10 New Upcoming Housing Sites Set for 2026 That Homebuyers Should Keep an Eye On

December 4, 2025

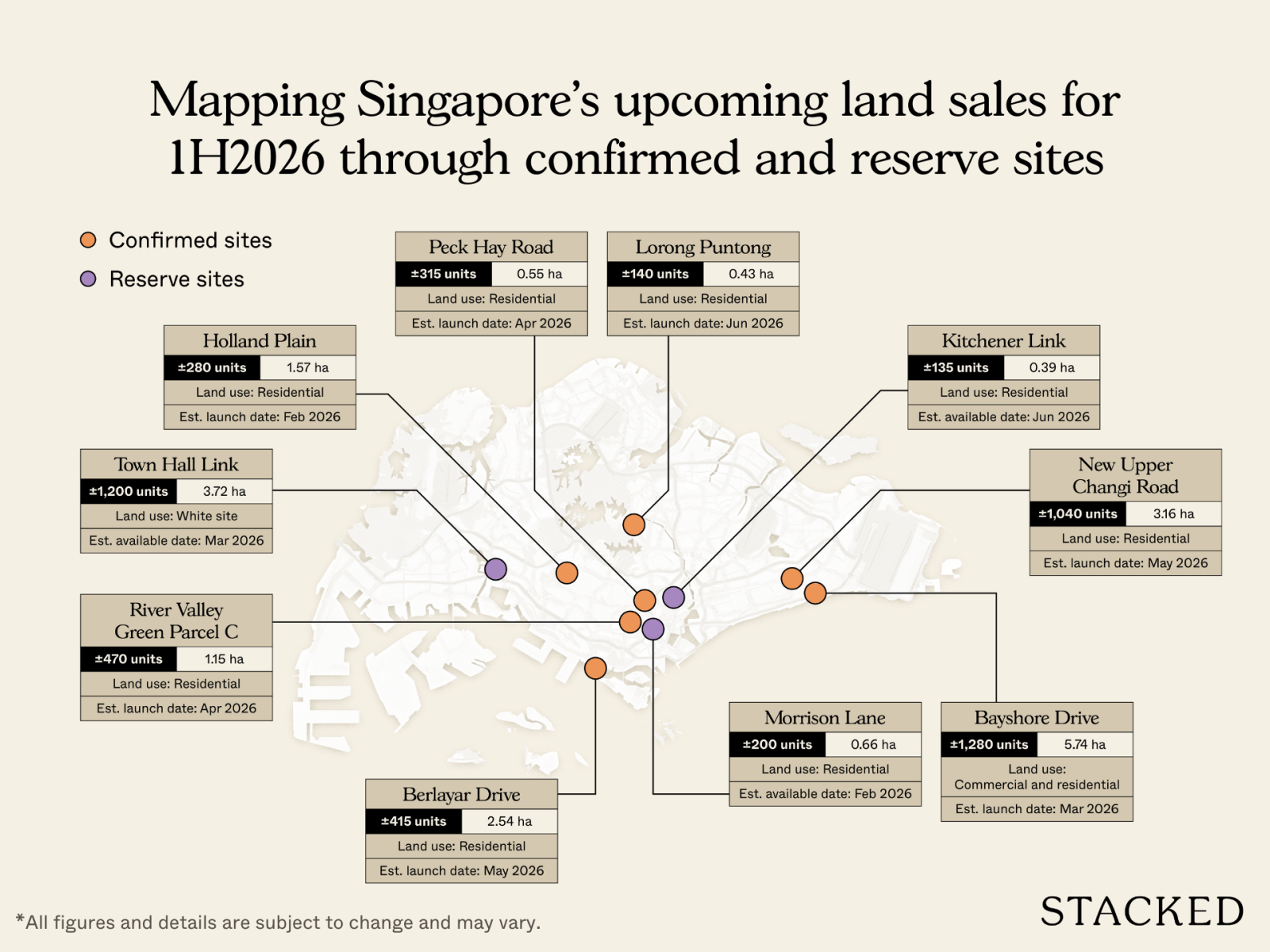

The pace of Government Land Sales (GLS) sites is slowing a little in 2026, with 10 sites announced for H1 2026. There are seven sites on the confirmed list and three more on the reserve list; and as of now, it’s predicted that the confirmed list alone will yield around 4,575 new homes, inclusive of 635 new EC units. Of special interest is a 3.72-hectare site (Town Hall Link) in Jurong Lake District; this is not a confirmed site, but it could be a lynchpin in the ongoing development of the Jurong Lake District. Here’s what to watch for:

And with supply moving at this more measured pace, the bigger question for many buyers is how these sites will shape pricing and availability over the next few years. If you’d like help understanding what these upcoming plots could mean for your own plans, reach out here and we’ll connect you with a trusted partner agent who can walk you through the implications.

Confirmed sites

- Holland Plain (Feb 2026)

- Bayshore Drive (Mar 2026)

- River Valley Green Parcel C (Apr 2026)

- Peck Hay Road (Apr 2026)

- Berlayar Drive (May 2026)

- New Upper Changi Road (May 2026)

- Lorong Puntong (Jun 2026)

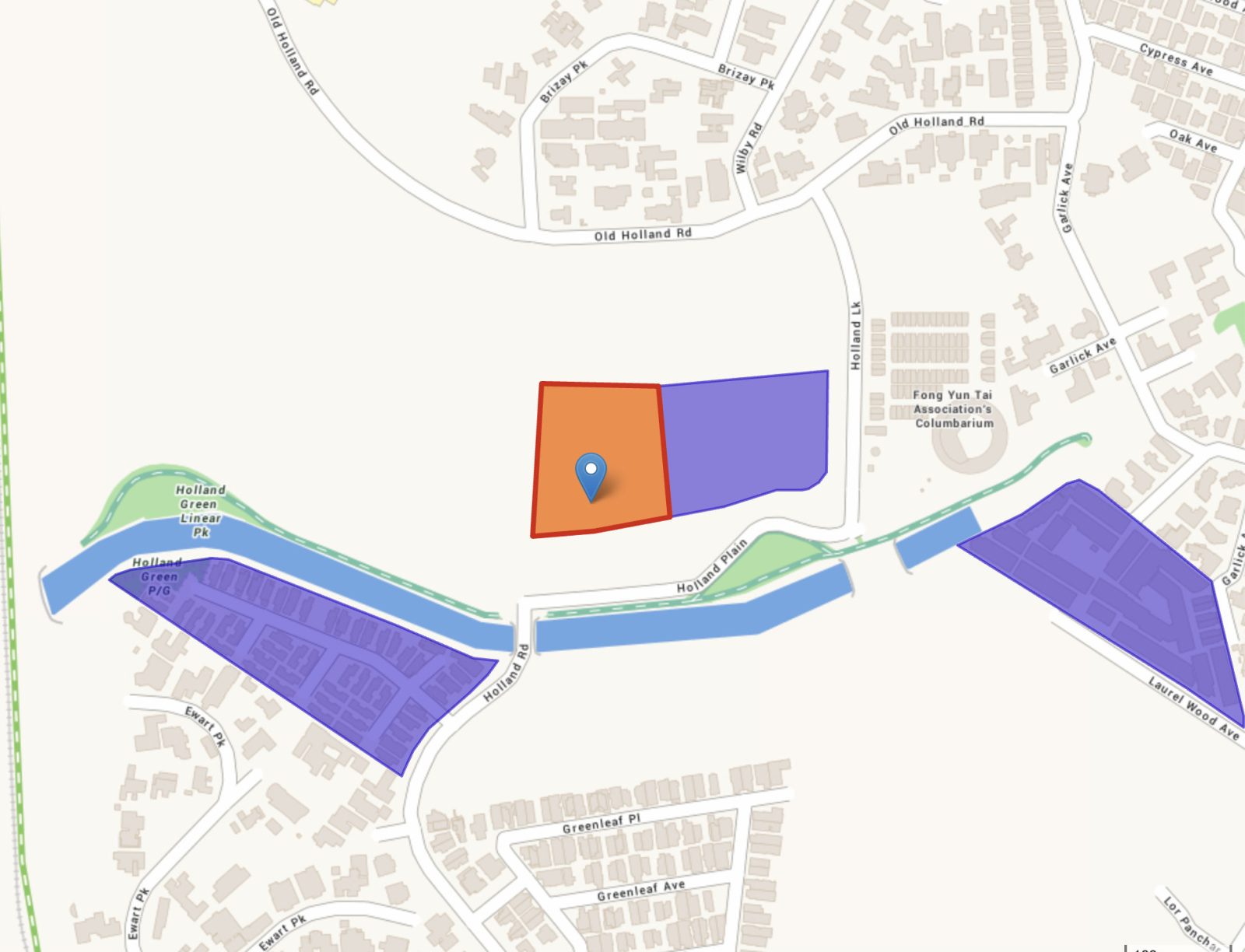

1. Holland Plain (Feb 2026)

This is a small 1.57 ha. site with a Gross Plot Ratio of 1.8, which could yield about 280 new homes.

The Holland Plains area is a low-density location, surrounded on almost all sides by landed homes. The nearby Greenleaf Forest also adds greenery to the area, and this location will draw buyers who prioritise exclusivity and privacy. The Rail Corridor is also quite close to this land parcel, which will appeal to the more outdoorsy families.

Like many landed enclaves, the trade-off is weaker accessibility and sparse amenities. There’s no MRT station within easy walking distance of here, and we don’t see other primary schools besides Methodist Girls Primary/Secondary in range. Most of the amenities in this area are currently clustered along Bukit Timah Road, where there’s a Cold Storage and a few restaurants; but this is rather far, and many won’t consider it a comfortable walking distance.

Issues aside, this land parcel will serve those who believe in first-mover advantage. This part of Bukit Timah has a lot of room for future development, and this particular plot is the tip of the spear for the wider Holland Plain precinct. URA plans for this to be a park-heavy, car-lite area; which means its current inaccessibility will likely be addressed at some point.

For now though, buyers in this area probably should drive, as it could take a while for all of the planned changes. A project here will most likely draw downsizers from the surrounding landed homes, whereas HDB upgraders are likely to see it as being rather ulu. It will be quite a shock to move from densely packed heartland amenities to this (for now) spartan location.

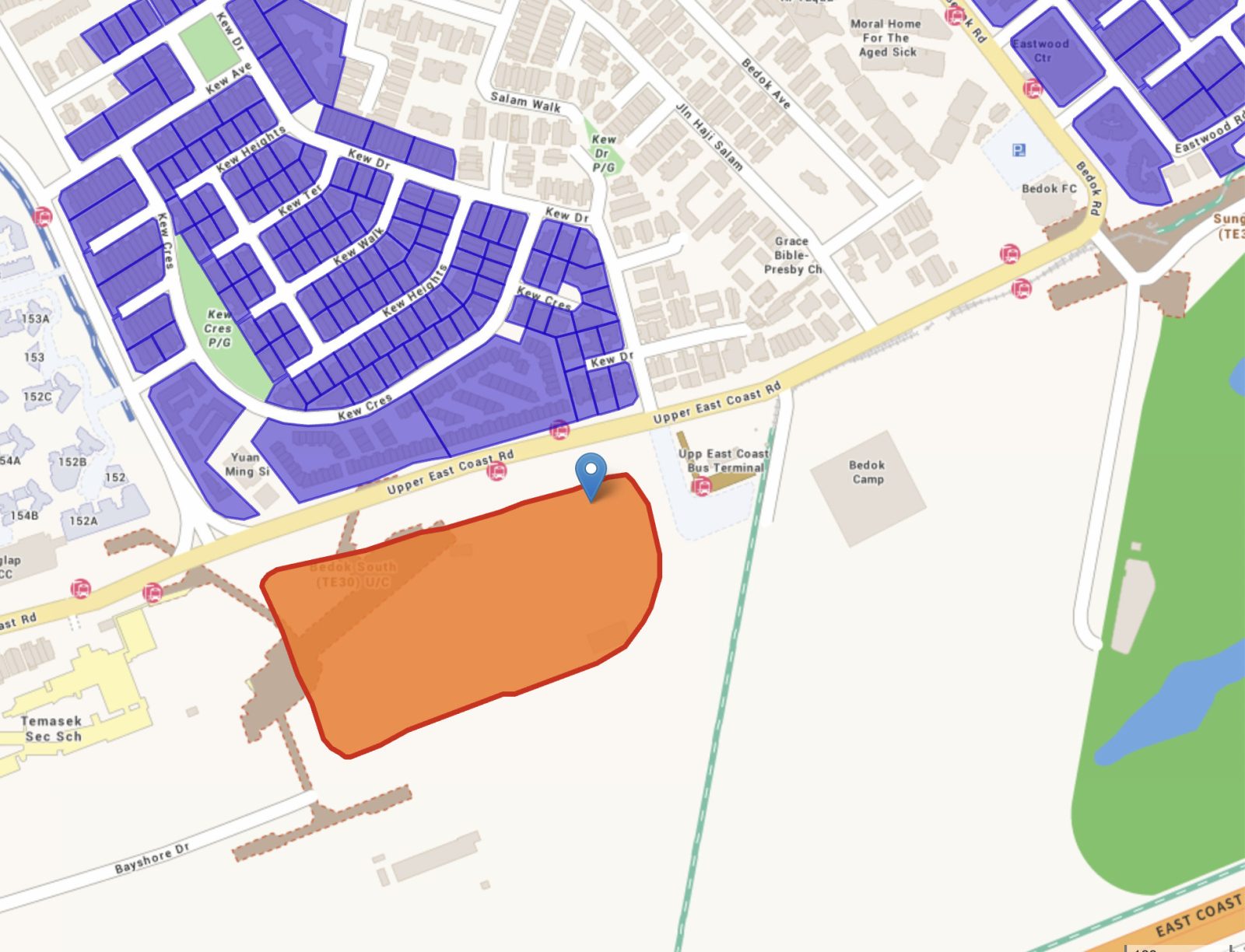

2. Bayshore Drive (Mar 2026)

This is the largest site for 1H 2026, at 5.7 ha and with a GPR of 3.5. This site will yield approximately 1,280 new homes and features a commercial element, comprising about 242,188 sq ft of commercial space. It’s linked to the new Bedok South MRT station (TEL).

This is a further development of the upcoming Bayshore town, a new HDB enclave. It faces a low-density enclave across from Upper East Coast Road, and is next to the Bedok military camp (although there’s a good enough distance that disruptions are unlikely). On the other side of the landed homes, there’s a sea view across from East Coast Parkway.

As this is a rather new area, amenities here are currently sparse, but the development here, along with the previous Bayshore site in 2025, is meant to correct exactly that. The project here will be the first big mall for the area, and this will serve the upcoming Bayshore Palms and Bayshore Vista projects.

There are no primary schools within one kilometre, but Temasek Secondary School is next to this site.

With regard to accessibility, Bedok South station is going to be far from town even after it’s up; but it does provide direct line access to the Marine Parade/Katong area, which is a major lifestyle hub with Parkway Parade, i12 Katong, and other such amenities. This is a good project for those willing to wait out the development times of the wider area, and who want good access to the East Coast beach area (although the first Bayshore site is a bit closer for that).

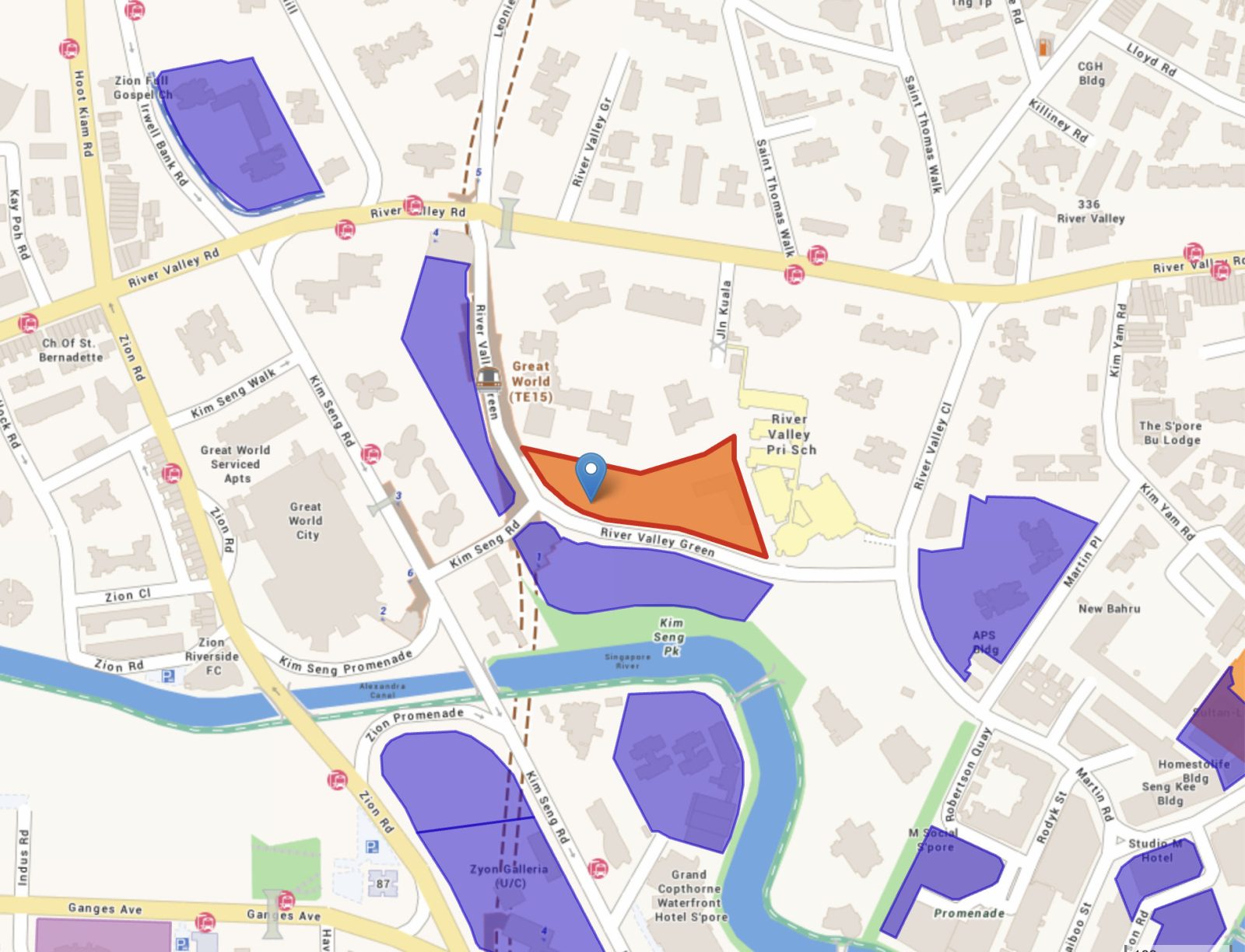

3. River Valley Green Parcel C (Apr 2026)

This is a 1.15 ha site with a GPR of 3.0, and it can yield around 470 units. There may be higher expectations here, since River Green (Parcel A) was one of the fastest-selling projects in 2025, although this is very much dependent on the final price and product.

This site is located between Great World MRT Station (TEL) and River Valley Primary. Alexandra and Zhangde Primary may be within one kilometre as well, though we don’t yet know this for sure. This is one of the most convenient locations on the list, as the plot is next to Great World City, a major mall; and the Zion Riverside Food Centre is nearby as well. Buyers who missed their shot at River Green will likely want to take a look at this.

Even though it’s in an increasingly crowded area with competition, we’ve pointed out that Great World has a unique strength: it manages to be quite central, whilst still retaining strong family appeal. So even with many new alternatives, we would expect strong developer interest.

The important issue here is how the developer distinguishes the project from nearby launches like River Green, as age difference won’t be a relevant factor. Beyond this, we’d suggest checking out our review of River Green, as many of the locational advantages will be similar.

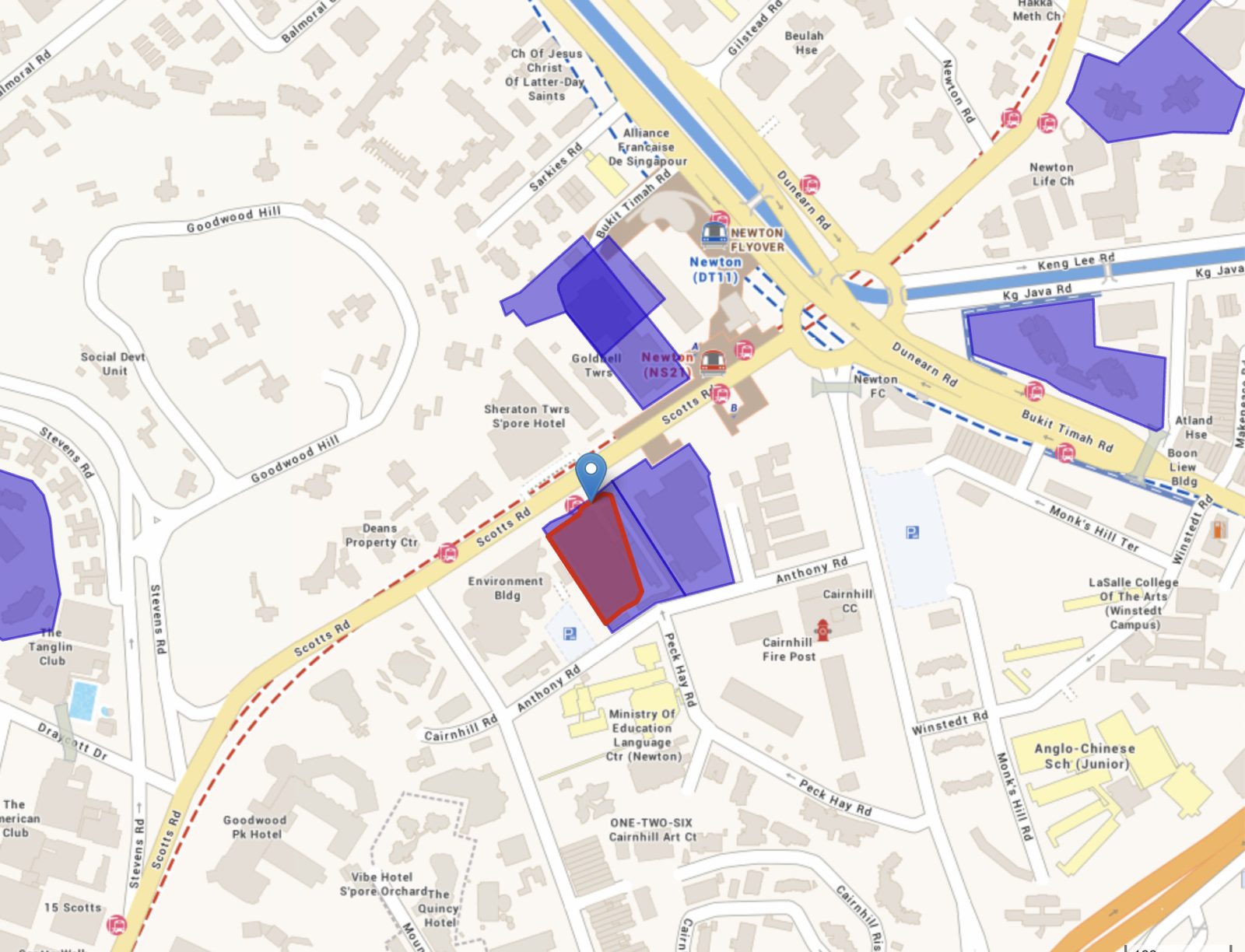

4. Peck Hay Road (Apr 2026)

This is one of the smallest CCR sites on the confirmed list, at 0.55 ha with a Gross Plot Ratio of 4.9, yielding roughly 315 new homes. It’s along Scotts Road, just across the road from Sheraton Towers and next to the NEA building.

This plot is in a heavily built-up area, just a short walk from Newton MRT station (DTL, NSL). This provides excellent access for those who want to live near Orchard or have easy access to the CBD. This is the most centrally located land plot on the list so far.

However, being in this city centre comes with expected drawbacks. ACS would likely be the main draw for families, but other than that, there are not many Primary school options. This is also less of a family area due to tight roads, higher traffic, and a general lack of green spaces. In general, this location will appeal more to singles, investors, or couples working in the CBD–Orchard–Newton corridor. The compact size and ultra-central location mean it could appeal to landlords.

The developer will also have to be smart with the architecture, as the small land space makes it challenging to squeeze in many facilities.

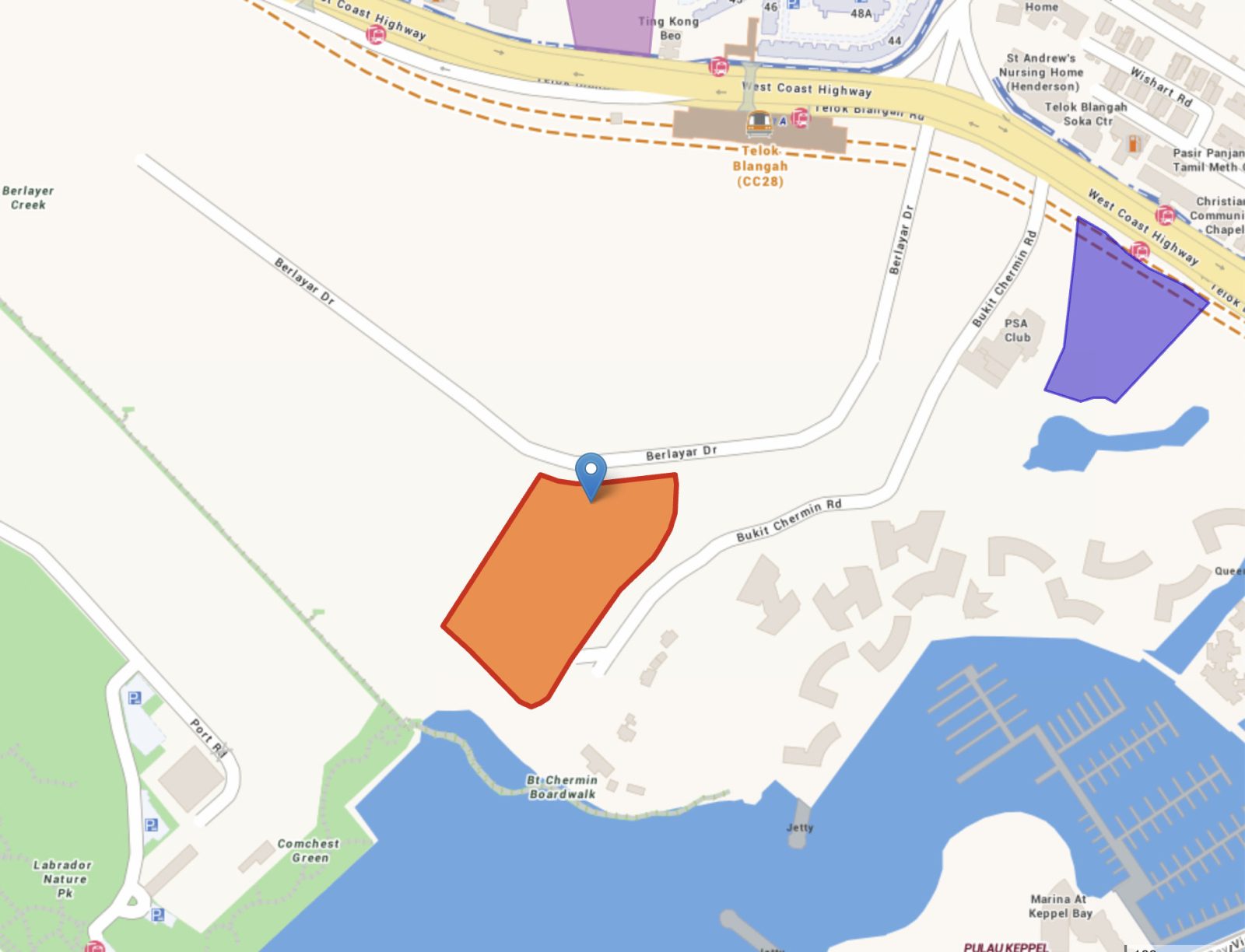

5. Berlayar Drive (May 2026)

This 2.54 ha plot has a GPR of 1.4 and can yield around 415 homes. This plot, located between Berlayar Drive and Bukit Chermin Road, will inevitably draw comparisons to a famous nearby condo: Reflections at Keppel Bay.

This land plot is behind the famed Reflections, although there’s still some clearance, so the waterfront view doesn’t appear to be blocked. Like its famous neighbour though, this is a project for those who drive. Telok Blangah MRT (CCL) might be an okay walk for some, but it could be a little over 10 minutes. Once you do have private transport, the location improves exponentially: the large Vivocity mall is nearby, as is the famed Seah Im hawker centre. For those who frequent Sentosa, this is a good way to be close to that island without the inconvenience of living on it.

However, the plot shares many of the locational issues that Reflections also has: there’s no Primary school nearby except possibly Blangah Rise Primary, and it’s lacking in more immediate across-the-road amenities. As a tradeoff, what you get is a great view, as well as proximity to Mount Faber and Sentosa.

More from Stacked

Exploring Tiong Bahru In 60 Pictures: A Detailed Walkthrough Of What Makes This Old Estate So Charming

What makes a place feel like home? Is it that 50m infinity pool, the numerous dining pods, or the fact…

One notable point of variance between this plot and Reflections is that, while Reflections is very large (1,129 units), the smaller unit count here (415) affords it a lot more privacy.

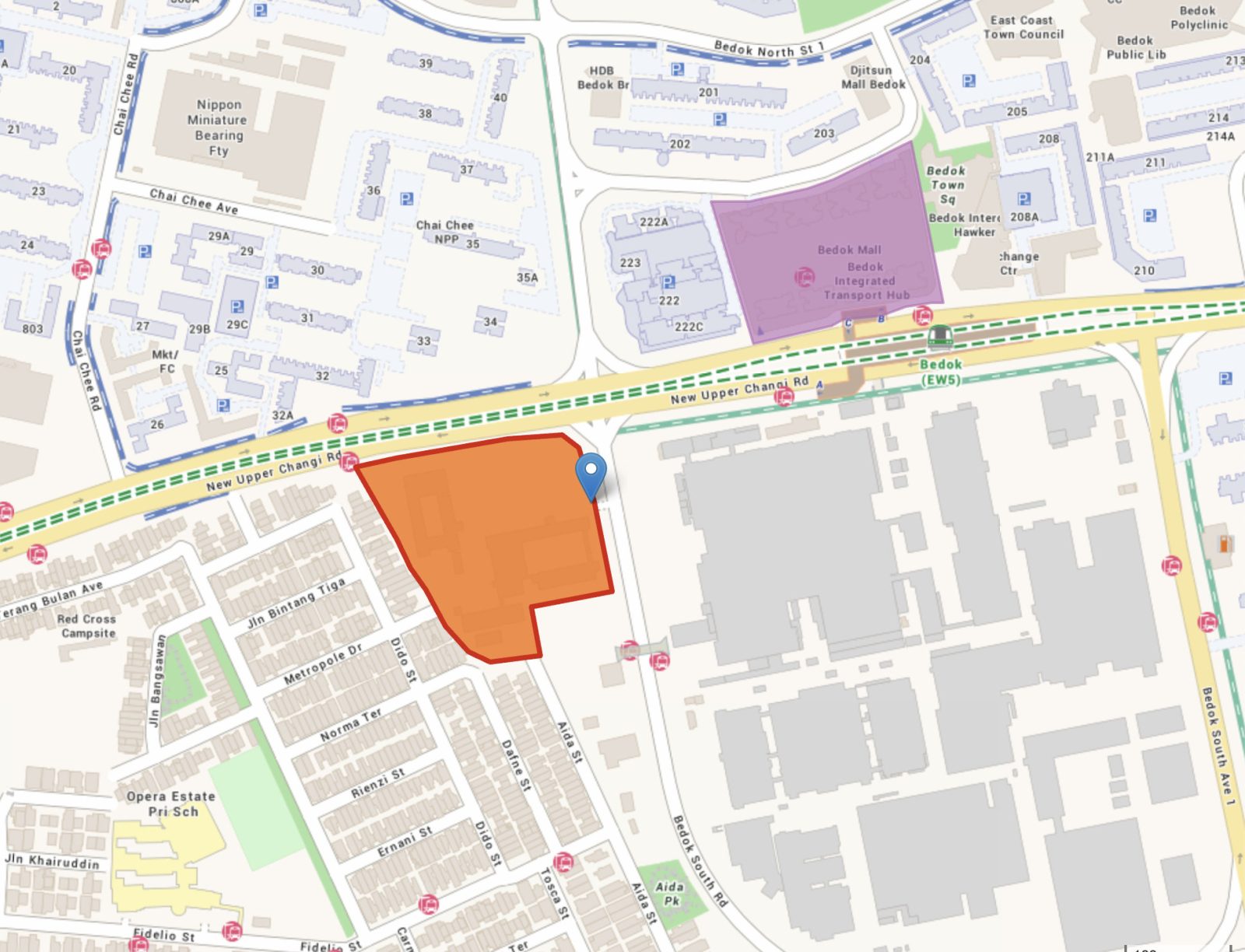

6. New Upper Changi Road (May 2026)

This plot is around 3.16 ha with a GPR of 2.8, and is expected to yield a very high unit count of 1,040 units; that’s mega-development status. And New Upper Changi Road is a very long stretch, but this specific part is simply Bedok – in fact, the hub of Bedok.

This land parcel is near Bedok Mall, and hence also close to Bedok MRT station (EWL). This area has been built up quite a bit over the years: besides Bedok Mall and the adjoining Bedok Interchange Hawker Centre, there’s also Djitsun Mall and a dense cluster of heartland amenities across the road. Sky Eden @ Bedok will also add further amenities to the area, once it’s built.

Fenghan Primary and Opera Estate Primary schools seem likely to be within one-kilometre, and Yu Neng Primary might be as well.

While this area is limited in terms of green space, it’s still very viable as a family area; it’s just that it’s a mature heartland area that’s heavily built-up, so it will appeal more to urbanites. The high unit count will compound this issue, so you’re trading some peace and quiet for better accessibility and convenience.

Some buyers may also dislike the traffic at a crossroads, but we assume the developer will take steps to handle any lower-floor noise issues.

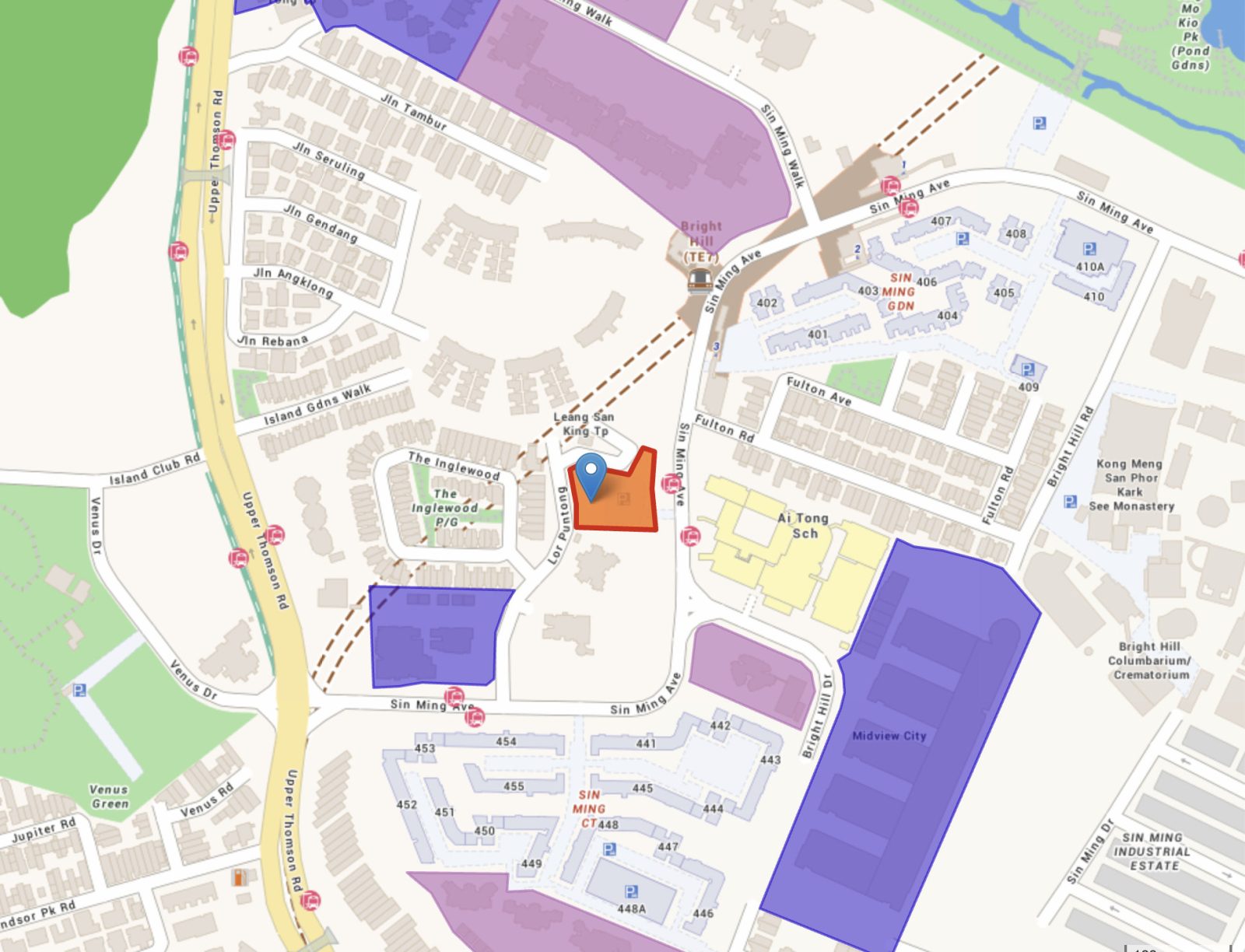

7. Lorong Puntong (Jun 2026)

This is the smallest plot on the confirmed list at 0.43 ha, with a GPR of 2.8. Some might call the project here a boutique development, with just around 140 units expected.

This land parcel is something of a mixed bag. It appears relatively close to Bright Hill MRT (TEL, CRL), but the walk may be a bit long; it may take a bit over 10 minutes. The facing toward Lorong Puntong will hold some appeal, being mainly landed homes in that direction, but there are also tall nearby projects like Country Esquire. We’ll have to wait to see how the developer maximises the views.

Ai Tong Primary is just across the road from this plot, but we don’t see other primary schools likely to fall within one kilometre. As for amenities, Midview City surprisingly has some famous food outlets, despite being an industrial area; and popular restaurants dot the wider Sin Ming industrial area. Retail is quite limited here though; you’ll have to take the train one stop from Bright Hill to Upper Thomson, where you’ll find Thomson Plaza.

Some homebuyers may also like the proximity of MacRitchie Reservoir nearby; and there is a facing toward Lorong Puntong that is a landed area (The Inglewood).

Overall, Lorong Puntong is difficult to read. It’s not conventionally attractive, yet it isn’t weak either. The nearby industrial workforce could mean a steady tenant pool; families may eye Ai Tong; and outdoor-oriented buyers might like the MacRitchie access. There is also room for future development in the area. But the surroundings are also not very mature (in the sense of supporting residential enclaves), and we don’t see any plans to build them up extensively; 140 units is hardly justification for that.

This may be one of the more unpredictable plots in the 1H 2026 GLS slate.

Reserve list sites

These sites will be put up for sale only if a developer’s bid meets a minimum set by the government.

- Morrison Lane (Feb 2026)

- Town Hall Link White Site (Mar 2026)

- Kitchener Link (Jun 2026)

1. Morrison Lane (Feb 2026)

This is a small 0.66 ha site with a GPR of 2.8, and an estimated yield of 200 new homes. There’s also 700 sqm of available commercial space.

The smaller size of the plot, along with the location along Mohammed Sultan Road, might raise developer confidence; we won’t be surprised to see if this one gets taken up. The location is also close to Fort Canning MRT (DTL), and is close to major retail/lifestyle spots like Robertson Walk, UE Square, and Riverside Point. Access to the Singapore River area also means a lot of nightlife, and there are plenty of (generally high-end) restaurants in the area. While Clarke Quay isn’t what it used to be, it still remains a draw for younger tenants or homeowners.

Rental is the first thing that comes to mind here, as the location is close to the CBD and has an established expatriate presence. However, it might also appeal to singles and couples, who have shown an interest in properties like River Green of late; it will come down to how low the developers manage to keep the quantum (and less so $PSF).

River Valley Primary is within one kilometre of here, but we doubt this is relevant; this is really more a location for working professionals and investors, and less so for families.

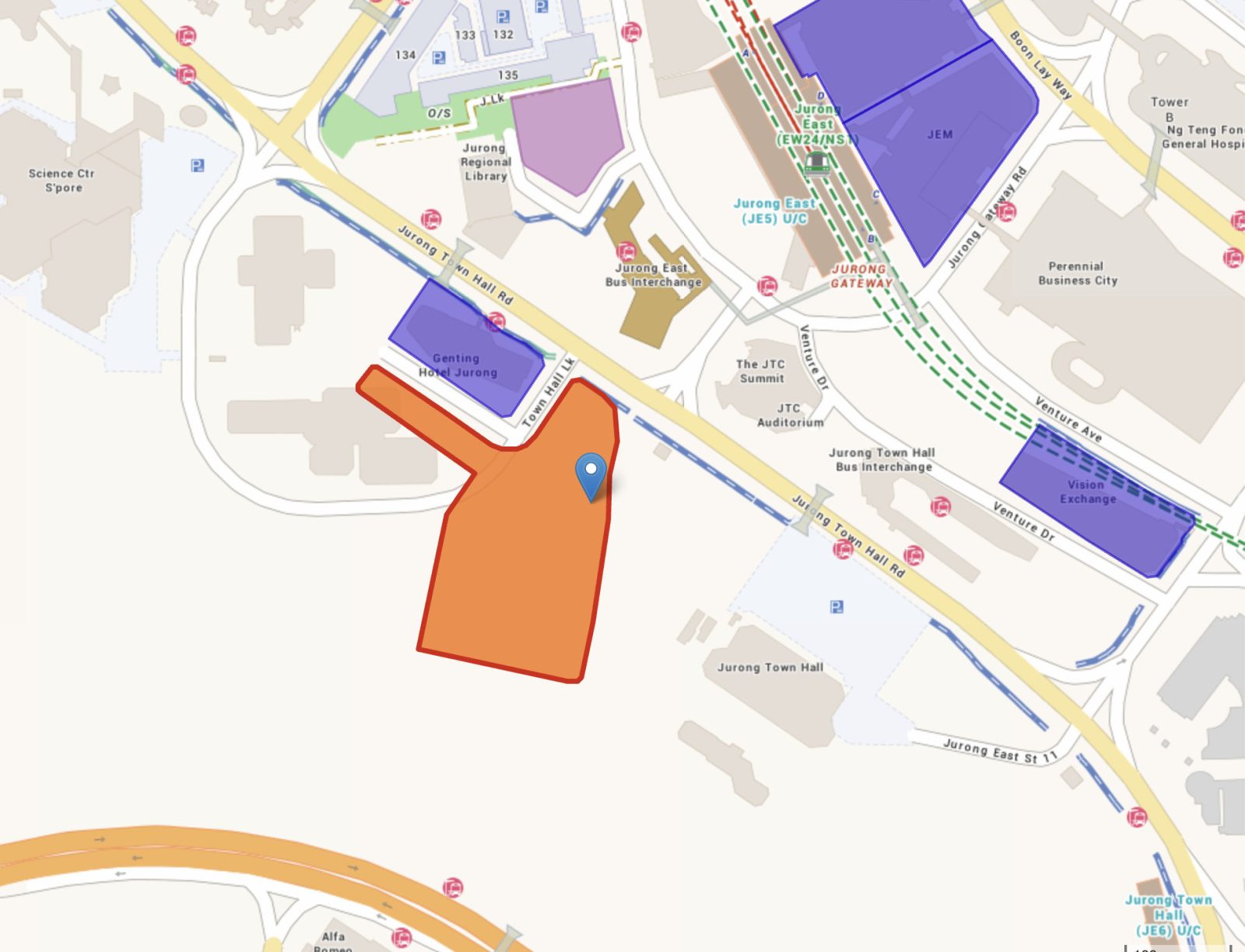

2. Town Hall Link White Site (Mar 2026)

This white site will be closely watched, as it’s a major part of the Jurong Lake District’s development. This is a 3.72 ha site that can yield an estimated 1,200 new homes, with 84,000 sqm of commercial space: sufficient to form a major new hub. It’s part of the JLD master developer site, which was earlier split into different parcels for easier sales.

This plot is just across from the Jurong East Interchange (EWL, JRL), and the various malls like JEM that now define the area. For buyers, a future project here could be a large-scale integrated development, with a mall component, MRT link, and park connectors by Jurong Lake.

However, the sheer size and multi-use expectations mean this is a colossal undertaking for a developer; and it will take a very large and confident entity – or perhaps a consortium – to start building this next urban centre. Whatever results from it, launch prices will have to be competitive, given the number of units and scale of the project. Early-movers here, by which we refer to the developer(s) and their first buyers, would be betting on JLD’s long-term future as a second CBD.

The response to this site might be viewed as a bellwether of developer confidence, so it’s definitely worth keeping an eye on.

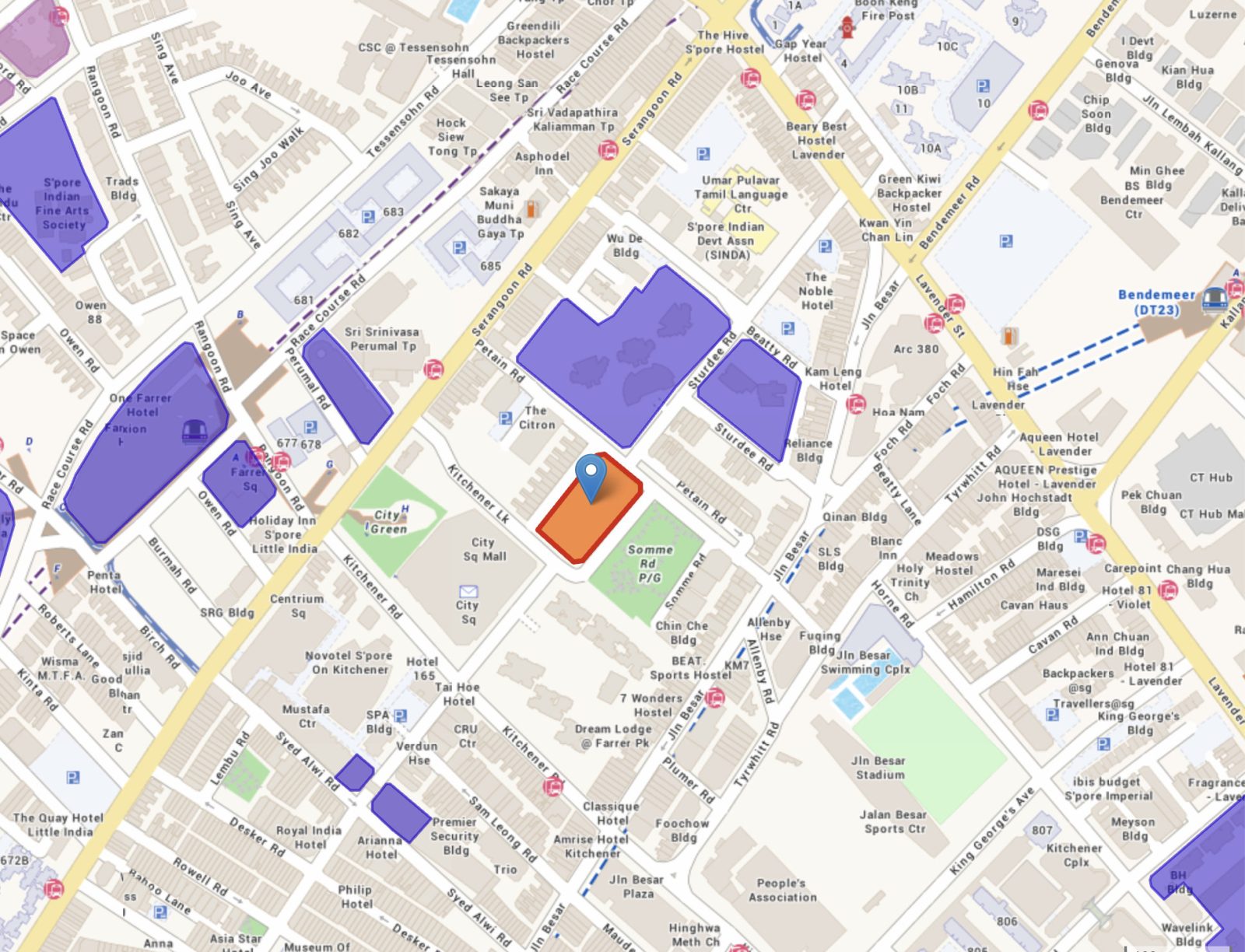

3. Kitchener Link (Jun 2026)

This is a very small 0.39 ha site with a GPR of 3.0, which can yield an estimated 135 new homes; some might consider the resulting development to be boutique.

This area had a bit of a rough past, as some older Singaporeans might remember Petain Road to be a red light area; but today the area consists of conservation shophouses with offices, studios, and some eateries. It’s better known for being close to City Square Mall, and also for easy access to the heart of Little India. This also makes it a very convenient location, with lots of food, convenience stores, shopping, etc. in the immediate surroundings.

Accessibility is good here, as it’s close to two MRT lines: Farrer Park on the NEL, and Jalan Besar on the DTL. While there are also Primary schools nearby (Farrer Park and Stamford Primary might be within one-kilometre), it’s not really a family location – it’s heavily built up and lacks green spaces, and this is a location for urbanites only. A project here would be well-suited to investors or to singles and young couples who enjoy proximity to the city centre.

These sites suggest H12026 might see a rather interesting range of developments, with a continued drive toward city centre locations. Follow us on Stacked, so we can update you on the changes as they happen.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are the upcoming new housing sites in Singapore for 2026?

How old is the Holland Plain site set for development in 2026?

What is special about the Bayshore Drive site coming in 2026?

Where is the River Valley Green Parcel C located and what can it offer?

What are the main features of the Peck Hay Road development in 2026?

What is the significance of the Town Hall Link White Site on the reserve list?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Singapore Property News The Most Expensive Resale Flat Just Sold for $1.7M in Queenstown — Is There No Limit to What Buyers Will Pay?

Latest Posts

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

On The Market Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

0 Comments