Will Core Central Region Condos Make A Comeback In 2025? Here’s What’s Changing

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

The Core Central Region (CCR) has long held a reputation of being exclusive, expensive, and the stomping ground of wealthy foreigners. For this reason, news about the CCR seldom gets as much traction: most people want to read or know about the Outside of Central Region (OCR), where more Singaporeans tend to live, or the Rest of Central Region (RCR), which tends to have the highest prices most of us call reasonable. But there’s been a huge shift in the market of late, and the next half of 2025 might see much more attention being on the CCR. Here’s why:

Factors driving interest to the CCR in the coming year

1. Availability of new launches

The current batch of new launches, such as Parktown Residence, Aurelle of Tampines, Lentor Central Residence, Bagnall Haus, ELTA, etc. are almost sold out, or selling fast. What’s coming after these new launches are overwhelmingly in the CCR.

One realtor explained that, for 2025, there are about 30 new projects. Of these, around eight have already launched. Of the remaining 22, more than half (about 14 projects) will be in the CCR. (Valid as of March 2025)

This has also been cited as the reason for strong sales at Parktown, Lentor Central, etc. Even the OCR-located ELTA managed to move 65 per cent of its units during launch weekend, despite online perceptions of high prices.

In many of these cases, buyers are reacting to the plainly written truth: if they haven’t bought now, their next new launch choices are going to be in the CCR. If they’re priced out of the CCR, they’re going to be forced into fighting for the few resale options currently on the market: there are fewer sellers in 2025, on account of the higher cost of replacement properties.

As we write this, Aurea (formerly Golden Mile) has begun sales. The rest of the coming line-up involves names like Marina View, Arina East, and the as-yet unnamed prime spots along Zion Road and Margaret Drive. As such, we’d brace for property news or new launch recommendations to be heavily CCR-focused.

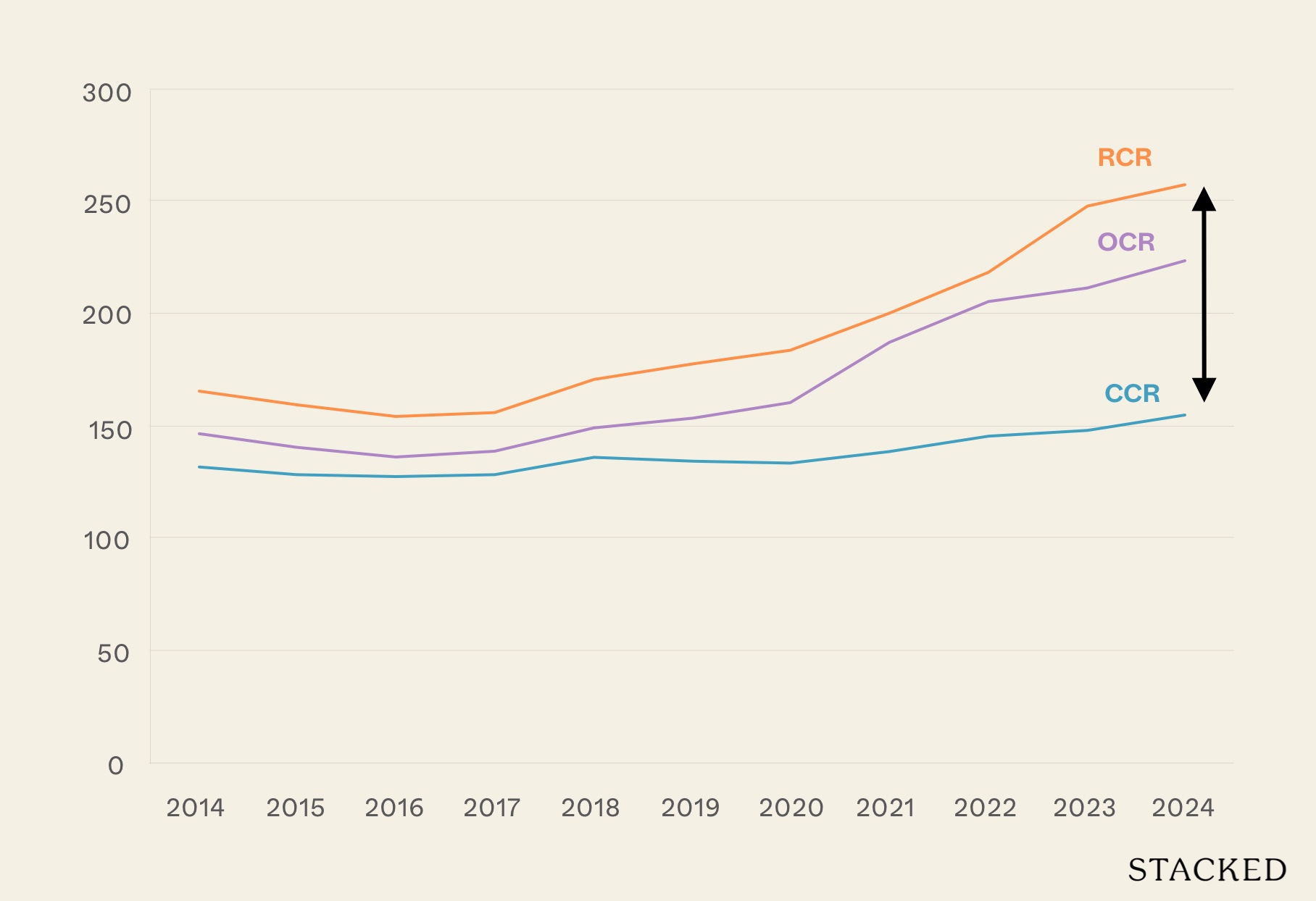

2. Narrower price gaps

Perhaps due to the pounding taken from a cooling measure (see below), the RCR and OCR have had an opportunity to catch up. This was what led us to question, as far back as May 2023, whether the CCR was becoming undervalued.

There was a lot of foreshadowing to what we’re seeing now. At Parktown, a roughly similar-sized three-bedder might be around $2.07 million. In contrast, Aurea’s three-bedders are priced at around $2.86 million for around 1,001 sq.ft. – but given the central location and larger size, buyers with sufficient budget may see it as a better deal. Another point of comparison would be Emerald Of Katong (about $2.1 million to $2.3 million for various three-bedders), which might sometimes be even a bit lower than its OCR and RCR counterparts.

Property agents noted that, once projects in a given region come close to the prices of a more central or prestigious region, buyers tend to upgrade. E.g., if OCR prices come close to the RCR, then buyers may decide they may as well buy in the RCR. But now, we’re seeing both OCR and RCR prices come very close to the CCR.

One realtor opined that this likely wouldn’t last, and that the gap will likely widen again in future (some of this is a reaction to the cooling measure) – but it does provide a brief window of opportunity for upgraders.

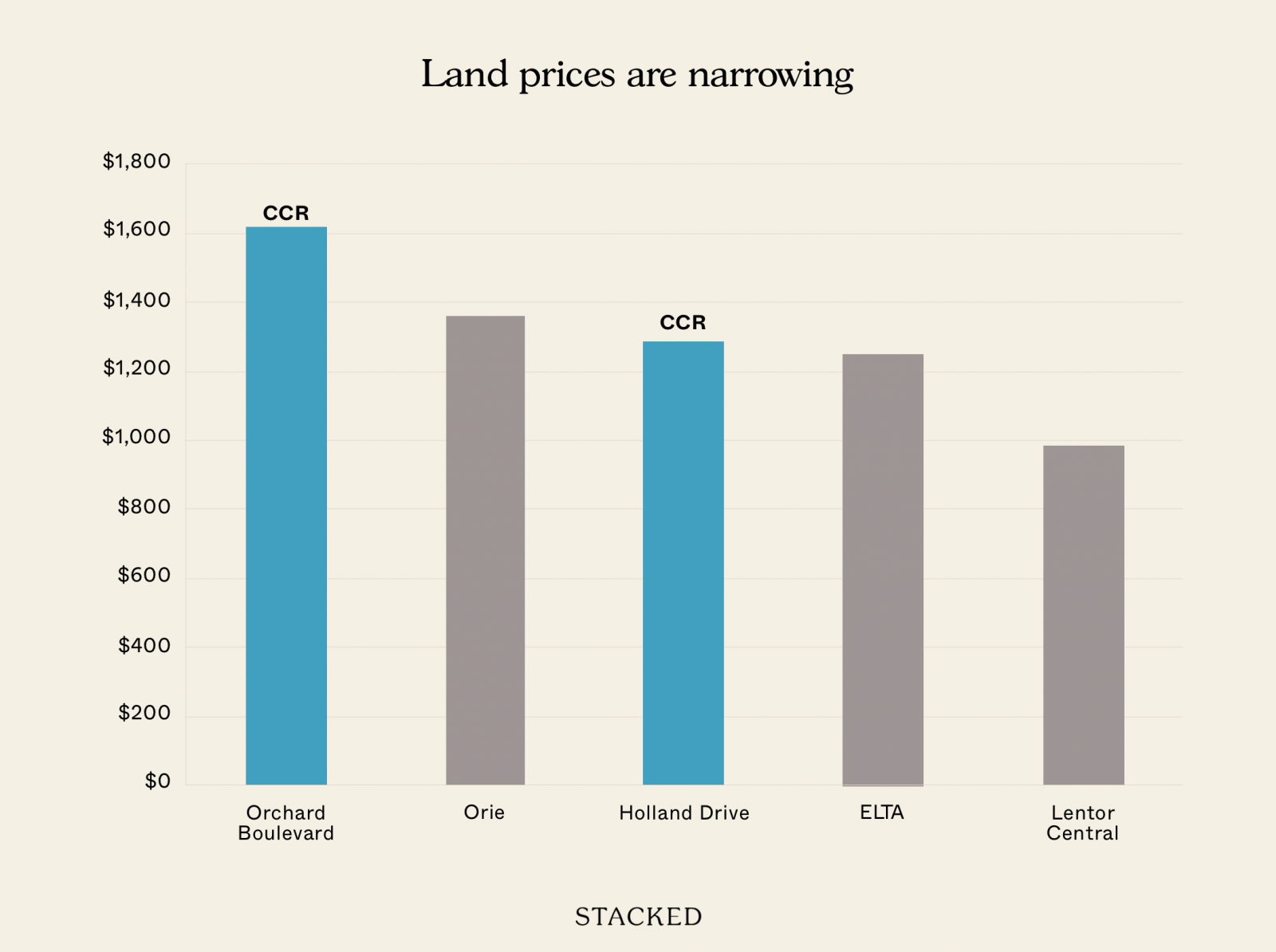

3. Narrowing of land sale prices

The Government Land Sales (GLS) price for the Lentor Central site was $435.17 million, which translates to approximately $982 psf. The price for the ELTA development site was approximately $633.45 million, which translates to about $1,250 psf. These were in the OCR. Meanwhile the Orie in the RCR had a land bid price of $1,360 psf.

More from Stacked

Buying Land At A 30% Discount At Marina South: A Good Deal Or A Sign Of Weak Demand?

That’s how I would feel, if I were the consortium of developers that won the recent bid for a Marina…

Now consider that the Holland Drive land site (a 680-unit condo near Holland Village in the CCR) was acquired in May 2024 for $805.39 million, or about $1,285 psf. Also, the Orchard Boulevard GLS site (for a 280-unit luxury project) was acquired at $428.28 million, or $1,617 psf.

In the eyes of developers, this could make it more sensible to pick a CCR plot, if the land prices are closer to the RCR, or possibly even some of OCR condos.

Besides this, we note that the available supply of GLS land in the CCR has gone up. This is not recent: the CCR supply was already raised from 270 units in 2H 2023 to1,060 units back in 1H 2024, and there’s plans for more to come. As such, it’s not too surprising to see a bigger number of projects there.

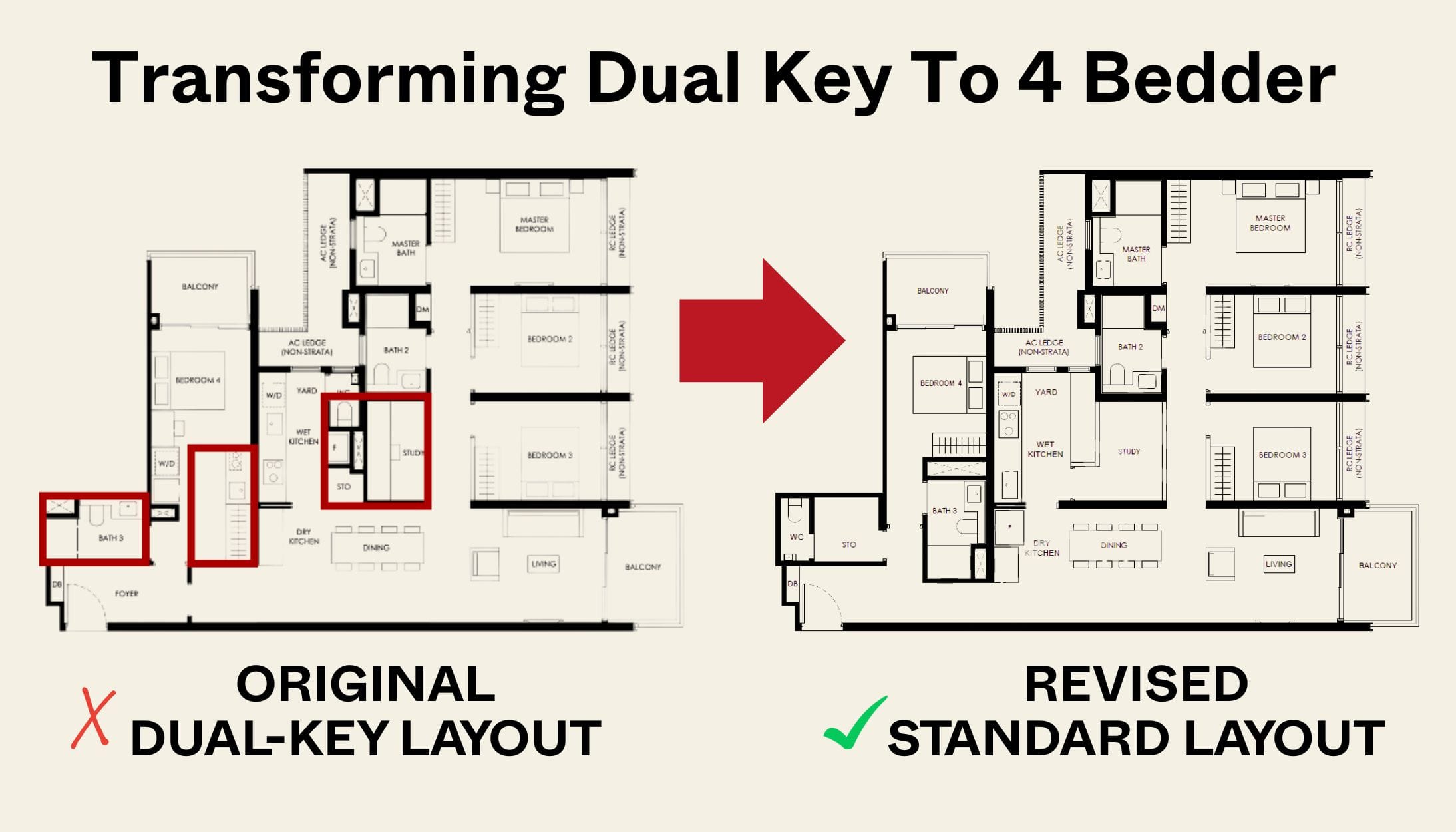

4. Better catering to families

Properties in the CCR used to be more investor-oriented, and lacking in certain qualities that families prefer. Projects may have been angled more toward tenants, or toward affluent singles / young urban professional couples.

But recent CCR projects like Aurea* and The Collective at One Sophia have taken to more family-friendly layouts: like their fringe region counterparts, there’s more attention to details like effective kitchen spaces, making sure bedrooms can fit at least queen-sized beds, using efficient dumbbell layouts, etc.

The only thing the CCR will struggle with for some time though, is the lack of school access for some projects (Aurea has this issue).

URA’s attempts to “balance out” the CCR will also take time. There are ongoing efforts to make CCR neighbourhoods into versatile live-work-play environments; so we won’t have situations like the CBD, which becomes a ghost town every weekend. This transformation will improve future appeal to family buyers, and it might change the view of the CCR as a zone for just rich expatriates.

*Aurea is in District 7, which is technically in the RCR. However, parts of District 7 are arguably within the CCR, and Aurea has been marketed as a CCR property.

5. Less competition from landlords and foreign investors

Earlier we mentioned that cooling measures have hit the CCR hard. What we refer to, specifically, is the doubling of Additional Buyers Stamp Duty (ABSD) for foreigners: this now stands at 60 per cent. Even for local landlords, an added ABSD of 20 per cent is a considerable cost.

Previously, these investors with deep pockets emboldened developers to price much higher. Now that the ABSD has disincentivised them, developers have to factor in local buyers and family units, which is a rather significant change. During this transition period, there’s a natural restraint on how much a CCR property can cost.

Is this good news or bad news?

It’s a mix of both. For some, this represents an opportunity to break into the CCR – and in the very long-term picture, it avoids a situation where Singapore’s central areas are almost entirely dominated by affluent foreigners or landlords.

In the more immediate sense, however, this could be a limiting factor to homebuyers. When it comes to the CCR, it’s not just about money: some families don’t want to live in glass-and-concrete jungle, or in an area far from familiar heartland settings. They may be disappointed to see fewer OCR new launches going forward, as resale options are also limited.

For more on the situation as it unfolds, follow us on Stacked. If you’d like to get in touch for a more in-depth consultation, you can do so here.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Market Commentary

Property Market Commentary A First-Time Condo Buyer’s Guide To Evaluating Property Developers In Singapore

Property Market Commentary Why More Young Families Are Moving to Pasir Ris (Hint: It’s Not Just About the New EC)

Property Market Commentary This Upcoming 710-Unit Executive Condo In Pasir Ris Will Be One To Watch For Families

Property Market Commentary Which Central Singapore Condos Still Offer Long-Term Value? Here Are My Picks

Latest Posts

Landed Home Tours Where $4 Million Semi-Ds Sit Next To $40 Million GCBs: Touring First Avenue In Bukit Timah

Singapore Property News So Is The 99-1 Property Split Strategy Legal Or Not?

New Launch Condo Reviews Transforming A Dual-Key Into A Family-Friendly 4-Bedder: We Revisit Nava Grove’s New Layout

On The Market 5 Cheapest HDB Flats Near MRT Stations Under $500,000

New Launch Condo Reviews The Robertson Opus Review: A Rare 999-Year New Launch Condo Priced From $1.37m

Singapore Property News Higher 2025 Seller’s Stamp Duty Rates Just Dropped: Should Buyers And Sellers Be Worried?

Pro Same Location, But Over $700k Cheaper: We Compare New Launch Vs Resale Condos In District 7

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

New Launch Condo Analysis This Rare 999-Year New Launch Condo Is The Redevelopment Of Robertson Walk. Is Robertson Opus Worth A Look?

Pro We Compared New Vs Resale Condo Prices In District 10—Here’s Why New 2-Bedders Now Cost Over $600K More

Singapore Property News They Paid Rent On Time—And Still Got Evicted. Here’s The Messy Truth About Subletting In Singapore.

New Launch Condo Reviews LyndenWoods Condo Review: 343 Units, 3 Pools, And A Pickleball Court From $1.39m

Landed Home Tours We Tour Affordable Freehold Landed Homes In Balestier From $3.4m (From Jalan Ampas To Boon Teck Road)

Singapore Property News Is Our Housing Policy Secretly Singapore’s Most Effective Birth Control?

On The Market A 10,000 Sq Ft Freehold Landed Home In The East Is On The Market For $10.8M: Here’s A Closer Look

What does the 0 – 300 on the y axis refer to?

presumably, price movement, indexed to 100. they don’t state where the starting point is