The Costly Mistake Of Buying The Wrong Property In Singapore In 2024

June 2, 2024

The high cost of getting your property purchase wrong in Singapore.

Do you need to wait a few more years to afford a condo? Or are you just unsure? Then you may just want to wait.

There are people – some of them industry professionals – who will tell you that’s bad advice. The cost of private properties increases every year, rises faster than HDB flats, etc. By now you’ve probably seen the “HDB vs. Condo price gap” chart a million times over. And I’m not saying they haven’t got a point:

Yes, it’s true that waiting longer probably means paying more for your private property. But the thing is, paying a bit more is much less painful – and less risky – than buying a condo when you’re not ready.

Case in point: young, over-eager buyers who jump into the first condo unit they can afford, even if it’s just a one-bedder. They may not even be staying in it, just looking to rent it out while they’re still living with parents, a partner, etc.

And if it’s not the investment prospects, there’s the appeal of being able to say you live in a condo in Bugis, Anson Road, Holland V, etc. Even in 2024, this really is possible for under a million dollars, if you stick with a one-bedder.

But what really came to mind to me was this, when I wrote about the craziest property flipping piece recently:

There’s no undo button if you buy a condo before you’re ready.

Unlike the earlier years where you could buy a property and sell it the next day if you suddenly had cold feet, or stayed for a month and realise that quiet living next to the forest isn’t for you – you don’t have that luxury today.

First, there’s the Sellers Stamp Duty (SSD). Sell within the first three years of buying, and you’ll be taxed 12%, 8%, and 4% of the sale proceeds on the first, second, and third years respectively.

Second, consider that the sale proceeds may not also cover renovations. If you’ve blown $30,000 to $50,000 renovating your shoebox unit, don’t assume you’re getting it back when you sell. It doesn’t matter how new the renovations are: I’ve seen homebuyers tear down renovations less than three years old because they want to make it their own space.

Third, unless you’re 55 years old and downsizing to a smaller flat, there’s a 15-month wait for you to buy a resale flat. If you don’t want a resale flat that’s pricier, older, and requires more renovations…good luck, because you need to wait 30 months before you can apply for a BTO flat.

So consider what happens if you buy a one-bedder, and a short while later you meet the right person. You want to move in together, start a family, etc. But a one-bedder isn’t big enough for that; and you can’t get a flat while you own a private property. So this forces you to sell the condo, possibly in a downmarket.

There’s a real risk that the financial damage is so significant, you would have been better off just waiting a few more years.

More from Stacked

The Hidden Cost Of Homeownership: How A $1M Home Could Lead To $300K In Interest Alone Over 10 Years

One of the least interesting property topics is financing. Home loans are dry, complicated, and don’t make for easy reading;…

As such, regulations such as the SSD or MOP make it even more important that you get that decision right – if not, it would become a big regret.

In other news, HDB is piloting a new layout: an open-concept unit without partition walls.

This design, which is also beamless, can be found in the Kallang-Whampoa area, sometime during the October BTO launch. It’s called the White Flat Layout, and it gives the home buyers total flexibility in how they customise their units.

I see this as a nod to smaller families and lifelong singles. For the past decade, Singaporeans have had fewer children, with many opting to stay single, or as a couple for life. For this group, it may be preferable to have a bigger living room, study, or specialised room (e.g., music studio or home gym), rather than an added bedroom.

However, the question is whether this adds to the complexity of renovations (not necessarily in terms of monetary cost, but also time required). And we’ve long heard that having more rooms is generally better for resale gains; most people want more bedrooms, not fewer. Overall, I think the new concept may appeal a little less to families, but more to couples and lifelong singles.

Interior Designers are going to throw a party over this though. Finally, versatile and easy-to-work-with layouts!

Meanwhile in other property news:

- Freehold, three-bedder condos aren’t going to be cheap; and maybe the best we can do right now is to keep it below $2 million.

- 3-room or 4-room flats? Here are a couple of other things to consider, besides the size.

- There are some harsh truths about the Singapore property market that need to be addressed, but the quicker we accept it the better.

We compared the profits of one, two, and three-bedder condos to check out the returns. Here’s what we found.

Weekly Sales Roundup (20 May – 26 May)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SKYWATERS RESIDENCES | $47,342,000 | 7761 | $6,100 | 99 yrs |

| THE RESERVE RESIDENCES | $7,419,561 | 3003 | $2,471 | 99 yrs (2021) |

| WATTEN HOUSE | $4,799,000 | 1539 | $3,118 | FH |

| PERFECT TEN | $4,359,000 | 1281 | $3,403 | FH |

| THE MYST | $3,316,000 | 1690 | $1,962 | 99 yrs (2023) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| LENTORIA | $1,220,000 | 538 | $2,267 | 99 yrs (2022) |

| THE LANDMARK | $1,476,000 | 517 | $2,857 | 99 yrs (2020) |

| HILLHAVEN | $1,513,850 | 721 | $2,099 | 99 yrs (2023) |

| THE MYST | $1,545,000 | 678 | $2,278 | 99 yrs (2023) |

| LENTOR HILLS RESIDENCES | $1,633,000 | 721 | $2,264 | 99 yrs (2022) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| HILLTOPS | $8,360,000 | 2,379 | $3,514 | FH |

| MARINA BAY SUITES | $5,650,000 | 2,691 | $2,100 | 99 yrs (2007) |

| THE PEAK@BALMEG | $4,900,000 | 3,068 | $1,597 | FH |

| CHELSEA GARDENS | $4,700,000 | 2508 | $1,874 | FH |

| D’LEEDON | $3,980,000 | 1981 | $2,010 | 99 yrs (2010) |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PRESTIGE HEIGHTS | $668,000 | 398 | $1,677 | FH |

| EDENZ SUITES | $700,000 | 484 | $1,445 | FH |

| SKYSUITES17 | $735,000 | 366 | $2,008 | FH |

| EUHABITAT | $765,000 | 549 | $1,394 | 99 yrs (2010) |

| KINGSFORD . HILLVIEW PEAK | $770,000 | 527 | $1,460 | 99 yrs (2012) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| MANDARIN GARDENS | $2,820,000 | 2034 | $1,386 | $1,910,000 | 18 Years |

| THE PEAK@BALMEG | $4,900,000 | 3068 | $1,597 | $1,699,000 | 14 Years |

| SOLEIL @ SINARAN | $3,850,000 | 1722 | $2,235 | $1,689,000 | 17 Years |

| THE NEXUS | $2,220,000 | 947 | $2,344 | $1,463,000 | 17 Years |

| HAIG COURT | $2,868,000 | 1453 | $1,974 | $1,443,000 | 14 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| MARINA BAY SUITES | $5,650,000 | 2691 | $2,100 | -$2,050,000 | 9 Years |

| THE ASANA | $1,588,000 | 635 | $2,500 | -$115,000 | 6 Years |

| SPOTTISWOODE 18 | $1,200,000 | 753 | $1,593 | -$80,100 | 13 Years |

| DUO RESIDENCES | $1,550,000 | 721 | $2,149 | -$27,000 | 10 Years |

| PARC SOPHIA | $1,273,000 | 840 | $1,516 | -$7,000 | 11 Years |

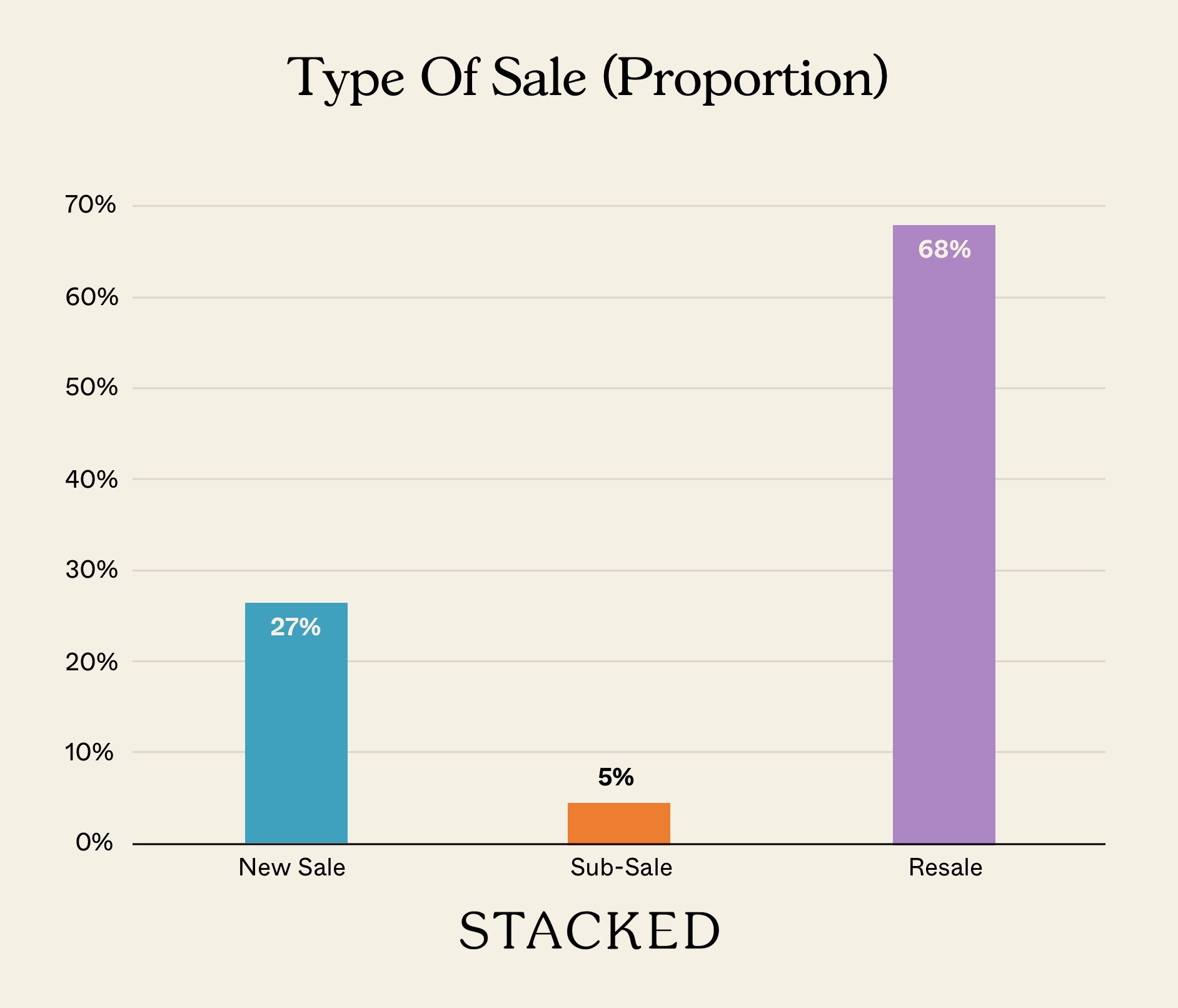

Transaction Breakdown

For more news on the Singapore property market, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why is buying a property before you're ready considered a costly mistake in Singapore?

What are the risks of selling a condo shortly after purchasing it in Singapore?

How do regulations like Seller's Stamp Duty and Minimum Occupation Period influence property buying decisions in Singapore?

What is the new open-concept flat layout introduced by HDB, and who might it appeal to?

Are freehold, three-bedroom condos in Singapore still affordable?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Singapore Property News The Most Expensive Resale Flat Just Sold for $1.7M in Queenstown — Is There No Limit to What Buyers Will Pay?

Latest Posts

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

On The Market Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

0 Comments