An Introvert Buys Property: Getting Prepared To Pull The Trigger (Part 4)

December 11, 2021

Every journey has to end. And sometimes, as poet T.S. Eliot wrote, it’s not with a bang, but with a whimper. And I certainly felt like whimpering when I made the decision to buy my flat.

I’ve read countless articles on property-buying advice, but not one of them actually tells you what it’s like when you have to decide whether to pull the trigger.

After almost a year of property hunting, it looked like I had found the one. But – I wasn’t sure.

It was a resale HDB flat in Bukit Panjang. The flat was well within my budget and also ticked most of my boxes, and more:

- The flat was a freshly MOP-ed unit, meaning it was five years old.

- Bukit Panjang was close enough to my parents to qualify for the Proximity Housing Grant.

- At 1,000 square feet and with three bedrooms, it was more space than I’d hoped for.

- It was on a high floor, so generally bright and airy.

- With the newer HDB flat layouts, all the spaces were squarish and easy to space-plan.

- The kitchen was a good size.

- It had unblocked and (partially) green views all around, even from the service yard.

Like most introverts and chronic overthinkers, I have a tough time making decisions. And as a single home buyer, the decision to buy the flat rested solely (and very heavily) upon my shoulders.

I’m actually sweating just recalling the day.

Just to be absolutely clear, I’m not giving you tips to become a savvy, informed home buyer. Instead, I’m sharing how I built my confidence up to make the decision to purchase a property. For the single buyer who thinks they may have found their dream home, I hope my experience will be the support you need to bite the bullet.

Firstly, have you done your homework? It’s a cliché for a reason, but knowledge is indeed power. The knowledge I’m referring to here is not about the property market, but about the process of purchasing a property.

When I started looking at property in 2019, I didn’t know Buyer’s Stamp Duty from conveyancing fees. It was all Greek to me.

Eventually, I had to educate myself on buying private and public property as both were on my radar. Here are a few Stacked articles that really helped me prepare:

- The Ultimate Guide to Buying a Resale Flat in 2017

- 6 Things To Prepare If You’re Buying A Home In 2021

- Can I Afford to Buy Private Property As a Single Before 35?

- An Ultimate Guide To Using Your CPF To Buy Property: How Much Can You Really Use?

- 6 Things To Prepare If You’re Buying A Home In 2021

Knowing exactly what will happen once you do decide to make the purchase is incredibly empowering. More importantly, you don’t want to be floundering at the point of sale – it’ll just make a stressful situation even more stressful.

At that point, I had all my sums done and paperwork at the ready. Being prepared to buy property really helped boost my confidence when the moment came to make an offer.

Secondly, what will not buying this property cost you? Too often, we fixate on what we stand to lose when we make a decision to buy a property. It’s completely natural to want to hold out for a better deal, but to what end?

My introverted self has a very poor appetite for risk. And what I was risking with the Bukit Panjang flat was my hard-earned savings. Even though I didn’t believe the new launch-good, resale-bad philosophy of the property agent Sandra in Part 2, I had become extremely fearful of capital depreciation.

And there was just plain ol’ FOMO – if I’d purchased the flat, I’d have to forgo all the imaginary ‘better’ properties I’d yet to see, at least for the next five years before my own MOP date.

If you’ve had these kinds of thoughts too, it’s important to acknowledge that while they may or may not be sensible, or even logical, they do represent real fears and anxieties.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Why Older Freehold Condos Are Struggling to Go En-Bloc in 2025

“It wasn’t meant to be like this.” That’s a common sentiment I’ve come across in 2025, and based on what…

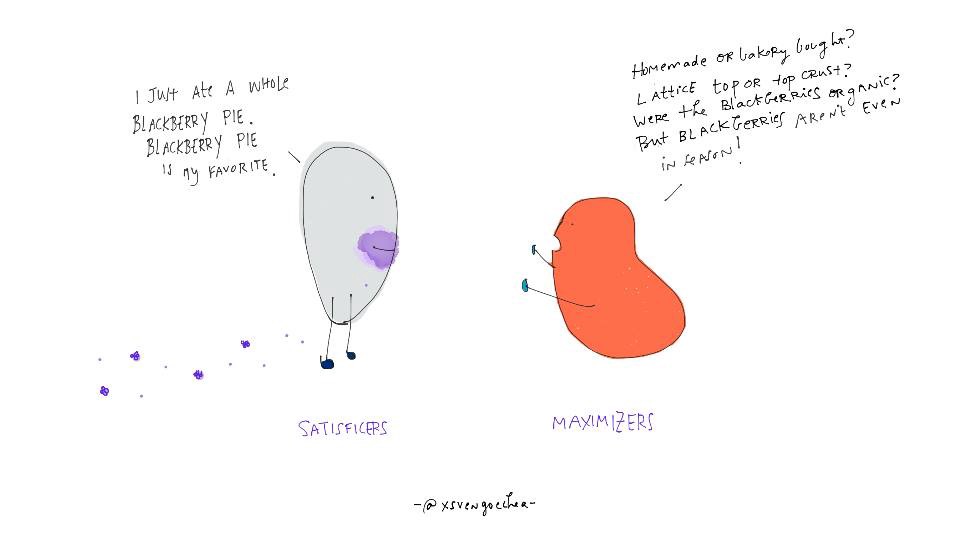

Behavioural scientists call people who go out of their way to make the very best decisions ‘maximisers’. The thing is, despite all their efforts, maximisers don’t always make the best decision, but they always end up worrying themselves sick.

The trick is to divert your maximising mind towards thinking about what you would miss out if you didn’t make the purchase. For me, I’d be delaying the move out of my family home. I’d be putting off that independent life I’d always wanted, and I wasn’t getting any younger. That became my motivation to pull the trigger on buying the flat.

Thirdly, how do you truly feel about the property? We’re getting into woo-woo territory, but I do think it’s important to take stock of how you’re feeling when you have to make a decision as important as buying a home.

If you feel like you’ve fallen in love with the property – congratulations! You probably don’t even need my advice. Go forth and send that OTP, and I sincerely hope it’s accepted.

If you feel like you’re being pressured into buying the property, I’d call that a red flag. I shared in Part 1 what aggressive sales tactics can sound like, and while those can put pressure on you to put in an offer, a good deal doesn’t mean that the property is right for you. I personally don’t like my hand being forced, so I usually remove myself from such situations. But if closing a quick and good deal is enough to make you happy, then, by all means, make the purchase!

In my 10-month long property search, I’ve definitely fallen in love with some properties and had others forced upon me. When it came to this Bukit Panjang flat, I remember leaving the viewing thinking, “Nothing about it offended me.”

Before

After

Remember the maximisers seeking to make the best decisions? I was a maximiser when I started my property-buying journey in 2019. Ten months later, I had become a ‘satisficer’, someone who was happy with ‘good enough’. And research has shown that while satisficers don’t necessarily get the best returns, they are markedly happier than maximisers.

I know it’s not quite a fairy-tale ending, but after spending one full day wallowing in anxious thoughts, I came to the conclusion that the Bukit Panjang flat was good enough for me. The nerves went, and I made up my mind to buy it.

The Single, Introverted Dream Home

Buying property is a huge undertaking, and the odds are stacked against you if you’re single and introverted. For those of you who feel like they’re struggling to look for your dream home, I hope you feel seen and heard after reading my story.

Your journey could be entirely different. You may be braving the journey alone, or with a property agent, you trust. You might buy the first property you view or be searching for months on end. You may eventually fall in love with a property, or settle for what you can find.

But if there’s any insight I can offer you as someone who’s been on the journey and emerged on the other side somewhat unscathed, it’s that a dream home is not something you buy, but create. Whatever property you find yourself with, trust yourself to make it the home of your dreams. So take a deep breath, and dive right in.

Thank you for reading An Introvert Buys Property! If you’ve enjoyed the series, please let me know in the comments section on Instagram or Facebook. And share the articles in this series with anyone you know who’s single, introverted, and looking to buy property.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Dan

Dan is a diehard introvert, freelance writer, first-time property owner, and backseat interior designer. He posts pictures of his home and writes about an odd combination of interior design, lifestyle, and self-development on his Instagram channel @stayingonthehill.Need help with a property decision?

Speak to our team →Read next from Homeowner Stories

Homeowner Stories We Could Walk Away With $460,000 In Cash From Our EC. Here’s Why We Didn’t Upgrade.

Homeowner Stories What I Only Learned After My First Year Of Homeownership In Singapore

Homeowner Stories I Gave My Parents My Condo and Moved Into Their HDB — Here’s Why It Made Sense.

Homeowner Stories “I Thought I Could Wait for a Better New Launch Condo” How One Buyer’s Fear Ended Up Costing Him $358K

Latest Posts

Property Advice Should I Pay $500K More For A New Launch — Or Buy A Resale Condo Instead?

Singapore Property News A Rare Freehold CBD Office Unit Is Up For Sale At $20.5M — And Foreigners Can Buy It

Pro This Popular 520-Unit Condo Sold 85% At Launch — Here’s What Happened To Prices After

1 Comments

“Hi Dan, I feel vindicated reading your series. Thank you so much for sharing your experiences. I could almost have mistaken you for my twin. Like you, I’m single and extremely introverted. Although I did engage an agent, I chose to look for listings and arrange viewings myself. The thought of having to liaise with someone for things I could do myself, and feeling pressured to provide my availability, to view units was overwhelming.

After 6 months, I have placed an option for an HDB flat instead of a one-bedder condo. The flat is not surrounded by greenery, sadly. But it is near enough my family and it is in an estate that I’m fairly familiar with. That said, I still rue the lack of green spaces. It is also a corridor unit which runs counter to my need for a corner unit and absolute privacy.

What resonated most with me in this article is your reflection that property purchase for a singleton and an introvert is mentally, physically and psychologically demanding. My bandwidth to engage in leisurely chit-chat with acquaintances and friends went completely flat!

You might be completing your MOP soon. I wish you all the best in your next property search.”