Property Market Predictions In 2021: Have Cooling Measures Been Effective? (A Savills Research Recap)

July 27, 2021

In the Savills blog, executive director Alan Cheong recently examined the correlation between Singapore’s GDP, and rising property prices. In this recap, we’ve picked out the crucial points that we feel are most useful to home buyers/investors right now; along with some thoughts and on-the-ground observations.

First, why align home prices to GDP?

This was the first area we looked at, since it’s often asked whether home prices should have any relation to GDP. Savills highlighted the following advantages, in aligning the two:

- Prevents further deterioration or improvement of a modified Gini coefficient for asset prices (the Gini coefficient is one way to describe inequality. In a broad sense, the division between haves and have-nots in Singapore is well reflected by the kind of housing we buy.

- Reduce odds of overconsumption in residential real estate (prevents too much buying into residential properties)

- Matches changing home prices with productivity changes*

- Keeping household debt in check

*We’re aware there are arguments about the relationship between GDP and productivity, but it’s outside the scope of this recap

There are downsides to this approach as well. One notable example is that it sometimes helps to have home prices high when the GDP falls, given our high home ownership rate.

If you lose your job in a bad economy and need to downsize, for instance, it’s helpful if home prices are high, so you can sell your condo for more. This could work for Singapore given that 90 per cent of the population are home owners, with a property asset.

So how well do current prices match our GDP?

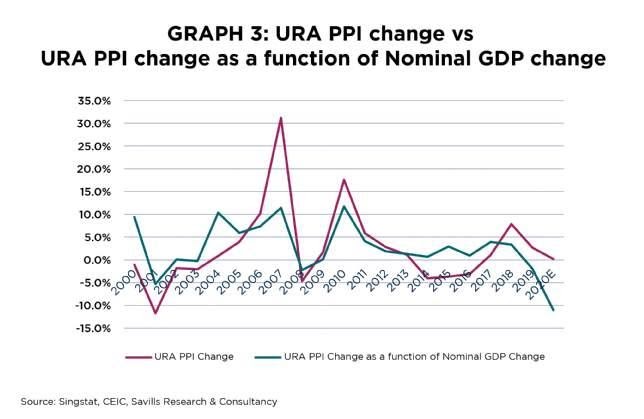

The Savills article notes the current correlation is “already quite good”.

The tracking error, or the degree of difference between nominal GDP and the URA PPI, was at 6.92 per cent between 2000 and 2020. It was at 6.34 per cent between 2013 and 2020.

While there’s no full proof way to identify what causes private property prices to deviate from the wider economic situation, Savills did say that over the decades, the causes have shifted from the economic to the psychological.

Some of the factors they identified as relevant are:

(Everything in parentheses is our addition)

- HDB resale prices (if these are a lot cheaper, they may be preferred to a smaller condo unit, and vice versa)

- Land bid prices (the more expensive the land, the more the developer has to charge you)

- Land supply, including the number of GLS sites (when available land is scarce, prices for the land go up, and the number of potential new homes goes down)

- Alternative investment channels (during a recession, investors sometimes flee from equities markets, or find that low interest rates make fixed-income products unattractive; and they may rush into the property market instead)

- Immigration policy toward higher skilled foreigners (these tend to be more highly-paid, and are more likely to buy homes or rent private properties)

- Policy intervention (cooling measures, loan curbs, eligibility restrictions, and so forth)

- Technology (consider the impact of being able to search property prices instantly, in a wide radius, via a property portal. This was a huge game changer from the past, when prices were more opaque to home buyers)

Policy measures are probably the most visible and dramatic factor; and authorities use them to try and reign in (or let loose) prices to better match the wider economic reality.

However, Savills notes that certain policy intervention methods, such as ABSD, do not “self-correct when markets reverse course”. For example, the ABSD rate doesn’t go down if property prices fall.

This can lead to measures that overcompensate, and distort the market. The example given was between 2012 to 2017, when property prices fell behind GDP growth due to cooling measures.

In addition, the cooling measures can cause “adaptive expectations”. As we’ve also found in recent cases, people may react to fears of cooling measures by accelerating their purchase (they want to buy before new measures kick in).

Cooling measures that “price out” segments of the population can also increase underlying demand, as an emotional effect. Part of the appeal of a $15,000 handbag, for example, is how unaffordable it is.

While cooling measures have helped prices to track the GDP, there are potential long-term drawbacks

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Are New ECs Still Attractive After The New Cooling Measures?

After the December 2021 cooling measures, the general consensus was that Executive Condominiums (ECs) would be more attractive. At the…

The Savills article notes that each time a cooling measure kicks in, prices “flatline for a period thereafter” and then rise again. When they do rise, they tend to shoot up faster than actual economic growth.

The reasons why prices recover so quickly after cooling measures are:

- Belief in land scarcity in Singapore, and the related belief that property prices can only rise

- Singapore courts new growth industries, with lucrative salaries. This contributes to more demand for private properties.

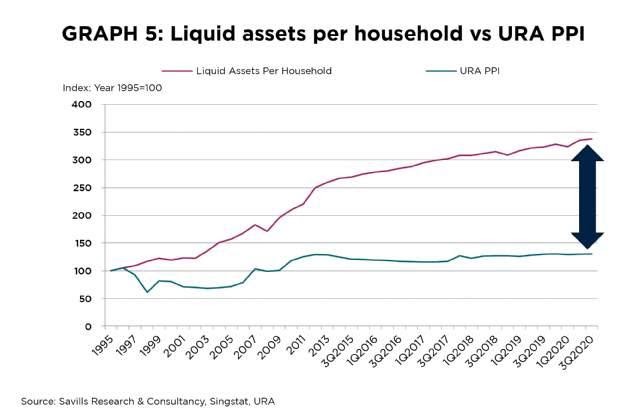

- Singaporeans’ liquid assets have been growing faster than nominal GDP:

Liquid assets among our households grew at around 3.8 per cent per annum, between 2013 and 2020. In the same time, nominal GDP only rose about 2.6 per cent.

Because Singaporeans store up wealth faster than the wider economy grows, we can still see demand and home prices rising even in rough economic conditions. The article suggested this is overall a negative – it can lead to further cooling measures being used to restrain demand, and even more market distortions.

- An ageing population of private home owners

The number of older Singaporeans (50 to 69 years old) owning private property was around 87,503 in 2000. As of 2020, the number has grown 2.5 times, to 221,274.

When these older Singaporeans retire and downgrade, they will drive up the cost of their right-sized homes (e.g., resale flats or smaller condo units). At the same time, they could provide sufficient wealth to their children, to result in a demand for two residential properties in the next generation.

(Singapore’s shrinking population also contributes to this, as the accumulated wealth is distributed between fewer children).

Property Trends4 Ways Singapore Population Trends Can Impact Home Buyers

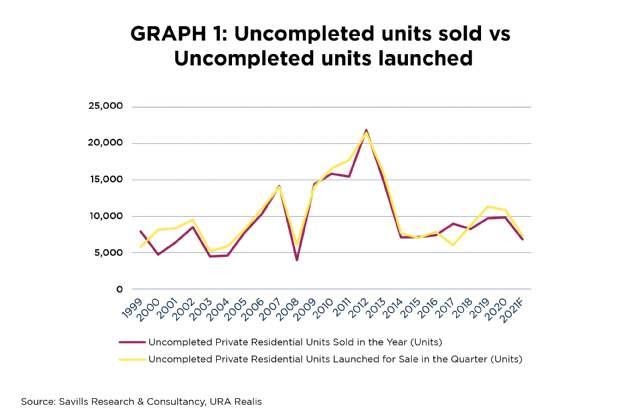

by Ryan J. OngWith regard to sales volumes, it’s mostly the number of developer launches is what correlates to new sales

The article pointed out that many of the “intuitive” variables, which we would assume correlate well to developer sales, actually don’t. From 2004 to 2020, factors such as:

- GDP

- Home loan rates

- Household assets

- Unemployment rates, and

- URA Property Price Index (URA PPI)

All didn’t show “significant” correlation to developer sales. Rather, it was developer launches (from 2000 to 2020) that showed the best correlation:

Overall, it suggests to us that developers can move units, almost regardless of how well the wider economy is doing!

This could be a further enticement to impose cooling measures, as we can see even mega-developments selling out despite the biggest GDP contraction on record last year.

Cooling measures may be a case of kicking the proverbial can down the road

The article notes that cooling measures have been created “to lower demand by reducing affordability”. In the immediate sense, this widens the inequality in property ownership – the wealthy can buy their homes right now, while the less affluent take an even longer time to afford an upgrade.

When the latter can finally afford a property, they could race to meet their aspirations by stretching their finances. Also, if the concept of cooling measures becomes normalised (as we at Stacked think it has been), it creates a constant demand.

If you don’t buy now, it could be less affordable when (not if) the next round of cooling measures kicks in. This mindset would be a worrying development, and we agree it’s a contributing reason as to why Singaporeans buy regardless of wider economic issues.

The original article is on Savills and goes into much more detail, but these are what we feel are key points of interest to buyers.

As always, we suggest you stick to the parameters of affordability when buying. Try not to let fear of cooling measures, or relatives getting rich with their homes, be the main drivers.

For more on the Singapore private property market, and in-depth reviews of new and resale developments alike, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How are property prices in Singapore related to the country's GDP?

What factors influence Singapore's private property prices besides the economy?

Do government cooling measures effectively control property prices in Singapore?

Why do property prices tend to rebound quickly after cooling measures are introduced?

What is the impact of cooling measures on different segments of the population?

How do developer launches relate to property sales in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Singapore Property News River Modern Sells Over 90% Of Units At Launch — Here’s What Buyers Paid

0 Comments