Will Rich Foreigners Still Want Your Prime District Condo In 2022?

April 29, 2022

As of December 2021, there’s been an ongoing debate on whether Singapore property is still attractive to foreigners. Some believe the answer is a definite no, with stamp duties hiked by a whopping 10 per cent; yet others point to the brewing crisis in Ukraine, and a potential flight to safety. Who’s right, and do you still have a chance of a healthy sale to a foreigner? Here’s what’s to know:

Table Of Contents

- A more expensive flight to safety for foreigners

- How certain are we of foreign interest right now?

- 1. The latest ABSD increase is twice as high as the previous rounds

- 2. Our stamp duties are now higher than our regional counterparts

- 3. The CCR has seen declining transaction volumes

- 4. Foreign buyers don’t just look at residential properties

- Does this mean wealthy foreign investors won’t be buying your property this year?

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

A more expensive flight to safety for foreigners

In December 2021, new cooling measures were added, and the Additional Buyers Stamp Duty (ABSD) for residential properties was raised. Foreigners and developers bore the brunt of the increase, with the rate now at 30 per cent of the price or valuation (whichever is higher). This is a 10 per cent increase from previous rates.

However, many realtors we spoke to have argued that increased ABSD won’t quell a flight to safety.

Russia is currently facing sanctions for its invasion of Ukraine. As a result, we’re seeing some of the highest oil prices since the 1973 OPEC embargo. These high energy prices affect business costs and consumer numbers, as we’re already seeing in Singapore.

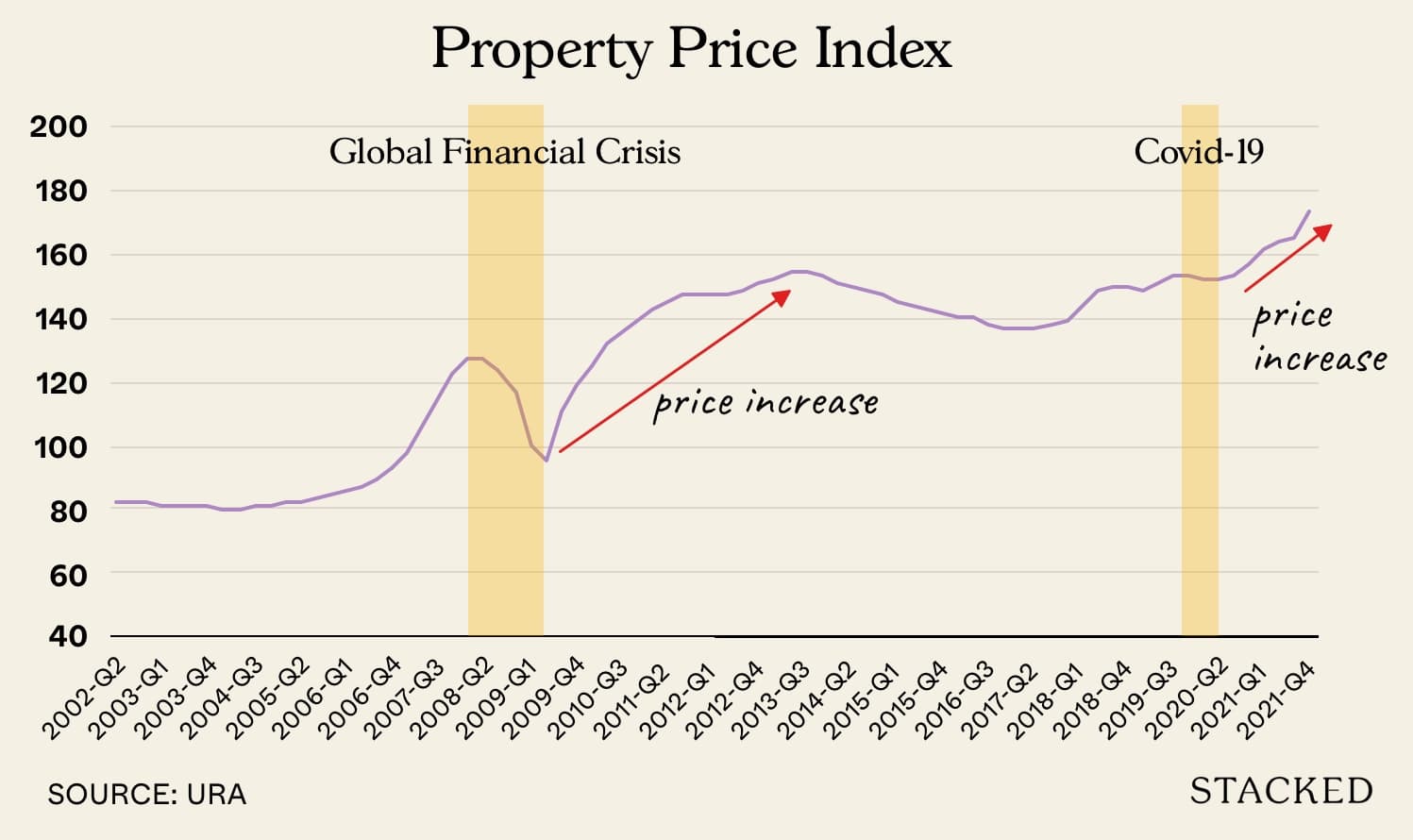

At this point, you will be told – loudly and often by sellers – that Singapore property is a haven in such volatile times. You’ll be shown something like this graph, highlighting the rise in prices during the Global Financial Crisis, and the Covid-19 period:

(Do keep in mind that, while those show rising prices in general, they don’t indicate the percentage of foreign buyers; for details on that, check out this article instead).

Property Market CommentaryHow Many Foreigners Are Really Buying Properties In Singapore? (A Breakdown From The Last 10 Years)

by Ryan J. OngAs such, a foreigner who tolerates both rising prices, as well as higher ABSD, would be buying a very expensive flight to safety.

How certain are we of foreign interest right now?

Some of the main factors to consider are:

- The latest ABSD increase is twice as high as the previous round

- Our stamp duties are now higher than our regional counterparts

- The CCR has seen declining transaction volumes

- Foreign buyers don’t just look at residential properties

1. The latest ABSD increase is twice as high as the previous rounds

If you’re not a foreign buyer, it’s easy to underestimate the impact of the December cooling measures.

In January 2013, cooling measures raised ABSD on foreigners by just five per cent (10 per cent to 15 per cent). In July 2018, new measures raised the rate by five per cent again (15 per cent to 20 per cent).

The jump in December 2021 was an increase of 10 per cent; twice as high as the previous rounds.

In the news, property agents have already mentioned the declining number of inquiries, and expectations of a slowdown. One of the realtors that we spoke to said there’s no more underplaying the effects of ABSD on foreigners:

“Today it’s so high that, if I get a foreign buyer, it’s purely as a luxury home. The last foreigner I sold to, they weren’t interested in gains. The straight away told me ‘There’s no way to make money on this, we buy to enjoy only.’ All the overseas buyers I see today are looking for homes, not investing.”

More from Stacked

I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Hi Stacked,

2. Our stamp duties are now higher than our regional counterparts

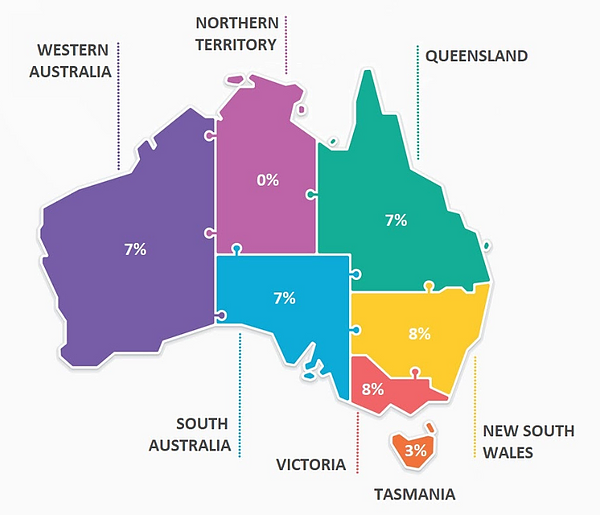

Some realtors mentioned that an older sales pitch, from around 2017, is no longer valid. At the time, it was common to point out that Singapore was still cheaper than regional rivals Australia and Hong Kong, despite ABSD (the rate back then was just 10 per cent).

Today, it’s sellers in Australia and Hong Kong who could use the same argument against us. Australia has an additional seven per cent stamp duty for foreigners, while Hong Kong places an added 15 per cent on foreigners.

One relator felt that the only remaining reason Chinese buyers still favour Singapore, at our current stamp duty rates, is ongoing political unrest in Hong Kong.

As the supply of new launches falls, and cooling measures sink in, we may lose a fair portion of foreign buyers to our neighbours.

3. The CCR has seen declining transaction volumes

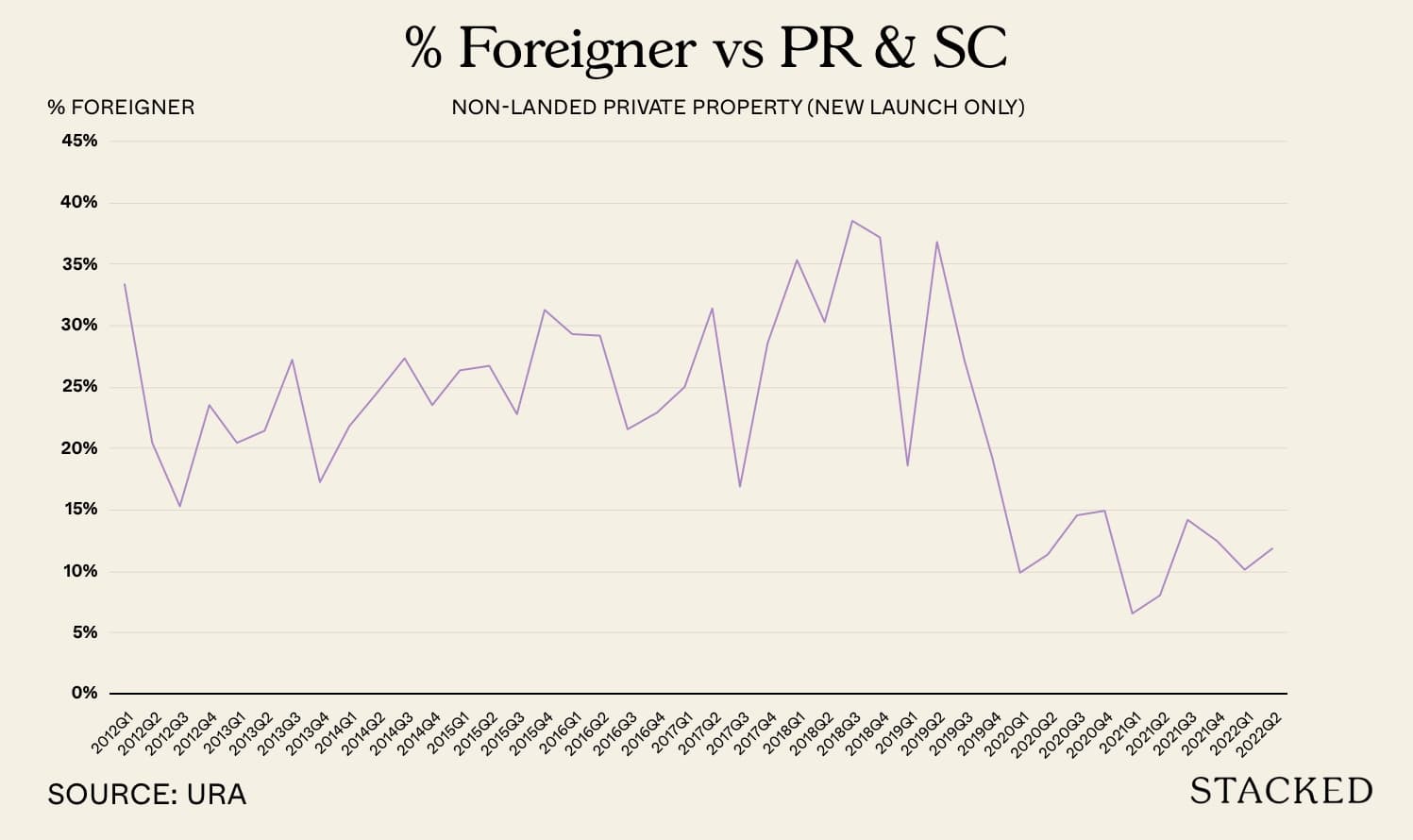

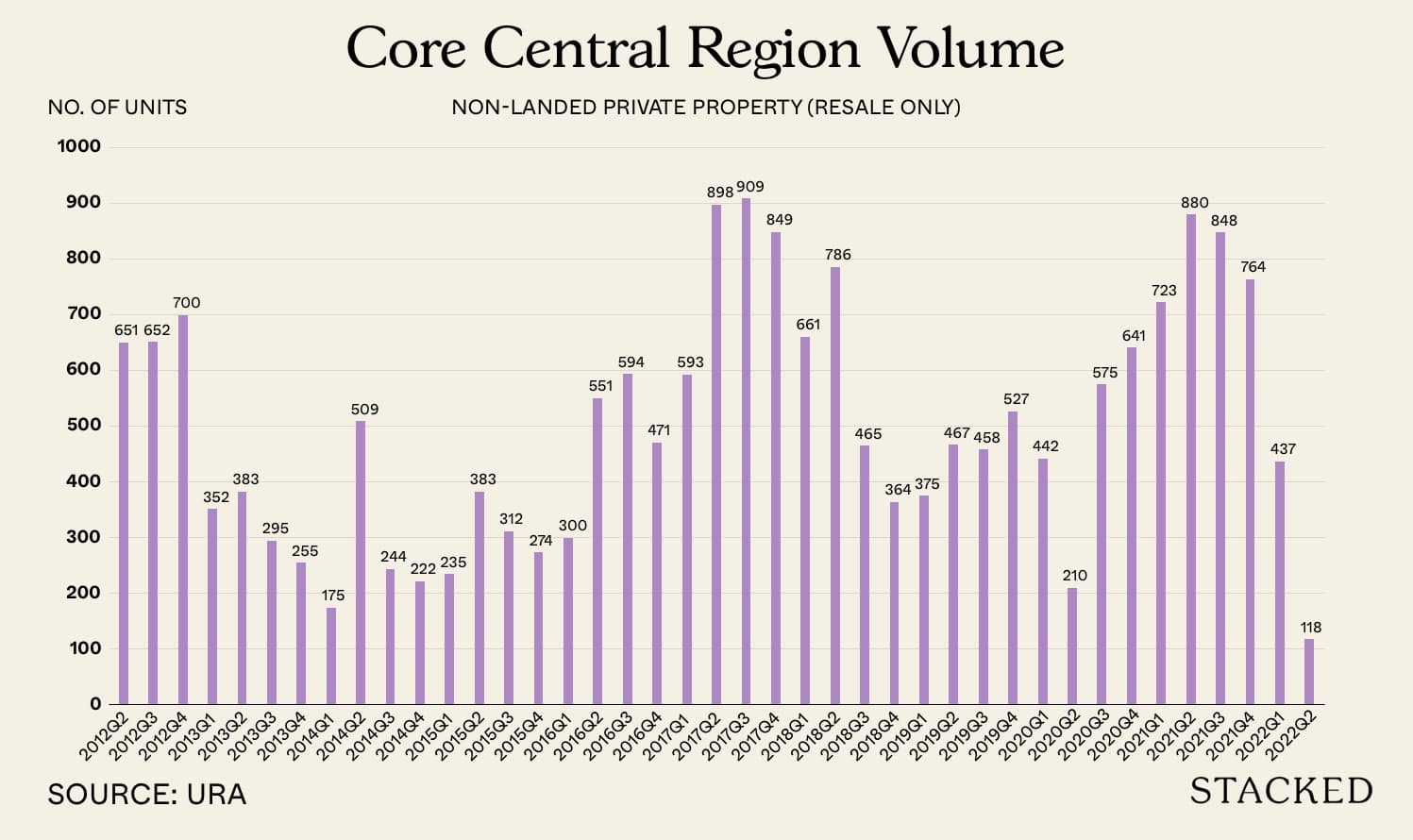

A good way to guess the interest of foreign buyers is to look at the Core Central Region (CCR). This is where most foreigners end up buying.

For the following, we’ve excluded new launch condos in the CCR (as otherwise, the transaction volumes will be more affected by the number of new launches):

Put aside the price for the moment (it’s moving up due to high demand and limited supply, an issue that’s been going on since 2020). You’ll notice that, after the surge of transactions between Q1 and Q2 last year, transaction volumes in the CCR have been dipping. There were 764 resale transactions in the CCR as of Q4 last year, but only 437 in Q1 this year.

4. Foreign buyers don’t just look at residential properties

Residential is only one segment of the Singapore property market; keep in mind that commercial properties have no ABSD.

Commercial properties do, however, incur GST – and the planned GST hikes in 2023 and 2024 are prompting investors to move now. Given the sharp rebound of commercial properties in 2021, we can’t discount the possibility of investors looking outside of residential markets.

Along with non-residential REITs, commercial properties may draw away some foreign interest in the coming year. How this plays out will be influenced by the ongoing Russia – Ukraine situation.

Does this mean wealthy foreign investors won’t be buying your property this year?

The signs suggest a wealthy foreign investor might be put off by rising stamp duties. However, sellers can have hope in the form of a wealthy foreign home buyer.

A 30 per cent price hike is hard to justify for almost any investor; especially in unpredictable times like the present. But this doesn’t change Singapore’s inherent appeal as a place to live. Wealthy foreigners who don’t care about cash-on-cash return, rental yields, etc., are likely to comprise a bigger portion of buyers at this stage; and their purchases are more likely to be indulgences than investments.

So while the number of foreign buyers may dip, we’re far from seeing a spectacular crash in foreign demand.

For more on the situation as it unfolds, follow us on Stacked. We also provide in-depth reviews of new and resale properties alike, so you can make a better-informed decision.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Are foreigners still interested in buying Singapore condos in 2022 despite higher stamp duties?

How has the recent increase in stamp duties affected foreign property buyers in Singapore?

Is the interest of foreign buyers in Singapore property declining in 2022?

Do foreign investors consider commercial properties when buying in Singapore?

Will the higher stamp duties prevent wealthy foreigners from buying luxury condos in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Singapore Property News Two New Prime Land Sites Could Add 485 Homes — But One Could Be Especially Interesting For Buyers

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

2 Comments

So right about indulgence from foreign buyers! And the skilful buyer (whether foreign or local) always balance their portfolio! A good spread of local vs overseas homes, a good spread of residential vs non-residential! So, the real equation is how much you have to invest, then followed by what to invest, … not about rushing to buy at new launches ; )