2B2B Vs 2B1B New Launch Condo Units: Which Is A Better Investment?

February 22, 2023

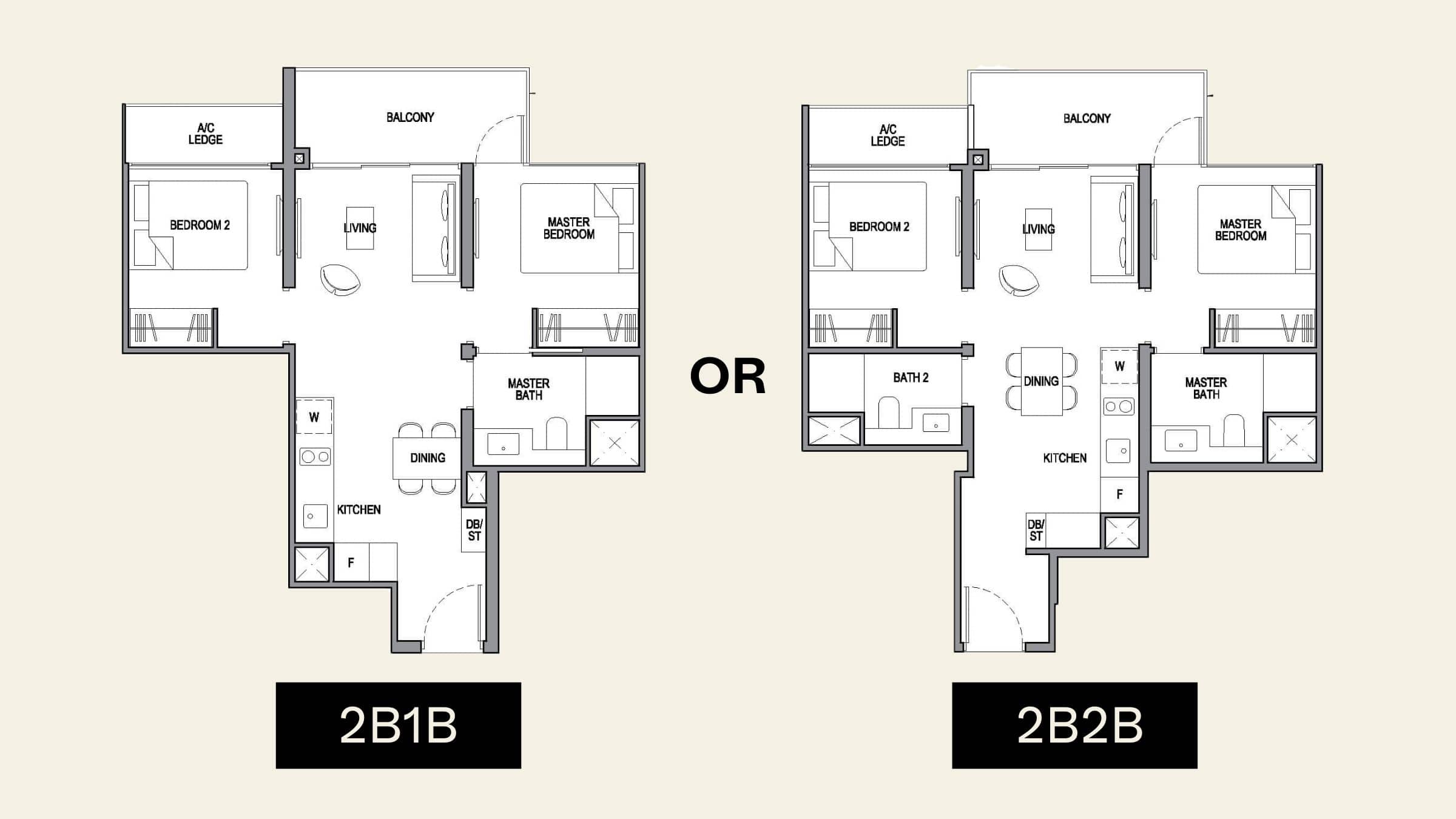

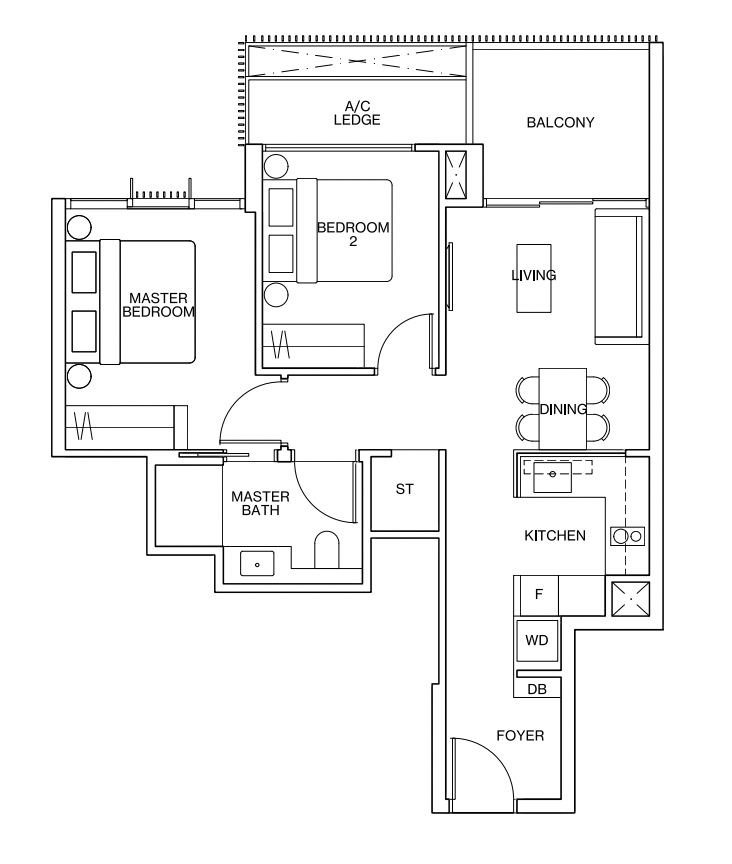

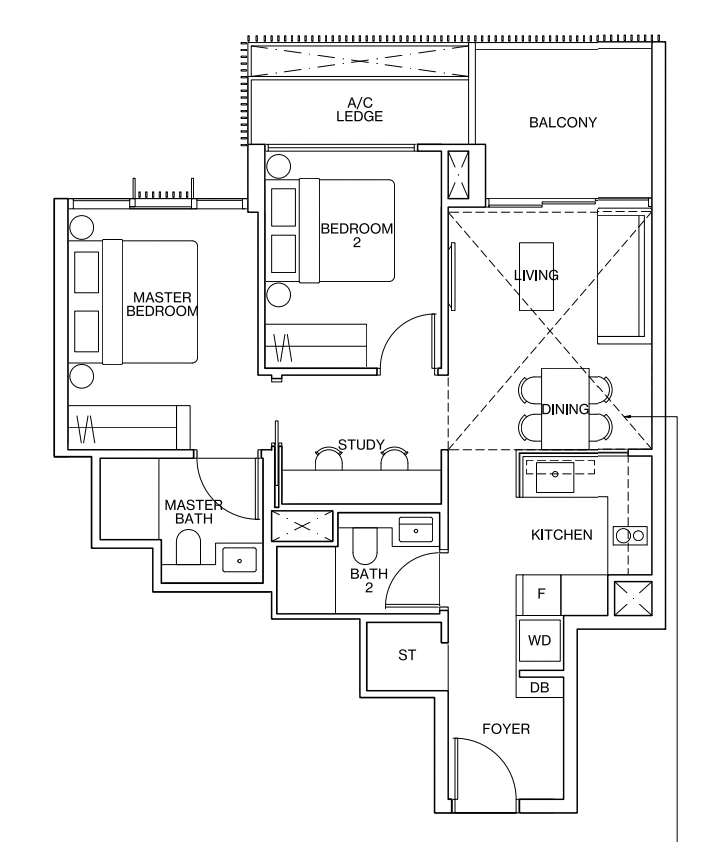

When it comes to a 2-bedder condo layout for investment, there is one vital question: one bathroom or two? Conventional “property wisdom” holds that two bathrooms are always the preferable choice; and like a high ceiling or sea view, it’s a feature that will pay for itself.

However, given the typically lower prices that you can buy a 2 bed 1 bath unit for, is this really true?

So this week, we looked at some two-bedders from various projects and tried to determine if purchasing a 2 bathroom layout or a 1 bathroom layout is generally more profitable from a capital appreciation standpoint.

But first, here’s a look at the average prices of 2-bedders with 1 and 2 bathrooms across recent new launch projects.

Do note that the dataset here is not exhaustive due to the number of projects with such layouts. We’ve also taken recent projects as these are the data we have readily available to us.

Table Of Contents

- Price differences between 1 and 2 bathrooms:

- Is a 2-bathroom or 1-bathroom layout better for capital gains?

- What if we looked at the premium gap between 1 and 2-bathroom layouts within projects?

- Beyond the data, there are some qualitative factors to note

- As a final consideration, realtors agreed that it’s generally easier to sell a two-bathroom unit.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Price differences between 1 and 2 bathrooms:

| 2BR 1BA | 2BR 2BA | Difference | |||||

| Projects | Average Price | Average $PSF | Average Price | Average $PSF | Quantum Difference | $PSF Difference | |

| KI RESIDENCES AT BROOKVALE | $1,436,700 | $2,053 | $1,374,419 | $1,809 | -4.3% | -11.9% | |

| UPTOWN @ FARRER | $1,063,980 | $2,038 | $1,051,296 | $1,953 | -1.2% | -4.2% | |

| PARC CLEMATIS | $1,176,456 | $1,688 | $1,175,991 | $1,630 | 0.0% | -3.5% | |

| THE FLORENCE RESIDENCES | $1,050,461 | $1,636 | $1,077,639 | $1,550 | 2.6% | -5.2% | |

| URBAN TREASURES | $1,294,746 | $1,968 | $1,348,903 | $1,842 | 4.2% | -6.4% | |

| AMBER PARK | $1,715,445 | $2,530 | $1,791,414 | $2,464 | 4.4% | -2.6% | |

| AVENUE SOUTH RESIDENCE | $1,428,720 | $2,125 | $1,516,691 | $2,117 | 6.2% | -0.4% | |

| KOPAR AT NEWTON | $1,540,275 | $2,510 | $1,641,167 | $2,382 | 6.6% | -5.1% | |

| THE JOVELL | $899,741 | $1,366 | $963,139 | $1,336 | 7.0% | -2.2% | |

| PASIR RIS 8 | $1,187,114 | $1,665 | $1,284,721 | $1,645 | 8.2% | -1.2% | |

| BARTLEY VUE | $1,312,455 | $1,999 | $1,424,090 | $1,946 | 8.5% | -2.7% | |

| SKY EDEN@BEDOK | $1,420,313 | $2,129 | $1,546,333 | $2,161 | 8.9% | 1.5% | |

| DAINTREE RESIDENCE | $1,121,262 | $1,736 | $1,228,456 | $1,679 | 9.6% | -3.3% | |

| LENTOR MODERN | $1,468,620 | $2,166 | $1,617,540 | $2,210 | 10.1% | 2.0% | |

| ROYALGREEN | $1,800,287 | $2,754 | $1,985,569 | $2,739 | 10.3% | -0.6% | |

| IRWELL HILL RESIDENCES | $1,635,263 | $2,665 | $1,808,113 | $2,709 | 10.6% | 1.6% | |

| MIDTOWN MODERN | $1,702,396 | $2,743 | $1,889,011 | $2,619 | 11.0% | -4.5% | |

| AMO RESIDENCE | $1,421,739 | $2,150 | $1,579,163 | $2,126 | 11.1% | -1.1% | |

| PARK COLONIAL | $1,159,711 | $1,821 | $1,299,675 | $1,894 | 12.1% | 4.0% | |

| THE TAPESTRY | $872,915 | $1,427 | $980,514 | $1,392 | 12.3% | -2.4% | |

| STIRLING RESIDENCES | $1,189,134 | $1,840 | $1,338,703 | $1,894 | 12.6% | 2.9% | |

| FOURTH AVENUE RESIDENCES | $1,507,303 | $2,347 | $1,707,518 | $2,425 | 13.3% | 3.3% | |

| GRANGE 1866 | $1,928,000 | $2,714 | $2,185,056 | $2,771 | 13.3% | 2.1% | |

| THE WATERGARDENS AT CANBERRA | $1,001,338 | $1,494 | $1,136,302 | $1,454 | 13.5% | -2.7% | |

| MIDWOOD | $1,070,493 | $1,686 | $1,217,988 | $1,689 | 13.8% | 0.2% | |

| RIVERFRONT RESIDENCES | $830,925 | $1,346 | $948,178 | $1,300 | 14.1% | -3.4% | |

| ONE PEARL BANK | $1,712,271 | $2,447 | $1,955,754 | $2,377 | 14.2% | -2.9% | |

| CLAVON | $1,107,800 | $1,634 | $1,269,921 | $1,662 | 14.6% | 1.7% | |

| VERTICUS | $1,367,029 | $2,084 | $1,568,455 | $2,116 | 14.7% | 1.5% | |

| DUNEARN 386 | $1,398,000 | $2,498 | $1,607,637 | $2,469 | 15.0% | -1.2% | |

| LEEDON GREEN | $1,705,228 | $2,716 | $1,970,234 | $2,676 | 15.5% | -1.5% | |

| TREASURE AT TAMPINES | $824,011 | $1,405 | $952,556 | $1,419 | 15.6% | 1.0% | |

| NYON | $1,653,417 | $2,293 | $1,911,766 | $2,250 | 15.6% | -1.9% | |

| THE LINQ @ BEAUTY WORLD | $1,279,767 | $2,204 | $1,485,133 | $2,225 | 16.0% | 1.0% | |

| HYLL ON HOLLAND | $1,512,956 | $2,548 | $1,760,838 | $2,552 | 16.4% | 0.2% | |

| AFFINITY AT SERANGOON | $993,360 | $1,589 | $1,157,618 | $1,562 | 16.5% | -1.7% | |

| ONE BERNAM | $1,705,514 | $2,387 | $1,988,718 | $2,400 | 16.6% | 0.5% | |

| 8 HULLET | $2,268,852 | $3,427 | $2,682,927 | $3,368 | 18.3% | -1.7% | |

| JUNIPER HILL | $1,687,071 | $2,806 | $1,995,700 | $2,865 | 18.3% | 2.1% | |

| THE COMMODORE | $970,240 | $1,554 | $1,149,033 | $1,525 | 18.4% | -1.9% | |

| SENGKANG GRAND RESIDENCES | $1,108,605 | $1,734 | $1,313,995 | $1,725 | 18.5% | -0.5% | |

| PARC KOMO | $960,350 | $1,511 | $1,147,754 | $1,558 | 19.5% | 3.1% | |

| PARC ESTA | $1,099,055 | $1,741 | $1,314,548 | $1,699 | 19.6% | -2.4% | |

| JADESCAPE | $1,109,794 | $1,718 | $1,328,882 | $1,735 | 19.7% | 1.0% | |

| FYVE DERBYSHIRE | $1,444,749 | $2,448 | $1,733,168 | $2,398 | 20.0% | -2.0% | |

| DAIRY FARM RESIDENCES | $1,003,226 | $1,587 | $1,214,606 | $1,678 | 21.1% | 5.7% | |

| 35 GILSTEAD | $1,462,800 | $2,645 | $1,772,234 | $2,533 | 21.2% | -4.2% | |

| THE M | $1,514,607 | $2,462 | $1,840,024 | $2,475 | 21.5% | 0.5% | |

| PETIT JERVOIS | $2,335,000 | $2,698 | $2,838,146 | $2,826 | 21.5% | 4.7% | |

| LIV @ MB | $1,626,914 | $2,444 | $1,990,053 | $2,433 | 22.3% | -0.4% | |

| MAYFAIR MODERN | $1,309,400 | $2,098 | $1,606,649 | $2,084 | 22.7% | -0.6% | |

| VERDALE | $1,075,024 | $1,752 | $1,321,205 | $1,802 | 22.9% | 2.8% | |

| KENT RIDGE HILL RESIDENCES | $1,145,697 | $1,724 | $1,409,880 | $1,779 | 23.1% | 3.2% | |

| ONE HOLLAND VILLAGE RESIDENCES | $1,812,127 | $2,624 | $2,244,610 | $2,664 | 23.9% | 1.5% | |

| WHISTLER GRAND | $906,475 | $1,472 | $1,123,949 | $1,466 | 24.0% | -0.4% | |

| RV ALTITUDE | $1,330,900 | $3,016 | $1,654,800 | $2,707 | 24.3% | -10.2% | |

| THE WOODLEIGH RESIDENCES | $1,086,431 | $1,873 | $1,361,103 | $1,962 | 25.3% | 4.7% | |

| VAN HOLLAND | $2,018,639 | $2,964 | $2,530,702 | $2,994 | 25.4% | 1.0% | |

| VIEW AT KISMIS | $902,667 | $1,747 | $1,135,954 | $1,724 | 25.8% | -1.3% | |

| PENROSE | $976,565 | $1,512 | $1,254,890 | $1,701 | 28.5% | 12.5% | |

| FORETT AT BUKIT TIMAH | $1,169,574 | $2,019 | $1,506,380 | $2,030 | 28.8% | 0.5% | |

| PHOENIX RESIDENCES | $912,598 | $1,514 | $1,197,910 | $1,601 | 31.3% | 5.7% | |

| THE HYDE | $1,950,498 | $2,822 | $2,578,087 | $2,993 | 32.2% | 6.0% | |

| 3 CUSCADEN | $1,747,151 | $4,162 | $2,749,602 | $3,668 | 57.4% | -11.9% | |

| ATLASSIA | $1,305,840 | $2,128 | $2,408,757 | $1,905 | 84.5% | -10.5% | |

More from Stacked

Why Rivergate Outperformed Its District 9 Rivals—Despite Being Nearly 20 Years Old

In this Stacked Pro breakdown:

Projects with only either a 1-bathroom or 2-bathroom layout were excluded as there is no basis for comparison.

It goes without saying that 2-bedders with 1 bathroom cost less than those with 2 bathrooms. However, projects such as Ki Residences registered, on average, higher prices for their 1 bathroom layout.

The reason is simply due to timing – transactions at Ki Residences for the 1 bathroom layout happened mostly in 2022, whereas 2 bathroom layouts transacted in 2020 and 2021. Most of the 1 bathroom units were also situated in 1 stack. This happens sometimes as 2 bed 1 bath units will typically be seen as a more popular layout, and would be the first to go.

Now that we’ve seen the price difference between both types of layouts, how different are they when it comes to capital appreciation?

Is a 2-bathroom or 1-bathroom layout better for capital gains?

Based on the above projects, there were a total of 225 buy/sell transactions. From there, we singled out projects that had fewer than 10 units changing hands.

We were then left with 184 units changing hands in the following projects:

| Projects | Volume |

| JADESCAPE | 13 |

| THE TAPESTRY | 16 |

| PARK COLONIAL | 21 |

| WHISTLER GRAND | 22 |

| PARC ESTA | 26 |

| RIVERFRONT RESIDENCES | 38 |

| STIRLING RESIDENCES | 48 |

Here’s a look at their performance on average:

| 2 Bedroom Type | Average Performance ($) | Average Performance (%) | Annualised Returns (%) |

| 2B 1B | $170,756 | 17.16% | 4.57% |

| 2B 2B | $200,310 | 16.81% | 4.46% |

As you can see, the annualised performance between both types of layouts isn’t that different.

Here’s a look at the breakdown by project:

| Average Performance ($) | Average Performance (%) | Annualised Returns (%) | ||||

| PROJECT | 1 Ba | 2 Ba | 1 Ba | 2 Ba | 1 Ba | 2 Ba |

| JADESCAPE | $175,633 | $184,778 | 15.70% | 14.40% | 4.22% | 3.99% |

| PARC ESTA | $212,892 | $271,324 | 20.25% | 20.47% | 5.29% | 5.53% |

| PARK COLONIAL | $201,324 | $140,765 | 17.64% | 11.84% | 4.34% | 3.17% |

| RIVERFRONT RESIDENCES | $105,696 | $128,293 | 12.96% | 13.78% | 3.35% | 3.64% |

| STIRLING RESIDENCES | $229,804 | $234,544 | 20.50% | 17.91% | 5.41% | 4.65% |

| THE TAPESTRY | $87,413 | $134,743 | 10.01% | 13.82% | 3.57% | 3.49% |

| WHISTLER GRAND | $183,527 | $238,857 | 21.53% | 22.77% | 5.82% | 6.16% |

Similarly, a look at the average performance shows that in most cases, the performance between both types of layouts is not that much different. However, 1 project does stand out: Park Colonial.

When we looked at transactions of 1 bathroom layouts, their average purchase price came to $1,145,667. The average purchase price of the 2 bathroom layouts that sold was $1,252,444.

This translated to a difference of 9.32%. However, upon selling, the difference in premium between the 1 and 2 bathrooms fell to 3.43%.

This closing in the premium gap between both the 1 and 2 bathrooms could have boiled down to timing.

Out of 12 sale transactions of the 1 bathroom units, 11 took place in 2022.

In contrast, out of 9 transactions of the 2 bathroom units, 5 took place in 2022.

While it’s a long shot to conclude anything from a handful of transactions, it’s more likely the case of good (lucky) timing versus a black-and-white rule of whether one unit type is better for appreciation over another.

What if we looked at the premium gap between 1 and 2-bathroom layouts within projects?

One train of thought could be – if the 2 bathroom has a larger price gap compared to the 1 bathroom layout, would this translate to better gains for the 1 bathroom, and conversely poorer returns for the 2 bathroom?

Also, 2-bathroom layouts usually (but not always) sell for a premium over single-bathroom units; this assumes we set aside other factors such as better views, premium stacks, etc.

Here’s a look at the premium gap of the same projects above at launch, and subsequently when it sold in the resale market:

| New Sale | Sub-Sale/Resale | ||||||

| PROJECT | 1 Bathroom Avg. Price | 2 Bathrooms Avg. Price | Premium Difference | 1 Bathroom Avg. Price | 2 Bathrooms Avg. Price | Premium Difference | Difference |

| RIVERFRONT RESIDENCES | $822,758 | $938,352 | 14.0% | $929,033 | $1,065,916 | 14.7% | 0.7% |

| WHISTLER GRAND | $896,940 | $1,108,107 | 23.5% | $1,046,789 | $1,300,256 | 24.2% | 0.7% |

| PARC ESTA | $1,087,088 | $1,305,694 | 20.1% | $1,269,499 | $1,616,199 | 27.3% | 7.2% |

| JADESCAPE | $1,103,495 | $1,324,816 | 20.1% | $1,304,000 | $1,473,521 | 13.0% | -7.1% |

| PARK COLONIAL | $1,147,563 | $1,293,829 | 12.7% | $1,347,626 | $1,406,492 | 4.4% | -8.4% |

| STIRLING RESIDENCES | $1,175,613 | $1,326,002 | 12.8% | $1,353,788 | $1,550,830 | 14.6% | 1.8% |

| THE TAPESTRY | $869,645 | $969,645 | 11.5% | $999,361 | $1,085,000 | 8.6% | -2.9% |

Whistler Grand, Parc Esta, and Jadescape all saw substantially higher prices for 2-bathroom units, at 20 per cent above single-bathroom counterparts. However, eventual sub-sale/resale transactions show that the premium may be justified, as it was maintained when it changed hands (in Parc Esta’s case, the premium actually widened).

Conversely, a small premium gap doesn’t necessarily mean it could widen later. Park Colonial had a premium gap of 12.7%, however, this narrowed to 4.4%.

Still, this could boil down to transaction timing – as such, we really cannot draw any conclusion from just looking at premium differences either.

Beyond the data, there are some qualitative factors to note

Some benefits of two-bathroom units may not be reflected in the data alone.

(Note: rentability refers to how easily and quickly you can find a tenant – it shouldn’t be mistaken for more quantitative factors like rental yield).

When you have tenants who are roommates, or who are sharing space with another stranger, the preference is almost always for two bathrooms. If you’ve ever had to wake up early for work, and found the only bathroom occupied for too long, you’ll understand the frustration it causes.

Some tenants also feel there’s a loss of privacy when they’re forced to share a single bathroom. It’s not uncommon, for instance, for some female tenants to insist the other unrelated tenant also be female if they’re sharing the same bathroom.

On the flip side, one realtor pointed out that tenants who are strictly single and renting out a two-bedder for themselves may see the second bathroom as a drawback.

If you’re strictly living alone, you don’t want an additional bathroom to have to maintain; and you’d probably be willing to trade it for more living space.

As a final consideration, realtors agreed that it’s generally easier to sell a two-bathroom unit.

This doesn’t guarantee a higher price – but it could mean you’re able to sell the unit more quickly. We can chalk it up to, well, the longstanding belief that two-bathroom units are better investments.

And as one realtor points out, the two-bathroom option appeals to those with foresight. You may be satisfied with one bathroom while you’re single – but what if one day you decide to settle down with your partner, or decide to use the unit as a rental asset? You might have some regrets about not picking two bathrooms then.

For more information on the Singapore private property market, as well as in-depth looks at new and resale properties alike, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Is a two-bathroom condo unit a better investment than a one-bathroom unit?

Do two-bedroom condos with two bathrooms sell for more than those with one bathroom?

Which layout is more popular among tenants: one bathroom or two bathrooms?

Does having two bathrooms in a condo guarantee higher capital gains?

Are two-bathroom units easier to sell than one-bathroom units?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Investment Insights This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Property Investment Insights River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

Latest Posts

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

2 Comments

Your first table and the paragraphs below are very confusing. In the table, it seems like more of the 1 bathroom units are selling for higher price but the paragraph suggests otherwise. Also, Ki residence 1 bathroom is shown as selling for higher price but in the para below, you mentioned Ki residence 1 bathroom is priced lower.