Additional Buyer’s Stamp Duty (ABSD): A Comprehensive Guide

June 24, 2020

Additional Buyer’s Stamp Duty (ABSD) is, without a doubt, one of the least liked terms in Singapore.

This disfavour for ABSD applies not just to Singaporeans (who certainly pay the least hefty ABSD amounts when they buy a residential property), but PRs and Foreigners as well.

Numerous changes have been made to Additional Buyer’s Stamp Duty rates over the years, with many growing to hate this form of stamp duty following every revision – the most recent of which raised rates even higher, making serious headlines.

But there are two sides to this coin…

For one, ABSD helps to deter ‘get-rich-quick’ house flippers, while also saving us from a terrifying reality – homes we can’t afford.

In this article, we break the ABSD topic down, making the concept simpler for you to understand.

We’ll first be exploring a brief history of the origins of ABSD, followed by how it actually works and impacts your transaction costs as a home seller (regardless of citizenship).

We then conclude with some tips on how you can potentially avoid paying ABSD, so it doesn’t add an exorbitant (and unwanted) cost to your transactions.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

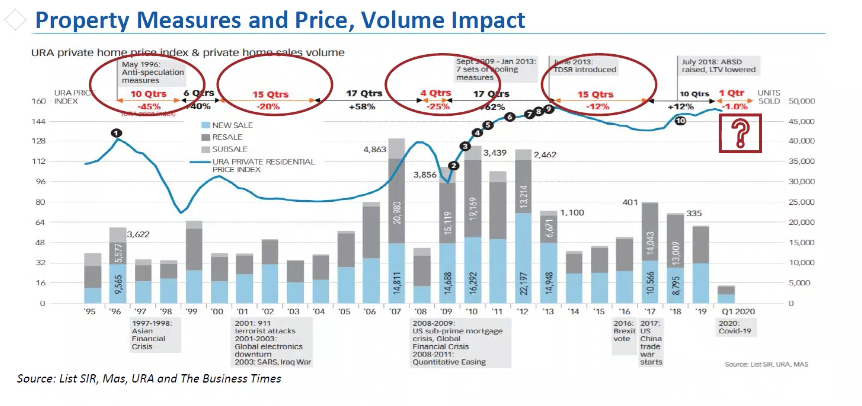

A Brief History on the Additional Buyer’s Stamp Duty

Covid-19 aside, I’m sure many of you will recall the two previous hits (huge hits) to Singapore’s economy – the ‘07/‘08 Global Financial Crisis, and the Singapore property market crash of ‘08/‘09.

As we know, in the years following both crises, the economy recovered, wages increased, crocodiles returned to the Singapore River – and yes, property prices skyrocketed.

You could pin that skyrocketing of prices partly on the increased numbers of investors, entities and foreigners investing in residential properties (multiple properties, at times), creating a higher demand in residential housing.

What did this result in?

Increased likelihood of property speculation (where buyers rush to purchase residential properties before a predicted spike in market prices, in the hopes of reselling them in the future for profits), and thus the looming threat of a housing bubble problem.

As a result of this, the government began introducing cooling measures from 2009 to soften the demand on residential housing – thus, ensuring a smooth and sustainable property market recovery, while keeping housing prices affordable for Singaporeans.

These measures have been revised continuously over the years, and include changes in loan-to-value (LTV) ratio requirements, Total Debt Service Ratio (TDSR), and of course, the infamous stamp duties – Seller Stamp Duty (SSD) and ABSD.

So, what exactly is the Additional Buyer’s Stamp Duty?

ABSD, the second form of stamp duty implemented after SSD (on which we have previously written a full breakdown), was effective as of 8th Dec 2011.

In essence, ABSD is a tax levied together with Buyer’s Stamp Duty (BSD) when you acquire a property in Singapore (we will go into the nitty-gritties in a bit).

The Additional Buyer’s Stamp Duty payable varies depending on your citizenship, and is calculated based on the selling price or valuation of your newly-acquired property (whichever is higher).

Here’s a sneak peek of how ABSD rates have changed over the years:

Introduction back in Dec 2011

ABSD tax computed as follows:

- 1% on the first $180,000

- 2% on the next $180,000

- 3% on the remainder

| Singapore Citizens | Permanent Residents | Foreigners | |

| Purchase of 1st property | NIL | NIL | 10% |

| Purchase of 2nd property | NIL | 3% | 10% |

| Purchase of 3rd & subsequent properties | 3% | 3% | 10% |

12th January 2013

| Singapore Citizens | Permanent Residents | Foreigners | Companies | |

| Purchase of 1st property | NIL | 5% | 15% | 15% |

| Purchase of 2nd property | 7% | 10% | 15% | 15% |

| Purchase of 3rd & subsequent properties | 10% | 10% | 15% | 15% |

6th July 2018 (Latest)

| Singapore Citizens | Permanent Residents | Foreigners | |

| Purchase of 1st property | NIL | 5% | 20% |

| Purchase of 2nd property | 12% | 15% | 20% |

| Purchase of 3rd & subsequent properties | 15% | 15% | 20% |

Not even entities (companies or associations) can escape from paying ABSD; the ABSD rate for them is 25% on a purchase of any residential property.

It’s worse if you’re a developer – you pay an additional 5% on top of that 25%!

Fortunately, these developers are subject to ABSD remissions if all built units on the acquired land are sold within 5 years of land purchase.

(All the more reason for developers to offer attractive discounts on their projects to sell off those units ASAP when markets/demand is down!)

Latest Updates on ABSD with respect to Covid-19

Covid-19 has brought an onslaught of drawbacks for the majority of Singapore’s population (not to mention the rest of the planet!!).

One of these drawbacks impact married home-buyers who have already invested in a second or subsequent home just before the implementation of Covid-19 circuit breakers – and as a result, find it increasingly harder to qualify for ABSD remission benefits due to low unit resale opportunities.

What do I mean by this?

When you buy a second property before selling your current home, you still have to pay the ABSD on that sale.

As long as you sell off your initial property within 6 months of buying the second, you can apply for a full ABSD refund. (or 6 months after the issue of the TOP date if the residential property was incomplete at the time of purchase – whichever is earlier)

Now Covid-19 didn’t exactly make things easier.

With the recent circuit-breaker, it hasn’t been easy to sell off a property considering how impossible it was to host/attend a property viewing.

That’s months of opportunity to sell wasted, with the impending ABSD deadlines drawing closer.

But good news!

Under the Temporary Relief Measures due to the pandemic, the deadline for applying for ABSD remission will be extended by 6 months, giving couples additional time to look for prospective buyers, close a deal, and still apply for ABSD refunds.

(Note that buyers looking for a second or subsequent home at this current point are unfortunately not covered by the temporary ABSD relief measures. To further clarify, you will qualify for this extension only if your second property was jointly purchased on/before 1st June this year, and if the original timeline for sale of your current home expired on/before 1st February this year.)

How does ABSD impact my transactions, you say?

I’ll keep this digestible.

Here’s a little continuation of our (very) hypothetical scenario from our SSD article, featuring James and Johnson.

Scenario 1:

On 1st August 2018, shortly after the July ‘18 changes to ABSD rates, James bought himself a 3-bedder condo unit for $2mil.

The unit’s valuation, however, was $2.1mil.

James is a Singaporean, and since his unit’s valuation was higher than its selling price, the higher value was used to calculate the ABSD payable.

Scenario 2:

Likewise, on 1st August 2018, Johnson also bought a 3-bedder unit in the same condo for $2mil.

Johnson’s unit was similarly valued at $2.1mil.

The higher value was also used to calculate the ABSD payable. But unlike James however, Johnson is a foreigner.

James does not have to pay any ABSD on his purchase, since he was not holding on to a second residential property prior to the transaction.

Johnson, on the other hand, is not so fortunate; Since he is a foreigner, his ABSD payable amounts to $420,000 ($2,100,000 x 20% ABSD rate = $420,000), regardless of whether or not he was holding on to any residential properties beforehand.

Both units were bought and were valued at the exact same prices respectively, and yet, James didn’t have to pay a cent since he was a Singaporean.

This little comparison briefly illustrates how hefty the costs of ABSD can be on your transactions, simply because of your citizenship.

How do you pay ABSD?

ABSD payments, unfortunately, have to be paid in full and not in instalments.

If you are expected to pay ABSD anytime soon, here are some pointers that may help facilitate the process.

How

- IRAS e-stamping portal

Methods of payment via the portal include eNETS, cheque or cashier’s order.

- CPF (Ordinary Account)

Yep, your CPF savings can also be used to make any stamp duty payments when you buy a property!

There’s a slight twist to this, though – you first need to use your own cash for the payment, then apply for reimbursement from your CPF account.

- IRAS e-Terminals

These e-Terminals are located at the Taxpayer & Business Service Centre (In the Main Lobby on the 1st floor of Revenue House).

- Specific Singpost branches (Service Bureaus)

Novena, Raffles Place, Shenton Way and Chinatown Post Offices are the only branches that offer stamping services, although they charge service fees between $10 to $35.

On a side note, don’t forget to complete the requisition form if you plan to head down to any of these branches.

When

Like all other taxes, ABSD must be paid within a specific timeframe. The deadline for all stamp duty payments are as follows:

- Within 14 days of purchasing the residential property and signing of the purchase agreement document

- If the document was signed overseas, payment must be made within 30 days after the document is received in Singapore

A word of wisdom – never miss stamp duty payment deadlines, or you will have to pay a penalty!

For delays in payment not exceeding 3 months, the penalty is either $10, or an amount equalling the ABSD payable (whichever is the higher value).

For delays in payment exceeding 3 months, the penalty is a tad more painful – either $25, or an amount 4 times the ABSD payable! (Also depending on which value is higher)

Bonus Tip: Stamp Duty Calculators

In case you want to be sure of how much ABSD you have to pay before buying a residential property, stamp duty calculators are available on the IRAS website to help you out!

So How do I avoid ABSD?

Here comes the juiciest part.

ABSD might be far more taxing (literally) on PRs and foreigners than it is on Singaporeans, but there are some ways to avoid it completely.

Here’s a look at our top tips for that, broken down into bite-sized (and hopefully digestible) pointers:

Tax remissions are always a welcome sight for those in Singapore (and anywhere else), especially with costs of living on the rise year after year. Here are a few forms of ABSD Remissions:

- Remission for Married Couples

If you’ve recently tied the knot (or planning to) and would like to move into a new house, this is for you – you are entitled to an ABSD refund if you move as a married couple.

This applies as long as you sell your old residential property within 6 months of buying the second residential property (not taking into account the temporary Covid-19 relief measures).

Side note – This also applies to couples with at least 1 Singapore Citizen.

More details on this particular benefit can be found on the IRAS website here.

- Matrimonial Proceedings

If an Order of Court (judicial separation, nullity of marriage, etc) requires you to sell your residential property to your spouse or either of your children, rest assured that the purchase will be conducted ABSD-free.

- Eligible foreigners (ONLY private residential property)

This one is interesting – under the respective Free Trade Agreements, citizens or PRs of these countries will be entitled to the same ABSD benefits/treatment as Singapore Citizens:

- Iceland

- Liechtenstein

- Norway

- Switzerland

- United States of America (Citizens only, not PRs)

Property Market CommentaryABSD remission in Singapore – Everything you need to know

by Druce TeoMarried? Plans to move? Sell off your current property

Selling off your current property before buying a new one guarantees you an exemption from paying ABSD (if you’re Singaporean).

However, there is a possibility that you may experience problems looking for buyers, especially if you are a married couple who applied for a 1-year extension;

If you pass that deadline, you will no longer be able to apply for ABSD remission.

That being said, although none of the following tips is guaranteed, here are a few that could help with the selling of that property if you’re a married couple rushing to meet the deadline:

- If there are prospective buyers, identify their issues

This is especially important if you have prospective buyers who seem slow to close (most of the time, it’s due to financing issues).

You can seem genuine to close a sale by requesting a note from the buyers, or proactively reach out to independent mortgage brokers to see if any of them can assist your buyer.

This is also useful if you’re writing an appeal letter to IRAS (which we’ll talk about in a moment).

- Re-evaluate your asking price

If your asking price is above the bank’s valuation, there’s a chance your buyers will be aware too.

As you re-evaluate your asking price, consult your property agent (if you have one) about a more realistic asking price given the time frame.

Worst case scenario – if you’re too close to missing the ABSD remission deadline, you have to accept a lower price to cut losses (still beats losing more by not applying for ABSD remission)

- Consider a property auction

“But property auctions are for bankrupts…”

Quite the contrary, that hasn’t been true for a long time.

Property auctions give you a chance to hear several offers at once – it’s much faster for you to identify a realistic price point, and who knows, you may just get a signature in a few hours!

That said, it is also wise to approach a property firm directly if you plan to set up an auction.

- Provide extra incentives to a property professional

Using multiple agents to sell your property?

Consider putting a stop to that and leave the job to one dedicated agent who will have your residential property as their main concern, with a promise of stronger incentives should the agent close a deal by the deadline (if you’re willing to offer it).

- Write an appeal to IRAS

No guarantees that this will work, but the IRAS is fairly reasonable as tax bodies go.

If you can prove that you’re actively making efforts to close a deal (e.g showing the Option to Purchase has been signed), IRAS may just grant you an extension on the ABSD remission deadline.

An added boost would be the help of your conveyance firm – they may be able to assist you in writing that letter to IRAS.

(By the way, if you would like more details on these 5 pointers, check out our previous article where we first featured them!)

Unfortunately for all the singles out there, this ingenious method also applies only if you’re a married couple.

Simply put, de-coupling means removing one spouse from the ownership of the residential property, by buying over your partner’s share of the property.

The transfer of ownership will be done through a traditional Sales and Purchase agreement, which will have to be stamped.

In doing so, you free up one name to purchase another residential property (which will be considered that partner’s 1st property) – if that partner is Singaporean, ABSD is completely avoided.

Your spouse holding the initial property, though, will have to deal with the Buyer’s Stamp Duty (BSD) and all the necessary legal fees, but it’s still far less expensive compared to ABSD.

Final Words

At the end of the day, ABSD still adds unwanted, jaw-dropping amounts to your overall cost when you purchase a property.

The amount you are subject to pay also heavily depends on how many residential properties you already have, and your citizenship;

An extra sum that could have been set aside for any of your other endeavours when it was needed.

That said, as our previous tips have hinted, ABSD is not entirely unavoidable.

It just comes down to your current personal circumstances, and how much of your funds you are willing to fork out for tax payments in your property journey.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Reuben Dhanaraj

Reuben is a digital nomad gone rogue. An avid traveler, photographer and public speaker, he now resides in Singapore where he has since found a new passion in generating creative and enriching content for Stacked. Outside of work, you’ll find him either relaxing in nature or retreated to his cozy man-cave in quiet contemplation.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Latest Posts

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

4 Comments

ABSD has its uses – and it’s definitely not possible to avoid it for most people which is why it’s still so effective till today.

Not sure if this was asked before. Scenario, mum owns 3 properties and son none. Mum wants to get a fourth private property with son( his first property ) under tenancy in common. Mum holds 1% and Son holds 99%. What would be the ABSD on mum and son for this property?