Affordable Condos you can consider in every HDB town

March 27, 2018

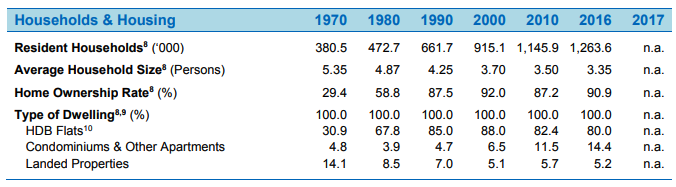

If you have been looking at buying a home in Singapore (and are Singaporean or a PR), chances are you would be considering an HDB resale flat. Taking the age old debate on resale HDB vs BTO out of the equation here, you are left with a choice of between a resale HDB or resale condominium. Most people would immediately dismiss the possibility of a buying a condo at this point, but if you were to look at the image below, the percentage share of condos have actually increased since the year 2000 from just 6.5% to 14.4% as of 2016.

There are young couples out there that start their home buying journey by jumping in head first, without taking into consideration their long term plan financially. For example, they budget for a 4 or 5 room flat as the thinking is always bigger is better.

Think about it this way:

The extra rooms really only come in handy if you are planning to have more than one child, and even then this might only be useful in 10-15 years when they are a lot older and require more space. So if you do not envision your first home to be a long term plan, it could be worthwhile thinking about buying a resale condominium as a stepping stone first. This means looking for a 2 bedroom affordable condos and making the step up to a bigger place in the future if your needs do expand.

So why consider a resale condo?

1. En Bloc potential (Just look at the number of transactions in 2018 so far)

2. Facilities

3. Capital Appreciation

Of course resale condos will always be more expensive, but if you do have some wiggle room financially even after looking at our guide on household income for resale HDB, please do read on. You will be surprised at some of these affordable condos.

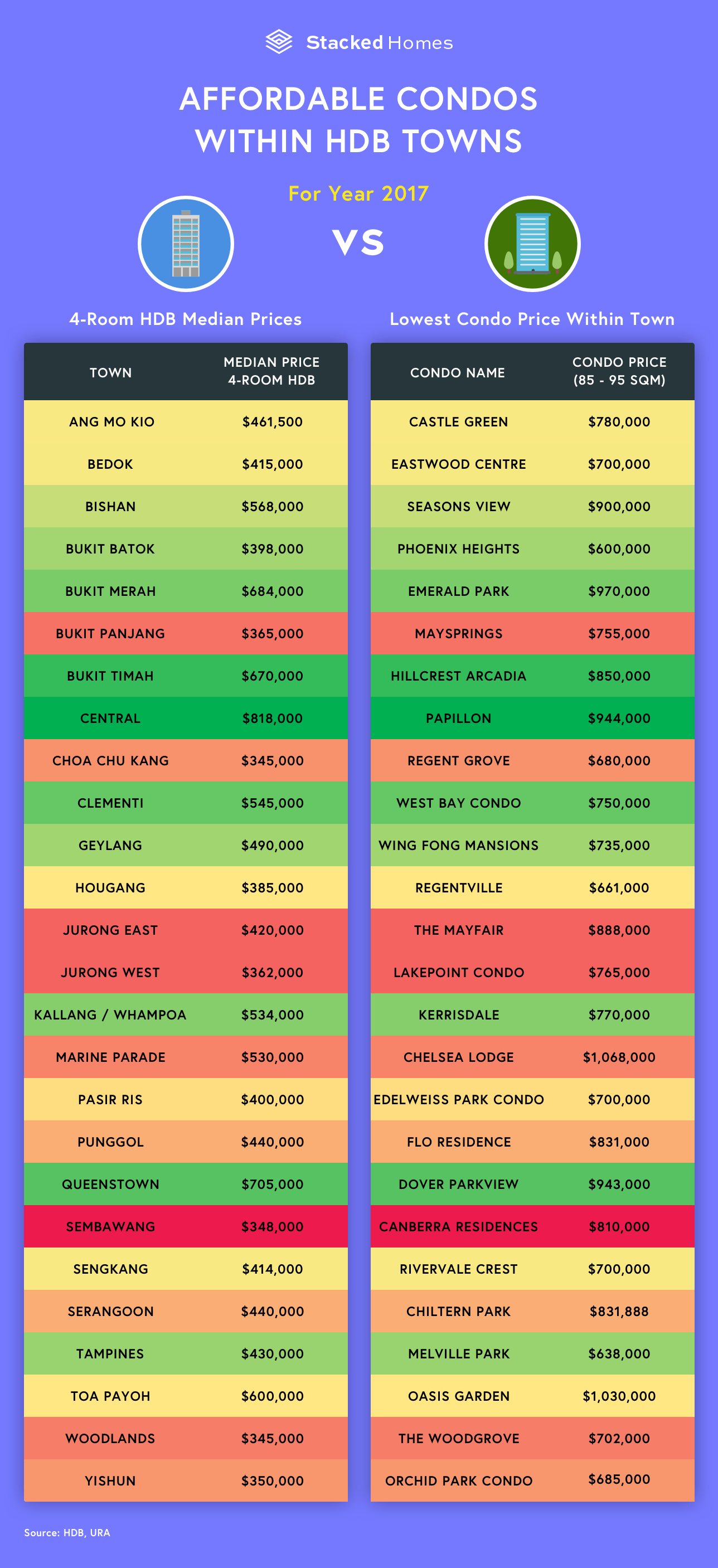

Here are all the affordable condos in the different HDB towns

Bear in mind that under the affordable condos option for each HDB town, these are based on 2 bedroom units of between 85 to 95 sqm. Even so, the results are pretty surprising. As you can see from the chart, the affordable condos highlighted in green are the ones that are close to their HDB counterparts. We can see immediately that the top options are all the traditionally more mature estates, so for those of you that are in the hunt for these locations you are in luck!

Let’s go right in to the top 10 affordable condos.

1. Central – Papillon

Papillon is a freehold apartment that was built in 2004 and has a total of 73 units. It is located at Jalan Rama Rama in District 12 and the nearest MRT station is Toa Payoh at about 670m away from the development. The lowest recent price for the development is at $944,000 in June 2017. It was a 936 sqft unit that was sold for $1,008 PSF.

Now let us take a look at the monthly repayments for the Papillon versus the resale HDB.

| Name | Papillon | Central |

|---|---|---|

| Price | $944,000 | $818,000 |

| Downpayment | $188,800 | $81,800 |

| Loan Amount | $755,200 | $736,200 |

| Loan Term | 25 years | 25 years |

| Interest Rate | 2.6% | 2.6% |

| Mortgage | $3,426 | $3,340 |

All things considered, when you compare the prices between both it is really quite close. Not to mention, the Papillon enjoys a freehold status as well. Talk about an affordable condo! Of course this area would not be as prime as the Central area resale HDBs like the Pinnacle at Duxton, but it is still very convenient!

2. Hillcrest Arcadia – Bukit Timah

Hillcrest Arcadia is a 99 years leasehold condominium that was built in 1980 and has a total of 272 units. It is located at Arcadia Road in District 21 and the nearest MRT station is Tan Kah Kee at about 860m away from the development. The lowest recent price for the development is at $850,000 in October 2017. It was a 926 sqft unit that was sold for $918 PSF.

Now let us take a look at the monthly repayments for the Hillcrest Arcadia vs the resale HDB.

| Name | Hillcrest Arcadia | Bukit Timah |

|---|---|---|

| Price | $850,000 | $670,000 |

| Downpayment | $170,800 | $67,800 |

| Loan Amount | $680,000 | $603,000 |

| Loan Term | 25 years | 25 years |

| Interest Rate | 2.6% | 2.6% |

| Mortgage | $3,085 | $2,736 |

3. Dover Parkview – Queenstown

Dover Parkview is a 99 years leasehold condominum that was built in 1997 and has a total of 686 units. It is located at Dover Crescent in District 5 and the nearest MRT station is Buona Vista at about 640m away from the development. The lowest recent price for the development is at $943,000 in Februrary 2017. It was a 969 sqft unit that was sold for $973 PSF.

Now let us take a look at the monthly repayments for Dover Parkview vs the resale HDB.

More from Stacked

The Cheapest 3-Bedroom Condos in Singapore You Can Buy Right Now Under $1.2M

3-bedroom condos are where family living starts to become more flexible. With three bedrooms, families have options, whether for a…

| Name | Dover Parkview | Queenstown |

|---|---|---|

| Price | $943,000 | $705,000 |

| Downpayment | $188,600 | $70,500 |

| Loan Amount | $754,400 | $634,500 |

| Loan Term | 25 years | 25 years |

| Interest Rate | 2.6% | 2.6% |

| Mortgage | $3,422 | $2,879 |

4. West Bay Condo – Clementi

West Bay Condo is a 99 year leasehold condominium that was built in 1994 and has a total of 318 units. It is located at West Coast Crescent in District 5 and the nearest MRT station is Clementi at about 1.78km away from the development. The lowest recent price for the development is at $750,000 in September 2017. It was a 936 sqft unit that was sold for $801 PSF.

Now let us take a look at the monthly repayments for Westbay Condo vs the resale HDB.

| Name | West Bay Condo | Clementi |

|---|---|---|

| Price | $750,000 | $545,000 |

| Downpayment | $150,800 | $54,500 |

| Loan Amount | $600,000 | $490,500 |

| Loan Term | 25 years | 25 years |

| Interest Rate | 2.6% | 2.6% |

| Mortgage | $2,722 | $2,226 |

5. Emerald Park – Bukit Merah

Emerald Park is a 99 year leasehold condominium that was built in 1993 and has a total of 280 units. It is located at Indus Road in District 3 and the nearest MRT station is Tiong Bahru at about 450m away from the development. The lowest recent price for the development is at $970,000 in May 2017. It was a 926 sqft unit that was sold for $1,048 PSF.

Now let us take a look at the monthly repayments for Emerald Park vs the resale HDB.

| Name | Emerald Park | Bukit Merah |

|---|---|---|

| Price | $970,000 | $684,000 |

| Downpayment | $194,000 | $68,400 |

| Loan Amount | $776,000 | $615,600 |

| Loan Term | 25 years | 25 years |

| Interest Rate | 2.6% | 2.6% |

| Mortgage | $3,520 | $2,793 |

Property Market CommentaryHere’s how long a millennial will take to save for a down payment of a condo in Singapore

by Druce Teo6. Kerrisdale – Kallang/Whampoa

Kerrisdale is a 99 year leasehold condominium that was built in 1996 and has a total of 481 units. It is located at Marna Road in District 8 and the nearest MRT station is Farrer Park at about 400m away from the development. The lowest recent price for the development is $770,000 in September 2017. It was a 990 sqft unit that was sold for $778 PSF.

Now let us take a look at the monthly repayments for Kerrisdale vs the resale HDB.

| Name | Kerrisdale | Kallang/Whampoa |

|---|---|---|

| Price | $770,000 | $534,000 |

| Downpayment | $154,800 | $53,400 |

| Loan Amount | $616,000 | $480,600 |

| Loan Term | 25 years | 25 years |

| Interest Rate | 2.6% | 2.6% |

| Mortgage | $2,795 | $2,423 |

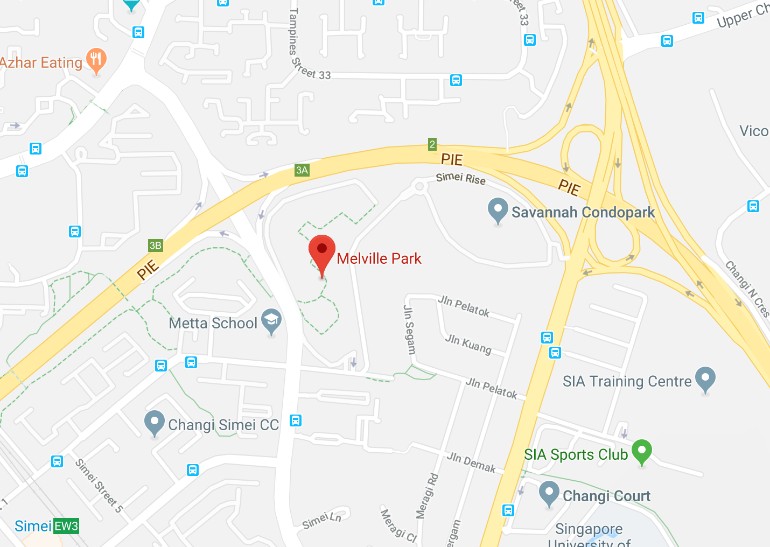

7. Melville Park – Tampines

Melville Park is a 99 year leasehold condominium that was built in 1996 and has a total of 1232 units. It is located at Simei Road in District 18 and the nearest MRT station is Upper Changi MRT station at about 740m away from the development. The lowest recent price for the development is $638,000 in April 2017. It was a 936 sqft unit that was sold for $681 PSF.

Now let us take a look at the monthly repayments for Melville Park vs the resale HDB.

| Name | Melville Park | Tampines |

|---|---|---|

| Price | $638,000 | $430,000 |

| Downpayment | $127,600 | $43,000 |

| Loan Amount | $510,400 | $387,000 |

| Loan Term | 25 years | 25 years |

| Interest Rate | 2.6% | 2.6% |

| Mortgage | $2,316 | $1,756 |

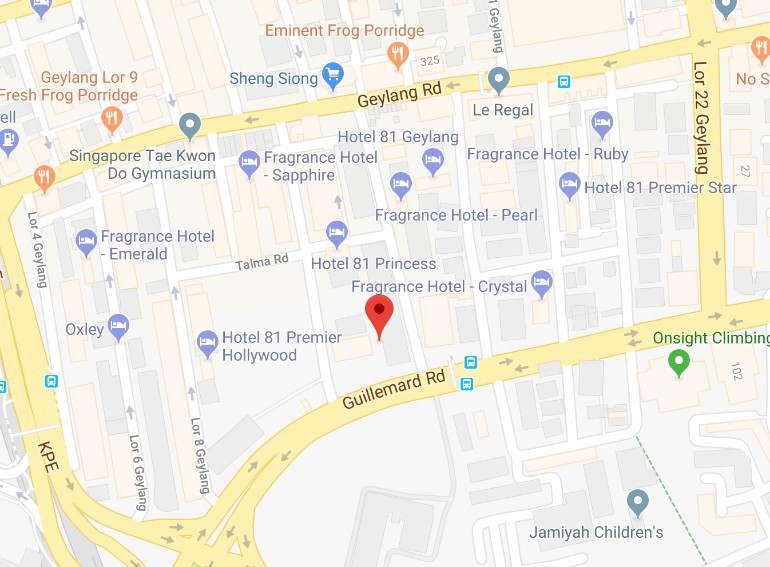

8. Wing Fong Mansions – Geylang

Wing Fong Mansions is a 99 year leasehold apartment that was built in 1997 and has a total of 218 units. It is located at Lorong 14 Geylang in District 14 and the nearest MRT station is Mountbatten at about 600m away. The lowest recent price for the development is $735,000 in September 2017. It was a 958 sqft unit that was sold for $767 PSF.

Now let us take a look at the monthly repayments for Wing Fong Mansions vs the resale HDB.

| Name | Wing Fong Mansions | Geylang |

|---|---|---|

| Price | $735,000 | $490,000 |

| Downpayment | $147,000 | $49,000 |

| Loan Amount | $588,000 | $441,000 |

| Loan Term | 25 years | 25 years |

| Interest Rate | 2.6% | 2.6% |

| Mortgage | $2,668 | $2,001 |

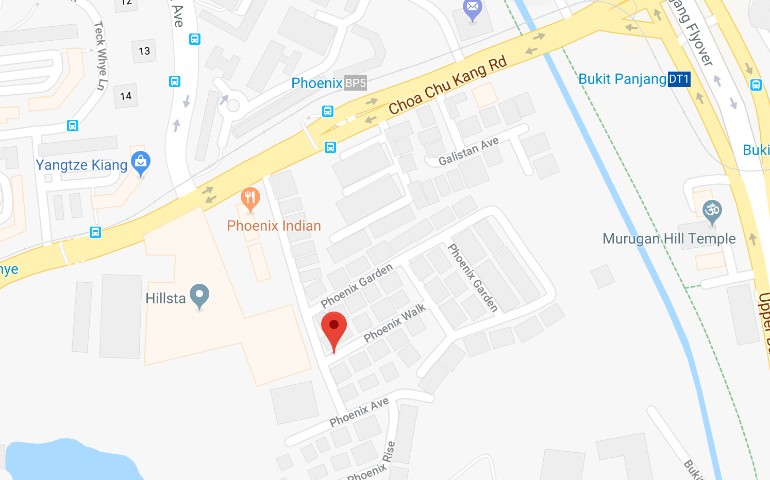

9. Phoenix Heights – Bukit Batok

Phoenix Heights is a 99 year leasehold apartment that was built in 1970. It is located at Phoenix Walk in District 23 and the nearest MRT station is Bukit Panjang at about 500m away. The lowest recent price for the development is $600,000 in April 2017. It was a 980 sqft unit that was sold for $613 PSF.

Now let us take a look at the monthly repayments for Phoenix Heights vs the resale HDB.

| Name | Phoenix Heights | Bukit Batok |

|---|---|---|

| Price | $600,000 | $398,000 |

| Downpayment | $120,800 | $39,800 |

| Loan Amount | $480,000 | $358,200 |

| Loan Term | 25 years | 25 years |

| Interest Rate | 2.6% | 2.6% |

| Mortgage | $2,178 | $1,626 |

10. Seasons View – Bishan

Seasons View is a 99 year leasehold condominium that was built in 2000 and has a total of 188 units. It is located at Pemimpin Drive in District 20 and the nearest MRT station is Marymount at about 480m away. The lowest recent price for the development is $900,000 in February 2017. It was a 969 sqft unit that was sold for $929 PSF.

Now let us take a look at the monthly repayments for Seasons View vs the resale HDB.

| Name | Seasons View | Bishan |

|---|---|---|

| Price | $900,000 | $568,000 |

| Downpayment | $180,000 | $56,800 |

| Loan Amount | $720,000 | $511,200 |

| Loan Term | 25 years | 25 years |

| Interest Rate | 2.6% | 2.6% |

| Mortgage | $3,266 | $2,320 |

Conclusion

At the end of the day, the point of this article is not to bring about another debate on how affordable condos are in Singapore. This is merely just to show that if you are more flexible with your short term planning for your homes, the gap between a condo and resale HDB in certain areas may be closer than you think.

As always, feel free to reach out to us at stories@stackedhomes.com or leave a comment below!

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are some affordable condos to consider in Singapore's HDB towns?

Why might someone choose a resale condo over an HDB flat in Singapore?

How do the prices of affordable condos compare to resale HDB flats in Singapore?

What factors should I consider when choosing an affordable condo in Singapore?

Are there specific districts in Singapore where affordable condos are more accessible?

Druce Teo

Druce is one of the co-founders at the Stacked Editorial. He was first interested in property since university but never had any aspiration to become an agent, so this is probably the next best thing.Need help with a property decision?

Speak to our team →Read next from Property Picks

Property Picks Where to Find Singapore’s Oldest HDB Flats (And What They Cost In 2025)

Property Picks Where To Find The Cheapest 2 Bedroom Resale Units In Central Singapore (From $1.2m)

Property Picks 19 Cheaper New Launch Condos Priced At $1.5m Or Less. Here’s Where To Look

Property Picks Here’s Where You Can Find The Biggest Two-Bedder Condos Under $1.8 Million In 2025

Latest Posts

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

On The Market Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

On The Market A 40-Year-Old Prime District 10 Condo Is Back On The Market — As Ultra-Luxury Prices In Singapore Hit New Highs

0 Comments