dress their avatar up. It’s frankly quite wild to think that some of these digital replicas can cost more than their physical counterparts…

A Gucci bag in Roblox resold for 350,000 Robux or roughly $4,115. The same purse IRL costs $3,400.

— Alexis Ohanian 7️⃣7️⃣6️⃣ (@alexisohanian) May 24, 2021

Remember: this Roblox purse is not an NFT and thus has no value/use/transferability outside the Roblox world-yet it’s worth more than the physical one.

Watch this space. pic.twitter.com/m4WjfC1Eq1

There are many different metaworlds (think Enjin, Decentraland, The Sandbox), which creates a diversity of altcoins that powers these digital worlds as currencies. This also means that there are different opportunities on these platforms.

Here’s the catch: Apart from purchasing skins, inventory, or other virtual goods for the user’s avatars in these games, players can now purchase plots of ‘land’ within the game’s virtual map called ‘parcels’.

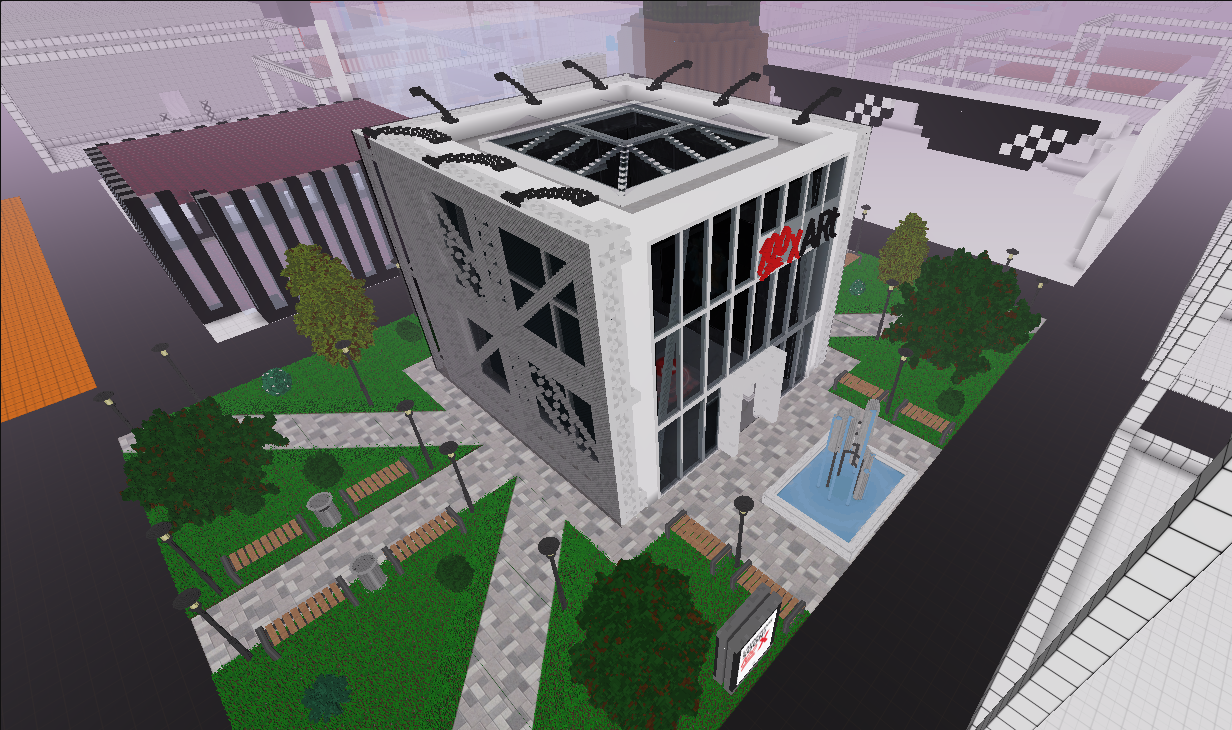

Owners of these parcels can build anything they’d like – casinos, hotels, cafes, or a shopping mall. For me, I can’t quite decide if I’ll be building the bathhouse in Spirited Away or Paradis Island from Attack on Titan. In fact, there are already digital architects that can charge upwards of $300,000 to design buildings in various digital worlds.

In the case of Decentraland, its LAND Estates feature allows multiple plots of land to be managed – plots with similar themes can be grouped as districts, which allows users of similar interests to form a community. Cool, huh?

What boosted confidence for me was when JP Morgan confirmed to have set up a lounge in Decentraland called Onyx Lounge. It signals that big names have identified the metaverse as an outlet for future opportunities for their business.

With DeFi (which I can probably go on for days about) as the next big technology, I can see how this space can alter business models and even birth new sectors. All its necessary building blocks are already in place, and it’s just a matter of time before the whole thing will kick off. And it will kick off hella fast.

My first thoughts were that this could be seen as a more attractive alternative to physical real estate due to the:

- (slightly) lower quantum,

- lack of tax payable (currently),

- high potential for capital appreciation,

- More liquid exit strategies and

- Scalability & Accessibility for Consumers.

Yet, it does come with its own sets of risks.

Due to its current beta stage and lack of adoption, the main question that lingers is: “Is there a real value for these NFTs and digital assets?”

To me, you’d always need to look towards the future when you are investing in something. Think about the early days of the Internet. If you knew back then what you knew now, what would you have done differently? Would you have invested in prime domain names like insurance.com (sold for $35.6 million), or invested in the early days of Amazon? It’s easy to see in hindsight that e-commerce would be such a big part of our world today, but truthfully, you might be surprised at how many naysayers there were back in the day. Just look how silly the article below looks today (it was written in 1999).

Listen and be open, but don’t let anybody tell you who you are. This was just one of the many stories telling us all the ways we were going to fail. Today, Amazon is one of the world’s most successful companies and has revolutionized two entirely different industries. pic.twitter.com/MgMsQHwqZl

— Jeff Bezos (@JeffBezos) October 11, 2021

Likewise, for me, digital real estate and the metaverse will be playing a major role in how humans communicate, transact, and interact. As such, buying digital real estate in the metaverse is like putting your stake into the next wave of technology, commercialism, and ways of socialising. It is pretty much like buying real estate in a country. Just that this country is a digital one, and people are not really living inside it.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

How The Endowment Effect Is Hurting Your Property Decision Making – Case Study Of A Rental Investor

Despite property being such a big ticket item (especially in Singapore), it is frankly quite astounding when you hear the reasons…

Businesses would still need ‘land’ to set up their businesses in the metaverse, and what’s enticing is that by owning these virtual parcels of land, you could potentially rent it out in the future or sell ads. A constant revenue stream, just like how a physical property would.

The key reason why I am bullish on this digital world is the opportunities that the Ethereum blockchain technology can create – there won’t be a need for third parties through a decentralised platform, and transactions can be done much more liquid and efficient. For those who are unfamiliar with this concept, you might find it useful to read this as a primer.

Big names like Sotherby’s, Adidas, Walmart, Disney, Louis Vuitton, and Samsung are already going headfast to adapt this new technology into their business model – and it is these big names that can change the way we consume and the way they produce.

In just a year, the NFTs market has grown from a market cap of around $340M to $14B, while some are still laughing at the idea of investing in a .jpg or a gif. Value has now taken on a completely new interpretation to cater to the next generation, and it is your call whether to ride the wave or not.

Why did I buy Decentraland?

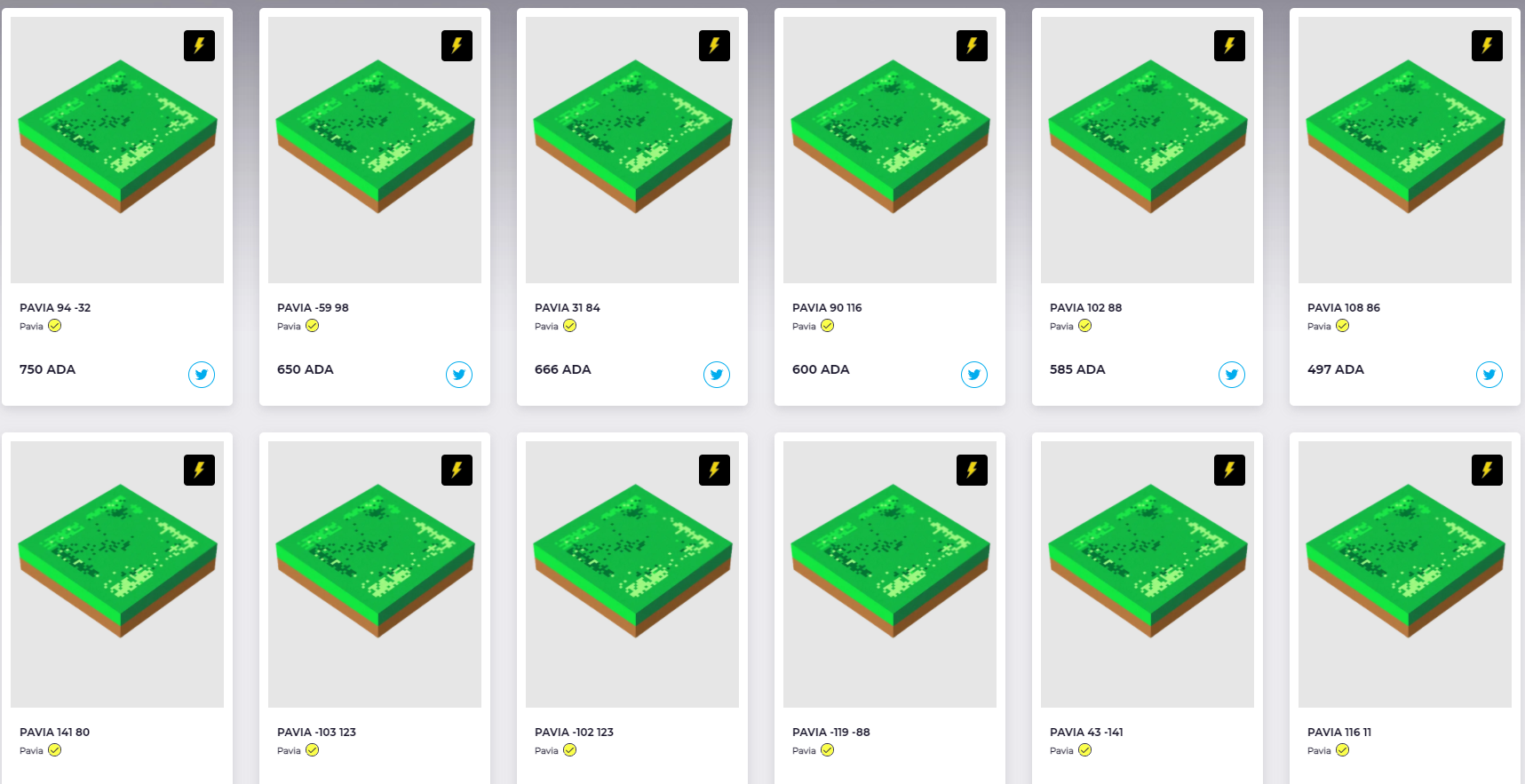

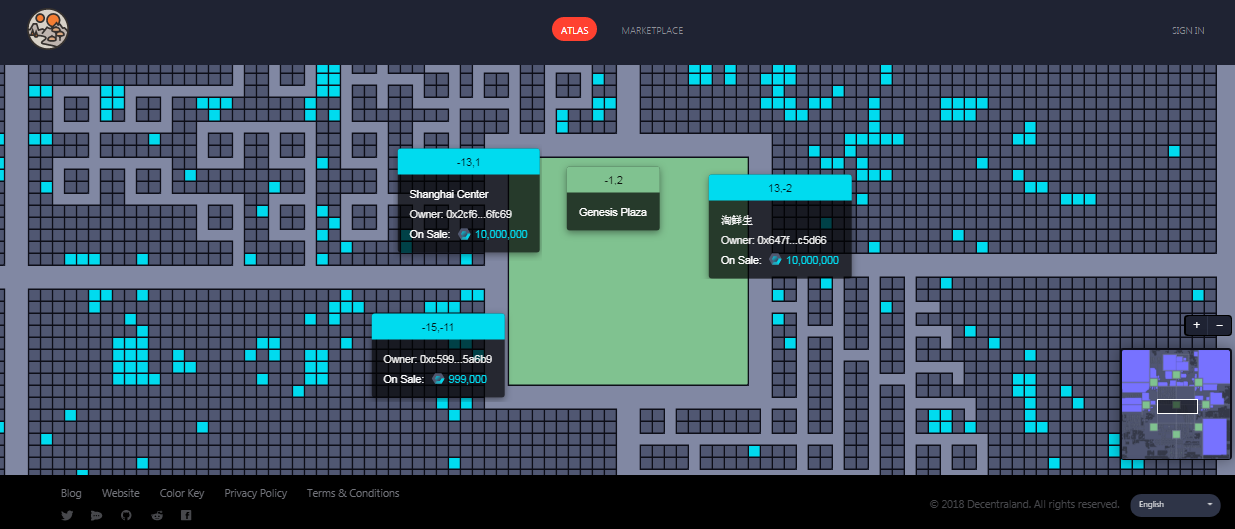

I’m no expert by any means, but the biggest reason as to why I chose to purchase a virtual ‘parcel’ in Decentraland compared to other metaverses was due to its scarcity – there were 90,601 equal-size individual plots of virtual land in Decentraland compared to other meta worlds like Sandbox, which has 166,464 LANDs. Although, I would say that Axie Infinity and Sandbox could give Decentraland a run for its money.

To me, scarcity would be a huge factor in determining its resale value. Furthermore, the people behind Decentraland have a great vision for the 3D platform, and it is mainly built for content creators, businesses, and individuals. Which is why I’m also pretty bullish on MANA coins right now. Apart from the increasing number of brands and influencers joining its platform, its ecosystem is growing strong alongside its number of users. Even Samsung hosted their product launch for their phone there.

How I bought – the process

The Decentraland marketplace is key to facilitating any transactions – it has open P2P (peer to peer) exchange systems that enable users to trade NFTs (aka your virtual ‘parcels’ or other inventory) with each other. Apart from using MANA, they support ETH as well – which could be a win depending on your rates that day.

I know there are people that are fearful of a complicated process to transact, but frankly, it was really a pretty simple process. MANA coins are readily accessible on a variety of cryptocurrency exchange platforms, where some platforms accept only BTC and ETH, whereas others support fiat exchanges.

- Set up your Crypto Wallet

Some platforms to consider using are Coinbase, Crypto.com, Binance, Gemini, and Kucoin. In my case, I used my existing Coinbase account to exchange some ETH into MANA coins by doing a currency pairing of ETH/MANA. Remember to keep your tokens safe by transferring your coins into a cold wallet – I always do this if I’m dealing with a huge amount by transferring to my Ledger.

- Select a Reputable Metaverse Platform to Transact

Not only is a reputable metaverse platform important for your exit strategy, but it is also important to ensure security in your transactions. Do your research on platforms as there are dodgy ones out there, and make sure to double-check the authenticity of your site (over and over again). We are after all still in the early days of the metaverse, and it is still a bit like the wild wild west out there.

- Select your Ideal ‘Parcel’

Just like buying physical real estate, I considered its variables and offerings by doing my due diligence on the different plots of land. Budget is also something I set from the beginning to make sure I don’t go too off track.

- Connect your Crypto Wallet with The Platform of your Choice

When you enter Decentraland’s Marketplace, this is what your user page would look like.

Connect your digital wallet by clicking the left option.

Select the relevant option that best applies to you.

- Finalise your Purchase

You could consider buying or bidding. In this particular listing, 2 LANDS cost 250,000 MANA coin – and once ready, check out your purchase.

And you’re done! Congratulations on your first purchase.

See, it’s easy peasy, lemon squeezy. Though I have to remind you guys again to ensure the authenticity of your purchase – scammers are everywhere, so beware.

Final Thoughts

In order for a boom, there must be a spark. And this new tech wave was sparked by the pandemic, the rise of decentralised systems, and the shift of our work life to WFH. We have now normalised working, consuming, socializing, and brainstorming through the prevalence of the Internet.

I love that there are so many different platforms that people can join to experience this new tech phase, where competition often means progression. Microsoft and Meta’s participation also shows signs of positive signals that this is a space to pay attention to.

Tech always finds a way to evolve – and it will change in ways that we can’t even imagine right now. Just see how quickly things have evolved. In 1989, these were the most valuable companies in the world.

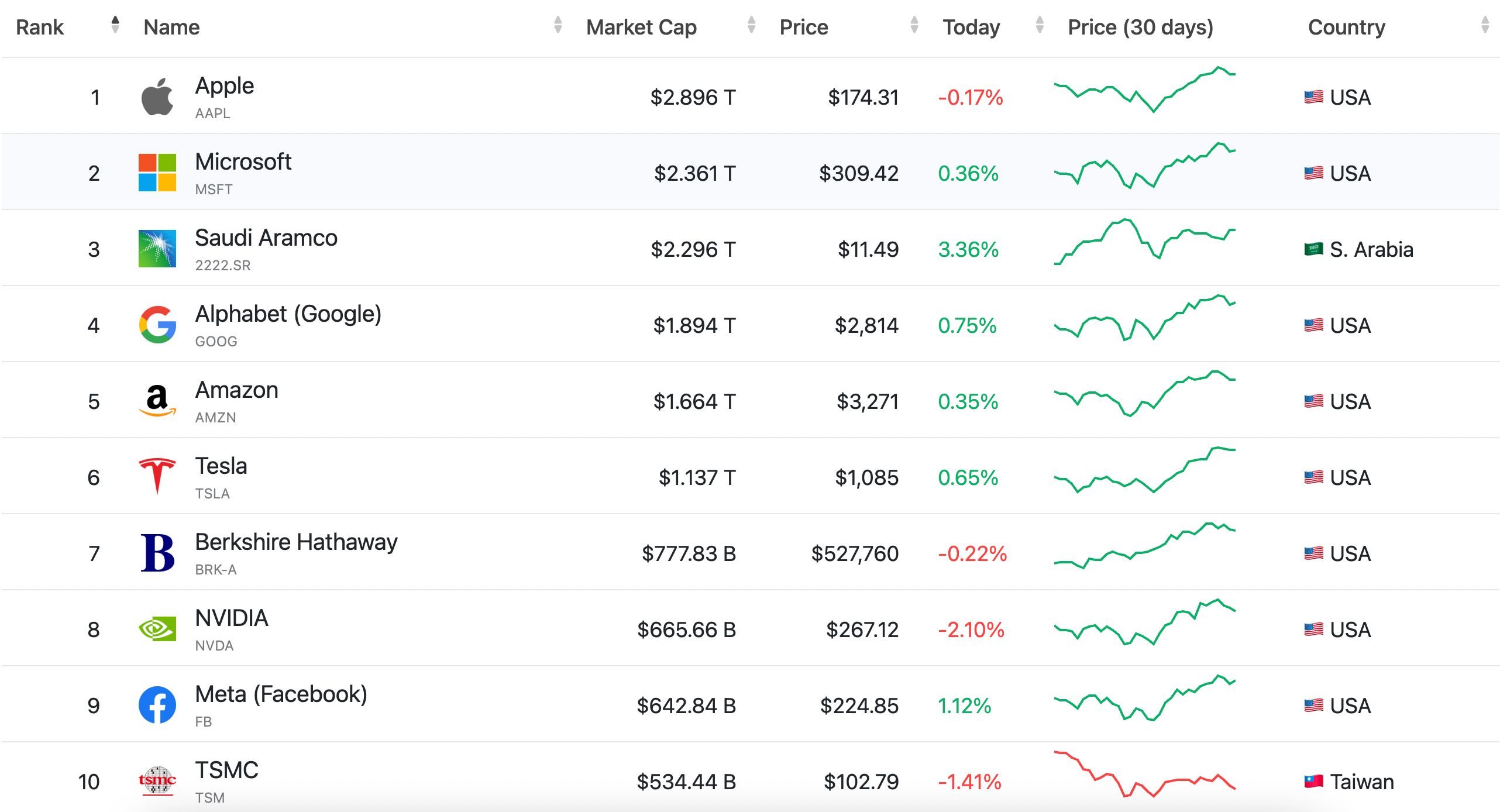

And look how much things have changed, a little over 30 years later:

Likewise, it may be hard to see today. But there’s no question that this will change drastically again in the next ten years – and whose to say that companies focused on the metaverse/digital real estate would not be featured here? Not only will it alter the gaming scene, but it will also completely revolutionise the way we socialise and how businesses operate.

Till then, hang on tight and hope to see y’all in the metaverse.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Cheryl Teo

Cheryl has been writing about international property investments for the past two years since she has graduated from NUS with a bachelors in Real Estate. As an avid investor herself, she mainly invests in cryptocurrency and stocks, with goals to include real estate, virtual and physical, into her portfolio in the future. Her aim as a writer at Stacked is to guide readers when it comes to real estate investments through her insights.Need help with a property decision?

Speak to our team →Read next from Homeowner Stories

Homeowner Stories We Could Walk Away With $460,000 In Cash From Our EC. Here’s Why We Didn’t Upgrade.

Homeowner Stories What I Only Learned After My First Year Of Homeownership In Singapore

Homeowner Stories I Gave My Parents My Condo and Moved Into Their HDB — Here’s Why It Made Sense.

Homeowner Stories “I Thought I Could Wait for a Better New Launch Condo” How One Buyer’s Fear Ended Up Costing Him $358K

Latest Posts

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

5 Comments

Hi, so which plot did u buy? I only got 1 at -31,14 bought at 5888 Mana. U buying Shib land?

U never design and publish your land?

hey cheryl, great article. keep it comin’. are you on twitter?