Why DBSS Flats Are Defying The Odds: Achieving Record Million-Dollar Prices Despite Past Criticisms

July 24, 2023

Approximately a decade ago, when the Design, Build and Sell Scheme (DBSS) came to an end, the event was largely met with nonchalance. From property blogs to casual conversations, the consensus seemed to favour the scheme’s termination.

For most people, the differences between an HDB and a DBSS often weren’t stark enough to justify the higher price tags. Neither were the supposed higher-quality finishings, as a few high-profile cases showcased instances of poor workmanship.

But fast forward to today, and DBSS flats are often joining the ranks of million-dollar transactions. What happened? Is it just collective short-term memory, or something else entirely?

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

A Recollection of DBSS Housing

The Design Build and Sell Scheme (DBSS) was another form of “sandwich housing.” Just like an Executive Condo (EC) is between a flat and a private condo, a DBSS flat was somewhere between a flat and an EC.

(Even though toward the end of the scheme, there were DBSS offerings that matched ECs in price).

A DBSS project is, like an EC, built by a private developer. However, it does not have full-suite condo facilities like the clubhouse, pool, gym, etc. Also unlike an EC, DBSS projects will never see privatisation; they are and always will be HDB flats.

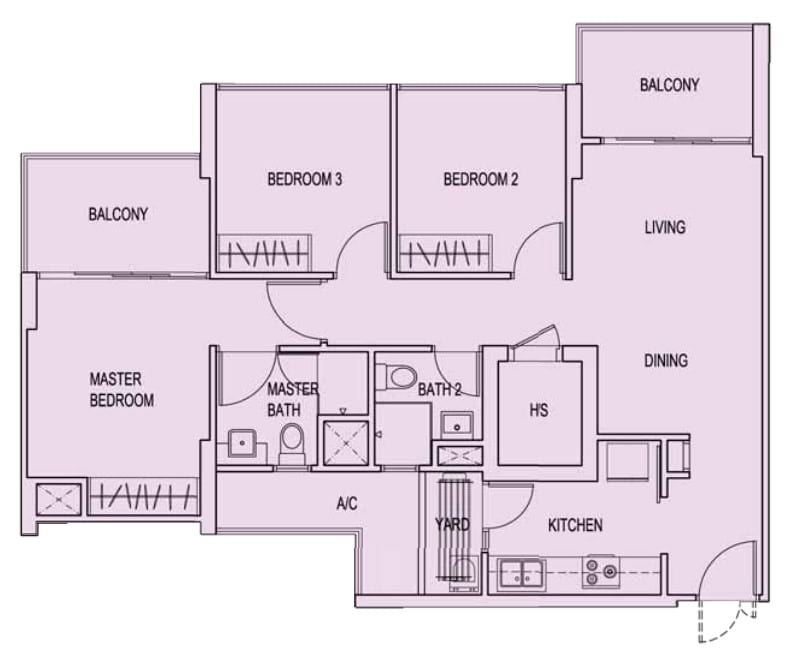

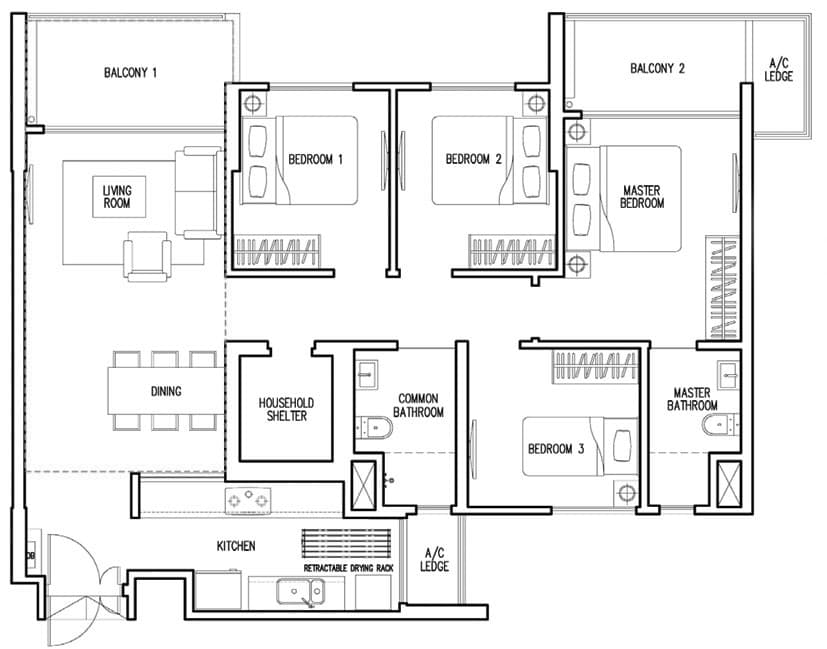

What a DBSS flat does have is supposedly better finishing (more on this below), design features that are usually found in condos (e.g., floor-to-ceiling windows, balconies, and so forth), and – most important of all – an additional bedroom in 5-room layouts. Some DBSS projects even come with secured gates with access cards for more security.

The DBSS scheme only lasted around six years (2005 to 2011), and saw 13 projects:

- Pasir Ris One

- Parkland Residences

- Lake Vista @ Yuan Ching

- Trivelis

- Centrale 8

- Belvia

- Adora Green

- The Peak @ Toa Payoh

- Parc Lumiere

- Natura Loft

- City View @ Boon Keng

- Park Central @ AMK

- The Premiere @ Tampines

Property PicksA Detailed List Of 13 DBSS Projects And Their Prices Today

by Ryan J. OngDBSS Flats have a Reputation for Breaching the Million-Dollar Mark Today

Back in July last year, Natura Loft was briefly the most expensive HDB flat ever sold, at $1.295 million. By September, The Peak @ Toa Payoh surpassed this, with a flat sold at $1.35 million. By July of this year, The Peak again broke its record, with a unit transacted at $1.42 million.

You get the idea: DBSS flats, like maisonettes and jumbo flats, are among the priciest options in the resale market today.

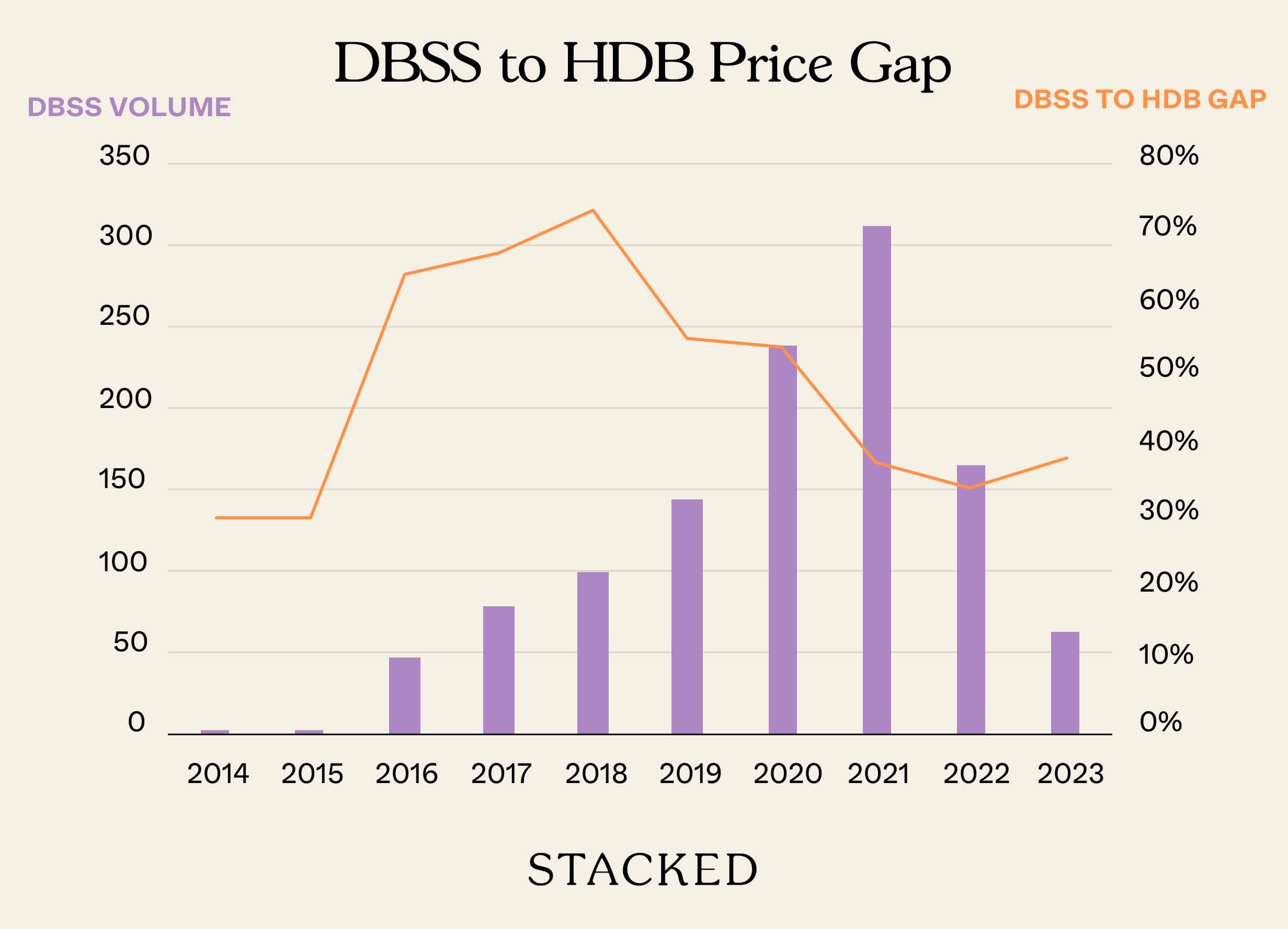

In case you’re wondering about the price gap between the typical DBSS flat and an HDB flat, it looks something like this:

The reason for the big jump in resale volume, over the years, is simply more DBSS flats crossing the five-year MOP over time. We can see that the price gap between DBSS and regular gaps was in 2018, and that over time, it’s simmered down to about 38.5 per cent today.

A Recollection of DBSS Problems

DBSS came to an end for good reasons. For starters, the “higher quality” expected of private developers often didn’t come to pass. In fact, toward the tail-end of the scheme, there was more bad press about DBSS unit quality than we’d seen for any regular HDB projects.

Trivelis saw around 500 residents protest the finished project, citing issues from shattered glass panelling, to rusted dish racks, exposed sanitary pipes, and flooding in common corridors.

Pasir Ris One, the last of the DBSS projects, has common corridors so narrow that two people struggle to walk side-by-side. This was along with issues like popping floor tiles and cracked windows.

The Peak at Toa Payoh saw laminates peeling off kitchen cabinetry, along with cracked tiles and bedroom cabinets with sagging doors.

And for those of you veteran market watchers, you probably notice that DBSS projects happened in the same era of developer shenanigans. Indeed, some DBSS flats also suffered from issues like bigger air-con ledges and excessive balconies.

If you want to know more, you can check out our video here.

Simply put, DBSS wasn’t the best idea our country had. Kudos to the authorities for canning it quickly, but it still begs the question: Why are they now commanding such high prices?

What makes people buy a DBSS flat at high prices?

- The simple fact that they were already expensive before

- Rare layout features

- Some DBSS flats are in high-demand, mature neighbourhoods

- HDB loans are a bonus if you can get them

1. The simple fact that they were already expensive before

Don’t be misled by the high quantum of DBSS flats today. Despite the original intent, many DBSS flats ended up costing as much as an EC counterpart when it was launched.

More from Stacked

My Experience Staying In A Ground Floor Unit: Here Are The Pros And Cons To Know

'When buying my first property, I was cautioned by my realtor: “Either you buy very high, or buy very low…

Note that the Mortgage Servicing Ratio (MSR) was not implemented until 2013. This meant that developers could place very high prices on the DBSS flats, and buyers could still qualify (as the loan repayment was not capped at 30 per cent of monthly income).

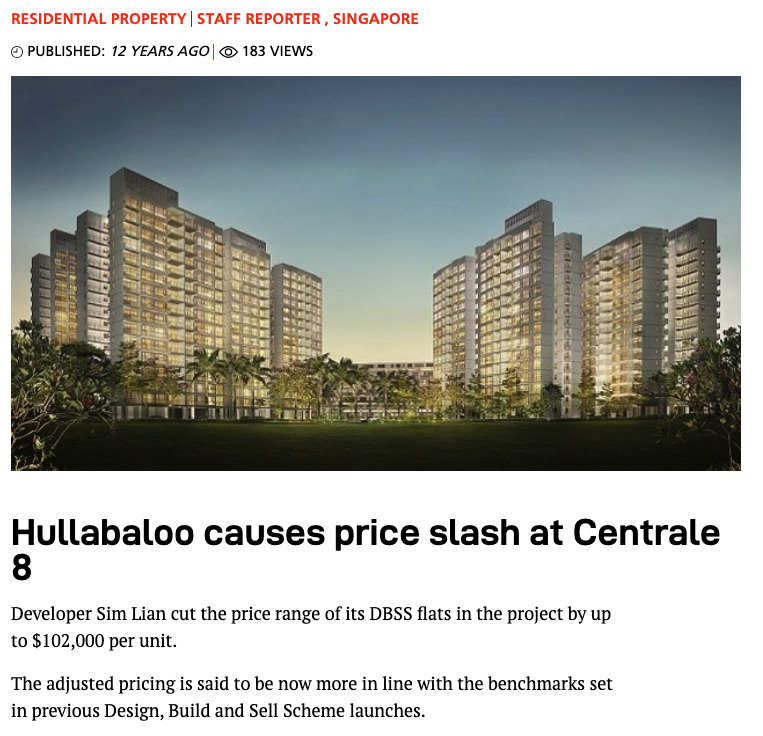

The most notorious DBSS flat when it came to pricing was probably Centrale 8, where 5-room flats cost around 50 per cent more than nearby counterparts. Some of these units were priced as high as $880,000 (and bear in mind this was back in 2011!)

It was so bad the developer discounted the prices, to try and calm the uproar.

So while the flats sell for a high quantum, it’s balanced out by the fact that they were bought for a high quantum. Natura Loft, for instance, last saw a transaction for $1.25 million on August 2022. Quite impressive for a 5-room flat. However, most of the flats were priced at around $739,000 at the time of launch. That’s an annual gain of around 5.3 per cent per annum, which is good but far from unheard of, for 5-room flats.

The sellers don’t have much room or inclination to drop their prices, regardless of the former reputation of their flats.

Of course, it must be said that DBSS apartments aren’t the only ones with high prices now. This is across the board, even with much older HDB apartments due to the effects of the pandemic.

2. Rare layout features

Sometimes, home buyers just want a loft unit, an extra bedroom, or three bathrooms (never found in regular flats, only in some DBSS flats like Belvia). A condo or EC may be priced too high, so a DBSS flat may be the only one to get it.

Realtors also said that DBSS can represent a more luxurious option than regular flats, to retirees who are rightsizing. If you’ve just sold a condo, then even a $1.5 million flat may not be priced out of reach; so these flats do continue to have a pool of buyers.

3. Some DBSS flats are in high-demand, mature neighbourhoods

One realtor handwaved issues like private development, saying some (not all) DBSS flats do well simply based on location. He observed that:

“Centrale 8 is walking distance to Tampines MRT. Natura Loft is walking distance to Bishan. The Peak is walking distance to Toa Payoh hub. This is what keeps the prices high.

An EC cost about the same as some of these, but most ECs are in non-mature towns or very far from public transport. Some buyers are more practical-minded, for the same price they rather a DBSS with a more convenient location.”

4. HDB loans are a bonus if you can get them

This doesn’t apply to every buyer: if your income is too high. HDB may still tell you to use a bank loan, and we believe most DBSS buyers are on the higher end of the income scale.

Nonetheless, it’s still possible to get an HDB loan for a DBSS flat, whereas it’s outright impossible for an EC.

Given that home loan rates are now rising past 3.7 per cent, HDB loan rates of 2.6 per cent are much more attractive; especially since HDB hasn’t changed this rate for decades.

This adds a bit more attractiveness to DBSS flats, versus their EC and private counterparts.

Apart from the above, we do think time plays a part. Fewer buyers will recall DBSS issues every year, and it’s incredible how quickly the market’s regard for any given property can turn.

(Remember the now conserved Golden Mile Complex? Back in the 1990s, almost everyone agreed it was an eyesore, with calls to tear it down.)

The rocky start that DBSS flats had will eventually fade from memory, along with some defects that will (hopefully) vanish under repeated renovations. There’s no fixing those horrible common corridors though.

For more on the Singapore property market, follow us on Stacked. We’ll also provide you with reviews of new and resale properties alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why are DBSS flats now selling for record prices despite past issues?

What makes DBSS flats different from regular HDB flats?

Why did the reputation of DBSS flats decline in the past?

Are HDB loans available for purchasing DBSS flats?

How have the prices of DBSS flats changed over time?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

1 Comments

There is one more thing about DBSS flats compared to normal HDB flats in its vicinity in that the conservancy fees are much higher. With DBSS being predominantly a HDB flat with no facilities, it’s hard to justify for a premium charged to the conservancy fee. Hope the authorities can review this policy.