This Korean Housing System Lets You Live Rent-Free: Could It Work in Singapore? (And Other Unique Housing Models)

June 18, 2024

Like Singapore, every country has its own challenges and hence its own unique quirks, when it comes to housing. These are of interest to local property investors as well: apart from the most obvious use cases (e.g., they intend to invest in overseas property, as ABSD rates are high), they might also provide alternative ideas for property assets. Cities and their various authorities also learn from one another, and in the future, we may see more borrowed ideas. Here are some unusual ones from around the globe:

1. Jeonse (or Chonsei) Housing System

Used in South Korea, this is the only widely used rental method that does away with monthly rental payments. Instead, the tenants pay a lump-sum deposit to the landlord, which is returned after the end of the lease (with no interest paid on the deposit).

This deposit can range between 50 to 80 per cent of the property’s market value, depending on factors like location and housing type. We did ask some people who rent in South Korea and were told a typical one-bedder in a major city like Seoul could have a deposit of between KRW 300 million to KRW 500 million (roughly S$250,000 to S$490,000 at the time of writing). The lease term is two years.

As to why they don’t just buy the house instead, the reasons are complex. Korean banks’ strict financing requirements, coupled with issues like much higher interest rates than ours (5.54 per cent at the time of writing), and the commitment to keep paying for decades, could get in the way.

So with this system, the landlord benefits from the time value of money: the lump sum can be invested all at once, in financial instruments of their choice. In addition, the lump sum helps with the property purchase, as the buyer can cover their initial cash layout very quickly with the first tenant.

For tenants, this is theoretically cheaper than paying rent, as they’ll recover the full deposit eventually; their only cost is the interest they could have earned on the lump sum.

In the event of the landlord’s financial distress, such as bankruptcy, the tenant has first priority (Hogu-won) and is among the creditors who need to be paid back first.

However, the system has seen a lot of criticism lately, and is prone to certain abuses

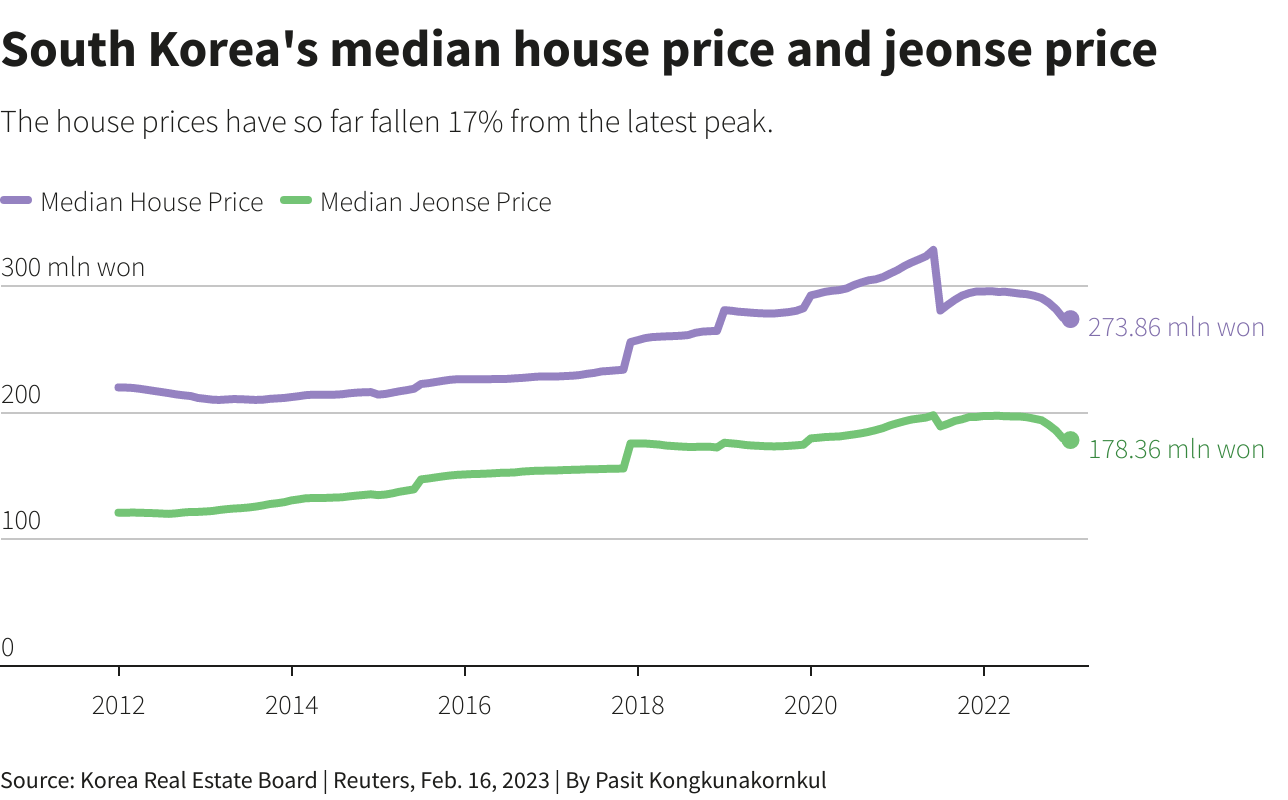

In recent years, there’s been a shift to a more conventional system (wolse, which is the monthly rent we’re familiar with). One of the main issues is the widening inequality: the lump sum deposit has been rising so much, that many tenants now find it unaffordable – and coupled with high property prices, this creates a real risk of homelessness.

Another issue was that the sharp rise in property values was primarily driven by the low national interest rates. However, in 2022, when the government hiked interest rates, tenants began demanding their deposits back to invest in banks. This created significant issues for landlords who had leveraged these deposits to incur heavy debts and acquire more properties. Many people would buy one unit, take the Jeonse money from a tenant, and then use that money to buy another unit and rinse and repeat.

So when prices stopped going up, some were unable to repay their tenants, and some landlords absconded, leaving many tenants without their deposits. This situation contributed to the further decline of the Korean housing market, marking the burst of the property bubble.

This housing system has meant that for many younger South Koreans, housing affordability is a real issue today. It is widely attributed that this is one of the main reasons why they have the world’s lowest birth rate, which is why housing stability is such an important factor.

2. The Housing First Programme in Finland

Housing First is one of the most successful policies in ending homelessness in Europe. Over a span of 10 years (2008 to 2018), Finland is the only EU country that has managed to decrease homelessness, by a significant margin of 35 per cent. Finland currently aims to end homelessness altogether by 2027.

The programme is run by a non-profit social enterprise (Y-Foundation), which has about 18,500 apartments across 57 cities. The premise of Housing First is simple: public housing is made available with zero preconditions. A homeless person doesn’t need to first “get clean,” be in therapy, or have their first job, etc. The public housing is provided to them first, thus giving them accommodation while they work on their other issues.

This does bring some expected issues, such as addicts living on the premises; but rather than use hard coercion (e.g., kicking them out or punishing them), the management only attempts to minimise the harm caused. This goes to the extent of providing clean needles and safe injection spaces, while all rehabilitation programmes are voluntary.

This results in a host of benefits for both the homeless and their society: given proper housing and support, they have a higher chance of recovery. At the same time, the country is able to reduce the demand for emergency services, as well as law enforcement and hospital spaces. The police need to chase down fewer addicts causing problems, and there are fewer cases of infection or drug overdoses.

More from Stacked

We Work In The CBD: Would Emerald Garden/UE Square Or Pinnacle @ Duxton Be A Better Choice?

Hello, Stacked homes,

While its success is hard to deny though, it’s unlikely that many other countries have cultures that can tolerate this (possibly including Singapore, with our hard stance on drug use). It’s also expensive in the upfront sense, although later on the savings could more than make up for it.

3. Japan’s stable, low-carbon housing approach

Japan’s housing market is a paradoxical mix of ideas that should oppose each other, but somehow don’t; instead, they have an odd synergy that makes for a highly stable and ecologically friendly built environment (we have written about this in more detail here).

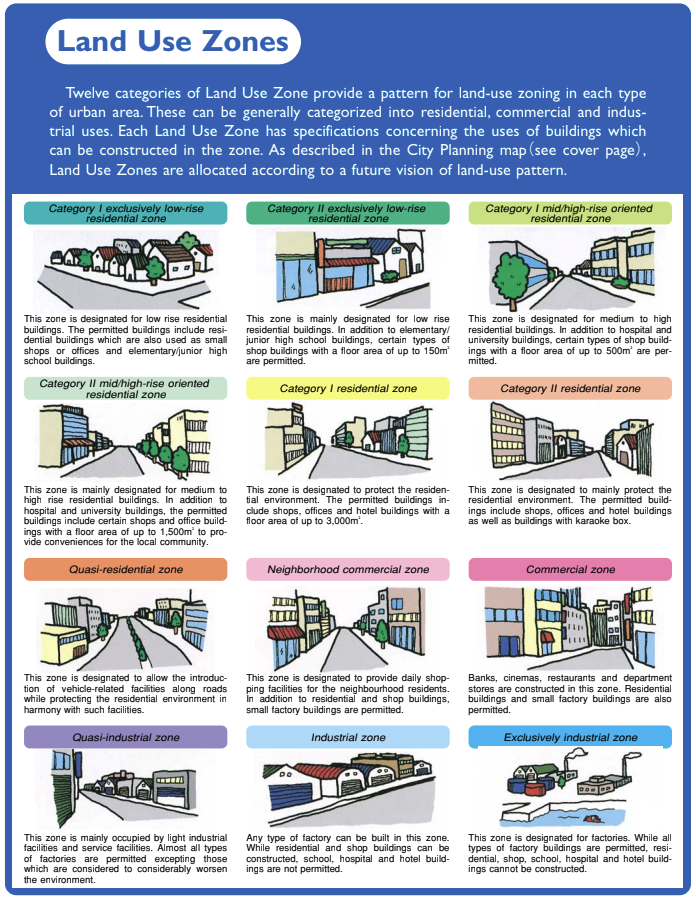

On the one hand, Japan is very strict concerning urban construction. On the other hand, they have zoning laws that are much more flexible than ours. Some degree of “wildcard” space is included in every zone type, which allows for amenities to emerge organically (e.g., a school can appear in a residential zone if it’s needed, or a clinic or convenience store).

The flexibility of the planning zones, coupled with the liberal use of mixed-use developments (these are the norm in Japanese cities) means there’s less need for an extensive transport infrastructure; every neighbourhood is “self-contained” to some degree. Singapore does aim to do this with decentralisation, but Japan more or less did it organically, since the end of the Second World War and its reconstruction.

One other innate cultural advantage is that Japanese people overwhelmingly prefer new construction. This leads to frequent rebuilding (30 to 40 years) even without government prompting, and shorter housing lifespans are accepted; quite different from our quibbling over 99-year leases, or obsession with freehold.

4. Germany’s super stable, pro-tenant housing policies

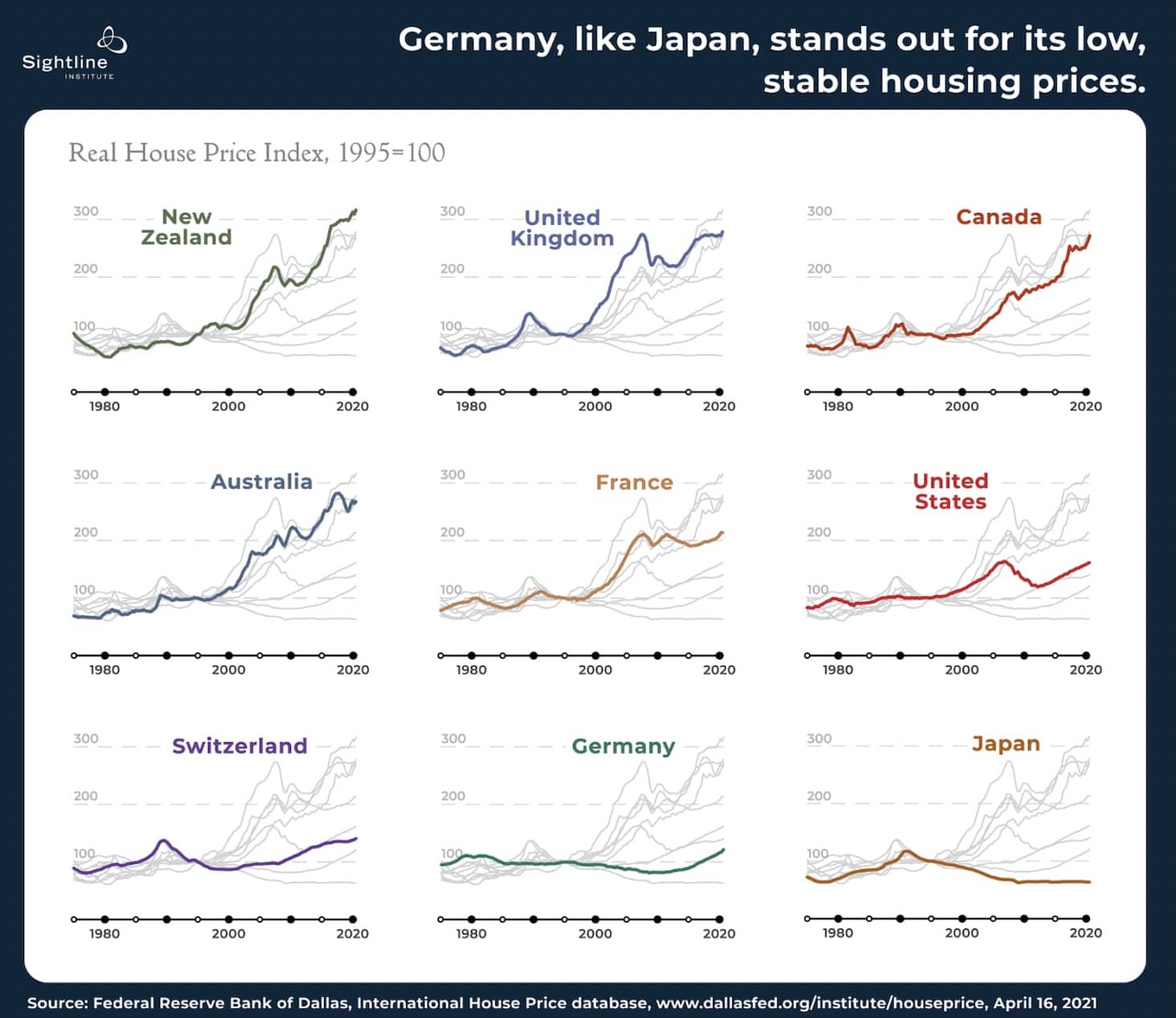

Its strong tenant protections aside, Germany’s housing stands out for its uncanny price stability; homes in the country have moved little more than 21 per cent since 1995. However, it must be said in recent years, the increase in financing costs and the challenging economic environment have led to a slowdown in price growth, and even some price declines, which were uncommon in the past. For instance, in 2023, the transaction volume dropped significantly, reflecting a cautious market environment.

But beyond its modest price and rent levels, Germany also stands out for the stability of its housing costs: they’re uncannily, freakishly stable. As illustrated in the figure below, residential prices in Germany have changed little in the last few decades, never varying by more than 21 per cent from their 1995 level. That’s quite impressive, given they also went through events like the Global Financial Crisis; they just lack the same kind of volatility seen in most markets elsewhere.

The country has housing cooperatives (Wohnungsbaugenossenschaft) which are non-profit entities. These are managed collectively, like a condo’s MCST in Singapore; the difference is they don’t necessarily need to own the property. Rather, a tenant applies to be a member and purchases a share in the cooperative (subject to eligibility set by the cooperative government).

Upon becoming a member, you’re entitled to occupy a unit run by the relevant cooperative. The rental is paid to the cooperative rather than to a specific landlord; and being non-profit, the rental is used to cover the maintenance, or reserved for future improvements. This is quite different from most tenant-landlord relationships, where the landlord benefits disproportionately.

The tenants have a host of protections not common to most countries. The rate of rental increase is restricted (Mietpreisbremse), in areas that are experiencing housing shortages; this is in addition to other rent control measures (usually, rent is capped at a certain amount relative to surrounding properties).

Rental periods can be indefinite, which makes renting for life much more possible; and low-income tenants can benefit from free legal assistance, from specialists in housing law. Tenants can even withhold rent on the basis of poor maintenance or repairs.

Troublesome for a landlord right? And that’s the secret sauce: because it’s much tougher to take on tenants, most people invest elsewhere. This has the dual effect of keeping housing prices stable, whilst also discouraging a rentier economy (because the capital flows into new businesses, for example, rather than being locked up in housing).

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is the Jeonse housing system in South Korea?

How does Finland’s Housing First programme help reduce homelessness?

What makes Japan’s housing approach unique and stable?

Why are Germany’s housing policies considered very stable for tenants?

Could South Korea’s housing system work in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

0 Comments