Can New Launches Raise the Prices of Older Condos Nearby?

August 30, 2020

It happens to every property owner at some point: you look out the window, and see that a massive crane is now obstructing your expensive/expansive view. Along with the drilling noises and dust, it slowly sinks in: the land plot next door is being taken by a newer, fancier condo.

Complain about this, and you might hear an old spiel: at least new condos are priced higher, so there’ll be a knock-on effect as older properties go up in price too. This is one of those things that’s commonly believed, but seldom looked at closely.

Out of curiosity, we decided to look at how the values of surrounding properties have moved, since a new launch appeared in the same area.

Will a new, higher priced launch also pull up overall prices of older units?

Some notes on our comparison

We will pick some of the popular new launches from 2017, instead of immediate new launches (this gives us some time to see how surrounding property prices responded).

We’ll then look at older developments within one kilometre of these new launches. We’ll examine how the prices of these older developments have moved between 2017 to the present, after the arrival of the new launch.

Because some of the older condos have transaction data going back to the 1990s, we’ll be drawing transactions from a year before the launch of Park Place Residences.

Caveat:

Note that in July 2018, new cooling measures were passed. This could depress the results for older condos, if their last recorded transaction after 2017 falls at around the same time.

Also, note that it’s impossible for this to be conclusive, as property price movements are subject to many variables (everything from poor condo management in older projects, to overall improvements in the wider neighbourhood).

As such, it’s not really possible to isolate a single factor, such as the effect of a new launch property nearby. However, we can see some correlations between the arrival of a new launch, and older property prices.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Comparison 1: Park Place Residences Vs Older Condos

Launch date: Mar. 2017

Address: Paya Lebar Road

Park Place Residences is an integrated development. This project adds office and retail space to the area, so it brings significantly more to surrounding residential properties than other points of comparison on this list.

Older condos within 1 km:

- Katong Regency (2015)

- Paya Lebar Residences (2003)

- Sims Residences (2002)

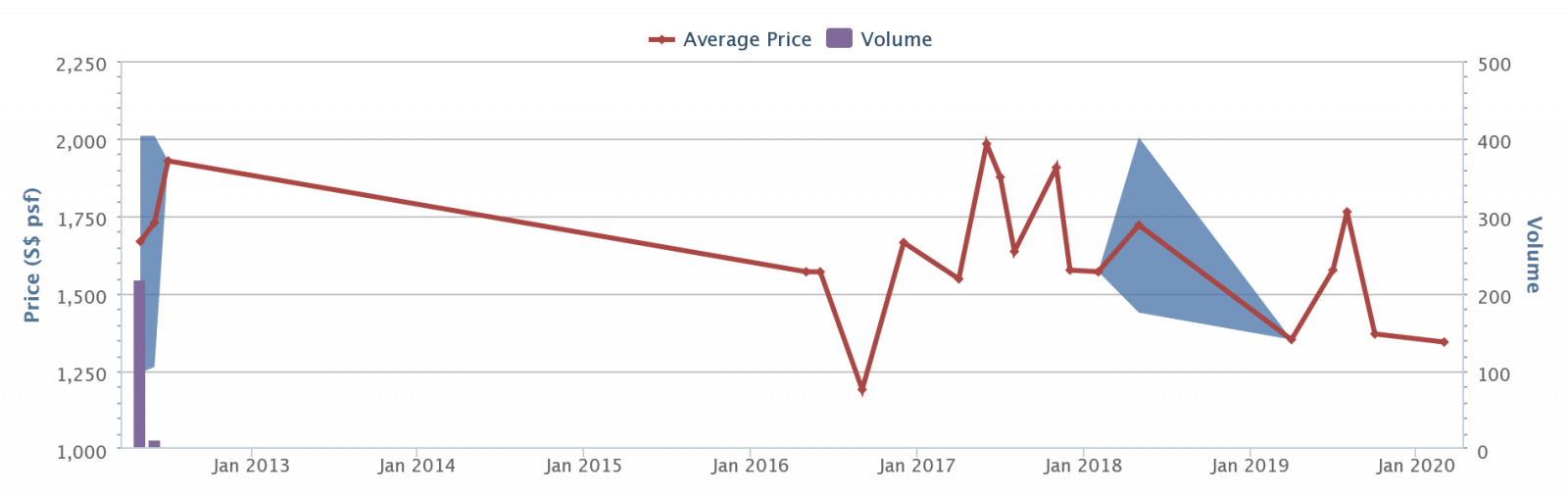

1. Katong Regency (2015)

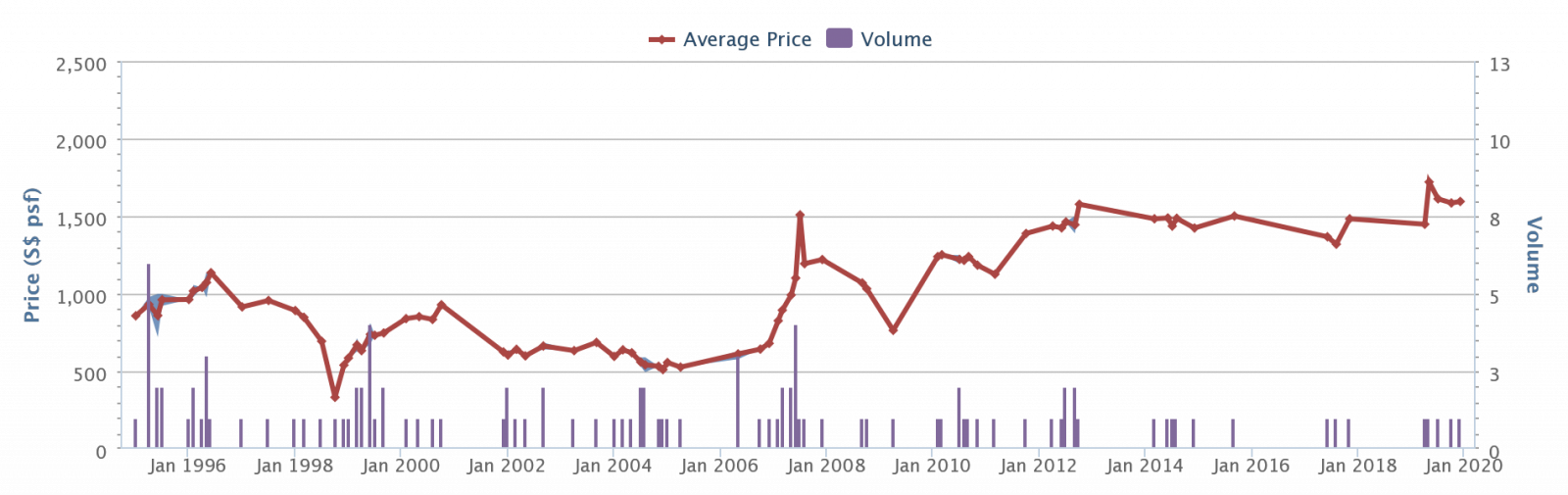

The last transaction at Katong Regency, before the launch of Park Place Residences, was in December 2016. This was at $1,665 psf. Average transactions so far before the launch of Park Place Residences was at $1,499 psf.

Since the launch of Park Place Residences, prices at Katong Regency have averaged $1,639 psf. This is an increase of about 9.33 per cent.

2. Paya Lebar Residences (2003)

(This condo is often confused with Park Place Residences due to the name)

The last transaction at Paya Lebar Residences before the launch of Park Place Residences was in December 2015 – this was at $1,016 psf. Average transactions so far before the launch of Park Place Residences was at $1,061.

Since the launch of Park Place Residences, prices at Paya Lebar Residences have averaged $1,229 psf. This is an increase of about 15.83 per cent.

3. Sims Residences (2002)

The last transaction at Sims Residences, before the launch of Park Place Residences, was in September 2016. This was at $534 psf. Average transactions so far before the launch of Park Place Residences was at $754 psf.

Since the launch of Park Place Residences, this has appreciated to an average of $808 psf.

This is an 7.16 per cent increase.

Comparison 2: Martin Modern Vs Older Condos

In 2017, Martin Modern was the first major residential launch in the prime Robertson Quay area in the past eight years. This makes it an especially good point of comparison for older surrounding condos.

Launch Date: Jul. 2017

Address: 8 Martin Place

Older condos within 1 km:

- Martin Place Residences (2011)

- Euro-Asia Court (1994)

- Oleanas Residence (1999)

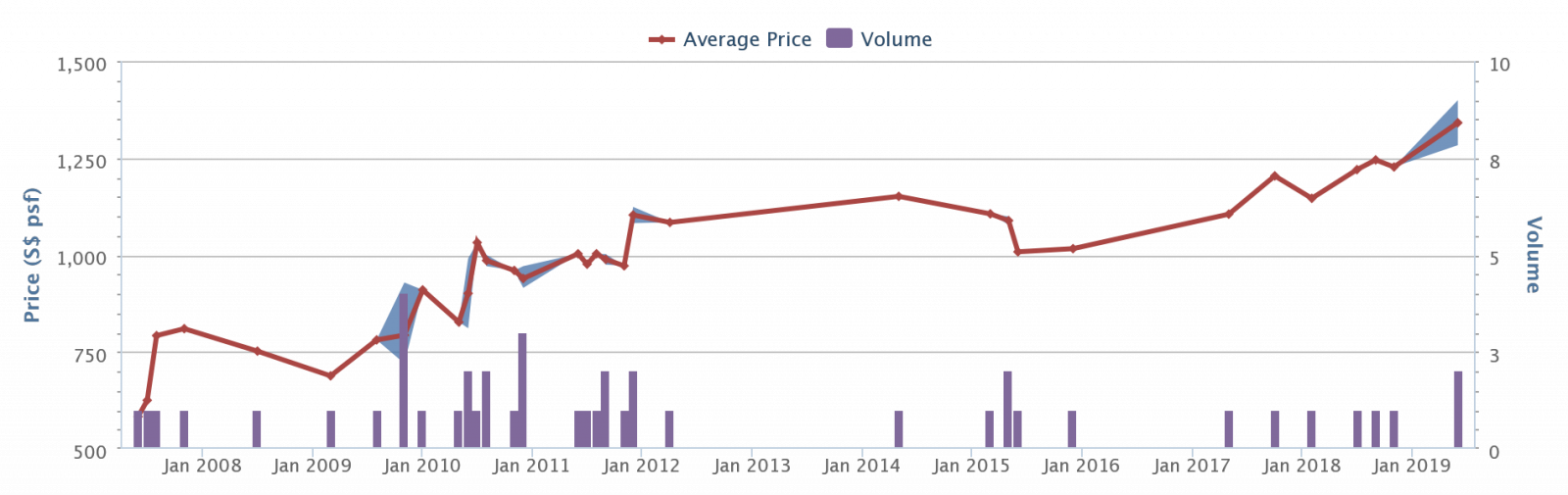

1. Martin Place Residences (2011)

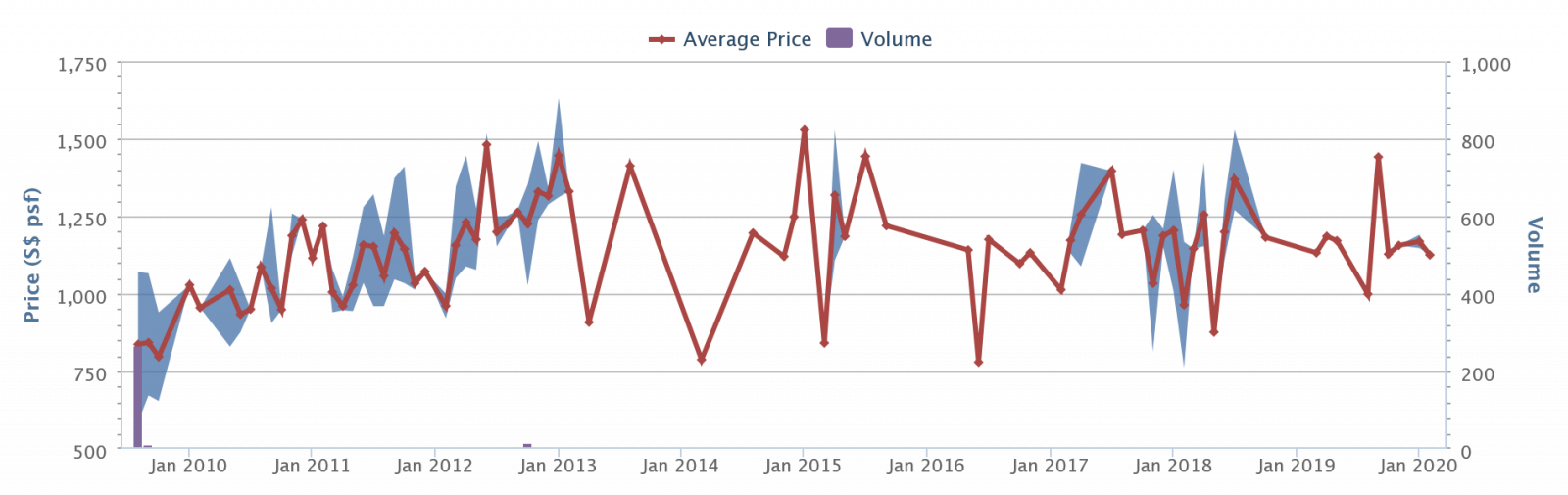

In Martin Place Residences, transactions just before the launch of Martin Modern (Jun. 2017) placed average prices at $2,001 psf. Following the launch of Martin Modern, prices here rose to $2,179 psf, an increase of 8.9 per cent.

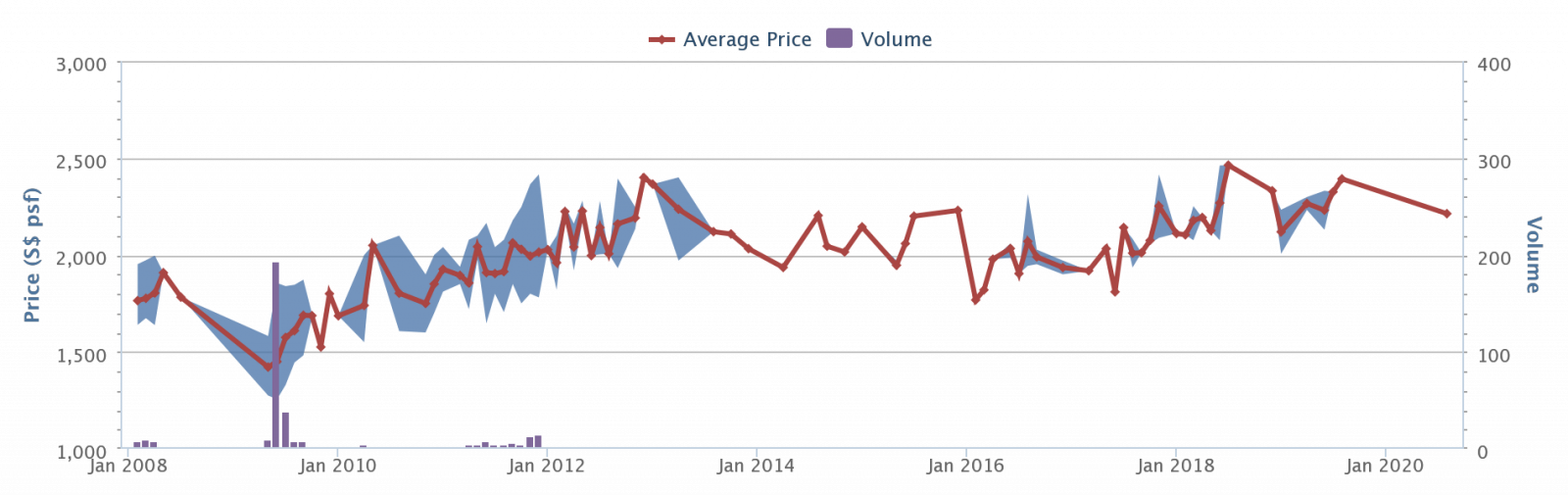

2. Euro-Asia Court (1994)

More from Stacked

High Park Residences vs Parc Botannia: A Data-Driven Look At Mega vs Mid-Sized Condo Performance

In this Stacked Pro breakdown:

At Euro-Asia Court, the last few transactions before the launch of Martin Modern was at an average of $1,462 psf. But following the launch of Martin Modern, average prices have risen to $1,516 psf, an increase of 3.69 per cent.

3. Oleanas Residence (1999)

Just prior to the launch of Martin Modern, the average price at Oleanas Residence was $1,511 psf. Since the launch, average prices here have risen to $1,550 psf, an increase of 2.58 per cent.

Property Market CommentaryNew Condos That Saw Prices Fall Soon After Completion: What Went Wrong?

by Ryan J. OngComparison 3: Grandeur Park Residences Vs Older Condos

Launch date: Feb. 2017

Address: New Upper Changi Road

Older condos within 1 km:

- Optima @ Tanah Merah (2012)

- The Tanamera (1994)

- Bedok Court (1985)

1. Optima @ Tanah Merah (2012)

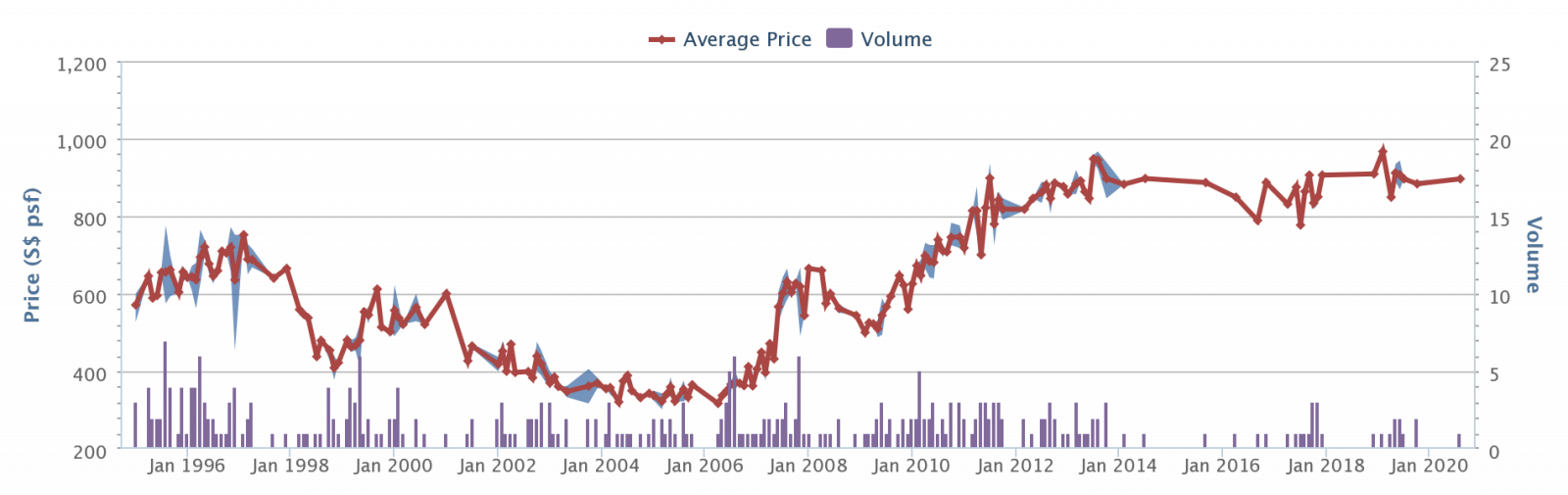

Just before the launch of Grandeur Park Residences, the average price at Optima @ Tanah Merah was $1,065 psf. After the new launch, prices edged up to $1,179 psf. This is an increase of 10.7 per cent.

2. The Tanamera (1994)

Transactions at The Tanamera averaged $842 psf, before the launch of Grandeur Park Residences. As of today, the average transaction price had edged down to $875 psf. This is a slight increase of around 3.9 per cent.

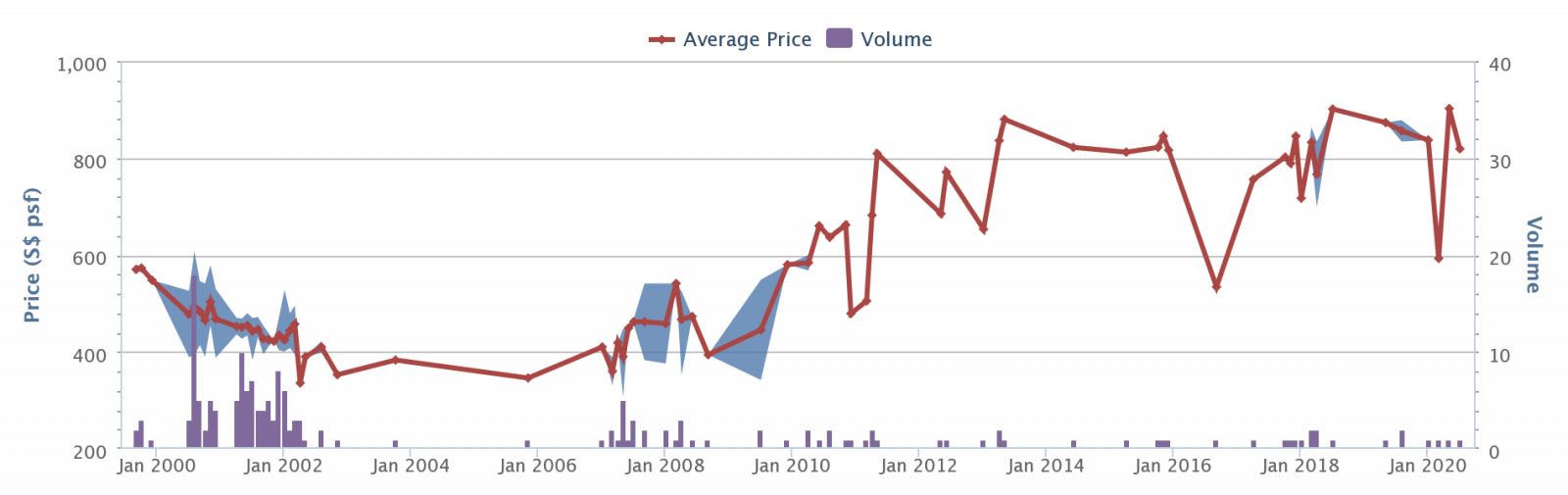

3. Bedok Court (1985)

Prices at Bedok Court averaged $655 psf before the new launch. After Grandeur Park Residences, prices now average $685 psf, a slight increase of about 4.58 per cent.

The nature of the new launch, and the existing supply, could play a significant role

With regard to Park Place Residences, we saw there was quite a significant jump in average transacted price at Sims Residence and Paya Lebar Residences. However, Park Place Residence – as we pointed out – is an integrated development, that brought a lot more to the table that higher new launch pricing; it brought shops and office space with it, which is not something that all new launches do.

With regard to Martin Modern, all three nearby condos that we compared to it showed price increases. However, we need to emphasise that Martin Modern was the first new launch to appear in the area in eight years; the area had a more limited supply of residential options at the time it was launched.

You could say that the launch of Martin Modern had an effect on Martin Place Residences, because the age gap is not that far away. Euro-Asia Court and Oleanas Residence at a more than 20 year gap for both – barely registered much of a price increase.

As for Grandeur Park Residences, well, the Tanah Merah area had a known oversupply issue even back in 2016. You can bet existing owners at the time were less than happy to hear about another new condo.

But you can see a similar story here, where a new launch could have an effect on a close by development that doesn’t have that big an age gap. Optima @ Tanah Merah registering a 10.7 per cent increase, as compared to the much older Bedok Court and The Tanamera, as both only clocked in a 3 – 4 per cent increase.

Overall, however, it’s remains hard to predict how a new launch within 1 km will affect your existing property.

This is likely to be one of those arguments that’s on par with freehold versus leasehold, or new versus resale. Whatever the general consensus, there’s bound to be thousands of exceptions, and many situations where we need to add “unless…”

For all practical purposes, landlords and investors shouldn’t focus too much on this abstraction. What’s important is to study the zoning in the Master Plan, and be wary of large residential plots near your condo.

If you’re considering buying an older condo, drop us a message on Facebook, and we can give you a heads-up on what’s to come. You can also check out our condo reviews on Stacked, to look for unique properties that will hold their value.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Do new condo launches usually increase the prices of nearby older condos?

How does the type of new condo development affect surrounding property prices?

Has the launch of Martin Modern in 2017 caused nearby older condos to increase in value?

What should property owners consider instead of just focusing on new launches affecting prices?

Is it possible to predict how a new condo launch will impact existing property prices?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Investment Insights This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Latest Posts

On The Market A Rare Pair Of Conserved Shophouses In Chinatown Just Hit The Market For $32.5M

Singapore Property News Some Units At This Freehold Riverfront Condo Could Lose Their Views — But Here’s How Prices Have Actually Moved

Property Market Commentary Singapore’s Tallest HDB Yet: A 60-Storey Project Is Coming To Pearl’s Hill

2 Comments

Hi Ryan, what if the new development is a HDB BTO? Will it have the same impact on surrounding condos? Thank you!