Slower Sales At One Marina Gardens And Bloomsbury Residences: A Sign That Buyer Sentiment Is Cooling?

April 17, 2025

The fast sales of Parktown Residence, Lentor Central Residences, and previously Emerald of Katong have set expectations quite high. A number of market watchers speculated that we might see the same for Bloomsbury Residences and One Marina Gardens (OMG). After all, both new launches had sales pitches positioning them as “first movers,” which also echoes the main advantage of Parktown. However, sales have been – to put it bluntly – a little on the average side. What might this imply about the market so far?

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

A rundown on Bloomsbury and OMG sales

OMG was 38 per cent sold on its launch weekend, at an average price of about $2,953 psf. Bloomsbury Residence achieved slightly over 25 per cent at $2,474 psf. For reference, the expected performance of most new launch condos to date – according to agents on the ground – is about 60 to 70 per cent sold on launch weekend.

That said, there were expectations that these new launches might be slower, for reasons detailed further below.

Realtors said the bulk of units sold for OMG were one and two-bedders, and for Bloomsbury two-bedders made up about 70 per cent of units sold (note that Bloomsbury has no one-bedders). One of the units sold at Bloomsbury was notably a six-bedder penthouse, which fetched a reported $2,700 psf.

It’s also unsurprising that the smaller units moved first, given the low quantum: the one-bedders at OMG ranged at around $1.2 million, whilst Bloomsbury’s two-bedders were at around $1.37 million. However, it is an interesting departure from recent launches like Orie, where two and three-bedders were the more popular, and also from Parktown Residence, where 82 per cent of the three-bedders were sold at launch.

The performance contrasts strongly with recent success stories like Parktown Residence (87 per cent sold on launch weekend), Lentor Central Residences (93.3 per cent sold on launch weekend), and Emerald of Katong (99 per cent sold at launch).

For Lentor Central Residences and Emerald of Katong, we can chalk it up to exceptional layouts (Lentor) and lower prices than nearby launches (Emerald). But Parktown Residence was in a rather similar position to both Bloomsbury and OMG: it was largely pushed on the basis of “first mover advantage.”

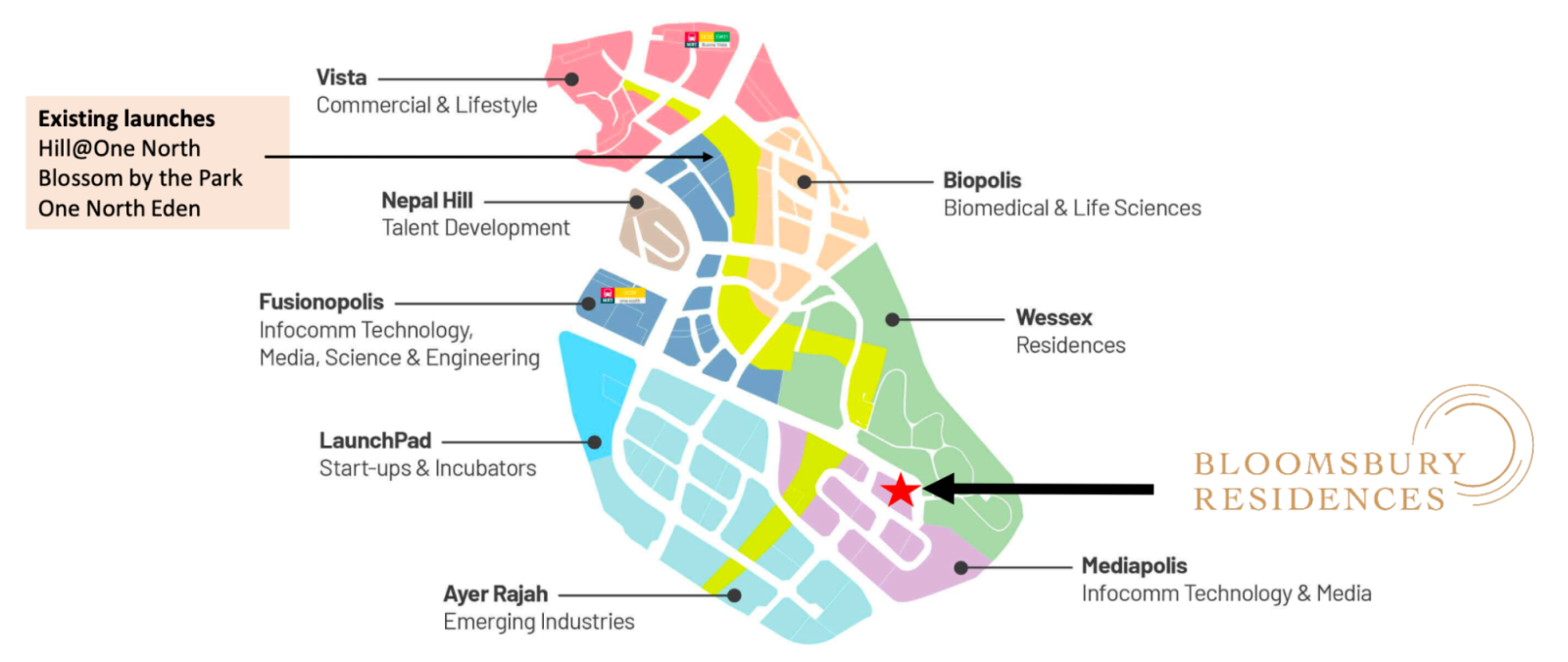

OMG, for instance, is the first residential project in Marina South (details here), and is the first of 16 residential plots in the area. We also noted that Bloomsbury is the largest launch in One-North so far; while there are other condos in One-North, most are smaller and have more limited facilities. So to be clear, we don’t think it’s just marketing spiel that these projects meet the qualities of being first movers. They do. But unlike the strong response from Parktown Residence, buyers didn’t seem too moved.

So, what are the reasons for the slower launch numbers?

Some of the main hurdles that these launches faced were:

1. Concerns of MRT access for Bloomsbury

Bloomsbury Residences doesn’t have an MRT station within easy walking distance. While there are bus connections, this could be a concern for family buyers who may not drive. So even though Bloomsbury is definitely more for own-stay use than for rental, it could impact those who do intend to rent out.

This is less of an issue for OMG, which is directly accessible to the Marina South MRT station (TEL). While this station is not yet operational, it is already completed – it’s just shuttered until sufficient people are living nearby to justify its opening.

2. OMG is a bit early on the ground

OMG is very early, and has even fewer supporting elements in its surroundings than Lentor Central Residences (which at least has a landed enclave to support sales). Despite being in the Marina area, Marina South, as a concept, “10-minute neighbourhood” is only just getting off the ground.

More from Stacked

HDB Landed Terrace Houses: 5 Factors You Must Consider Before Buying One

If an HDB property is 49-years old, you’d expect nothing but depreciation. But what if it’s a landed home? This…

For buyers who seek instant convenience – not unreasonable for a central region buyer – the wait isn’t always palatable.

3. Transitional land pricing issues, and price perception

The general perception of the pricing is “expensive,” although as a point of note, Bloomsbury Residences is actually a bit cheaper than ELTA on average. This perception may also be linked to buyers focusing on price per square foot – an indicator that disadvantages newer projects, which have to exclude features like air-con ledges due to GFA harmonisation rules.

However, a realtor clued us in on another factor for OMG: higher land prices. He pointed out a situation in the past, when land prices in 2016/2017 were lower than in 2018. At the time, this caused projects launched in 2018 to be harder to sell (e.g., Florence Residences, Dairy Farm Residences, and Woodleigh Residences, which even lowered prices). We might be seeing this effect for OMG, where the land was acquired for $1,402 psf in June 2023.

This was a record high for the Marina South area: consider that just a couple of years prior, in 2021, the Marina View site was acquired for just $1,379 psf.

On a wider scale, in 2024, the government paused its previous ramp-up in the supply of sites. This pause was coupled with a move to put up more high-value (read: expensive) plots. This was also accompanied by developers shying away from the en-bloc market; factors that subsequently raised land prices for some of the latest launches.

The same agent opined that, once the recent Bayshore plot is developed and launched, OMG may even look cheap (the Bayshore development is expected to start from $2,500 to $2,600 psf). But for now, the perception is that OMG is pricey; a fact that isn’t helped by Marina’s longstanding association with wealthy expat renters and foreign buyers.

For Bloomsbury Residences, the still-unfolding One-North area is of a more niche interest to homebuyers, and the high quantum of larger premium units (see our linked review above) may be a stretch at this point.

4. Bad timing, as the launches coincided with tariff announcements

Tariffs by the US and China in an escalating trade war coincided with these two launches. From the news and on the ground, we’ve heard this being blamed for buyers turning cautious and stalling their decision to buy.

Whilst plausible, we don’t have any way to test or prove this theory. Some agents we spoke to were skeptical of this, noting that there were fears about the wider economy during the launches of Parktown, Lentor Central, ELTA, etc., as well, but those launches performed well anyway.

5. The aftermath of high consumption from previous launches

The reason for the slower sales may very well be the higher sales previously. As we’ve mentioned, the bulk of new launches (14 out of around 22 to go) are all slated for the high-priced CCR.

For buyers watching the market, they would have been well aware that projects like ELTA, Parktown, Aurelle at Tampines, etc., are among the last few that are outside the CCR, and hence affordable. These buyers may have rushed in to make their purchases already, hence the more limited interest in later, high-quantum launches.

We may well see repeat incidents of slower launch weekends as they begin to fill the CCR over the coming year. This is yet another reason why market watchers predicted slower sales for OMG and Bloomsbury; and we can say things broadly fell in line with expectations.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why did sales for Bloomsbury Residences and One Marina Gardens fall short of expectations?

How did the sales performance of Bloomsbury Residences and One Marina Gardens compare to other recent launches?

What factors affected buyer interest in One Marina Gardens and Bloomsbury Residences?

Are the prices of these new launches considered high compared to other projects?

Could the timing of the launches have influenced sales?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

0 Comments