The Ultimate Guide to buying a resale HDB flat in 2017

July 14, 2017

For the majority of Singaporeans, applying for a BTO would be a common route to take when looking for their first matrimonial home. However, with a wait of 3 to possibly even 5 years for the flat to be ready as well as a limited choice in location, some couples are forced to look at resale flats as an option.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Why buy a resale HDB?

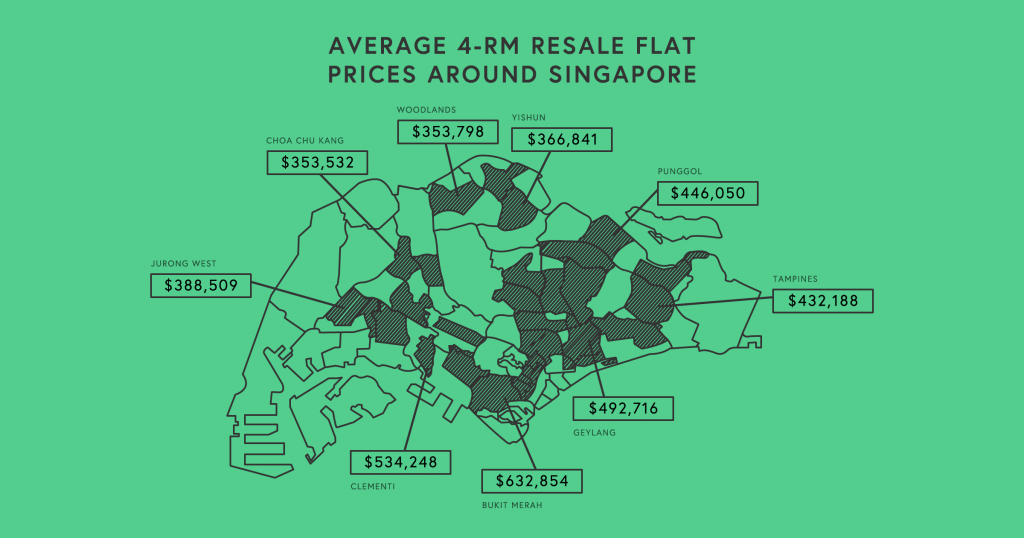

Even though they are priced higher, resale HDB flats can be an attractive option. You are now able to choose the location you like (subject to higher prices for premium locations). There is also no longer a time constraint, so you will be better able to plan for your wedding and moving in period. Use Stacked Homes Ultimate Guide to resale flat prices in Singapore to get a better idea of how much the average prices are in each estate.

In addition, resale prices across the board have dropped by 11.7 percent since the peak in April 2013. If you are a first-timer couple looking at a resale HDB flat, the amount of subsidies that you are eligible for has also increased. In the recent Singapore Budget 2017, the CPF Housing Grant that was previously capped at $30,000 has been raised to $40,000 for couples who purchase five-room flats and bigger, and to $50,000 for those who purchase four-room flats or smaller from the resale market. Coupled with the Additional CPF Housing Grant (AHG) and Proximity Housing Grant (PHG), you are now able to receive up to a maximum of $110,000 in subsidies.

How much are property agent fees in Singapore?

There are no official guidelines as to how much an agent can charge you for commissions in helping you buy your resale HDB. However, the common practice in Singapore is for the agent to charge you a percentage based on the final transaction price of the property, typically being 1% to 2%. This can also be negotiated down depending on how marketable the property is and the current market conditions. Bear in mind that these commissions often do not include GST charges, which is at the time of this writing, an additional 7% on top of the commissions.

Common terms that you should be aware of

Ethnic Integration Policy (EIP)

The Ethnic Integration Policy was established to ensure that there is a healthy balanced mix of the various ethnicity in the HDB estates and blocks. This will apply to all buyers. You can use the HDB online service to check your eligibility.

Singapore Permanent Resident (SPR) quota

The Singapore Permanent Resident quota ensures that permanent residents in Singapore are able to integrate smoothly into the local community. This will apply to non-Malaysian SPR households where no buyer is a Singapore citizen or Malaysian SPR. You can use the HDB online service to check for eligibility.

Note: The EIP and SPR quota are updated on the 1st of every month and will apply to all completed resale applications received during that month.

Eligibility Schemes

In order to purchase a HDB resale flat, you have to meet certain conditions of the HDB eligibility schemes. You can use the HDB service to find out an indication of your eligibility.

General things that apply to everyone

Income Ceiling

A common question many people ask, is there an income ceiling for resale HDB? You will be happy to hear that there is no income ceiling whatsoever! However, do take note that your level of income will determine the amount of CPF Housing Grants that you are eligible for.

Ownership of HDB flats

HDB does not allow for multiple ownership of HDB flats, if you do purchase a resale HDB flat, the existing flat must be disposed of within 6 months of the resale flat purchase.

Ownership of private or overseas property

If you own a private or overseas property, these have to be disposed of before or within 6 months of the resale flat purchase.

Now that we have gone through the general schemes that apply to everyone, lets move on to specific schemes as buyers have to qualify under one of these schemes to be able to buy a resale HDB flat.

How much do you need to budget for your resale HDB flat?

More often than not, first time buyers will start looking around for a resale HDB flat and spend lot of time searching for a suitable home only to find that their approximate budget in their heads does not translate to affordability in real life. As a result, some buyers have lost their dream homes because other more prepared buyers have done their necessary homework and beat them to the chase. Bottom line? If finding your dream home is important to you, it is vital that you plan your finances first before you even start the search process. There are two ways to go about this:

- HDB loan

- Bank loan

Here is a great infographic by Red Brick Mortgage Advisory to show you the difference in a nutshell.

Let’s begin by exploring the HDB loan.

HDB Loan

Many Singaporeans probably feel that taking a HDB loan is the safer route. Taking up a HDB loan allows you to loan up to 90% of the purchase price or current market value of the flat, whichever is lower. Note: Many people assume that the HDB loan interest rate is fixed at 2.6% per annum. In fact, the HDB loan interest rate is actually pegged to the current CPF ordinary account interest rate, plus 0.1%. This means that HDB can change the interest rate based on the market situation.

HDB loan eligibility

HDB loan payment

When taking up a HDB loan, there are still several payments that you have to take note of.

1. Monthly loan instalment

The monthly instalment of the loan is due on the 1st day of each month until the loan is fully redeemed.

2. Arrears Payment

Arrears payment can be paid through CPF, cash, cheque or through electronic payment methods. Arrears Payment

3. Late Payment Charges

If monthly instalments are not paid for the month, a late payment charge will be imposed at the end of the month.

4. Capital Repaymenta

These can be made in parts or in full and you have to give HDB a month’s notice in advance. Partial capital repayments can be made to shorten the loan tenure with no changes to the monthly instalment amount. You are also able to revise your monthly instalments instead.

If you are looking at a full capital repayment, this can be made via cash, cheque, GIRO and CPF.

In addition to the points above, there will be an additional conveyance fee that will be imposed as well as a registration fee when taking up a HDB loan.

Arrears payment can be paid through CPF, cash, cheque or through electronic payment methods. If monthly instalments are not paid for the month, a late payment charge will be imposed at the end of the month. These can be made in parts or in full and you have to give HDB a month’s notice in advance. Partial capital repayments can be made to shorten the loan tenure with no changes to the monthly instalment amount. You are also able to revise your monthly instalments instead. If you are looking at a full capital repayment, this can be made via cash, cheque, GIRO and CPF. In addition to the points above, there will be an additional conveyance fee that will be imposed as well as a registration fee when taking up a HDB loan.

Registration fee

A one-time charge of $38.30.

Conveyancing fee

1-room $23.50 2-room $35.30 3-room $47.05 4-room $58.85 5-room $70.60 Executive $82.35

Bank Loan

A housing bank loan is usually more flexible, when compared to the numerous eligibility factors that HDB imposes. As mentioned, the HDB loan rate is 2.6% and does not fluctuate much at all. For bank loans, these are dependent on two types of loan packages: floating and fixed rate. Fixed rates means you are usually guaranteed the interest rate for 3 to 5 years at best. Anything beyond that and you will be left to the market conditions. Floating rates are more volatile and most of them do not come with a lock-in period. People usually prefer fixed rates as it is more stable. However, the stability comes at the expense of a higher loan interest rate. For a more in depth look into home loans for Singapore, take a look at Red Brick’s ultimate guide to home loans. If you want to find out more and compare loan rates from the banks you can do so here. You will be able to schedule a free, no strings attached call with a Red Brick advisor, and they will be able to advise you on the best option moving forward. Let’s say you have decided to go with a HDB home loan, what do you do next?

1. Find out your HDB home loan eligibility

You can apply for this here. You will need:

- A minimum of 3 months of your latest pay slips

- 15 months of CPF contribution history (You can obtain this online via from the CPF website, here is a pictorial guide and you can do it from here.

Once this is done, you will be able to see the maximum amount you are able to loan as will as monthly instalments and repayment details. HDB also provides an online enquire for your monthly instalments here. When you have your HLE, sellers are then able to know that you have a genuine interest, and have taken the necessary first steps towards the purchase of your potential new home.

Note: HDB needs 2 weeks to process the HLE application

2. Find out how much CPF housing grants you are entitled to

Here are the CPF housing grants available for resale HDB:

- Family Grant

- Half Housing Grant

- Singles Grant

- Additional Housing Grant (AHG)

- Proximity Housing Grant (PHG)

Here’s the breakdown:

Family Grant

- At least 21 years of age when submitting flat application

- Both owner have to be first timer applicant

- 4-room and below will get $50,000

- 5-room and above will get $40,000

Half Housing Grant

- At least 21 years of age when submitting flat application

- One owner has to be first timer applicant

- 4-room and below will get $25,000

- 5-room and above will get $20,000

Singles Grant

- 35 years of age when submitting the application

- All owners have to be first timer applicant

- 4-room and below $25,000

- 5-room and above $20,000

Additional Housing Grant (AHG)

A first-timer household may be eligible for 1 of the following AHGs:

- AHG for family of up to $40,000

- AHG for singles of up to $20,000

Additional Housing Grants (AHG) are available to first-timer households where at least 1 applicant has worked continuously for 12 months before applying for the flat, and is still working when the resale HDB flat application is submitted.

AHG for Family

The AHG amount is based on the average gross monthly household income for the 12 months prior to the submission of the application for the flat. Up to $1,500$40,000

| Household Income Bracket | CPF Grant Amount |

|---|---|

| $1,501 to $2,000 | $35,000 |

| $2,001 to $2,500 | $30,000 |

| $2,501 to $3,000 | $25,000 |

| $3,001 to $3,500 | $20,000 |

| $3,501 to $4,000 | $15,000 |

| $4,001 to $4,500 | $10,000 |

| $4,501 to $5,000 | $5,000 |

AHG for Singles

The Additional Housing Grant (AHG) is also available to:

- First-Timer/Second-Timer couples

- Orphan Scheme Applicants

- Singles living with parents

The grant amount will be based on the average gross monthly household income for 12 months prior to the submission of the application for the flat. Half of average monthly household income over 12 months AHG for singles

| Household Income Bracket | CPF Grant Amount |

|---|---|

| Up to $750 | $20,000 |

| $751 to $1,000 | $17,500 |

| $1,001 to $1,250 | $15,000 |

| $1,251 to $1,500 | $12,500 |

| $1,501 to $1,750 | $10,000 |

| $1,751 to $2,000 | $7,500 |

| $2,001 to $2,250 | $5,000 |

| $2,251 to $2,500 | $2,500 |

Proximity Housing Grant (PHG)

The Proximity Housing Grant helps those families who want to buy a resale HDB flat to live near their parents or married child/children. Eligible singles can also benefit from the PHG is they buy a resale HDB flat with their parents. You can apply for this if you are a first-timer or second-timer buyer of a resale HDB flat.

Citizenship

You have to be a Singapore citizen Family: Your family nucleus must comprise of at least another Singapore Permanent Resident or Singapore Citizen Singles: At least one of your parents or married child must be a Singapore Permanent Resident or Singapore Citizen

Age

Family: You have to be 21 years of age or above Singles: You have to be 35 years of age or above

Family Nucleus

Family: You are applying with your:

- Spouse and children (if any)

- Fiance/Fiancee

- Children under your legal custody, care and control (if widowed or divorced)

Singles: You are applying with your parents Proximity Condition Family: Your parents/married child are:

- Living with you in the DBSS flat

- Living in an HDB flat in the same town or within 2km

- Owner-occupants of private property in the same town or within 2km

Singles: Your parents are living with you in the DBSS flat

Proximity Housing Grant

Family $20,000 Singles $10,000

Note: The proximity grant applies even if it is 2 different estates! It just has to be within 2km of each other.

Once the budget and loan details have been settled, its time for the most exciting part of this process. The search for your dream home!

First off, there are many available avenues when it comes to searching for your new resale HDB flat.

1. Classifieds

These have been around as an option for ages but the search can often become an arduous process. As each listing is limited to a small squared space on the newspaper, there isn’t much information or coloured pictures as these are expensive. So, much of your time will be spent hunched over the newspaper armed with a highlighter to manually shortlist these homes. After which you would have to call them up for more information.

It is still recommended that you comb through these listings as there might be some unique listings there that do not exist on the online property portals. This is due to the older clientele that still frequents the Classifieds.

2. PropertyGuru and 99.co

These are the two prominent ones in Singapore and feature thousands of listings at one go. Propertyguru is one of the oldest and therefore has the most comprehensive set of listings for you to browse.

99.co is one of the new boys on the block, but have already garnered an impressive array of listings and is consistently mentioned as one of the top few real estate portals in Singapore despite its young age. If you are looking for a modern intuitive way to look for your resale HDB, this can be a good choice.

Note: The numerous listings on these portals can come at a detriment. Many listings are duplicates that you have to sift through. One such tactic that has resulted from this is called fishing.

Here’s how it works. You see a great listing on the site, it has everything you want and at a great price. And it was just listed a couple of hours ago. You reach for your phone as fast as you can to contact the agent and make an appointment to view the place that very day. You view the place and absolutely fall in love. You say I will make a firm offer tonight. Fast forward a couple of hours later and the agent tells you I am so sorry but the property has already been sold, someone made an offer before you and it is gone. BUT, turns out he has a whole lot of other places to show you. Congrats you have just becomes the agent’s new lead. To counter this, just be wary of when a listing seems to good to be true. Ask a lot of questions and do your research on the prices of resale HDBs in the area.

3. Direct resale HDB sites like Stacked Homes

Saving the best for last 😉 You can always look at the direct resale HDB option. Stacked Homes is a direct buying and selling property portal, and some listings will be unique to the site that you will be unable to find on property portals like PropertyGuru as these people only want to sell direct without the agent. We have also created a guide to HDB resale prices if you are still undecided on which estate is best for you.

Now you know where to look, let’s move on to a few tips that you should keep in mind when searching for your own dream home.

- Make a shortlist of what features of the home is important to you and rank them. These can include things like location, age of flat (be aware of the lease) , amenities and design.

- Always use the filters on the websites to narrow down to exactly what you want

- Visit the different HDB estates if you are not already familiarly acquainted with them. Go at different times of the day so you can get a better judge of the noise levels as well as how crowded the area can get.

- Once you have narrowed down to a particular estate, make repeated visits. You will never know what you will find that you might dislike about the place!

BONUS GUIDE: Questions to ask when viewing a property

For a more comprehensive list of things to look out for, check out Renonation’s article.

Once you have decided on the unit that you like, you can then make an offer to the owner. It is important that you know the prices of resale HDB in the area that you are interested in. The good news is that in general prices of the different units do not deviate that much and are all available for you to check. You must research on the prices so that you can make a reasonable offer and avoid over paying.

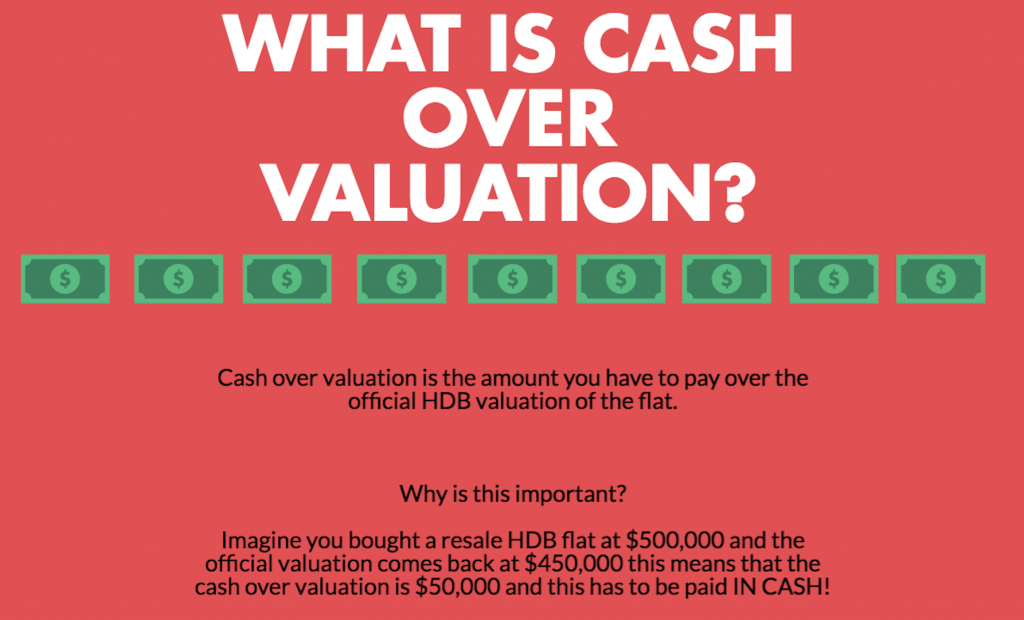

Note: It has happened before. You see a nice place online, you view the place and find out from the agent that it was done by someone reputable, the marble flooring is of the highest quality, and thus this justifies the inflated price of the apartment and adding to the cash over valuation (COV). Please do the necessary homework and find out if these claims are true before proceeding, otherwise you will be faced with a hefty COV that you have to pay in cash!

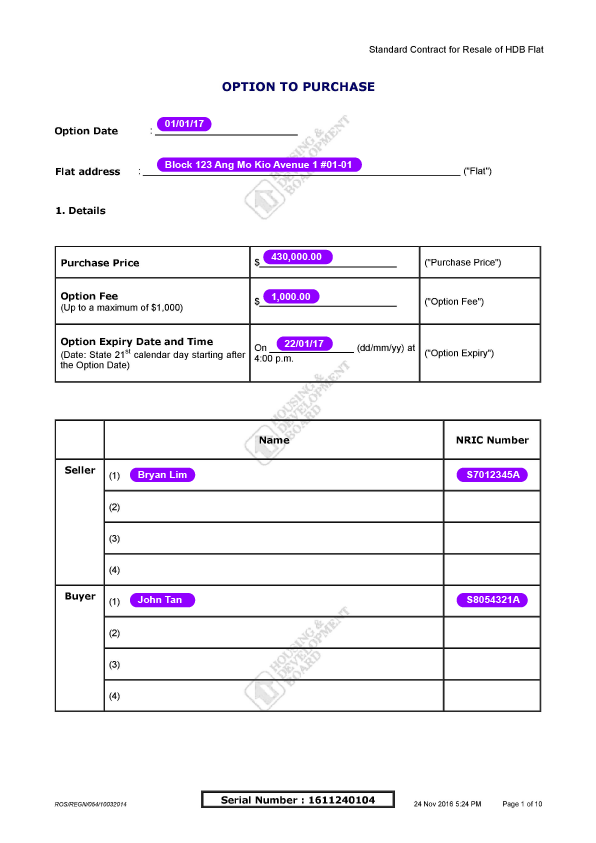

Once you have negotiated a price and the owner accepts it, he will then offer you an Option to Purchase (OTP) The OTP will have to be paid by either cash or cheque to the seller. It is important to note the sections that have to be filled up in the OTP: Page 1

- Option date

- Flat address

- Purchase price (resale price of the flat)

- Option fee (between $1 to $1,000)

- Option Expiry date (21 calendar days from the option date [including Saturday, Sunday and public holidays]. E.g. if seller grants the OTP to you on 1st April, the Option will expire on 22nd April)

- Names and NRIC numbers of all the sellers and buyers

Top half of page 8

- Option date

- Flat address

- All co-owners of the flat have to sign on the OTP

- A witness must sign on the OTP

Here is an example of Page 1 and 8.

This OTP is a contract between you and the seller. This means that you have the right to purchase the flat at the agreed selling price for the duration of the contact (21 days). You also do not have to worry about anyone else coming in with a higher bid at this point as the seller is legally forbidden to sell the flat to anyone else. Do note however that if you decide not to purchase the flat for any reason, you do not have to do anything but wait for the expiry date to lapse. After the 21 days has lapsed the seller is able to offer the flat to any one else. The fee will also not be refundable under any circumstances. Note: The OTP will expire at 4pm on the option expiry date Here are some important notes on the OTP.

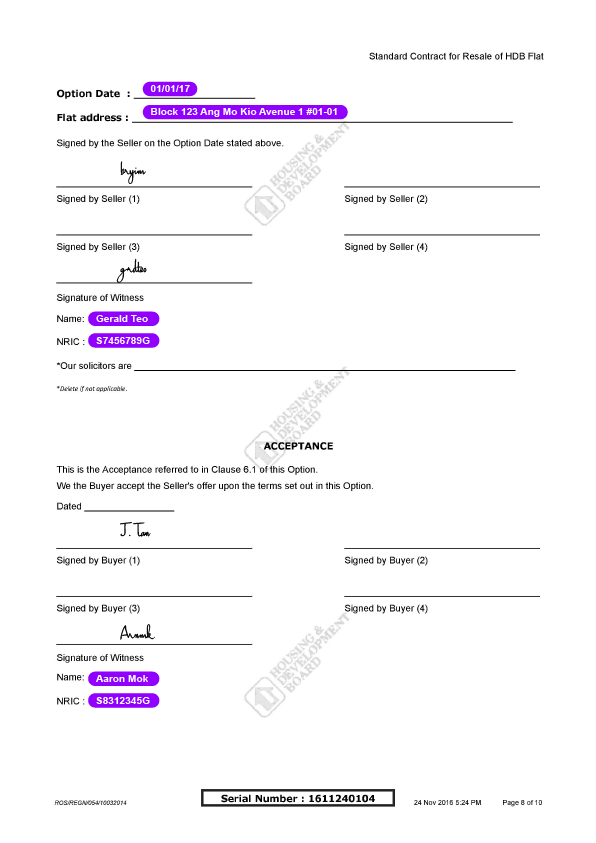

Once the OTP has been settled, you can then proceed to submitting a valuation request to HDB. This can only be done by you (the buyer) or if you are represented by an agent. To submit the valuation request you will need:

- Resale flat address

- Name and NRICs of all flat buyers

- Requestor’s email address

- OTP details (option date, resale price and OTP serial number)

- Scanned copies of Page 1 and 8 of the OTP

- Flat owner’s details (name, NRIC, contact number, and email address)

Valuation Fees

The cost for this report is $140.40 (for 1 and 2 room flats) and $199.25 (for 3 room and bigger flats).

Valuation Process

Once the request has been sent, HDB will send a valuer to assess the flat value and this will be arranged with the seller so you don’t have to worry about this part! The valuation report will be ready typically within 7 to 10 working days. You can log in to using your Singpass.

You HAVE to complete and submit the resale checklist before proceeding to exercise the option. This is a document from the HDB to make sure that you are aware of all policies prior to your purchase of the resale flat. You can do so here.

Once you have done the resale checklist you can then proceed to exercising the OTP. You can exercise it by signing the form and paying the deposit to the seller. This will amount to not more than $5,000, inclusive of the OTP fee. So for example, if you paid an OTP fee of $1,000 to the seller (which is the usual amount), the maximum amount you have to pay for the deposit to seller is $4,000. Simple. When this is done, both you and the seller have to submit your respective portions of the resale application. Please note that buyers and sellers will have to submit their portion of the application separately. Either the buyer or seller can submit their portion first, but once the first party has submitted, the second party will have to do so within 7 calendar days if not the submissions will LAPSE and you will have to restart the process. There are fees involved for the processing of the resale application, this will cost $40 for 1 and 2-room flats and $80 for 3 room flat onwards. Once the second party has submitted, the resale application will be considered as complete. If you are the second party, you will have to book the First Appointment.

You and the seller have to agree on the appointment date and time, and the second party will have to book the available dates for the Resale First Appointment. Try to book your First Appointment date as soon as possible as these can fill up very quickly, even now if you take a look at the schedule you will not be able to get an appointment immediately, this will usually be 4 to 5 weeks from the date of submission of the resale application.

What is the First Appointment for?

The First Appointment will be used to verify your eligibility to buy the resale flat and have the procedures be explained to you. They would also need to confirm on the Manner of Holding (for application with more than 1 buyer). Lastly, they will fix the completion date for the purchase.

What is Manner of Holding?

If you are buying the resale flat jointly (up to a maximum of 4 owners), you will have to decide how you and the other owners want to hold the property. This can be done in 2 ways.

Joint Tenancy

Under joint tenancy, all the flat owners have an equal share in the flat. In joint tenancy, the right of survivorship applies. This means that upon the demise of any joint owner, his interest in the flat would automatically be passed on to the remaining co-owners. This is regardless of whether the deceased joint owner has left behind a Will. Get more information on the retention of flat upon the demise of a joint owner.

Tenancy-in-common

Under tenancy-in-common, each co-owner holds a separate and definite share in the flat. The right of survivorship does not apply. Upon the demise of a co-owner, his interest in the flat will be distributed according to his Will (if any). If there is no Will, his interest in the flat will be distributed to the beneficiaries in accordance with the provisions of the Intestate Succession Act. Read more on the retention of flat upon the demise of a tenant-in-common

Documents you need to bring for First Appointment

You must bring the original copy of these documents, of all persons listed in the application:

- Identity Card or Passport in absence of Identity card, along with 1 photocopy

- HDB Loan Eligibility (HLE) Letter and latest pay slip, if taking an HDB housing loan

- Letter of Offer from a bank or financial institution, if taking a housing loan from a bank or financial institution

- Income documents for assessment of income ceiling if taking the CPF Housing Grant

- Income documents for assessment of income ceiling if taking the Additional CPF Housing Grant (AHG)

- Power of Attorney, if applicable

- Lasting Power of Attorney (LPA), if applicable

- Marriage Certificate, if applicable

- Child’s Birth Certificate, if applicable

- Deed of Separation, Divorce Certificate, Decree Nisi/ Interim Judgement, Certificate Making Decree Absolute/ Certificate Making Interim Judgement Absolute, if applicable

Important: Your parents or married child must be present during the First Appointment if you are applying for the Proximity Housing Grant.

Note: If you are eligible for the CPF housing grant you will be doing the application here as well. If you are an employed person, please remember to bring the latest 12 month’s pay slips and CPF statements showing contributions for the last 12 months. If you are self-employed, you will need the Latest Notice of Assessment (NOA) from IRAS and the ACRA business profile.

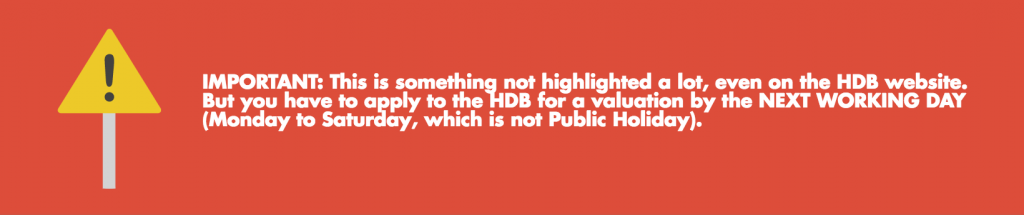

Once this is done, you have to make the initial payment after the HDB First Appointment. This amount will be based on the resale price or market valuation of the flat, whichever is lower. Here is a breakdown of how much you will have to prepare, depending on if you have taken a HDB or bank loan.

Finally, legal fees will have to be paid accordingly. In this instance, we will be taking the prices of the solicitor’s appointed by the HDB. You can get a gauge of the prices from here. If not, here is a breakdown of the legal fees that you will incur.

Conveyancing Fees

For transfer

(Based on selling price and subject to a minimum fee of $20; fee is rounded up to the nearest dollar) – First $30,000: 13.50 cents per $100 or part thereof – Next $30,000: 10.80 cents per $100 or part thereof – Remainder: 9 cents per $100 or part thereof

For mortgage*

(Based on loan amount and subject to a minimum fee of $20; fee is rounded up to the nearest dollar) – First $30,000: 13.50 cents per $100 or part thereof – Next $30,000: 10.80 cents per $100 or part thereof – Remainder: 9 cents per $100 or part thereof * Notes for mortgage conveyancing fees: For housing loan from HDB If the solicitor is acting for you in the mortgage of the flat to HDB, they will charge: A full-scale fee as HDB’s solicitor (subject to a minimum fee of $20 for 1 and 2-room flats, and $40 for other flat types) Half of the scale fee as the mortgagor’s solicitor (subject to a minimum fee of $20 for all flat types)

For housing loan from a bank

If our solicitor is acting for you in the mortgage of the flat to the bank, we will charge: Half of the scale fee as the mortgagor’s solicitor (based on the loan amount from the bank)

Stamp Duty

For Option to Purchase (Based on selling price or market valuation, whichever is higher) – First $180,000: 1% – Next $180,000: 2% – Remainder: 3% For mortgage (Based on loan amount) – 0.40% of the loan granted, subject to a maximum of $500 Note: The stamp duty will be collected by HDB regardless of your loan type

Registration Fees

For transfer – $38.30 For mortgage – $38.30

For caveat

With housing loan from HDB – Buyer’s caveat: $64.45 – Mortgagee’s caveat: $64.45 – Title Search fee: $10.40 Total = $139.30 With housing loan from a bank, or no housing loan taken – Buyer’s caveat: $64.45 – Mortgagee’s caveat: $0 – Title Search fee: $10.40 Total = $74.85

Miscellaneous

$15 (Subject to GST) Once all these have been completed, you can expect your Second Appointment in about 8 weeks as that will be the time it takes for the resale transaction to be complete.

Finally, the day has arrived. This will be one of the milestones in your life as you collect what could possibly be the biggest purchase of your life up to date. Please remember prior to this, you should inspect the resale flat to check that it will be handed over in the condition as agreed. Also, you will be paying the balance of the purchase price if any remains with either Cashier’s Order or NETS. Note: If you are taking a housing loan from HDB, it is a requirement that you purchase a fire insurance policy from FWD. You need to produce a valid certificate of insurance issued by FWD on this day as well. Once everything is finalised, you will be handed the keys to your new home. Congratulations, you have just completed the purchase of your home!

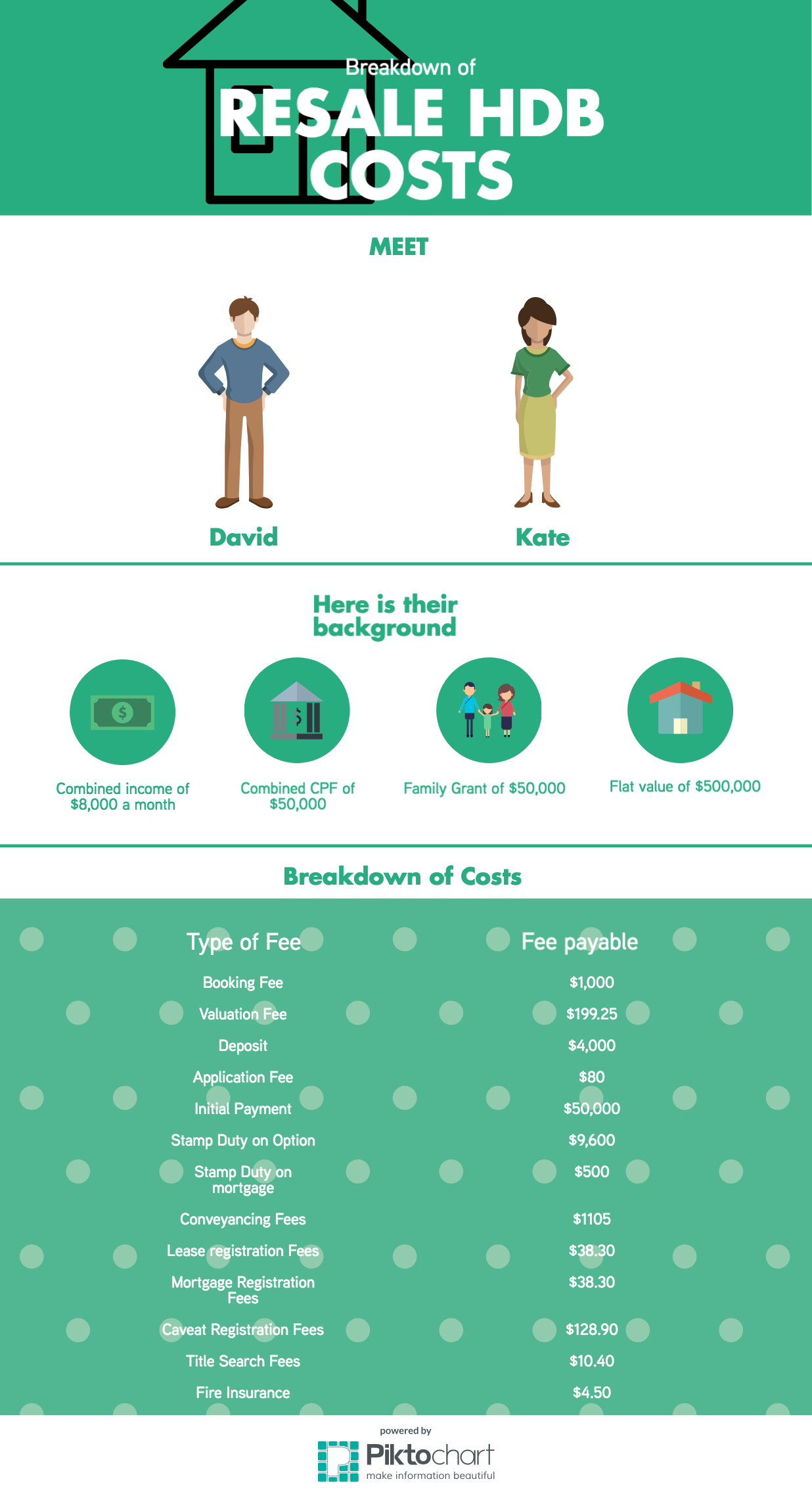

There are a lot of additional costs involved to buying a resale HDB. Here is an overview of all the fees that you will have to prepare for.

Here is another bonus tip for you. Sometimes when people buy a home, they get caught up in the entire process of it. The excitement of hunting for your dream home and finally purchasing it can prevent you from thinking about the long term future of your home and how you can go about protecting it. One of the most common misconceptions is that you do not need any type of home insurance because HDB has a mandatory fire insurance. Although this can be useful, in many cases it is not entirely adequate. Here are some home insurance covers that you should be aware of.

Mortgage Insurance

A resale HDB flat will probably be most people’s biggest purchase in their life, however many do not consider to have mortgage insurance as a means to protect their family members in any case of unexpected death. Having a mortgage insurance can ensure that remaining family members are not burdened by a home loan and will not be without a roof over their heads. This is particularly a must have, especially if the insured borrower is the sole breadwinner of the household.

Home Protection Scheme (HPS)

The Home Protection Scheme (HPS) is dispensed by the CPF board. It is a mortgage reducing insurance that protects flat owners from losing their home in the event of death, terminal illness or total permanent disability. This will insure owners up to age 65 or until the housing loans are fully paid up, whichever comes first. If you are using your CPF to pay for the monthly instalments, you will be required to be insured under the HPS. If you are using cash, you are not required but will be strongly encouraged to do so. For more information you can visit here.

If this article was useful to you, please share it! If you have any comments please do let us know.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Sean Goh

Sean has a writing experience of 3 years and is currently with Stacked Homes focused on general property research, helping to pen articles focused on condos. In his free time, he enjoys photography and coffee tasting.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Pro Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

On The Market A Rare Pair Of Conserved Shophouses In Chinatown Just Hit The Market For $32.5M

Singapore Property News Some Units At This Freehold Riverfront Condo Could Lose Their Views — But Here’s How Prices Have Actually Moved

3 Comments

If some one wants expert view on the topic of blogging afterward i propose him/her to visit this weblog, Keep up the nice work.

hi, can you do an updated version, since there is only 1 appointment nowadays?