Loan to Value (LTV): How To Increase The Loan Quantum For Your Property

August 12, 2020

After five years, you’re ready to sell your flat and make the jump to a private property. Or perhaps you’ve got your heart set on an Executive Condominium, for which you need to use a bank loan. In both cases, you’ll face the same hurdle a lot of Singaporeans are confronted with: the hefty minimum down payment.

This is also when many home buyers realise they can’t get the full financing from the bank; or that it’s possible for two banks to offer the same Loan to Value (LTV) ratio, yet the loan quantum differs.

In this article, we’ll clear up the often confused factors, and look at ways to increase the loan quantum:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

The Loan to Value ratio and your loan quantum

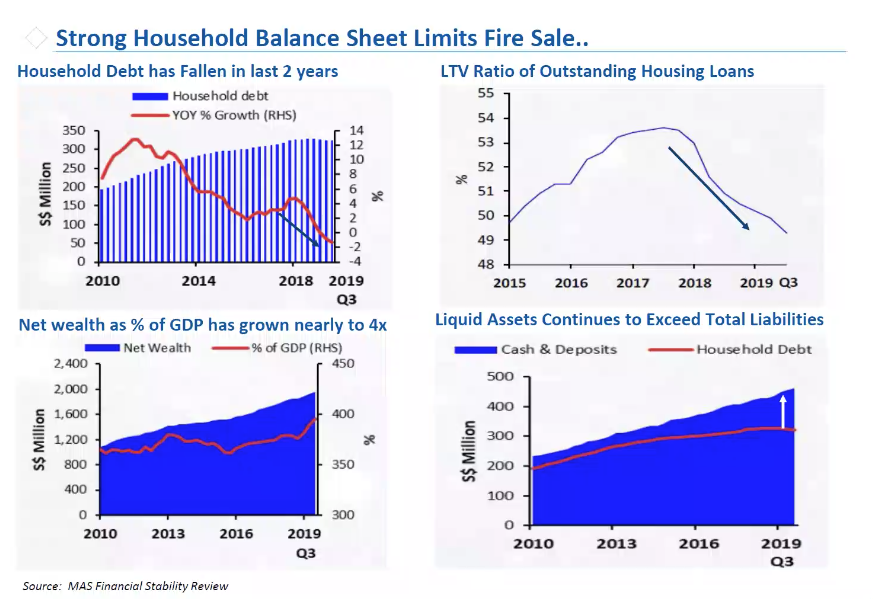

The LTV is the ratio of your loan quantum (the amount you can borrow), to the overall value of your home. As a quick summary:

In Singapore, the maximum LTV ratio granted by banks is 75 per cent; so you can borrow up to $750,000 for a $1 million property, for example.

HDB can provide a maximum LTV ratio of 90 per cent; so you can borrow up to $450,000 for a $500,000 flat (note that you can use either an HDB loan or a bank loan for a flat, although you can only use bank loans for private properties and ECs).

That said, nothing compels the bank – or even HDB – to grant you the maximum LTV. Some home buyers may face lower LTV ratios, or find that the loan quantum from one bank is actually higher, even though the LTV ratio is unchanged.

Here are some ways to increase your loan quantum:

- New launch properties are the best for getting a bigger loan quantum

- Approach a non-banking Financial Institution

- You may have to shorten the loan tenure

- Find a younger co-borrower, who also earns more than you

- Settle your previous home loan before buying the new property

- Start repairing your credit score at least 12 months prior to loan application

1. New launch properties are the best for getting a bigger loan quantum

When you buy a resale property, there could be a discrepancy between the seller’s asking price and the actual valuation of the property.

(For an HDB property, the valuation is provided by HDB after you agree on the price and secure the option; for private property, the valuation is provided by a third-party expert that the bank recognises).

The problem is that the LTV is always based on the lower of the price or valuation. So if the seller’s price is $1 million, but the actual valuation is $970,000, then the maximum LTV is 75 per cent of $970,000 ($727,500).

We mentioned above that it’s possible to have the same LTV ratio from two banks, but still get a higher loan quantum from one of the banks. This would happen if, for instance, bank A accepts a valuation of $970,000, but bank B accepts a higher valuation of $990,000 (in which case, bank B could offer a maximum loan amount of $742,500).

As such, you may need to go from bank to bank, to try and find one that accepts a valuation closer to the seller’s price (or you can contact us for help, if you don’t have time to hunt across the various banks).

New properties – by which we mean both condos and BTO flats – have it easier, as the developer’s price is simply taken as the valuation.

Another advantage is that new launch properties don’t have issues of lease decay, and are less likely to be in poor condition or “problem areas”

Resale properties that are very old, such as those reaching their 30th year or beyond, will often see a reduced Loan to Value. Maximum financing can be as low as 45 per cent. For properties with only 30 years left on the lease, no bank loan is possible.

The same can happen with properties deemed to be in undesirable conditions or locations (e.g. Orchard Towers, or the red light area of Geylang).

2. Approach a non-banking Financial Institution (FI)

By this, we refer to organisations that can provide loans, but are not banks; the most well-known in Singapore is probably Hong Leong Finance.

A non-banking FI may sometimes grant you the full LTV of 75 per cent, even when regular banks won’t. For example, a non-banking FI may be willing to overlook a lower credit rating*, or they might be the ones to accept a property valuation that all the regular banks consider too high.

The trade-off is that you may have to accept a higher interest rate, or higher fees. These vary between non-banking FIs, on a case-by-case basis.

Consult a mortgage specialist first though, if you’re having trouble getting a sufficient loan.

*Some non-banking FIs may also grant home loans to discharged bankrupts. Regular banks will usually require discharged bankrupts to wait five to seven years after the official discharge, to receive a home loan.

3. You may have to shorten the loan tenure

The maximum loan tenure for HDB flats is 30 years, and the maximum loan tenure for private properties is 35 years.

However, the Loan to Value limit is reduced to 55 per cent, for HDB loans that exceed 25 years, and private home loans that exceed 30 years. In addition, the minimum cash down payment will be raised from five per cent to 10 per cent.

The same applies if the loan tenure plus your age would exceed 65. For example, if you’re 45 years old, and you take a loan tenure of 25 years to buy a condo, your maximum LTV ratio would also fall to 55 per cent.

As such, you may have to shorten the loan tenure with regard to your age, or collective age if you have co-borrowers (see below).

The shorter loan tenure will result in higher monthly loan repayments, however. For example, a $1 million loan at 1.3 per cent per annum, on a 25-year loan tenure, would incur monthly repayments of about $3,900. If shortened to 20 years, the loan repayments would increase to around $4,730.

(Ps. Don’t forget that the total of your home loan repayment, plus other monthly debt obligations, cannot exceed 60 per cent of your monthly income to qualify for the loan)

4. Find a younger co-borrower, who also earns more than you

If you have a co-borrower, banks will use your collective age – called the Income Weighted Average Age (IWAA) – to work out your maximum loan. The formula is:

(Monthly income of first borrower x age of first borrower) + (Monthly income of second borrower x age of second borrower) / total monthly income

So say borrower A is 35 years old, and makes $6,000 a month. Borrower B is 43 years old, and makes $8,000 a month. Their IWAA is around 40 years old (rounded up).

Note that the collective age will decrease if the younger co-borrower earns more. For example, let’s invert the above: say borrower A is 35 years old, and makes $8,000 a month. Borrower B is 43 years old, and makes $6,000 a month.

Their IWAA would be 38 instead of 40.

Of course, not all of us conveniently have a much younger co-borrower who earns a lot more; but it helps if you can find one!

5. Settle your previous home loan before buying the new property

If you have one outstanding home loan when applying for another, your maximum Loan to Value on the second home loan falls to 45 per cent (or even 25 per cent, if you also break the age and loan tenure limits in point 5).

As such, you might consider selling your previous property first – and paying off its outstanding mortgage – before you buy the next property.

If you’re upgrading, such as from a flat to a condo, speak to a mortgage broker or the bank’s loan officer. If you can provide the documents that show you’re in the process of selling your flat, you may be treated as if you don’t have an outstanding home loan.

6. Start repairing your credit score at least 12 months prior to loan application

Late payments will lower your credit score, which in turn causes banks to lower the amount they’re willing to lend you. You can check your current creditworthiness with the Credit Bureau of Singapore (CBS); a report costs $6.42.

As such, you do need to start repairing bad credit – such as by paying off debts, closing unused lines of credit, etc. – to ensure you can get the home loan you need. Do consult a financial adviser or credit counsellor regarding this.

It does take some time for your efforts to be reflected in the credit report. If you try to do it a short time before your loan application (e.g. one or two weeks before you apply for a home loan), you may still fail to qualify for the full loan. As such, it’s usually best to start at least 12 months prior to any home loan application.

If you’re a recently discharged bankrupt, or urgently need a bigger loan despite credit issues, see point 2 about non-banking FIs.

If you can manage the down payment though, don’t forget that a lower Loan to Value is not always a bad thing.

A lower LTV ultimately means you’re borrowing less. That means you pay less interest, and have lower monthly repayments.

For example, if you borrow $1 million at 1.3 per cent over 25 years, you’ll pay around $3,900 a month, and pay total interest of about $172,000 by the time the loan’s finished.

If you get a lower Loan to Value and borrow just $925,000, loan repayments drop to around $3,610 per month, with a total interest repayment of around $159,000. That’s a $13,000 difference; and the less interest you pay, the better your resale gains and rental yield.

Do give it some thought, before pushing for the biggest loan quantum possible.

In the meantime, make sure that your home loan repayments go toward the best property for you. Check out Stacked for in-depth reviews on Singapore’s top real estate offerings, as well as news and tips.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

0 Comments