Why This New Clementi Condo Sold 326 Units At $2,537 PSF: 4 Reasons For Elta’s Demand

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Perhaps it’s an echo chamber effect; but despite a lot of online grumbling, ELTA defied expectations on the ground to sell 65 per cent of its units at launch. This Clementi-area condo, which drew some negative comments over pricing and an AYE facing, has more or less shrugged off its detractors. We spoke to market watchers to find out why ELTA’s sales still look robust:

What happened at ELTA’s launch?

ELTA sold 326 of 501 units over its launch weekend, at prices averaging $2,537 psf. Note, however, that the high price psf is partly due to GFA harmonisation: the square footage excludes elements like air-con ledges, which can push up the price psf (without changing the actual total price).

ELTA’s two-bedders led sales, with almost all of the 179 units sold at an average quantum of $1.388 million. Meanwhile, the three-bedders averaged $2.198 million, while the one-bedders averaged $1.158 million.

We do note, however, that dual-key units moved slowly during the launch. Out of 36 such units (all four-bedders), only two such units were sold. In theory, the dual-key units should see buyers because they can serve intergenerational families, and avoid the ABSD on a second unit. However, the market doesn’t seem too moved by this, but this is similar to what we are seeing from other new launches as well.

We were told only a single five-bedder was bought. We don’t have the details on this single transaction, but a five-bedder at ELTA is expected to reach around $3.88 million. This isn’t too surprising, as the largest units in any new launch are normally the slowest to move.

Why is ELTA selling well, despite the negative reaction to the price?

Some of the reasons given were:

1. Demand from “westies” and tight supply in the area

One realtor told us the buyers of ELTA were mainly “westies,” who prefer to live on that end of Singapore. This is significant as there’s not a lot of supply available for them, particularly in a desirable spot like Clementi. From word on the ground, agents told us that a lot of buyers were from areas like Bukit Timah, who see ELTA as a good own-stay unit.

ELTA is likely the final GLS site along Clementi Ave.1, at least for the foreseeable future. As such, upgraders in the surrounding HDB areas, or other west-side areas like Queenstown, could see ELTA as a rare opportunity.

That said, we should add that we have seen planned future developments near ELTA. One example of this is the Faber Walk GLS site, which was secured by GuocoLand in 2024. But this may not matter to the current market perception, which is that ELTA may be the lone development for some time to come.

2. Pricing was not actually much higher than many recent launches

Do note that, earlier in the announcement of ELTA, the perception of pricing was different. It did, for instance, gain attention for a starting quantum as low as $1.16 million.

Now we still wouldn’t call ELTA cheap, as it does set a new price record in this part of Clementi. But ELTA may not be as expensive as perceived, compared to some other recent launches. One example cited was the resistance price (i.e., the upper limit on a price the marker accepts) on three-bedders, in a new launch like Nava Grove. The resistance price for these units at Nava Grove was about $2,550 psf, which ELTA only slightly surpassed at around $2,600 psf.

More from Stacked

First Time Home Buyer Story: Buying A Condo After The 2007 Financial Crisis And Lessons Learned

It's certainly been some time since our last buyer story, but nonetheless we have quite an interesting feature this week.

In addition, the cheapest three-bedder in Nava Grove (at the time of writing) is $2.50 million, which forms the support price for ELTA. This means buyers may be looking at ELTA at least until its three-bedders exceed $2.5 million, at which point the pendulum may swing and buyers may go back to Nava Grove.

For reference, we have also made price comparisons between ELTA’s two-bedders, and some projects like Clavon or LakeGarden Residences. But we would consider ELTA’s pricing to be well-supported by the nearby Clavon in particular (see the link above for a more detailed breakdown).

In an overall market sense, we’d add that almost every new launch is crossing the $2 million mark for a three-bedder right now; so buyers are just unfazed by the quantum of an ELTA unit.

3. Units were built to match expected square footage, despite GFA harmonisation

This was something of a double-edged sword for the developer.

Due to GFA harmonisation, which excludes air-con ledges and other such unlivable spaces, the total square footage of ELTA would appear smaller – especially in contrast with pre-GFA harmonisation projects like Clement Canopy.

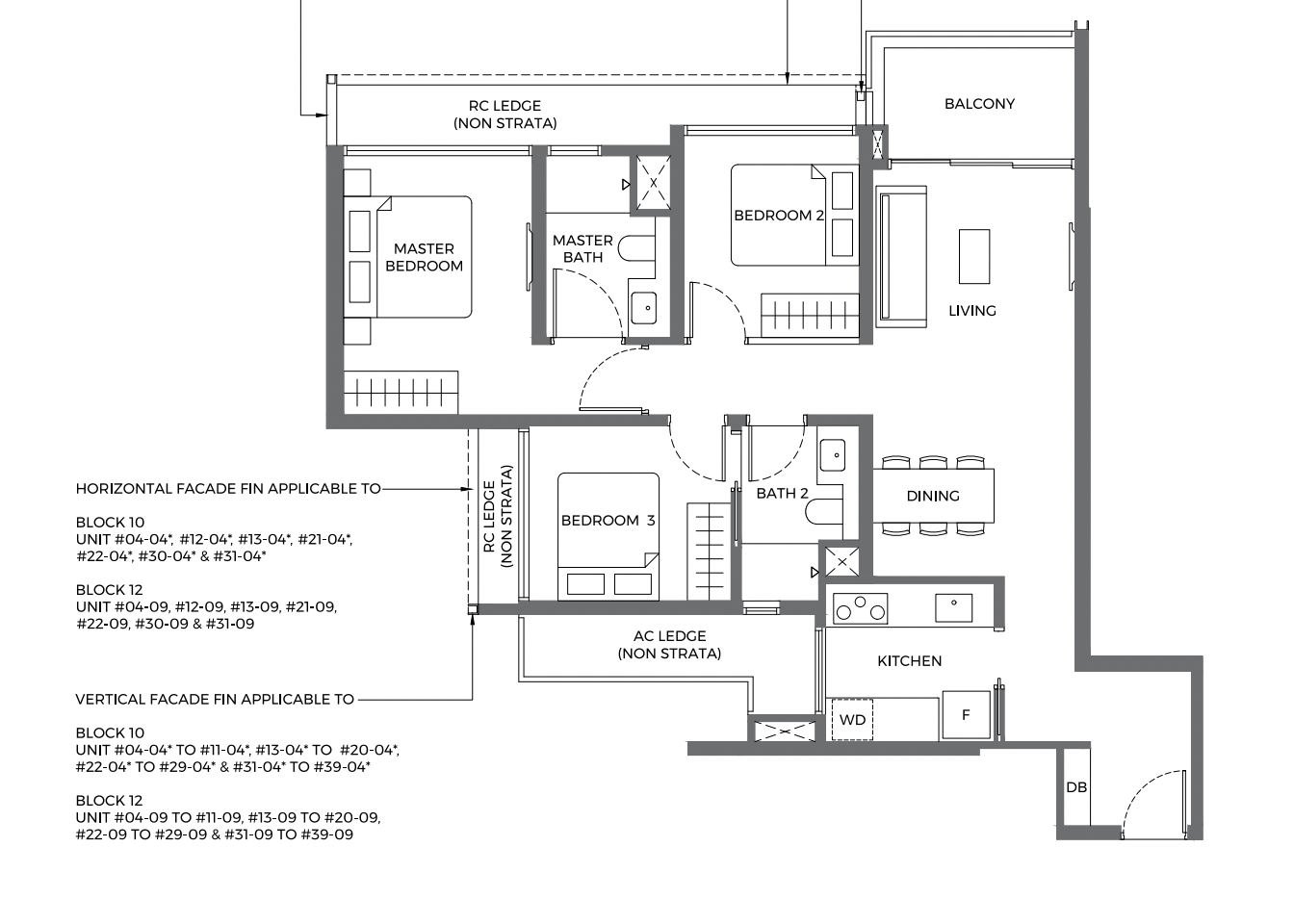

But take a closer look at the unit sizes: You’ll notice that, even with GFA harmonisation, ELTA’s square footage still closely matches that of some older condos. ELTA’s three-bedders, for instance, retain their 900+ sq. ft. sizes. The two-bedders still go up to 700 sq. ft. It seems that, even though they can’t include air-con ledges, the developer sought to match the size profiles of pre-harmonisation condos anyway.

This has the effect of pushing up the quantum though, and making the units more expensive. So on the one hand, the larger square footage could have ended up closing a few sales for ELTA; especially among buyers who were focused on larger units, or who were comparing it to other resale options (without being aware of GFA harmonisation factors).

On the other hand, we could also argue that ELTA might have sold more units, had they simply allowed their units to be smaller (as we’ve seen with the popular compact 3-bedders at The Orie). A lower quantum could have pulled in more buyers. And had they opted to skip the dual-key units in particular, sales would also have been higher (as dual-key units are moving the slowest, and also have niche appeal).

In practical terms, it does mean ELTA’s units have a good amount of spaciousness, with rooms that fit proper queen-sized beds (even some of the smaller bedrooms), and even proper-sized helper’s rooms. Check out our previous article on the layouts here.

4. The usual draw of school/institutional access in Clementi

This is as true of ELTA as it is of most Clementi properties. Schools and institutions are abundant here, as Clementi provides proximity to NUS, Ngee Ann Polytechnic, Singapore Polytechnic, the NUS High School of Maths and Science, and many, many more.

When you couple this with Clementi’s mature town status – and large shopping hubs like Clementi Mall – you get a highly desirable, west-end hotspot. Simply put, Clementi is an easy sell as far as OCR districts go.

While ELTA didn’t see the same explosive success as Parktown Residence, it has performed better than many of its detractors expected. The next challenge, however, will be for ELTA to move its dual-key units and five-bedders. These higher-quantum units may be out of reach of HDB upgraders, so the surrounding HDB enclaves may provide much less help.

For more on the Singapore property market, follow us on Stacked. If you’d like to get in touch for a more in-depth consultation, you can do so here.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Market Commentary

Property Market Commentary A First-Time Condo Buyer’s Guide To Evaluating Property Developers In Singapore

Property Market Commentary Why More Young Families Are Moving to Pasir Ris (Hint: It’s Not Just About the New EC)

Property Market Commentary This Upcoming 710-Unit Executive Condo In Pasir Ris Will Be One To Watch For Families

Property Market Commentary Which Central Singapore Condos Still Offer Long-Term Value? Here Are My Picks

Latest Posts

New Launch Condo Analysis This Rare 999-Year New Launch Condo Is The Redevelopment Of Robertson Walk. Is Robertson Opus Worth A Look?

Pro We Compared New Vs Resale Condo Prices In District 10—Here’s Why New 2-Bedders Now Cost Over $600K More

Singapore Property News They Paid Rent On Time—And Still Got Evicted. Here’s The Messy Truth About Subletting In Singapore.

New Launch Condo Reviews LyndenWoods Condo Review: 343 Units, 3 Pools, And A Pickleball Court From $1.39m

Landed Home Tours We Tour Affordable Freehold Landed Homes In Balestier From $3.4m (From Jalan Ampas To Boon Teck Road)

Singapore Property News Is Our Housing Policy Secretly Singapore’s Most Effective Birth Control?

On The Market A 10,000 Sq Ft Freehold Landed Home In The East Is On The Market For $10.8M: Here’s A Closer Look

On The Market 5 Spacious Old But Freehold Condos Above 2,650 Sqft

Property Investment Insights We Compared New Launch And Resale Condo Prices Across Districts—Here’s Where The Price Gaps Are The Biggest

Pro Similar Layout, Same District—But Over $500K Cheaper? We Compare New Launch Vs Resale Condos In District 5

New Launch Condo Analysis The First New Condo In Science Park After 40 Years: Is LyndenWoods Worth A Look? (Priced From $2,173 Psf)

Editor's Pick Why The Johor-Singapore Economic Zone Isn’t Just “Iskandar 2.0”

Editor's Pick URA’s 2025 Draft Master Plan: 80,000 New Homes Across 10 Estates — Here’s What To Look Out For

Pro Analysing Forest Woods Condo at Serangoon: Did This 2016 Project Hold Up Over Time?

Property Advice We Ranked The Most Important Things To Consider Before Buying A Property In Singapore: This One Came Top

The 3 bedders averaged from 2.198m? I think you meant starting from? The cheapest 3 bedder compact is already that price.

Where do you get the primary school ranking from?