New Condos That Saw Prices Fall Soon After Completion: What Went Wrong?

July 16, 2020

We all say we want a running start to our home values; but we don’t mean a running start off a cliff. Sometimes though, that’s exactly what happens: the price looks like it’s going to hike up all the surrounding properties, then falls flat when the market turns up its nose.

In this article, we look at some Singapore new condos that have seen their prices fall shortly after completion; and some commentary into what could possibly have gone wrong:

Note: For all of the following except Sky Habitat, we compared the new condos median selling price to the property’s price based on transactions in the last six months.

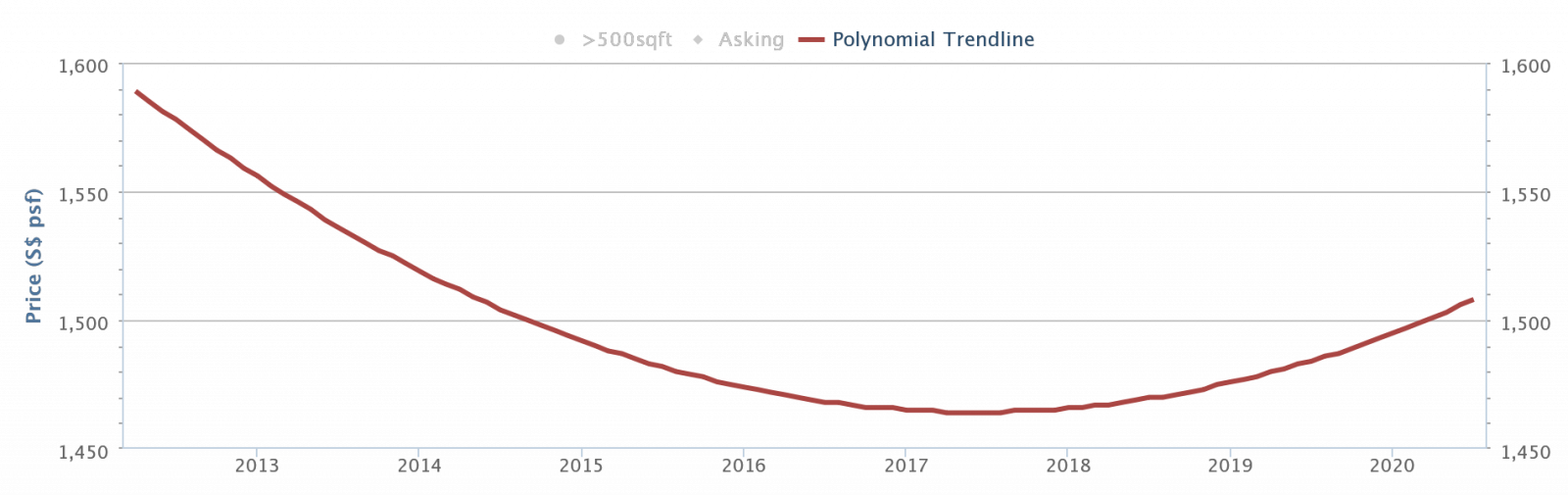

1. Sky Habitat

Price drop: $1,589 psf to $1,508 psf, around 5.1 per cent from initial (2012) launch price*

*Based on historical transaction prices, as the data was available

Probable cause: Initial asking price was too high

Sky Habitat is a condo in the Bishan area, and is the tallest skyscraper in Bishan at 38 storeys. When it was initially launched in 2012, the asking prices ranged between $1,435 to $1,893 psf.

Many interested buyers needed to sit down for a few minutes when they heard it.

At that price point, Sky Habitat was the most expensive suburban condo Singapore had ever seen; you’d be looking at prices like $2.18 million for a three-room condo in Bishan (in 2012 mind you).

In 2014 Sky Habitat was relaunched, with asking prices slashed by 10 to 15 per cent. Asking prices ranged from $1,276 to $1,590 psf, with the median price from real transactions being at $1,377 psf.

As such, Sky Habitat’s first price drop after launch can be chalked up to developer overconfidence. The last property peak was in 2013, so in 2012 developer optimism was still strong; but at a price that could get you a small unit in Orchard, Sky Habitat was a tough sell.

Today, the indicative price range is around $1,446 psf; a roughly five per cent increase from the 2014 relaunch. However, it’s still down around 9.9 per cent from the initial median launch price (in 2012).

Info sheet:

Address: Bishan Street 15 (District 20)

Developer: CapitaLand, Mitsubishi Estate Asia, Shimizu Corp.

Site Area: Approx. 129,137 sq.ft.

Tenure: 99-years

TOP: 2015

Units: 509

2. The Siena

Price drop: From $1,763 psf to $1,667 psf, around 3.74 per cent

Probable cause: Boutique development with few transactions, and three unprofitable transactions in a short span.

First, we should note that The Siena has only 54 units. A prevalent problem with small developments is the limited number of transactions; even a handful of units selling low can quickly drag down the pricing.

So it doesn’t help that between 2019 to this year, we saw three unprofitable transactions at The Siena:

- Transaction on 9th September 2019 at $1,745 psf (purchased at $2,311 psf, for an overall loss of $451,000)

- Transaction on 19th March 2020 at $1,765 psf (purchased at $1,979 psf, for an overall loss of $115,140

- Transaction on 27th April at $1,629 psf (purchased at $1,717 psf, for an overall loss of $69,456)

There’s also the current market situation to consider. In light of Covid-19, buyers may hold off on high-end developments like The Siena for now, given the higher price tag.

Info sheet:

Address: Tan Kim Cheng Road (District 10)

Developer: Far East Organization

Site Area: Approx. 29,536 sq.ft.

Tenure: 99-years

TOP: 2016

Units: 54

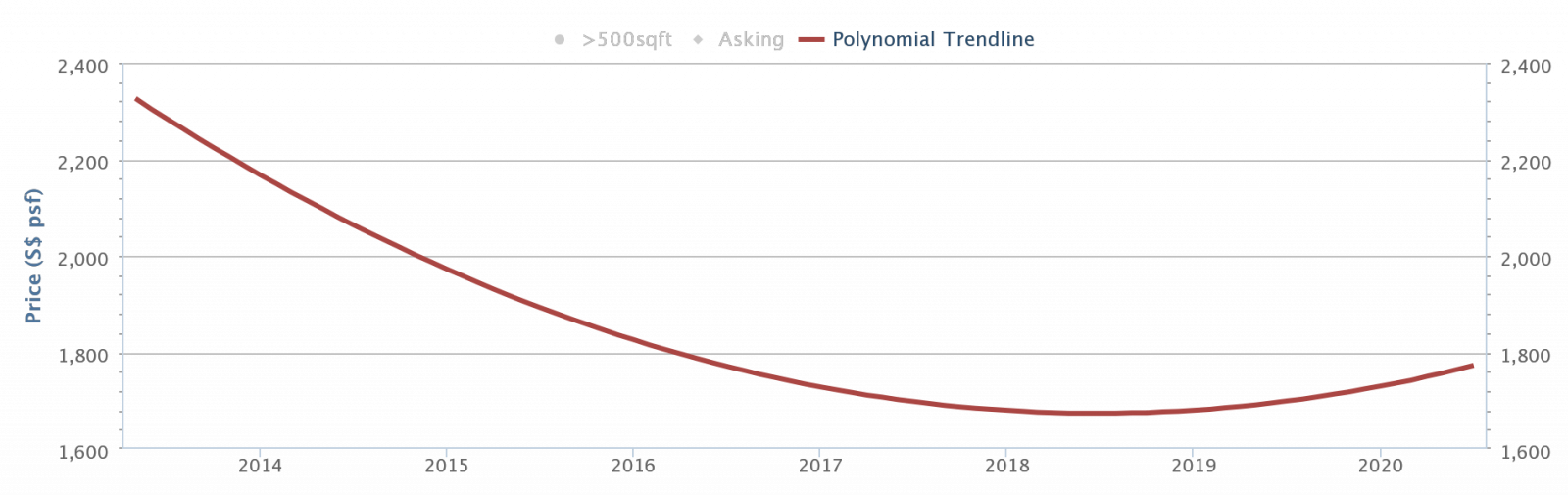

3. Cluny Park Residence

Price drop: $2,620 psf to $2,345 psf, around 10.5 per cent

Probable cause: More or less the same issue with The Siena

Cluny Park Residence is just 600 metres from The Siena (see #2). It’s also a boutique development, with just 52 units; so you can see the two developments share largely similar issues.

Note that Cluny Park Residence started off on a much higher price, however, as it’s just next to the Botanic Gardens MRT station. Another reason for the much higher initial price is that Cluny Park Residence is a freehold property; but at its young age (it was completed in 2016), the freehold status doesn’t make enough of a difference to the resale price yet.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Some Units At This Freehold Riverfront Condo Could Lose Their Views — But Here’s How Prices Have Actually Moved

When the Draft Master Plan 2025 was released, some owners living in the condos along Kallang Riverside Park scrutinised it…

Units are also quite small in comparison to the rest of the immediate area, so at the initial asking prices it was quite a tough ask as those who could afford such prices would probably prefer bigger living spaces.

Info sheet:

Address: Cluny Park Road (District 10)

Developer: Shelford Properties Pte. Ltd.

Site Area: Approx. 48,907 sq.ft.

Tenure: Freehold

TOP: 2016

Units: 52

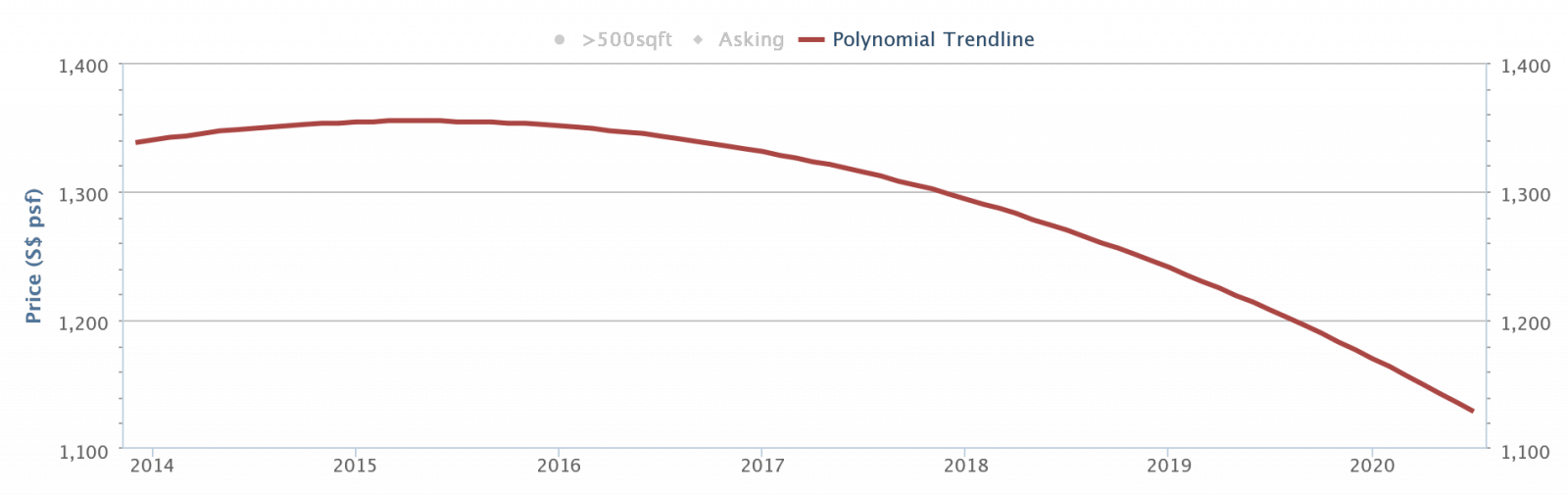

4. Hills TwoOne

Price drop: $1,386 psf to $1,052 psf, around 24 per cent

Probable cause: Units are on the small end, although there’s only 71 of them. It’s far from the MRT station and amenities.

This development has mainly one to three-room units only, despite having 71 units. Most units don’t go beyond 947 sq.ft. (the largest are up to 1,055 sq.ft). All of this is in a single, six-storey block. You may feel that tight interior space, even if the developer did a good job keeping the common facilities green and open.

You’ll also want to drive if you live here. West Mall, the nearest major mall, is around a kilometre away; as are the Bukit Batok town centre and MRT station.

The main issue could be the combination of small units, in a less urbanised area like Bukit Batok. Buyers who choose this sort of location tend to be willing to sacrifice convenience for space; but with all the small units squeezed into one block, they may feel like they’re getting neither.

Info sheet:

Address: 21 Hillview Terrace (District 23)

Developer: MACLY RL PTE LTD.

Site Area: Approx. 28,175 sq.ft.

Tenure: Freehold

TOP: 2016

Units: 71

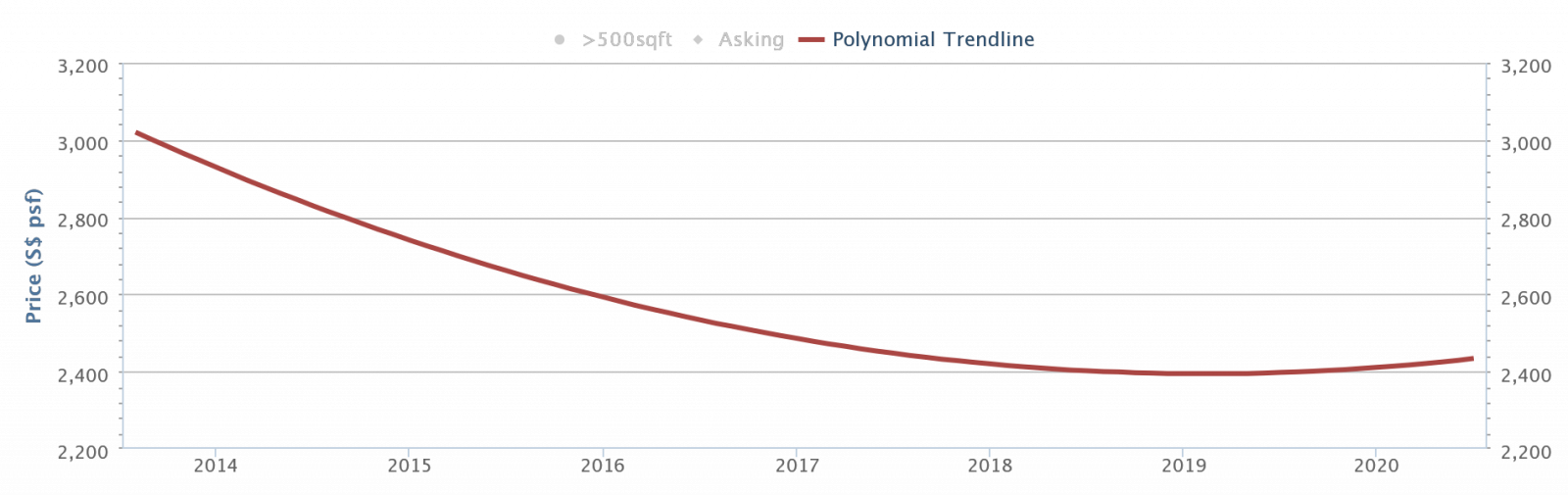

5. Marina One Residences

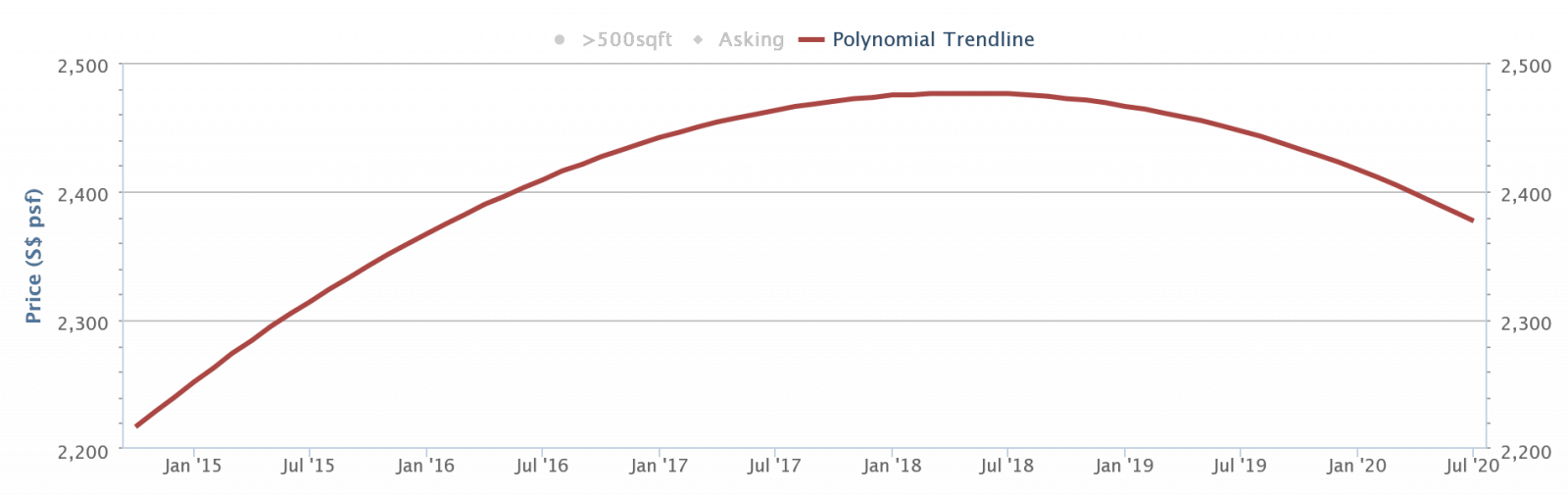

Price drop: $2,400 psf to $2,340 psf, around 2.5 per cent

Probable cause: Strong alternatives in prime region properties, rental market jitters

If you’ve bought a unit here, don’t panic. It’s hard for a Marina Bay area condo to go wrong. However, the slight dip in price is likely due to the strong slate of offerings in central districts.

In particular, buyers and investors have paid more attention to new condos in areas like District 7 of late. This is where prices are rising to beat out Orchard, and we’ve seen low quantum offerings like Midtown Bay and The M.

Besides this, there are fears of a weakening rental market in the aftermath of Covid-19. Apart from travel restrictions, there are the usual fears that a global downturn will see companies cut housing allowances, and bring in fewer expatriates. That means a tough rental market for prime region condos, such as Marina One (and consequently, investor interest in lower quantum properties as mentioned above).

This dip is likely to be a short-term issue for Marina One Residences.

Info sheet:

Address: Marina Way (District 1)

Developer: M + S Pte. Ltd.

Site Area: Approx. 282,017 sq.ft.

Tenure: 99-years

TOP: 2017

Units: 1,042

Of course, this isn’t something that happens to all new condos – there are a lot of other factors that come into play

Are you totally nonchalant about this, or do price drops so soon after a new condos completion worry you? Comment on Facebook and let us know your expectations. In the meantime, you can follow us on Stacked to see reviews of the latest properties, and trends in the market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why did the price of Sky Habitat in Singapore fall shortly after it was completed?

What factors caused the prices of The Siena and Cluny Park Residence to decrease after they were completed?

Why did Hills TwoOne see a significant drop in its property prices shortly after completion?

What is the reason behind the slight decrease in prices of Marina One Residences?

Are price drops soon after a new condo's completion common, and should buyers be worried?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary Singapore’s Tallest HDB Yet: A 60-Storey Project Is Coming To Pearl’s Hill

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Pro Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

On The Market A Rare Pair Of Conserved Shophouses In Chinatown Just Hit The Market For $32.5M

Singapore Property News Some Units At This Freehold Riverfront Condo Could Lose Their Views — But Here’s How Prices Have Actually Moved

5 Comments

Do you think the condos in Bartley area is a good buy at the moment? There is Bartley Residence, Ridge, Botanique, and Oasis Garden to name a few.

I loves to hear from u about Hillsta. Price wasn’t increase after 5Yrs TOP. U think price will increase in next few yers?

The prices of new condos drop because when they are launched, they are asking too high and many people fall for them because there is so much hype about them. However, when the condos are not so new anymore, the reality sets in and the prices will drop as they are not worth the initial launching prices. Only buy condos in areas which have strong fundamentals and are freehold. Resale condos are better choices!