Removing The Income Ceiling For BTO Flats: Is It Fair Or Crazy?

September 8, 2020

In recent news, MP Gan Thiam Poh (Ang Mo Kio GRC) raised the suggestion that we should remove the income ceiling for first-time buyers of BTO flats. This was based on his interaction with young couples, who told him they had issues with busting the current income ceiling.

This has caused some debate in the real estate market. The issue is only simple on the surface; in reality, there are some consequences that future Singaporeans may face from this. Here’s as unbiased a view as we can present:

How much of an issue is the income ceiling?

At present, the income ceiling for a BTO flat is $14,000 per month (although it can be as low as $7,000 for some two and three-room flats, or as high as $21,000 for multi-generational family flats).

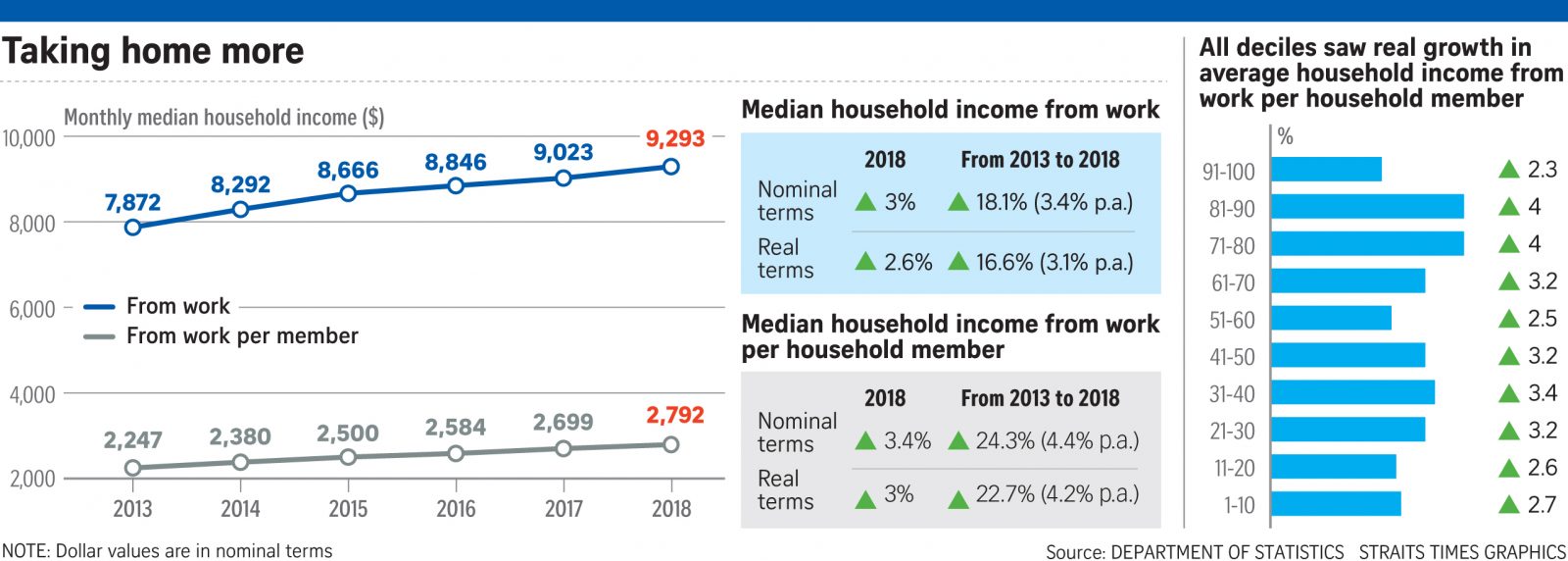

In light of this, we checked the median household income in Singapore from Singstat. As of 2019, the median household income stood at $9,293 per month, with median income for each household member being about $2,792.

As such, the majority of Singaporeans would need to see their incomes rise by over 50.6 per cent, before they’re disqualified from a BTO flat. Given that wages increased just 3.9 per cent per annum between 2014 to 2019, it could be a while before the existing $14,000 ceiling is too low.

So the income ceiling is probably not an issue for the average Singaporean; can the sandwiched group afford to go private?

We can thus assume that the complaints are coming from sandwiched Singaporeans – a demographic that earn too much to get BTO flats, but still find private housing to be out of reach.

Let’s take a look at the numbers involved here:

We’ll assume that a family can’t have enough space in a small condo unit, such as a compact unit or two-bedder. As such, let’s say their alternative to a BTO flat is a three-bedroom condo.

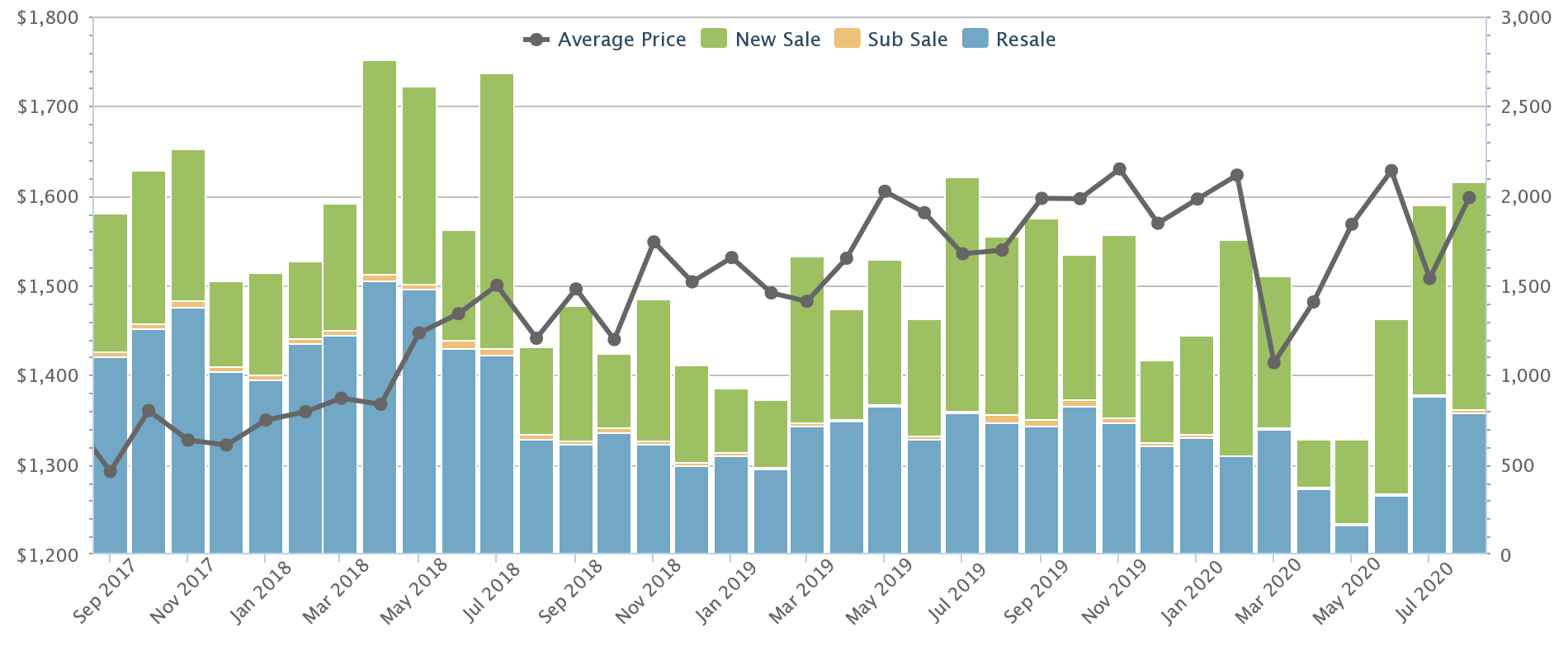

The average price of a condo, Singapore-wide, averages $1,598 psf (at time of writing). The typical size of a three-bedder today is roughly 1,000 sq.ft. (although it can differ widely based on the project). This means that the typical condo, fit for a young family, would cost about $1.59 million.

Some might say that’s a bit rich, as there are more affordable new launches on the market today, like the Treasure at Tampines. A current three bedder unit is going for around $1.137 million.

But for the sake of a comparison, let’s just go with the average figures.

Remember the parameters of affordability: a home should cost no more than five times the annual household income.

(Though admittedly, this is a stance by the CPF board, so take with that what you will).

So here we have a young family that breaches the income ceiling – they have a monthly household income of $18,000 per month.

This is an annual income of $216,000, which means their home – if they exercise prudence – should not cost more than $1.08 million. The typical three-bedder, as described above, would already exceed this limit.

To be clear, it’s not completely unaffordable to them if they want to take the shot.

If they were to get full financing (75 per cent of the property price, or $1,192,500), the loan at 1.3 per cent interest over 25 years means they’d pay around $4,670 per month (only around 26 per cent of their monthly household income) – a very viable scenario for most people.

However, you can still see why some sandwiched Singaporeans would hesitate to jump right into private property, especially given situations like the Covid-19 downturn.

Also, the minimum down payment is $397,500, of which only $318,000 can be paid from CPF. This may not be within the reach of some younger couples.

With these facts in mind, the following issues are still up for debate:

- If private condos are out of the question, what’s wrong with ECs and resale flats?

- Will it be harder to get a BTO flat, if more Singaporeans can ballot?

- Could it help the upward mobility of the middle class?

- It may not be viable to build so many new flats

1. If private condos are out of the question, what’s wrong with ECs and resale flats?

Let’s look at two alternatives to private condos.

The first is the Executive Condominium (EC), such as The Ola EC, Parc Canberra, or Piermont Grand. ECs come with lower price points than fully private condos – The Ola EC, for instance, ranges between $976 to $1,154 psf. It’s possible to find EC units large enough for young families, at price points of around $900,000 to just over $1 million.

More from Stacked

Many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

I’m A Single Mum Making $100k Per Year: Should I Wait To Buy A BTO Or Resale HDB?

Hello,

New Launch Condo ReviewsOla EC Review: Challenging The Definitions Of An EC (Updated with Prices!)

by Reuben DhanarajThe second is to buy a resale flat, which has no income ceiling. These do tend to cost a bit more than BTO flats, especially in mature areas; but the difference in price is more than tolerable if a household makes $14,000 or more per month.

We took a look at the average prices of four-room resale flats across the island:

The average is $426 psf. At around 970 sq.ft. on average, the typical resale four-room flat should have a quantum of about $413,220.

Some Singaporeans may object to being forced into these two property types. For example, they may point out – that ECs don’t appreciate as well as condos, despite often having the same high maintenance costs, and also requiring bank loans (this means there’s a minimum 25 per cent down payment for ECs as well).

As for resale flats, a common complaint is the issue of lease decay – a resale flat has less time on its lease than a brand new BTO flat.

But are these sufficient justifications, as to why higher income families should get new flats?

We also have to ask…

2. Will it be harder to get a BTO flat, if more Singaporeans can ballot?

Balloting for a flat is tense enough as it is; especially in areas like Tampines or Bidadari, where oversubscription is a norm.

If we open up the balloting process to every Singaporean, it makes it harder still for each applicant to secure their flat. We can also expect some resentment if a family earning, say, $25,000 a month takes a flat from a family struggling to get by on $8,000 a month.

We could make up for this by building more BTO flats, but see point 4.

3. Could it help the upward mobility of the middle class?

This is a question our readers will have to consider on a personal level: do you see BTO flats as one of the ways we narrow our wealth gap?

This is not the first time we’ve heard the suggestion that income ceilings should be lifted. We heard the same proposal last year: at the time, it was in response to an NUS study, which showed that:

- The existing housing policy helped children from lower-income families to upgrade their housing when older

- But children from middle-income families tended to do the opposite, downgrading when older due to the cost of private property (about 50 per cent of them, according to the NUS study).

As such, removing the income ceiling could help the upward mobility of the middle class.

4. It may not be viable to build so many new flats

If we open up BTO flats to everybody, we’ll also have to build more (either that or let many families fail in their application).

But the government can’t aim to provide new homes to every buyer. Someone needs to buy all the older properties that are lying around; we can’t just leave them empty, and build more and more new flats all the time.

That’s just not efficient use of limited land space, and can devalue public housing through excessive supply.

The proposal to lift the income ceiling is not as simple as it seems

Singaporeans have always been wired to demand fairness, and we get really upset when that doesn’t happen.

(Just consider the raging debates about whether it’s fair to have public housing in central areas; just because those who obtain such flats are seen as winning the “lottery”.)

There’s no clear-cut answer as to whether lifting the income ceiling is good, but one thing’s for sure:

We wouldn’t want to be the ones explaining to regular Singaporeans that – despite the existence of ECs and resale flats – we’re going to let their wealthier half compete with them for BTO flats.

In the meantime, if you’re looking for a home and can’t get a BTO flat, perhaps we can help. Contact us on Facebook, and we can help to find something that fits your sandwiched situation. You can also check out our in-depth reviews of various property options on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is the current income ceiling for BTO flats in Singapore?

Why are some middle-income Singaporeans concerned about the income ceiling for BTO flats?

What are the alternatives to BTO flats for those who earn above the income ceiling?

How might removing the income ceiling impact the availability of BTO flats?

Could lifting the income ceiling help middle-income families improve their social mobility?

What are some challenges in building more flats if the income ceiling is removed?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

0 Comments