How I Lost $5,400 In A Rental Scam In Singapore: Here’s My Story And How These Scammers Work

September 16, 2022

The property rental market is booming in 2022, and tenants are fighting tooth and nail for affordable accommodation. This sort of scenario is fertile ground for rental scams: tenants who are in urgent need may go out on a limb, and trust listings that they normally wouldn’t. In 2022 so far, $3.9 million has been lost to scammers posing as property agents.

This week, we get a first-hand account on how these scams work and how their tactics have evolved:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

The difficulty of finding a rental unit in 2022

When M decided he needed larger accommodation, he started his hunt on the internet. He was looking to upgrade from his current studio apartment to a two-bedder, which would have been perfect for his partner and their three cats.

M said the usual portals didn’t seem to have listings that matched their criteria. “The prices have gone up so much, and the supply of the units on the market seemed to be at an all-time low. By the time we enquired on other listings, it had always been either taken or no response.”

Besides the difficulties searching, M was on a time limit: his current lease would expire by the end of the year. The current experience has been quite different from what M previously encountered. He says that:

“When I got this place that I’m currently in, I used PropertyGuru and the experience was uneventful, and it was through a landlord’s agent. It was hassle-free. But I guess that it was a different time.”

As he was short on options, M settled on a listing he spotted on Facebook.

M’s experience is one that many other tenants have gone through, over the past year. Rental rates are at a six-year high: between returning foreign workers, upgraders waiting for their homes to be built, and people priced out of home ownership, affordable accommodation is hard to come by. Landlords definitely have the upper hand at this point. This has resulted in more tenants looking outside of property portals, and into private listings on social media, at bus stops, via word-of-mouth, etc. Unfortunately, the less-regulated channels also tend to draw rental scammers.

Interacting with the “landlord’s agent”

M enquired about the listing, which was for a Stirling Residences unit – this would have been a brand-new unit, given the TOP was just this year. The offer was $3,000 a month (negotiable), for a 2+1 bedder unit.

New Launch Condo ReviewsStirling Residences Review: A Surprisingly Quiet But Convenient Location At Queenstown

by Cheryl TeoM sent the usual details like his lease duration, profile, intended move-in date, etc. He felt compelled to do this quickly, given the hot rental market. This was on a Friday.

“After he replied, he said that there were a lot of viewings that were scheduled over the weekend,” M said, “but if I could offer a price that was reasonable, he did not want to entertain so many viewers. I thought to myself, wow, this agent is pretty nice as he was trying to help me.”

M offered $2,700 a month for a two-year lease or $2,800 a month for a one-year lease.

The listing agent replied that the unit was “already very cheap” and wasn’t too happy that M still wanted to negotiate.

M said that “In a little bit of an anxious state, I tried to collect my emotions and said if I can’t get the price that I want, I would like to view first.”

The scammer asked for a moment to “check with the landlord”, then replied that “The landlord accepted it, can you quickly transfer to the landlord?”

M was asked to transfer two months’ rent ($5,400) for a two-year lease. In addition, he was asked to prepare a Letter Of Intent (LOI). M sent the LOI with the deposit and was told he would receive a copy once the owner signed off on everything.

In hindsight, this exchange would probably have raised a red flag. It was suspicious that, when M asked to actually view the unit, his previously rejected price was suddenly acceptable. But it’s an oversight that could easily happen when you’re in urgent need and can’t afford to lose out. We suppose Singapore’s typically safe environment also works against us, as people naturally just don’t think that scams such as this would happen to them. As such, people are just more trusting.

Getting ghosted by the scammer

M says that:

“After I sent the deposit via Paynow and the LOI, I didn’t get any response for the next two hours. I texted again but did not get a reply.

So I waited for a while and called some friends who were also renting. Some said maybe it takes a bit of time, but some had suspicions. I called the number again, but the other phone seemed to be switched off. I also checked the Paynow screenshot (there was no recipient name). That’s when I realised I probably got scammed.

More from Stacked

PPVC Construction : Why It Matters For Investors (The Good, Bad, And Ugly)

Let’s roll back time to the year 2017.

So I called a friend who had an agent to ask about it, and his agent quickly checked the unit number: true enough, the listing was bogus: the unit at that address was a totally different unit type. Also, he told me to check with the CEA registry, to verify if the person I spoke to was an agent – but that came up empty as well.”

CEA maintains a registry that allows you to check whether a realtor is licensed. We suggest you check on the registry even if someone shows you a physical ID: it’s possible to use a fake or expired license, but the scammers can’t manipulate the CEA registry. There are also cases of scammers impersonating real property agents by taking their CEA license number online, so you should always check to see if the phone number they are using is the same as what is registered.

As M’s experience teaches us, you should do this before transferring any documents or cash.

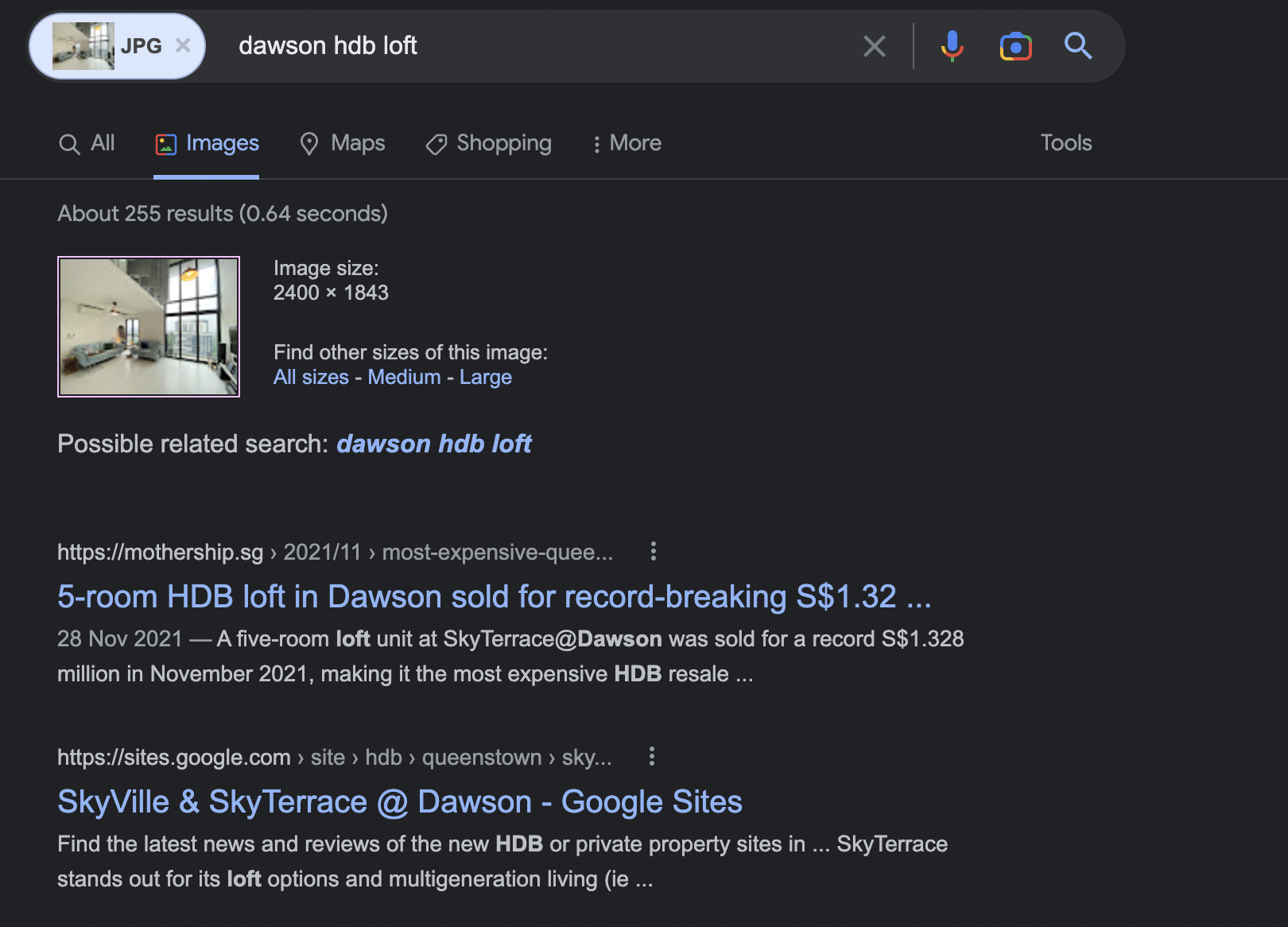

Checking if the listing is real can be tougher, especially for older developments where you can’t always Google the floor plans for an address. We would suggest you insist on a viewing of the property, which the scammers usually can’t handle. If there aren’t even any photos of the listing in the first place, that is a giant red flag. And if there are photos? Check to see if they match the description of the unit.

Another way is to use a reverse image search on Google to see if the photos come up anywhere else. Typically, you’d find that most of these fake listings would just try to use photos that they’ve found elsewhere online.

That said, we’ve also heard of cases where the agents would just tell all prospective tenants that because of overwhelming response, it’s a first come first serve basis on who puts up the deposit first. Put bluntly, they’re telling you that if you even want to bother viewing, you are likely not going to get it as there are others who are willing to put down a deposit even without viewing.

In more elaborate scams, con-artists may even use a vacant property to conduct fake showings – but this requires much more effort, and many scammers will give up as soon as you insist on a viewing.

Reporting the scam doesn’t mean you’ll get your money back

M followed up with a police report. While the authorities were sympathetic – and mentioned a few similar issues – M was told there’s no guarantee of getting the money back. Even if they catch the scammer, there’s a chance the money has already been spent.

As for social media, M notes the posting has already vanished from Facebook.

In hindsight, M warns that:

“If the price and location is too good to be true, it isn’t. Use the trusted portals such as PropertyGuru. The scammer preyed on the market situation for potential tenants to find a ‘unicorn’.”

It’s especially tempting in the current hot market, where tenants tend to be more desperate. There are even cases of these scammers asking for payment just to secure a viewing! But keeping to established portal sites really does help – for example, 99.co and PropertyGuru only allow registered agents to put up listings. This makes it difficult for any scammers to sneak fake listings on the sites. Places like Facebook, forums and sites like Carousell will just be more prone to such happenings – you’d need to be doubly careful here.

M also advises tenants today to check the realtors’ phone number under the CEA registry and to get proof of ownership – don’t transfer the money without seeing the property yourself, and verifying the address.

To sum up, if the listing is too good to be true, it almost always is. Think about it this way, especially in this period of hot rentals – why would any landlord need to be renting it out at an attractive rate when people are fighting tooth and nail to secure one?

For more on renting or buying homes safely, follow us on Stacked. We’ll also provide you with in-depth reviews of new and resale properties alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Homeowner Stories

Homeowner Stories We Could Walk Away With $460,000 In Cash From Our EC. Here’s Why We Didn’t Upgrade.

Homeowner Stories What I Only Learned After My First Year Of Homeownership In Singapore

Homeowner Stories I Gave My Parents My Condo and Moved Into Their HDB — Here’s Why It Made Sense.

Homeowner Stories “I Thought I Could Wait for a Better New Launch Condo” How One Buyer’s Fear Ended Up Costing Him $358K

Latest Posts

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

0 Comments