6 Developer Pricing Strategies For New Launch Condos

November 18, 2020

One of the great mysteries in Singapore’s private property market is developer pricing for new launches. We’ve encountered few events that are more laden with myth, rumours, and outright falsehoods. In most cases, the only part that most people get right is “buy earlier = cheaper” (and even that isn’t always true).

To give you a better sense of how developer pricing works, you should know these six general approaches to new launch pricing. If nothing else, it’s more useful than looking at the “$1,5XX psf” signs plastered all over the showflat:

Note: These developer pricing tactics are not exclusive, and can be combined

For example, a condo can be launched in phases, have a VVIP launch, and also change pricing based on floor. Developers may use a combination of the following in setting the price.

Tactic #1: Soft Launch / VVIP launch

This is the best known, and almost universal tactic among developers.

The soft launch occurs just before the actual launch, and is invite-only. Buying at this point brings “early bird” discounts, which might range from five per cent, to as high as 15 per cent. In May this year, for instance, we highlighted some new developments with discounts of up to 8.74 per cent.

Units sold during the soft launch are often loss-leaders; the developer accepts a lower margin on these units, to get the sales momentum going. You’ll often be told this is the best point to buy as it’s practically a guaranteed profit (e.g. if you buy for $50,000 less in this phase, you effectively “make” $50,000 once the units start selling at the regular price). Which isn’t wrong per se, if others do buy at the regular price you do get some price protection.

In theory, the VVIP phases are invite-only; often the guest list will include:

- Major property investors

- Former customers

- Celebrities or other buyers who could bring prestige to the development

- Friends & family

One example was the launch of Boulevard 88, where some members of the CDL family bought in at a discount.

In reality, it’s not that hard to get in if you know the right property agents. Policies differ between developers, but some will let you if you simply register for it.

Things to note:

It’s never guaranteed that you’re getting the best discount. The developer can choose to lower prices even more later. One example of this was the fire sale at 38 Jervois in June 2020, where discounts ranged from 13 to 24 per cent (this was because the developer had to clear the remaining units to meet the Additional Buyers Stamp Duty deadline).

You may also find that prices are cheaper if there’s a re-launch, as we’ll explain next.

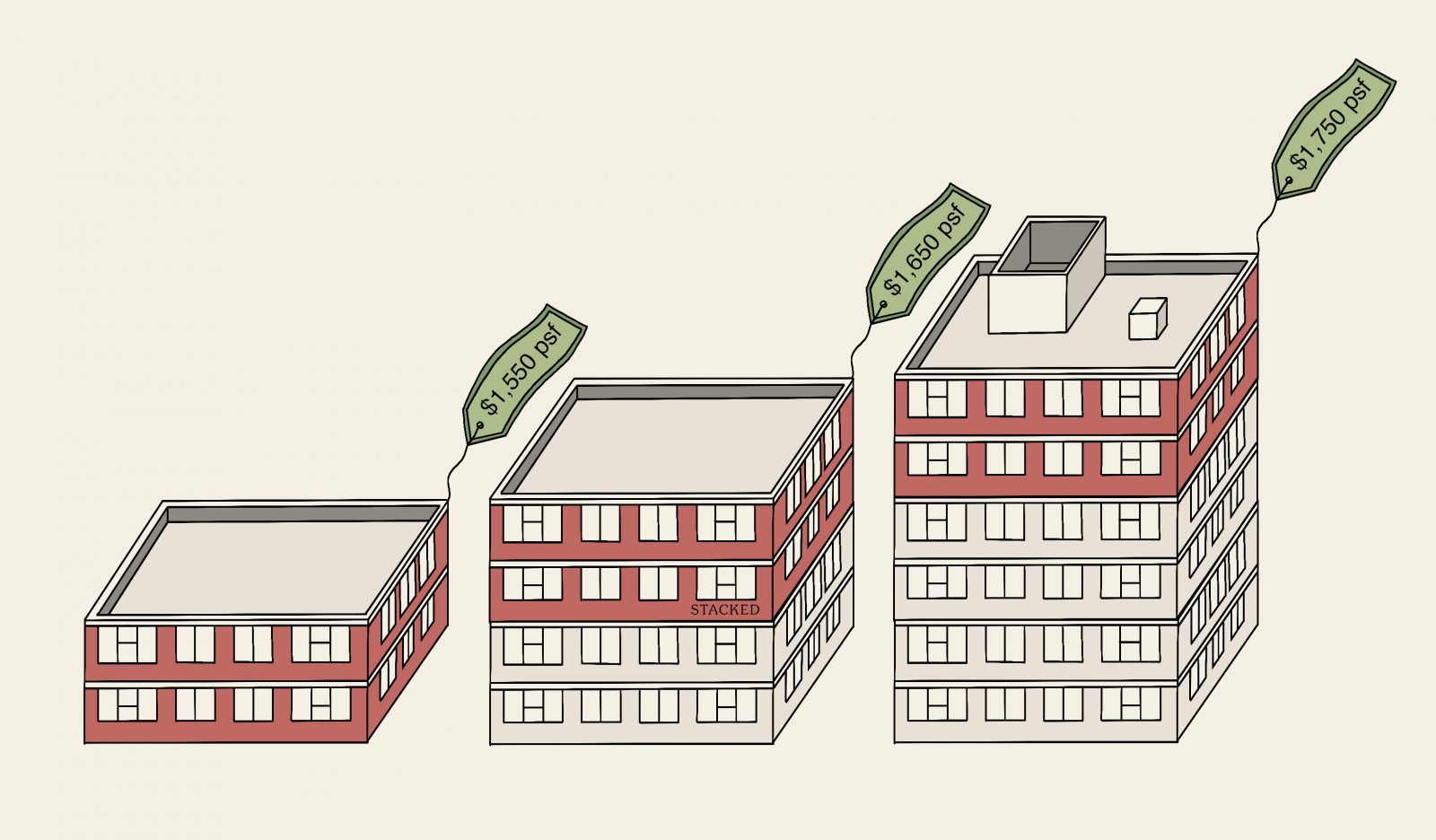

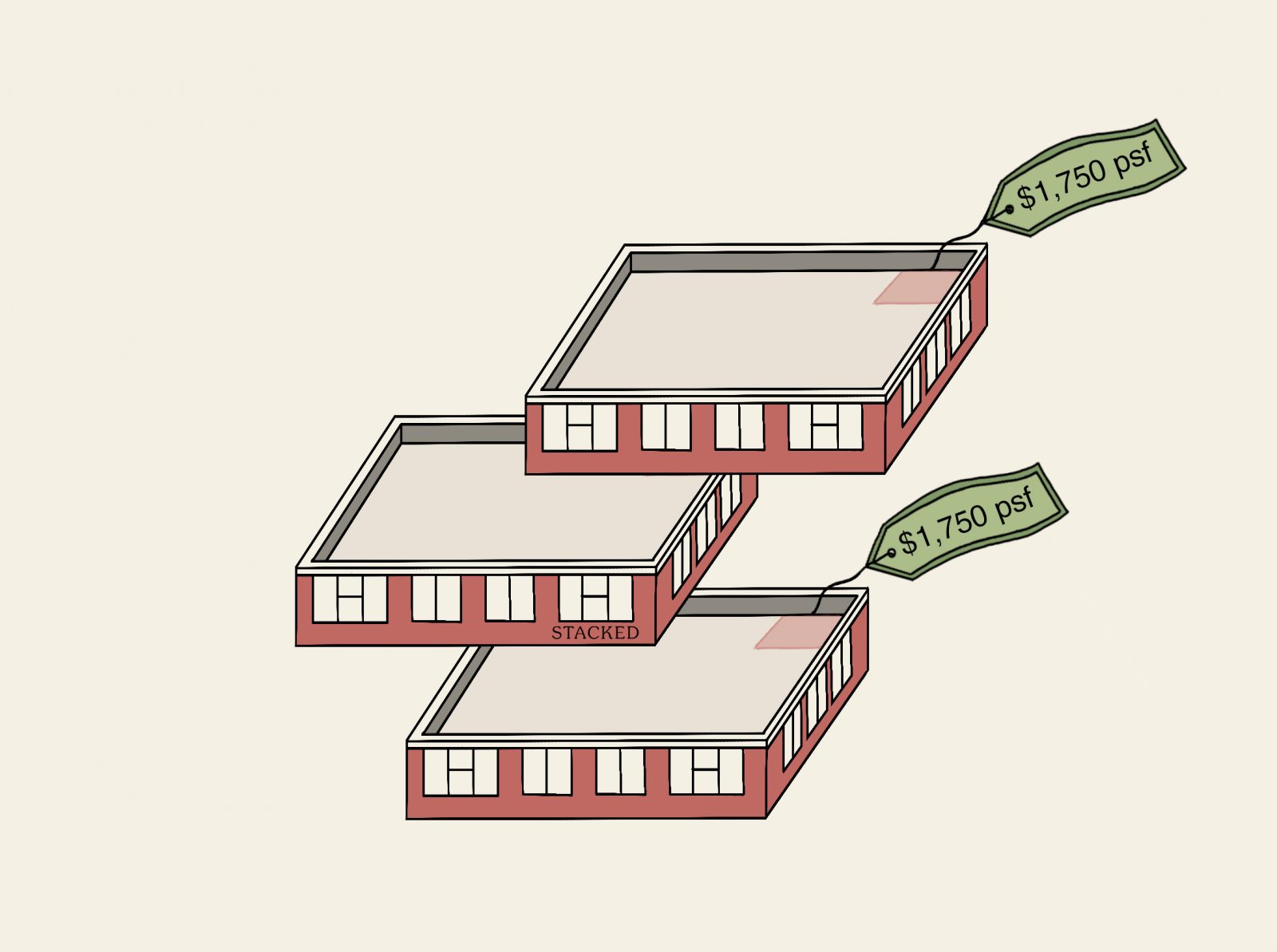

Tactic #2: Launch in phases / relaunch

Rather than launch all the units at one go, a developer may launch the units in batches; these are referred to as phases. This allows the developer to “test the waters” and see how receptive buyers are to the pricing.

The earlier phases tend to be cheaper, with developers gradually raising the price to see how far they can go (e.g. $1,550 psf in phase one, $1,650 psf in phase two, $1,750 psf in phase three, and so forth).

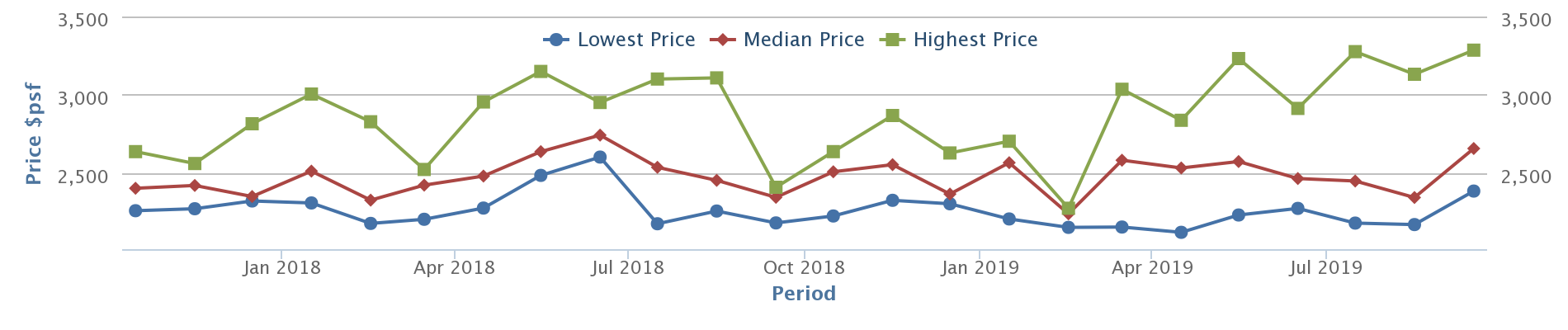

Marina One Residences, for instance, had its initial launch in 2014. At the time, the average price was about $2,546 psf. By the next phase in 2018, developer prices were about $2,506 psf. As of 2019, the developer pricing for Marina One Residences averaged $2,655 psf.

Note that this process can go on for a very long time. One of the longest in recent years was Luxus Hills, a landed development where sales spanned 10 years and 25 phases. The final phase, consisting of 39 of 900 total units, was only in February 2020.

Besides launching in phases, developments that don’t receive a good initial response may see a relaunch.

One example of this was Sky Habitat in Bishan. While it was a high-end development, it was uncertain how the market would react to condo units with a quantum crossing the $2 million mark; at the time of its initial launch in 2012, Sky Habitat was the most expensive suburban condo in Singapore. Buyers balked at the price; this prompted a relaunch in 2014, which saw prices fall by 10 to 15 per cent (from $1,435 to $1,893 psf, to $1,276 to $1,590 psf).

Woodleigh Residences also saw a re-launch in May 2020, a price drop from its initial launch in October 2018 (the launch in 2018 didn’t do as well because it was too close to the new cooling measures that year). Back in 2018, asking prices averaged around $1,909 psf, but were only about $1,733 psf in May this year; a decrease of about nine per cent.

There’s a bit more on Woodleigh in our pick of integrated developments.

Things to note:

As with point 1, note that buying earlier doesn’t always mean better discounts. The entire purpose of launching in phases is that the developer can test the market, and possibly drop prices if they’re too high.

Also, note that sometimes the units you want may not be available in the earlier phases. Your desired stack, for instance, may not be up for grabs until phase two or phase three.

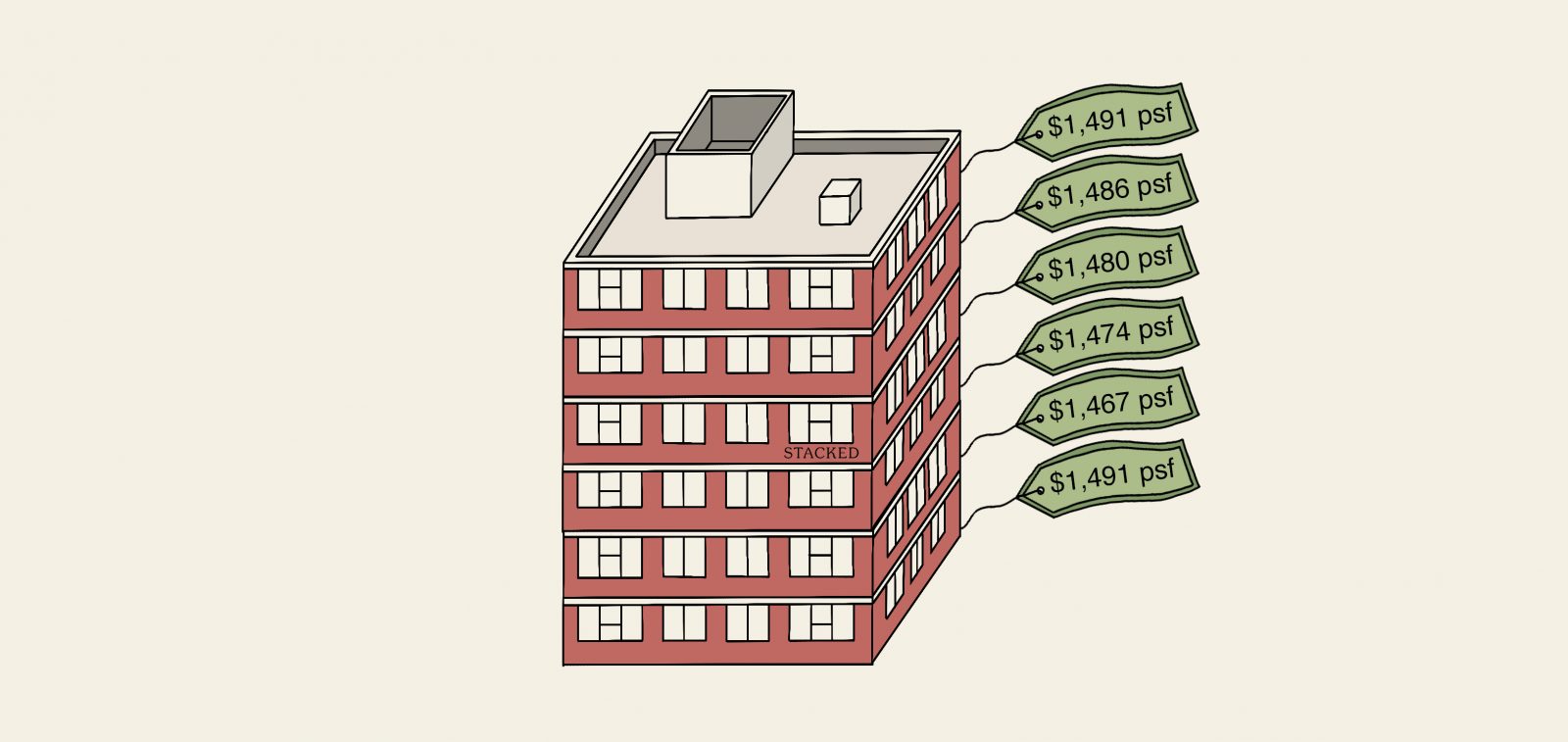

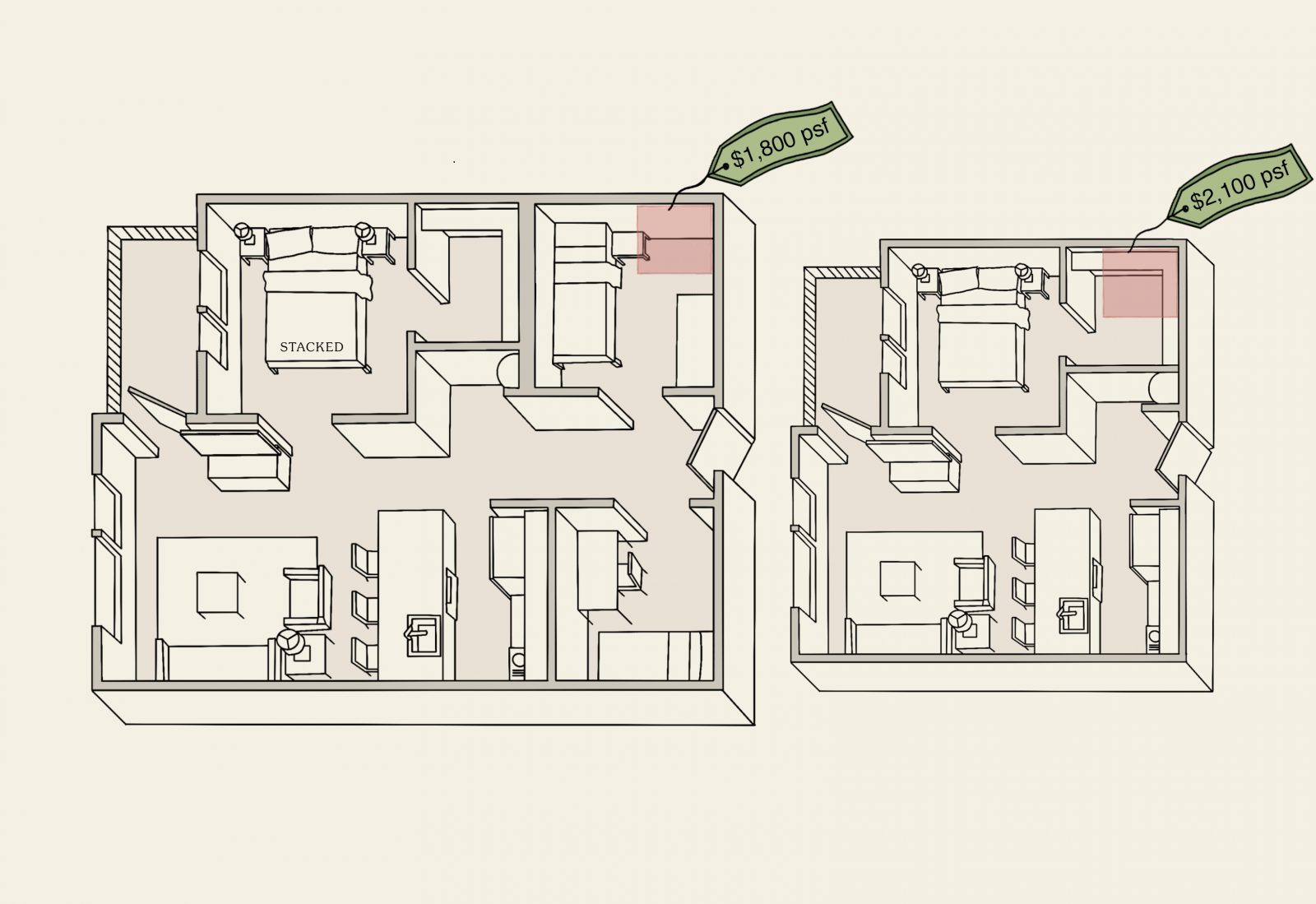

Tactic #3: Prices based on your unit’s floor level, or by “floor batches”

We most recently saw this with The Penrose. The development consists of 566 units in five blocks of 18 storeys.

Here are some of the recorded transactions, in order of lowest to highest floor:

| Date | Unit Floor | Unit Size | Price PSF | Price |

| 21 Oct 2020 | 5 | 797 | $1,719 | $1,369,000 |

| 2 Nov 2020 | 7 | 797 | $1,729 | $1,377,000 |

| 24 Oct 2020 | 8 | 797 | $1,734 | $1,381,000 |

| 29 Oct 2020 | 9 | 797 | $1,739 | $1,385,000 |

As you can see, the prices generally go up as the units get higher (although not always by an exact, uniform amount such as this $4k jump at The Penrose). A variant of this is to increase the price by “floor batches”, such as from floors 11 to 20, floors 21 to 25, and so forth.

Developers know that higher floors are generally more desirable, as they provide a better view. As such, units with the same floor plan can be priced significantly higher or lower, depending on which floor they’re on.

Things to note:

This can help you save money. For example, say you want to buy at The Penrose because of the Aljunied location, which is on the city fringe; but you have a tight budget, and access to the CBD matters more than a nice view. You might want to deliberately go for the lower floors, to meet your price point.

As an aside, some buyers are avowed believers in low floor units – this means you avoid having to wait for the lift (and it’s a godsend if multiple lifts ever break down at once, or during holiday periods when visitors swamp the lifts). It’s an extra bonus if they also get to pay less.

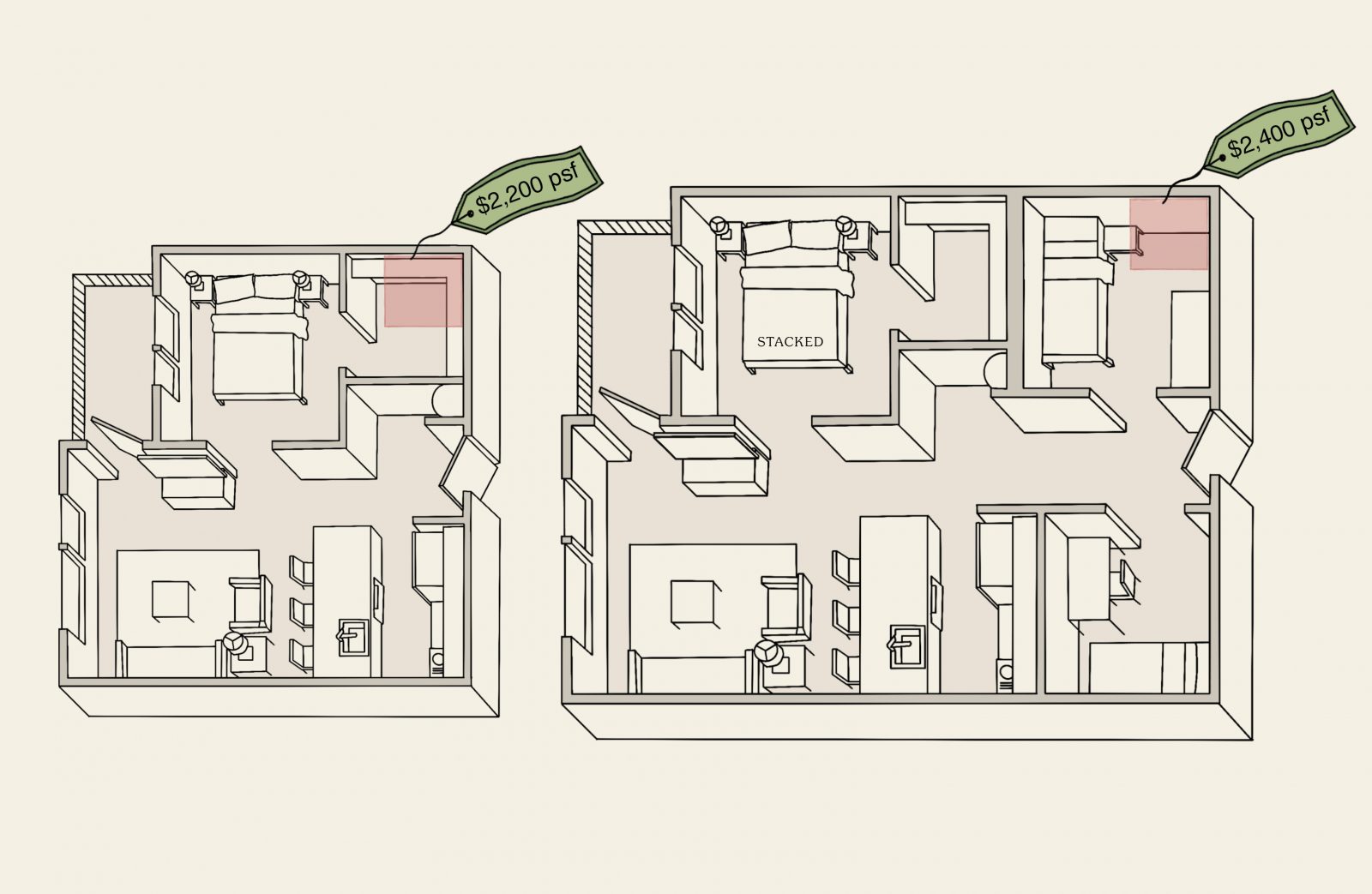

Tactic #4: Low psf for big units, high psf for small units

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

A $6 Million Landed Home Nightmare: Owning A Landed Home But Struggling To Make Ends Meet

Homeownership is a sensitive and emotional issue for many, but the consensus is that owning a pricey landed property can…

In general, bigger homes have a lower price psf than smaller ones. With regard to condo launches, however, this is emphasised in the form of shoebox or compact units.

The best known recent example is The M at Middle Road; some of the units here featured very high psf prices, with a low quantum (in some cases below $1 million). Here’s an example based on launch transactions; it’s in order of smallest to largest:

| Date | Unit Size | Price PSF | Price |

| 20 Oct 2020 | 592 sq. ft. | $2,703 | $1,600,000 |

| 16 Sep 2020 | 635 sq. ft. | $2,560 | $1,626,000 |

| 8 Oct 2020 | 721 sq. ft. | $2,496 | $1,800,000 |

| 14 Oct 2020 | 1,012 sq. ft. | $2,471 | $2,500,000 |

As the unit size and quantum increases, the price psf goes down. These smaller units, with high price psf but a low quantum, are the “low hanging fruit” for the sales team – the low price point makes them easier to sell, thus improving the take-up rate. At the same time, they help to push up the perceived price psf for the entire development.

Things to note:

A low quantum is a powerful draw, as your total loan amount and stamp duties are based on the total price, not the price psf.

But bear in mind that small units come with limitations, despite the low quantum. For example, they can be harder to sell in future, as HDB upgraders (who make up a large demographic) are typically families who can’t settle into a 500+ sq. ft. unit. Likewise, units that are so small often preclude roommates, which means tenants have no one to split rental costs with; this can lower rentability somewhat.

We have a more detailed discussion on shoebox units in a prior article.

Tactic #5: Higher psf for bigger units, lower psf for smaller units

In rare circumstances, you may see a reversal of point #4. The last time we spotted it was during the initial launch of Fourth Avenue Residences:

| Unit | Unit Size | Price PSF | Price |

| #06-69 | 969 sq. ft. | $2,458 | $2,382,000 |

| #06-66 | 506 sq. ft. | $2,444 | $1,237,000 |

It didn’t last however, and the last time we checked prices had “normalised”, with bigger units being cheaper per square foot (e.g. a transaction on 30th October was at $2,166 for a 1,076 sq. ft. unit).

We’ve received different interpretations of why a developer would do this, temporarily or otherwise. The two most common theories are:

- The developer believes larger units will be in greater demand in the area, as supply of bigger homes has been scarce. As such, the bigger units are priced higher than the smaller ones to match demand.

- The higher price for the large units isn’t due specifically to their size, but to the fact that the units are somehow special – for example, luxurious penthouse units with different finishing, or units with better views and greater floor-to-ceiling height, etc. Such units also tend to be bigger, thus giving the impression of a higher price psf for larger units.

(Note: We don’t think this is the probable explanation for Fourth Avenue Residences, where the differentiation of large units is not so huge)

There’s no way to verify what goes through the development team’s mind though, so we can’t tell you for sure; all we can say is that it does happen from time to time.

Things to note:

Unless there’s something super special about a unit, like having the best view, being the only unit high enough for a mezzanine floor, etc., it’s hard to justify paying a higher price psf for a bigger unit.

Conversely, a shoebox unit with a low price psf sounds like it could be a goldmine, if the location is right.

Tactic #6: One price for different floors

This is when the same price applies to units on different floors, instead of rising with each floor. The M also did this after its initial successful launch:

| Date | Address | Size | PSF$ | Price |

| 14 Oct 2020 | 30 Middle Road #18-02 | 904 | $2,765 | $2,500,000 |

| 14 Oct 2020 | 30 Middle Road #16-02 | 904 | $2,765 | $2,500,000 |

| 14 Oct 2020 | 30 Middle Road #17-02 | 904 | $2,765 | $2,500,000 |

In the “one price promo”, the same price of $1,520,000 would apply for all 527 sq. ft. units on floors 17, 18, and 19 in stack 39. In stacks 40 and 31, the same price would apply to all the 527 sq. ft. units from floors 15 through to 19.

From what agents have told us though, this sort of “single price” strategy is seldom maintained throughout; once a certain quota of sales has been met, the developer tends to remove the single price.

Things to note:

In general, buyers will go for the highest floor of the single-priced units; it’s assumed that higher floors mean a steeper discount (as higher up units tend to cost more; see point #3).

But don’t jump to conclusions. Just because it’s “one price” doesn’t mean you’re getting the best price. Do press the sellers on what the usual price differences between those floors are, to get a sense of the discount you’re truly getting.

Also, pay close attention to the floor plan / unit size that the single price applies to. Single price is sometimes a tactic used to clear out units of less favourable configurations (e.g. unit types with wasteful corridor spaces or odd shaped rooms).

Final Words

Ultimately, most people don’t really think about the developer’s pricing strategy – but depending on how it is implemented and the timing of it – it can make quite a big difference.

Ironically, if a development sells too well, it could point to the possibility of a project being under-priced. In other words, the developer essentially left money on the table for the consumer to take.

On the flip side, too high an initial price might affect their reputation as they are forced to drop the price further down to move the units – making the early buyers a disgruntled lot.

Which is why the choice for most would be to sell enough to meet the targets for existing cashflow, and sell more when the market is on an upturn, so that prices can be increased in tandem with the rising demand.

But finally…

Don’t be swayed by gimmicks, stay focused on the fundamentals

Whatever lures are presented to you, remember these factors take priority:

- Plan ahead and buy accordingly to your need.

- The location is the most convenient one for you (it’s easy to get bored of the nicest view, but you’ll always appreciate being five minutes from your workplace).

- You’ve secured a home loan via Approval In Principle (AIP). Don’t put down a cheque for the deposit otherwise, no matter the time limit of any sales promotions – The deposit is non-refundable, even if you’re unable to secure a home loan later.

(The old practice of re-issuing the Option To Purchase, if you can’t get a home loan on time, has now been restricted by URA).

For more on the latest launch promotions and issues, feel free to contact us on Facebook and ask. You can also follow us on Stacked to get in-depth reviews on various properties, and decide if they’re worth the launch price.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is a soft launch or VVIP launch for new condos in Singapore?

How do developers price units in phases or relaunches?

What does it mean when condo prices are based on floor levels or floor batches?

Why are smaller units sometimes priced with higher psf than larger units?

What is the 'one price for different floors' strategy in condo launches?

Should I buy early in a condo launch to get the best price?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

0 Comments