Here’s how long a millennial will take to save for a down payment of a condo in Singapore

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

Druce is the Chief Editor at the Stacked Editorial. He was first interested in property since university but never had any aspiration to become an agent, so this is probably the next best thing.

A recent survey conducted by Apartment List found that Millennials looking to buy their first home may face up to two or more decades of saving up just for the down payment. :O

Although these figures are obtained from the US, a quick search on Google shows that it is increasingly a widespread problem due to rising property prices and the current saving rates of Millennials.

These results should serve as a waking call to young potential homebuyers who may not have a realistic sense of how long it takes to save, and how much they would have to set aside each month to be able to afford the down payment.

Millennials in Singapore

Interestingly, many Singapore Millennials view home ownership as a top savings target.

Thankfully, we have public housing as a more affordable option for Singaporean Millennials to rely on. So if you are taking a HDB housing loan, the down payment for a new Built-to-Order flat can be as low as 10 percent. Additionally, this can be paid in full if you have an adequate amount in your CPF, so there is no need to even come up with any cash!

However, because other countries do not have the option of public housing, and for the sake of comparison, let us take a look at how long a Millennial in Singapore will take to save for the down payment of a condo.

readthisnext

First things first, if you were to buy a condo in Singapore, you will be faced with a minimum of 20% down payment. According to Yahoo, an average condominium in the OCR (Outside Central Region) will cost $1.2 million. This results in a down payment of $240,000, and a monthly mortgage of about $4,400. Because of the TDSR (Total Debt Servicing Ratio), Singaporeans are limited to 60% of their gross total income. Hence, we are looking at an average of $3,700 per spouse.

More from Stacked

Worrying About Your Property Purchase Choice? 5 Logical Things To Consider Before Backing Out

It’s not uncommon to get cold feet when buying a property. It’s a huge purchase that can mean a big…

Now let us find out how much most Millennials will have in savings at this point. Figures obtained from EnjoyCompare.com show that a quarter will have savings of less than $6,000, while 36% will have no savings at all.

So let’s say that an average Singaporean will have around $6,000 in savings and a starting salary of $3,700 which ends up being $2,960 (after CPF), how long will it take to save up for a condo down payment?

Let’s do the sums.

After we take away savings of $6,000, we are left with $194,000 to save for. According to SingSaver.com, the average savings rate is about 20%. This means that an average Millennial in Singapore will save around $592 from his/her starting salary, double that for the partner and we are looking at savings of $1184 a month.

So to save for $194,000 that will take a Millennial couple on average, 13.6 years to save for! Even if we take a higher savings rate at 50%, which means savings of $2,960 per month per couple, it will take 5.5 years to save! Of course, these figures are all savings on cash only and not inclusive of using a part of your CPF to pay for the down payment. But, these figures do not take other things into account, like saving for a wedding or any rainy day savings!

Saving for a home

So if you were hoping to buy your own private property in Singapore as a first home, you may need to rethink your plan as it does take a substantial number of years to save up for. If you like more tips on how you can save for it here is an article by the folks from the New Savvy. If you want to think about a resale HDB as an option, here is our ultimate guide on everything you need to know about buying a resale HDB!

Druce Teo

Druce is the Chief Editor at the Stacked Editorial. He was first interested in property since university but never had any aspiration to become an agent, so this is probably the next best thing.Read next from Property Market Commentary

Property Market Commentary A First-Time Condo Buyer’s Guide To Evaluating Property Developers In Singapore

Property Market Commentary Why More Young Families Are Moving to Pasir Ris (Hint: It’s Not Just About the New EC)

Property Market Commentary This Upcoming 710-Unit Executive Condo In Pasir Ris Will Be One To Watch For Families

Property Market Commentary Which Central Singapore Condos Still Offer Long-Term Value? Here Are My Picks

Latest Posts

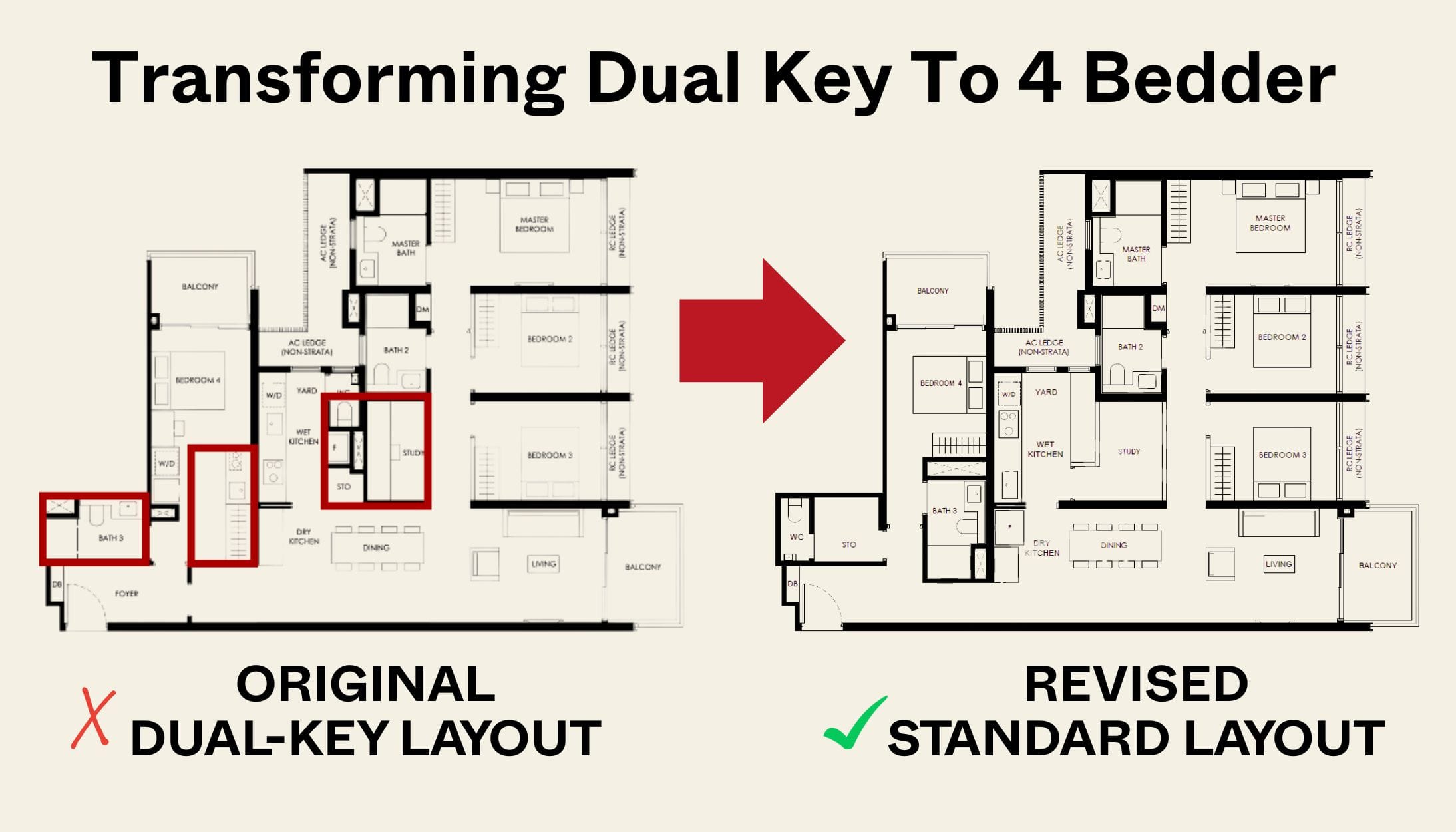

New Launch Condo Reviews Transforming A Dual-Key Into A Family-Friendly 4-Bedder: We Revisit Nava Grove’s New Layout

On The Market 5 Cheapest HDB Flats Near MRT Stations Under $500,000

New Launch Condo Reviews The Robertson Opus Review: A Rare 999-Year New Launch Condo Priced From $1.37m

Singapore Property News Higher 2025 Seller’s Stamp Duty Rates Just Dropped: Should Buyers And Sellers Be Worried?

Pro Same Location, But Over $700k Cheaper: We Compare New Launch Vs Resale Condos In District 7

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

New Launch Condo Analysis This Rare 999-Year New Launch Condo Is The Redevelopment Of Robertson Walk. Is Robertson Opus Worth A Look?

Pro We Compared New Vs Resale Condo Prices In District 10—Here’s Why New 2-Bedders Now Cost Over $600K More

Singapore Property News They Paid Rent On Time—And Still Got Evicted. Here’s The Messy Truth About Subletting In Singapore.

New Launch Condo Reviews LyndenWoods Condo Review: 343 Units, 3 Pools, And A Pickleball Court From $1.39m

Landed Home Tours We Tour Affordable Freehold Landed Homes In Balestier From $3.4m (From Jalan Ampas To Boon Teck Road)

Singapore Property News Is Our Housing Policy Secretly Singapore’s Most Effective Birth Control?

On The Market A 10,000 Sq Ft Freehold Landed Home In The East Is On The Market For $10.8M: Here’s A Closer Look

On The Market 5 Spacious Old But Freehold Condos Above 2,650 Sqft

Property Investment Insights We Compared New Launch And Resale Condo Prices Across Districts—Here’s Where The Price Gaps Are The Biggest