Biggest Winners And Losers Of The New Property Cooling Measures: Which Side Are You On?

December 22, 2021

The much-anticipated property cooling measures have struck, as of 16th December 2021. As the smoke clears, it’s become apparent who comes out on top of this; and who ends up having to uh, “review” their real estate plans for the year. Here’s hoping that this Christmas season, you end up at the top of the pile:

Winners of the new property cooling measures

- Buyers’ side of the property market (especially first-time buyers)

- Property owners who can decouple

- Singaporean buyers were eyeing prime or luxury properties

- Small developments looking for an en-bloc sale

- Developers with current dual-key offerings

1. Buyers’ side of the property market in general (especially first-time buyers)

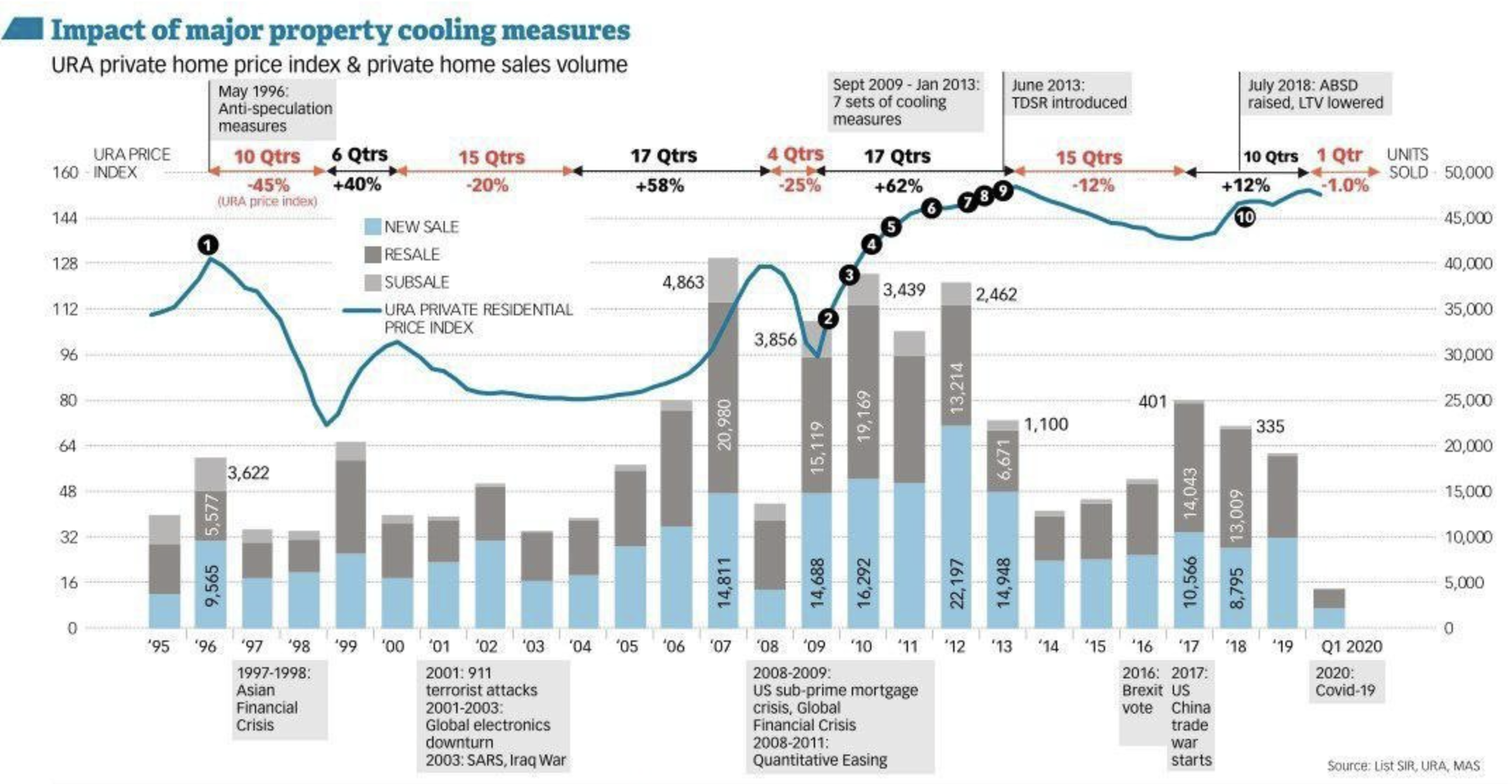

The main benefit falls on those who are just about to buy. Historically, we’ve seen there’s a knee-jerk reaction to cooling measures, at least in the short term.

In 2013, for example, prices fell across the board, right up till around two years later:

This isn’t to say we’ll see an exact repeat of 2013, as the changes this time around are not as drastic (Work From Home necessities, a slew of HDB upgraders, and low-interest rates maintain almost unflagging demand).

Property Market CommentarySingapore Cooling Measures – History of cooling measures since 2009

by Stanley GohEven though some buyers will switch to a wait-and-see mode, we don’t think prices are likely to fall; but it could at least arrest the upward momentum of condos, HDB flats, and landed homes all at one go.

This could alleviate one of the most common tensions among buyers: the fear that if you don’t rush to buy right now, you could be priced out of the market in a year or two.

The higher Additional Buyers Stamp Duty (ABSD) on second and third properties also helps home buyers, albeit indirectly. Investors will find property assets less palatable with these taxes; so genuine home buyers won’t be competing against them for homes (a competition that pure home buyers tend to lose, because investors often have deeper pockets).

First-time buyers, in particular, have the most to gain from all this: most of the cooling measures have little to no effect on them while putting a slight brake on rising prices.

2. Property owners who can decouple

Decoupling is when you transfer your share of the home to another co-owner, and then buy another property under your own name.

Once you’ve transferred your existing home, the next property you buy is technically your “first” home. As such, you wouldn’t have to pay the ABSD; and the higher tax is irrelevant to you.

Note that only private property owners can do this (see below).

Homeowners who previously used tenancy-in-common (e.g., one spouse owns 99 per cent while the other owns one per cent), rather than a joint tenancy, are probably celebrating that decision.

3. Singaporean buyers were eyeing prime or luxury properties

Prior to the cooling measures, we were expecting the return of foreign investors; this would have meant a pick-up in Core Central Region (CCR) condo prices, which sees more affluent foreign buyers.

In fact, it was the return of foreign investors – particularly those seeking safe-haven assets during Covid-19 – that drove luxury home purchases to a 10-year high in 2021.

Outside of foreigners, affluent Singaporeans also dove headfirst into the property market. The main property of choice for them was freehold landed homes, which similarly climbed to 10-year highs.

Now, however, cooling measures impose a flat 30 per cent tax on foreign buyers (an additional 10 per cent, which is a big jump). Even among locals, the prospect of buying a second or third property for rental has become less palatable, with ABSD rates reaching 17 per cent for the second property, and a whopping 25 per cent for the third home.

This is likely to dissuade the landlords who seek out shoebox or two-bedder units in the CCR, in the hopes of renting to affluent foreign tenants.

All in, this means the luxury segment has lost more prospective buyers than mass market homes. This could take the proverbial wind out of the luxury market’s sails, and provide reasonable buys for locals seeking higher-end homes.

Some developers have already made their move, with the newly launched Perfect Ten opting for a 5 per cent discount instead of delaying their launch. Other similar developments such as The Avenir, and The Landmark have likewise followed suit with certain star buys of their own.

4. Small developments looking for an en-bloc sale

With developers now facing a 35 per cent ABSD (plus five per cent non-remissible), property development just became a dicey proposition.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

Serenity Park, a freehold condominium on Tamarind Road, has been launched for collective sale at an asking price around $505…

The ABSD deadline is set at five years, regardless of the development’s size; and some 40 per cent of the land price is a steep cost to swallow. This makes larger plots even more unpalatable: not only do developers have to cough up more capital, but they also have to be confident enough to complete and sell, say, a 1,000+ unit condo during Covid-19.

(Covid-19 already makes construction costs more volatile for developers)

However, if you look at the en-bloc sales from 2017, you will see many of them are already redeveloped and sold. This leaves many developers still seeking to replenish their land banks.

For these reasons, smaller developments have a better shot of getting an en-bloc deal going forward, while their larger counterparts will probably be shelved for later.

5. Developers with current dual-key offerings

We expect an uptick in interest for dual-key condo units. These are units that are separated into two sub-units, each with its own kitchen, bathrooms, etc.

A dual-key unit makes it possible to live with an extended family, such as your parents, and maintain privacy; or to live in one sub-unit while collecting rental from the other.

The advantage here is that, even though you sort of own two units, it’s still technically a single home. You don’t have to pay the 17 per cent ABSD on a separate unit.

Losers of the new cooling measures

- Buyers who want to keep their flats

- Foreign buyers

- Property developers

1. Buyers who want to keep their flats

If you’ve waited out your five-year Minimum Occupancy Period (MOP), you can keep your flat while investing in a private property. However, you’re subject to the ABSD.

This may have been more tolerable prior to new cooling measures when ABSD rates for Singaporeans’ second properties were just 12 per cent. A five per cent increase is a significant hike (e.g., the typical new launch mass-market condo is around $1.6 million, making a difference of around $80,000).

Those who were on the verge of doing this will probably have to pull back and reconsider. Rather painful, if they’ve been saving up and waiting at least five years to meet their goals.

On top of this, owners of HDB flats cannot decouple, except under special conditions (e.g., divorce). This has long been a disadvantage of HDB versus private properties and intensifying the ABSD really drives it home.

2. Foreign buyers

This doesn’t take much explanation – they have to fork out 30 per cent more for any residential property they buy.

3. Property developers

Property developers already work on thin margins. A higher ABSD, at a time when land is already scarce, threatens to make many projects an unsustainable venture. It could also mean fewer discounts from developers going forward, or higher prices if developers pass down the costs. Realistically, it may also result in cost-cutting measures in the upcoming launches – less immersive show flats, a possible downgrade in materials used, and cheaper brands in terms of white goods.

This higher ABSD cooling measure also has the side effect of disadvantaging owners of large, older properties, such as former HUDC estates – developers that are too hard-pressed aren’t in a position to buy these large plots, leaving their current owners void of en-bloc prospects.

We do wonder if anyone would be keen to take on Golden Mile’s redevelopment now, given its significant site area.

A potential hidden winner in all this is commercial real estate

With sky-high ABSD and tighter loan curbs in residential, some investors may start looking at commercial properties instead. These have no ABSD, and property loans are at record lows.

However, the viability of commercial real estate is threatened by Covid-19. It’s uncertain, for instance, how well offices can fare with Work From Home becoming a new norm; and whether retail or F&B tenants won’t quit and leave vacancies.

Nonetheless, we do expect some residential investors to cast their net wider, and at least consider commercial real estate at this point.

For more on the situation as it develops, follow us on Stacked. We’ll also provide you with the most in-depth reviews, of new and resale condos alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Who benefits most from the new property cooling measures?

How do the cooling measures affect foreign property buyers?

What impact do the new cooling rules have on property developers?

Are there any groups that are negatively impacted by the cooling measures?

Could the new measures lead investors to consider commercial real estate?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Property Advice Should I Pay $500K More For A New Launch — Or Buy A Resale Condo Instead?

Singapore Property News A Rare Freehold CBD Office Unit Is Up For Sale At $20.5M — And Foreigners Can Buy It

Pro This Popular 520-Unit Condo Sold 85% At Launch — Here’s What Happened To Prices After

0 Comments