Are HDB Upgraders Over-Leveraging In Today’s Hot Property Market?

December 4, 2021

According to JLL, the number of HDB upgraders moving to condos is currently up over 21 per cent from last year. The idea of a condo-buying spree, in the midst of a pandemic, seems worrying; and perhaps it should, given the steadily rising prices we’ve seen over the past nine months. At the current prices, it’s possible that some HDB upgraders may be overreaching:

A quick explanation of the real estate market in 2021

For those who haven’t been following the property market, it can be hard to digest how high prices have gotten. Here’s a quick snapshot:

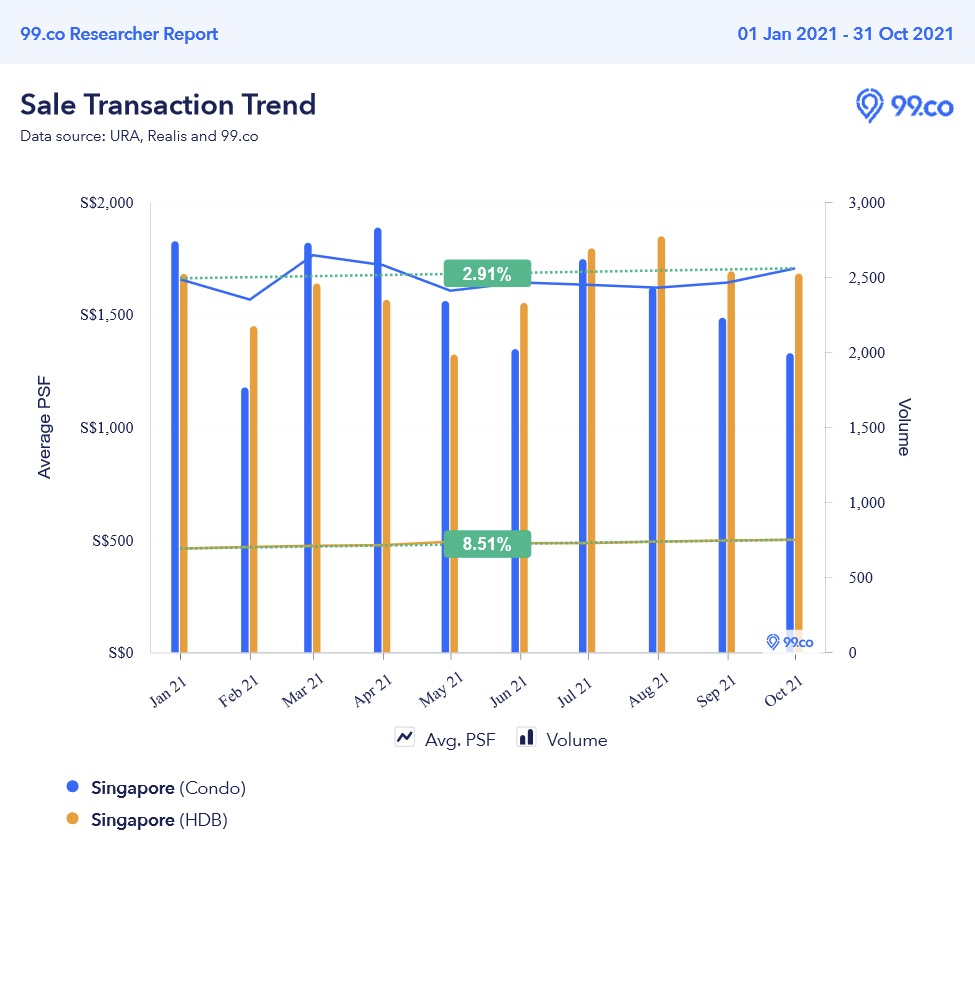

From January to October, prices have risen in both the HDB and condo markets. The average condo, islandwide, costs around $1,705 psf, while resale flats average $500 psf.

This puts condo prices roughly 20.7 per cent above the last peak in 2013; and recall that in that year, we saw the start of several rounds of cooling measures to bring the price back down.

Resale flat prices are also roughly 3.2 per cent above the 2013 peak and are also at their highest point in over eight years.

The property market may have begun adapting to measures like Additional Buyers Stamp Duty (ABSD) and loan curbs.

That said, measures to kill Cash Over Valuation (COV), undertaken for the resale flat market in around 2013, have clearly lost their bite. While COV data is no longer published, both realtors on the ground – as well as news media – have seen it rising:

One-third of resale flats purchased in 2021 involved COV, unlike one-fifth in 2020. By contrast, zero COV had been a growing norm in end-2013 and was the norm for most of 2014 to mid-2019.

Despite higher resale flat prices, are HDB upgraders starting to over-leverage?

- Upgraders show a preference for large units

- A lot of FOMO buying

- Low mortgage rates can give the appearance of affordability

- CPF spent on the down payments to meet TDSR

1. Upgraders show a preference for large units

It’s sometimes pointed out that HDB upgraders tend to buy larger resale condos, where the average price point is closer to $1,300 to $1,400 psf. However, this doesn’t actually mean much.

When it comes to affordability, the quantum and not the price psf is the key issue. Smaller units can go up to $3,000 psf but have a total quantum of $1.3 million or below; conversely, a 2,000 sq. ft. four-bedder would cost $2.8 million, at just $1,400 psf.

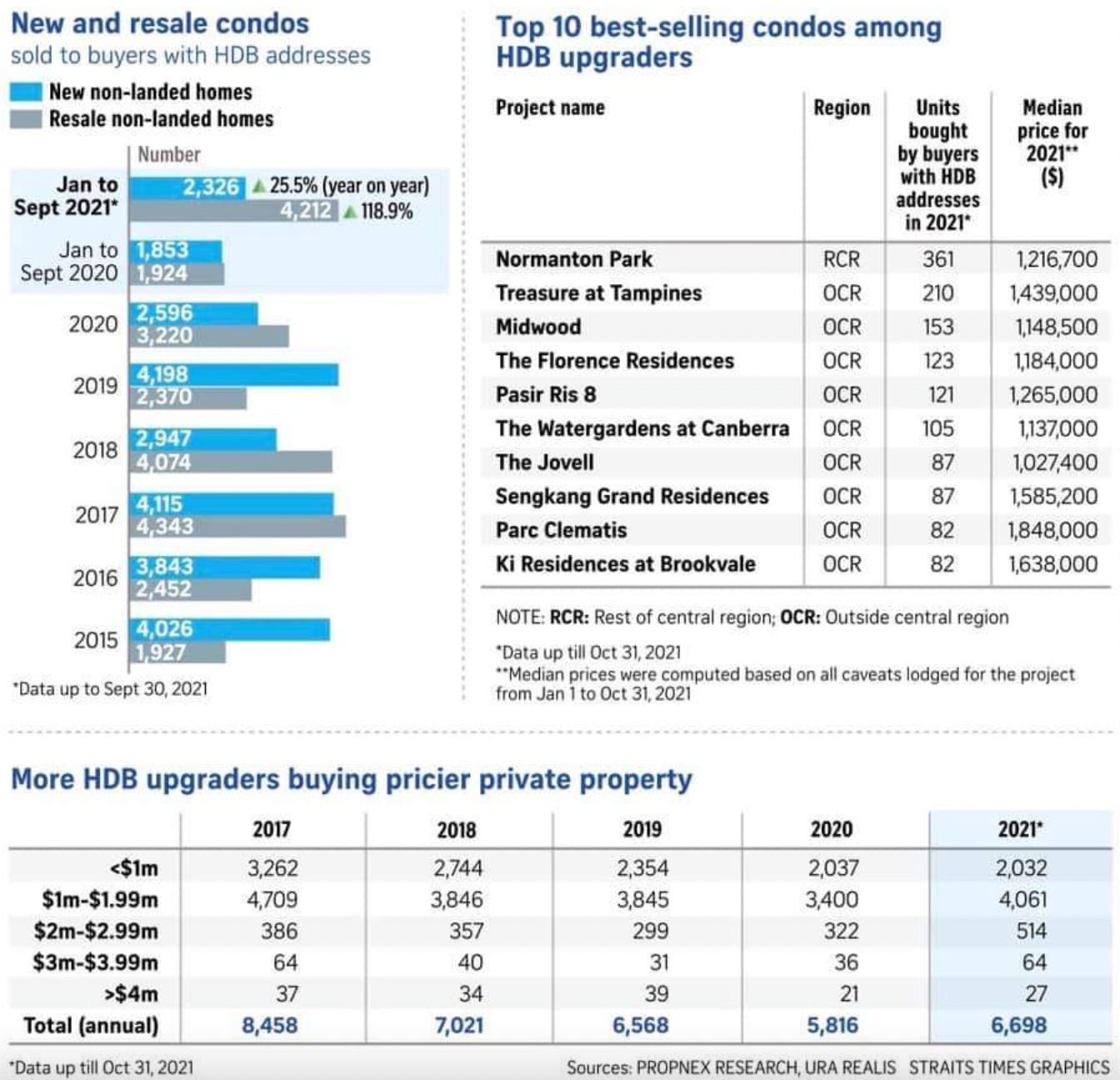

According to research from Cushman and Wakefield, the median size of units purchased has grown about 4.5 per cent, year-on-year. In the same linked report, Orange Tee & Tie noted a 72 per cent increase in new home sales above 1,200 sq. ft., between Q4 2020 and Q1 2021.

On the ground, realtors have pointed out that – to many upgraders – it doesn’t feel like an upgrade unless the new home is at least the same size as the previous one.

Note that most four-room flats are at least 970 sq. ft., and condos of a similar size average $1.3 million (resale) or $1.84 million (new launch); we’ll explain more on this in point 4 below.

In any case, the desire for larger homes means taking on a bigger quantum; and this ultimately means bigger loans and down payments.

2. A lot of FOMO buying

Fear Of Missing Out (FOMO) has been a major motive force in 2020 and 2021. This is due to two factors:

First, the rising home prices are creating the feat that – if upgraders wait any longer – they will end up being priced out of the market. There’s also a sense that this is a “once in a lifetime” chance, to profit off the price explosion of resale flats (note that between 2013 to around 2019, resale flat prices only saw a steady decline).

The current growth in resale flat prices is probably unsustainable, driven by temporary factors like the surge in five-year-old flats, or urgent housing needs from Covid-19.

As such, many upgraders fear missing out on good prices for their flat; perhaps ignoring that, even if they sell high, they’re also buying high anyway.

Second, there’s an underlying fear that rising home prices could prompt government intervention. Some worry that new loan curbs, or higher stamp duties, will kick in and prevent them from buying if they wait too long.

All this could cause some buyers to jump in, long before they have sufficient savings. On the ground, for instance, realtors have seen buyers turn to banks with higher interest rates, simply because those banks are willing to accept higher valuations – a move that could imply a desperate need for larger loan amounts.

Property Market CommentaryBreaking Down The Costs Of Development: Is Property Development Unsustainable In Singapore?

by Ryan J. Ong3. Low mortgage rates can give the appearance of affordability

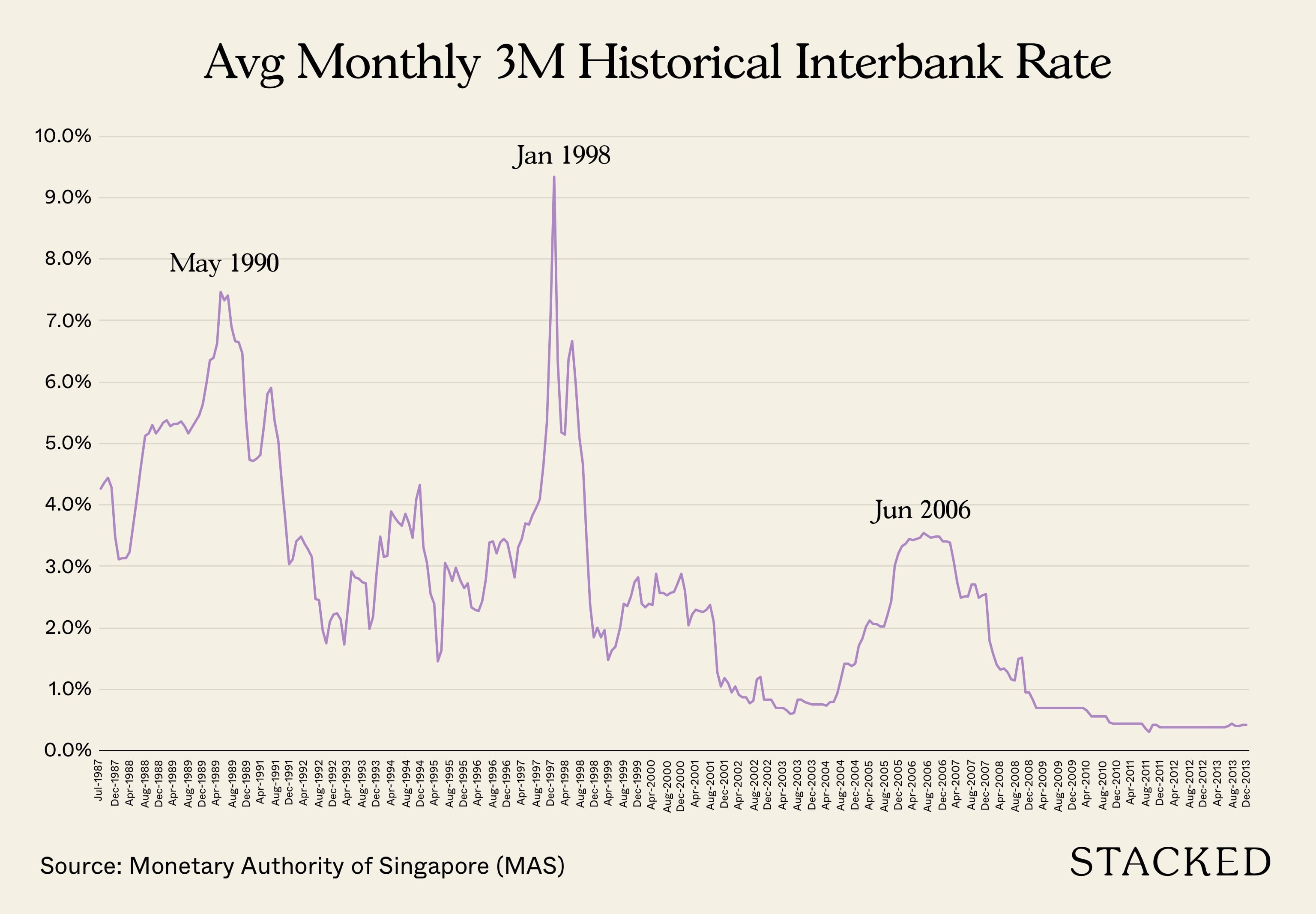

During economic crises, interest rates tend to drop. This is due to the United States Federal Reserve lowering rates, to stimulate their economy.

The last time this happened, during the Global Financial Crisis, home loan rates in Singapore fell to record lows. This fueled property purchases, due to low monthly repayments and the prospect of “borrowing for free” (i.e., the interest rate on home loans was below the CPF interest rate).

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Narra Residences Sets a New Price Benchmark for Dairy Farm at $2,180 PSF — and the sales breakdown offers

A consortium of developers led by Apex Asia Development and Santarli Realty has sold 135 units (24.8%) at Narra Residences…

The same thing happened during Covid-19, with home loan rates falling to an average of 1.3 per cent per annum. This is half the HDB loan rate of 2.6 per cent and below the prevailing CPF rate of 2.5 per cent.

The lower interest rate could create the appearance of affordability. However, a faster pace of Federal rate hikes is now expected in the US, starting early next year.

Now assuming a mortgage of $1 million at 1.3 per cent, for 25 years, current borrowers would be paying around $3,906 per month. An increase to two per cent – the average in 2018 – would raise repayments to around $4,239 per month; a difference of $333 a month.

Incidentally, before the last financial crisis, home loan rates averaged around four per cent per annum; and there’s no guarantee we won’t go back to that someday. A lot can change over a 25-year loan tenure.

4. CPF spent on the down payments to meet TDSR

The Total Debt Servicing Ratio (TDSR) caps a borrower’s loan repayment to 60 per cent of their monthly income; you can see our guide for more details on how it works. Furthermore, the TDSR is calculated at an interest rate of 3.5 per cent, regardless of the actual market rate.

Consider a condo with a price of $1.6 million. The maximum loan (75 per cent) would be $1.2 million.

At 3.5 per cent over 25 years, this is a loan repayment of around $6,007 per month. This would require the borrower to have a minimum income of about $10,012 per month. This is beyond the average income of most Singaporeans, and even some dual-income families might struggle to make the grade.

How then, do some families manage it?

The answer is to borrow less (i.e., make a bigger down payment). For example, if the borrowers have a combined income of just $8,000 per month, their TDSR limit is just $4,800.

This is attainable if they drop the loan about to $960,000, which means a total down payment of $640,000.

Some might be lucky and cover that with the sale price of their HDB flat, but that’s uncommon. Even at the current elevated price of $500 psf, the average 5-room flat (around 1,184 sq. ft.) comes to just $592,000. Don’t forget these buyers also need to cover Buyers Stamp Duty, discharging the existing home loan, etc.

So the question here is: where are so many upgraders getting the money for the down payment?

It’s hard to give an answer since most buyers are understandably tight-lipped about their financial sources. However, there’s a real possibility that it involves wiping out the CPF Ordinary Account to the last dollar (along with subsequent servicing of the loan), or in some cases having to rope in the in-laws.

If so, these buyers are likely going way beyond the 3-5-5 formula, which suggests the home be capped to five times the annual income, 30 per cent of their monthly repayments, and that buyers have 30 per cent of the needed capital upfront. Of course, many buyers feel this is way too conservative, so it all really depends on your personal risk appetite.

There are more controls in place, compared to 2008 – 2013

We don’t think we’ll see an overheated market as we did in 2008 to 2013 when prices rose roughly 60 per cent across the board. Certain controls, like the TDSR and ABSD, are in place to prevent that.

However, we are seeing a lot of HDB upgraders accept prices that, just in 2018, would have caused them to baulk. Even if private property could be a better appreciating asset in the future, it doesn’t necessarily mean you have to max out everything to get the biggest property you can afford.

Remember, what the bank or a mortgage calculator tells you is the maximum amount that you can borrow and not the optimal amount to borrow. Most people think they are making a rational decision because the bank has deemed it safe (obviously most people aren’t going to think of the worst-case scenario of losing their jobs), but the reality is everyone has different thresholds of what is a comfortable amount to pay in terms of the mortgage each month.

For more on the situation as it unfolds, follow us on Stacked. We’ll also provide you with in-depth reviews of new and resale properties alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Are HDB upgraders taking on too much debt in Singapore's property market?

Why are HDB upgraders buying larger condos despite high prices?

Is the current property market bubble in Singapore risky for HDB upgraders?

How do low mortgage rates influence HDB upgraders' purchasing decisions?

Where are HDB upgraders getting the money for their down payments?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Property Advice Should I Pay $500K More For A New Launch — Or Buy A Resale Condo Instead?

Singapore Property News A Rare Freehold CBD Office Unit Is Up For Sale At $20.5M — And Foreigners Can Buy It

Pro This Popular 520-Unit Condo Sold 85% At Launch — Here’s What Happened To Prices After

0 Comments