Be wary of cherry picked property data

I’ve seen quite a few property videos on YouTube lately; and while I’m not one to point fingers, some of them are showing price data that I just can’t corroborate.

Some videos have claims that certain nearby properties are $X,XXX sq. ft., which makes my eyebrows shoot up. This is, of course, done to make the property that they are trying to sell seem like a bargain in comparison.

Just to be sure I do run a check, and I find exactly zero transactions to match those suggestions. When my queries are answered, it’s always a dismissive statement like “Oh, it’s based on our internal research.”

Can’t be very good research if it directly contradicts URA’s recorded transactions, eh?

I suspect that in some cases, the intent is to point at asking prices to mislead the viewer.

As in, rather than give real transaction prices for comparison, the agent may try to make the home look cheaper by directing viewers to look at various property portals. Property newbies then see the asking prices, which can be much higher than real transaction prices, and take their word for it.

Or, it may just be misleading viewers with averages. E.g., if nine units in a development sell for $1.5 million, but one unit sells for $3 million, the average price becomes $1.65 million; even if none of the units actually have that price.

The comparison gets even harder to justify once it comes to psf.

I’ve also seen cases where the agent’s have used the average psf of the surrounding developments to compare, but it really isn’t fair when the property that you are trying to sell is a penthouse (which save for the newer luxury penthouses, will typically be a lower psf).

Another trick that I commonly see is to show the highest psf of the development (as compared to the actual average), which again helps to make the condo in question look “cheap”.

I’ve seen this happen in a couple of sales presentation slides that agents have used, but it’s an issue gets even harder to spot in YouTube videos, as these are only shown on screen for a few seconds.

We don’t see any crackdown on this so far; but keep it in mind. You can always check URA transaction records for clarity.

It’s not easy being a tech pioneer.

I don’t mean the first people to buy Apple’s latest money-gobbler here; I’m talking about the Tengah residents who bravely opted to be the first for a new centralised air-con system.

It’s part of Tengah’s branding as an eco-town: a new cooling system that moves chilled water through pipes, which run from a centralised chiller down the various common areas, and into the flats. This system is said to be more sustainable, and more efficient than traditional air-con systems.

But as with many people who sign up for pioneering new systems, you don’t always know what you’ll get. In this case, a giant trunking system that runs in from the front door, and runs across the walls.

If you ever looked at the way vents run around a car park or 40-year-old mall and though to yourself: Yes! This is exactly the kind of look I need for my living room! Then I guess you’d love it.

Look, I don’t mean to condemn progress, and aesthetics should be a minor factor in the pursuit of sustainability, etcetera etcetera.

But good lord, that trunking is huge.

If you ask an Interior Designer to conceal that, her solution will just be buying blindfolds for your guests. I think my full battle order gear from SAF would fit in there, and I was the guy carrying the signal set.

On the plus side, it’s great for Feng Shui, as the natural flow of cool water from the outside to the interior promotes great qi flow, according to consoling lies I am making up for the unit owners.

Meanwhile in other property news:

More from Stacked

HDB VERS – Good news? Here is everything you need to know

If you have not watched the National Day Rally 2018 yet, VERS might just be the next buzzword that you will…

- Check out an interesting new launch in Ulu Pandan, which is the first in 14 years for the location.

- One of the biggest (in terms of unit count) condo launches in 2023 is around the corner. Check out the gigantic Grand Dunman.

- 8 new GLS sites released for 2023. This is the biggest supply launched for a decade, and some are pretty prime plots.

- Here’s a reader who bought a condo at age 30, and renovated their condo for just $14,000. Here’s how they did it.

- Check out a dream makeover of this architect’s tropical home (and steal the good ideas because they look amazing!)

Weekly Sales Roundup (12 – 17 June)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| KLIMT CAIRNHILL | $5,650,000 | 1496 | $3,776 | FH |

| BOULEVARD 88 | $4,785,000 | 1313 | $3,644 | FH |

| PULLMAN RESIDENCES NEWTON | $4,487,670 | 1378 | $3,257 | FH |

| THE ATELIER | $4,032,210 | 1496 | $2,665 | FH |

| AMBER PARK | $4,000,000 | 2045 | $1,956 | FH |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| LAVENDER RESIDENCE | $1,036,000 | 463 | $2,238 | 99 yrs |

| THE LANDMARK | $1,420,280 | 495 | $2,868 | 99 yrs (2020) |

| BLOSSOMS BY THE PARK | $1,478,000 | 549 | $2,692 | 99 yrs (2022) |

| PULLMAN RESIDENCES NEWTON | $1,543,000 | 463 | $3,334 | FH |

| GRANGE 1866 | $1,592,000 | 527 | $3,018 | FH |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE LADYHILL | $7,500,000 | 3261 | $2,300 | FH |

| CAPE ROYALE | $5,744,700 | 2508 | $2,291 | 99 yrs (2008) |

| PEBBLE BAY | $5,000,000 | 2809 | $1,780 | 99 yrs (1994) |

| THE WATERSIDE | $4,200,000 | 2411 | $1,742 | FH |

| MARINA BAY RESIDENCES | $3,780,000 | 1636 | $2,310 | 99 yrs (2005) |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| KOVAN GRANDEUR | $548,000 | 366 | $1,497 | 99 yrs (2010) |

| STRATUM | $600,000 | 441 | $1,360 | 99 yrs (2012) |

| CAVAN SUITES | $608,000 | 323 | $1,883 | FH |

| JOOL SUITES | $678,000 | 388 | $1,750 | FH |

| NESS | $680,000 | 452 | $1,504 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE LADYHILL | $7,500,000 | 3261 | $2,300 | $2,120,000 | 17 Years |

| KING’S MANSION | $2,950,000 | 1604 | $1,839 | $2,095,000 | 16 Years |

| DE ROYALE | $2,200,000 | 1259 | $1,747 | $1,442,000 | 17 Years |

| TANGLIN PARK | $2,595,000 | 1109 | $2,341 | $1,375,000 | 23 Years |

| THE ATRIA AT MEYER | $3,120,000 | 1475 | $2,116 | $1,240,000 | 6 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE BOUTIQ | $2,730,000 | 1884 | $1,449 | -$573,000 | 9 Years |

| MARINA BAY RESIDENCES | $2,400,000 | 1055 | $2,275 | -$510,180 | 13 Years |

| ALTEZ | $1,480,000 | 764 | $1,937 | -$261,920 | 8 Years |

| MARINA BAY RESIDENCES | $3,780,000 | 1636 | $2,310 | -$228,200 | 16 Years |

| MARINA ONE RESIDENCES | $1,588,888 | 710 | $2,237 | -$108,362 | 9 Years |

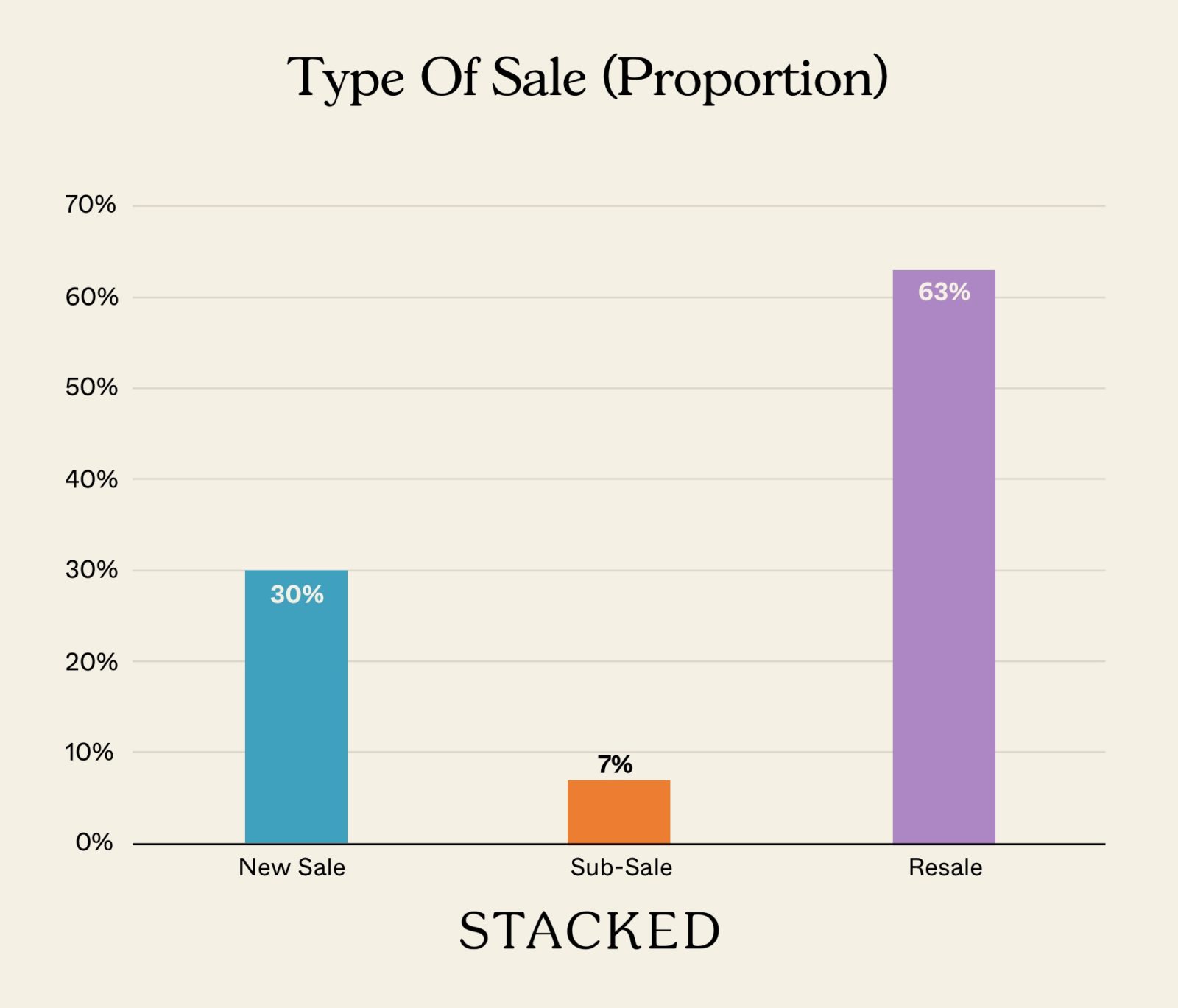

Transaction Breakdown

My most interesting links of the week:

- Why Singapore’s targeting of foreigners to cool the property market makes no sense

To be clear, this is the title taken from an article on the SCMP, and the accusation of making no sense is a little strongly worded. Also, this seemed to have rubbed off some readers, as the comments on the post were a little aggrieved at a foreigner writing this.

Anyway, I know this was written 2 weeks ago. But it seems timely to talk about this again, given the news on the new GLS supply that is coming up in 2023 – two of which is in prime areas like Orchard Boulevard and Great World (which usually sees a higher concentration of foreigners).

This may seem quite a strange move to some, given the new foreigner ABSD implementation. But this could also be a subtle move also to try and convert more foreigners into applying for a PR, rather than just buying and parking their money in a property here.

- What the top of the Empire State Building was originally designed for

As funny as it sounds today, in the late 1920s, it was believed that cross-Atlantic travel would be done via airships or zeppelins.

In the ideal world, the airship would arrive and dock at the building. This means that you could disembark by walking down a gangplank and be in Manhattan in just 7 minutes. So investors behind the Empire State Building saw this as the right site to invest for such a future.

However, the strong 50 mph winds meant that they couldn’t come up with a method to securely attach the airship. As such, there was only one docking ever done, and this was just 3 minutes (no unloading done at all).

Naturally, this all fizzled out with the famous 1937 Hindenburg disaster.

This made me wonder, what other future real estate predictions have not played out the way everyone thought they would? Let me know by just replying this email, it would be really interesting to know more obscure ones.

For more on the Singapore private property market, and word from realtors or other home buyers

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How do property agents use data to make homes seem cheaper or more attractive?

What should I do to verify property prices or data shown in videos or listings?

Why do some property agents compare asking prices instead of actual transaction prices?

What are common tricks used in property sales presentations to make a property look more affordable?

What are some recent property market updates mentioned in the article?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Latest Posts

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

0 Comments