8 Key Things Home Buyers Need To Know In 2022 To Be Prepared

December 28, 2021

2022 is just around the corner, and come January, most home buyers will be re-starting their search. The past two years have been a roller coaster due to both Covid, and rising home prices; so it’s important to dive in prepared. Here are the main factors you can expect to face when looking for a home in 2022 (and how to prepare for them):

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. COV, and hence valuations, will become a factor if buying resale homes

In 2021, about one-third of all resale flats sold above their valuation. The difference between the valuation and price, called Cash Over Valuation (COV), is not unique to HDB flats – realtors tell us that resale condos, too, are seeing asking prices above valuation.

It’s likely that a large number of resale home buyers in 2022 will face this issue, so you need to be prepared for two things:

First, amounts above valuation are not covered by your home loan (it doesn’t matter whether you use a bank or HDB loan). So if the seller’s price is $600,000 and the valuation is $550,000, you do need to have the extra $50,000 ready in cash.

This can’t be paid from your CPF, and banks are not allowed to give you loans for down payments. We suggest you have extra cash set aside for this if you’re intending to buy resale homes.

(New launches and BTO flats don’t have this issue; the developer’s price is considered the same as the value).

Second, you may need to try out different banks, which will accept different valuations. This may result in having to take on a higher interest rate. For example:

Say the resale unit is priced at $600,000. Bank A has an interest rate of 1.7% but accepts a valuation of $575,000. Bank B has a lower rate of 1.3% but accepts a valuation of $550,000.

You’ll have to decide if the difference in cash outlay ($25,000) justifies the higher interest rate.

2. Fewer new launches and a supply crunch gives the edge to resale sellers

For starters, buyers will be shorter on options, when it comes to new launches. In 2021 and last year, we saw roughly 50 new launches across Singapore. In contrast, 2022 is expected to see only around 41 new launches, with a total of 5,389 units. Based on the split, 22% are in the Core Central Region (CCR), 37% in the Rest of Central Region (RCR), and 41% in the Outside Central Region (OCR).

Most developers now have depleted land banks, with many of the en-bloc sites from 2017 having been redeveloped and sold; we cover this in greater detail in this article.

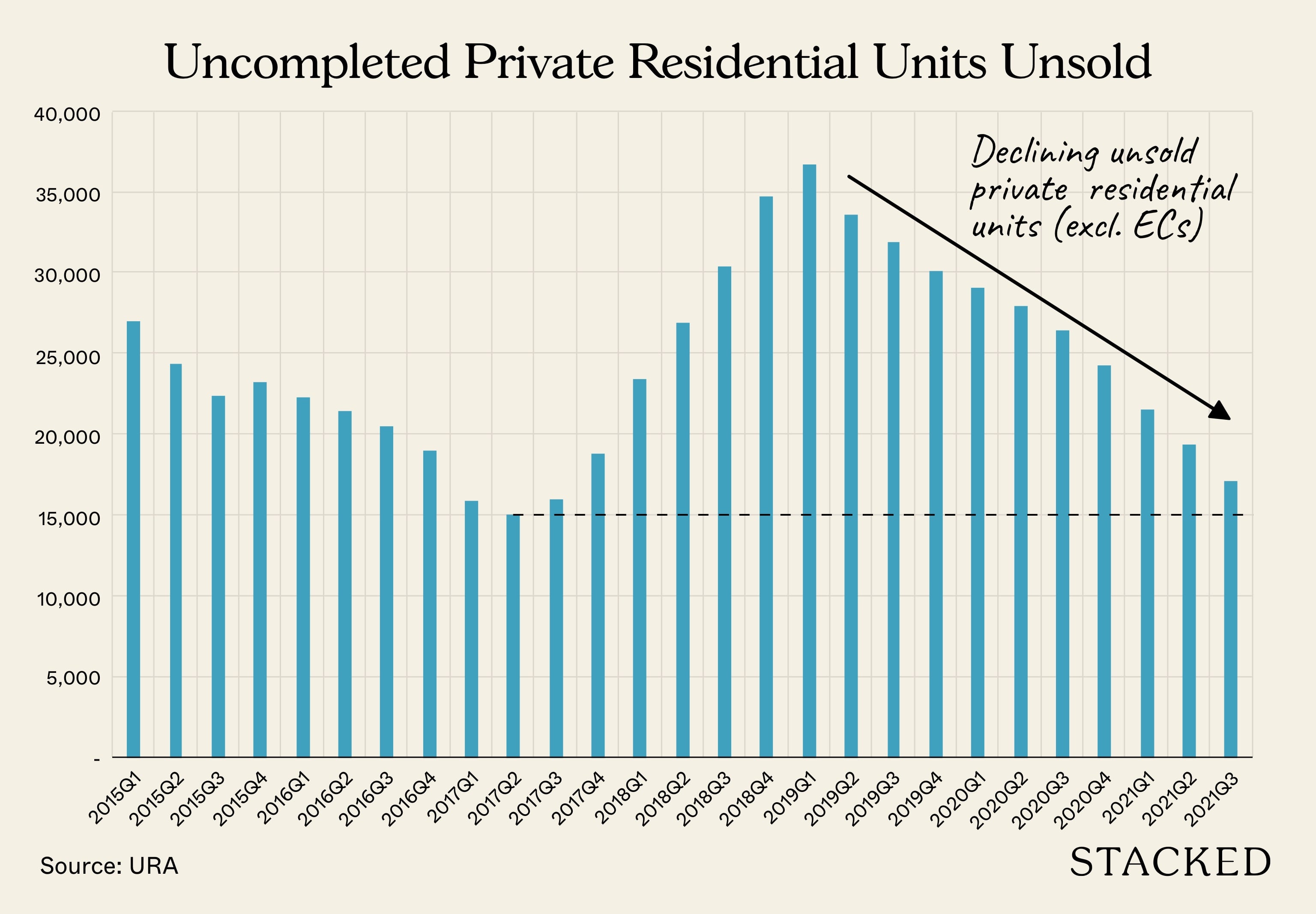

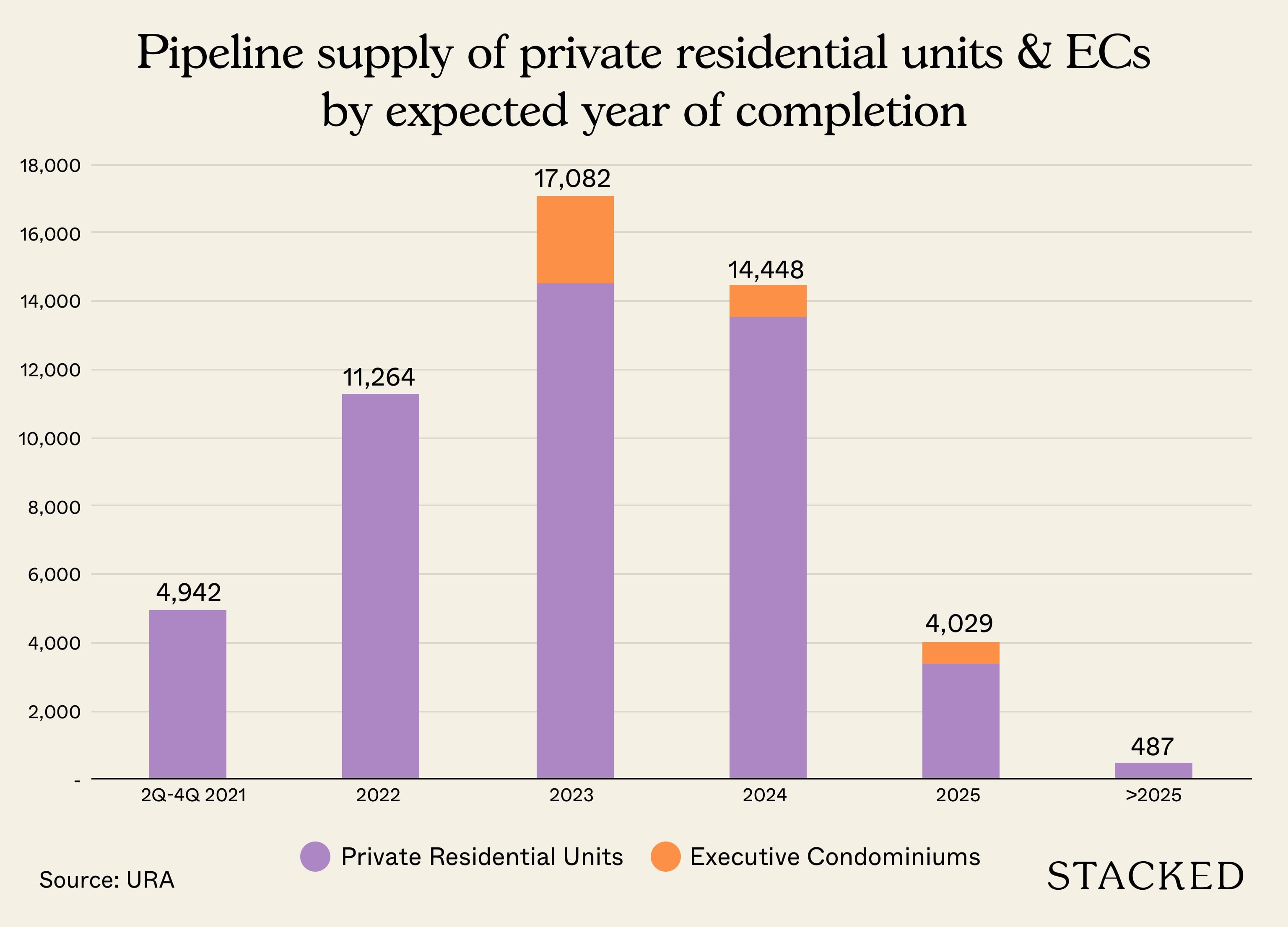

The existing stock of unsold private housing is also shrinking. In Q1, for instance, there was an estimated 21,602 unsold private homes. As of Q3 2021, this number was down to a mere 17,140 units.

Note that this has reversed the prior fears of a housing supply glut, which was expected to put downward pressure on home prices. In areas like Core Central Region (CCR), we have also seen the early return of foreign investors (which may now be on halt again because of the new cooling measures).

As a result, buyers may have to shift to resale options instead. This combination of factors gives sellers little reason to budge on prices; they hold almost all the cards right now.

This isn’t to say there are deals and discounts to be found, but you’ll have to dig deeper to find them in 2022.

3. Normalisation of interest rates is likely to start in 2022

The low-interest rate on home loans (average of 1.3 per cent at present) is due to interest rate cuts in the US. This was to stimulate economic recovery following Covid-19. However, the Fed can’t maintain the low rates indefinitely, for risk of runaway inflation.

As such, we’re likely to see the first steps toward normalising interest rates, starting in 2022. The first interest rate hikes will come in small steps, probably increments of 0.25 per cent.

As to how high the rates could go, well, we saw home loan rates of around two per cent in 2018 – just before Covid-19 struck. But keep in mind that, before the last Global Financial Crisis in ’08, the average home loan rate in Singapore was four per cent (although we don’t think it will go that high anytime soon).

Homebuyers in 2022 may want to consider loans with fixed-rate options to lock in lower rates, or loan packages with longer interest rate periods. Existing homeowners may want to look at refinancing options, to keep rates low. Speak to a mortgage broker for help on this.

4. Smaller projects going forward in 2022

2019 to 2021 saw a surge in mega-developments, such as Treasure at Tampines and Normanton Park. For 2022, however, the largest developments on the radar are probably Marina View (around 905 units), and whatever comes up at the Jalan Anak Bukit land plot (expected to yield around 845 units).

Other than that, most developments range from small to mid-sized. The likely headline developments, which are probably at the Tanah Merah Kechil Link site and Lentor Central, have 265 and 605 units respectively.

One of the downsides, these smaller developments will mean higher prices and less lavish facilities, compared to mega-developments. However, some buyers might enjoy greater privacy and exclusivity from a smaller development.

5. Demand will still be high in the Outside of Central Region (OCR)

We already explained why the OCR would dominate 2021; our view on that is unchanged for the coming year. Out of the 30+ launches expected, only around 11 may be in the OCR.

This will be disappointing to HDB upgraders, as OCR condos are the ones that tend to fall within their budget range (i.e., around $1.3 million to $1.5 million for a three-bedder).

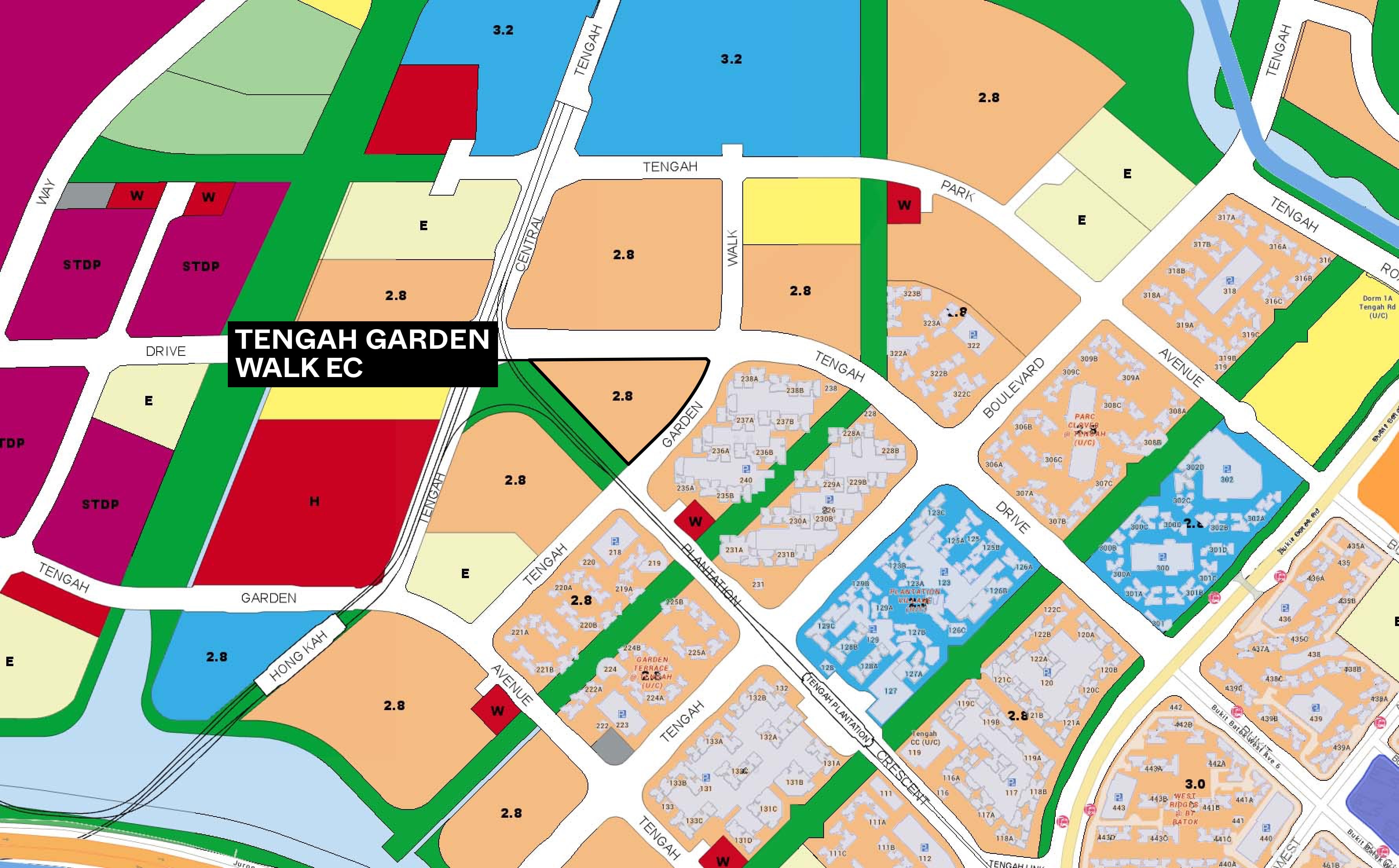

The OCR condos include just three Executive Condominiums (ECs), which are EC North Gaia (the Yishun Avenue 9 site), Tengah Garden Walk, and an upcoming launch at Tampines Street 62. While none of these are particularly close to MRT stations, they will be bastions of affordability in a very expensive year – and we expect high demand.

Property Picks26 Executive Condos That Are Within Walking Distance To The MRT

by Ryan J. Ong6. HDB resale flats are likely to retain their momentum

HDB resale prices are at their highest in eight years, and this is unlikely to slow in 2022. Two factors continue to drive up the price:

The first is fears of construction delay, related to Covid-19. This continues to push buyers toward resale, rather than cheaper BTO options. About two-thirds of BTO projects have seen delays due to Covid-19.

The other issue is the establishment of Work From Home (WFH) as a new norm. As most Singaporeans are discovering, it’s stifling and distracting to have multiple people working under the same roof, at the same time – from students having classes online, to parents and siblings having Zoom meetings right next to you.

Unfortunately, too many Singaporeans don’t really consider renting as a preferred option; and this is driving demand for resale flats that have no construction time (except for renovations).

7. Property taxes are going up next year

IRAS is reviewing the Annual Value (AV) of flats in 2022. The AV is the expected rental income the flat can generate, and your property tax is pegged to the AV. However, the increase is very small.

About 65 per cent of 3-room flats will see a property tax increase of about $8 to $14 annually. Larger flats may see an increase of about $21 to $26 annually, while 2-room flats will continue to pay no property tax.

This is in line with rising rental rates, in both public and private housing. While the amount for flats is almost negligible, there is a worry that an increase in AV will be substantial for some private properties; such as prime region rental units near the CBD. As such, buyers of these properties could see higher taxes from next year onward.

8. The Core Central Region (CCR) may face slower sales

Foreign investors have been returning to the Singapore private property market, regardless of Additional Buyers Stamp Duty (ABSD). We saw this as early as the Circuit Breaker, when Chinese buyers purchased Marina One units at around $20 million, sight unseen. There was also a notable increase in foreign buyers around March 2021, a time when luxury home sales were about 10 times higher than the previous year.

But all this was before the announcement of the new cooling measures. While most foreign property buyers are from the more affluent crowd, the new 30 per cent ABSD may be too off-putting for almost all but the wealthiest few. It is a big increase that may take a while for the foreign market to normalise to.

We’ve already seen the effects, with the recent measures already affecting a discount from the newly launched Perfect Ten, and a slew of other luxury launches having followed suit with discounts of their own.

While they don’t constitute a large number of buyers, those high-end new launches (especially within the Holland V area) will certainly not be looking forward to early-2022.

For more updates on the Singapore private property market as the situation unfolds, follow us on Stacked. You can also check out in-depth reviews of new and resale condos alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Pro This Popular 520-Unit Condo Sold 85% At Launch — Here’s What Happened To Prices After

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

0 Comments