HDB spoilers are even on Reddit now

I’m referring to the cluster of 984 flats about to be built in Sin Ming. It was originally seen on Reddit when someone spotted the construction signage and posted pictures.

Now part of me thinks HDB should either (1) tell the sites to keep things under wraps, or (2) ensure they inform the public before Reddit. But another part of me thinks this can be kind of fun: if HDB just secrets upcoming new sites for us to find, like Easter Eggs.

Find the secret site, write your name on the hidden list, and get an extra ballot chance!

(That was a joke. Let’s not do that. Young Singaporean couples would tear up half the country looking for them within minutes).

But seriously, what’s important here is that it seems HDB is now building ahead of time. As we’ve often said, it’s time to end or at least modify the old Built-To-Order system. This method, which requires sufficient expression of interest before HDB begins construction, is dated and slow; and given how oversubscribed many sites are, getting “sufficient interest” is almost assured.

As for the Sin Ming land plot, it’s something of an eye-opener. The last time there were flats built in Sin Ming, I hadn’t paid any attention because I was about seven years old (it was way back in the ‘80s).

It’s hard to predict the impact since we haven’t seen HDB launches in Sin Ming for so long – it’s a mature area for sure, but probably not “prime” enough to end with a 10-year Minimum Occupancy Period (MOP).

We also don’t see it up for the next two launches (May and August), so it may come much further down the road than we expect.

Nonetheless, those with parents, children, etc. in the Sin Ming area are forewarned; and some may opt to wait out new BTO launches till this option becomes available.

Meanwhile, in other serious property news…

- Check out this homeowner’s experience of moving from a massive 9,000 sq. ft. house, to a simple HDB flat.

- We look at new launch condos and their performance so far in 2023; check out the highlights.

- Some two-bedder condo layouts can be comfy and surprisingly spacious, despite the small square footage. Here are some to look at.

- Need a 5-room flat for $780,000 or under? Here are some of the first places you might want to check out.

Weekly Sales Roundup (1-7 May)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| KLIMT CAIRNHILL | $5,710,000 | 1496 | $3,816 | FH |

| AMBER PARK | $4,851,000 | 2142 | $2,265 | FH |

| THE CONTINUUM | $4,774,000 | 1690 | $2,825 | FH |

| MEYER MANSION | $4,576,400 | 1722 | $2,657 | FH |

| PULLMAN RESIDENCES NEWTON | $3,799,000 | 1163 | $3,268 | FH |

Top 5 Cheapest New Sales (By Project)

More from Stacked

Chuan Park En Bloc Saga: 4 Key Lessons To Learn For Future En Bloc Hopefuls

The collective sale of Chuan Park may be the biggest en-bloc deal since Tulip Garden, back in 2019. Despite the…

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE BOTANY AT DAIRY FARM | $1,157,000 | 506 | $2,287 | 99 yrs (2002) |

| TEMBUSU GRAND | $1,271,000 | 527 | $2,410 | 99 yrs (2022) |

| THE LANDMARK | $1,375,600 | 517 | $2,662 | 99 yrs (2020) |

| THE CONTINUUM | $1,512,000 | 560 | $2,701 | FH |

| PULLMAN RESIDENCES NEWTON | $1,517,000 | 463 | $3,278 | FH |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| CORALS AT KEPPEL BAY | $11,600,000 | 4855 | $2,390 | 99 yrs (2007) |

| REFLECTIONS AT KEPPEL BAY | $3,800,000 | 2357 | $1,612 | 99 yrs (2006) |

| D’LEEDON | $3,400,000 | 1755 | $1,938 | 99 yrs (2010) |

| PANDAN VALLEY | $3,350,000 | 2325 | $1,441 | FH |

| THE ARTE | $3,200,000 | 1873 | $1,709 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE HILLFORD | $549,000 | 398 | $1,378 | 60 yrs (2013) |

| KOVAN GRANDEUR | $550,000 | 398 | $1,381 | 99 yrs (2010) |

| D’NEST | $667,000 | 484 | $1,377 | 99 yrs (2010) |

| PALM ISLES | $688,000 | 517 | $1,332 | 99 yrs (2011) |

| OKIO | $750,000 | 420 | $1,787 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| PANDAN VALLEY | $3,350,000 | 2325 | $1,441 | $2,300,000 | 21 Years |

| CARIBBEAN AT KEPPEL BAY | $3,000,000 | 1647 | $1,822 | $1,815,825 | 18 Years |

| TWIN REGENCY | $2,495,000 | 1216 | $2,051 | $1,702,000 | 19 Years |

| THE ARTE | $3,200,000 | 1873 | $1,709 | $1,234,000 | 13 Years |

| THE INFINITI | $2,000,000 | 1346 | $1,486 | $1,206,000 | 17 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| REFLECTIONS AT KEPPEL BAY | $3,800,000 | 2357 | $1,612 | -$1,033,900 | 16 Years |

| V ON SHENTON | $1,130,000 | 484 | $2,333 | -$196,000 | 10 Years |

| WATERSCAPE AT CAVENAGH | $1,850,000 | 1066 | $1,736 | -$72,000 | 13 Years |

| KOVAN GRANDEUR | $550,000 | 398 | $1,381 | -$60,000 | 11 Years |

| VA RESIDENCES | $930,000 | 624 | $1,490 | -$55,000 | 10 Years |

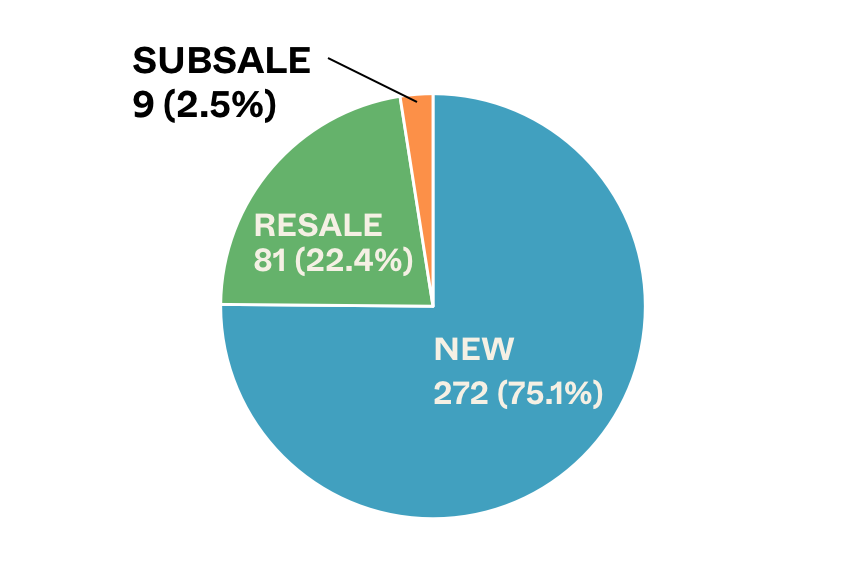

Transaction Breakdown

My most interesting links of the week

- King Charles and his real estate empire

Now I’m not sure how many of you watched the ceremony of King Charles and his coronation (I certainly didn’t), but what was more fascinating to me was reading about his real estate empire.

That led to a rabbit hole of discovering more about the British monarchy and the assets that they own.

Here’s just a list of some of the more eye-opening ones:

- Buckingham Palace $4.9 billion

- Duchy of Cornwall (135,000 acres) $1.3 billion

- Tower of London (apparently the most valuable piece of real estate in the UK) $81 billion

- Kensington Palace $630 million

There’s quite a number more which you can see here. But other than the fact that these are stunning figures, I do also wonder how these are actually valued. It’s not as if they have equivalent neighbouring transactions to go by. If Buckingham Palace was valued at $10 billion for example, who would be arguing that it should be lower/higher!?

- It’s about how you angle it

Most people looking at this will know that this is just a tablet blackboard that you can write on with chalk, but the unique twist on it will surely bring about a chuckle. Maybe someone may just buy it for the laughs!

Either way, it just reminds me of some of the developers in Singapore and their naming descriptions of some of the lesser facilities. Butterfly garden, rain forest deck, and banquet lawn are just some of the more fanciful names that basically just describe a wooden deck or a patch of grass.

For me, sometimes it’s really about quality rather than quantity.

Finally, we’re almost two weeks into the new cooling measures, and so far no panic – but hold your horses. It’s still early to draw conclusions, and a slower pace of rising home prices may be in the works. Follow us on Stacked Homes to get updated.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Is HDB building new flats in secret in Singapore?

How does HDB typically announce new flat projects, and is this changing?

What is the significance of the Sin Ming land plot for future HDB flats?

Why might some Singaporeans wait for new BTO launches in Sin Ming?

What are some recent property market highlights mentioned in the article?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

0 Comments