We Bought Our First Home On Carousell: Here’s What We Learnt

April 16, 2021

The digital aspects of Singapore’s private property market have grown to new proportions – from a time when people didn’t trust online listings, to today when you can buy a house by tapping on your phone. In this week’s property journey, we look at how a couple found their dream home online, and on Carousell:

Buying without an agent

P & A are a couple in their mid-twenties, who have also shared their home-buying journey on Instagram @ourfirsthome.sg. The couple was previously staying with their parents, so were eager to get a place of their own. However, they didn’t go the usual route and contact an agent.

“Being a first-time homeowner, we decided not to use a real estate agent to save some cash,” they said. Furthermore, they had “narrowed our options down to a resale HDB”.

Property agents typically have service fees* ranging from one to two per cent. For a 3-room resale flat at $350,000 for example, the added cost would often range from $3,500 to $7,000.

With HDB flats however, there’s a good amount of support for home buyers and sellers looking for Do-It-Yourself (DIY) transactions. HDB has a resale portal for buyers and sellers willing to do this.

*These rates are negotiable, and are not fixed.

Figuring out the right home

As P & A wanted their own home as soon as possible, they were set on a resale unit and not a Built To Order (BTO) flat. A new flat typically has a build time of four to five years, so it’s not an option for those who need their own space right away.

Besides this, there were three specific criteria the couple looked for in a home:

Fengshui: We are both believers of feng shui, and have calculated our ideal

main door facing direction! This was an extremely important factor during our

house hunting journey, but also challenging since it was very specific

Central location – Proximity to the CBD where we work, and also close to A’s

parents for the proximity grant!

Amenities – A short walk to the MRT, accessible supermarket and food options

The Proximity Housing Grant (PHG) applies only to resale flats. This provides a grant of $20,000, for flat buyers who live within four kilometres of their children or parents.

(The PHG is also available to singles, but the grant amount is up to $15,000 only).

Note that two of the aforementioned qualities – a central location and amenities like supermarkets – tend to go together. As a loose rule of thumb, the more central the location, the higher the odds of having an MRT station / supermarket in walking distance.

Searching for a home on Carousell

“We started with the popular platforms like Property Guru and 99.co and arranged for viewings ourselves,” P & A told us, but “Despite viewing close to 40 units over the span of three months, we unfortunately did not manage to find a dream home that fulfils all our criteria.

One night, the idea of searching on Carousell came to my mind. While doubtful, I started keying in some street names that we were eyeing on and stumbled across our current home for sale (listed by the seller herself)”.

One of the advantages that P & A found on Carousell was the range of options:

“You definitely get more options, as some of these listings are posted by the owners/sellers themselves and not present anywhere else. We would encourage other buyers to look on Carousell too, provided you already have some estates in mind that you can search using keywords.”

However, you might need a little more time to sift through the listings, as the couple also found that “Carousell is a platform for everyone and you will have to sieve through thousands of listings which can be quite daunting. Listings are also not as well presented compared to those on Property Guru or 99.co by qualified agents.

You will need lots of patience to look through and find your ideal home.”

Viewing and transacting

Even without a property agent. P & A found the process went smoothly:

“The viewing process was quick and fuss free. We made an appointment directly with the sellers immediately on the next day. We have already viewed a couple of units in that resale project so we are familiar with that area. Once we confirmed that the unit’s feng shui was ideal for us, we made an offer on the spot.”

Viewings are more productive, if you already have a clear idea of what you want, or are familiar with the area. This is one of the reasons we encourage buyers to discuss their needs and shortlist the requirements first.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

What “Lucky” Singaporean Homebuyers Used To Get Away With — That You Can’t Today

Singapore’s property market has evolved as a result of policy adjustments and shifting market trends, spurred by recent crises such…

A common mistake, which P & A avoided, is to meander around with random viewings, hoping for something to catch their eye. Buyers who do this are more prone to making bad decisions, as they can be seized by impulse.

P & A also found that negotiations were straightforward:

“Negotiation was also smooth, as there was no agent involved in this transaction on both sides. We showed our sincerity to the sellers and made a fair offer, albeit lower than what they asked for. They accepted the offer within three days.”

The transaction was remarkably quick, as the couple knew what they wanted:

“We did not take much time before deciding to go ahead with the purchase”, the couple told us. “It only took us one viewing and we were sure that this unit was the one for us, since the unit’s fengshui was the key factor.

We also love that it is a newly MOP flat (suitable for young couples like us) and the amenities surrounding it. While we were slightly concerned that the unit is not renovated, and that we do not have an agent with us to handle the administrative works, we decided to take the leap of faith.”

A “newly-MOP” flat refers to flats that have just reached their first five-year Minimum Occupation Period (MOP). These flats are ideal for younger buyers, as the lease decay (all HDB flats are on 99-year leases) is deemed to be less significant.

As such, a five-year old flat provides the ability to move in right away, without having lost its potential for resale gains.

Property Market CommentarySign of the Times: Comparing An Old Resale HDB To A New BTO

by Celine HThe couple’s 3-room flat in Commonwealth 10

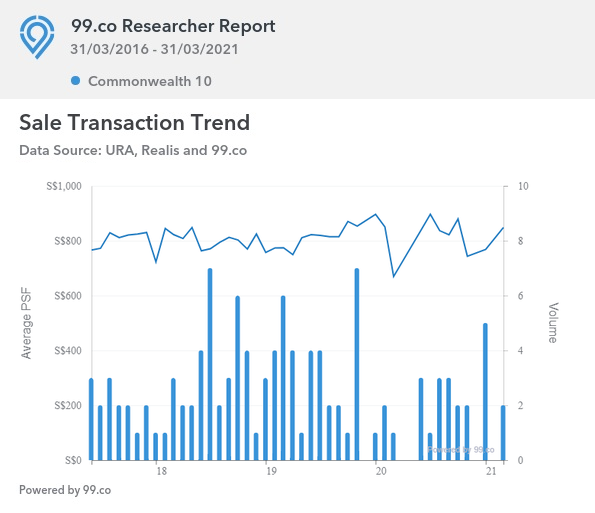

The 3-room flat that P & A bought was a 63 sqm one in Commonwealth 10. This is an HDB development that’s just 240 metres, or about three minutes’ walk, to the Commonwealth MRT station.

According to 99.co, the current average price in this development is around $848 psf:

These are five of the most recent transactions for 3-room flats in Commonwealth 10:

| Date | Unit Size | Approx. Price PSF | Price |

| Jan 2021 | 678 sq. ft. | $811 | $550,000 |

| November 2020 | 678 sq. ft. | $707.96 | $480,000 |

| August 2020 | 678 sq. ft. | $855.46 | $580,000 |

| August 2020 | 678 sq. ft. | $852 | $578,000 |

| July 2020 | 678 sq. ft. | $896.76 | $608,000 |

“It met all our expectations and beyond”, P & A told us, “It is within minutes’ walk to the MRT and Tanglin Halt food centres. There are also many old school shophouses right below ranging from hair salons, massage parlour, wet market and mamak shop. We love the amenities and friendly neighbour vibes.

While the unit itself is ‘bare’ and not renovated, we figured that this will be better for us to do a full revamp too!”

Long-time readers will know we suggest you don’t renovate before selling, in an attempt to raise the value. This is an example of what we’re talking about: most buyers will want to “do-up” the home to their own preferences anyway. It’s often better to sell the unit as-is, rather than paying for renovations the next buyers will have to hack away.

Would they use Carousell to buy a home again?

The house hunting experience on Carousell seems to have worked out well for the couple:

“We would try to sell our home on Carousell again since we will have significant savings from paying agent fees.

Of course, it may take a longer time to sell since not many are used to the idea of home searching on Carousell yet. We would also search for our next home on Carousell again, together with other property platforms in order to ensure we cover all grounds!”

In case you’re thinking of using Carousell to find a property, here’s some advice from them:

“Do your research! This is important as you do not want to get ‘cheated’ by agents or sellers. Always research on the market price for the different estates, room types, HDB policies, and regulations; especially if you don’t have an agent to represent you.

You can refer to PropertyGuru past transaction histories or SRX to look up the estimated value for your home. Also, take your time to look at more units before deciding which is the best option for you!”

For those of you researching the Singapore private property market, note that almost all the other websites draw from URA transaction data, which you can check online. The data is based on caveats lodged, and will reflect actual transaction prices instead of listing prices.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Homeowner Stories

Homeowner Stories We Could Walk Away With $460,000 In Cash From Our EC. Here’s Why We Didn’t Upgrade.

Homeowner Stories What I Only Learned After My First Year Of Homeownership In Singapore

Homeowner Stories I Gave My Parents My Condo and Moved Into Their HDB — Here’s Why It Made Sense.

Homeowner Stories “I Thought I Could Wait for a Better New Launch Condo” How One Buyer’s Fear Ended Up Costing Him $358K

Latest Posts

Singapore Property News This New 588-Unit Tampines Condo Will Launch From $1.486M — With A Mall And MRT Link

Property Advice Should I Pay $500K More For A New Launch — Or Buy A Resale Condo Instead?

Singapore Property News A Rare Freehold CBD Office Unit Is Up For Sale At $20.5M — And Foreigners Can Buy It

0 Comments