How The Endowment Effect Is Hurting Your Property Decision Making – Case Study Of A Rental Investor

November 29, 2019

Despite property being such a big ticket item (especially in Singapore), it is frankly quite astounding when you hear the reasons why some people made the purchase they did.

“Oh, I bought this because my friend said it will have good rental returns.”

“I thought District XX will confirm make money.”

“I bought during the new launch, the showflat looked really good!” (case in point)

“The agent told me it would be easy to rent out.”

Can you identify with any of these?

In a bull run property market, everyone is happy and sitting on a ton of (paper) profits.

But what happens when the market slows down?

When the Government intervenes with cooling measures, these usually have quite a drastic effect on the property market.

Resulting in people starting to question their initial property decisions.

Let me give you a real-life example.

Mr. Tan (name changed to protect privacy) reached out to us about his property situation.

He had purchased a second property as an investment at the Levelz condo when it was first launched in 2002.

But because he had always been working, he was never too worried about the rental he was receiving.

That is until he retired 2 years ago, and is now dependant on the rental income from the condo to live on.

Leading on to the reason why he was now concerned about maximising his rental gains from his investment.

So before I go on any further, there are two unique points you have to know about his scenario.

Number 1, the property has been fully paid (less of an issue to calculate the property returns).

Number 2, he is single with no children (no way to avoid ABSD).

So when I asked his reason for purchasing the condo.

He remarked, “The agent said District 10 is easy to rent out.”

While the agent isn’t wrong, this highlights why it is so important to know exactly why you are buying and how your needs can be met further down the road.

Let’s break down the numbers together and see how we can help.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

What do you look for in a property investment?

So as a property investment, what are the two figures that you’ll be most concerned about?

Capital appreciation and rental yield, you say?

Spot on.

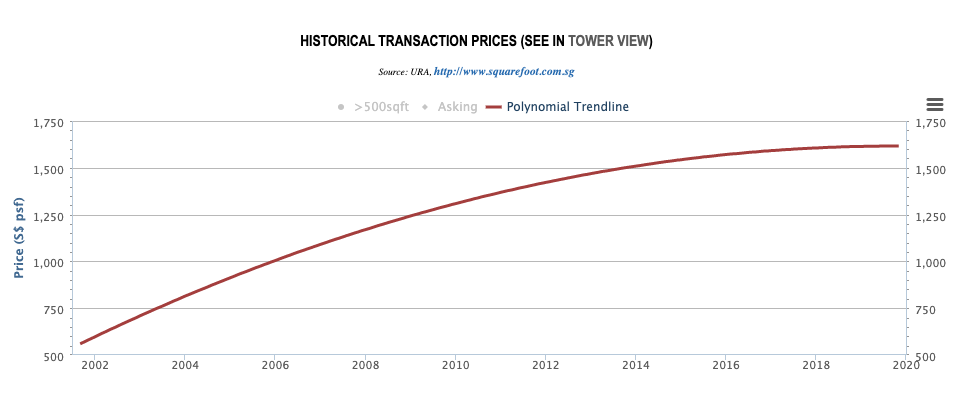

Objectively speaking, the Levelz condo has appreciated considerably since 2002.

Which fulfills the capital appreciation criteria.

But what about rental yield?

The current valuation for a 1 bedroom unit (786 sqft) at the Levelz is $1.228 million – with the average rental for that particular size at about $2,500 per month.

Which leaves us with a rental yield of 2.4%.

That’s about what you’d expect, right?

Wrong.

In order to really get an accurate picture, we have to get the net rental figure each month.

Basically, we need to deduct all the taxes and fees to arrive at this figure.

Let’s start with the property tax.

To calculate this figure, you’ll first have to determine the annual value of the property.

Normally this is estimated by the Inland Revenue Authority of Singapore (IRAS), but to keep things simple let’s assume that the gross rental income is the same as the official annual value of the property.

So for a property that has an annual value of $30,000, the property tax that you have to pay is $3,000.

Next, the monthly maintenance for the Levelz condo 1-bedroom is currently $450, which comes up to a yearly figure of $5,400.

Last but not least, the agent fee of $1,250 (half month commission for a 1-year rental).

This means you are left with a total of ($30,000 – $3,000 – $5,400 – $1,250) = $20,350.

That’s basically a monthly income of $1,695.80, a far cry from the initial figure of $2,500.

Not to mention, a paltry 1.65% rental yield.

And let’s not forget your own maintenance of the unit itself, which I’ll leave out at this point to keep things simple (but expect to set aside even more if the unit is old).

So after hearing his situation, this is the course of action we suggested to him:

Assuming that the 1 bedroom unit can be sold at valuation ($1.228 million), after deducting agency fees ($26,279.20) and conveyancing fees ($3,000), you are left with a total of $1,198,720.80.

Next, find a property that is newer in age (less maintenance work required), close to MRT (easier to rent), and has lower monthly maintenance fees (resulting in higher rental yield).

So after some searching based on the requirements, that landed us at the Alex Residences in Redhill.

To allow you to see the calculations clearly, let me present it in the form of a table:

| Levelz Condo | $1.228m |

| Alex Residence | $900,000 |

| BSD | $21,600 |

| ABSD | $108,000 |

| Conveyancing | $3,500 |

| Furnishing | $5,000 |

| Total | $1,038,100 |

| Balance Cash | $160,620.80 |

| Alex Residence Rent | $2,550 |

| Annual Value | $30,600 |

| Property Tax | $3,072 |

| Agent Fee | $1,275 |

| Maintenance | $3,600 |

| Monthly Rental Income | $1,887.75 |

So even after paying the cumulative stamp duty of $129,600, you are still left with a cash reserve of $160,620.80.

Not to mention, a higher monthly rental income of $191.95 more (total of $1,887.75).

Now that you know all these figures, let me throw the question back to you.

If you were in this scenario, what would you do?

I would like to think most people would agree with me that this is a much better outcome.

It is, after all, a win-win situation.

More from Stacked

6 Interesting 4-Room HDB Layout Ideas For DINK Couples

Until that magical time comes when we can specify the type of layout we want in our BTO flat, there…

More cash reserves, newer property, arguably easier to rent out, plus more monthly rental income!

But here comes the kicker…

Despite all the numbers being so clearly laid out, he opted to stay status quo.

The reason?

“It is a freehold D10 property plus it could en bloc in the future.”

And even after explaining that there are a ton of older condos in the queue for en bloc in the area (Spanish Village, Sommerville Park, Gallop Gables, and Sutton Place), he was unmoved.

Which finally leads me to my main point.

So, without further ado.

Let me introduce you to the phenomenon known as the endowment effect.

What is the Endowment Effect?

In the words of Wikipedia:

In psychology and behavioral economics, the endowment effect (also known as divestiture aversion and related to the mere ownership effect in social psychology) is the hypothesis that people ascribe more value to things merely because they own them.

Put in simple terms – the endowment effect is a phenomenon where you overvalue the things you own, simply because they are yours (regardless of its objective value).

This happens primarily because of two psychological reasons:

1. Ownership

You fall in love with what you already own, and therefore are prepared to pay more to retain something that you already own than pay for an item that you don’t own.

In what is now famously called the Mug Experiment, Daniel Kahneman, Jack L. Knetsch, and Richard H. Thaler conducted a study to see how the endowment effect can influence our decision making.

Participants were randomly divided into buyers and sellers, with sellers getting coffee mugs as a gift.

The sellers were asked to list the lowest price that they would sell the mugs for.

While the buyers had to list the highest price they’d be willing to pay.

The end result?

Most of the mugs ended up achieving no sale because most sellers listed too high of a price for buyers, and most buyers listed prices too low for sellers.

To cut a long story short, those that owned the mugs placed a significantly higher value ($7.12) on the mugs than the buyers did ($2.87).

So you feel attached to the things you own.

What’s wrong with that?

If you’ve ever tried to sell your own home, you might have encountered a very common situation in that your valuation of your own home is way higher than what a buyer is willing to pay.

It’s not because you are an unreasonable person, because who doesn’t want to extract as much value from a sale as possible?

After all, you yourself know deeply all the ins and outs of your home.

You value the peace and quiet in the mornings.

You have painstakingly repaired and upgraded parts of your home, sparing no expense.

Thus you are no longer being objective and attributing a higher value to your place.

2. Loss aversion

You feel the pain of loss twice as strong as the pleasure of an equal gain.

Studies have showed that losing $10 hurts more than gaining $10 feels good.

A very simple example will show you what I mean.

If I were to play a coin toss bet with you right now, offering you $10 if it lands on heads.

But if it lands on tails, you’ll have to pay me $10.

Would you take it?

Most people wouldn’t.

In fact, behavioral economists estimated the ratio of gains to losses at about 2.25 to 1.

Which basically means you value a gain 2.25 times more than its equivalent loss.

Now, if you were selling something inconsequential, like a laptop off Carousell, this would hardly matter.

Worst-case scenario would be to end up on the infamous Carouhell page.

My point is this:

Holding off for a superior price or holding on despite better options out there will not have a significant impact on your life.

But when it comes to a big-ticket item like property, the repercussions would be huge.

What if you hold off a perfectly good offer, only for the market to turn downhill after?

Or, like in the case above, what if you end up holding out for that elusive en bloc (which has no guarantee of coming), but miss out on years of higher rental income?

Final Thoughts

At the end of the day, it’s not that the Levelz condo is a bad development.

It is basically the wrong fit for the needs of the buyer.

But it is the endowment effect that is a tough one to avoid.

It causes you to miss better alternatives as you unknowingly continue to hold on to things that you have invested in.

But by taking the first step of being aware of it, allows you to make the process for buying and selling a home much easier and understandable.

Just imagine if you were in this situation, would you have been open-minded to this option?

A monthly income increase plus 6 figure extra cash might not have been enough to convince this owner, but to someone else, this could have made a huge compounding difference to their life further down the road.

If you have any further questions on the endowment effect feel free to reach out to us at stories@stackedhomes.com!

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is the endowment effect in property decision making?

How does ownership influence property valuation?

What is loss aversion and how does it affect property sellers?

Why might property owners resist selling or upgrading their property despite better financial options?

What can help property buyers and sellers avoid the negative effects of the endowment effect?

Ryan Ong

Ryan is part property consultant, part wordsmith, and a true numbers aficionado. Ryan's balanced approach to every transaction is as diverse as it is effective. Since starting his real estate journey in 2016, he has personally brokered over $250 million of properties. Beyond the professional sphere, you'll often find him cherishing moments with his beloved cats: Mia, Holly, Percy and Toto.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

7 Comments

It is obvious that most FH properties will yield less than leasehold. At the start state, FH will cost more, what more at D10 location. No tenants will pay more because your property is freehold. Even between leasehold properties of 99-year and 60-year leases, which I see may come, the yield will differ in favour of shorter lease as the invested capital will be less. That is because these yields/returns are calculated on annual basis instead of total quantum of its tenure or lifespan.

The attachment of endowment effect is common. A good agent will know how to temper these psychological expectations between the buyers and sellers.

From a rental perspective, it does make sense to opt for Alex Residences over Levelz for the reasons set out in the article. However, considering that Alex Residences is a 99 year leasehold, with multiple condominiums touting similar advantages in its vicinity (Artra, Metropolitan, Ascentia Sky etc), it seems that Levelz, a freehold property in D10 (with new launches approaching approximately $2400 – $2600psf), has the potential to achieve a higher sale price. If Mr Tan is not fully dependent on the rental income (the difference of approximately $180 a month), it might not be entirely unreasonable to hold on to the Levelz property.

Why do Mr Tan need to pay the ADSB of $108K? He can simply avoid it by selling his Levelz condo first before buying Alex Residences. Am I missing something?