Why The 2 Pine Grove Plots Are The Next Property Sites To Watch

December 10, 2021

There haven’t been many Government Land Sales (GLS) sites in 2021, so almost any plot is likely to draw developer interest. However, the recent launch of two adjacent sites, at Pine Grove, may be the ones to watch – while not as high profile as sites like Jalan Tembusu, these plots may be a bit of a dark horse. Here’s what to know about them:

Where are the two Pine Grove sites?

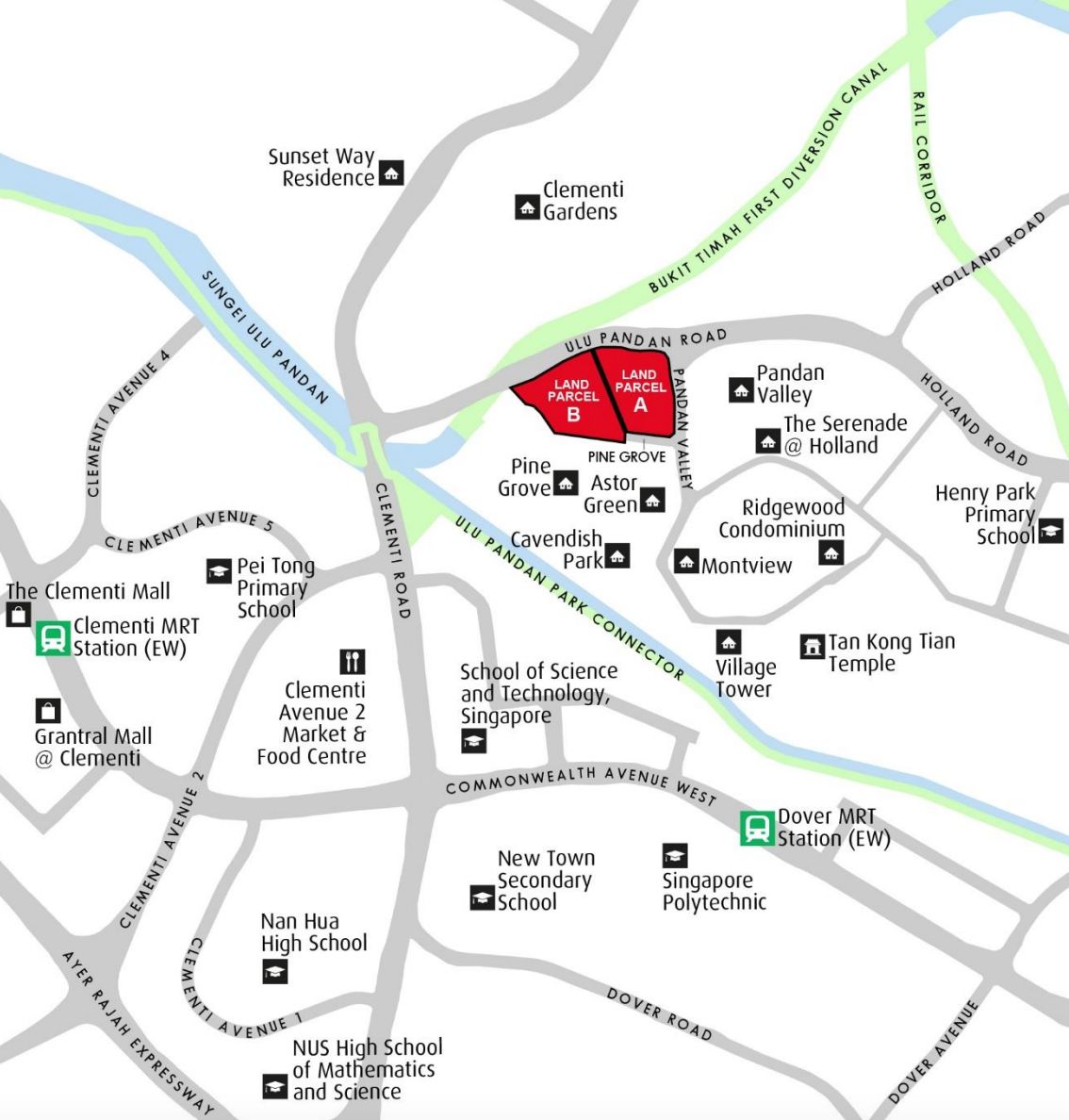

The adjacent sites are right across from Pandan Valley condominium, divided into parcels A and B. This is at the junction where Pandan Valley intersects with Ulu Pandan Road.

Parcel B is the larger of the two sites: it has a ground area of around 25,039 sq. m. and a Gross Floor Area (GFA) of 52,582 sqm. This is expected to yield around 565 units, which would potentially average 1,002 sq. ft.

Parcel A is slightly smaller at around 22,535 sq. m., with a GFA of 47,323 sq. m. It has enough room for around 520 units, which would potentially average 980 sq. ft.

The sites could have an impact on the existing Pine Grove condo

Some detractors question if developers will be interested, given en-bloc attempts nearby.

Pine Grove, which is located next to Parcel B, is a sizeable HUDC estate – it was last up for en-bloc in 2019 and is big enough to potentially hold more than 2,000 units (a size rivalling Treasure at Tampines). At the time, the asking price was $1,307 psf, with a total of $1.86 billion for the collective sale.

Having such a large potential plot nearby could be seen as a drawback, by both developers and prospective future buyers. As we’ve pointed out in this earlier article, a large residential development appearing next to yours can be a good or bad thing – bad in a way that this can provide future competition in resale and rental.

Nonetheless, if developers do bid for the land plots, it will be of great significance to Pine Grove owners. The bids for both parcels could end up “setting the price”, for future en-bloc attempts for Pine Grove.

(Without redevelopment, we don’t think Pine Grove will pose serious competition to a new launch in this area. The age difference and lease decay are quite significant for Pine Grove, which has a 99-year lease beginning in 1984).

Regardless of this drawback, here are some reasons to believe developers and buyers may see some key advantages:

- Proximity to One-North and Holland Village

- Close to many educational institutes

- Good-sized plots for land starved, major developers

- Possibility of purchasing both parcels

- Near the future Holland Plain

1. Proximity to One-North and Holland Village

If the success of Parc Clematis or Clavon is any indication, Clementi is a growing hot spot. A lot of this can be attributed to the growth of the One-North tech and media hub, and the JTC LaunchPad across the road from it.

These land parcels are only around an eight-minute drive to One-North, and buyers who miss out on Normanton Park or One-North Eden may see developments here as an alternative.

Holland Village, a major expat enclave and lifestyle hub, is just a six-minute drive from these land parcels; and any developments here are almost certain to be a cheaper alternative, to buying within Holland V itself.

2. Close to many educational institutes

NUS is just an eight-minute drive from these land parcels, and the NUS High School of Maths and Science is the same distance. Singapore Polytechnic is even closer, at around a six-minute drive.

For younger children, Henry Park Primary School is just a four-minute drive.

Good access to schools, coupled with a lot of open space, makes these plots ideal for family home buyers. This isn’t idle speculation, as nearby projects like Pine Grove and Pandan Valley are established favourites among the family crowd.

Given that the main force of buyers in recent years are HDB upgraders – who tend to be family units – developers can be fairly confident of some demand here.

3. Sizeable plots for land starved, major developers

As most home buyers are upgraders, there’s a strong demand for larger units (a trend we’ve covered in an earlier article). Along with the limited number of GLS sites this year, and mounting en-bloc interest, there could be more interest than you might think.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Is It Worth Buying A High-Ceiling Condo Unit?

High ceilings are among the most impressive features of a home. They make your place look bigger, they’re great for…

The two parcels are also a good size, compared to nearby en-bloc “targets” like Pandan Valley and Pine Grove. Both older projects are massive and are likely to come at a higher overall price tag than developers find palatable right now. A key concern is also the ability to move thousands of units, within the five-year ABSD time limit.

While the two Pine Grove parcels are large, they’re in the “sweet spot” between allowing for sizeable units and facilities, without the risk of mega-development numbers.

Like developers, buyers and investors also tend to like mid-sized unit counts of 500 to 600 units, which these parcels offer. This is large enough to lower maintenance costs, without a major loss of privacy.

4. Possibility of purchasing both parcels

One complaint is that, if a developer purchases Parcel A, then Parcel B represents future competition, and vice versa. However, it’s also possible that a developer could attempt to buy both parcels. They are, after all, right next to each other with no barrier.

Now, this would probably result in a mega-development (negating point 3), but it would make for a spacious project, that’s notably newer, more modern, and with better facilities than its neighbours. It would also reduce the risk that a separate developer, taking the next plot, could position stacks in such a way that views get impeded.

While common sense might dictate that a big plot is not palatable in the current market (and as mentioned in point 2), the bigger developers could also be encouraged by the performance of the mega-developments so far. Looking at the current sales figures, many of them are close to the finish line, and judging by the trend will likely sell out before their ABSD deadline.

| Project | Units | Take Up Rate |

| Normanton Park | 1,862 | 75.2% |

| Parc Esta | 1,399 | 99.9% |

| Parc Clematis | 1,468 | 95% |

| Treasure at Tampines | 2,203 | 98% |

| Florence Residences | 1,410 | 87.2% |

| Stirling Residences | 1,259 | 99.8% |

| JadeScape | 1,206 | 99% |

If you’ve noticed as well, the current trend for some of the recent GLS sites is for developers to do a joint venture together to spread the risk. You can see that in sites like the Jalan Anak Bukit (Far East Organization and Sino Group), as well as CDL and MCL for the Northumberland site – so it won’t be surprising to see that continue here.

5. Near the future Holland Plain

Holland Plain is just around a five-minute drive away from the land parcels. This will be a new lifestyle destination, once URA is finished with it. This area will bring the sort of greenery and park space common to Bukit Timah, while also capitalizing on waterfront potential.

This plays well into the family-friendly angle of the area, and it raises the appeal of the Pine Grove parcels for a family condo.

Overall, both parcels are worth keeping an eye out for, given the rising prominence of the Clementi area. While these parcels currently don’t have an MRT station nearby, they’re still close enough to major amenities near Clementi Mall (five minutes’ drive); and anything built here is likely to work as an affordable alternative to Holland V.

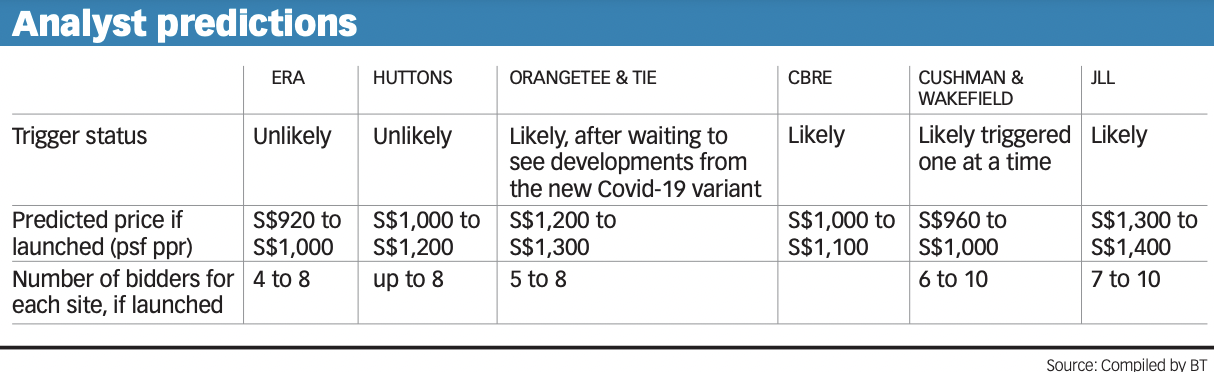

Interestingly enough, the response from various experts on these two sites has been a bit of a mixed bag. BT has collated their responses here:

Perhaps the response from Parksuites so far may just be weighing on their minds. It is, after all, in an arguably better location (just opposite Henry Park Primary, walking distance to Jelita, and closer to Ghim Moh and Holland Village).

For updates as the situation develops, follow us on Stacked; we can quickly notify you if anything’s about to be built here. In the meantime, you can also check out our reviews of new and old condos alike, within the same area.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Where are the two Pine Grove sites located?

Why are the Pine Grove sites considered potential property sites to watch?

How might the nearby Pine Grove condo affect new developments on these sites?

What are the advantages of these Pine Grove sites for developers and buyers?

What is the significance of the proximity to Holland Plain for these sites?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

0 Comments