Why We Upgraded To A 1,593 Sqft Executive Apartment From A 4-Room BTO (Despite Its Age)

May 10, 2022

There’s been much talk about HDB upgraders in 2021/2022, and while most of the attention seems to be on upgrading to a condo, there are also many who are looking for bigger resale HDB homes as an upgrade to their lifestyle. Homes seem to get smaller in Singapore every year; and for some buyers, today’s condos just can’t make the cut (at least, not at the outrageous price per square foot). That’s led some buyers, like M in our story, to stick with HDB flats – but we’re not talking about 5-room flats either. Here’s how they decided to upgrade from their 4-room HDB BTO in Keat Hong to a rare Executive Apartment (EA) in Bukit Batok, to maximise living space while keeping within budget:

Table Of Contents

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

What’s an Executive Apartment (EA)?

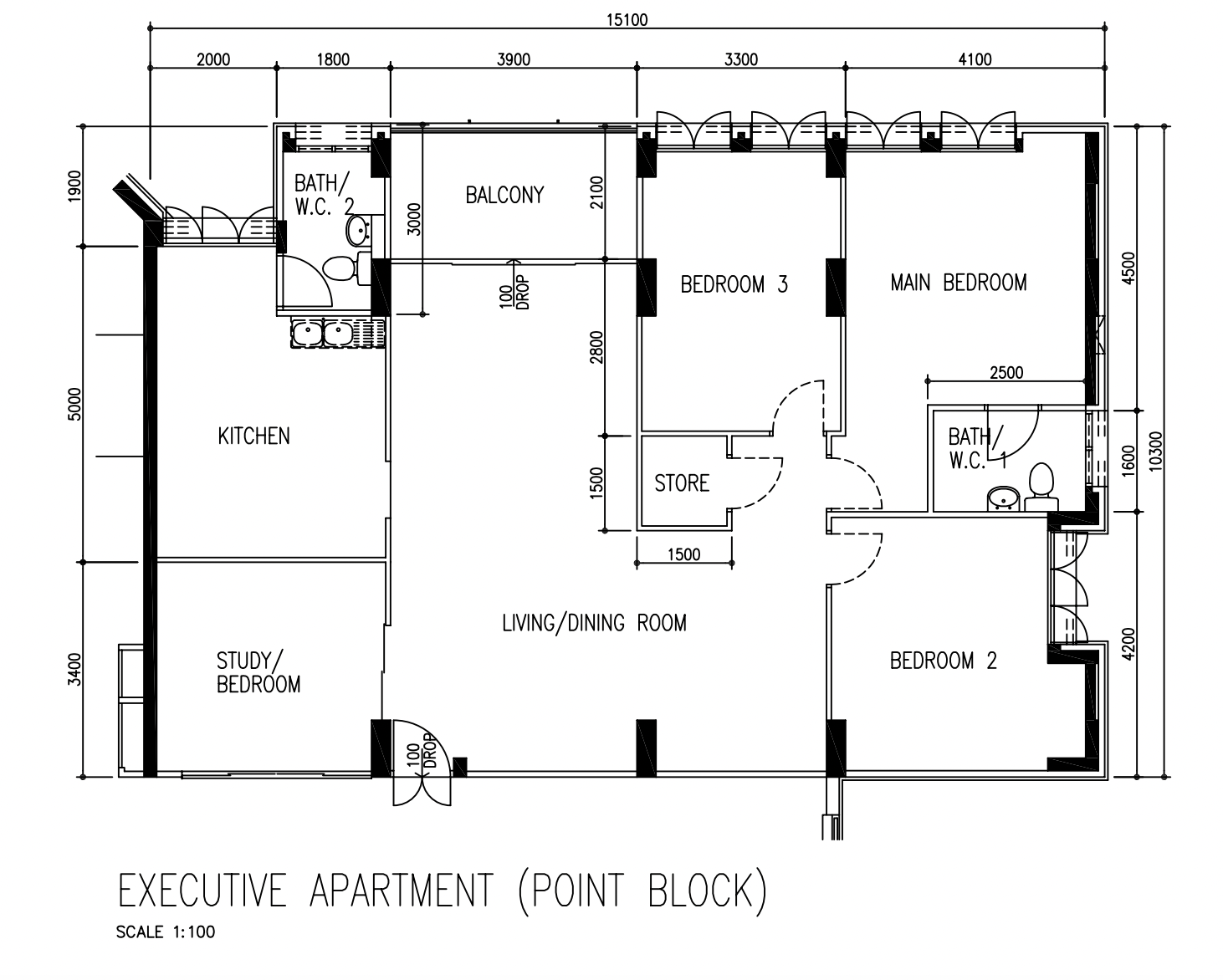

EAs were introduced by HDB in around 1983, as a bigger version of a 5-room flat. These units span about 146 to 150 sqm., and you can think of them as a 5-room flat plus a study.

EAs were introduced at the same time as a double-storey maisonette. Back in the 1980s, many “executive” flats built were maisonettes, but the decade saw more EAs built later. In 1987, there were some EAs that also featured four bedrooms instead of three bedrooms; and some EAs come with balconies.

By around the 1990s, HDB had stopped building EAs, making the few remaining units scarce and highly desirable. They’re especially favoured by families who want big spaces but don’t want to deal with the stairs in a double-storey maisonette.

In this week’s buyer story, M explains how he purchased his rare EA at Bukit Batok West Avenue 7. This gigantic 1,593 sq. ft. unit would have been one of the last generations of EAs, completed in 1993. The best part about it? The price tag of just around $640,000. That’s just around $402 per square foot!

(For comparison, the average price of an HDB flat in 2022 is about $519 per square foot).

Finding the prized EA

For M and family, their first home was a BTO at Keat Hong Link. It was a 4-room unit that was 990 sq. ft. in size, which was certainly doable for a family of 4, but they always knew they wanted to upgrade to a bigger space once their 5-year MOP was up.

While it wasn’t within walking distance to an MRT station, you are close enough to the LRT, and Keat Hong Mirage just next door offered a good range of amenities like a McDonald’s, a supermarket, and a bakery.

Still, a bigger place was always on the top of their minds, and they made the decision to purchase their next home, an EA in July 2021, at a time when HDB resale prices were peaking. He notes that:

“There were very limited EA and Executive Maisonette (EM) flats available within our budget, and we only had around 20 days left to choose. This EA was actually our last resort; it did not have the view we wanted, but it fit the budget and was near our parents.”

Another bonus for M was the sheer size; he points out that it was the largest unit they had found – bigger even than the other EM options they’d viewed. We’d have to agree that 1,593 sq. ft. is absolutely jaw-dropping for an HDB property, and this may be the largest flat we’ve seen to date.

Also, going by prices in 2021, a resale condo of the same size (average of $1,400 psf) would have exceeded $2.2 million. As M’s family needed space (they are a family of 4), this meant condos were out of the question.

In fact, even most EMs are priced around $700,000+, as M noticed. This exceeded their planned budget of $650,000. They did come close to buying one, with M saying:

“We passed about five houses before reaching an EM we nearly bought. It was $670,000, slightly above budget; but we were ready to make a down payment already.

But then we viewed this particular EA, which had been listed for quite some time. It was only in the last five days of our 20 day time frame when we spotted it.”

More from Stacked

How To Decide Between A High Or Low Floor Condo Unit — And Why Most Buyers Get It Wrong

Floor height is one of the main factors in developer pricing. It almost goes without saying that, as far as…

M and his family loved the space the moment they viewed it, and the seller asked for $680,000; only a bit higher than the next last alternative. Nonetheless, they managed to haggle the price down to $640,000. When the valuation came in, they were lucky: there was no Cash Over Valuation (COV).

COV is quite the hazard when negotiating prices; especially for older flats like EAs and EMs. The COV is any part of the seller’s price that’s above the official HDB valuation; and it must be paid in cash.

Without any COV, however, M was spared the need for a higher cash outlay.

M also got lucky regarding age. Had the flat been older (shorter lease remaining), the amount of the loan could have been reduced. HDB can reduce both loan quantum and CPF usage, if the lease of the flat won’t last till the youngest buyer turns 95. This restriction can be an issue when purchasing older property types, such as EAs, EMs, or HDB terraced houses.

The benefits of age can include being in an older estate

EAs started in the 1980s, so most of them are found in more established areas. However, M doesn’t feel the immediate amenities are anything spectacular:

“This area does not have any well-known supermarkets nearby. NTUC is at least two stops away, at the Home Team NS building at Bukit Gombak!”

M’s preferred supermarket, Giant or Sheng Siong, would be all the way at Bukit Batok Central, which for him is about a seven-minute drive. Nonetheless, he does note there are decent coffee shops and provisions shops nearby, as well as a clinic and a good massage place.

While some people feel that HDB areas are too dense and urban, they’re missing out on the little things like this. Sometimes you just want to duck out for a bowl of mee pok and not have to take the bus or get your feet properly massaged without heading all the way to Fu Lu Shou complex.

Bigger resale flat, bigger renovation costs

One drawback to resale flats is that you probably need more renovations: especially for an older unit from the 1990s.

(Although if you think about it, the lack of a four to five-year construction time probably more than makes up for higher renovation costs).

For M, the priority was to relocate the storeroom, making more efficient use of the space. They also shifted the entrance of the master bedroom, to allow for a common bathroom to be closer; the other bathroom, which was in the kitchen, was too far from the bedrooms. M noted that, when living with toddlers, it’s helpful to have the bathrooms nearer at hand.

The total cost for renovations was around $65,000. While above-average for an HDB flat (most people spend $50,000 or below), this is likely due to the huge floor space. But we note that even if you add the $65,000 to the total cost – making it around $705,000 – the entire unit is still below the price of some one-bedders in a new launch condo.

That should make some families question if private housing is really worth the price tag, in this booming market.

A good range of future options

Having spent $65,000 in renovations, M is intending to stay in the EA permanently. However, he also has the option to right-size to a smaller flat later; perhaps after all the children have moved out.

It’s a good idea, when buying a large home, to look a decade or two down the road. Big, empty homes can feel a bit oppressive; and it’s tough to keep the place clean when you’re older. As a bonus though, M’s unit isn’t a maisonette, so stairs won’t be a problem in their twilight years.

For more home buyer journeys and considerations, follow us on Stacked. We provide in-depth reviews and walk you through the key considerations, so you can make a better choice.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Homeowner Stories

Homeowner Stories We Could Walk Away With $460,000 In Cash From Our EC. Here’s Why We Didn’t Upgrade.

Homeowner Stories What I Only Learned After My First Year Of Homeownership In Singapore

Homeowner Stories I Gave My Parents My Condo and Moved Into Their HDB — Here’s Why It Made Sense.

Homeowner Stories “I Thought I Could Wait for a Better New Launch Condo” How One Buyer’s Fear Ended Up Costing Him $358K

Latest Posts

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

1 Comments

Can I have a video of the whole house renovation please? Cause I bought the exact same place as it shown here. Finding ideas to renovate the house.