42 Upcoming New Launches In 2020/2021 (Land Price/Breakeven)

August 27, 2020

Being the first major new launch since the start of the circuit breaker, it was no surprise that all eyes were on Forett at Bukit Timah during their launch weekend on 8th of August 2020.

For those competing developers keeping tabs, it wasn’t just about the sales performance, but also on how the first ever virtual balloting would be carried out.

I would say by and large it was a success, with Forett at Bukit Timah selling 190 units or 30% of its total 633 units. Considering the situation, I think most people would agree that it is quite encouraging.

That said, it’s too early to say we are out of the woods – particularly as the Government Covid-19 grants are still going on – with ongoing support extended until December. In other words, no one really knows the true impact of the pandemic as of yet.

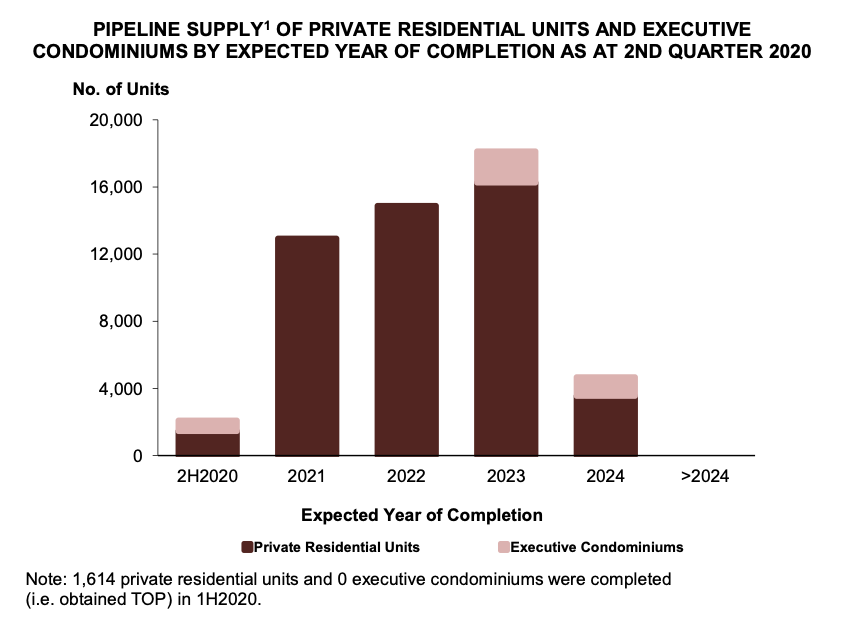

But despite all that, sales will still have to go on because of the 5-year sale period for developers (although extended by 6 months because of Covid-19). So before we go into the list of upcoming new launches, here’s a closer look at the pipeline supple of units in the next few years.

| Expected Year Of Completion | Private Residential Units | EC | Total Units |

| 2H2020 | 1,459 | 628 | 2,087 |

| 2021 | 12,932 | – | 12,932 |

| 2022 | 14,878 | – | 14,878 |

| 2023 | 16,265 | 1,864 | 18,129 |

| 2024 | 3,556 | 1,121 | 4,677 |

| >2024 | – | – | – |

| Total | 49,090 | 3,613 | 52,703 |

So without further ado, here are the 42 upcoming new launches in 2020/2021!

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

42 Upcoming New Launches in 2020/2021

| Project Name | Developer | District | Est Units | Tenure | Est Launch | Est Breakeven | Land Price | Site Area |

| 77 @ East Coast | KTC Group | 15 | 41 | Freehold | July | $1,404 | $29 million | 13,123 |

| Mooi Residences | Wenul HL | 10 | 24 | Freehold | July | – | $20.73 million | 13,305 |

| Cairnhill 16 | Tsky | 9 | 39 | Freehold | 24 July | $2,327 | $72.6 million | 15,408 |

| Forett @ Bukit Timah | Qingjian Realty | 21 | 633 | Freehold | 8 August | $1,636 | $610 million | 360,139 |

| NoMa | Macly Group | 14 | 51 | Freehold | 22 August | – | $20.55 million | 12,839 |

| The Verdale | CSC Land | 21 | 258 | 99 years | August | $1,602 | $215 million | 153,223 |

| Hyll on Holland | FEC Development | 10 | 319 | Freehold | September | $2,250 | $407.3 million | 138,105 |

| Myra | SDB Asia | 13 | 85 | Freehold | September | – | $60.26 million | 6,002 |

| The Landmark | ZACD, SSL, MCC | 3 | 390 | 99 years | September | $1,993 | $343 million | 60,821 |

| Ki Residences | Hoi Hup Realty | 21 | 660 | 999 years | September | $1,340 | $556 million | 373,008 |

| Penrose | CDL, HL | 14 | 566 | 99 years | September | $1,264 | $383.5 million | 174,648 |

| The Linq @ Beauty World | BBR Holdings | 21 | 120 | Freehold | October | $1,821 | $101.5 million | 30,874 |

| Clavon | UOL | 5 | 640 | 99 years | October | $1,334 | $493.1 million | 178,064 |

| Midtown Modern | Guocoland, HL | 7 | 580 | 99 years | 4th Qtr | $2,268 | $800.19 million | 124,118 |

| One North Gateway | HL, Mitsui | 5 | 165 | 99 years | 4th Qtr | $1,601 | $155.7 million | 62,201 |

| Normanton Park | Kingsford Huray | 5 | 1,900 | 99 years | 4th Qtr | $1,482 | $830.1 million | 660,999 |

| Parc Central Residences (EC) | Hoi Hup Realty | 18 | 695 | 99 years | 4th Qtr | $978 | $434.45 million | 268,386 |

| Perfect Ten | Japura Development | 10 | 190 | Freehold | 4th Qtr | $2,510 | $401.9 million | 104,531 |

| Grange 1866 | Heeton Holdings | 10 | 60 | Freehold | 2021 | $2,250 | – | 20,326 |

| The Ryse Residences | Allgreen | 18 | 600 | 99 years | 2021 | $1,204 | $700 million | 409,072 |

| Klimt Cairnhill | Low Keng Huat | 9 | 200 | Freehold | 2021 | $3,240 | $362 million | 43,103 |

| Bernam Street | Hao Yuan Realty | 2 | 325 | 99 years | 2021 | $2,178 | $440.9 million | 41,400 |

| Canberra Link (EC) | MCC | 27 | 385 | 99 years | 2021 | $963 | $233.89 million | 179,651 |

| Jalan Bunga Rampai | Wee Hur Holdings | 19 | 115 | 99 years | 2021 | $1,456 | $93.39 million | 50,231 |

| 14 Nassim Road | Shun Tak Holdings | 10 | 14 | Freehold | 2021 | $3,100 | $218 million | 66,452 |

| Park Nova | Shun Tak Holdings | 10 | 54 | Freehold | 2021 | $3,755 | $375.5 million | 46,084 |

| Irwell Bank | CDL | 9 | 445 | 99 years | 2021 | $2,243 | $583.9 million | 137,633 |

| Liang Court | CDL, CapitalLand | 6 | 700 | 99 years | 2021 | – | $375.9 million | 139,129 |

| Canberra Drive Parcel A | Oasis Development | 27 | 220 | 99 years | 2021 | $1,154 | $129.2 million | 143,326 |

| Canberra Drive Parcel B | United Venture | 27 | 455 | 99 years | 2021 | $1,162 | $270.2 million | 296,721 |

| Fernvale Lane (EC) | Frasers Property | 28 | 480 | 99 years | 2021 | $950 | $286.54 million | 184,386 |

| Keppel Bay | Keppel Land | 4 | 424 | 99 years | 2021 | – | – | 327,223 |

| Jewel @ Killiney Orchard | Lucrum Capital | 9 | – | Freehold | – | $2,935 | $84.88 million | 13,148 |

| The Atelier | Bukit Sembawang | 9 | 120 | Freehold | – | $2,251 | $168 million | 41,582 |

| Peak Residence | Tuan Sing, Rich Capital | 11 | 90 | Freehold | – | $2,081 | $118.88 million | 53,375 |

| Liv @ MB | Bukit Sembawang | 15 | 298 | 99 years | – | $1,847 | $345 million | 140,758 |

| Rymden 77 | Quek Hock Seng | 15 | 31 | Freehold | – | $1,673 | $37.89 million | 24,050 |

| Former 2 – 14 Phoenix Road Apartments | CNQC Realty | 23 | – | 99 years | – | $952 | $42.6 million | 63,002 |

| Phoenix Villas | OKP Holdings | 23 | 79 | 99 years | – | $1,043 | $33.1 million | 42,754 |

| Amber Sea | Urban Park | 15 | 132 | Freehold | – | $1,550 | $118.1 million | 40,917 |

| Royal Oak Residence | Far East Consortium | 10 | – | Freehold | – | $2,985 | $196 million | 49,040 |

More from Stacked

Units Of The Week Issue #4

It’s quite crazy how fast time flies - this is our Units Of The Week Issue #4 already (which marks…

As you can see from the table below, there are still quite a number of upcoming new launches planned for the rest of 2020.

Of the earlier upcoming new launches, the ones with the highest pull will definitely be the Penrose (next to Sims Urban Oasis), and Clavon (the land parcel next to Clement Canopy). These were both purchased at reasonable land prices, plus the mid-size of the developments are certainly attractive to potential home owners looking at the East and the West respectively.

It will also be interesting to see what price Amber Sea will be launched at, seeing as Far East Organization had purchased the existing development, Amber Glades way back in 2011.

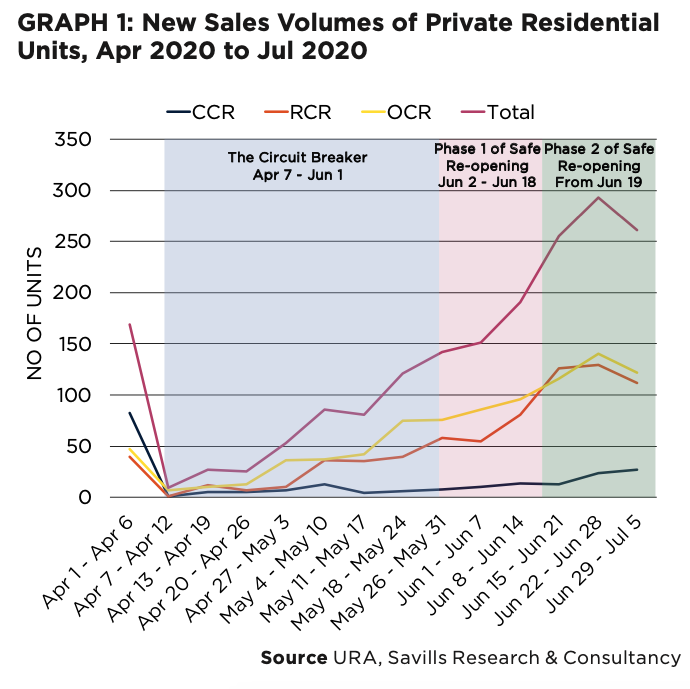

Last but not least, seeing how sales volume in the CCR has dropped (partly attributed to the lack of foreigners coming in, hence the pullback on new launches). It remains to be seen how the already launched Cairnhill 16 will perform, and what stance competing luxury projects like Perfect Ten or Park Nova will be taking moving forward.

If you have any questions or feedback feel free to reach out to us on Facebook or at stories@stackedhomes.com!

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What was notable about the launch of Forett at Bukit Timah in 2020?

How did the COVID-19 pandemic affect property sales in 2020?

What are some upcoming property launches planned for 2020 and 2021?

Which upcoming projects are expected to attract the most buyers?

What is the current trend in luxury property sales in the Core Central Region (CCR)?

Sean Goh

Sean has a writing experience of 3 years and is currently with Stacked Homes focused on general property research, helping to pen articles focused on condos. In his free time, he enjoys photography and coffee tasting.Need help with a property decision?

Speak to our team →Read next from Property Picks

Property Picks Where to Find Singapore’s Oldest HDB Flats (And What They Cost In 2025)

Property Picks Where To Find The Cheapest 2 Bedroom Resale Units In Central Singapore (From $1.2m)

Property Picks 19 Cheaper New Launch Condos Priced At $1.5m Or Less. Here’s Where To Look

Property Picks Here’s Where You Can Find The Biggest Two-Bedder Condos Under $1.8 Million In 2025

Latest Posts

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Singapore Property News Two New Prime Land Sites Could Add 485 Homes — But One Could Be Especially Interesting For Buyers

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

15 Comments

Forest is freehold…

Hi Kaylyn, thanks for pointing it out. We’ve made the change!

What about the upcoming EC launch at Tengah?

What is the ballpark margin we should to add on est. break even psf to good gauge of the launch psf? 30%?

to get** a good gauge… 😀

Hi Sean! Parc Central was launched last week and was wondering if you think it is a good investment?

Hey Beryl! Thanks for your question. Will drop you an email on it.

Hi,

Which new launch do you think is a good buy around D21 ? Looking primarily for child education and also for capital appreciation in future . Daintree Residence, Verdale, View at Kismis, Mayfair Modern, Mayfair Gardens, Forett, Ki Residence and the Linq. Or which resale development around this area can be another option too ?

Thanks.

Hey LZX! Will drop you an email! Thanks!

Thanks !

Hi Guys,

Do you know what is KAP king albert park residences developer breakeven price ? great if you guys can share the info. Thanks. And will be great to get your insight from my previous post. Thanks.

Hey! Have dropped you an email on the breakeven price as well as a reply on the previous comment. Thanks!

Hi Sean – We are looking to narrow one of the following for our own stay. Appreciate your thoughts.

a. Ki Residences

b. Midwood

c. Dairy Farm Residences

d. Normanton Park

e. Kent Ridge Residences

Hey Sam! Thanks for reaching out. Would drop you an email