China’s Biggest Developer Evergrande Is $300 Billion In Debt: Here’s What Overseas Property Investors Need To Know

September 16, 2021

Evergrande is China’s largest property developer and – at this point – possibly its largest real estate disaster. All of this has happened at a rapid pace – from red flags raised in 2018, to the risk of stalled construction and massive investor losses this year. This should also be taken as a warning of what can happen, if you jump into overseas properties.

But first, for those of you who are unaware, here’s the video that has been making its rounds on social media:

And well, here’s a condensed timeline for those interested in the background of the current situation:

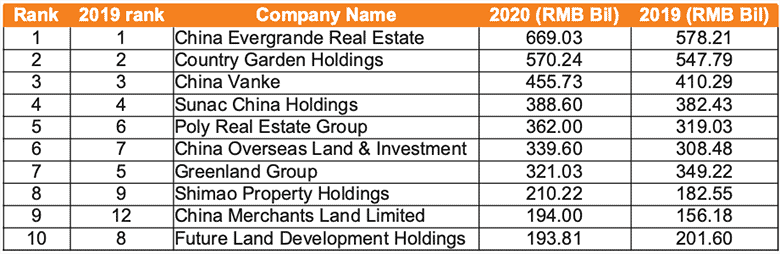

Evergrande is the biggest real estate developer in China (according to Mingtiandi) by revenues in 2020, and has completed nearly 1,300 commercial, residential, and infrastructure projects so far.

Their assets and equity have been booming over the past few years, but not in the way of its net income. There are many reasons mooted for this, but one major one was they seemed to be one of over-leveraging.

It’s now estimated that they’ve managed to rack up nearly USD $300 billion in debt, and a staggering 1.4 million properties that it has committed to complete – around S$270.75 billion in pre-sale liabilities, as of the end of June.

While this is still up in the air, hope is also diminishing that the Chinese government will bail out this company.

So what should Evergrande’s situation make us aware of?

- Don’t assume developers can complete construction

- If a developer fails, you don’t know who will take over

- Foreign legal jurisdictions are a major risk

- Size and branding may just further the deception

1. Don’t assume developers can complete construction

In China, as in Singapore, you pay a deposit to secure your unit, even if it hasn’t been built yet.

Those who bought Evergrande properties – of which there are around 778 projects in 223 cities as of 2020 – trusted the developer to finish work. But as of last week, Evergrande has begun halting construction work.

Evergrande’s suppliers and contractors need to be paid; and because the company is no longer stable, they’re unwilling to extend credit. In an extreme case, this could result in the project being suspended.

While that hurts for the contractor, the main losers are the property buyers. Their deposit is stuck, with construction that cannot – and may never – be completed.

The only “escape” is if Evergrande can sell more unbuilt units, thus funding continued construction. But who would buy property from a developer, who is on the verge of suspending projects? No one wants to take that risk.

This results in a downward spiral of declining sales, as Evergrande shows it can’t finish projects, and more project shutdowns as sales fall.

We have seen this happen in Singapore too, but it’s very rare

The last time this happened was in May 2019, when a developer was unable to complete Laurel Tree and Sycamore Tree condos. There wasn’t money left to pay the contractor, and buyers stood the risk of losing their deposits, with nothing in return (there has been no further news on the situation).

We can, at the very least, be assured that such cases are uncommon here. Property developers are vetted by the government, and need to show sufficient levels of capitalisation, safe amounts of debt, etc.

When you buy overseas, keep in mind you don’t know how strict their authorities are. It’s entirely possible that the developer doesn’t have the capital to finish the project; and is desperately seeking sales to fund it.

Be especially wary if the foreign developer is the one reaching out, via seminars or ads. If they have a good project in high demand, why aren’t the locals buying it? Why do they need to come to you?

2. If a developer fails, you don’t know who will take over

What happens if Evergrande goes bust, and can’t complete a project? It’s likely other developers will move in and finish it up if it’s to their advantage. This means that – if you pick a developer who can’t see it through – you don’t really know who you’ll end up with next.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

I Bought My First Condo At 30 And Renovated It For Just $14k: Here’s How I Did It As A Single

The simple truth about home ownership in Singapore is that for most, it takes two parties. Barring shoebox units and…

It may be another trusted name, or it may be a first-time developer, that sees a chance to execute its first project at a huge margin (which makes buyers their guinea pig).

This is worse when it happens overseas, as you don’t know the laws there. In some cases, the developer taking over may be allowed to charge more than the existing project – this could mean asking you to fork over more money, if you want your unit completed.

Overseas Property Investing7 Mythbusters Of Buying Overseas Property: Clarifying The Basic Risks

by Ryan J. OngThere may not be contractual terms that prevent the new developer from changing plans; they might reduce the number of facilities, shrink parking spaces, use cheaper finishing on the different units, etc.

Delays are also inevitable, as a new developer often wants to change the main contractor, or several of the sub-contractors. So even if another firm steps in, you’re likely to incur costs.

3. Foreign legal jurisdictions are a major risk

Pursuing legal action in Singapore is already tough. Imagine if you have to do it in China because you bought an Evergrande project; or in some other legal jurisdiction.

Even if you can find a lawyer abroad, fees are likely to be steep – and it may get frustrating to communicate over different time zones, have documents translated, or in some cases fly down in person.

Bear in mind that foreign property sellers, when they come to Singapore, may not be bound by regulatory bodies.

For example, say you go to a property seminar, hosted by a foreign sales team. As the sales team are not local property agents, they are not under the eye of the Council of Estate Agencies (CEA).

All the rules that CEA imposes – such as the need for full disclosure, proper licensing, sales commissions, and so forth – are not enforced. No one steps in if these sellers misrepresent the property, or outright lie.

This creates an unfair situation, where you have to buy without proper information.

4. Size and branding may just further the deception

Most property buyers are smart enough to avoid “fly by night” real estate companies. These tend to be small and obscure. However, Evergrande was China’s second-biggest real estate developer; and one of the biggest on an international scene.

The size of the company, and its branding, prompted buyers to be less cautious. Even now, some are making the assumption that China has to bail out Evergrande, so there’s a limit to their losses.

If it turns out that’s not true. then the company’s size and brand have simply fuelled a lack of caution.

So when you’re buying overseas, don’t assume it’s “safe” because you’re buying from a bigger developer.

Overseas property is not the best idea, for new investors

Before you buy property in another country, you should be prepared to take on a greater level of risk. You need to ensure that – if the property can’t be completed, or there are significant policy shifts abroad – you will not derail your financial plans. Only buy what you can afford to lose.

For more on the goings-on in the private property market, follow us on Stacked. For local properties, you can check out our in-depth reviews of new and resale properties alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What should overseas property buyers be cautious about with developers like Evergrande?

Why is it risky to buy property from foreign developers in overseas markets?

How does the size and branding of a developer like Evergrande affect the safety of an overseas property investment?

What happens if a developer like Evergrande cannot finish a property project?

Should new investors consider buying overseas property?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

1 Comments

Have Evergrande ever sell their China properties in Singapore, when presumably their China projects have been selling very well in China itself over the past several years, unlike the majority of the UK or Australian projects being promoted locally ? Beacause if they had, I have never come across newspaper advertisements or promotions of their China projects in the local media. Unless you are telling us that local Singapore buyers of the Evergrande China projects actually made their own way buying directly into the China cities? Besides are there no restrictions on foreign buyers into the Evergrande China projects that foreigners can freely buy into and compete with the locals? If all the above are not happening, using Evergrande failure at this juncture may not be a good illustration of choice of scapegoat as to why investing in overseas properties is often fraught with very high risks. As an additional consideration, since the CEA requires a locally licensed agent under its jurisdiction to be present and responsible for some of the representations being made locally, would that not at least afford some measures of comfort to local buyers? Besides the Evergrande story is a deadly matter of interest for overseas investors who bought into their shares or bonds but not for the other overseas property investors who bought elsewhere and from other non Chinese developers unless of copurse they happen to have bought into Country Garden’s Forest City in Iskandar due to contagion concerns.